Journal of Mathematical Finance

Vol.4 No.2(2014), Article ID:43032,11 pages DOI:10.4236/jmf.2014.42008

On Local Times: Application to Pricing Using Bid-Ask

1Centre of Mathematics for Applications, Department of Mathematics, University of Oslo, Oslo, Norway

2Institute for Financial and Actuarial Mathematics, Department of Mathematics, University of Liverpool, Liverpool, UK

Email: paulck@math.uio.no, Menoukeu@liverpool.ac.uk, proske@math.uio.no

Received October 12, 2013; revised December 3, 2013; accepted January 4, 2014

ABSTRACT

In this paper, we derive the evolution of a stock price from the dynamics of the “best bid” and “best ask”. Under the assumption that the bid and ask prices are described by semimartingales, we study the completeness and the possibility for arbitrage on such a market. Further, we discuss (insider) hedging for contingent claims with respect to the stock price process.

Keywords:Order Statistics; Semimartingales; Local Times; Arbitrage

1. Introduction

The theory of asset pricing and its fundamental theorem were initiated in the Arrow-Debreu model, the Black and Scholes formula, and the Cox and Ross model. They have now been formalized in a general framework by Harrison and Kreps [1], Harrison and Pliska [2], and Kreps [3] according to the no arbitrage principle. In the classical setting, the market is assumed to be frictionless i.e. a no arbitrage dynamic price process is a martingale under a probability measure equivalent to the reference probability measure.

However, real financial markets are not frictionless, and so an important literature on pricing under transaction costs and liquidity risk has appeared. See [4,]">5] and references therein. In these papers the bid-ask spreads are explained by transaction costs. Jouini and Kallal in []">5] in an axiomatic approach in continuous time assigned to financial assets a dynamic ask price process (respectively, a dynamic bid price process). They proved that the absence of arbitrage opportunities is equivalent to the existence of a frictionless arbitrage-free process lying between the bid and the ask processes, i.e., a process which could be transformed into a martingale under a well-chosen probability measure. The bid-ask spread in this setting can be interpreted as transaction costs or as the result of entering buy and sell orders.

Taking into account both transaction costs and liquidity risk, Bion-Nadal in [4] changed the assumption of sublinearity of ask price (respectively, superlinearity of bid price) made in []">5] to that of convexity (respectively, concavity) of the ask (respectively, bid) price. This assumption combined with the time-consistency property for dynamic prices allowed her to generalize the result of Jouini and Kallal []">5]. She proved that the “no free lunch” condition for a time-consistent dynamic pricing procedure [TCPP] is equivalent to the existence of an equivalent probability measure  that transforms a process between the bid and ask processes of any financial instrument into a martingale. See also Cherny [6] regarding the characterization of non-existence of arbitrage opportunities for stock prices constructed from bid and ask processes.

that transforms a process between the bid and ask processes of any financial instrument into a martingale. See also Cherny [6] regarding the characterization of non-existence of arbitrage opportunities for stock prices constructed from bid and ask processes.

In recent years, a pricing theory has also appeared taking inspiration from the theory of risk measures. First to investigate in a static setting were Carr, Geman, and Madan [7] and Föllmer and Schied [8]. The point of view of pricing via risk measures was also considered in a dynamic way using backward stochastic differential equations [BSDE] by El Karoui and Quenez [9], El Karoui, Peng, and Quenez [10], and Peng [11,12]. This theory soon became a useful tool for formulating many problems in mathematical finance, in particular for the study of pricing and hedging contingent claims [10]. Moreover, the BSDE point of view gave a simple formulation of more general recursive utilities and their properties, as initiated by Duffie and Epstein (1992) in their [stochastic differential] formulation of recursive utility [10].

In the past, in real financial markets, the load of providing liquidity was given to market makers, specialists, and brokers, who trade only when they expect to make profits. Such profits are the price that investors and other traders pay, in order to execute their orders when they want to trade. To ensure steady trading, the market makers sell to buyers and buy from sellers, and get compensated by the so-called bid-ask spread. The most common price for referencing stocks is the last trade price. At any given moment, in a sufficiently liquid market there is a best or highest “bid” price, from someone who wants to buy the stock and there is a best or lowest “ask” price, from someone who wants to sell the stock. The best bid price  and best ask (or best offer) price

and best ask (or best offer) price  are the highest buying price and the lowest selling price at any time

are the highest buying price and the lowest selling price at any time  of trading.

of trading.

In the present work, we consider models of financial markets in which all parties involved (buyers, sellers) find incentives to participate. Our framework is different from the existing approach (see [4,]">5] and references therein) where the authors assume some properties (sublinearity, convexity, etc.) on the ask (respectively, bid) price function in order to define a dynamic ask (respectively, bid). Rather, we assume that the different bid and ask prices are given. Then the question we address is how to model the “best bid” (respectively, the “best ask”) price process with the intention to obtain the stock price dynamics.

The assumption that the bid and ask processes are described by (continuous) semimartingales in our special setting entails that the stock price admits arbitrage opportunities. Further, it turns out that the price process possesses the Markov property, if the bid and ask are Brownian motion or Ornstein-Uhlenbeck type, or more generally Feller processes. Note that our results are obtained without assuming arbitrage opportunities.

This paper is also related with [13] where the authors explore market situations where a large trader causes the existence of arbitrage opportunities for small traders in complete markets. The arbitrage opportunities considered are “hidden” which means that they are almost not observable to the small traders, or to scientists studying markets because they occur on time sets of Lebesgue measure zero.

The paper is organized as follows: Section 2 presents the model. Section 3 studies the Markovian property of the processes, while Sections 4 and 5 are devoted to the study of completeness, arbitrage and (insider) hedging on a market driven by such processes.

2. The Model

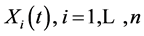

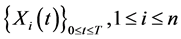

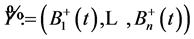

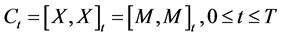

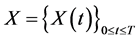

Let  (where

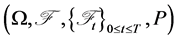

(where  denotes transpose) be a n-dimensional standard Brownian motion on a filtered probability space

denotes transpose) be a n-dimensional standard Brownian motion on a filtered probability space .

.

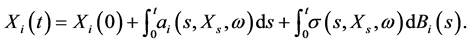

Suppose bid and ask price processes , which are modeled by continuous semimartingales

, which are modeled by continuous semimartingales

(1)

(1)

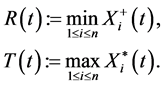

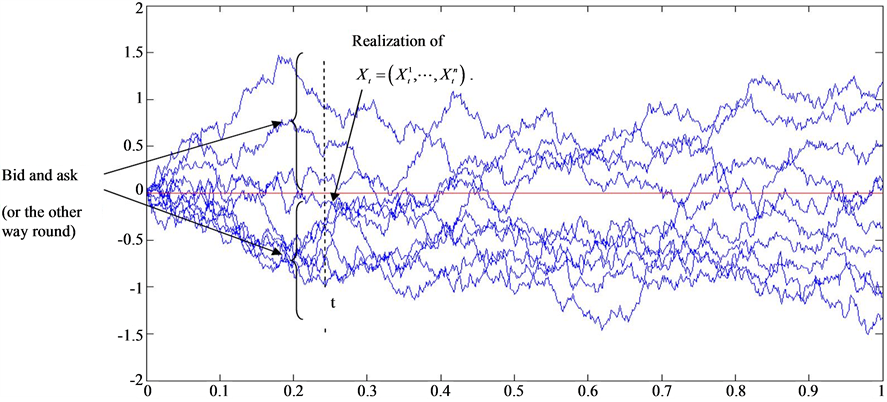

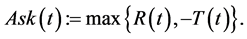

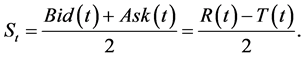

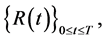

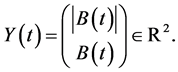

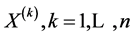

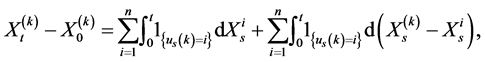

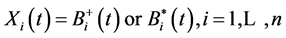

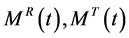

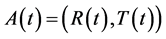

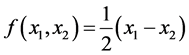

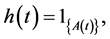

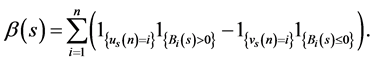

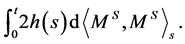

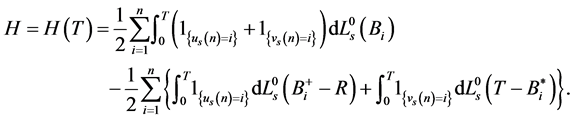

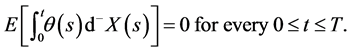

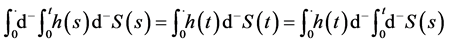

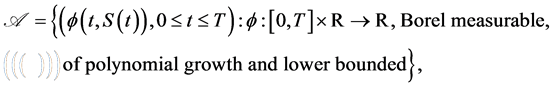

Here we consider the following model for bid and ask prices. See Figure 1.

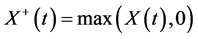

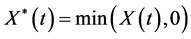

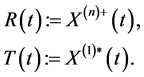

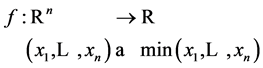

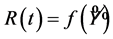

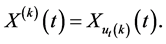

The evolution of the stock price process  is based on

is based on . Denote by

. Denote by  the Best Bid and Ask(t) the Best Ask at time t. Then

the Best Bid and Ask(t) the Best Ask at time t. Then  is the lowest price that a day trader seller is willing to accept for a stock at that time and Ask(t) is the highest price that a day trader buyer is willing to pay for that stock at any particular point in time. Let us define the processes

is the lowest price that a day trader seller is willing to accept for a stock at that time and Ask(t) is the highest price that a day trader buyer is willing to pay for that stock at any particular point in time. Let us define the processes  and

and . Further set

. Further set

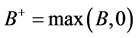

where we use the convention that  and

and . Then

. Then  and

and  can be modeled as

can be modeled as

(2)

(2)

and

Figure 1. Realization of bid and ask.

(3)

(3)

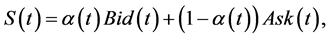

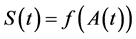

Given  and

and , the market makers will agree on a stock price within the Bid/Ask spread, that is

, the market makers will agree on a stock price within the Bid/Ask spread, that is

(4)

(4)

where  is a stochastic process such that

is a stochastic process such that  One could choose e.g.,

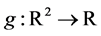

One could choose e.g.,  for a function

for a function  or

or  for a function

for a function .

.

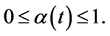

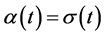

For convenience, we will from now on assume that , that is

, that is

(5)

(5)

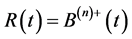

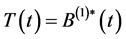

3. Markovian Property of Processes R, T and S

For convenience, let us briefly discuss the Markovian property of the processes

and

and

in some particular cases. The two cases considered here are the cases when the process

in some particular cases. The two cases considered here are the cases when the process

are Brownian motions or Ornstein-Uhlenbeck processes. Let us first have on the definition of semimartingales rank processes.

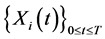

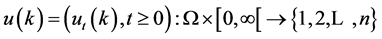

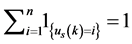

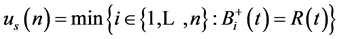

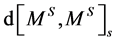

Definition 3.1 Let  be continuous semimartingales. For

be continuous semimartingales. For , the k-th rank process of

, the k-th rank process of  is defined by

is defined by

(6)

(6)

where  and

and .

.

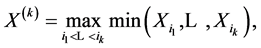

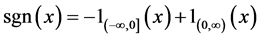

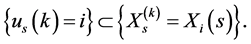

Note that, according to Definition 3.1, for ,

,

(7)

(7)

so that at any given time, the values of the rank processes represent the values of the original processes arranged in descending order (i.e. the (reverse) order statistics).

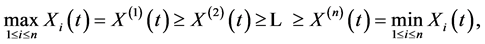

Using Definition 3.1, we get

(8)

(8)

3.1. The Brownian Motion Case

Here we assume that the processes  are independent Brownian motions.

are independent Brownian motions.

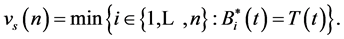

Proposition 3.2 The process  possesses the Markov property with respect to the filtration

possesses the Markov property with respect to the filtration

.

.

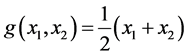

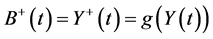

Proof. Let  be a one-dimensional Brownian motion. We first prove that

be a one-dimensional Brownian motion. We first prove that  is a Markov process. Define the process

is a Markov process. Define the process

Then  is a two dimensional Feller process.

is a two dimensional Feller process.

Let . One observes that

. One observes that  is a continuous and open map. Thus is follows from [14] (Remark 1, p. 327) that

is a continuous and open map. Thus is follows from [14] (Remark 1, p. 327) that  is a Feller process, too.

is a Feller process, too.

The latter argument also applies to the n-dimensional case, that is  is a Feller process. Since

is a Feller process. Since

is a continuous and open map we conclude that  is a Feller process.

is a Feller process.

Proposition 3.3 The process  possesses Markov property with respect to the filtration

possesses Markov property with respect to the filtration

.

.

Proof. See the proof of Proposition 3.2.

Corollary 3.4 The process  possesses Markov property with respect to the filtration

possesses Markov property with respect to the filtration

.

.

Proof. The process  defined by

defined by  for all

for all  is a Markov process as sum of two Markov processes.

is a Markov process as sum of two Markov processes.

3.2. The Ornstein-Uhlenbeck Case

Here we assume that the process  is an n-dimensional Ornstein-Uhlenbeck, that is

is an n-dimensional Ornstein-Uhlenbeck, that is

(9)

(9)

where  and

and  are parameters. It is clear that an Ornstein-Uhlenbeck process is a Feller process. So we obtain Proposition 3.5 The process

are parameters. It is clear that an Ornstein-Uhlenbeck process is a Feller process. So we obtain Proposition 3.5 The process  and

and  defined by (8) and (5) possess Markov property.

defined by (8) and (5) possess Markov property.

Proof. The conclusion follows from the proof of Proposition 3.2.

Remark 3.6 Using continuous and open transformations of Markov processes, the above results can be generalized to the case, when the bid and ask processes are Feller processes. See [14].

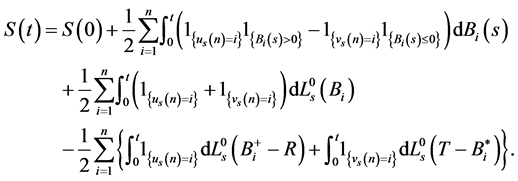

4. Further Properties of S(t)

In this Section, we want to use the semimartingale decomposition of our price process  to analyze completeness and arbitrage on market driven by such a process.

to analyze completeness and arbitrage on market driven by such a process.

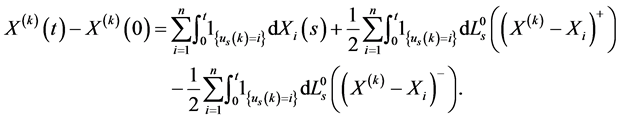

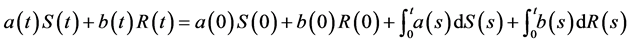

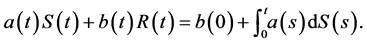

We need the following result. See [15] (Proposition 4.1.11). See also [16] for the continuous semimartingales case and [17] for general semimartingales.

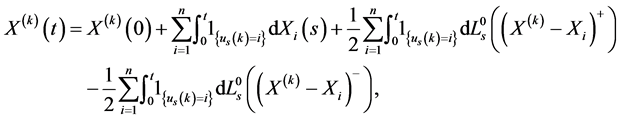

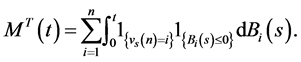

Theorem 4.1 Let  be continuous semimartingales of the form (1). For

be continuous semimartingales of the form (1). For  let

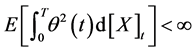

let  be any predictable process with the property:

be any predictable process with the property:

(10)

(10)

Then the k-th rank processes , are semimartingales and we have:

, are semimartingales and we have:

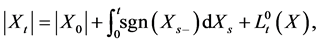

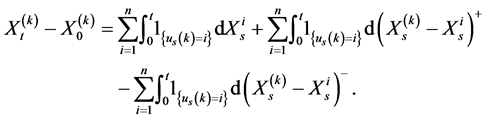

(11)

(11)

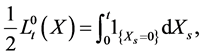

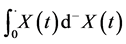

where  is the local time of the semimartingale

is the local time of the semimartingale  at zero, defined by

at zero, defined by

where .

.

For completeness, we give the proof of the proposition.

Proof. We find that

(12)

(12)

where we used the property . It follows,

. It follows,

We note the fact

(13)

(13)

We now use the following formula:

(14)

(14)

which is valid for non-negative semimartingales . See, e.g., [15,18]

. See, e.g., [15,18]

Then, by applying (14) to , (12) becomes:

, (12) becomes:

Then proof is completed.

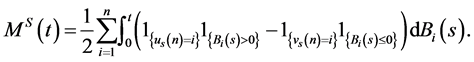

4.1. The Brownian Motion Case

If  are

are  independent Brownian motions, the evolution of

independent Brownian motions, the evolution of  and

and  follows from Theorem 4.1.

follows from Theorem 4.1.

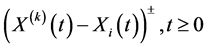

Corollary 4.2 Let the processes  and

and  be given by Equation (8). Then

be given by Equation (8). Then  and

and  and we have:

and we have:

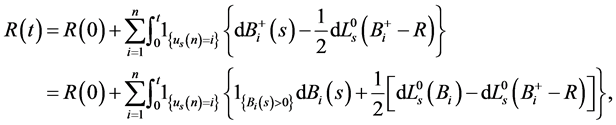

(15)

(15)

and

(16)

(16)

We can rewrite  and

and  as follows:

as follows:

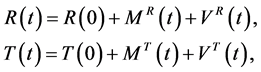

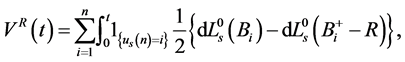

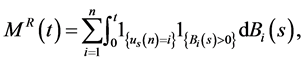

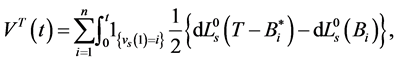

where  are continuous local martingales and

are continuous local martingales and  are continuous processes of locally bounded variation given by:

are continuous processes of locally bounded variation given by:

(17)

(17)

(18)

(18)

(19)

(19)

(20)

(20)

The following corollary gives the semimartingale decomposition satisfied by the process .

.

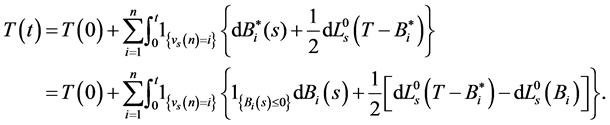

Corollary 4.3 Assume that the process  is given by (5). Then one can write

is given by (5). Then one can write

where  and

and , and we have:

, and we have:

(21)

(21)

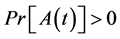

In order to price options with respect to , one should ensure that

, one should ensure that  does not admit arbitrage possibilities and the natural question which arises at this point is the following: Can we find an equivalent probability measure

does not admit arbitrage possibilities and the natural question which arises at this point is the following: Can we find an equivalent probability measure  such that,

such that,  is a

is a  -sigma martingale? Since the process

-sigma martingale? Since the process  is continuous, we can reformulate the question as: Can we find an equivalent probability measure

is continuous, we can reformulate the question as: Can we find an equivalent probability measure  such that,

such that,  is a

is a  local martingale1?

local martingale1?

We first give the following useful remark; See [19] (Theorem 1).

Remark 4.4 Let  be a continuous semimartingale on a filtered probability space

be a continuous semimartingale on a filtered probability space

. Let

. Let . A necessary condition for the existence of an equivalent martingale measure is that

. A necessary condition for the existence of an equivalent martingale measure is that .

.

Consequence 4.5 Since local time is singular, we observe that the total variation of the bounded variation part in 21 cannot be absolutely continuous with respect to the quadratic variation of the martingale. It follows that, the set of equivalent martingale measures is empty, and thus, such a market contains arbitrage opportunities.

4.2. (In)complete Market with Hidden Arbitrage

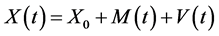

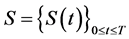

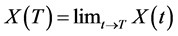

In this Section, we consider a model with , denoting a stochastic process modeling the price of a risky asset, and

, denoting a stochastic process modeling the price of a risky asset, and  denotes the value of a risk free money market account. We assume a given filtered probability space

denotes the value of a risk free money market account. We assume a given filtered probability space , where

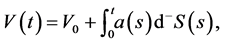

, where  satisfies the “usual hypothesis”. In such a market, a trading strategy

satisfies the “usual hypothesis”. In such a market, a trading strategy  is self-financing if

is self-financing if  is predictable,

is predictable,  is optional, and

is optional, and

(22)

(22)

for all . For simplicity, we let

. For simplicity, we let  and

and  (thus the interest rate

(thus the interest rate ), so that

), so that , and (22) becomes

, and (22) becomes

Definition 4.6 (See [13])

• We call a random variable  a contingent claim. Further, a contingent claim

a contingent claim. Further, a contingent claim  is said to be

is said to be  -redundant if, for a probability measure

-redundant if, for a probability measure , there exists a self-financing strategy

, there exists a self-financing strategy  such that

such that

(23)

(23)

where  is the value of the portfolio.

is the value of the portfolio.

• A market  is

is  -complete if every

-complete if every  is

is  -redundant.

-redundant.

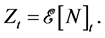

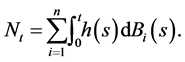

Define the process  as follows

as follows

(24)

(24)

Then the following theorem is immediate from [13] (Theorem 3.2).

Theorem 4.7 Suppose that there exists a unique probability measure  equivalent to

equivalent to  such that

such that  is a

is a  -local martingale. Then, the market

-local martingale. Then, the market  is

is  -complete.

-complete.

Proof. Omitted.

Proposition 4.8 Suppose that . Then, there exists no unique martingale measure

. Then, there exists no unique martingale measure  such that

such that  is a

is a  -local martingale.

-local martingale.

Proof. From (24), we observe that  is a

is a  -martingale. Let us construct another equivalent martingale measure

-martingale. Let us construct another equivalent martingale measure  For this purpose, assume without loss of generality that

For this purpose, assume without loss of generality that  and

and  are given by

are given by

and

Now define the process  as

as

where

with

(25)

(25)

One finds that  for all

for all . Let us define the equivalent measure

. Let us define the equivalent measure  with respect to a density process

with respect to a density process  given by

given by

Here,  denotes the Doléans-Dade exponential of the martingale

denotes the Doléans-Dade exponential of the martingale  defined by

defined by

Then, it follows from the Girsanov-Meyer theorem (see [20]) that  has a

has a  -semimartingale decomposition with a bounded variation part given by

-semimartingale decomposition with a bounded variation part given by  We have that

We have that

Since , it follows that

, it follows that

Thus  is a

is a  -martingale. Since

-martingale. Since  is also a martingale measure with

is also a martingale measure with , the result follows.

, the result follows.

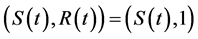

Remark 4.9 In the case  (a single Bid/Ask), the market becomes complete since the process

(a single Bid/Ask), the market becomes complete since the process , defined by Equation (25) in the proof is equal to

, defined by Equation (25) in the proof is equal to . Therefore the unique martingale measure is

. Therefore the unique martingale measure is .

.

We can then deduce the following theorem on our process .

.

Theorem 4.10 Suppose that  and

and  are given by (21) and (24), respectively. Then

are given by (21) and (24), respectively. Then

• For  (a single Bid/Ask), the market

(a single Bid/Ask), the market  is

is  -complete and admits the arbitrage opportunity (26).

-complete and admits the arbitrage opportunity (26).

• For  (more than a single Bid/Ask), the market

(more than a single Bid/Ask), the market  is incomplete and arbitrage exists.

is incomplete and arbitrage exists.

Proof. From Theorem 4.8, we know that the market is  -complete for

-complete for  and incomplete for

and incomplete for . Let

. Let  such that

such that  is a

is a  -local martingale. For

-local martingale. For , let us construct an arbitrage strategy. Let

, let us construct an arbitrage strategy. Let

(26)

(26)

where  denotes the

denotes the  by

by  support of the (random) measure

support of the (random) measure ; that is, for fixed

; that is, for fixed  it is the smallest closed set in

it is the smallest closed set in  such that

such that  does not charge its complement. (Compare with the proof of Proposition 4.8.) Let

does not charge its complement. (Compare with the proof of Proposition 4.8.) Let

Assume without loss of generality that . Then, by Theorem 4.7, there exists a self financing strategy

. Then, by Theorem 4.7, there exists a self financing strategy  such that

such that  However, from (26), we also have

However, from (26), we also have

Moreover, we have

Moreover, we have , by construction of the process

, by construction of the process .

.

Hence,  which is an arbitrage opportunity.

which is an arbitrage opportunity.

Remark 4.11 We do not make the assumption that we are working in an arbitrage free market, rather, we define the notion of redundancy (see [13] Definition 2.1), which in some sense is equivalent to the notion of replication with the difference that, replication is on a arbitrage free setting.

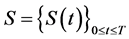

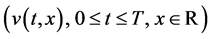

5. Pricing and Insider Trading with Respect to S(t)

In this Section, we discuss a framework introduced in [21], which enables us pricing of contingent claims with respect to the price process  of the previous sections. We even consider the case of insider trading, that is, the case of an investor, who has access to insider information. To this end, we need some notions.

of the previous sections. We even consider the case of insider trading, that is, the case of an investor, who has access to insider information. To this end, we need some notions.

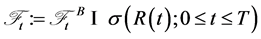

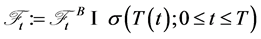

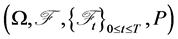

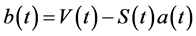

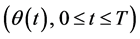

We consider a market driven by the stock price process  on a filtered probability space

on a filtered probability space

. We assume that, the decisions of the trader are based on market information given by the filtration

. We assume that, the decisions of the trader are based on market information given by the filtration  with

with  for all

for all  being a fixed terminal time. In this context an insider strategy is represented by an

being a fixed terminal time. In this context an insider strategy is represented by an  -adapted process

-adapted process  and we interpret all anticipating integrals as the forward integral; See, for e.g., [22,23] for more details. In such a market, a natural tool to describe the self-financing portfolio is the forward integral of an integrand process

and we interpret all anticipating integrals as the forward integral; See, for e.g., [22,23] for more details. In such a market, a natural tool to describe the self-financing portfolio is the forward integral of an integrand process  with respect to an integrator

with respect to an integrator denoted by

denoted by ; See [23]. The following definitions and concepts are consistent with those given in [21].

; See [23]. The following definitions and concepts are consistent with those given in [21].

Definition 5.1 A self-financing portfolio is a pair , where

, where  is the initial value of the portfolio and

is the initial value of the portfolio and  is a

is a  -adapted and

-adapted and  -forward integrable process specifying the number of shares of held in the portfolio. The market value process

-forward integrable process specifying the number of shares of held in the portfolio. The market value process  of such a portfolio at time

of such a portfolio at time , is given by

, is given by

(27)

(27)

while  constitutes the number of shares of the less risky asset held.

constitutes the number of shares of the less risky asset held.

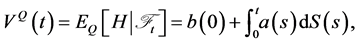

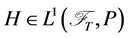

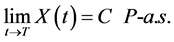

5.1.  -Martingales

-Martingales

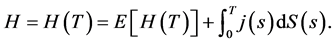

Now, we briefly review the definition of  -martingales which generalizes the concept of a martingale. We refer to [21] for more information about this notion. Throughout this Section,

-martingales which generalizes the concept of a martingale. We refer to [21] for more information about this notion. Throughout this Section,  will be a real linear space of measurable processes indexed by

will be a real linear space of measurable processes indexed by  with paths which are bounded on each compact interval of

with paths which are bounded on each compact interval of .

.

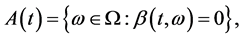

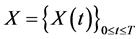

Definition 5.2 A process  is said to be a

is said to be a  -martingale, if every

-martingale, if every  in

in  is

is  -improperly forward integrable and

-improperly forward integrable and

(28)

(28)

Definition 5.3 A process  is said to be

is said to be  -semimartingale if it can be written as the sum of an

-semimartingale if it can be written as the sum of an  -martingale

-martingale  and a bounded variation process

and a bounded variation process , with

, with .

.

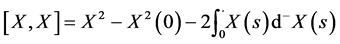

• Remark 5.4

• Let  be a continuous

be a continuous  -martingale with

-martingale with  belonging to

belonging to , then, the quadratic variation of

, then, the quadratic variation of

exists improperly. In fact, if  exists improperly, then one can show that

exists improperly, then one can show that  exists improperly and

exists improperly and .

.

• Let  a continuous square integrable martingale with respect to some filtration

a continuous square integrable martingale with respect to some filtration . Suppose that every process in

. Suppose that every process in  is the restriction to

is the restriction to  of a process

of a process  which is

which is  -adapted. Moreover, suppose that its paths are left continuous with right limits and

-adapted. Moreover, suppose that its paths are left continuous with right limits and . Then

. Then  is an

is an  -martingale.

-martingale.

5.2. Completeness and Arbitrage:  -Martingale Measures

-Martingale Measures

The subsequent definitions and notions are from [21].

Definition 5.5 Let  be a self-financing portfolio in

be a self-financing portfolio in , which is

, which is  -improperly forward integrable and

-improperly forward integrable and  its wealth process. Then

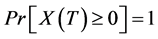

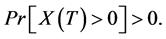

its wealth process. Then  is an

is an  -arbitrage if

-arbitrage if  exists almost surely,

exists almost surely,  and

and

Definition 5.6 If there is no  -arbitrage, the market is said to be

-arbitrage, the market is said to be  -arbitrage free.

-arbitrage free.

Definition 5.7 A probability measure  is called a

is called a  -martingale measure if with respect to

-martingale measure if with respect to  the process

the process  is an

is an  -martingale according to Definition 5.2.

-martingale according to Definition 5.2.

We need need the following assumption. See [21].

Assumption 5.8 Suppose that for all  in

in  the following condition holds. Then

the following condition holds. Then  is

is  -improperly forward integrable and

-improperly forward integrable and

(29)

(29)

The proof of the following proposition can be found in [21].

Proposition 5.9 Under Assumption 5.8, if there exists an  -martingale measure

-martingale measure , the market is

, the market is  -arbitrage free.

-arbitrage free.

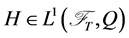

Definition 5.10 A contingent claim is an  -measurable random variable. Let

-measurable random variable. Let  be the set of all contingent claims the investor is interested in.

be the set of all contingent claims the investor is interested in.

• Definition 5.11

• A contingent claim  is called

is called  -attainable if there exists a self-financing trading portfolio

-attainable if there exists a self-financing trading portfolio  with

with  in

in , which is

, which is  -improperly forward integrable, and whose terminal portfolio value coincides with

-improperly forward integrable, and whose terminal portfolio value coincides with , i.e.,

, i.e.,

Such a portfolio strategy  is called a replicating or hedging portfolio for

is called a replicating or hedging portfolio for  and

and  is the replication price for

is the replication price for .

.

• A  -arbitrage free market is called

-arbitrage free market is called  -complete if every contingent claim in

-complete if every contingent claim in  is attainable.

is attainable.

Assumption 5.12 For every  -measurable random variable

-measurable random variable , and

, and  in

in  the process

the process , belongs to

, belongs to .

.

Proposition 5.13 Suppose that the market is  -arbitrage free, and that Assumption 5.8 holds. Then the replication price of an attainable contingent claim is unique.

-arbitrage free, and that Assumption 5.8 holds. Then the replication price of an attainable contingent claim is unique.

Proof. Let  be a given measure equivalent to

be a given measure equivalent to . For such a

. For such a , let

, let  be a set of all strategies (

be a set of all strategies ( - adapted) such that (28) in Definition 5.2 is satisfied. Then, it follows from Proposition 5.9 that the market

- adapted) such that (28) in Definition 5.2 is satisfied. Then, it follows from Proposition 5.9 that the market  in Section 4.2 is

in Section 4.2 is  -arbitrage free.

-arbitrage free.

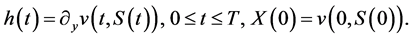

Next, we shall discuss attainability of claims in connection with a concrete set  of trading strategies.

of trading strategies.

5.3. Hedging with Respect to S(t)

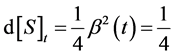

In this Section, we want to determine hedging strategies for a certain class of European options with respect to the price process  of Section 4.2. Let us now assume that

of Section 4.2. Let us now assume that  (a single Bid/Ask). Then, the price process

(a single Bid/Ask). Then, the price process  is the sum of a Wiener process and a continuous process with zero quadratic variation; moreoverwe have that

is the sum of a Wiener process and a continuous process with zero quadratic variation; moreoverwe have that , where

, where  is given by (25). We can derive the following proposition which is similar to [21] (Proposition 5.29).

is given by (25). We can derive the following proposition which is similar to [21] (Proposition 5.29).

Proposition 5.14 Let  be a function in

be a function in  of polynomial growth. Suppose that there exist

of polynomial growth. Suppose that there exist

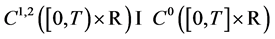

of class

of class  which is a solution of the following Cauchy problem

which is a solution of the following Cauchy problem

(30)

(30)

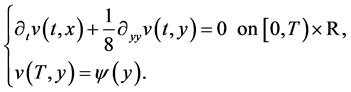

Set

Then  is a self-financing portfolio replicating the contingent claim

is a self-financing portfolio replicating the contingent claim .

.

In particular,  is

is  -complete, where

-complete, where  is given by

is given by

and  by all claims as stated in this Proposition.

by all claims as stated in this Proposition.

Proof. The proof is a direct consequence of Itô’s Lemma for forward integrals. See [21] (Proposition 5.29).

6. Conclusion

In this paper, assuming that the dynamics of the bid and ask prices are given by Itô processes, we derive the stochastic differential equation satisfied by the “best bid” and the “best ask” from which we get the dynamic of the middle (stock) price. The evolution of the latter is given by a semimartingale, whose final variation part, is not absolute continuous with respect to the Lebesgue measure. We then show that, such a market admits a hidden arbitrage opportunity and compute the arbitrage strategy. We also discuss the notion of (insider) hedging in this market.

REFERENCES

- J. Harrison and D. Kreps, “Martingales and Arbitrage in Multiperiod Securities Markets,” Journal of Economic Theory, Vol. 20, No. 3, 1979, pp. 381-408. http://dx.doi.org/10.1016/0022-0531(79)90043-7

- J. Harrison and S. Pliska, “Martingales and Stochastic Integrals in the Theory of Continuous Trading,” Stochastic Processes and Their Applications, Vol. 11, No. 3, 1979, pp. 215-260. http://dx.doi.org/10.1016/0304-4149(81)90026-0

- D. M. Kreps, “Arbitrage and Equilibrium in Economics with Infinitely Many Commmodities,” Journal of Mathematical Economics, Vol. 8, No. 1, 1981, pp. 15-35. http://dx.doi.org/10.1016/0304-4068(81)90010-0

- J. Bion-Nadal, “Bid-Ask Dynamic Pricing in Financial Markets with Transaction Costs and Liquidity Risk,” Journal of Mathematical Economics, Vol. 45, No. 11, 2009, pp. 738-750. http://dx.doi.org/10.1016/j.jmateco.2009.05.004

- E. Jouini and H. Kallal, “Martingales and Arbitrage in Security Market with Transaction Coast,” Journal of Economic Theory, Vol. 66, No. 1, 1995, pp. 178-197. http://dx.doi.org/10.1006/jeth.1995.1037

- A. Cherny, “General Arbitrage Pricing Model. II. Transaction Costs,” In C. Donati-Martin, M. Emery, A. Rouault and C. Stricker, Eds., Séminaire de Probabilités XL, Volume 1899 of Lecture Note in Mathematics, Springer, Berlin, Heidelberg, 2007, pp. 447-461.

- P. Carr, H. Geman and D. Madan, “Pricing and Hedging in Incomplete Markets,” Journal of Financial Economics, Vol. 62, No. 1, 2001, pp. 131-167. http://dx.doi.org/10.1016/S0304-405X(01)00075-7

- H. Föllmer and A. Schield, “Stochastic Finance: An Introduction in Discrete Time,” 2nd Edition, De Gruyter Studies in Mathematics, Berlin, New York, 2004.

- N. El Karoui and M. C. Quenez, “Dynamic Programming and the Pricing of Contingent Claims in Incomplete Markets,” SIAM Journal on Control and Optimization, Vol. 33, No. 1, 1995, pp. 29-66. http://dx.doi.org/10.1137/S0363012992232579

- N. El Karoui, S. Peng and M. C. Quenez, “Backward Stochastic Differential Equations in Finance,” Mathematical Finance, Vol. 7, No. 1, 1997, pp. 1-77. http://dx.doi.org/10.1111/1467-9965.00022

- S. Peng, “Non Linear Expectation, Nonlinear Evaluation and Risk Measure, Volume 1856 of Lecture Notes in Mathematics,” Springer, Berlin, Heidelberg, 2004, pp.165-253.

- S. Peng, “Modelling Derivatives Pricing Mechanisms with Their Generating Functions,” 2006. http://arxiv.org/pdf/math/0605599v1.pdf

- R. Jarrow and P. Protter, “Large Traders, Hidden Arbitrage, and Complete Markets,” Journal of Banking & Finance, Vol. 29, No. 11, 2005, pp. 2803-2820. http://dx.doi.org/10.1016/j.jbankfin.2005.02.005

- E. B. Dynkin, “Markov Processes, Volume 1,” Springer-Verlag, Berlin, Göttigen, Heidelberg, 1965.

- R. Fernholz, “Stochastic Portfolio Theory,” Springer-Verlag, Berlin, 2002. http://dx.doi.org/10.1007/978-1-4757-3699-1

- A. D. Banner and R. Ghomrasni, “Local Times of Ranked Continuous Semimartingales,” Stochastic Processes and their Applications, Vol. 118, No. 7, 2008, pp. 1244-1253. http://dx.doi.org/10.1016/j.spa.2007.08.001

- R.Ghomrasni and O. Menoukeu-Pamen, “Decomposition of Order Statistics of Semimartingales Using Local Times,” Stochastic Analysis and Applications, Vol. 28, No. 3, 2010, pp. 467-479. http://dx.doi.org/10.1080/07362991003708341

- R. J. Chitashvili and M. G. Mania, “Decomposition of the Maximum of Semimartingales and Generalized Itô’s Formula” In: V. V. Sazonov and T. L. Shervashidze, Eds., New Trends in Probability and Statistics, Volume 1, Proceedings of the Bakuriani Colloquium in Honour of Yu. V. Prohorov, USSR, Bakuriani, 24 February-4 March 1990, pp. 301-350.

- P. Protter and K. Shimbo, “No Arbitrage and General Semimartingales,” In: Markov Processes and Related Topics: A Festschrift for Thomas G. Kurtz, Volume 4, Institute of Mathematical Statistics, Beachwood, 2008, pp. 267-283.

- P. Protter, “Stochastic Integration and Differential Equations,” 2nd Edition, Springer-Verlag, Berlin, 2005. http://dx.doi.org/10.1007/978-3-662-10061-5

- R. Coviello and F. Russo, “Modeling Financial Assets without Semimartingale,” 2006. http://arxiv.org/pdf/math/0606642.pdf

- D. Nualart and E. Pardoux, “Stochastic Calculus with Anticipating Integrands,” Probability Theory and Related Fields, Vol. 78, 1988, pp. 535-581. http://dx.doi.org/10.1007/BF00353876

NOTES

1In fact since S is continuous and since all continuous sigma martingales are in fact local martingales, we only need to concern ourselves with local martingales