American Journal of Operations Research

Vol. 2 No. 4 (2012) , Article ID: 25142 , 9 pages DOI:10.4236/ajor.2012.24056

The Influence of Interactive Control on Subsidiary Performance: A Mediating Role of Subsidiary Managers’ Strategic Behavior

School of Management, University of Science & Technology of China, Hefei, China

Email: *yujj@mail.ustc.edu.cn

Received September 3, 2012; revised October 5, 2012; accepted October 18, 2012

Keywords: Enterprise Group; Interactive Control; Strategic Behavior; Performance

ABSTRACT

Under the principal-agent relationship, there are two major factors that directly affect subsidiary strategy’s implementation and performance—enterprise groups’ internal interactive control and subsidiary managers’ strategic behavior. Prior research showed that the parent companies hope their subsidiary managers to be obedient and active, i.e. to keep a high degree of strategic identity and subsidiary initiative. We build and analyze a model to test the mediating role of strategic identity and subsidiary initiative based on data collected from Chinese groups. The results show that interactive control, strategic identity and subsidiary initiative all could improve subsidiary performance, furthermore, subsidiary initiative is a mediator between decision-making decentralization and subsidiary performance, and also a mediator between horizontal communication and subsidiary performance, the mediating role of strategic identity is not tested, but vertical communication can improve strategic identity. In the conclusions, we provide guidance on how parent companies to choose excellent subsidiary managers, and then how to develop a suite interactive control system.

1. Introduction

Enterprise groups realize the value added through optimizing resources distribution, a long-term steady development must be safeguarded by a win-win relationship between parent companies and subsidiaries, and parent companies must make efforts to enhance subsidiary performance within the group strategy. In fact, the effective synergy can be realized only by solving information asymmetry between parent companies and subsidiaries. Certain control measures often been taken to control the subsidiary managers. The most common control mechanism is institutional control which has a series of standardized behavior rules, and another common is interactive control which is an interactive process of parentsubsidiary managers. Institutional control only prevents or reduces the loss risk caused by the subsidiary managers’ personal behavior through the bureaucratic, but this control mechanism requests all strategic process can be accurate prediction, and tends to ignore people’s subjective initiative [1]. By contrast, interactive control (including decision-making decentralization, vertical communication and horizontal communication) realizes advantage-resources shifting and sharing through the interpersonal interactions, enhances enterprise groups’ internal collaborative efficiency and coordination innovation ability [2,3], and also improve the reaction rate to environmental risks [4]. Thus, interactive control is the proper control mechanism to achieve value added or even achieve value breakthrough.

Besides, principal-agent relationship determines the subsidiary managers’ business capability and work efforts etc. all influence the subsidiary performance directly [5], so parent companies also need to control the subsidiary managers’ behaviors to achieve the final goal. However, there is a significant barrier—due to the target inconsistent between parent companies and subsidiaries, the subsidiary managers maybe behavior according to their own preferences or interests, so the key issue faced by parent companies is to drive the managers to acknowledge the groups’ goal or strategy, that is, make the subsidiary managers’ behaviors comply with the group and meet the group’s strategic demands (including strategic identity and subsidiary initiative) [6]. But there are always some gaps among interactive control, subsidiary managers’ strategic behavior and subsidiary performance in the past research [7], e.g. through both took interactive control as the independent variable, Siemsen & Balasubramanian (2007) took the subsidiary company managers’ behavior as the dependent variable, but ignore the behavior’s impact on performance [8], and hill & Bartol (2009) took subsidiary performance as the dependent variable, but ignore the subsidiary managers’ influence [9]. Therefore, we believe that it’s necessary to arrange and induction the relations among interactive control, strategic behavior and subsidiary performance.

Our major contribution is that we systematically analyze how the strategic behavior mediates the relationship between interactive control and subsidiary performance. We acquired data from a questionnaire investigation in China, and the analysis method is structural equation model (SEM). The conclusions provide theoretical references on the strategic management and human resource management practices of Chinese enterprise groups.

2. Conceptual Model and Hypotheses

2.1. Definition and Influence of Strategic Behavior

Jensen & Meckling module—a corporate governance module based on principal-agent theory suggests that the parent companies should take actions to ensure the subsidiary managers’ behaviors are in line with the groups’ requirements or interests [5]. Similarly, as early as 1947, Simon pointed out that the success of multi-units organizations is premised on the condition with which the units’ managers consider organizational objectives not just their own objectives [10]. So the strategic behavior we concerned in this paper is the behavior patterns that fit to parent companies’ expect. According to the related research, we can find out two basic behavior patterns, i.e. strategic identity and subsidiary initiative.

1) Strategic Identity

Strategic identity is defined as that the parent company and a subsidiary reach a consensus on strategic issues under the information asymmetry as a basic requirement to implement the current strategy. Valentine & Godkin (2002) treated the strategic identity as an intrinsic motivation for an individual to keep his behavior consistent with his organization [11], was a premise of organizational commitment. Tsai’s (2000) research showed that a high degree of strategic identity can improve collaborative validity by promoting the enterprise groups’ internal resources flow (especially some special resources) and strategic relevance [6].

Hypothesis 1. (H1.) Strategic identity could increase subsidiary performance.

2) Subsidiary Initiative

Subsidiary initiative is defined as that the process of the subsidiary manager aggressively to recognition and capture opportunities or overcome the difficult [12], subsidiary initiative is the driving force for developing and adapting to the future. From the emergent strategy viewthe subsidiary initiative would be considered as an enterprise strategic resources, to ensure a sustainable performance [13]. If the subsidiary managers’ initiative is high, then he may be able to display his enthusiasm in many ways, such as will be actively participate in the group’s decision-making process, and even actively strengthen the relationship with the parent company for more resources [14], “he is likely to raise the status of own company in the group”, Phelps & Fuller said [15].

Hypothesis 2. (H2.) Subsidiary initiative could increase subsidiary performance.

3) Strategic Identity and Subsidiary Initiative

Generally speaking, the subsidiary initiative mainly comes from entrepreneurship, but some research shows that it also could be affected by the organizational environment. In fact, there might be a connection between strategic identity and subsidiary initiative. Becker’s (1992) research indicated that the personal organization identity has a positive effect on “prosocial” behavior, and a negative effect on personal behavior [16], similarly, Hirst & Dick (2009) pointed out that organization identity could play an incentive role, increased organization members’ creativity and initiative [17]. It means enterprise groups can improve subsidiary initiative by establishing strategic identity.

Hypothesis 3. (H3.) Strategic identity could increase subsidiary initiative.

2.2. Definition and Influence of Interactive Control

There are competition and cooperation in an enterprise group, enterprise groups need a lot interpersonal interactions to achieve operational coordination and knowledge sharing [18], and also to improve the groups’ adaptability to internal or external environment, so interactive control is defined as the interpersonal interaction among enterprise groups’ different units which could be happened in two different ways: between the parent company manager and the subsidiary manager or between different managers in different subsidiaries, the level of interaction used to evaluation the information and decision sharing degree, Boone & Hendriks (2009) divided interactive control into three parts: decision-making decentralization, communications between the parent company manager and the subsidiary manager (vertical communication), communications between different managers in different subsidiaries (horizontal communication) [19]. Decisionmaking decentralization occurs in decision making or task allocation process, communication occurs in the decision’s convey process, training or visit process. In fact, knowledge and information transfer condition must be a basis for the subsidiary managers’ decisions.

1) Decision-Making Decentralization

Decision-making decentralization not only could improve the subsidiary’s response speed to the market, but also could improve the subsidiary managers’ job enthusiasm and satisfaction. First, due to subsidiary managers are more close to the market, and could make a timely response to the local environment or own company market; Second, subsidiary manager must be easier to accept the strategy in which themselves involve. Knight (1999) thought that the participation could cause a deeper strategic understanding, the team members would have more confidence on the strategy which has obtained a common recognized, then the managers would have a higher satisfaction to enhance the strategic implementation [20]. Third, decision-making decentralization may have an incentive function. Once the parent company gives a subsidiary manager enough freedom, participation, and sound shows that the parent company has an affirmation and trust on the managers’ ability. While the manager feels been trusted, his risk consciousness will be stronger, and will have a higher loyalty to the group [21], such as advance the strategic planning and build talents in a positive attitude. In short, decision-making decentralization can improve the subsidiary initiative, subsidiary initiative plays a mediating role between decision-making decentralization and subsidiary performance (“Decision-making decentralization → performance”, we will use the expression like this below).

However, decision-making decentralization will also increase information asymmetry between the parent company and subsidiary. Due to a lack of strategic understanding, the goal difference of parent company and subsidiary may increase, thus led the subsidiary manager only focus on his subsidiary performance, but cannot improve subsidiary performance by the group’s resources. So the strategic identity doesn’t play a mediating role on “Decision-making decentralization → performance”.

Hypothesis 4. (H4.) Decision-making decentralization could increase the subsidiary performance.

Hypothesis 4a. (H4a.) Subsidiary initiative is a mediator between decision-making decentralization and subsidiary performance.

2) Communication

Vertical communication and horizontal communication both could improve resource transfer efficiency and reduce transaction cost. On the one hand, communication is an effective tool to reduce the information asymmetry that produces conflict among different units. Communication can reduce frictions, and increase the units’ operational capability and bring a more matching motivation [22]. On the other hand, communication is the basic way of knowledge sharing and operational coordination. Transaction cost theory and organizational learning theory suggest that the subsidiaries could obtain the necessary knowledge systems within the group through an interactive process without paying a lot transaction costswhen there is a lack of communication, transaction costs will inevitably increase [23]. Therefore, enterprise groups’ internal communication has positive implications on the subsidiary performance.

Hypothesis 5. (H5.) Vertical communication could increase subsidiary performance.

Hypothesis 6. (H6.) Horizontal communication could increase subsidiary performance.

But vertical communication and horizontal communication have different effects on subsidiary managers’ strategy identity. As a resource and competence heart, vertical communication must contribute to the knowledge sharing, accelerate the personal knowledge turn into the group knowledge (or the group knowledge into the personal knowledge) [24], prompting the subsidiary manager have a better understanding to the parent company or other subsidiaries in a whole view [25], improve the identity to the group’s strategic decision. However, horizontal communication always informal, or with the parent company as a bridge, the phenomenon of competing for resources with each other frequently occurs. Moreover, horizontal communication often accompanied by staff mobility or interpersonal relationships, only can share strategic cognition in the two sides, it’s difficult to spread to the enterprise groups’ strategic level. If no communication with the parent company, simply horizontal communication may form an “informal organization”, and even has a negative impact on strategy identity [26].

Hypothesis 5a. (H5a.) Strategy identity is a mediator between Vertical Communication and performance.

Similarly, vertical communication and horizontal communication have different effects on subsidiary initiative. The subsidiary managers’ perceived control is altered under different communication. From the subsidiary managers’ view, knowledge transfer brought by horizontal communication is under an equal position, cross-border knowledge coordination and integration would be more effective [22], for example, when a subsidiary faces a unique competitive environment, it will develop a unique knowledge, competitors and customers which may serve as a sharing for other subsidiaries. Kahnke & Venzin (2003) pointed out that communication among subsidiaries can improve the subsidiary managers’ technical and managerial capacity, and then increase personal initiative and motivation [2]. However, subsidiary managers constantly regard the vertical communication as a waste of time or interference. They think the parent companies don’t concern about the two-way information transmission, interactive process may be regarded as a direct interference on the subsidiary’s operations [27], this will make the managers feel be controlled or not be trusted, communication’s efficiency will reduce [28], this means that the vertical communication is beneficial to commitment but not initiative.

Hypothesis 6a. (H6a.) Subsidiary initiative is a mediator between horizontal communication and performance.

3. Method

3.1. Data Collection and Measurement Scales

In order to obtain the real subsidiary managers’ strategic behavior information, a printed questionnaire was sent to the subsidiaries’ managers came from the EMBA or MBA in the University of Science & Technology of China, also includes some subsidiaries’ managers of the EMBA students’ groups who are suitable for the questionnaire. 429 questionnaires were issued, and 147 questionnaires were returned in which 140 were valid. The valid response rate is 32.6%.

To ensure the questionnaire’s reliability and validity, the measurement scales all reference to the original questionnaire of earlier studies. Consider that our samples all received the higher education, and have a higher understanding ability and discrimination ability, so we adjusted part of the original question for reducing the question number and shortening the required time. All questions were described as a five-point Likert scale, and the variables were measured as follows.

• Interactive control. Decision-making decentralization was measured from Persaud (2005), including: 1) Human resources (HR) or organizational structure change; 2) Budget allocation or profits expenditure; 3) Production and operation; 4) Marketing; 5) Pricing strategy [29]. Communication was measured from Subramaniam (2006), including: 1) Formal electronic communication; 2) Formal face-to-face communication; 3) Informal communication [30]. Communication’s frequency was asked from vertical communication perspective and horizontal communication perspective.

• Strategic behavior. Strategic identity was measured based on Kickul & Belgio’s (2004) research, including: 1) Overall strategy identity; 2) Priority strategy identity; 3) Key strategy identity [31]. Subsidiary initiative was measured based on Zeng’s (2001) research, including the subsidiary manager to show initiative on the following four aspects: 1) Technology/knowledge innovation; 2) Suggestion/proposal actively; 3) Operation innovation; 4) Explore markets [32].

• Subsidiary performance. Because our questionnaire involved a variety of industries, so we adopted a subjective measurement. The scales was based on Demirbag & Tatoglu’s (2010) research, including: 1) Market growth; 2) Profit margin; 3) Return on investment [33].

3.2. Measurement Testing

We used structural equation model (SEM) in this paper to analyze the hypotheses, the main analytical tools were Spss17.0 and Amos 17.0. SEM is a statistical analysis method for the quantitative research of behavior science and social science, and is often utilized to confirmatory analysis, its biggest advantage is that it can analyze the relations between several independent variable and several dependent variable which linear regression cannot achieve [34].

We tested the normal distribution by descriptive statistical, results shows that the skewness coefficient (maximum value 0.891) and the kurtosis coefficient (maximum value 0.895) both are smaller than 1.000, this means the data are approximately normal distribution.

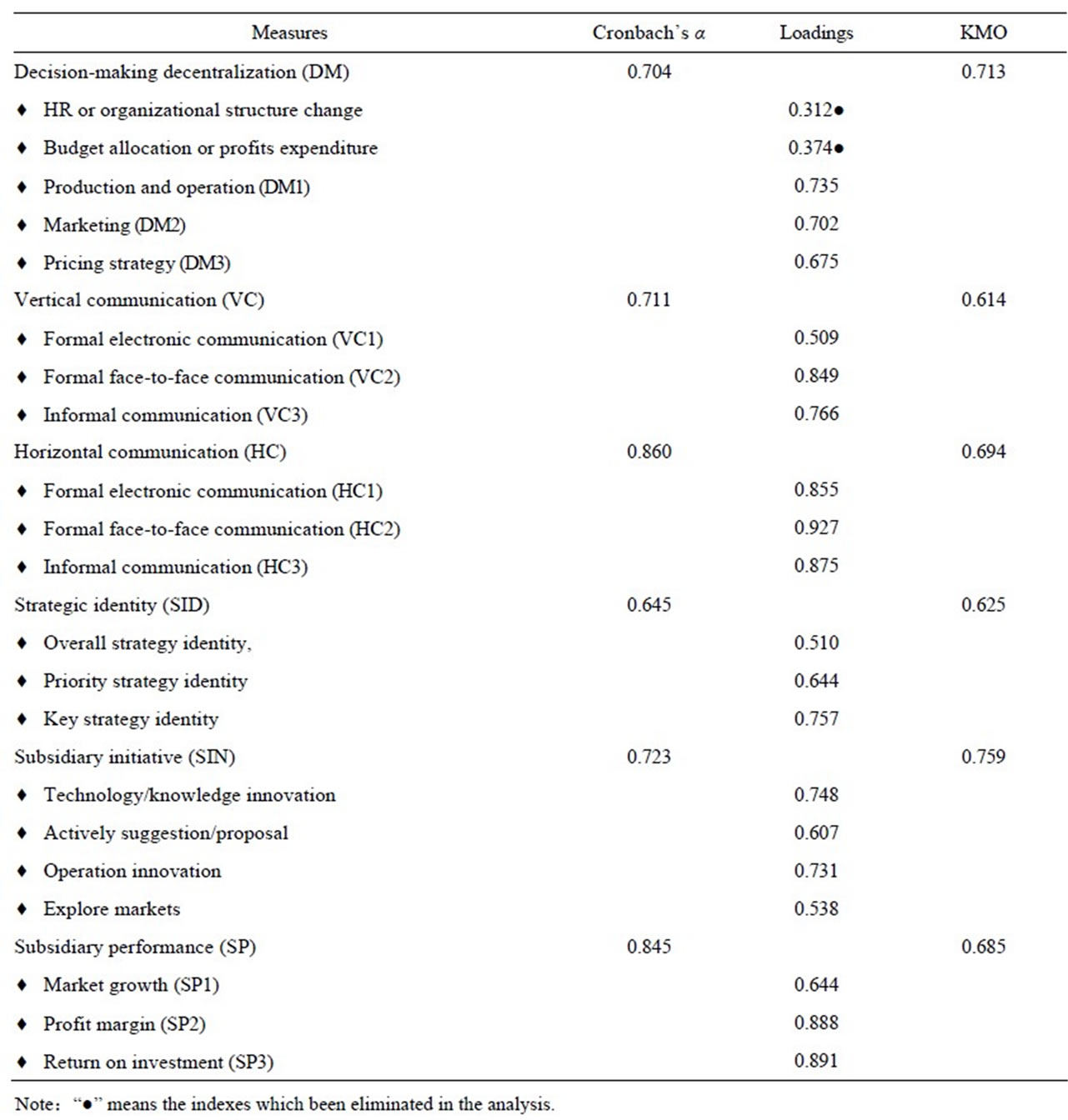

Since the original questionnaire had been modified, we test the questionnaire reliability and validity again. As the Table 1 shows, we use the Cronbach’s α to check the reliability, the minimum value of these latent variables coefficient is 0.645, all over 0.6, and this means the internal consistency is good. Besides, we use factor analysis to test the validity, the KMO values are greater than 0.6, and the loadings are greater than 0.5 except “HR or organizational structure change” and “budget allocation or profits expenditure” which are excluded in the follow analysis, the construct validity pass the test.

3.3. Model Testing and Results

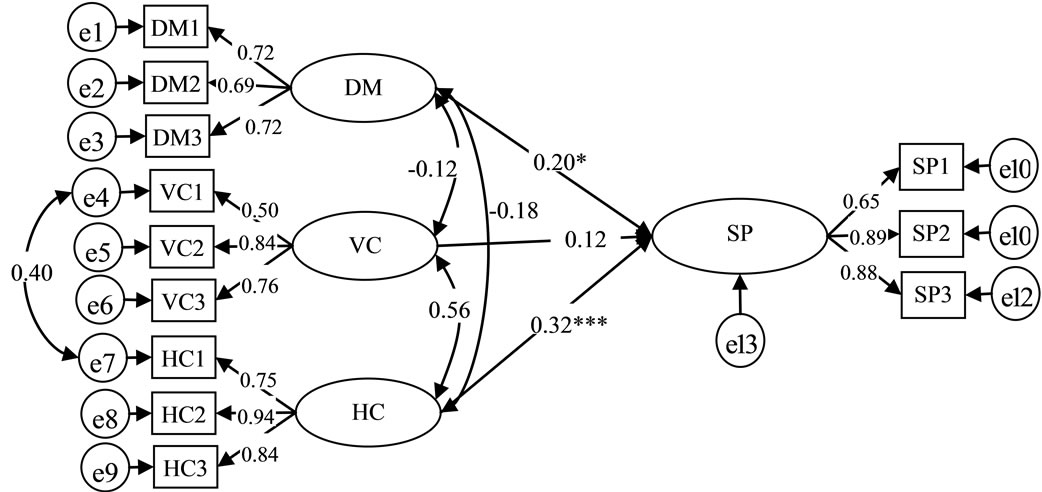

First, we test the immediate effects between interactive controls on subsidiary performance, the path analysis results are shown in Figure 1, there is a correlation between e4 and e7, maybe because enterprise groups usually adopt an electronic information-sharing platform. The fit indices including absolute fit indices (P = 0.169 > 0.08 and RMSEA = 0.037 < 0.05), incremental fit indices (IFI = 0.987 > 0.9, CFI = 0.941 > 0.9) and parsimonious fit indices (x2/df = 1.195 < 2) are all reach the fitting degree, this means the model agrees well with the practice.

As we can see in Figure 1, decision-making decentralization and horizontal communication are conducive to subsidiary performance. The standardization total utility of decision-making decentralization on performance is 0.20 (P = 0.047), and the standardization total utility of horizontal communication on the performance is 0.32 (P = 0.008), both reach the significant level. But the standardization total utility of vertical communication on performance doesn’t reach the significant level (P = 0.314). This shows that hypothesis 4 and hypothesis 6 pass the test, but hypothesis 5 doesn’t pass the test in this sample.

Second, in order to confirm the immediate effects and mediating role of strategic behavior, we construct two

Table 1. Results of reliability and validity test.

Figure 1. Results of the interactive control on subsidiary performance.

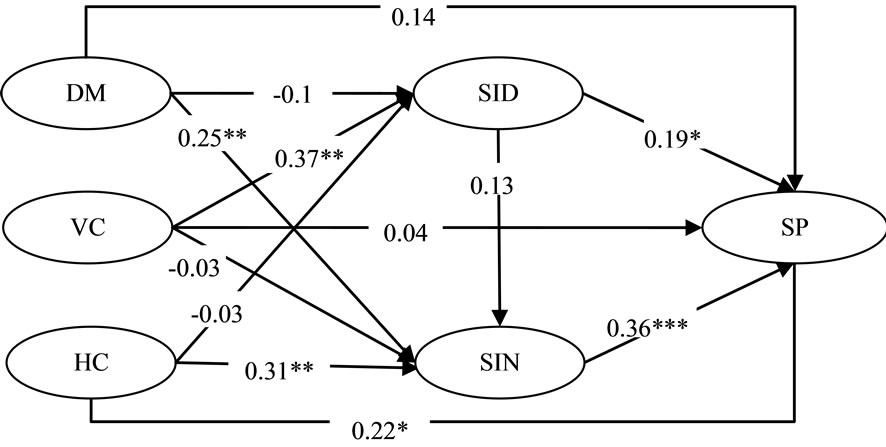

models with which strategic identity and subsidiary initiative as intermediary variables. In model 1, strategic identity and subsidiary initiative both are intermediary variables for three interaction (called “multi-intermediary variables model”), the results were shown in Figure 2, the fit indices reached the fitting degree (P = 0.386 > 0.08, RMSEA value = 0.015 < 0.05, IFI = 0.995 > 0.9, CFI = 0.995 > 0.9, x2/df = 1.031 < 2). This indicated that the model 1 was in good fit. As you can see from Figure 2, decision-making decentralization and Horizontal communication do not have significantly positive effect on strategic identity, and vertical communication do not have significantly positive effect on subsidiary initiative, and these relations also has not been hypothesis, so we could think that there are no intermediary relations that hadn’t been hypothesized in Section 2, thus, we delete the three path relations and then get model 2.

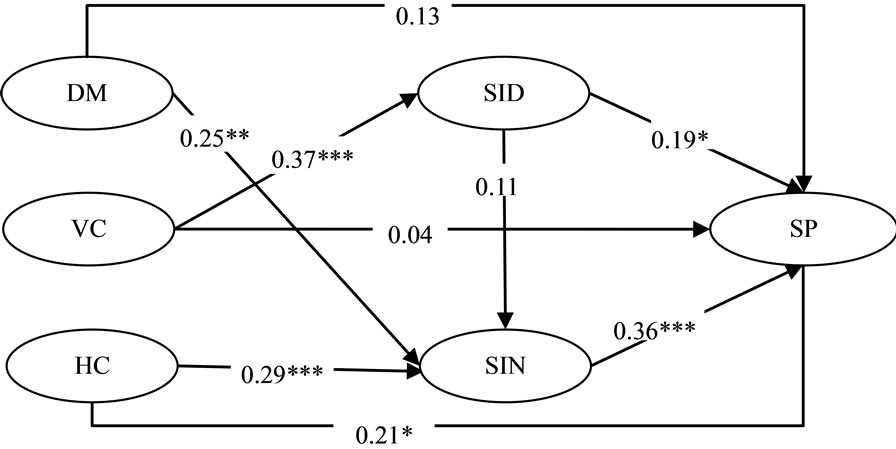

In model 2, there are only mediated relation had been hypothesized (called “hypothetical model”), the results were shown in Figure 3, and the fit indices (P = 0.437 > 0.08, RMSEA value = 0.01 < 0.05, IFI = 0.998 > 0.9CFI = 0.998 > 0.9, x2/df = 1.014 < 2) also reached the fitting degree. In addition, the model 2 was fitting better than model 1, from the path coefficients in model 1. So we would analysis the intermediary relationship through model 2 rather than model 1.

From the Figure 3, we could see the following relations: 1) Both subsidiary managers’ strategic identity (the path coefficient is 0.19) and subsidiary initiative (the path coefficient is 0.36) could improve subsidiary performance, hypothesis 1 and hypothesis 2 pass the test; 2) The initiative is the intermediary variable of “decisionmaking decentralization → subsidiary performance” and “horizontal communication → subsidiary performance”, through the medium of subsidiary initiative, the immediate effect of decision-making decentralization on subsidiary performance” becomes non-significant (from P = 0.047 to P = 0.181), the immediate effect of horizontal communication on subsidiary performance reduces (from P = 0.008 to P = 0.059), hypothesis 4a and hypothesis 6a passed the test. Moreover, due to there is non-significant positive effect between strategic identity on subsidiary

Figure 2. Results of the multi-intermediary variables model.

Figure 3. Results of the hypothetical model.

initiative, hypothesis 3 didn’t pass the test, the same as hypothesis 5 and hypothesis 5a, but vertical communication could improve subsidiary managers’ strategic identity.

4. Conclusions

Chinese Enterprise groups rise in 1980s by joint ventures or associated enterprises for the basic embryonic form. Although state-owned enterprises restructuring progress forward constantly, the modern groups still have some ills come from the planned economy. In recent years, the acquisition and merger activity increased year by year, it’s difficult to cope with the changeable and complex environment for many parent companies. This paper examined the mediating role of subsidiary managers’ strategic behavior by taking the interactive control as the independent variable and subsidiary performance as the dependent variable. This paper provides the following suggestions for Chinese enterprise groups’ strategic management, management control or human resource management.

First, parent companies should carry out interactions to promote resource integration and build interpersonal trust actively. Parent companies focus on institutional control under highly administration in Chinese groups, but institutional control only prevents the loss caused by the subsidiary managers’ individual behavior, cannot achieve emotional communication, moreover, the cost always very high, economic benefits often very far from satisfactory [35]. So the groups must enhance the trust between the parent company managers and the subsidiary managers by interactive control, and then to improve collaboration efficiency and resource efficiency. In addition, the accelerated internationalization process drives the subsidiary from a strategy implementer turn into an active participant, the passive interaction has been difficult to meet this transition, and only active interactions could promote resource flow within the groups effectively.

Second, enterprise groups should choose the subsidiary managers based on person-organization matching rule. Since the groups’ industry, business models, product characteristics have different requirements on the managers, as an important part of strategic human resource management, employ managers who are matched with the organization environment is very important. As the behavior patterns have been got a general consensus, strategic identity and subsidiary initiative both have a positive significance for subsidiary performance. Except derive from the group later, strategic identity and subsidiary initiative also depend on the inherent characteristics, such as entrepreneurship, so the personality characteristics and motivations likewise constitute a selection criterion.

Third, enterprise groups need to adopt differentiation interaction to enhance the subsidiary managers’ strategic identity and subsidiary initiative. Different enterprise groups have different demands on subsidiary managers, such as firms pursuing innovation need to strengthen the subsidiary initiative. But subsidiary managers’ intrinsic initiatives possibly have certain flaws or insufficient. The intermediary role of strategic behavior indicates that the strategic behavior may be controlled through later guidance: in respect to subsidiary initiative, if the managers are lack of autonomy, the parent companies could increases decentralization to improve their consciousness of risk taking, if the managers are lack of knowledge, the parent companies should increase the information and knowledge sharing by horizontal communication. In respect to strategic identity, the parent companies should build shared interests and increase common cognition by vertical communication.

5. Acknowledgements

This study was supported by the National Natural Science Foundation of China (No. 71272064). Many thanks to the EMBA students at the University of Science & Technology of China, as well as other managers who filled the questionnaires in Guangzhou, Beijing and other cities.

REFERENCES

- S. Kzlberg, “Max Weber’s Types of Rationality: Cornerstones for the Analysis of Rationalization Processes in History,” American Journal of Sociology, Vol. 85, No. 5, 1980, pp. 1145-1179. doi:10.1086/227128

- K. Kautz and V. Mahnke, “Value Creation through ITSupported Knowledge Management?” Informing Science, Vol. 6, No. 6, 2003, pp. 75-88. doi:10.1.1.101.7192

- S. Robert, “Levers of Organization Design: How Managers use Accountability for Greater Performance and Commitment,” Harvard Business School Press, Boston, 2005.

- J. R. Barker, “Tightening the Iron Cage: Concretive Control in Self-managing Teams,” Administrative Science Quarterly, Vol. 38, No. 3, 1993, pp. 408-437. doi:10.2307/2393374

- M. C. Jensen and W. H. Meckling, “Theory of the Firm: Managerial Behavior, Agency Costs and Owner-Ship Structure,” Journal of Financial Economics, Vol. 3, No. 4, 1976, pp. 305-360. doi:10.1016/0304-405X(76)90026-X

- W. Tsai, “Social Structure of ‘Coopetition’ with in a Multiunit Organization: Coordination, Competition, and Intraorganizational Knowledge Sharing,” Organization Science, Vol. 13, No. 2, 2002, pp. 179-190. doi:10.1287/orsc.13.2.179.536

- M. I. Rapert, A. Velliquetteb and J. A. Garretson, “The Strategic Implementation Process Evoking Strategic Consensus through Communication,” Journal of Business Research, Vol. 55, No. 5, 2002, pp. 301-310. doi:10.1016/S0148-2963(00)00157-0

- E. Siemsen, S. Balasubramanian and A. V. Roth, “Incentives that Induce Task-Related Effort, Helping, and Knowledge Sharing in Workgroups,” Management Science, Vol. 53, No. 10, 2007, pp. 1533-1550. doi:10.1287/mnsc.1070.0714

- N. S. Hilla, K. M. Bartolb, P. E. Teslukb and G. A. Langab, “Organizational Context and Face-to-Face Interaction: Influences on the Development of Trust and Collaborative Behaviors in Computer-Mediated Groups,” Organizational Behavior and Human Decision Processes, Vol. 108, No. 2, 2009, pp. 187-201. doi:10.1016/j.obhdp.2008.10.002

- R. A. Simon, “Administrative Behavior, a Study of Decision-Making Processes in Administrative Organization,” The Macmillan Co., New York, 1976

- S. Valentine, L. Godkin and M. Lucero. “Ethical Context, Organizational Commitment, and Person-Organization Fit,” Journal of Business Ethics, Vol. 41, No. 1, 2002, pp. 349-360. doi:10.1023/A:1021203017316

- U. K. Bindl, S. K. Parker and S. Zedeck, “Proactive Work Behavior: Forward-Thinking and Change-Oriented Action in Organizations,” APA Handbook of Industrial and Organizational Psychology, Vol. 2, No. 2, 2011, pp. 567- 598. doi:10.1037/12170-019

- T. J. Andersen, “Integrating Decentralized Strategy Making and Strategic Planning Processes in Dynamic Environments,” Journal of Management Studies, Vol. 41, No. 9, 2004, pp. 1271-1299. doi:10.1111/j.1467-6486.2004.00475.x

- A. K. Gupta and V. Govindarajan, “Knowledge Flows within Multinational Corporations,” Strategic Management Journal, Vol. 21, No. 4, 2000, pp. 473-496. doi:10.1002/(SICI)1097-0266(200004)

- N. Phelps and C. Fuller, “Multinational Enterprises, Repeat Investment and the Role of Aftercare Services in Wales and Ireland,” Economic Geography, Vol. 38, No. 7, 2004, pp. 783-801. doi:10.1080/0034340042000265269

- T. E. Becker, “Foci and Bases of Commitment: Are They Distinctions Worth Making?” Academy of Management Journal, Vol. 35, No. 1, 1992, pp. 232-244. doi:10.2307/256481

- G. Hirst, R. Van Dick and D. Van Knippenberg, “A Social Identity Perspective on Leadership and Employee Creativity,” Organizational Behavior, Vol. 30, No. 3, 2009, pp. 963-982. doi:10.1002/job.600

- S. W. O’Donnell, “Managing Foreign Subsidiaries: Agents of Headquarters, or an Interdependent Network?” Strategic Management Journal, Vol. 21, No. 5, 2000, pp. 525- 548. doi:10.1002/(SICI)1097-0266(200005)21:5

- C. Boone and W. Hendriks, “Top Management Team Diversity and Firm Performance: Moderators of FunctionalBackground and Locus-of-Control Diversity,” Management Science, Vol. 55, No. 2, 2009, pp. 165-180.

- D. J. Mcallister, “Affect-And Cognition-Based Trust as Foundations for Interpersonal Cooperation in Organizations,” Academy of Management Journal, Vol. 38, No. 1, 1995, pp. 24-59. doi:10.2307/256727

- R. M. Kanter, “The New Managerial Work,” Harvard Business Review, Vol. 6, No. 4, 1989, pp. 85-92. http://hbr.org/1989/11/the-new-managerial-work/ar/1

- M. Osterloh and B. Frey, “Motivation, Knowledge Transfer and Organizational Forms,” Organization Science, Vol. 11, No. 5, 2000, pp. 538-550. doi:10.1287/orsc.11.5.538.15204

- T. Pedersen, B. Petersen and D. Sharma, “Knowledge Transfer Performance of Multinational Companies,” Management International Review, Vol. 43, No. 3, 2003, pp. 69-90. http://www.jstor.org/stable/40835968

- C. Inkpen, “Creating Knowledge through Collaboration,” California Management Review, Vol. 39, No. 1, 1996, pp. 123-140. doi:10.2307/41165879

- S. A. Zahra, “Predictors and Financial Outcomes of Corporate Entrepreneurship: an Exploratory Study,” Journal of Business Venturing, Vol. 6, No. 2, 1991, pp. 259-285. doi:10.1016/0883-9026(91)90019-A

- D. B. Minbaeva, “HRM Practices and MNC Knowledge Transfer,” Personnel Review, Vol. 34, No. 1, 2005, pp. 125-144. doi:10.1080/095851997341414

- K. Roth and D. Nigh, “The Effectiveness of Headquarters-Subsidiary Relationships: The Role of Coordination, Control and Conflict,” Journal of Business Research, Vol. 25, No. 54, 1992, pp. 277-301. doi:10.1016/0148-2963(92)90025-7

- A. M. Grant, S. Nurmohamed, S. J. Ashford and K. Dekas, “The Performance Implications of Ambivalent Initiative: The Interplay of Autonomous and Controlled Motivations,” Organizational Behavior and Human Decision Processes, Vol. 116, No. 2, 2011, pp. 241-251. doi:10.1016/j.obhdp.2011.03.004

- A. Persaud, “Enhancing Synergistic Innovative Capability in Multinational Corporations,” Product Innovation Management, Vol. 22, No. 2, 2005, pp. 412-629. doi:10.1111/j.1540-5885.2005.00138.x

- M. Subramaniam, “Integrating Cross-Border Knowledge for Transnational New Produce Development,” Journal of Product Innovation Management, Vol. 23, No. 6, 2006, pp. 541-555. doi:10.1111/j.1540-5885.2006.00223.x

- J. Kickul, E. Belgio and M. Green “Emerging with Allies: The Role of Top Management Strategic Congruence in the Creation of Inter-Firm Relationships,” Journal of Enterprising Culture, Vol. 12, No. 1, 2004, p. 35. doi:10.1142/S0218495804000038

- Z. H. Zeng, “The Determinants of MNC Subsidiary’s Autonomy and Initiative: An Empirical Study of MNC Subsidiary in Taiwan,” Ph.D. Thesis, National Sun Yat-sen University, Kaohsiung, 2007.

- M. Demirbag, E. Tatoglu, K. W. Glaister and S. Zaim, “Measuring Strategic Decision Making Efficiency in Different Country Contexts: A Comparison of British and Turkish Firms,” Omega, Vol. 38, No. 1-2, 2010, pp. 95- 104. doi:10.1016/j.omega.2009.05.001

- M. L. Wu, “Structural Equation Model,” Chongqing University Publishing House, Chongqing, 2009.

- M. L. Bouillona, G. D. Ferrierb, M. T. Stuebs Jr. and T. D. Westb, “The Economic Benefit of Goal Congruence and Implications for Management Control Systems,” Journal of Accounting and Public Policy, Vol. 25, No. 3, 2006, pp. 265-298. doi:10.1016/j.jaccpubpol.2006.03.003

NOTES

*Corresponding author.