Paper Menu >>

Journal Menu >>

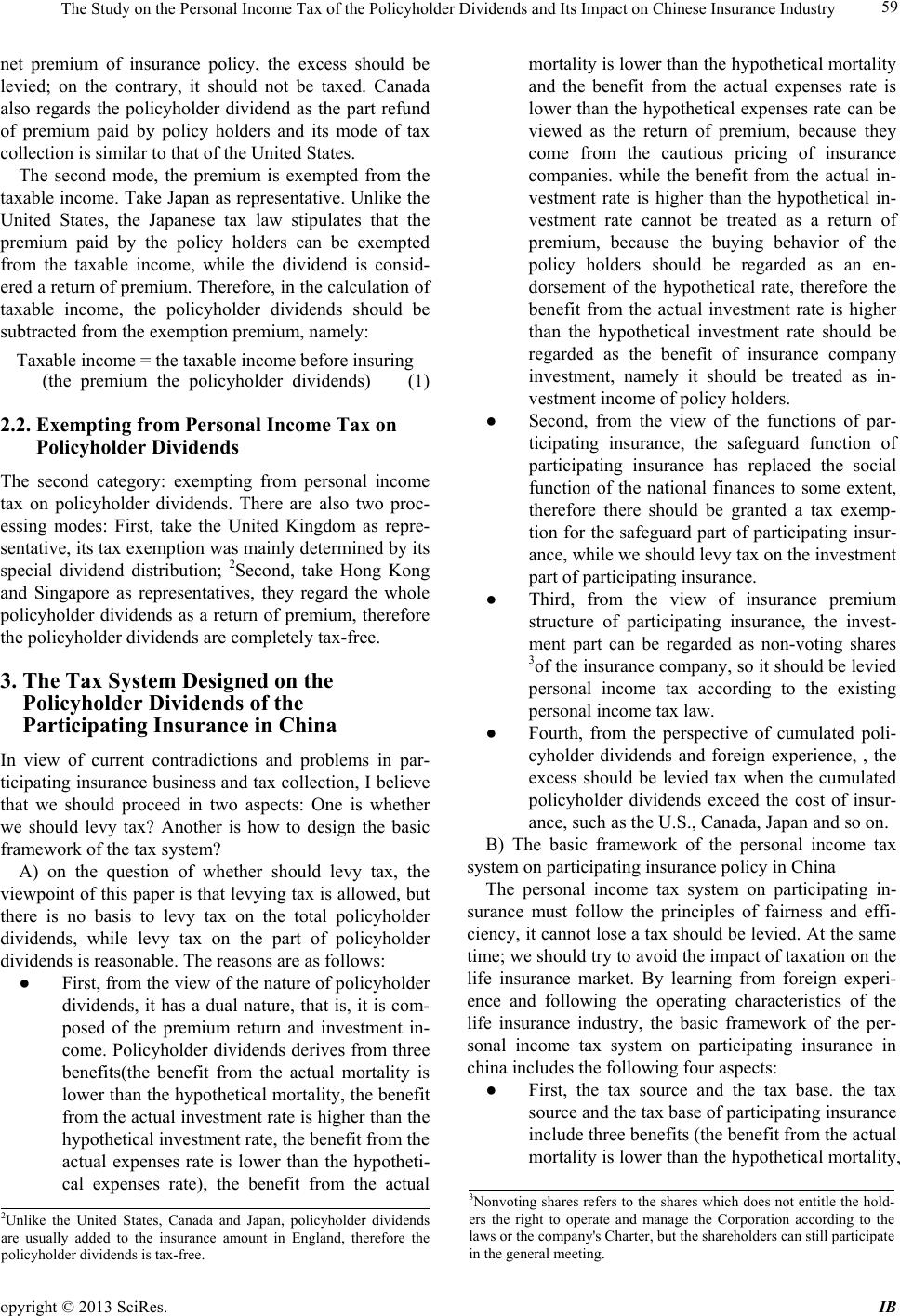

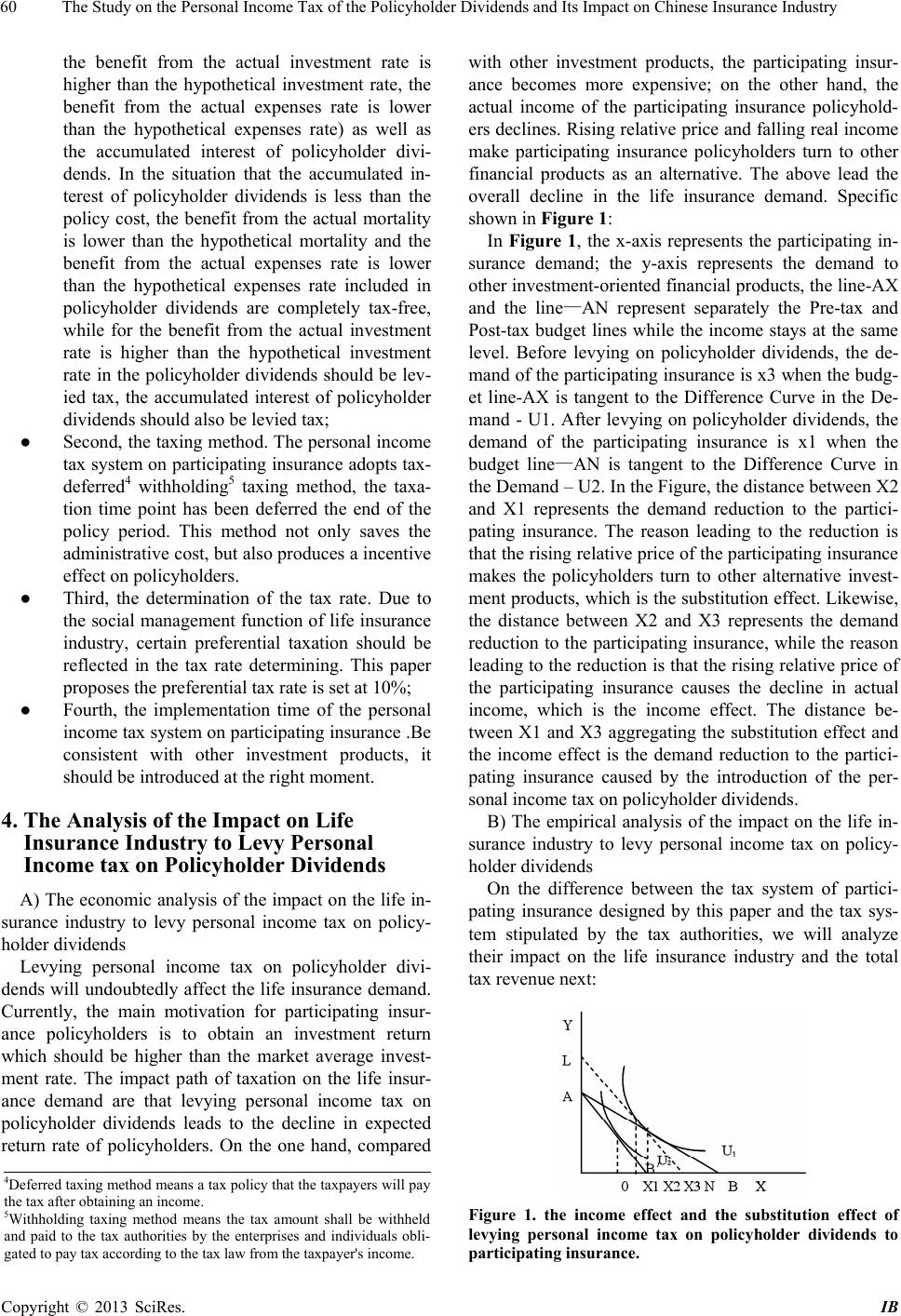

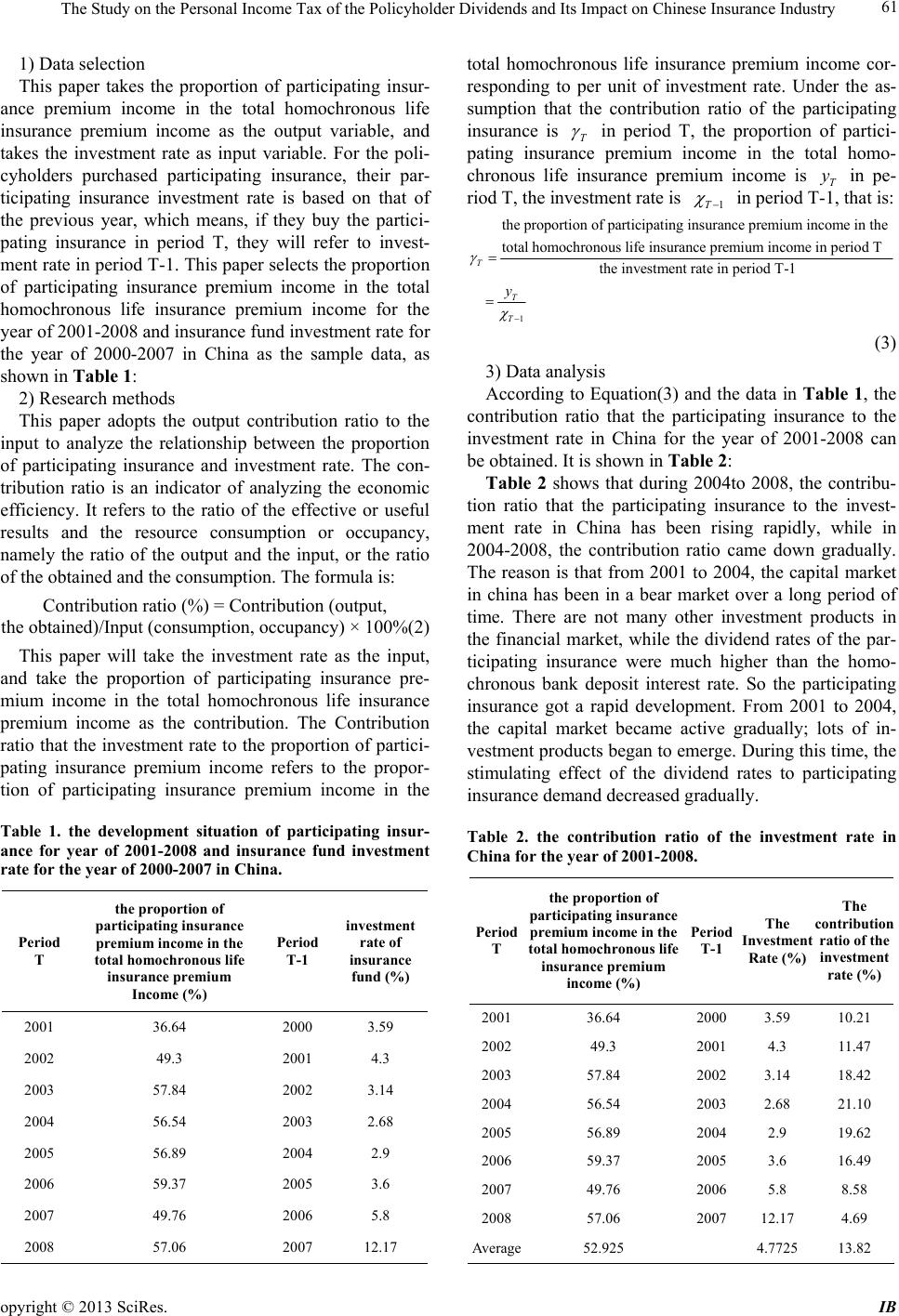

iBusiness, 2013, 5, 58-63 doi:10.4236/ib.2013.51b013 Published Online March 2013 (http://www.scirp.org/journal/ib) The Study on the Personal Income Tax of the Policyholder Dividends and Its Impact on Chinese Insurance Industry Wen Yan School of Public Administration, Southwest Jiaotong University, Chengdu, China. Email: sherrywen.001@163.com Received 2013 ABSTRACT The policyholder dividend of participating insurance is essentially different from the usual equity and bond profit. There are disputes on taxing methods in theory and practice, and different countries adopt different taxing methods. This paper designs a basic framework of the personal income tax system on participating insurance policy. This policy is based on the reality that the participating insurance accounts for a higher proportion in the Chinese insurance market, which is conducive to increase the demand for insurance and the tax sources. The author believes that levying taxes is allowed, but there is no basis to tax on the total policyholder dividends, while tax on the part of policyholder dividends is rea- sonable. Finally, this paper analyzes the impact on the demand of life insurance industry and the total tax revenue to levy personal income tax on policyholder dividends. The author concludes that the taxing method designed in this paper is better than the taxing method levying tax on the total policyholder dividends. Keywords: Income Tax; Policyholder Dividends; Chinese; Insurance; Industry 1. Introduction Life insurance and tax are two important concepts in the modern economy; they display the social management functions both in the micro and macro economy. The relationship between life insurance and tax reflects that on one hand, the tax policy may encourage or inhibit the demand and supply to life insurance and on the other hand, the development of life insurance industry also affects the government's tax revenue to a certain extent. As the leading product of the life insurance industry in China, since 2002, the proportion of participating insur- ance premium income in the total premium income of life insurance has been more than 50% for a long time. It was up to 57.09% in 2008. Therefore, how to design a reasonable personal income tax system on the dividend income from participating insurance has a significant impact on the stable development of China’s life insur- ance industry and even the insurance industry. The pre- vious research in this area is mostly limited to the discus- sion of whether to levy tax, but lacks systematic study and plan design on the tax system. This paper designs a concrete plan on how to levy personal income tax on participating insurance in China; at the same time, the paper analyzes the possible impact and makes a empiri- cal test on the impact. 2. The Introduction of Personal Income Tax System on Policyholder Dividends from Participating Insurance By the analysis on the personal income tax system on policyholder dividends from participating insurance in the developed insurance market, the personal income tax system can be divided into two categories and four proc- essing modes. 2.1. Levying Personal Income Tax on Policyholder Dividends The first category is the levying personal income tax on policyholder dividends. This mode stipulates to exact personal income tax from policy holders within a certain range. In the practice of insurance tax, it may be divided into two modes according to the different calculations. The first mode is the premium not be exempted from the taxable income. Take US and Canada as representa- tives. U.S. Internal Revenue Service defines the policy- holder dividend as the part refund of premium paid by policy holders, which reduces the cost of policy holders, should not be included in income. 1So whether to tax depends on the total amount of policyholder dividends. If the total amount of policyholder dividends surpasses the 1IRS,2004, “Your Federal Income Tax” (for individuals for use in pre- p aring 2004 returns), www.irs.gov. Copyright © 2013 SciRes. IB  The Study on the Personal Income Tax of the Policyholder Dividends and Its Impact on Chinese Insurance Industry 59 net premium of insurance policy, the excess should be levied; on the contrary, it should not be taxed. Canada also regards the policyholder dividend as the part refund of premium paid by policy holders and its mode of tax collection is similar to that of the United States. The second mode, the premium is exempted from the taxable income. Take Japan as representative. Unlike the United States, the Japanese tax law stipulates that the premium paid by the policy holders can be exempted from the taxable income, while the dividend is consid- ered a return of premium. Therefore, in the calculation of taxable income, the policyholder dividends should be subtracted from the exemption premium, namely: Taxable income = the taxable income before insuring (the premium the policyholder dividends) (1) 2.2. Exempting from Personal Income Tax on Policyholder Dividends The second category: exempting from personal income tax on policyholder dividends. There are also two proc- essing modes: First, take the United Kingdom as repre- sentative, its tax exemption was mainly determined by its special dividend distribution; 2Second, take Hong Kong and Singapore as representatives, they regard the whole policyholder dividends as a return of premium, therefore the policyholder dividends are completely tax-free. 3. The Tax System Designed on the Policyholder Dividends of the Participating Insurance in China In view of current contradictions and problems in par- ticipating insurance business and tax collection, I believe that we should proceed in two aspects: One is whether we should levy tax? Another is how to design the basic framework of the tax system? A) on the question of whether should levy tax, the viewpoint of this paper is that levying tax is allowed, but there is no basis to levy tax on the total policyholder dividends, while levy tax on the part of policyholder dividends is reasonable. The reasons are as follows: ● First, from the view of the nature of policyholder dividends, it has a dual nature, that is, it is com- posed of the premium return and investment in- come. Policyholder dividends derives from three benefits(the benefit from the actual mortality is lower than the hypothetical mortality, the benefit from the actual investment rate is higher than the hypothetical investment rate, the benefit from the actual expenses rate is lower than the hypotheti- cal expenses rate), the benefit from the actual mortality is lower than the hypothetical mortality and the benefit from the actual expenses rate is lower than the hypothetical expenses rate can be viewed as the return of premium, because they come from the cautious pricing of insurance companies. while the benefit from the actual in- vestment rate is higher than the hypothetical in- vestment rate cannot be treated as a return of premium, because the buying behavior of the policy holders should be regarded as an en- dorsement of the hypothetical rate, therefore the benefit from the actual investment rate is higher than the hypothetical investment rate should be regarded as the benefit of insurance company investment, namely it should be treated as in- vestment income of policy holders. ● Second, from the view of the functions of par- ticipating insurance, the safeguard function of participating insurance has replaced the social function of the national finances to some extent, therefore there should be granted a tax exemp- tion for the safeguard part of participating insur- ance, while we should levy tax on the investment part of participating insurance. ● Third, from the view of insurance premium structure of participating insurance, the invest- ment part can be regarded as non-voting shares 3of the insurance company, so it should be levied personal income tax according to the existing personal income tax law. ● Fourth, from the perspective of cumulated poli- cyholder dividends and foreign experience, , the excess should be levied tax when the cumulated policyholder dividends exceed the cost of insur- ance, such as the U.S., Canada, Japan and so on. B) The basic framework of the personal income tax system on participating insurance policy in China The personal income tax system on participating in- surance must follow the principles of fairness and effi- ciency, it cannot lose a tax should be levied. At the same time; we should try to avoid the impact of taxation on the life insurance market. By learning from foreign experi- ence and following the operating characteristics of the life insurance industry, the basic framework of the per- sonal income tax system on participating insurance in china includes the following four aspects: ● First, the tax source and the tax base. the tax source and the tax base of participating insurance include three benefits (the benefit from the actual mortality is lower than the hypothetical mortality, 3Nonvoting shares refers to the shares which does not entitle the hold- ers the right to operate and manage the Corporation according to the laws or the company's Charter, but the shareholders can still participate in the general meeting. 2Unlike the United States, Canada and Japan, policyholder dividends are usually added to the insurance amount in England, therefore the p olicyholder dividends is tax-free. opyright © 2013 SciRes. IB  The Study on the Personal Income Tax of the Policyholder Dividends and Its Impact on Chinese Insurance Industry 60 the benefit from the actual investment rate is higher than the hypothetical investment rate, the benefit from the actual expenses rate is lower than the hypothetical expenses rate) as well as the accumulated interest of policyholder divi- dends. In the situation that the accumulated in- terest of policyholder dividends is less than the policy cost, the benefit from the actual mortality is lower than the hypothetical mortality and the benefit from the actual expenses rate is lower than the hypothetical expenses rate included in policyholder dividends are completely tax-free, while for the benefit from the actual investment rate is higher than the hypothetical investment rate in the policyholder dividends should be lev- ied tax, the accumulated interest of policyholder dividends should also be levied tax; ● Second, the taxing method. The personal income tax system on participating insurance adopts tax- deferred4 withholding5 taxing method, the taxa- tion time point has been deferred the end of the policy period. This method not only saves the administrative cost, but also produces a incentive effect on policyholders. ● Third, the determination of the tax rate. Due to the social management function of life insurance industry, certain preferential taxation should be reflected in the tax rate determining. This paper proposes the preferential tax rate is set at 10%; ● Fourth, the implementation time of the personal income tax system on participating insurance .Be consistent with other investment products, it should be introduced at the right moment. 4. The Analysis of the Impact on Life Insurance Industry to Levy Personal Income tax on Policyholder Dividends A) The economic analysis of the impact on the life in- surance industry to levy personal income tax on policy- holder dividends Levying personal income tax on policyholder divi- dends will undoubtedly affect the life insurance demand. Currently, the main motivation for participating insur- ance policyholders is to obtain an investment return which should be higher than the market average invest- ment rate. The impact path of taxation on the life insur- ance demand are that levying personal income tax on policyholder dividends leads to the decline in expected return rate of policyholders. On the one hand, compared with other investment products, the participating insur- ance becomes more expensive; on the other hand, the actual income of the participating insurance policyhold- ers declines. Rising relative price and falling real income make participating insurance policyholders turn to other financial products as an alternative. The above lead the overall decline in the life insurance demand. Specific shown in Figure 1: In Figure 1, the x-axis represents the participating in- surance demand; the y-axis represents the demand to other investment-oriented financial products, the line-AX and the line—AN represent separately the Pre-tax and Post-tax budget lines while the income stays at the same level. Before levying on policyholder dividends, the de- mand of the participating insurance is x3 when the budg- et line-AX is tangent to the Difference Curve in the De- mand - U1. After levying on policyholder dividends, the demand of the participating insurance is x1 when the budget line—AN is tangent to the Difference Curve in the Demand – U2. In the Figure, the distance between X2 and X1 represents the demand reduction to the partici- pating insurance. The reason leading to the reduction is that the rising relative price of the participating insurance makes the policyholders turn to other alternative invest- ment products, which is the substitution effect. Likewise, the distance between X2 and X3 represents the demand reduction to the participating insurance, while the reason leading to the reduction is that the rising relative price of the participating insurance causes the decline in actual income, which is the income effect. The distance be- tween X1 and X3 aggregating the substitution effect and the income effect is the demand reduction to the partici- pating insurance caused by the introduction of the per- sonal income tax on policyholder dividends. B) The empirical analysis of the impact on the life in- surance industry to levy personal income tax on policy- holder dividends On the difference between the tax system of partici- pating insurance designed by this paper and the tax sys- tem stipulated by the tax authorities, we will analyze their impact on the life insurance industry and the total tax revenue next: 4Deferred taxing method means a tax policy that the taxpayers will pay the tax after obtaining an income. 5Withholding taxing method means the tax amount shall be withheld and paid to the tax authorities by the enterprises and individuals obli- gated to pay tax according to the tax law from the taxpayer's income. Figure 1. the income effect and the substitution effect of levying personal income tax on policyholder dividends to participating insurance. Copyright © 2013 SciRes. IB  The Study on the Personal Income Tax of the Policyholder Dividends and Its Impact on Chinese Insurance Industry 61 1) Data selection This paper takes the proportion of participating insur- ance premium income in the total homochronous life insurance premium income as the output variable, and takes the investment rate as input variable. For the poli- cyholders purchased participating insurance, their par- ticipating insurance investment rate is based on that of the previous year, which means, if they buy the partici- pating insurance in period T, they will refer to invest- ment rate in period T-1. This paper selects the proportion of participating insurance premium income in the total homochronous life insurance premium income for the year of 2001-2008 and insurance fund investment rate for the year of 2000-2007 in China as the sample data, as shown in Table 1: 2) Research methods This paper adopts the output contribution ratio to the input to analyze the relationship between the proportion of participating insurance and investment rate. The con- tribution ratio is an indicator of analyzing the economic efficiency. It refers to the ratio of the effective or useful results and the resource consumption or occupancy, namely the ratio of the output and the input, or the ratio of the obtained and the consumption. The formula is: Contribution ratio (%) = Contribution (output, the obtained)/Input (consumption, occupancy) × 100%(2) This paper will take the investment rate as the input, and take the proportion of participating insurance pre- mium income in the total homochronous life insurance premium income as the contribution. The Contribution ratio that the investment rate to the proportion of partici- pating insurance premium income refers to the propor- tion of participating insurance premium income in the Table 1. the development situation of participating insur- ance for year of 2001-2008 and insurance fund investment rate for the year of 2000-2007 in China. Period T the proportion of participating insurance premium income in the total homochronous life insurance premium Income (%) Period T-1 investment rate of insurance fund (%) 2001 36.64 2000 3.59 2002 49.3 2001 4.3 2003 57.84 2002 3.14 2004 56.54 2003 2.68 2005 56.89 2004 2.9 2006 59.37 2005 3.6 2007 49.76 2006 5.8 2008 57.06 2007 12.17 total homochronous life insurance premium income cor- responding to per unit of investment rate. Under the as- sumption that the contribution ratio of the participating insurance is T in period T, the proportion of partici- pating insurance premium income in the total homo- chronous life insurance premium income is T in pe- riod T, the investment rate is y 1T in period T-1, that is: 1 the proportion of participating insurance premium income in the total homochronous life insurance premium income in period T the investment rate in period T-1 T T T y (3) 3) Data analysis According to Equation(3) and the data in Table 1, the contribution ratio that the participating insurance to the investment rate in China for the year of 2001-2008 can be obtained. It is shown in Table 2: Table 2 shows that during 2004to 2008, the contribu- tion ratio that the participating insurance to the invest- ment rate in China has been rising rapidly, while in 2004-2008, the contribution ratio came down gradually. The reason is that from 2001 to 2004, the capital market in china has been in a bear market over a long period of time. There are not many other investment products in the financial market, while the dividend rates of the par- ticipating insurance were much higher than the homo- chronous bank deposit interest rate. So the participating insurance got a rapid development. From 2001 to 2004, the capital market became active gradually; lots of in- vestment products began to emerge. During this time, the stimulating effect of the dividend rates to participating insurance demand decreased gradually. Table 2. the contribution ratio of the investment rate in China for the year of 2001-2008. Period T the proportion of participating insurance premium income in the total homochronous life insurance premium income (%) Period T-1 The Investment Rate (%) The contribution ratio of the investment rate (%) 200136.64 2000 3.59 10.21 200249.3 2001 4.3 11.47 200357.84 2002 3.14 18.42 200456.54 2003 2.68 21.10 200556.89 2004 2.9 19.62 200659.37 2005 3.6 16.49 200749.76 2006 5.8 8.58 200857.06 2007 12.17 4.69 Average52.925 4.7725 13.82 opyright © 2013 SciRes. IB  The Study on the Personal Income Tax of the Policyholder Dividends and Its Impact on Chinese Insurance Industry 62 Dividends rate is 5%, the personal income tax rate is 10% on policyholder dividends, the market interest rate is 0, the extra policy dividends more than the insurance cost accounts for 80%. According to the calculation for- mula of the contribution ratio, this paper selects the av- erage contribution ratio between 2005 and 2008 as a ref- erence point to the impact degree of the participating insurance, which is 12.35.Take 2007 as the example: First, let us analyze the tax system stipulated by the tax authorities. The total Post-tax policyholder dividend is 400*5%*(1-10%)*10=180 Billion Yuan; Taxable per- sonal income amounts to 400*5%*10%*10=20 Billion Yuan. After the taxation, the proportion of participating insurance premium income in the total homochronous life insurance premium income refers to 49.76% - 5.8*10%*12.35=42.6%, dropping by (5.8 * 10% * 12.35 /49.76%) *100%=14.39%. After the taxation, the pre- mium income of the life insurance industry drops by (5.8*10%*12.35/49.76%)*49.76% = 7.16%. Second, we design the tax system of participating in- surance designed by this paper. The viewpoint in this paper is that the tax-deferred withholding taxing method should be adopted to levy personal income tax on the policyholder dividends. The tax scope includes the extra policyholder dividends more than the insurance cost and the accumulated interest of policyholder dividends. Therefore, at the expiry time of insurance policy, the policyholder dividends and interest amounts to 400*5%* 10 (11.05 ) 11.05 =251.56 billion Yuan, of which the policyholder dividends is 20 billion Yuan, and the accumulated interest is 5.156 bil- lion Yuan. Taxable personal income tax totals 200 * 80% * 10% +51.56 * 10% = 2.116 billion Yuan, an in- crease of 116 million Yuan more than the original. Af- ter the taxation, the total policyholder dividends is 251.56-21.56 = 23 billion Yuan, the policyholder divi- dends rate is 5.75%,the proportion of participating in- surance premium income in the total homochronous life insurance premium income refers to 49.76%-5.8*(5-5.75)/5*12.35 = 60.50%, increasing by 10.74%. After the taxation, the premium income of the life insurance industry increases by 10.74%*49.76% = 5.35%. 5. Conclusions and Suggestions This paper has made theoretical and empirical analysis on the question whether personal income tax should be levied on the policyholder dividends of participating in- surance. By contrast, we conclude that if levying 10% personal income tax on the policyholder dividends of the participating insurance in accordance with the claims of the tax authorities, the market share of the participating insurance will drop by 14.39%, as well as the premium income of the participating insurance will decreases by 7.16%. Following the recommendations in this paper, whether to levy personal income tax depends on the dif- ferent sources of policyholder dividends. On one hand, the market share and premium income of the participat- ing insurance will increase; on the other hand, the tax revenue of tax authorities also increases. The viewpoint in this paper is that the tax-deferred withholding taxing method should be adopted to levy personal income tax on the policyholder dividends, compared with the claim of the tax authorities. This taxing method has a strong ad- vantage both on policy benefit of policyholders and on the total tax revenue of tax authorities. In short, there will be a greater negative impact on the development of life insurance industry undoubtedly to levy personal income tax on the policyholder dividends of the participating insurance. However we can minimize the negative impact through designing reasonable tax system, even the negative impact can be transformed into a positive impact, and make the participating insurance business develop healthily. REFERENCES [1] Li Guodong.Shall Individual Income Taxes be Paid on Dividends from Participating Policy? [J]. Foreign tax,2006,No.9, 33-36. [2] Wang Han, Gu Yi. The characteristics and the tax system improvement of new life insurance products in China[J]. Accounting Communications, 2007, 6, 23-24. [3] Wang Han. the study on perfecting the tax system of new life insurance in China[J]. Shenzhen finance, 2007, 11, 29-31. [4] Liu Di. The innovation on insurance products challenges existing insurance tax system [J]. Shanghai Finance, 2004, 11, 13-15. [5] Wang Yanbin. The study of levying personal tax on the participating insurance [J]. Shanghai Finance, 2006 ,3, 14-16. [6] Deng Yunan. The impact of insurance tax system on in- surance product innovation [D]. Chengdu: finance de- partment of Southwest University of finance and eco- nomics, 2006. [7] OECD,2001, “ Taxing Insurance Companies”,OECD Tax Policies Studies No.3,the Chinese name is called The internal target management and tax management in insurance company (not published). [8] IRS,2004, “Your Federal Income Tax”(for individuals for use in preparing 2004 returns),www.irs.gov [9] Harold D. Skipper Jr., 2001, “The Taxation of Life Insurance Policies in OECD countries: Implications for Tax Policy and Planning”, www.oecd.org/daf/insurance-pensions/ Copyright © 2013 SciRes. IB  The Study on the Personal Income Tax of the Policyholder Dividends and Its Impact on Chinese Insurance Industry opyright © 2013 SciRes. IB 63 [10] Establishing Life Insurance Tax Policy in Developing Countries. UNCTAD (United Nations Conference on Trade and Development) . 1985 [11] Swiss Reinsurance Company. A Comparison of Social and Private Insurance, 1970-1985, in Ten Countries, Sigma, Swiss Reinsurance Co., Zurich. (1987). [12] Seiichi Kondo.Insurance and Private Pensions Compen- dium for Emerging Economies (2002), OECD, Paris. [13] OECD (1999). Report on the conference on insurance regulation and supervision in Asia (Singapore,1-2 Febru- ary 1999), OECD, Paris. [14] Goshay. Robert.Net Income as a Base for Life Insurance Company Taxation in California: Implications.1976. Journal Of Risk and Insurance. 1976. [15] Gupta.K Newberry.Determinants of the Variability in Corporate Effective Tax Rates:Evidence from Longitudi- nal Data. Journal of Accountancy. 1997. |