Theoretical Economics Letters

Vol.2 No.5(2012), Article ID:25939,6 pages DOI:10.4236/tel.2012.25105

Investment Incentives under Price-Cap Regulation*

1Department of Economics and Social Sciences, Università Politecnica delle Marche, Ancona, Italy

2Organisation for Economic Co-Operation and Development, Paris, France

Email: #d.bartolini@univpm.it

Received September 26, 2012; revised October 28, 2012; accepted November 29, 2012

Keywords: Price Regulation; Investments; Incomplete Contracts

ABSTRACT

In the literature on price regulation, the price-cap mechanism is seen as a very powerful incentive mechanism towards efficiency improvements. What about quality investments? The empirical literature is not univocal: Some studies suggest a deterioration of quality, while others do not find any statistically significant impact. We analyze the incentive provided by price-cap regulation in a setting in which the investment decisions of the regulated firm suffer from hold-up, and contacts are incomplete. We show that the incentives to invest in cost-saving innovations can be fostered by a price-cap contract with a “sufficient” regulatory lag, while for other types of investments, such as quality enhancement, the same contract does not help. Furthermore, we show that if the firm faces a binding resource constraint the price-cap contract generates a crowding-out effect between the two types of investment. This might explain the non univocal empirical evidence.

1. Introduction

In the economic literature and in the practice of regulation, one of the most interesting mechanism is the pricecap. Its main virtue is the powerful incentive it provides the firm with, without requiring much information1. The mechanism consists in fixing the price variation for a given number of periods (regulatory lags), making the firm residual claimant for any efficiency improvement. In fact, efficiency enhancement is only one of the many types of investments the firm can undertake; for instance, the firm could invest in quality enhancement, in the safety of the production process, or in the reduction of the environmental impact of either the production process or the product, or both. The aim of the paper is to asses the impact of price-cap regulation on the incentives to undertake such investments.

The empirical evidence from industries regulated by price-cap is not univocal: Some studies suggest a deterioration of investments on maintenance and quality enhancement [2,3], while others do not find any significant evidence of quality deterioration [4,5]. It is, therefore, compelling to better understand the impact of price-cap regulation on different types of investments. We do so by studying a regulatory environment where a monopolistic firm can undertake a cost-reducing and a quality-enhancement investment.

There are two problems a regulator faces when dealing with investments: The moral hazard problem, stemming from the presence of asymmetric information; and dynamic inconsistency, stemming from the regulator’s temptation to reap all the benefits produced by the firm’s investment. In both cases, the result is underinvestment.

In the present work we focus on the second issue: the regulator’s commitment problem. From this point of view, the price-cap mechanism may induce the first best level of investments by making the firm residual claimant of any efficiency improvement. This feature of the price-cap mechanism can be best understood in an incomplete contract environment, where the effects of investments are not verifiable in front of a court of law, thus ruling out contracts contingent on such investments [6, for an introduction to the incomplete contract approach]2. This implies that the firm and the regulator would bargain over the returns of the investments, and the length of the regulatory contract would play a crucial role in shaping the parties’ outside option.

Our analysis provides two important insights. Firstly, we show that a price-cap contract can induce the first best level of cost-saving investment, with a “sufficient” regulatory lag, while the quality investment is not affected. Secondly, when the firm faces a binding resource constraint, we show that price-cap regulation actually harms the quality investment, creating a crowding-out effect in favor of the efficiency investment. These results might explain the non univocal empirical evidence: According to our model, we would expect the impact of price-cap on quality to be statistically significant only when the firm is resource constrained, and the regulatory lag is long enough for the investment to produce some returns.

In the following, we present a simple analytical model which is instrumental to show our preliminary results. We deliberately omit the analysis of many interesting issues, such as the welfare impact of price-cap regulation, and impose some restrictions, such as rigid demand, common discount factor, or only two periods, that allow us to show our results in the simplest way. These restrictions do not affect the validity of our results that are based on the assumption of incomplete contracts and the use of the Nash Bargaining Solution to characterize the negotiation between players.

In the next section we describe the general framework of the analysis; in the third section we study the outcome of the equilibrium drawing some preliminary conclusions on the effect of price-cap for the incentives; and finally, in the forth section we show that some of the results in the previous section depend on the assumption of unlimited resources.

2. The Model

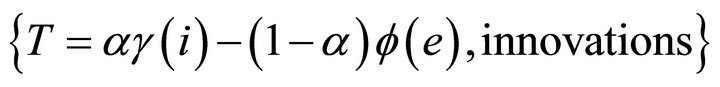

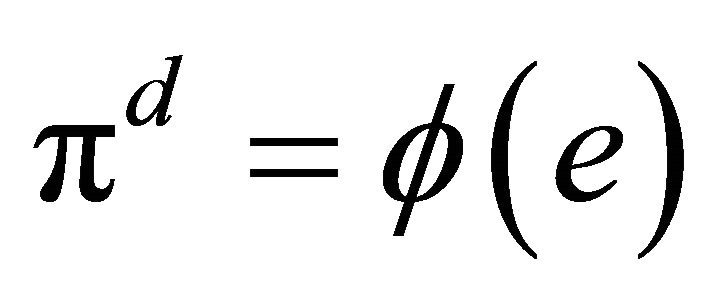

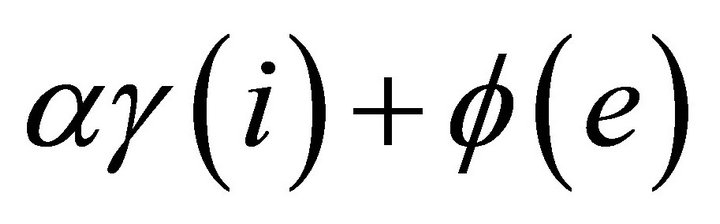

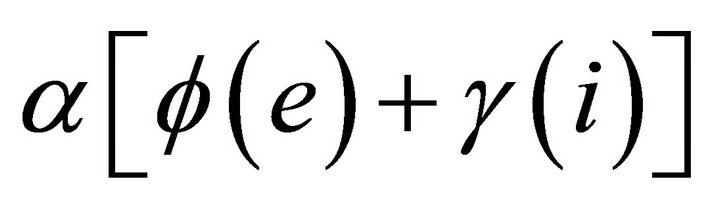

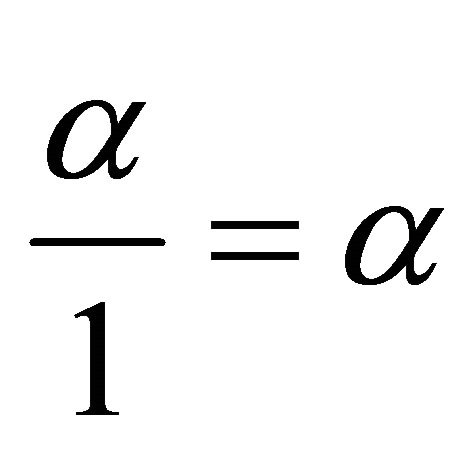

We consider a two-period model, where a monopolistic firm faces a rigid demand, normalized to 1, in each period. The firm satisfies such demand incurring in a total production cost,  , in both periods. The price citizens pay for the goods is determined by the sector regulator3. The firm’s objective is to maximize profits over the two periods, while the regulator cares only about citizens’ benefit, which is represented by a real value function

, in both periods. The price citizens pay for the goods is determined by the sector regulator3. The firm’s objective is to maximize profits over the two periods, while the regulator cares only about citizens’ benefit, which is represented by a real value function , decreasing and convex in price, P4. We assume a common discount factor

, decreasing and convex in price, P4. We assume a common discount factor .

.

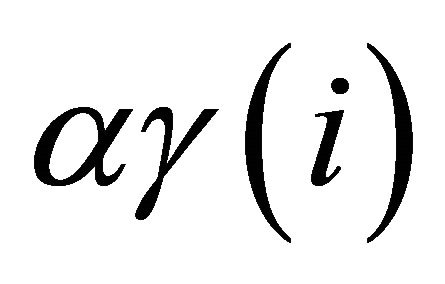

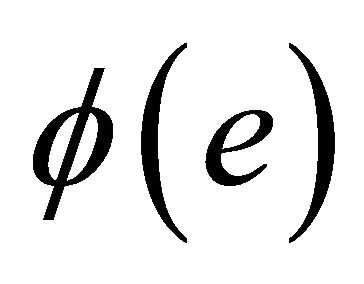

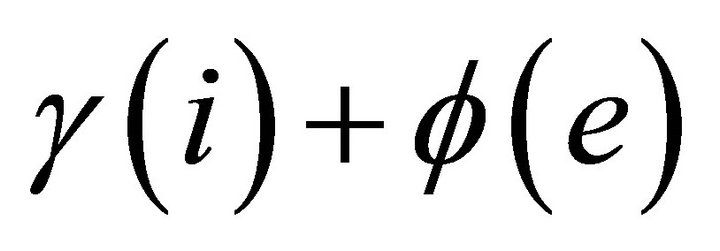

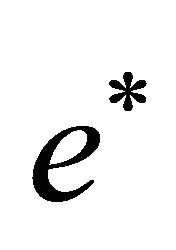

In the first period, the firm can invest in two types of projects: A cost-saving technology, and a quality enhancement technology. The former generates a reduction of costs equal to , where

, where  is the amount of investment. The quality enhancement technology generates an improvement in consumers’ benefit, equal to

is the amount of investment. The quality enhancement technology generates an improvement in consumers’ benefit, equal to , where

, where  is the amount of quality investment. We adopt the standard assumption of

is the amount of quality investment. We adopt the standard assumption of  and

and  increasing and strictly concave in their arguments, which captures the idea of decreasing marginal returns of the investment. The cost to undertake such investments is linear and equal to

increasing and strictly concave in their arguments, which captures the idea of decreasing marginal returns of the investment. The cost to undertake such investments is linear and equal to  and

and , respectively, implying a constant marginal cost equal to 1. Finally, we assume relationship-specific investments, that is, the firm cannot find alternative uses for such technologies5. The latter assumption seems quite reasonable in industries subject to price regulation, such as the utility sectors: For instance, an innovation which allows a better monitoring of the quality of water, is unlikely to be used in other industries.

, respectively, implying a constant marginal cost equal to 1. Finally, we assume relationship-specific investments, that is, the firm cannot find alternative uses for such technologies5. The latter assumption seems quite reasonable in industries subject to price regulation, such as the utility sectors: For instance, an innovation which allows a better monitoring of the quality of water, is unlikely to be used in other industries.

The timing of the game is as follow:

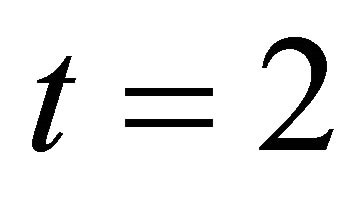

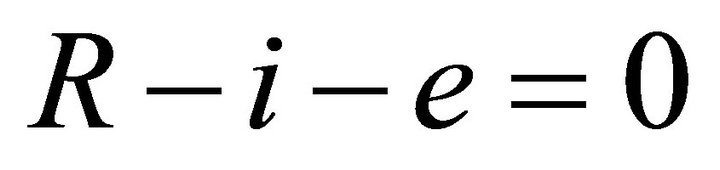

• In period , the regulator decides the price

, the regulator decides the price , the firm produces at cost

, the firm produces at cost  and chooses the level of

and chooses the level of  and

and ;

;

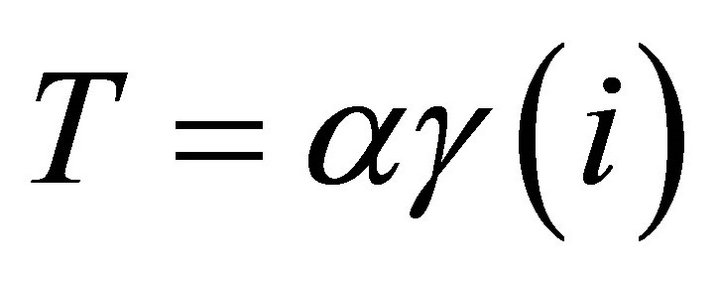

• In period , the firm and the regulator bargain over the returns of the two investments, the regulator decides the price

, the firm and the regulator bargain over the returns of the two investments, the regulator decides the price , and the firm decides whether to introduce the innovations stemming from the two investments.

, and the firm decides whether to introduce the innovations stemming from the two investments.

The key element of our approach is the bargaining game at the beginning of period 2, which determines the share of investment returns that goes to the firm, and, hence, its incentive to invest.

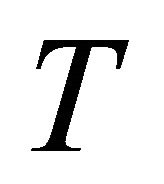

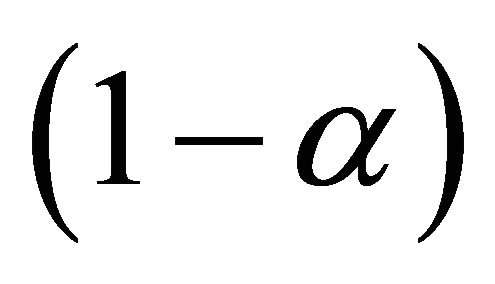

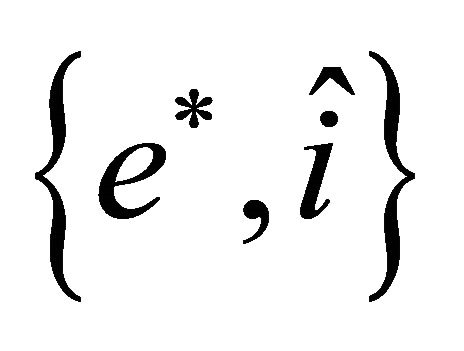

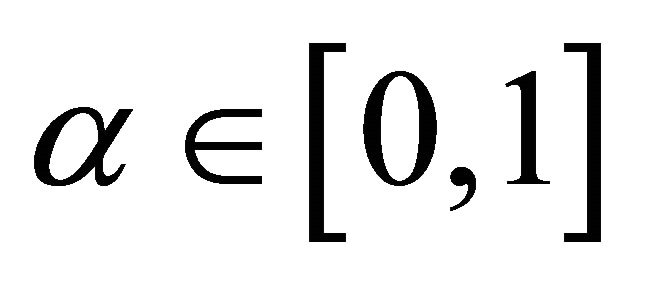

The outcome of the bargaining game between the firm and the regulator is modeled using the Nash Bargaining Solution (NBS) concept, which assigns a share of the returns according to the parties’ bargaining power and disagreement payoffs. The NBS provides the same outcome as an infinite horizon bargaining game of alternating offers when information is perfect and complete [8], therefore, in our setting of complete and perfect information, the NBS is quite robust. The NBS is obtained assuming exogenous bargaining powers, with the firm’s power equal to , and the regulator’s power

, and the regulator’s power .

.

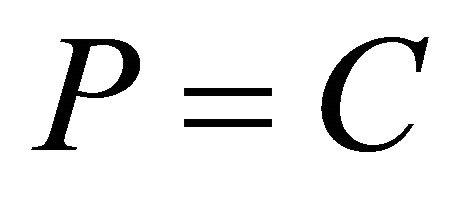

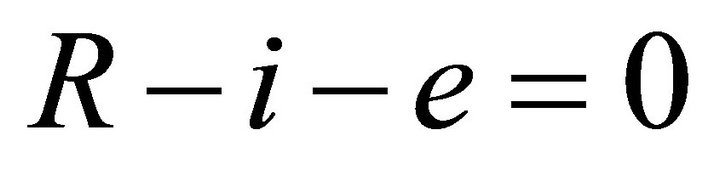

The distribution of the investments return between the firm and the regulator can be implemented either by a modification of the second period price or a monetary transfer , or both. Although the two options may have a different impact on consumers’ benefit, they are equivalent from the perspective of the firm, thus providing the same incentive to invest. Therefore, without loss of generality, we assume that the bargaining outcome is settled through a monetary transfer, while prices are set to cover the production cost,

, or both. Although the two options may have a different impact on consumers’ benefit, they are equivalent from the perspective of the firm, thus providing the same incentive to invest. Therefore, without loss of generality, we assume that the bargaining outcome is settled through a monetary transfer, while prices are set to cover the production cost,  , in both periods. Notice that, in a complete information environment and with the absence of any investment, the price which maximizes consumers’ benefit is

, in both periods. Notice that, in a complete information environment and with the absence of any investment, the price which maximizes consumers’ benefit is . Basically, we are assuming that the regulator uses two separate instruments: the price to maximize its payoff with respect to the basic cost

. Basically, we are assuming that the regulator uses two separate instruments: the price to maximize its payoff with respect to the basic cost , and the transfer to maximize its payoff with respect to the two investments.

, and the transfer to maximize its payoff with respect to the two investments.

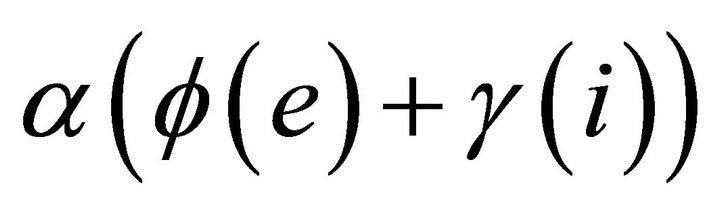

The provision of the goods determines the following benefit to citizens

(1)

(1)

(2)

(2)

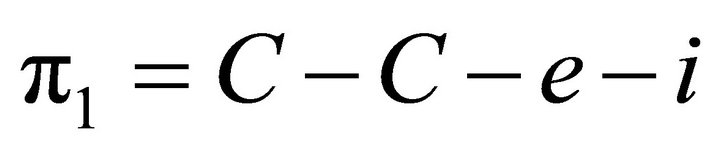

while firm’s profit in each period is

(3)

(3)

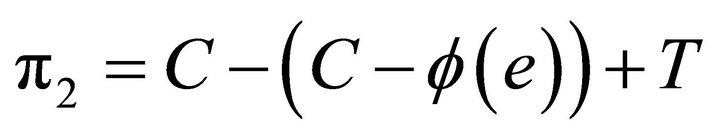

(4)

(4)

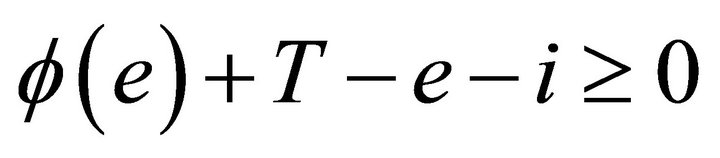

The firm would accept the contract only if her intertemporal payoff is non negative, . This condition, however, is always satisfied by the NBS.

. This condition, however, is always satisfied by the NBS.

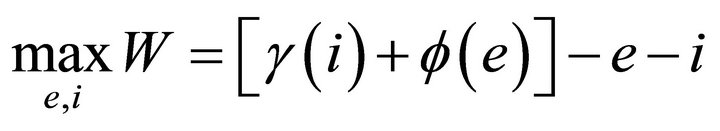

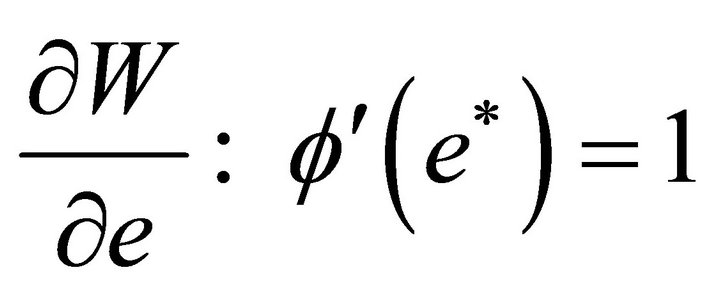

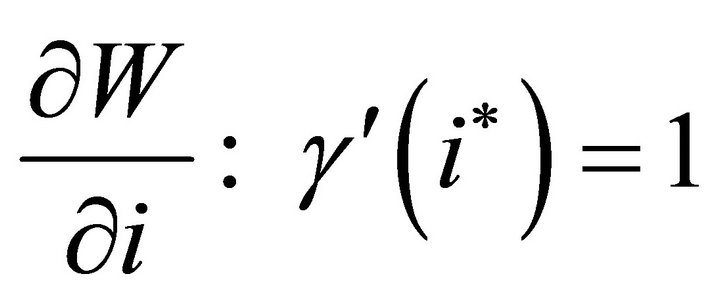

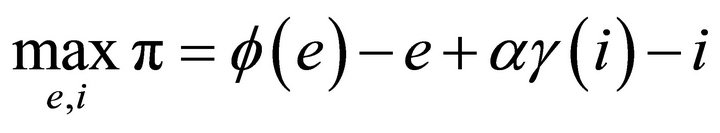

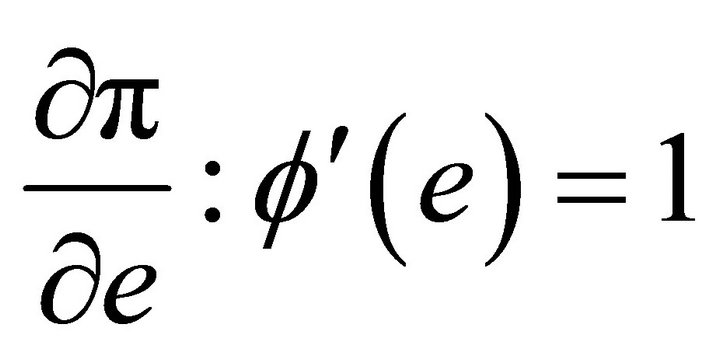

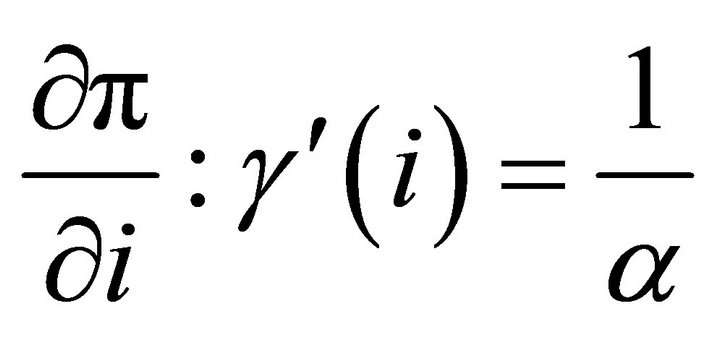

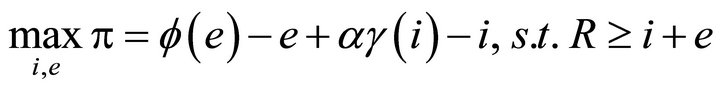

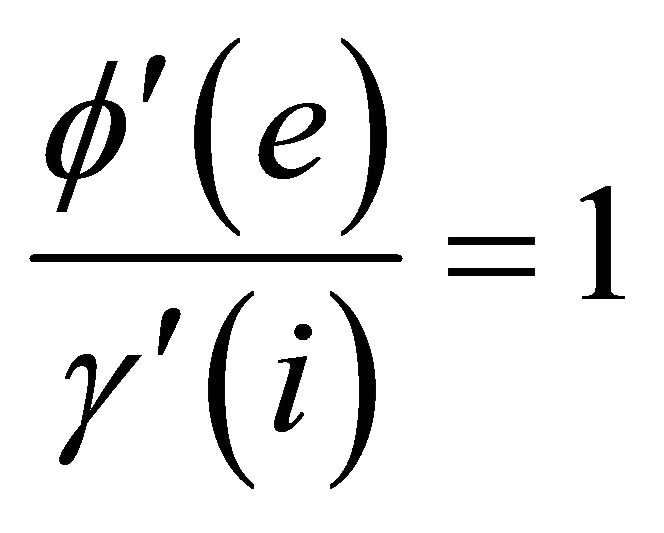

The ex-ante optimal level of investments is obtained by maximizing the total net return from the two investments,

(5)

(5)

(6)

(6)

(7)

(7)

where  and

and  are the first best levels of efficiency and quality investment, respectively. In both cases, the optimal level is such that the marginal benefit is equal to the marginal cost.

are the first best levels of efficiency and quality investment, respectively. In both cases, the optimal level is such that the marginal benefit is equal to the marginal cost.

The price-cap mechanism is such that the regulator commits to a given price variation for a given number of periods (lags). In the following analysis we consider two types of contracts: Short term (S), where the price-cap lasts for 1 period; and long-term (L), where the price-cap is enforced for 2 periods. In the former case, the regulator and the firm commit only for one period, while in the latter case the regulator commits to a given price for two periods, and the firm commits to provide the goods for two periods at the agreed price.

We can think of the (S) case as a price-cap with a regulatory lag which is smaller than the number of periods necessary for the investments to provide any return, while the (L) case represents a price-cap with a sufficiently long regulatory lag. It is worth noting that a one-period price-cap contract is equivalent to no contract in terms of the incentives to invest. The comparison between the equilibria in the two scenarios would allow to assess the impact of the price-cap on efficiency and quality investments.

2.1. Short-Term Regulation

At the beginning of time , the regulator would bargain with the firm to determine the amount of resources

, the regulator would bargain with the firm to determine the amount of resources  to transfer as a compensation for the investments undertaken.

to transfer as a compensation for the investments undertaken.

Applying backward induction, we start by defining the NBS in the second period bargaining game. In case of disagreement, the short-term nature of the first period contract implies that there is no provision of goods, so that both firm’s profit and consumers’ benefit are equal to zero. The NBS tells us the terms and conditions for production to take place.

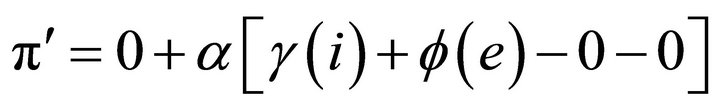

Lemma 1. The Nash-bargaining solution is given by the firm obtaining a share of the investment returns equal to .

.

Proof. The disagreement payoff of both firm and regulator is zero. The surplus to be divided is the sum of the effects of the two innovations, i.e. . Applying the NBS we get, a share for the firm equal to

. Applying the NBS we get, a share for the firm equal to , where the first term represents the firm’s disagreement payoff, and the term inside brackets the total surplus minus the disagreement payoff of the two parties. The share of the regulator is computed in the same way, with a bargaining power equal to

, where the first term represents the firm’s disagreement payoff, and the term inside brackets the total surplus minus the disagreement payoff of the two parties. The share of the regulator is computed in the same way, with a bargaining power equal to . ■

. ■

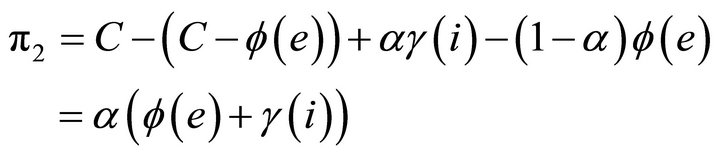

Lemma 2, together with the assumption of , implies that the firm would receive a transfer

, implies that the firm would receive a transfer , so that the firm’s second period payoff is exactly equal to its share of investments return, as can be seen by substituting out

, so that the firm’s second period payoff is exactly equal to its share of investments return, as can be seen by substituting out  and

and  in Equation (4),

in Equation (4),

(8)

(8)

Anticipating this outcome the firm would choose the investment levels that maximize the intertemporal profit function,

(9)

(9)

(10)

(10)

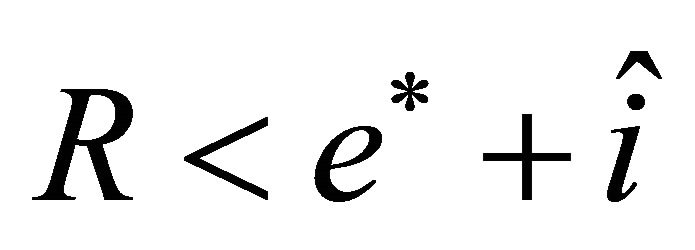

The firm would invest in the efficiency and the quality enhancement technologies an amount of resources that is lower than the first best, unless the firm has full bargaining power, . Let

. Let  and

and  be the level of investment that satisfies the FOCs.

be the level of investment that satisfies the FOCs.

Proposition 1 The strategy , in the first period, and

, in the first period, and  in the second period, represent the unique Subgame Perfect Equilibrium.

in the second period, represent the unique Subgame Perfect Equilibrium.

The uniqueness of the equilibrium rests on the assumption that the monetary transfer is the only way to settle the bargaining game. However, the first period investment strategy is not affected by this restriction, no matter how the firm is compensated the incentive is always the same.

2.2. Long-Term Regulation

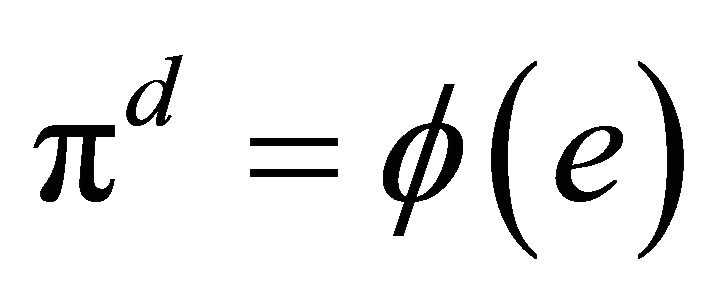

The regulatory contract consists of a price-cap regulation in which the regulator commits to the same level of price for the two periods. The key difference with respect to the short-run, is that the contract is valid for two periods, therefore, at the beginning of period 2, if no agreement is reached the parties will comply with the prescriptions of the original contract. The long-term nature of the contract makes the firm residual claimant of the efficiency investment, which is undertaken even if no agreement is reached at the beginning of period 2. The disagreement payoff of the firm is therefore equal to , the full return of the efficiency investment. By contrast, the regulator does not obtain any return form the firm’s investment if no agreement is reached. It is worth noting that this result does not depend on the assumption made on transfers, even if the regulator uses the price to settle the bargaining outcome, it could not impose a price lower than what it is prescribed in the contract.

, the full return of the efficiency investment. By contrast, the regulator does not obtain any return form the firm’s investment if no agreement is reached. It is worth noting that this result does not depend on the assumption made on transfers, even if the regulator uses the price to settle the bargaining outcome, it could not impose a price lower than what it is prescribed in the contract.

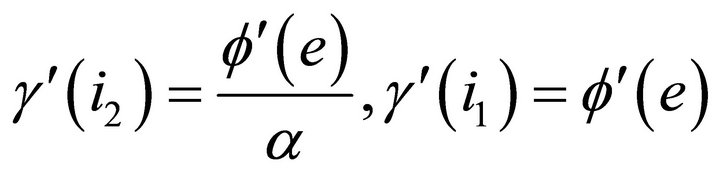

Lemma 2. The Nash-bargaining solution is given by the firm obtaining a share of returns of the quality investment equal to , and the full return on the efficiency investment,

, and the full return on the efficiency investment, .

.

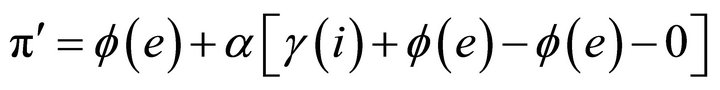

Proof. The proof of this result comes from the application of the Nash-Bargaining solution formula. The surplus to be divided is the sum of the effects of the two innovations, i.e. ; the default payoff of the firm is

; the default payoff of the firm is , because in case of disagreement the firm can still produce the goods at the previous period price, hence earning the full return on cost saving; by contrast the regulator would get no share of the investments return in case of disagreement. Applying the formula we get the firm’s share,

, because in case of disagreement the firm can still produce the goods at the previous period price, hence earning the full return on cost saving; by contrast the regulator would get no share of the investments return in case of disagreement. Applying the formula we get the firm’s share, . In the same way we can obtain the share of the regulator. ■

. In the same way we can obtain the share of the regulator. ■

The NBS is such that the regulator transfer the firm an amount .

.

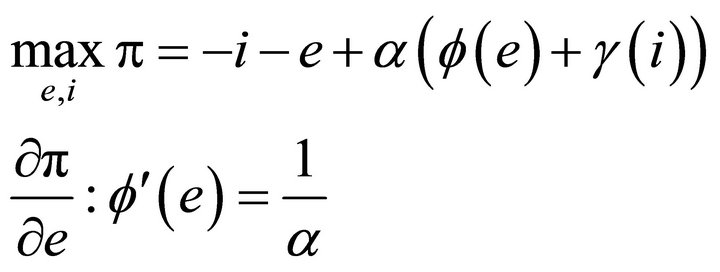

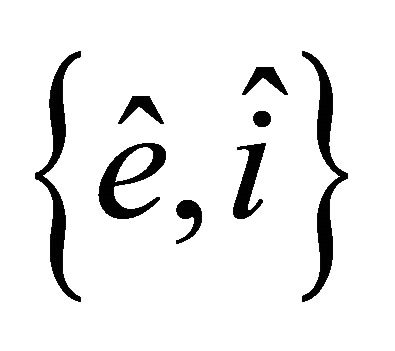

At date 1, the firm will anticipate the Nash-Bargaining solution and it will chose  and

and  in order to maximize,

in order to maximize,

(11)

(11)

(12)

(12)

(13)

(13)

Let  be the value of investment that satisfies condition 13.

be the value of investment that satisfies condition 13.

Proposition 2. The strategy  in the first period and

in the first period and  in the second period, is the unique Subgame Nash Equilibrium of the game.

in the second period, is the unique Subgame Nash Equilibrium of the game.

The equilibrium strategy prescribes the firm to invest the first best level  on the cost-saving technology, and

on the cost-saving technology, and  on the quality-enhancement technology; then, in the second period, the firm and the regulator agree on a monetary transfer

on the quality-enhancement technology; then, in the second period, the firm and the regulator agree on a monetary transfer , and the firm introduces both innovations. It is clear that the level of the quality investment is not affected by the price-cap contract, for the level is the same as in the short-run. The power of the price-cap regulation as an incentive to reduce costs, derive from the possibility to bind the parties to some verifiable actions: the level of price and the provision of goods. This is in line with [9], which show that the hold-up problem can be solved by a simple specificperformance contract.

, and the firm introduces both innovations. It is clear that the level of the quality investment is not affected by the price-cap contract, for the level is the same as in the short-run. The power of the price-cap regulation as an incentive to reduce costs, derive from the possibility to bind the parties to some verifiable actions: the level of price and the provision of goods. This is in line with [9], which show that the hold-up problem can be solved by a simple specificperformance contract.

Our analysis so far shows that cost reducing investment and quality investment are independent; the firm would choose the amount that equalize marginal benefit to marginal costs. In reality, however, the firm might face a tight budget constraint, so that it cannot meet both optimal conditions. The next section will investigate how the firm would allocate the resources between the two investments, when a price-cap is imposed.

3. Binding Resource Constraint

In this section we abandon the assumption of unlimited resources. In particular, we assume that the amount of resources is not enough to provide the unconstrained equilibrium level of efficiency and quality investment6,

where  is the amount of financial resources available over the two periods. The binding resource constraint affects the investment decision, but not the NBS which takes place after the investment has been undertaken and paid for.

is the amount of financial resources available over the two periods. The binding resource constraint affects the investment decision, but not the NBS which takes place after the investment has been undertaken and paid for.

In the long-term regulation, the NBS assigns the firm a share  (lemma 2), so that the firm’s investment choice would solve

(lemma 2), so that the firm’s investment choice would solve

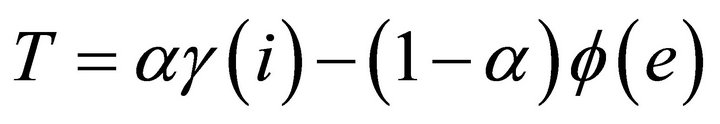

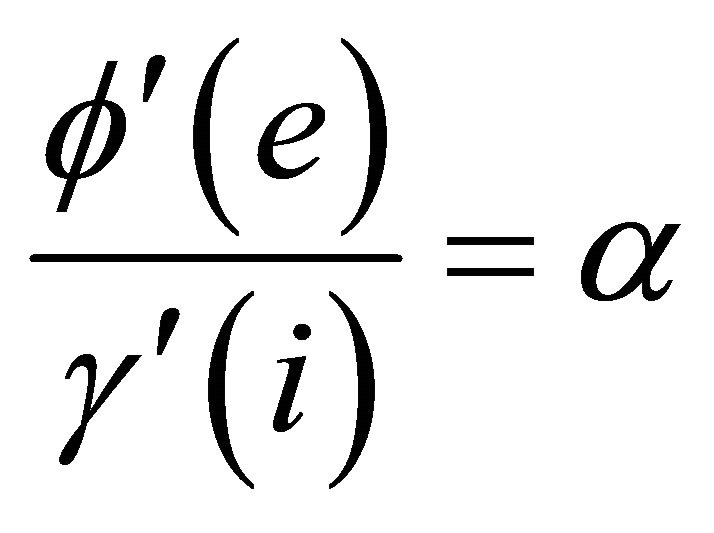

The FOC of the constrained optimization problem is characterized by the following two conditions:

(14)

(14)

(15)

(15)

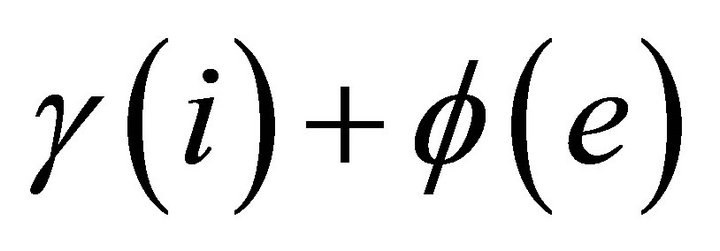

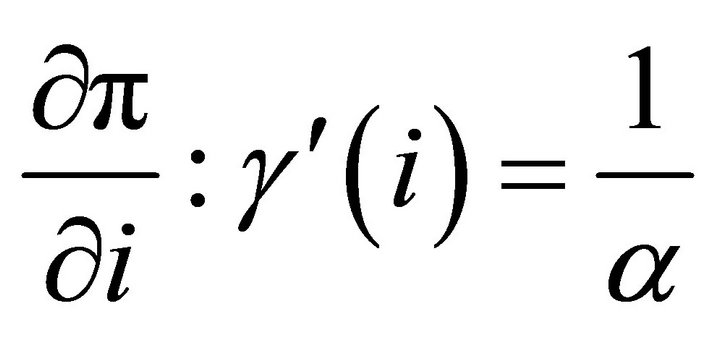

The level of investment in the two technologies must be such that the ratio between the two marginal impact is equal to . Condition (14) is required also in the unconstrained scenario, but now condition (15) requires the firm to satisfy the resource constraint. Therefore, a binding resource constraint determines a scale down of both investments, without changing the ratio between the investments.

. Condition (14) is required also in the unconstrained scenario, but now condition (15) requires the firm to satisfy the resource constraint. Therefore, a binding resource constraint determines a scale down of both investments, without changing the ratio between the investments.

In the short-term contract, the NBS assigns the firm a share , the firm’s investment choice is now characterized by the following two conditions:

, the firm’s investment choice is now characterized by the following two conditions:

(16)

(16)

(17)

(17)

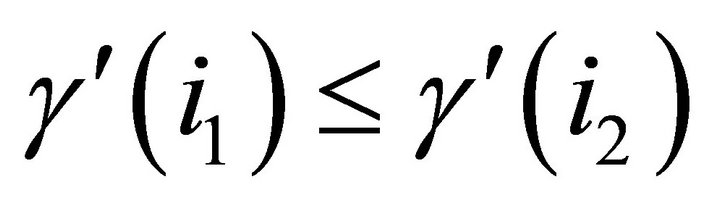

The ratio between the marginal impact of the two investment is now equalized, meaning that in equilibrium the marginal impact of the efficiency investment and the quality investment must be the same.

Proposition 3. The introduction of a price-cap contract of length two (two lags), decreases the amount of resources assigned to the quality investment if the firm’s resource constraint is binding.

Proof. Let  and

and  be the investment levels in case of short and long-term, respectively. Since the strict concavity of

be the investment levels in case of short and long-term, respectively. Since the strict concavity of , we have

, we have  if and only if

if and only if . From condition (14) and (16) we get

. From condition (14) and (16) we get

which implies , because

, because . ■

. ■

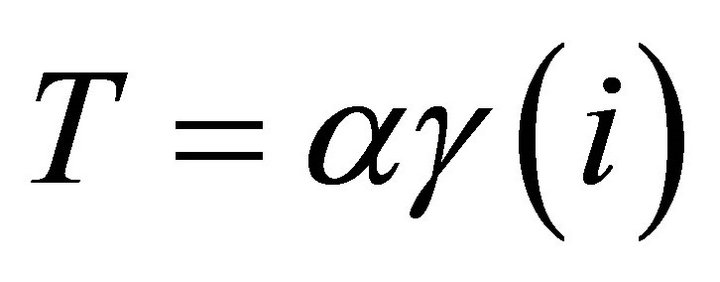

In our setting the incentive to invest depends on the bargaining game between the firm and the regulator. The share of resources that goes to each investment depends on condition 16, which represents the ratio of the firm’s bargaining power on the two investments. In the shortterm case the bargaining power is the same, hence the ratio is

;

;

by contrast in the long-term case the firm has full bargaining power on the efficiency investment, hence the ratio is

.

.

The firm, in general would allocate more resources to the investment in which its bargaining power is larger. In the case of non binding resource constraint, price-cap cap regulation would simply provide an incentive to put more resources on the efficiency investment, while the presence of a binding resource constrain would force the firm to trade resources from the quality to the efficiency investment.

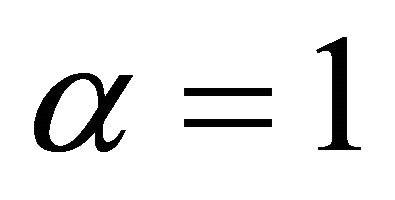

Remark 1. The presence of a binding resource constraint creates a crowding-out effect between efficiency and quality investments Remark 2. The crowding out effect is negatively related to the bargaining power of the firm, . If

. If  there is no crowding out.

there is no crowding out.

The crowding out effect is a consequence of the difference in returns of the two investments introduced by the price-cap mechanism. In our model, the return of the efficiency investment is maximum under the mechanism, while the return of the quality investment is equal to the bargaining power of the firm. The higher the bargaining power the smaller is the difference in the returns of the two investments. In the case of a firm enjoying all the bargaining power,  , there would be no difference in returns between the two investments, so that they become perfect substitute from the point of view of the resource constrained firm.

, there would be no difference in returns between the two investments, so that they become perfect substitute from the point of view of the resource constrained firm.

4. Concluding Comments

We can conclude that a price-cap contract with a regulatory lag which provides a strong incentive to the efficiency investment does hinder the quality investment only if the firm faces a binding resource constraint. This result provides a possible explanation for the non univocal results obtained, so far, by the empirical literature on price-cap regulation.

REFERENCES

- M. Armstrong, S. Cowan and J. Vickers, “Regulatory Reform: Economic Analysis and British Experience,” The MIT Press, Cambridge, 1994.

- L. O. Facanha and M. Resende, “Price Cap Regulation, Incentives and Quality: The Case of Brazilian Telecommunications,” International Journal of Production Economics, Vol. 28, No. 2, 2003, pp. 133-144.

- M. E. Clements, “Local Telephone Quality-Of-Service: A Framework and Empirical Evidence,” Telecommunications Policy, Vol. 28, No. 5-6, 2004, pp. 413-426. doi:10.1016/j.telpol.2004.02.001

- D. E. M. Sappington, “The Effects of Incentive Regulation on Retail Telephone Service Quality in the United States,” Review of Network Economics, Vol. 2, No. 4, 2003, pp. 355-375. doi:10.2202/1446-9022.1034

- A. Banerjee, “Does Incentive Regulation ‘Cause’ Degradation of Retail Telephone Service Quality?” Information Economics and Policy, Vol. 15, No. 2, 2003, pp. 243-269. doi:10.1016/S0167-6245(02)00096-3

- O. Hart and J. Moore, “Incomplete Contracts and Renegotiation,” Econometrica, Vol. 56, No. 4, 1988, pp. 755- 785. doi:10.2307/1912698

- B. Klein, R. Crawford and A. Alchian, “Vertigal Integration, Appropriable Rents, and the Competitive Contracting Process,” Journal of Law and Economics, Vol. 21, No. 2, 1978, pp. 297-326. doi:10.1086/466922

- M. J. Osborne and A. Rubinstein, “Bargaining and Markets,” Academic Press, Waltham, 1990.

- P. Aghion, M. Dewatripont and P. Rey, “Renegotiation Design with Unveriable Information,” Econometrica, Vol. 62, No. 2, 1994, pp. 257-282. doi:10.2307/2951613

NOTES

*The views expressed are those of the author and do not reflect those of the OECD or its member countries.

#Corresponding author.

1For an introduction to the pros and cons of the price-cap mechanism see [1].

2The price-cap contract is feasible, under the incomplete contract approach, because it is possible (easy) to verify the terms of the contract: The level of the cap and the provision of the goods. By contrast, for a contract to be contingent on quality, a court should be able to judge the level of quality of the goods provided by the firm in a perfect and costless way. We reckon this is quite unrealistic; at the very least going to court is costly for the parties. The same is true for the possibility to verify the reduction of production costs.

3The model is easily applicable to procurement contracts, where the public administration pays a price for a given product (or service) produced by the firm.

4We can easily remove the assumption of rigid demand and introduce the concept of consumers’ welfare, but this would have no impact on the firm’s incentive to invest. In fact, demand would play a crucial role in the welfare analysis of price-cap regulation, which is outside the scope of the present work.

5This is the standard setting where a hold-up problem is likely to arise [7].

6If the firm has sufficient resources to finance the equilibrium levels of investment, the constraint is not binding and the equilibrium would be the same as in the previous section.