Paper Menu >>

Journal Menu >>

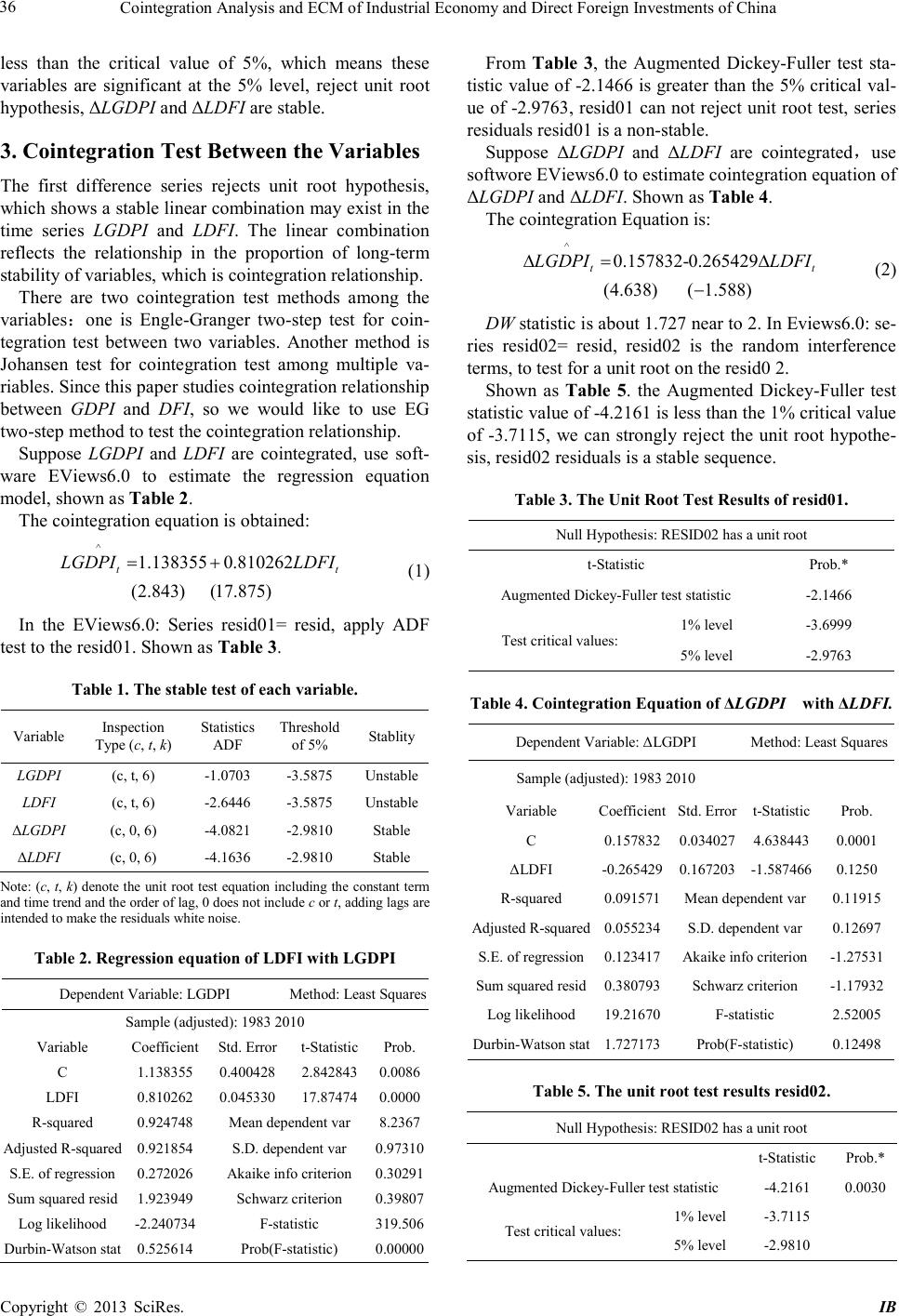

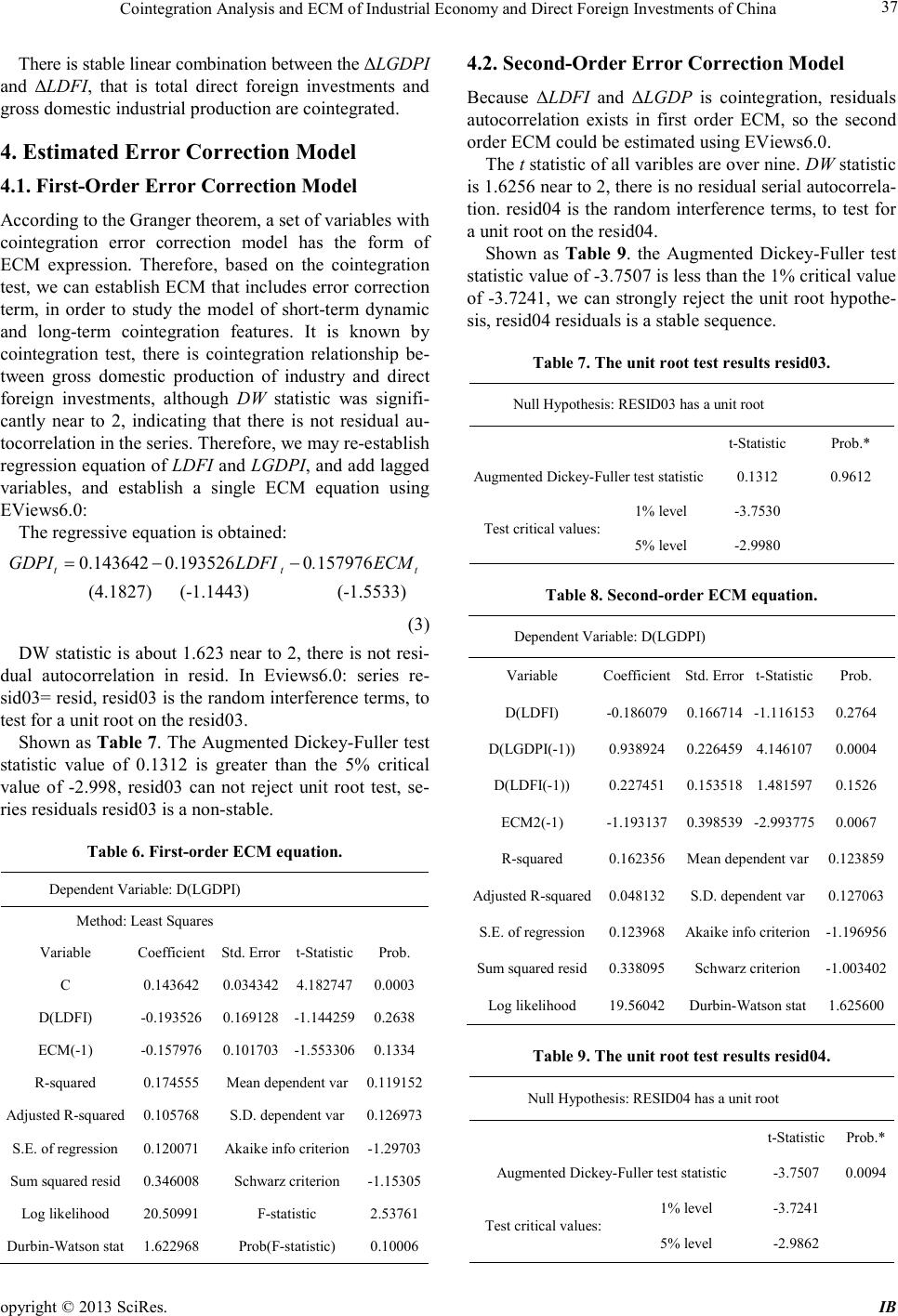

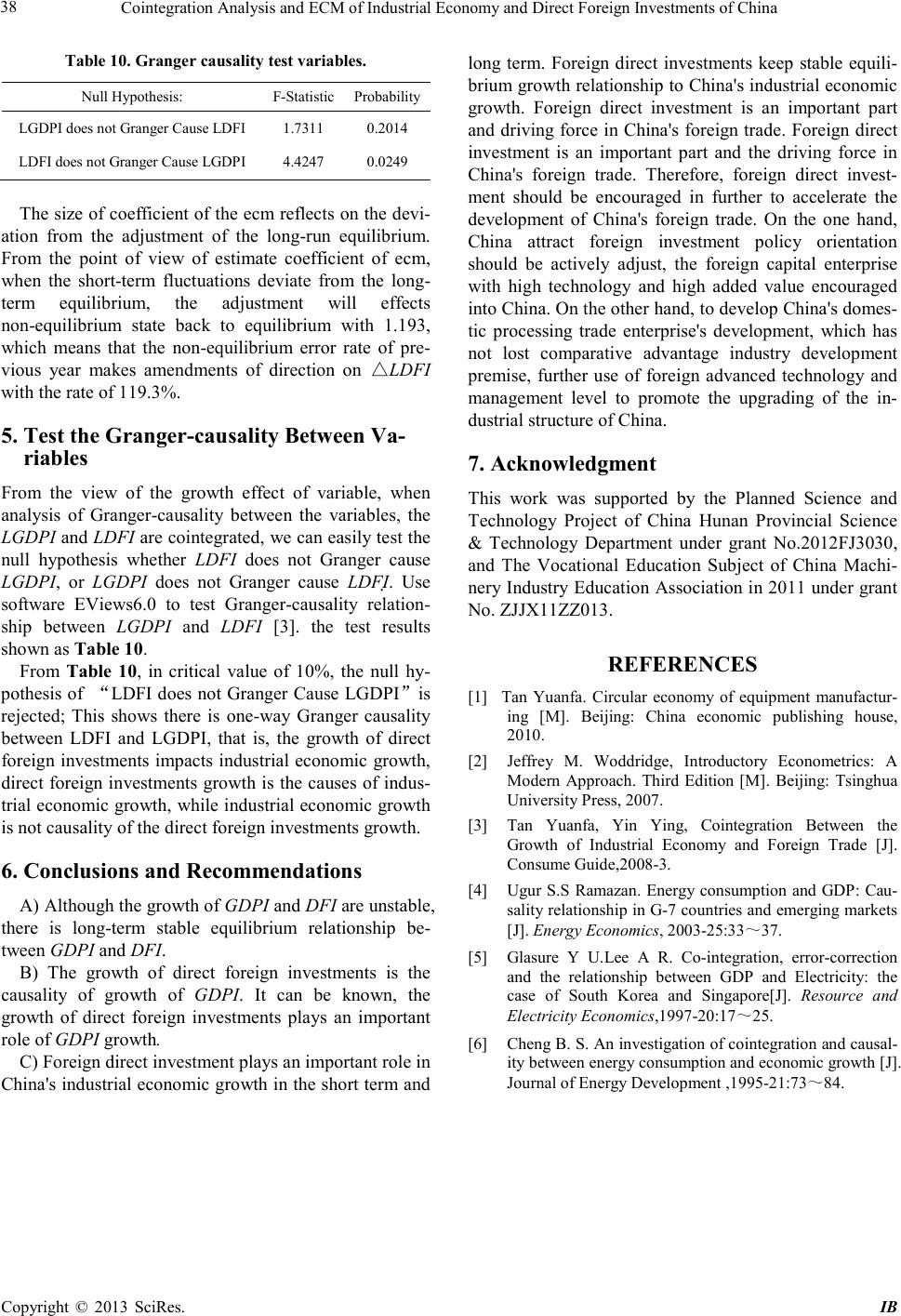

iBusiness, 2013, 5, 35-38 doi:10.4236/ib.2013.51b008 Published Online March 2013 (http://www.scirp.org/journal/ib) Copyright © 2013 SciRes. IB 35 Cointegration Analysis and ECM of Industrial Economy and Direct Foreign Investments of China Ying Yin Department of Economics and Management , Hunan Electrical College of Technology, Xiangtan Hunan, China. Email: fa0256@126.com Received 2013 ABSTRACT Based on cointe gratio n theor y and Granger causality test, applied on the gross domestic production of industry and di- rect foreign investments economic statistic data from 1983 to 2010 of China to analyze the long and steady dynamic equilibrium relations. Research results indicate that there is long-term stable one-way Granger causality relationship between the growth of gross domestic production of industry and direct foreign investments. The gro wth of direct for- eign investments affect the growth of gross domestic production of industry, but industri al economic growth is not the reasons of the direct foreign investments. Keywords: Gr owt h of Gross Domestic Production of Indust ry; Anal ys is of Cointegration; Direct Foreign I nvestments 1. Introduction Industrial economic growth is a major macroeconomic indicator to measure a country's overall level of econom- ic development and national comprehensive strength. Gross domestic production of industry is the important part of GDP, and a country's economic develop ment lies in the development of industry [1]. This paper analyses whether direct foreign investments is the causality of the growth of industrial economy. And the error correction model (ECM) is established for direct foreign invest- ment s and industrial economic growth, which plays an important role in analyzing direct foreign investments. The data of direct foreign investments and the gross domestic production of industry from 1983 to 2010 are collected. This paper analyzes the relations between di- rect foreign investments and economic growth in indus- trial by using cointegration analysis and Gran- ger-causality test theory methods. The results show that there is a long-term equilibrium relationship between direct foreign investments growth and industrial eco- nomic growth of China, and there is a one-way Gran- ger-causality from direct foreign investments growth to industrial eco nomic growth. 2. Data Processing and Unit Root Test This data selected for analysis is from “China Statistical Yearbook” (1990−2011). Let DFI denote the direct for- eign investments, which reflects the overall growth of direct foreign investments. Let GDPI denote the gross domestic production of industry, which reflects the in- dustrial economi c growt h. Before cointegration test between GDPI and DFI, firstly test unit roots to d eter mine whether the t ime series is stable. If the time series is unstable, the cointegration test will be making a spurious regression, leading incor- rect conclusion. The growth of GDPI and DFI have the exponential trend and more consistent direction change trend, consistent cha nges rate and unstable characteristics. Through the ADF testing, GDPI and DFI is unstable. Since the natural logarithm transformation does not change the relatio nship of the original variables, and can make it linear trend, and eliminate heteroskedasticity in time series. Use software EViews6.0 to implement natu- ral logarithm trans for matio n on GDPI and DFI, a nd then implement differencing. LGDPI =log (GDPI), LDFI =log (DFI), ΔLGDPI=log(GDPI)-log( GDPI(-1)), ΔLDFI=log(DFI)-log(DFI(-1)) ADF test on LGDPI and LDFI and ΔLGDPI and ΔLDFI wit h so ft ware EVi ews 6 .0. Sho wn as Table 1, the ADF statistics of LGDPI and LDFI is larger than the critical value of 5%, which means the LGDPI and LDFI can not reject unit root h ypothesis, i ndicati ng LGDPI and LDFI is not sig nifica nt at the 5 % level, LGDPI and LDF I is unstable. T he ADF statistic s of ΔLGDPI and ΔLDFI is *Fund Project: China Hunan Provincial Science & technology Projects (2012FJ3030), The Vocational Education Subject of China M achinery Industry Education Association in 2011 under grant No. ZJJX- 11ZZ013.  Cointegration Analysis and ECM of Industrial Economy and Direct Foreign Investments of China Copyright © 2013 SciRes. IB 36 less than the critical value of 5%, which means these variables are significant at the 5% level, reject unit root hypothesis, ΔLGDPI and ΔLDFI are stable. 3. Cointegration Test Between the Variables The first difference series rejects unit root hypothesis, which sho ws a stable li near combinatio n may exis t in the time series LGDPI and LDF I. The linear combination reflects the relationship in the proportion of long-term stability of variab le s, which is c ointegratio n re la tionship. There are two cointegration test methods among the variables:one is Engle-Granger two-step test for coin- tegration test between two variables. Another method is Johansen test for cointegration test among multiple va- riables. Since this pap e r studies co integration relationship between GDPI and DFI, so we would like to use EG two-step method to te st the cointe gra tion relationship. Suppose LGDPI and LDFI are cointegrated, use soft- ware EViews6.0 to estimate the regression equation model, shown as Tab l e 2. The cointegratio n equation is obtained: ^ 1.138355 0.810262 (2.843) (17.875) tt LGDPI LDFI= + (1) In the EViews6.0: Series resid01= resid, apply ADF test to the resid01. Shown as Table 3. Table 1. The stable test of e ach var iabl e . Variabl e Inspection Type (c, t, k) Statistics ADF Threshold of 5% Stablity LGDPI (c, t, 6) -1.0703 -3.5875 Unst able LDFI (c, t, 6) -2.6446 -3.5875 Unstable ΔLGDPI (c, 0, 6) -4.0821 -2.9810 Stable ΔLDFI (c, 0, 6) -4.1636 -2.9810 Stable Note: (c, t, k) denote the uni t root test equation in cluding the const ant t erm and time trend and the ord er of lag, 0 d oes not inc lude c or t, adding lags are intended to make the residuals white noise. Table 2. Regression equatio n of L DF I with LGDPI Dependent Variable: LGDPI Method: Least S q uar es Samp le (adjust ed): 1983 201 0 Variabl e Coeffi cient Std. Error t-Statistic Prob. C 1.138355 0.400428 2.842843 0.0086 LDF I 0.8 10262 0.045330 17.87474 0.0000 R-squared 0.924748 Mean dep en dent var 8.2367 Adjusted R-squared 0.921854 S.D. dependent var 0.97310 S.E. of r egress ion 0.272026 Aka ike info criterion 0.30291 Sum squared resid 1.923949 Schwarz criterion 0.39807 Log likelih ood -2.240734 F-statistic 319.506 Durbin-Watson stat 0.525614 Prob(F-statistic) 0.00000 From Table 3, the Augmented Dickey-Fuller test sta- tistic value o f -2.1466 is greater than the 5% critical val- ue of -2.9763, resid01 can not reject unit root test, series resid uals resid01 is a non-stable. Suppose ΔLGDPI and ΔLDFI are cointegrated,use softwore EViews6.0 to estimate cointegration equation of ΔLGDPI and ΔLDFI. Shown as Table 4. The cointegratio n Equation is: ^0.157832-0.265429 (4.638) (1.588) tt LGDPI LDFI∆= ∆ − (2) DW statistic is about 1.727 near to 2. In Eviews6.0: se- ries resid02= resid, resid02 is the random interference terms, to test for a unit root on the resid 0 2. Shown as Table 5. the Augmented Dickey-Fuller test statistic value of -4.2161 is l ess tha n t he 1 % critical value of -3.7115, we can strongly reject the unit root hypothe- sis, resid02 residuals is a stable sequence. Table 3. The Unit Root Test Results of resid01. Null Hypothesis: RES ID02 has a unit root t-Statistic Prob.* Augmented Di ckey-Fuller test statistic -2.1466 Test critical values: 1% level -3.6999 5% lev el -2.9763 Table 4. Cointegration Eq uation of ΔLGDPI with ΔLDFI. Dependent Variable: ΔLGDPI Method: Least S q ua r es Samp le (adjust ed): 1983 201 0 Variabl e Coeffi cient Std. Error t-Statistic Prob. C 0.157832 0.034027 4.638443 0 .0001 ΔLDFI -0.265429 0.167203 -1.587466 0.1 250 R-squared 0.0915 71 Mean dep en dent var 0.11915 Adjusted R-squared 0.055234 S.D. dependent var 0.12697 S.E. of r egress ion 0.1234 17 Aka ike info criterion -1.27531 Sum squared resid 0.380793 Schwarz criteri on -1.17932 Log likelih ood 19.21670 F-statistic 2.52005 Durbin-Watson stat 1.7271 73 Prob(F-statistic) 0.12498 Table 5. The unit root test results resid02. Null Hypothesis: RES ID02 has a unit root t-Statistic Prob.* Augmented Di ckey-Fuller test statistic -4.2161 0.0030 Test critical values: 1% level -3.7115 5% lev el -2.9810  Cointegration Analysis and ECM of Industrial Economy and Direct Foreign Investments of China opyright © 2013 SciRes. IB 37 There is stable linear co mbination bet ween the ΔLGDPI and ΔLDFI, that is total direct foreign investments and gross do mestic industrial production are cointegrated. 4. Estimated Error Correction Model 4.1. Fi rst-Order Error Correction Model According to the Granger theorem, a set of variables with cointegration error correction model has the form of ECM expression. Therefore, based on the cointegration test, we can establish ECM that includes error correction term, in order to study the model of short-term dynamic and long-term cointegration features. It is known by cointegration test, there is cointegration relationship be- tween gross domestic production of industry and direct foreign investments, although DW statistic was signifi- cantly near to 2, indicating that there is not residual au- tocorrelation in the series. Therefore, we may re-establish regr essio n equati on o f LDFI and LGDPI, and add lagged variables, and establish a single ECM equation using EViews6.0: The regressive equation is obtained: 0.1436420.1935260 157976 (4.1827) (-1.1443) (-1.5533) t tt GDPILDFI.ECM =−− (3) DW statistic is about 1.623 near to 2, there is not resi- dual autocorrelation in resid. In Eviews6.0: series re- sid03= resid, resid03 is the random interference terms, to test for a unit root on the re si d03. Sho wn a s Table 7. The Augmented Dickey-Fuller test statistic value of 0.1312 is greater than the 5% critical value of -2.998, resid03 can not reject unit root test, se- ries residuals resid03 is a no n-stable . Table 6. First-or der ECM equation. Dependent Variable: D(LGDPI) Met hod: Least S q ua r es Variabl e Coeffi cient Std. Error t-Statistic Prob. C 0.143642 0.034342 4.182747 0.0003 D(LDFI) -0.193526 0.169128 -1.144259 0.2638 ECM( -1) -0.157976 0.101703 -1.553306 0.1334 R-squared 0.174555 Mea n dep en dent var 0.119152 Adjusted R-squared 0.105768 S.D. dependent var 0.126973 S.E. of regression 0.120071 Akaike info crit eri on -1.29703 Sum squared resid 0.346008 Schwarz criteri on -1.15305 Log likelih ood 20.50991 F-statistic 2.53761 Durbin-Watson stat 1.622968 Prob(F-statistic) 0.10006 4.2. Second-Order Error C orrec tion Mod e l Because ΔLDFI and ΔLGDP is cointegration, residuals autocorrelation exists in first order ECM, so the second order ECM could be estimated using EViews6.0. The t statistic o f all varible s ar e o ver nine. DW statistic is 1.6256 near to 2, there is no residual serial autocorrela- tion. resid04 is the random interference terms, to test for a unit root on the resid04. Shown as Table 9. the Augmented Dickey-Fuller test statistic value o f -3.750 7 is less than the 1% critic al value of -3.7241, we can strongly reject the unit root hypothe- sis, resid04 residuals is a stable sequence. Table 7. The unit root test results resid03 . Null Hypothesis: RES ID03 has a unit root t-Statistic Prob.* Augmented Di ckey-Fuller test statistic 0.1312 0.9612 Test critical values: 1% level -3.7530 5% lev el -2.9980 Table 8. Second-order ECM equation. Dependent Variable: D(LGDPI) Variabl e Coeffi cient Std. Error t-Statistic Prob. D(LDFI) -0.186079 0.166714 -1.116153 0.2764 D(LGDPI(-1)) 0.938924 0.226459 4.146107 0.0004 D(LDFI(-1)) 0.227451 0.153518 1.481597 0.1526 ECM2(-1) -1.193137 0.398539 -2.993775 0.0067 R-squared 0.162356 Mean dependent var 0.123859 Adjusted R-squared 0.048132 S.D. dependent var 0.1270 63 S.E. of r egress ion 0.123968 Aka ike info criterion -1.196956 Sum squared resid 0.338095 Schwarz criterion -1.003402 Log likelih ood 19.56042 Durbin-Watson stat 1.625600 Table 9. The unit root test results resid04. Null Hypothesis: RES ID04 has a unit root t-Statistic Prob.* Augmented Di ckey-Fuller test statistic -3.7507 0.0094 Test critical values: 1% level -3.7241 5% lev el -2.9862  Cointegration Analysis and ECM of Industrial Economy and Direct Foreign Investments of China Copyright © 2013 SciRes. IB 38 Table 10. Granger causali ty test variables. Null Hypothesis: F-Statistic Probability LGDPI does not Granger Cause LDFI 1.7311 0.2014 LDFI does not Granger Cause LGDPI 4.4247 0.0249 The size of coefficient of the ecm reflects on the devi- ation from the adjustment of the long-run equilibrium. From the point of view of estimate coefficient of ecm, when the short-term fluctuations deviate from the long- term equilibrium, the adjustment will effects non-equilibrium state back to equilibrium with 1.193, which means that the non-equilibrium error rate of pre- vious year makes amendments of direction on △LDF I with the rate of 119.3%. 5. Test the Granger-causality Between Va- riables From the view of the growth effect of variable, when analysis of Granger-causality between the variables, the LGDPI and LD F I are cointegrated, we can easily test the null hypothesis whether LDFI does not Granger cause LGDPI, or LGDPI does not Granger cause LDFI. Use software EViews6.0 to test Granger-causality relation- ship between LGDPI and LDFI [3]. the test results sho wn as Table 10. From Table 10, in critical value of 10%, the null hy- pothe sis of “LDFI does not Granger Ca use LGDPI”is rejected; This shows there is one-way Granger causality between LDFI and LGDPI, that is, the growth of direct foreign investments impacts industrial economic growth, direct foreign investments growth is the cause s of indus- trial econo mic gro wth, while ind ustria l economic growth is not cau s ality of the dire ct fore ign investments growth. 6. Conclusions and Recommendations A) Alt ho u gh t he growth o f GDPI and DFI are unstable, there is long-term stable equilibrium relationship be- tween GDPI and DFI. B) The growth of direct foreign investments is the causality of growth of GDPI. It can be known, the growth of direct foreign investments plays an important role of GDPI growth. C) Foreign d ir e c t invest ment plays an important role in China 's indu strial ec onomic g rowth in t he short term and long term. Foreign direct investments keep stable equili- brium gro wth relationship to China's i ndustrial economic growth. Foreign direct investment is an important part and driving force in China 's foreign trade. Foreign direct investment is an important part and the driving force in China's foreign trade. Therefore, foreign direct invest- ment should be encouraged in further to accelerate the development of China's foreign trade. On the one hand, China attract foreign investment policy orientation should be actively adjust, the foreign capital enterprise with high technology and high added value encouraged into C hi na . On t he o the r ha nd , t o d e vel op Chi na 's domes- tic processing trade enterprise's development, which has not lost comparative advantage industry development premise, further use of foreign advanced technology and management level to promote the upgrading of the in- dustrial str ucture o f Chi na. 7. Acknowledgment This work was supported by the Planned Science and Technology Project of China Hunan Provincial Science & Technology Department under grant No.2012FJ3030, and The Vocational Education Subject of China Machi- nery Industry Education Association in 2011 under grant No. ZJJX11ZZ013. REFERENCES [1] Tan Yuanfa. Circular economy of equipment manufactur- ing [M]. Beijing: China economic publishing house, 2010. [2] Jeffrey M. Woddridge, Introductory Econometrics: A Modern Approach. Third Edition [M]. Beijing: Tsinghua Universit y Pr ess, 2007. [3] Tan Yuanfa, Yin Ying, Cointegration Between the Growth of Industrial Economy and Foreign Trade [J]. Consume Guide,2008-3. [4] Ugur S.S Ramazan. Energy consumption and GDP: Cau- sality relationship in G-7 cou ntries and emergin g markets [J]. Energy Economics, 2003-25:33~37. [5] Glasure Y U.Lee A R. Co-integration, error-correction and the relationship between GDP and Electricity: the case of South Korea and Singapore[J]. Resource and Electricity Economi cs,1997-20:17~25. [6] Cheng B. S. An investigation of cointegration and causal- ity between energy consumption and economic growth [J]. Journal of Energy Development ,1995-21:73~84. |