Paper Menu >>

Journal Menu >>

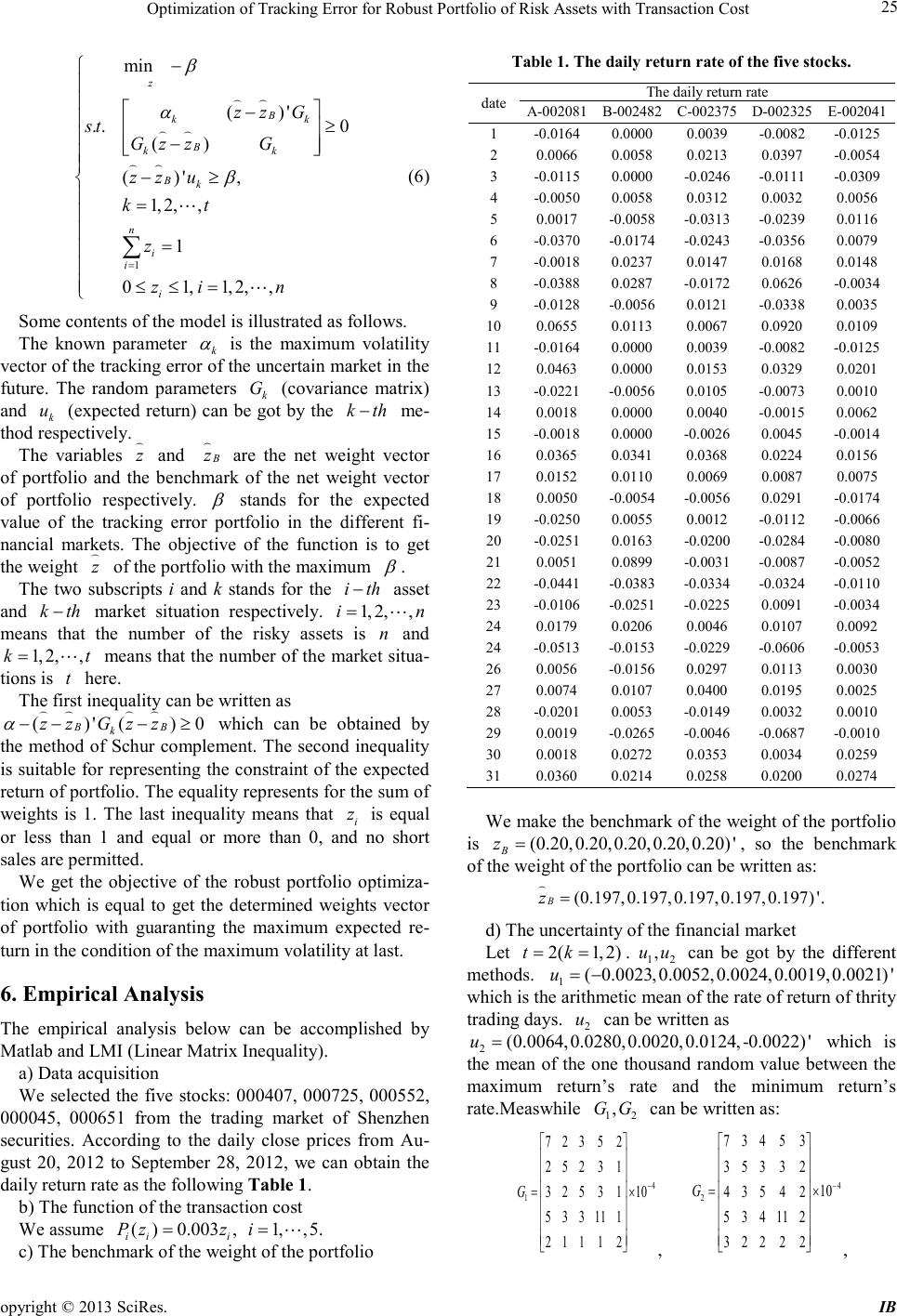

iBusiness, 2013, 5, 23-26 doi:10.4236/ib.2013.51b005 Published Online March 2013 (http://www.scirp.org/journal/ib) Copyright © 2013 SciRes. IB 23 Optimization of Tracking Error for Robust Portfolio of Risk Assets with Trans ac t ion Cost Dong Zheng, Xi-kun Liang Hangzhou Institute of Service Engineering, Hangzhou Normal University, Hangzhou, China. Email: 772827344@qq.com, schenken@163.com Received 2013 ABSTRACT Based on the optimization of robust portfolio with tracking error, a robust mean-variance portfolio selection model of tracking error with transaction cost is presented for the case that only risky assets exist and expected returns of assets are uncertain and belong to a convex polyhedron. This paper aims to solve the problem of the portfolio with the selec- tion o f the rat io on the c onditi on of ma ximumi mum fluc tuation o f the tra cking e rror, mak ing the e xpectat ion of t he re- turn to be the maximumimum. It also makes the portfolio ’s practica l c ho ic e by the function of the linear transaction co st as the same time of construction and application of the model. Empirical analysis with five real stocks is performed by the metho d o f LMI (Linear Matrix Inequality) to show the efficiency of the model. Keywords: Transaction Co st; T r a c king Error; Robust; Risk y Assets; Portfolio Optimizatio n 1. Introduction The Mean-Variance model developed by Markowitz [1] has been playing an important role in the field of asset allocation. Based on this theory, some robust portfolio optimization methods later has made up it effectively [2-11]. Ben has researched the topic of the robust opti- mization method and applications [2]. Pinara has studied the issue about the robust profit opportunities in risky financial portfolios [7]. On the condition of the separa- tion of ownership of the funds and the rights of invest- ment and management in the recent financial trading market, the model of tracking error robust portfolio op- timization has been applied in the practice of financial investment: Assuming the situation that both the rate of expected returns and the covariance matrix is uncertain which belong to the known convex combinations, Costa has studied the issue about tracking error robust portfolio with the method of the linear-matrix inequalities [12]. Moreo ver, robust po rtfolio sel ection with transac tion co st has been given high priority: Bertsimas[13] has re- searched about robust multiperiod portfolio management in the presence of transaction cost. Xue [14] has studied about mean-variance portfolio optimal problem under concave transaction cost and Erdogany [15] has studied the issue about ro bust active portfolio management. In this paper, we have researched the topic of tracking error robust portfolio of risky assets with transaction cost on the condition of the uncertainty of both the expected return rate and the covariance matrix belonging to the known con ve x set s. In t he e nd of th is pa per , an e mpirical analysis is given through the method of LMI (Linear Matrix Inequa lity) to show the efficiency of the model. 2. Introdution to Parameters It is assumed that there are only n risky assets in the market and which c an be writ ten as ( ) 12 ,, n A aaa= . a) The weight vector of the risky portfolio is ( ) 12 ,,, ' n z zzz= where ( ) 12 ,,, ' n zz z is the transpose of ( ) 12 ,,, n zz z. i z is the weight of portfolio in the i th− assets, 01, 1,2,, i zi n ≤≤= , and it satisfied with '1zI⋅= in which I is the n-di me nsiona l uni t colu mn ve ct or . b) The rate of the return vector of the risky assets can be expressed as ( ) 12 ,, ,' n r rrr= , where the transpose of ( ) 12 ,,, n rr r is ( ) 12 ,, ,' n rr r. c) The rate of the expected return vector of the risky assets can be written as: ( ) 12 (),, ,' n Er µ µµµ = = . while the covariance matrix is noted as nn GR × ∈ . d) The vector of the transaction cost can be noted as: 11 21 ()( ( ),( ),,())' nn PzPzPzP z= , where () ii Pz is the individual transaction cost on the i th− risky ass et. e) The net weight vector of po r tfolio is ( ) 12 (), , ,' n zzPzz zz=−= ,  Optimization of Tracking Error for Robust Portfolio of Risk Assets with Transaction Cost Copyright © 2013 SciRes. IB 24 where () ii ii zz Pz= − is denoted for the weights of the i th− risky ass ets with tr ansact i on c ost. f) The sum of the returns can be expressed as: 1 () '. n ii i R zzuz µ µ = == ∑ g) T he net of the returns of the risky assets can be de- noted as 11 ( )(()) nn i uiii ii ii NRzu zuzPz = = = =− ∑∑ (1) h) The variance of the net returns of the portfolio can be written as: 2 () 'z zGz σ = (2) i) The function of linear transaction cost of the risky assets can be expressed as: (),1, 2,, i iiii P zazbin=+= As the fixed cost can be omitted, the above formula can be simplified for ( ),01 i iiii P zaza= << (3) 3. Tracking Error Robust Portfolio Optimization under Certain Condition Tracking error can be actually called for the difference between the return of the investor’s portfolio and bench- mark return portfolio. It can be assumed that the vector of the predetermined benchmark return is ( ) 12 , ,,' n B BBB z zzz= here. Usually, the tracking error can be expressed either as the relative return ( ) () ' B zzz u β = − or as the variance ( )( ) 2()' BB zzz Gzz σ =−− . Actually, it can be written into two situations which are equal with each other in the optimization of the tracking error: the first situation is to minimum the va- riance in the condition of guaranting the fixed objective of the relative return, the second situation is to maximum the return under guaranting fixed the relative variance. The model of the second situation can be expressed as [12] 22 0 max( ) ..( ) z z st z z β σσ ≤ ∈Ψ (4) 4. Tracking Error Robust Portfolio Optimization in Uncertain Market The uncertain condition here is that both the expected return and the covariance can be variable with the change of the environment of the financial market. Costa as- sumed that the parameter µ and G belong to two different convex combinations respectively to describe the uncertain[12], it can be written as { } 12 ,,, t uCon uuu∈ , { } 12 ,,, t GCon GGG∈ where 12 (,,, )',,1,2,, kk kknk uuuu Gkt= = are stood for the expected return and the covariance rerespectively under the uncertain condition which are obtained by the different methods. The reference [12] demo nstrates the form of the linear matrix inequalities to denote for the optimization in the uncertain condition of the tracking error robust portfolio with n risky assets and 1 risk-free asset based on the condition above, so we can get robust portfolio optimiza- tion with n risky assets through the model above as fol- lows: 1 min ( )' .. 0 () () ',1, 2,, 1 01,1, 2,, z k Bk kB k Bk n i i i zz G st Gzz G zz ukt z zi n β α β = − − ≥ − − ≥= = ≤≤ = ∑ (5) where max()' ,1,2,... Bk k zzukt β =−= has introduced the bounded variable of the deviationist fluctuations, the function of the model is to get the vector of weight of the portfolio z to satisfy the condition of the maximum ex- pected return β . The significance of mathematical finance is to find a portfolio with maximum worst case expected performance about a benchmark, with guaran- teed fixed maximum tracking error volatility. Actually, the maximum re turn ca n be writt en as: { } min max()';() Bk zkzz uz βα =−− −∈Λ where { } ();()'( )0,1,2,, kBk B zzzGzzkt αα Λ=∈Ψ− −−≥= and ()'()0 kBkB zz Gzz α −−− ≥ can be obtained by the method of Schur complement, 12 ( ,,...,)' kt α αα α = is the vector of maximum volatility of the tracking error in uncer t ain eco nomy of the future[12]. 5. Tracking Error Robust Portfolio Optimization of Risky Assets with Transaction Cost Based on model (5) above, we consider the linear trans- action cost to bulid a new model of tracking errof robust portfolio optimization of risky assets with transaction cost. T his model is express as follo wing formula.  Optimization of Tracking Error for Robust Portfolio of Risk Assets with Transaction Cost opyright © 2013 SciRes. IB 25 1 min ( )' .. 0 () ( )', 1,2,, 1 01,1, 2,, z B kk B kk Bk n i i i zz G st Gzz G zz u kt z zi n β α β = − − ≥ − −≥ = = ≤≤ = ∑ (6) So me c ontents of the model is illustrated as follo ws. The known parameter k α is the maximum volatility vector of the tracking error of the uncertain market in the future. The random parameters k G (covariance matrix) and k u (expected return) can be got by the k th− me- thod respectively. The variables z and B z are the net weight vector of portfolio and the benchmark of the net weight vector of portfolio respectively. β stands for the expected value of the tracking error portfolio in the different fi- nancial markets. The objective of the function is to get the wei ght z of the portfolio with the maximum β . The two subscripts i and k stands for the i th− asset and k th− market situation respectively. 1, 2,,in= means that the number of the risky assets is n and 1, 2,,kt= means that the number of the market situa- tions is t here. The first inequality can be written as ()'()0 BB k zz Gzz α −−−≥ which can be obtained by the method of Schur complement. The second inequality is suitable for representing the constraint of the expected return of portfolio. The equality represents for the sum of weights is 1. The last inequality means that i z is equal or less than 1 and equal or more than 0, and no short sales are permitted. We get the objective of the robust portfolio optimiza- tion which is equal to get the determined weights vector of portfolio with guaranting the maximum expected re- turn in the condition of the maximum vola tility at last. 6. Empirical Analysis The empirical analysis below can be accomplished by Matlab and LMI (Linear Matrix Inequality). a) Data acq uisition We selected the five stocks: 000407, 000725, 000552, 000045, 000651 from the trading market of Shenzhen securities. According to the daily close prices from Au- gust 20, 2012 to September 28, 2012, we can obtain the daily return rate as the following Table 1. b) The function of the t ra ns action cost We assume ()0.003 ,1,,5. ii i Pzz i== c) The benchmark of the weight of the portfolio Table 1. The daily retu rn rate of the five stocks. date The daily return rate A-002081 B-002482 C-002375 D-002325 E-002041 1 -0.0164 0.0000 0.0039 -0.0082 -0.0125 2 0.0066 0.0058 0.0213 0.0397 -0.0054 3 -0.0115 0.0000 -0.0246 -0.0111 -0.0309 4 -0.0050 0.0058 0.0312 0.0032 0.0056 5 0.0017 -0.0058 -0.0313 -0.0239 0.0116 6 -0.0370 -0.0174 -0.0243 -0.0356 0.0079 7 -0.0018 0.0237 0.0147 0.0168 0.0148 8 -0.0388 0.0287 -0.0172 0.0626 -0.0034 9 -0.0128 -0.0056 0.0121 -0.0338 0.0035 10 0.0655 0.0113 0.0067 0.0920 0.0109 11 -0. 0164 0.0000 0.0039 -0.0082 -0.012 5 12 0.0463 0.0000 0.0153 0.0329 0.0201 13 -0. 0221 -0.0056 0.0105 -0.0073 0.0010 14 0.0018 0.0000 0.0040 -0.0015 0.0062 15 -0. 0018 0.0000 -0.0026 0.0045 -0.0014 16 0.0365 0.0341 0.0368 0.0224 0.0156 17 0.0152 0.0110 0.0069 0.0087 0.0075 18 0.0050 -0.0054 -0.0056 0.0291 -0.0174 19 -0. 0250 0.0055 0.0012 -0.0112 -0.006 6 20 -0. 0251 0.0163 -0.0200 -0.028 4 -0.0080 21 0.0051 0.0899 -0.0031 -0.0087 -0.0052 22 -0. 0441 -0.0383 -0.0334 -0.0324 -0.0110 23 -0. 0106 -0.0251 -0.0225 0.0091 -0.0034 24 0.0179 0.0206 0.0046 0.0107 0.0092 24 -0.0513 -0. 0153 -0.0229 -0.0606 -0.0053 26 0.0056 -0.0156 0.0297 0.0113 0.0030 27 0.0074 0.0107 0.0400 0.0195 0.0025 28 -0.0201 0.0053 -0.0149 0.0032 0.0010 29 0.0019 -0.0265 -0.0046 -0.0687 -0.0010 30 0.0018 0.0272 0.0353 0.0034 0.0259 31 0.0360 0.0214 0.0258 0.0200 0.0274 We make the benchmark of the weight of the portfolio is (0.20,0.20,0.20,0.20,0.20)' B z=, so the benchmark of the weight of the portfolio c a n b e written as: (0.197,0.197,0.197,0.197,0.197)'. B z= d) The uncert ainty of the financial market Let 2( 1,2)tk= =. 12 ,uu can be got by the different methods. 1 ( 0.0023,0.0052,0.0024,0.0019,0.0021)'u=− which is the arithmetic mean of the rate of return of thrit y trading days. 2 u can be written as 2 (0.0064,0.0280,0.0020,0.0124,-0.0022)'u= which is the mean of the one tho usand random value between t he maximum return’s rate and the minimum return’s rate.Measwhile 12 , GG can be written as: 4 1 72352 25231 10 325 31 53311 1 211 1 2 G − = × , 4 2 73453 35332 10 435 4 2 534112 32222 G − = × ,  Optimization of Tracking Error for Robust Portfolio of Risk Assets with Transaction Cost Copyright © 2013 SciRes. IB 26 where 1 G can b e got by the r ate of ret urn o f thrit y trad- ing days, 2 G can be obtained by the method that we endued 0.4 and 0.6 to the first 20 trading days and the last 10 trading days respectively accroding to the weig h ts. e) The max i mu m volat ility of tra c king er ror The maximu m volatility of tra cking error can be set to 12 0.0013, 0.0034 αα = = , so the solution of the model (6) is able to be calculated as follows: (0.3217,0.2078,0.1153,0.2065,0.1487)', 0.1689 z β = = 7. Conclusions In this paper, a tracking error robust portfolio optimiza- tion model of risky assets with transaction cost is estab- lished for the pr actice of financial market. T he optimiza- tion expands the previous theory of the portfolio. More- over, it can be much more useful and efficient in the ap- plication of the practice of portfolio selection. We will have a further discussion on the other types of the func- tion with transactio n cost and the issue o f portfolio selec- tion in the condition of the uncertain financial market. 8. Acknowledgemen ts Our researching work is supported by the National Natu- ral S cience Fo undatio n of China ( 109711 62) and the nat- ural science foundation of Zhejiang Province (Y6110178) and the Research Founds of Hangzhou Normal Univer- sity. We would like to express our gratitude to all those who he lped us duri ng t he writi ng of this thesis. REFERENCES [1] Markowitz H.M., “Portfolio selection,” Journal of Finance, Vol. 7, 1952, pp. 77-91. [2] Ben A.,Nemirovski A., “Robust optimiza- tion-methodology and applications,” Mathematics Pro- gram, Vol. 92, 2002, pp. 889-909. [3] Ben -Tal A. and Nemirovski A., “Robust convex optimi- zation,” Mathematics of Operations Research, Vol. 23, 1998, pp. 769-805. [4] Chen W. and Tan,S.H., “Robust portfolio selection based on asymmetric measures of variability of stock returns,” Journal of Computational and Applied Mathematics, Vol. 232, 2009, pp. 295-304. [5] Goldfarb D.and Iyengar G., “Robust portfolio selection problems,” Mathematics of Operations Research, Vol. 97, 2003, pp. 1-38. [6] Lobo Vandenberghe L, Boyd S. and Lebert H., “Secon d-order cone programming: Interior-point methods and engineering applications,” Linear Algebra Applica- tion, Vol. 284, 1998, pp. 193-228. [7] Pinara M. C.,Tutuncu R H., “Robust Profit Opportunities in Risky Financial Porfolios,” Operations Research Let- ters, Vol. 33, 2005, pp. 331-340. [8] Lu Zhaosong, “Robust portfolio selection based on a joint ellipsoidal uncertainty set,” Optimization Methods and Software, Vol. 26, 2011, pp. 89-104. [9] Fab ozzi F.J. , Petr N.K., D essislava A.P . and Sergio M.F., “Robust portfolio optimization,” The journal of Portfolio Management, 2007, pp. 40-48. [10] Roll R., “A mean - variance analysis of tracking error,” Journal of Portfolio Management, Vol. 18, 1992, pp. 13- 22. [11] Soyster A.L., “Convex programming with set inclusive constraints and applications to inexact linear program- ming,” Operations Research, Vol. 21, 1973, pp. 1154-1157. [12] Costa O.L.V . and Pai va A.C., “R obust portfolio selectio n using linear-matrix inequalities,” Journal of Economic Dynamics and Control, Vol. 26, 2002, pp. 889-909. [13] Bertsimas D. and Pachamanova D., “Robust multiperiod portfolio management in the presence of transaction costs,” Computers and Operations Research, Vol. 35, 2008, pp. 3-17. [14] Hong-Gang Xue. Cheng-Xian Xu. and Zong-Xian Feng, “Mean–variance portfolio optimal problem under concave transact ion co st,” Applied Mathematics and Computation, Vol. 174, 2006, pp. 1-12. [15] Erdogany E., Goldfarb D. and Iyengar G., “Robust active portfolio Management,” Department of Industrial Engi- neering and Operations Research, Columbia University, USA, CORC Technical Report TR-2004-11, Nov.2006. http://www.corc.ieor.colimbia.edu/reports/techreports/tr-2 004-11.pdf. |