American Journal of Operations Research

Vol.05 No.06(2015), Article ID:60989,12 pages

10.4236/ajor.2015.56040

When to Sell an Asset Where Its Drift Drops from a High Value to a Smaller One

Pham Van Khanh

Institute of Economics and Corporate Group, Hanoi, Vietnam

Copyright © 2015 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

Received 28 June 2015; accepted 8 November 2015; published 11 November 2015

ABSTRACT

To solve the selling problem which is resembled to the buying problem in [1] , in this paper we solve the problem of determining the optimal time to sell a property in a location the drift of the asset drops from a high value to a smaller one at some random change-point. This change-point is not directly observable for the investor, but it is partially observable in the sense that it coincides with one of the jump times of some exogenous Poisson process representing external shocks, and these jump times are assumed to be observable. The asset price is modeled as a geometric Brownian motion with a drift that initially exceeds the discount rate, but with the opposite relation after an unobservable and exponentially distributed time and thus, we model the drift as a two-state Markov chain. Using filtering and martingale techniques, stochastic analysis transform measurement, we reduce the problem to a one-dimensional optimal stopping problem. We also establish the optimal boundary at which the investor should liquidate the asset when the price process hit the boundary at first time.

Keywords:

Optimal Stopping Time, Posterior Probability, Threshold, Markov Chain, Jump Times, Martingale, Brownian Motion

1. Introduction

In this paper we consider the following problem: How to find the optimal stopping time to sell a stock (or an asset) when the expected return of a stock is assumed to be a constant larger than the discount rate up until some random, and unobservable, time τ, at which it drops to a constant smaller than the discount rate.

An investor wants to hold the position as long as the inertia is present by taking advantage of the drift which is exceeding the discounted rate (or interest rate). On the other hand, when the inertia disappears the investor would like to exit the position by selling the asset.

The under study problem in this paper was also addressed in [1] where the buying problem with the same assumption was solved. The results of [1] showed that the optimal buying time was the first passage time over some unknown level for the a posteriori probability process

defined below and by simulating it was found that the optimal time to buy an asset was the time which the asset price process had just passed the trough.

defined below and by simulating it was found that the optimal time to buy an asset was the time which the asset price process had just passed the trough.

The author of [2] studied a problem of finding an optimal stopping strategy to liquidate an asset with unknown drift; more exactly he wanted to find the best time to sell a stock when its drift was a discrete random variable which took the given values. The first time the posterior mean of the drift passes below a non-decreasing boundary that is the unique solution of a particular integral equation is shown to be optimal.

Some classical optimal stopping time problem has been considered in [3] . These are applied in mathematical finance but these are basic problem, and it is difficult to apply in real world.

For related studies of stock selling problems, see [4] [5] and for studies of basic optimal stopping problems see [3] . The method we use to study in this paper is the martingale theory, the transformation theory of measuring and the optimal stopping time is referenced in the literature [3] [6] [7] .

In this paper, the asset price is modeled as a linear Brownian motion with a drift that drops from one constant to a smaller constant at some unobservable time. This drift is modeled as a Markov chain with two states which are denoted by 0 and 1 where 0 is denoted for price decrease and 1 is denoted for price increase.

We define the asset price model in Section 2, and the optimal selling problem is set up. In Section 3, we study the simulation to examine our studies and finally, Section 4 is conclusion.

2. The Model

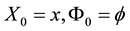

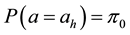

We take as given a complete probability space . On this probability space, let the change-point τ be a random variable with distribution

. On this probability space, let the change-point τ be a random variable with distribution

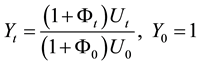

where λ is the intensity of the transition from state 1 to state 0 and assume that λ is positive and that belongs to [0; 1). Denote the drift of the price process at, t ≥ 0, can be modeled as a Markov chain with two states al denoted by state 0 and ah denoted by state 1 such that ;

;

at time 0, al < r < ah where r is discounted rate which is a given constant and process at, t ≥ 0 can only transit from state 1 to state 0

at time 0, al < r < ah where r is discounted rate which is a given constant and process at, t ≥ 0 can only transit from state 1 to state 0

with transition density matrix as follows

Next, let W be a Brownian motion which is indepen-

Next, let W be a Brownian motion which is indepen-

dent of τ. The asset price process X is modeled by a geometric Brownian motion with a drift that drops from ah to al at time τ. More precisely,

and , where

, where

i.e.

i.e.

if

if

and

and

if

if

the volatility

the volatility

is a constant.

is a constant.

At the time of

we define the a posteriori probability process

we define the a posteriori probability process

where

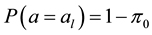

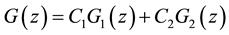

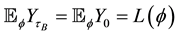

Find

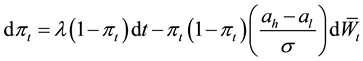

Similar the buying problem, posterior probability process

or

where

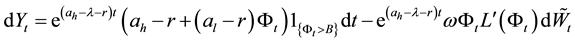

Moreover, in terms of

Processes

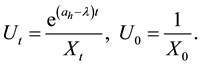

Put

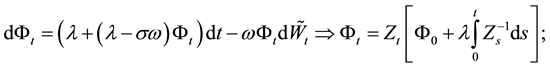

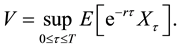

We define new process

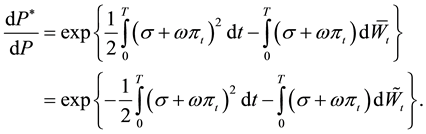

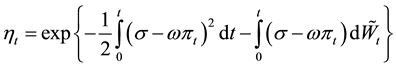

and a new measure

By Girsanov theorem,

where

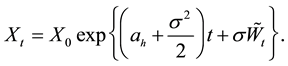

The price process

or in term of

The solution of this stochastic equation is

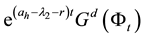

Now we consider the process:

then

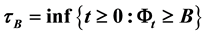

Let

Put

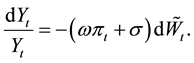

From this we have

Denote

then

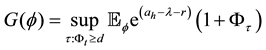

To solve the problem (2.1) we solve the following auxiliary problem:

Put

The optimal stopping time is the first hitting time of the process

where

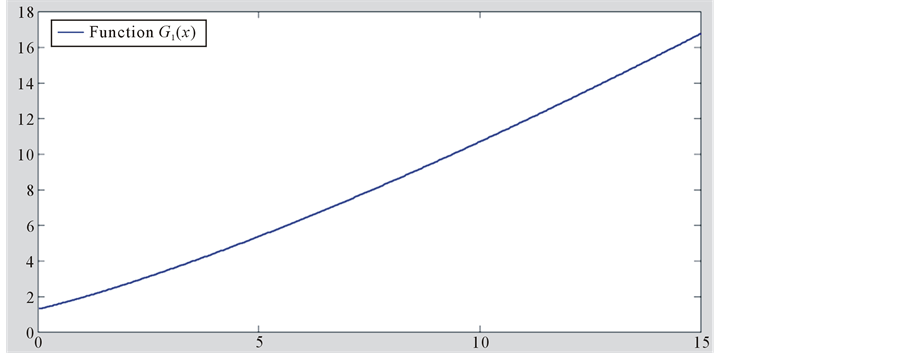

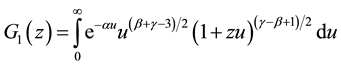

Differential equation in (2.3) has the general solution as follows:

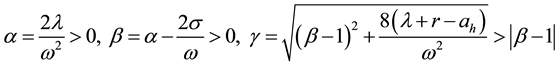

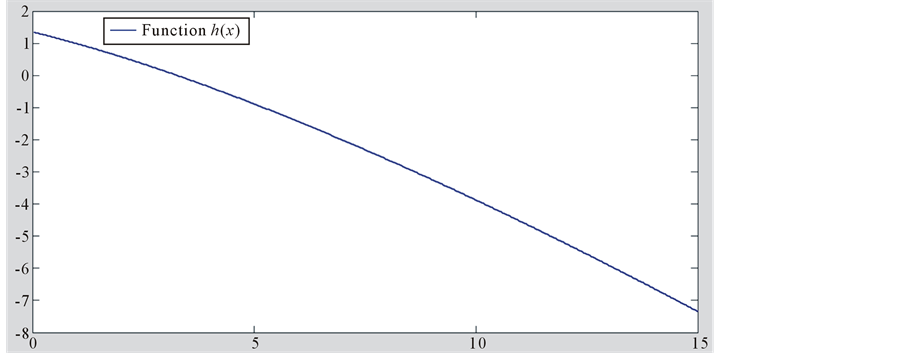

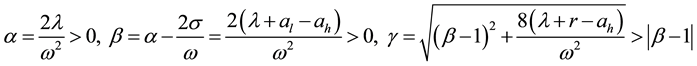

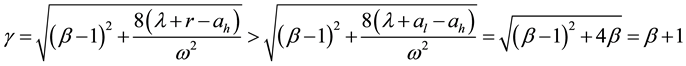

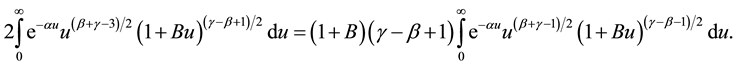

Changing variables and using some analytic transformations we obtain:

then

We also have

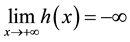

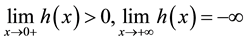

as

We have

since

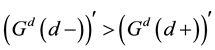

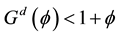

Moreover

since

These mean that the function

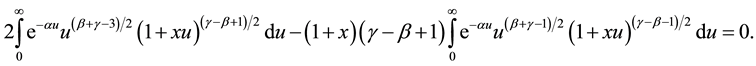

Figure 1 shows the graph of function

But

According to (2.3) we have

Figure 1. Graph of the function

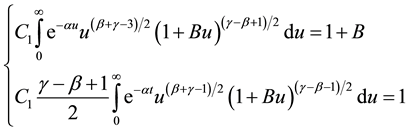

Figure 2. Graph of the function

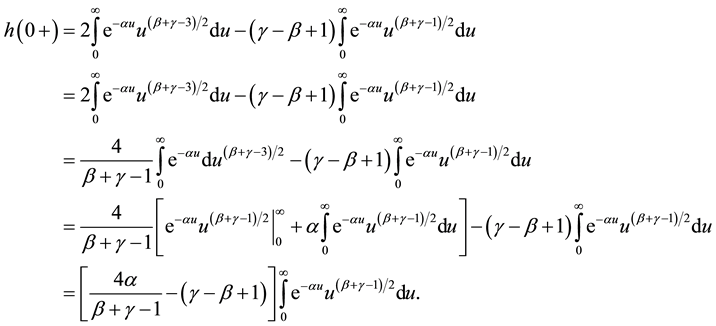

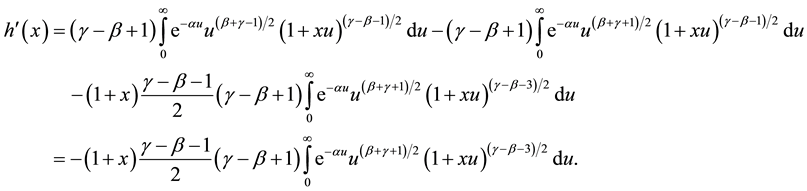

So B is the solution of the following equation:

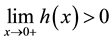

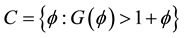

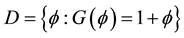

Lemma 2.1. The free boundary Equation (2.4) has unique positive solution B.

Proof: The Equation (2.4) is equivalent to

Denote:

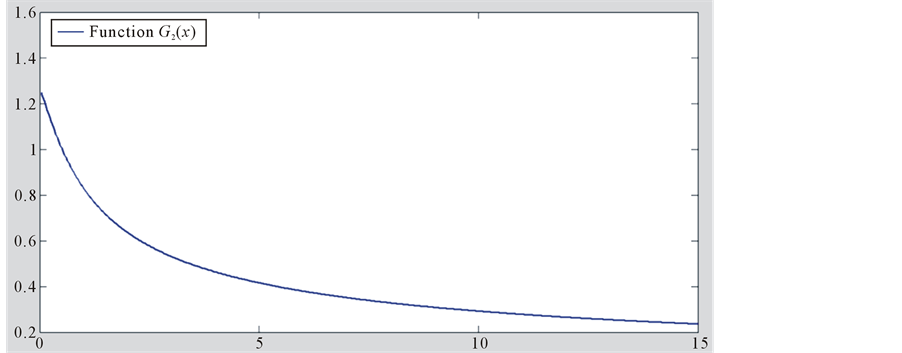

The graph of

We have

Figure 3. Graph of the function

It follows that

Because

and

we obtain

We will prove that

since

Consequently,

solution on

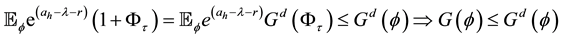

Theorem 2.2. Stopping time

Proof: Let

and we will prove that

Now, we examine the function

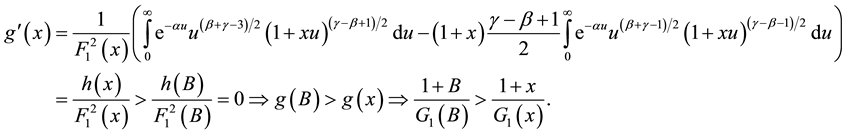

Take the derivative we obtain

This follows

Using the Dynkin’s formula to the process

Because B satisfying

By

We will show that B satisfy the condition:

with positive value will be in continuation area

The optimal stopping time is the first hitting time of

Thus function G satisfy the following condition:

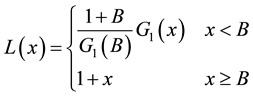

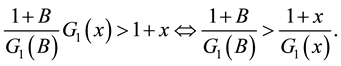

We define the function:

Now, we assume

This contradicts to the existence of

The optimal stopping time

But

by this, we have finished the provement.

3. Simulation Study

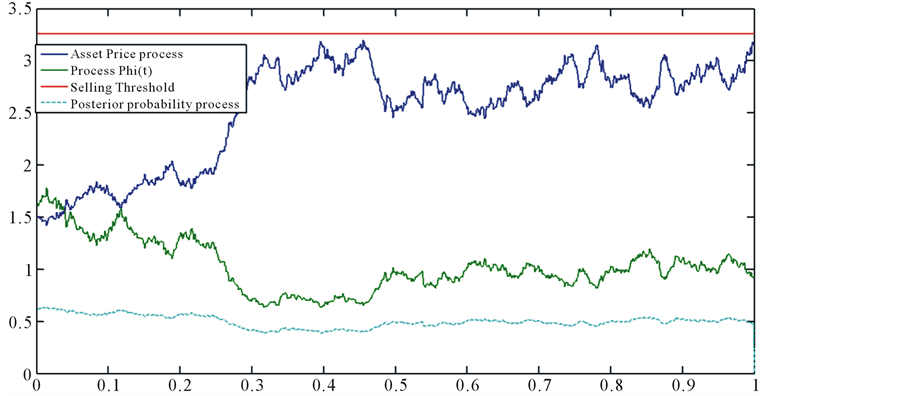

To make visual for the above theory we simulate the asset price process, the posterior probability process

process

parameters is used in our simulating are

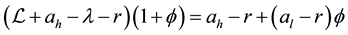

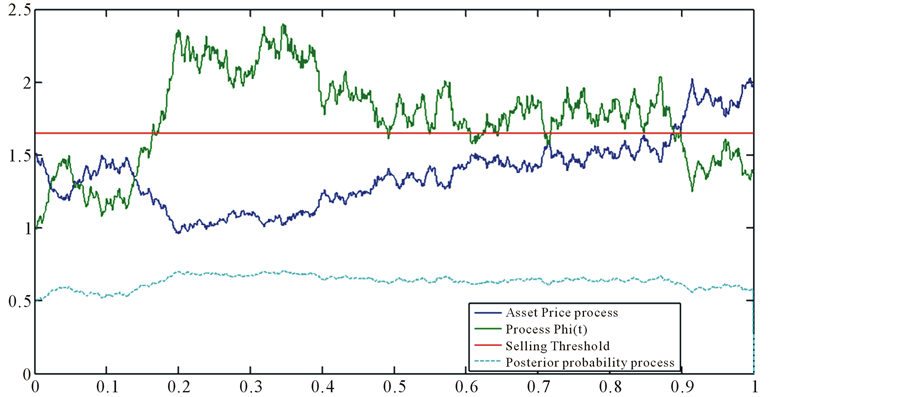

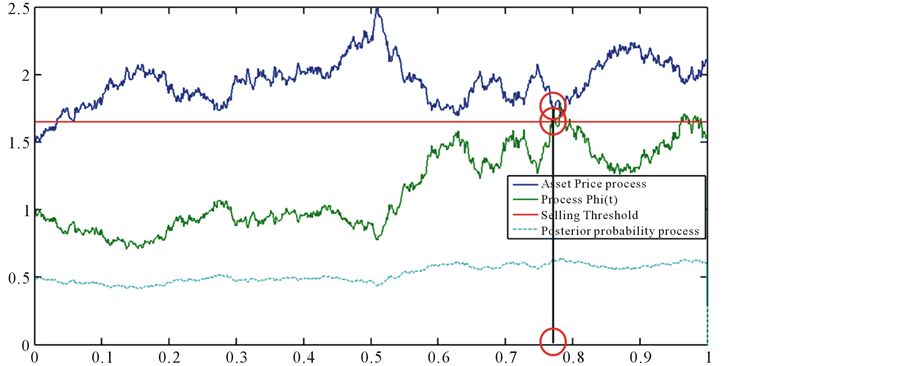

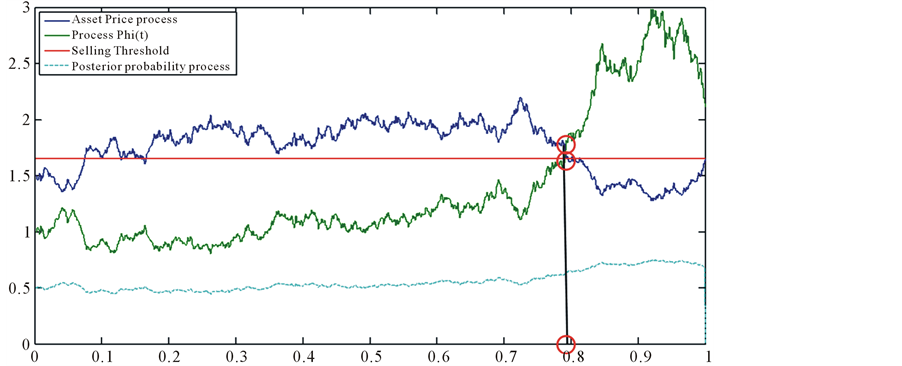

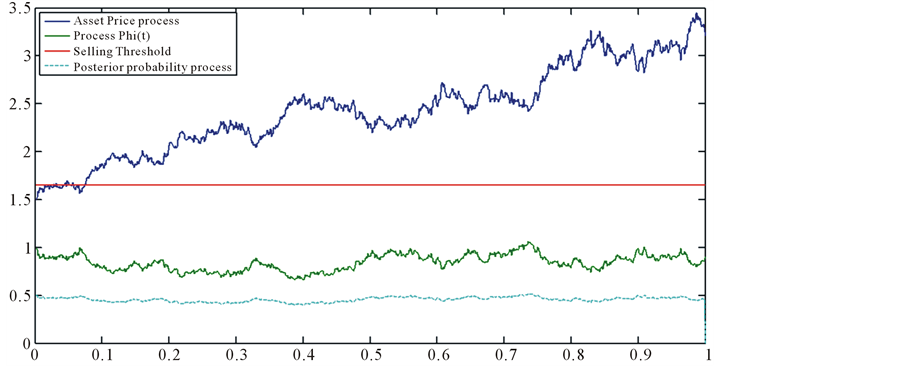

As can be seen in the figures from 4 to 8 if the price is increasing then the

Figure 4 shows the price process has increased since the time 0.2 so the

Figure 5 simulate a price process which is fluctuated from time 0 to 0.14 and decrease dramatically at the time 0.14 so the process

Another simulation is shown in Figure 6. Clearly, whenever the price process is increasing, the

Figure 4. A simulation of asset price process, the posterior probability process, process Φ(t), the threshold probability and the optimal stopping time. In this case, the process Φ(t) always under the threshold probability so the optimal stopping time is the final time 1.

Figure 5. A simulation of asset price process, the posterior probability process, process Φ(t), the threshold probability and the optimal stopping time. In this case, the first time that the process Φ(t) over passes the threshold probability at the time 0.17 so the optimal stopping time is 0.17.

In Figure 7, we can see the same scenario with the simulation in Figure 6. The time to liquidate in this case is 0.795, the price is about 1.75 whereas the started price was 1.5. We can see

The same scenario with the simulation in Figure 1, the simulation results in Figure 8 show the price illustrates an uptrend from time 0 to the end that the process

4. Conclusion

This research considers the problem of how to find the optimal time to liquidate an asset when the asset price is modeled by the geometric Brownian motion which has a change point. In particular, the drift of the process drops from a high value to a smaller one and this drift process can be modeled as two-state Markov process. The results of this research indicate that a optimal selling decision is made when the probability of downtrend surpassed some certain threshold. We also simulate the price process with a number of parameters and conduct

Figure 6. A simulation of asset price process, the posterior probability process, process Φ(t), the threshold probability and the optimal stopping time. In this case, the first time that the process Φ(t) over passes the threshold probability at the time 0.77 so the optimal stopping time is 0.77.

Figure 7. A simulation of asset price process, the posterior probability process, process Φ(t), the threshold probability and the optimal stopping time. In this case, the first time that the process Φ(t) over passes the threshold probability at the time 0.795 so the optimal stopping time is 0.795.

Figure 8. A simulation of asset price process, the posterior probability process, process Φ(t), the threshold probability and the optimal stopping time. In this case, the process Φ(t) always under the threshold probability so the optimal stopping time is the final time 1, the same with the case in Figure 4.

numerical solution to the experimental selling threshold. In next studies, we will consider problems in which the price growth rate is a Markov process which has more than 2 states and establish some properties as well as distribution of stopping time.

Acknowledgements

This research is funded by Vietnam National Foundation for Science and Technology Development (NAFOSTED) under grant number 10103-2012.17.

Cite this paper

PhamVan Khanh, (2015) When to Sell an Asset Where Its Drift Drops from a High Value to a Smaller One. American Journal of Operations Research,05,514-525. doi: 10.4236/ajor.2015.56040

References

- 1. Khanh, P. (2014) Optimal Stopping Time to Buy an Asset When Growth Rate Is a Two-State Markov Chain. American Journal of Operations Research, 4, 132-141.

http://dx.doi.org/10.4236/ajor.2014.43013 - 2. Khanh, P. (2012) Optimal Stopping Time for Holding an Asset. American Journal of Operations Research, 4, 527-535.

http://dx.doi.org/10.4236/ajor.2012.24062 - 3. Peskir, G. and Shiryaev, A.N. (2006) Optimal Stopping and Free-Boundary Problems (Lectures in Mathematics ETH Lectures in Mathematics. ETH Zürich (Closed)). Birkhäuser, Basel.

- 4. Shiryaev, A.N., Xu, Z. and Zhou, X.Y. (2008) Thou Shalt Buy and Hold. Quantitative Finance, 8, 765-776.

http://dx.doi.org/10.1080/14697680802563732 - 5. Guo, X. and Zhang, Q. (2005) Optimal Selling Rules in a Regime Switching Model. IEEE Transactions on Automatic Control, 9, 1450-1455.

http://dx.doi.org/10.1109/TAC.2005.854657 - 6. Lipster, R.S. and Shiryaev, A.N. (2001) Statistics of Random Process: I. General Theory. Springer-Verlag, Berlin, Heidelberg.

- 7. Shiryaev, A.N. (1978) Optimal Stopping Rules. Springer Verlag, Berlin, Heidelberg.