K. JIA ET AL.

Inherent Risk (IR, B1)

IR is the susceptibility of a financial institution to money

laundering occurred given inherent and environmental charac-

teristics, but without regard to the internal control structure. IR

comprises a number of elements among which the following

three are the most significant.

The size of the institution (C1). A multi-national bank has a

higher possibility of being misused in laundering money

than a local saving bank (Reserve Bank of New Zealand,

2011). Although the measurements of institution size are

various (e.g. by asset, capital, revenue, profit, employee

number or branch number, etc.), the number of customers is

the most relevant indicator in analyzing the interaction be-

tween size and MLR of an institution because all money

launderings are eventually committed by “customers”, and

thus could be used here to define the size of institution.

The geographic location of the institution (C2). This ele-

ment actually concerns where the customers come from. In-

stitutions operating in the regions with high crime rate

would face more potential money-launderers and thus have

higher MLR (Federal Financial Institutions Examination

Council, 2010).

The business nature of the institution (C3). Institutions with

high proportion of cash deposit or withdrawal, cross-border

wire transfer and non-face-to-face businesses are normally

more vulnerable to money laundering. (Council of Europe,

2010).

Control Risk (CR, B2)

CR is the risk that money laundering may occur and not be

prevented or detected on a timely basis by the internal control

structure of the institution. CR is determined by the factors

inside an institution and can be controlled by the institution.

This paper identified the following seven fundamental factors

which directly affect CR level and from which other inside

factors are derived (Ma, 2009).

Management attitude and knowledge (C4). Reviewers can

assess the senior executives’ attitude and knowledge about

AML by interviewing the executives as well as the em-

ployees or by checking the written responsibilities of the

executives.

Procedures and measures (C5). Reviewers can assess the

validity of the AML procedures and measures in an institu-

tion by off-site reviews.

Computer system (C6). The two core roles that the computer

system is expected to play in the AML structure of an insti-

tution are storing customer identification information and

transaction records and analyzing abnormal transactions.

On-site test is needed to assess the efficiency of the AML

computer system in an institution.

Resources allocated (C7). The resource allocated in AML

can be measured by the total working hours of all AML

staff in the institution or the amount of funds spent on

AML.

Performance of customer due diligence (C8). On-site in-

spection is needed to assess whether the performance of

customer due diligence regulatory requirements or internal

procedures are fully implemented within an institution, in-

cluding identifying and verifying the identity of the cus-

tomer and the beneficial owner, recording the basic identity

information of the customer, and so on.

Performance of suspicious transactions report (C9). On-site

inspection is needed to assess whether STR regulatory re-

quirements or internal procedures are fully implemented

within an institution, including analyzing abnormal transac-

tions, filing reports and making them to the financial intel-

ligence unit.

Trainings (C10). To be assessed by interview or examina-

tion.

Making Pair-Wise Comparisons and Obtaining the

Judgmental Ma t ri x

After building AHP model, the priorities have been decided.

Elements are compared pair-wise and judgments on compara-

tive attractiveness of elements are captured using the traditional

9 rating scale, with 9 indicating “extreme importance”, 7 indi-

cating “very strong or demonstrated importance”, 5 indicating

“strong or essential importance”, 3 indicating “fairly impor-

tance”, 1 indicating “equal importance” when give the intensity

of importance. Scores of 2, 4, 6, 8 demonstrate intermediate

values and reciprocals show inverse comparison.

16 experts were invited to give the relative importance, and

for the convenience of calculation, the average value is round

number.

Results and Discussion

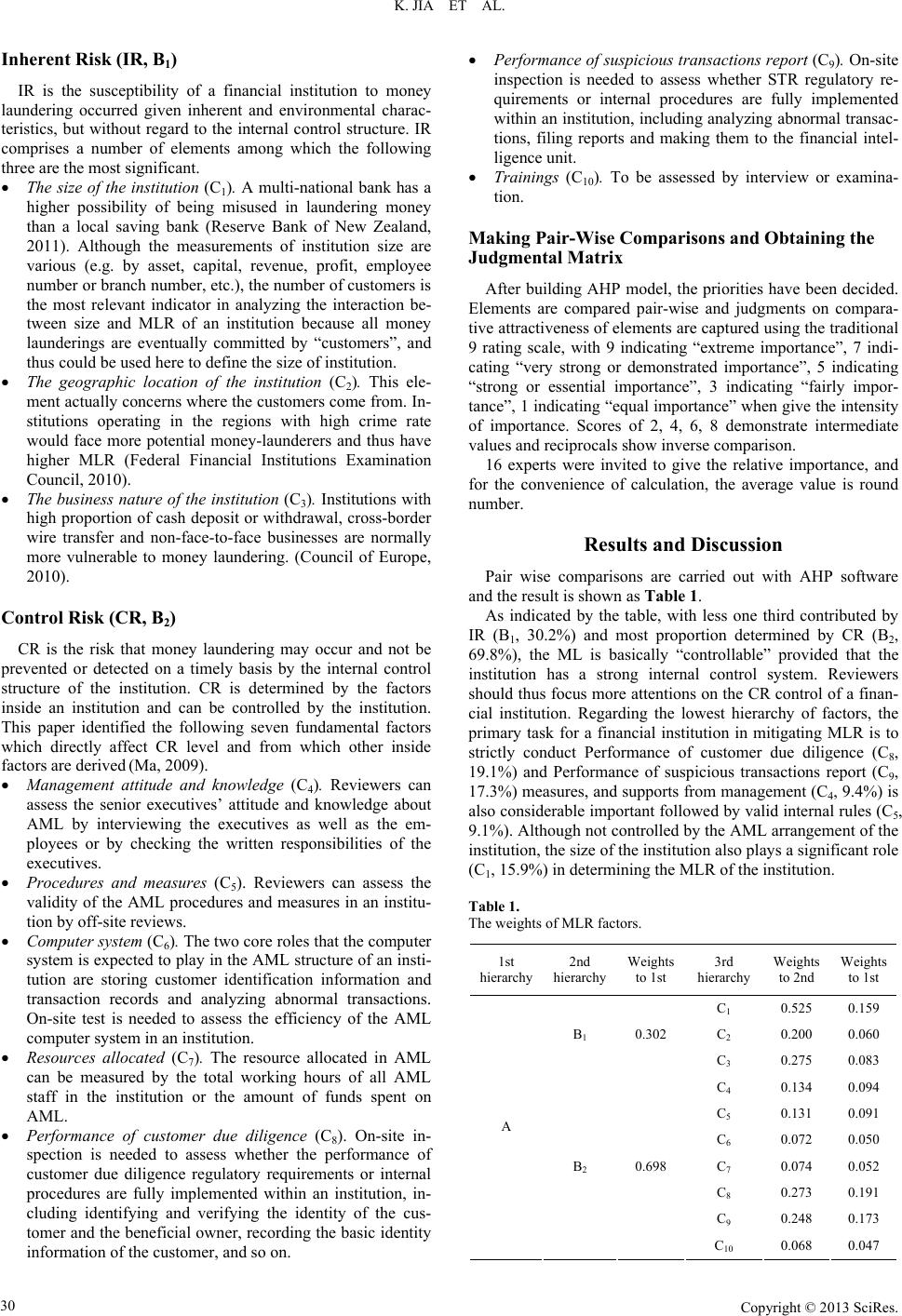

Pair wise comparisons are carried out with AHP software

and the result is shown as Table 1.

As indicated by the table, with less one third contributed by

IR (B1, 30.2%) and most proportion determined by CR (B2,

69.8%), the ML is basically “controllable” provided that the

institution has a strong internal control system. Reviewers

should thus focus more attentions on the CR control of a finan-

cial institution. Regarding the lowest hierarchy of factors, the

primary task for a financial institution in mitigating MLR is to

strictly conduct Performance of customer due diligence (C8,

19.1%) and Performance of suspicious transactions report (C9,

17.3%) measures, and supports from management (C4, 9.4%) is

also considerable important followed by valid internal rules (C5,

9.1%). Although not controlled by the AML arrangement of the

institution, the size of the institution also plays a significant role

(C1, 15.9%) in determining the MLR of the institution.

Table 1.

The weights of MLR factors.

1st

hierarchy 2nd

hierarchy Weights

to 1st 3rd

hierarchy Weights

to 2nd Weights

to 1st

C1 0.525 0.159

C2 0.200 0.060 B1 0.302

C3 0.275 0.083

C4 0.134 0.094

C5 0.131 0.091

C6 0.072 0.050

C7 0.074 0.052

C8 0.273 0.191

C9 0.248 0.173

A

B2 0.698

C10 0.068 0.047

Copyright © 2013 SciRes.

30