Advances in Applied Sociology 2013. Vol.3, No.1, 69-78 Published Online March 2013 in SciRes (http://www.scirp.org/journal/aasoci) http://dx.doi.org/10.4236/aasoci.2013.31009 Copyright © 2013 SciRes. 69 The ODM Model and Co-Evolution in the Global Notebook PC Industry: Evidence from Taiwan Daniel You-Ren Yan g 1, Yun-Chung Chen2 1Department of Sociology, Tunghai Universi t y, Taichung, Taiwan 2Department of Sociology, Hong Kong Baptist University, Hong Kong, China Email: yyren@ms34.hinet. ne t, ycchen@hkbu.edu.hk Received December 24th, 2012; revised January 25th, 2013; accepted February 9th, 2013 This paper aims to explore the evolutionary dynamics of the ODM model in the global notebook PC in- dustry. We found that the “modular design” process of notebook products requires plenty of technical in- teraction and tacit knowledge exchanges among branding companies, key component suppliers and ODMs. Taiwanese ODMs serve as important sources of information and knowledge for specifications formulation through their system integration and technological development abilities. With increasing complexity and shorter design life-spans, the mutual dependency among the lead firms and ODMs in- creases, leading to the regional agglomeration in Taiwan and China. Keywords: Subcontract Manufacturing; Modularity; Innovation; Global Production Networks; Value Chain Governance; Latecomer’s Upgrading Introduction: The Absentness of ODMs? ODM (original design manufacturer) is a popular model of production in East Asian’s industrialization, especially for Taiwanese enterprises. The model was considered as a main strategy for Taiwanese companies to upgrade from the OEM (own equipment manufacturer) that the firm produces the com- plete, finished product (both consumer and industrial product) to the specification and design provided by the foreign custom- ers (such as buyers or TNCs) in a subcontract arrangement (Amsden & Chu, 2003; Cy nn, 2002; Hobday, 1995, 2003). How- ever, the ODM model seemed to be ignored in the discussions of global value chains as well as strategic outsourcing (Berg- gren & Bengtsson, 2004; Dankbaar, 2007; Steinle & Schiele, 2008). For example, in the study of iPod and notebook PC value chain (Dedrick, Kenneth, & Linden, 2010), there was for almost no discussion of the Taiwanese ODMs. The roles of these ODMs were almost absent in the global PC industry that seemed to be overly dominated by the lead firms, such as HP and Wintel, as described by the article: “… PC makers carry out systems integration at a functional level, but most of the im- portant system-level decisions have already been made by Mi- crosoft and Intel… Many microchip vendors pursue a similar strategy to Intel’s, offering complete reference designs, includ- ing recommended system layout and software, which can be im- plemented rapidly by customers with limited internal exper- tise…” (Dedrick, Kenneth, & Linden, 2010). Is the story really true? Under ODM, the latecomer carries out some or all of the product design and process task needed to produce a good ac- cording to a general design layout from the foreign buyers or TNCs (Hobday, 1995, 2002). Nevertheless, we observed that the ODMs had advanced their technological competence and applied not only to incremental designs, but also the leadership product innovation after late 90’s. This article aims to investi- gate the notebook PCs’ product innovation of Taiwanese ICT (information-communication technology) ODM manufacturers as an illustration of the special upgrading pattern in East Asia. Two research questions were raised: Is the notebook PC Indus- try dominated by the production networks in which brand-name companies practice worldwide sourcing? Is the lead firm from advanced economies determined the modular system architec- ture of the notebook PC products that facilitate the borderless global sourcing? The modularization thesis argues that the competitiveness of the ODMs in the PC industry is resulted from the modulariza- tion of PC’s system architecture. The thesis gives prominence to the roles played by the lead firms and the platform leaders (such as Intel and Microsoft) in setting up such architecture (Borrus, 2000; Borrus & Zysman, 1997; Sturgeon & Lee, 2005; Kawakami, 2011; Sturgeon & Kawakami, 2011). For instance, emphasizing the dominant role of the Wintelism and the lead firms (HP, Dell, IBM, etc.), Sturgeon and Lee (2005) illustrated how the intense competition and short product life cycles in the PC market motivate lead firms to spread risk and lower cost by outsourcing production to the ODMs (Sturgeon & Lee, 2005). Kawakami’s decent study acknowledges the Taiwanese ODMs had exploited those inter-firm relationships in enhancing their capabilities, she still highlights the role of the platform leader— WINTEL, simplified the story with the large substitutability of these ODMs in the modular system architecture (Kawakami, 2011). However, in other ICT products like iPhone, the ODMs’ collaboration with the brand companies is even more durable than those platform providers like INTEL. The PC industry is a paradigmatic example of technological modularization, with modularity in product design increasing the ease of use and maintenance for customers and affecting the modularization of production1. Furthermore, it is also the case utilized by the “strong modularity school” most often to support 1For example, module components (CPU, HDD, CD-ROM, Modem, LCD panel, memory module, etc.) make up 60% of Quanta’s procurement cost (Yung, Le e, & Lai, 2009).  D. Y.-R. YANG, Y.-C. CHEN the “natural” convergence of industries toward a modular con- figuration (Campagnolo & Camuffo, 2010). Taking notebook PCs as an example, however, we find that Taiwanese ODMs’ share of the global market volume has increased continuously from 40% in 1998 to 85% in 2005 (Dedrick & Kraemer, 2008) during the process of further modular design, which is a pattern that departs from the assumed high substitutability through in- creasing modularity2. Moreover, these ODM activities are also geographically concentrating in the industrial clusters in Tai- wan and then China, instead of spreading evenly in the global scale (Yang & Coe, 2009; Yang & Hsia, 2007). We acknowledge that the open system architecture and tech- nological modularization of the notebook PC industry did lay a foundation of learning for Taiwanese OEM manufacturers in the early stage. While what more significant for us is the trans- formation of contract manufacturing model after late 90’s. In the ODM model, we observed that the lead firms (including the brand name companies and the key component suppliers) no longer direct the industrial specification in the product design of the notebook PC. The ODMs get deeply involved in the process of technological codification and play even active roles in the product innovation. Taiwanese ODMs serve as important sources of information and knowledge for specifications for- mulation and roadmap development through their system inte- gration and technological design capabilities. Increasingly new product innovation (not merely process innovation) is initiated at the ODM-based technology cluster in Northern Taiwan Re- gion, creating a new form of technology interdependency. With increasing complexity and shorter design life-spans, the mutual dependence among the lead firms and ODMs does not decrease during the process of technological modularization, on the con- trary, mutual dependency in the production networks actually increases. Through investigating the specification—the most concrete technological modularization—and its historical transformation in the ODM model after late 90’s, this research therefore claims the “co-evolution” of technological development and organiza- tional governance. The GVCs’ (global value chain) theorization should take such evolutionary characteristic of product innova- tion into account, as well as its influence on organizational and industrial structure. To summarize, we are opposed to the mo- dular organization theory with the style of technological deter- minism, and provide concrete evidence based on the notebook PC industry. Methodologically, this article zooms in on the organizational behaviors of those ODMs with regard to product innovation in the industrial as well as firm level, and uses specifications (or simply “specs” as commonly used in the industry) as the plat- form to discuss the negotiations between the lead firms and the ODMs. Our argument unfolds in five further stages. First we position our conceptual argument within the wider literatures of technology development and value chain analysis to provide a theoretical framework of the empirical investigation. Second, we discuss the basic pattern of notebook PC’s product devel- opment in the ODM model. Third, we provide firm-level evi- dences of the intense technical interaction between branding companies, ODMs and key component manufacturers. Forth, we illustrated the practice of these technological-organizational features in the daily “search routine3” (Dosi & Nelson, 1994) of the ODMs’ technical teamwork. In the final section we offer some concluding comments and the wider implications of our analysis. Modularity, Value Chains and Technology Evolution The establishment of industrial standards and specifications in global production networks not only affected geographical industrialization but also influenced interactions and systems of governance between companies. The notion of modularization emerges from the post-Chandlerian industrial organization de- bate in the organization economics field since the 1990s (Chan- dler, 1962, 1977, 1990; Lamoreaux, Raff, & Temin, 2003; Lan- glois, 2002, 2003, 2004). The modularization thesis highlights that the industrial standards and specifications are important mechanisms that unify various production phases, and the pro- cess of standardization massively decreases the information needed for coordination between companies (Langlois, 2002, 2003, 2004). Sturgeon (2002, 2003) examined the tacit and co- dified knowledge exchange in leading American electronics firms and suggested that the “modular production networks” is rising. He stated that “key node” in the global value chain relies on internal, tacit knowledge exchanges, while other nodes were linked with the key node through codified, standardized know- ledge and information, which drive the production networks toward global expansion through speed, flexibility, and cost de- creases. The growth of “EMS (electronic manufacturing ser- vices)” companies (such as Flextronics, Jabil Circuit, & Ce- lestica) illustrates a new American model of contract manufac- turing under modular production networks. Furthermore, the increased technological modularization and spec. codification enhanced the electronics companies with the ability of global expansion. The EMS companies that have global operations are in a better position to serve the lead firms by providing stan- dardized modules, and the lead firms are freed from mutual dependence on their suppliers and could source from multiple suppliers globally (Sturgeon, 2002, 2003). The modularization thesis is showing its influence, for ex- ample, in the conceptualization of global value chains (GVCs), with the key idea of “value chain modularity”(Gereffi, Hum- phrey, & Sturgeon, 2005; Sturgeon, Biesebroeck, & Gereffi, 2008; Sturgeon & Kawakami, 2011). The idea implicitly as- sumes that the “technological modularity” (such as modular product design) will inevitably lead to “organizational modula- rity”, in which “… suppliers and customers can be easily linked and de-linked, resulting in a very fluid and flexible network structure…” (Gereffi, Humphrey, & Sturgeon, 2005). In the follow-up studies that utilize the GVCs framework, the precon- dition of modularity was taken for granted, and the roles of the platform leaders were given overly prominence frequently in explaining the complicated inter-organizational process. Nev- ertheless, it is running the danger of oversimplification as well as under-socialization. For example, Kawakami (2011) argued that “… Intel possesses the power not only to set standards but also to drive the chain dynamics by redistributing the value- added in its favor”. However, even the Wintelism did deter- mine everything, the narrowly defined theoretical framework of 2For example, as Kawakami (2011) shows, Intel had launched the low- power Centrino platform in 2003, further increased the modularity of the industry by integrating even more functions within the chip-set, including wireless internet connection, power management and others. 3Search routines focuson one or another aspect of the firm’s behavior and capabilities, and come up with proposed modifications which may or may not be adopted (Dosi & Nelson, 199 4 ). Copyright © 2013 SciRes. 70  D. Y.-R. YANG, Y.-C. CHEN GVCs provides very few conceptual tool to further explore such relevant “black box” (Wen & Yang, 2010). Although the “value chain modularity” thesis is full of insights, to what ex- tend does the modularity explain the historical experience and learning opportunity of the latecomer remains unclear. The rationale of organizational modularity lies in that tech- nological modularity lowers the need of embeddedness4 in en- hancing communication and constraining opportunism. In the case of modular products, component producers do not need information about the inner workings of other components (Baldwin & Clark, 2000). For a modular product, the need for communication and governance is low and the additional tech- nical capabilities more than offset the lack of prior experience. In other words, modular product designs make the benefits of prior transactions much less important, and firms are able to reconfigure their supply chains for modular products more freely. For example, Baldwin and Clark (2000) explored the increasing modularity in the development of IBM’s System/360, provided evidence for the impact of increasing product modu- larity on organizational modularity in the PC industry. Such rationale was challenged by recent studies yet. For ex- ample, Brusoni and Principe (2001) traced the aircraft engine and chemical engineering industries and found that modular product architectures actually required highly interactive or- ganizational set-ups to provide the information structure neces- sary to coordinate the various organizational units involved in production. Hoetker (2006) used the LCD panel design in note- book PC as the example and found that while product modular- ity allows firms to adopt new suppliers more freely, it does not help firms move activities out of hierarchy. Finally, by illus- trating the powerful counter-forces that causing organizational structures to become more integrated in the chip design indus- try, Ernst (2005) reminded us the danger of generalizing em- pirical observations that are context-specific and to confound them with prescription as well as pre d i ct i o n . Moreover, the “strong modularization school” could under- estimate the nature of product development as an evolutionary process to a certain degree, wherein the knowledge involved is path-dependent and context sensitive (Nelson & Winter, 1982). Technology and new product development is a dynamic process that connects a sophisticated circuit of knowledge users and producers who interact, imitate, adjust, correct, exploit, adapt and learn mutually. In their evolutionary model of growth, Dosi and Nelson (1994) conceptualized the technology progress as an explicit process of search and competition among hetero- geneous actors, involving the periods of iteration, cumulating as well as network externalities. Firms’ search process provides the source of differential fitness and tends to bind them together as a community (Dosi & Nelson, 1994). The standard inter- face developed from the modularized technology may not be able to cope with the “uncertainty” and “novelty” that inherited from the design process; on the other hand, it may serve as just the starting point of the “search R&D” assumed to uncover new techniques or to improve prevailing ones. From the similar perspective, Sabel and Zeitlin (2004) ar- gued that the “iterated collaboration” between lead firm and suppliers was utilized wherein the suppliers could contribute to the redefinition of interface specifications for new products based on their experience. That is, the de facto coordination and system-wide integration alongside the modularized interface would be required in the product design process, unfolding the relevance of embeddedness. Economic geographer Michael Storper also argued the mechanism of “conventions” is de- voted in the process of technology development, especially in solving the problems of uncertainty, jointing collective action and collaborative innovation. It is the “untraded interdepend- ence” among production networks that contributes to the re- gional “relational assets”, including informal rules, routines and socially embedded networks (Storper, 1997). In short, the global notebook PC production network is not just constituted of manufacturing process and flows of modular products and materials. It also includes a complex of know- ledge interaction and embedded relationships that are coopera- tive and interdependent by nature. The potentiality of the lead firms to “drive” production networks through modularization doesn’t overshadow these inter-dependencies in the networks. Based on the notion of technology evolution and embedded in- terdependence, this study challenges two basic and inter-related assumptions of the modularization thesis: The thesis claims that the lead firms and key component suppliers dictate the bulk of technology designs and shape if not determine the innovation patterns of other firms in the production networks. We however, argue that the concrete process of product development involves the abundant pra- ctices of tacit knowledge within intra-firm and inter-firm interactions. The technology standards and specifications dictated by the lead firms are just the starting points of such knowledge interac t io n s. The thesis assumes the modularization of technology de- creases mutual dependence among the lead firms and the contract manufacturers. In contrast, we argue that the mu- tual dependence among the lead firms and ODMs does not decrease during the process of modular design. With in- creasing complexity and shorter design life-spans, the mu- tual dependency actually increases, leading to regional ag- glomeration in Taiwan and China. In the following sections, we would investigate how the tech- nology and product specifications were defined in the real “world of production” by analyzing the interactions and organ- izational governance among the lead firms, key component suppliers and the ODMs. The empirical study was conducted through qualitative interviews. From May 2004 to August 2011, we interviewed 65 professionals from companies located in Northern Taiwan Region, Greater Suzhou Region and Greater Dongguan Region in China. The companies included 28 Tai- wanese ODMs, such as Quanta, Compal, Wistron, Inventec, ASUSTeK and Foxconn etc.; IPOs (International Procurement Offices) of 16 name brand companies, including DELL, HP, IBM, Toshiba, Fujitsu, Hitachi, IngramMicro, Nokia and Acti- bit; as well as 12 key component suppliers including INTEL, AMD, Nvidia, Atheros, Philips, Seagate and TI. The positions of the interviewees ranged from manager to general manager. The companies in the sample were carefully and systematically selected to cover the most important firms in the market and in each region. For example, all top twelve systems manufanctur- ers, accounting for over 60 percent of the total value of PC- related industrial output in Taiwan, were included. The inter- views were designed to reveal both qualitative and quantitative details about the key network relations in the firm, with a par- ticular focus on the relationships between the lead firms and ODMs, and between those ODMs and the key component sup- pliers. The fieldwork was in part facilitated by ongoing contacts 4For the discussion of e mbeddedness, please refer to Hess (2004). Copyright © 2013 SciRes. 71  D. Y.-R. YANG, Y.-C. CHEN Copyright © 2013 SciRes. 72 with industry representatives (e.g., at technology seminars and procurement events) through the first author’s position as a consultant for the Taipei Computer Association (TCA), the lar- gest PC industry trade union in Taiwan. engage in constant negotiation with the lead firms and the key component suppliers to reach a final consensus on the specifi- cations. There are three key assertions regarding this negotia- tion process. Firstly, innovation on the part of ODMs is based on massive information and not merely on codified requirements from the lead firms, especially with regard to negotiating the spe- cifications. ODMs in the Global PC Production Networks In 2006, Taiwanese ODMs accounted for approximately 86% and 99% of the worldwide production of notebook PCs and motherboards respectively (Market Information Center, Insti- tute for Information Industry, 2007). Today, the top 5 tier-one ODMs—Quanta, Compal, Inventec, Wistron and ASUSTeK to- gether provide over 70% of the notebook PC production in the world (Kawakami, 2011). We start by understanding the global PC production networks in functional and geographical terms (Figure 1). Secondly, the core of innovation by ODMs has been to integrate the scattered specifications into one adequate frame and become a complete system, thus having a large say in the direction of technology development, and not merely dependent on the lead firm. Thirdly, these specifications are not static; they evolve very rapidly. The innovation process of the ODMs requires con- stant contact with related companies for information and knowledge. In the past, the lead firms focused primarily on product de- sign and customer relations, while outsourcing the remainder of the production process to other firms. Today, manufacturing operations usually are subcontracted by the lead firms to the ODMs that not only assemble the PC products but also design the product specifications. Now, most lead firms (or brands)— such as Dell, HP, Apple and Toshiba—rely on Taiwanese sub- contractors for manufacturing and product design/development. Each lead firm tends to contract to two or three Taiwanese ODMs that have a major share in the lead firm’s total global laptop production, such as approximate 90% for Dell and HP. The Northern Taiwan Region (NTR) is a critical node in the global PC production networks. Although Taiwanese electron- ics firms have been moving production “offshore” to Southeast Asia, Europe and, most importantly, China since the early 1990s, the headquarters of the ODMs in the NTR are responsi- ble for product research and development, technology research, materials procurement, financial management and marketing (see Figure 1). Our analysis involves each stage of product development in the ODM model as shown in Figure 2. With an “RFP”, or “Request for Proposal”, the lead firm submits a request to the system ODMs in Taiwan. The lead firm defines the product’s initial specifications, which include the whole system’s speci- fications. Meanwhile the ODMs conduct feasibility studies on potential market and technology trends. Simultaneously, ODMs also assess the possible technical providers and feasible com- ponents. In other words, Taiwanese ODMs must propose a basic system framework to respond to the client’s requests and then send a revised proposal to the client. After handling the “RFP”, the ODMs wait for a Request for Quote (RFQ) from the lead firm. At this stage, detailed specs will have been framed; however, the lead firms do not com- pletely control the drafting of the detailed specifications. The detailed system specs consist of a “feature list”, among which certain features are determined by the lead firm while others are determined by the ODMs. During this process, lead firms and ODMs exchange ideas frequently. A lead firm’s RFQ serves as an aid to the ODMs in technical learning as lead firms devote a lot of effort to the study of user demands. The strength of Tai- wanese ODMs lies in creating a total solution through system PC production requires the contracted manufacturer follows the specifications set by the lead firm. In actual practice how- ever, in contrast to the modularization thesis, ODMs do not merely accept a specification from the lead firms. They actually Figure 1. The illustration of PC industry’s global production networks. Source: adapted from Yang and Coe (2009).  D. Y.-R. YANG, Y.-C. CHEN Figure 2. The product development process in the ODM model. Source: adapted from Yang and Hsia (2007). integration of related components. In products such as notebook PC, Taiwanese ODMs are ex- pected to propose a “total system solution” and system specifi- cations. In order to do that, ODMs form long-term working partnerships with the lead firms. The ODMs will recognize the lead firms’ future needs and undertake related development. They interact with the component suppliers constantly, espe- cially their key components suppliers and platform providers, such as INTEL and AMD, to identify new product features and functions, as well as to integrate a new system structure based on these new components. Every month, ODMs develop new product models regardless of whether or not orders have been placed. Is the innovation of ODMs limited to product assembly based on specifications provided by key component suppliers? No. Taiwanese ODMs have gradually come to occupy the co- pilot seat in leading major design and research activities, espe- cially in systems integration. The features, functions, com- patibility, security, and cost of the components in a system re- quire extensive study and familiarity, which is often accom- plished through interactions and negotiations among firms. The development of electronics products requires extensive integra- tion among different components to ensure full support and conflict-free functioning among all parts. The key is the so- called “solution”. In terms of “modules”, a system should be viewed as several modules, not only one. Some scholar asserted that the PC industry is the exemplar case of modular production because Intel and Microsoft set the standards and specs that everyone else has to follow. These platform leaders are in the driver’s seat so the contract manu- facturers (including the ODMs and EMSs) have no other choice but to follow those specs set by Intel and Windows. However, our detail empirical study showed that the platform leaders (such as Intel) do not completely control the development of the entire system. For example, the motherboard might not be a technology-intensive product in itself, but its integration into the system remains difficult. This integration relies on thou- sands of inputs from various components built on the mother- board. A manager in charge of Intel’s Asia Pacific chipset busi- ness unit commented: What we really need is the total solution. What else is there when our chipset and the clients’ motherboards are both ready? With PCI-Express, for example, we can test bugs on the moth- erboard, yet we can’t test the graphics card before it is ready. Graphics card companies have to test the product themselves. Therefore, in addition to the hard disk and graphics card com- panies, equipment companies such as Agilent should have ready testing equipment. A total supporting network is what we need, because Intel can’t do everything. Taiwanese ODMs pro- vide the total solution that integrates Intel’s Chipset. To summarize, the ODMs retain a certain amount of auton- omy and control over system technology development, and they play the role of the integrator between the lead firms and the component suppliers. Below we will go further to explore two inter-related questions. Firstly, do the lead firms have complete control over product technology and related modules? And secondly, do their relations with Taiwanese ODMs push them to arm’s length transactions? Co-Evolution through Co-Location: The Upgrading of Lead Firm’s IPOs in Taiwan The lead firms use their IPOs (International Procurement Of- fices) located in Northern Taiwan as a conduit to establish in- teractions with ODMs. Instead of starting in the core region and then sourcing worldwide, the PC industry started “globally” with many lead firm’s branch offices co-operating with Tai- wanese suppliers in the region. Starting with IPOs since the 1960s and upgrading to R&D centers in the 2000s, the PC lead firms continue to maintain their branch offices in Taiwan to in- teract closely with the ODMs there. IBM established its first foreign electronics procurement of- fice in Taiwan in 1966. Its primary function was to procure related parts and perform certification. After IBM started its PC business in 1982, the role of its procurement office changed. IBM’s procurement office began to find Taiwanese products and then sell them to IBM’s branch factories worldwide. IBM’s procurement office also played another important role in the 1980’s by familiarizing the emerging PC industry in Taiwan with future technological trends and with IBM’s management and technical resources. In other words, IBM’s procurement office not only served as a conduit for transferring overseas orders and promoting Taiwanese electronic products, it also acted as an important agent of technology transfer. The procurement offices of major lead firms played signifi- cant roles in the early stages of Taiwan’s PC industry take off. Under the assistance of these foreign procurement offices, many ODMs started out as component suppliers, accumulating their own design capabilities. At the first stage, the contract manufacturers followed specifications from the lead firms for early-stage produc t assembly , which i s commonly referred to as original equipment manufacturer (OEM). However, the “in- structor” role of major foreign lead firms subsided as the manu- facturers upgraded their technologies to become ODMs. The following case studies illustrate the transformation of the lead firms’ procurement offices after the late 1990’s. Dell’s Taiwan procurement office was established in 1990, and it served as a node in the company’s worldwide procure- ment (WWP) system. The WWP served three functions: first, it offered global commodity management (GCM) to supplier Copyright © 2013 SciRes. 73  D. Y.-R. YANG, Y.-C. CHEN sourcing, quotation negotiations, and outsourcing management; second, it acted as the global supply manager (GSM) in charge of global supplier logistics, stock adjustment, and just-in-time supplies; and third, it was the SQE (supplier quality engineer- ing) responsible for quality control. Each of the three functions weighed differently and varied according to global business demands5. However, after 2000, Dell’s Taiwan procurement office was given more decision-making, handling not only pro- duct procurement but also outsourcing business management. In 2003, the Dell’s Taiwan procurement office even made pro- curement and RFQ decisions for Dell’s notebook PCs. In order to support the new functions, Dell upgraded its presence in Taiwan by establishing a “technology development center (TDC)” in Taipei that focused on engineering development. The co-evolution of the lead firms’ branch facilities with the Taiwanese ODMs resulted in the upgrading of the lead firms’ facilities. For example, with Dell’s TDC model, the related spe- cifications of Dell’s notebook PC and RFQ features were de- termined jointly by the Taiwan procurement office, TDC and ODMs. The upgrading of HP’s Taiwan procurement office was no less than that of Dell. Our interview with HP’s Taiwan pro- curement office indicated that the office had strong influence over HP headquarters’ decision-making on issues such as the technical structure of the products and the choice of ODMs. HP has also set up a “technology development center (TDC)” in Taiwan for the development of niche technologies and solu- tions6. HP and their ODM partners jointly developed the feature list of a product. The ODM partners contributed the common features that did not require patented technologies, while the other features incorporated HP solutions. “Roadmaps” are the basis of communication between the lead firms and the ODMs. Generally, a roadmap is lead firm’s future product plan based on the convergence of industry, product and technology trends. Not only is roadmap a visual display of technological performance, it is also confidential. When the lead firms’ technology development centers in Tai- wan plan new products after 2000s’, they begin to request a roadmap from ODMs. The discussion of the roadmap requires “face-to-face” communication; otherwise it is difficult to un- derstand a roadmap. Many unique solutions are incorporated into the map, and face-to-face communication can facilitate the exchange of ideas and minimize misunderstandings. At this stage, communication between lead firms and ODMs is not sim- ply one way, i.e., from lead firms to ODMs. On the contrary, the lead firms also receive new knowledge from ODMs. The partnership between HP and the ODMs, for example, has fur- thered the exchange of roadmaps, resulting in the “co-design” projects. Beyond Arm’s Length Relationship Because of the importance of the ODMs, we wonder if the transactional relationship between the lead firms and the ODMs will shift toward the arm’s length mode as suggested by the modularization thesis. In our fieldwork, we discovered that there are at least three modes of governance between the lead firms and the ODMs regarding system-level roadmap formation, knowledge exchange, and the practical transaction mechanisms. The modes are “long-term relationships,” “institutionalized price competition,” and “arm’s length transactions”. These modes overlap and interact with and affect each other. Long-Term Relationships As Taiwanese ODMs provide the lead firms with abundant technology resources, more solutions are being accepted and included in the lead firms’ specification requirements in this pattern. Such long-term relationships result in more orders from the lead firms to the ODMs. The key to a “long-term relation- ship” rests in the ODMs’ proposed solutions being accepted by the lead firms. This relationship is often found between Tai- wanese ODMs and Japanese lead firms and also some Ameri- can lead firms. For instance, Dell and former Gateway estab- lished long-term relationships with Quanta and Compal in Tai- wan in late 90’s. Under such relationships, these ODMs were guaranteed to have a higher investment return rate. But even under the long-term relationships, Taiwanese ODMs retain a certain level of autonomy (instead of becoming “captive”), which also ensures the openness of transaction networks and technological reference resources. Institutionalized Price Competition In this pattern, the lead firms’ choice of ODMs is based on price competition. However, this doesn’t mean that the cus- tomer-supplier relationship is arm’s length. For instance, HP’s outsourcing policy is the most “opportunistic” among American companies, and its “online bidding system” forces Taiwanese ODMs into intense price competition. However, similar to long-term relationships, HP’s specification decisions also initi- ate intensive information exchange and communication, as well as roadmap exchanges with the ODMs. The difference is that HP may add one ODM’s solutions to its RFQ but still open the order bidding to all ODMs. In other words, HP may “capture” an ODM’s intellectual property and then proceed with its cost- based bidding system. We observed that many American and Japanese lead firms adopt “long-term relation ships” and “institutionalized price com- petition” simultaneously through a quarterly business review (QBR)—a benchmarking mechanism–to include several appro- priate ODMs in its available list (AVL) for closer relationships. For instance, former Gateway first established long-term rela- tionships with Quanta, then after the acquisition of the E-Ma- chine, its procurement policy was geared towards the “institu- tionalized price competition” model. EPSON and HITACHI also adopted the combination of the two modes under cost re- duction and competitive pressure from their headquarters. Arm’s Length Transaction The third cooperation mode—“arm’s length transaction” happens in the transaction between Taiwanese ODMs and the “clones”. The “clone” refers to the non-brand sellers, regional distributors or minor brands. When the leading brand compa- nies do not accept an ODM’s proposed product solution, the ODM would sell it to those clones. The clone buyers do not develop system specifications such as the leading brand com- panies do. Instead, the ODMs fully control all the specifications 5The SQE function had moved to the manufacturing location in China. 6In addition to DELL and HP, EPSON established a Sourcing and Manu- facturi ng Service Cen ter in Tai pei in 20 01. The Tai wan bran ch is in ch arge of selected corporate products at the design stage, its work includes setting specifications, providing working samples, performing pilot runs and qua- lity control. I BM has also established a server de s ign center in Taipei. Copyright © 2013 SciRes. 74  D. Y.-R. YANG, Y.-C. CHEN and design for such clones. It is for the marketing purposes that the ODMs cooperate with the clones (such as Actibit & Dixon). These types of transactions often take place at COM-PUTEX TAIPEI, the second largest computer trade show in the world, where thousands of less-known or non-brand computer sellers from around the world come to search for suitable ODMs. In this mode, the ODMs have autonomy to decide which models are appropriate for that country’s market. With a historical perspective, although foreign lead firms play an important role in Taiwanese ODMs’ technology learn- ing, their dominance over product specifications is gradually decreasing. In their cooperation with ODMs after 2000s’, for- eign lead firms neither play their roles as the modular definer nor do they engage in arm’s length transactions. Arm’s length transactions do exist, but only in supplementing the “long-term relationships” and “institutionalized price competition” modes of governance. Mutual Learning between Key Component Suppliers and ODMs In this section, we want to explore the interaction between the key component suppliers (CPUs, chipsets, graphic chip, display panels, memory, wireless chips, and hard drives) and the ODMs. Furthermore, we also investigate if key component suppliers hold full control over related specifications and if Taiwanese ODMs merely follow the specifications. In order to adequately understand component functionality and to integrate proper solutions with the features list, ODMs communicate and exchange knowledge with key component suppliers frequently. In addition, since the ODMs are more sensitive to the market than are the key component suppliers, learning from the ODMs is critical to those suppliers. The in- teraction and negotiation is part of a routine. The transactions between key component suppliers and the ODMs are not arm’s length transactions. When component suppliers promote their products, this usually triggers a know- ledge exchange on technology development and specifications. Such communication must be done face-to-face because much of the technology content needs to be explained in full detail. The opinions and knowledge exchanges revolve around the de- velopment of the technology roadmap and affect co-develop- ment of technology in the future as well. We argue that cu- mulated product innovation and system integration knowledge of Taiwanese ODMs is helpful to key component suppliers not only in terms of technology learning but also in terms of speci- fication developments. We also found the capabilities of the ODMs were result from long-term research on extensive com- ponent specifications and future technological trends. The scope of technical knowledge for system integration is a valu- able reference for key component suppliers who focus on their own product development. With such reciprocal knowledge exchanges, some ODMs actually take the lead in certain speci- fication developments of key components. As a R&D executive at Quanta said: A Nvidia CEO will bring its R&D managers to meet with us for future projects and the specifications required. We lead the process, but most people don’t know this. In short, although key component suppliers—potential plat- form leader—own innovation resources to magnify their lead- ing role in technology specification, they still need the consent and mutual understanding from major ODMs. These ODMs are the “first-tier followers”, usually have influence on key com- ponent suppliers’ specification decisions. We then turn to another assertion by the modularization the- sis that ODMs merely build their innovation activities on fea- tures provided by key component suppliers. As seen in Figure 2, if this assertion was true, ODMs would have been slacking off for the three to six months starting from “kick-off” to mass production. This is obviousl y an unlikely scenar i o. For example, to customize or modify WLAN requires a large amount of development work as well as collaborative innova- tion. In assembling notebook PCs with strong multimedia ap- plications, ODMs must think carefully about how to integrate the WLAN module with the CPU and OS specifications. On the other hand, WLAN chip suppliers such as TI, Broadcom and Atheros sometimes have to collaborate with their ODM clients’ R&D staffs to develop various special applications based on their chip design. In other words, when it comes to modulariza- tion, the final integration of key components is not fully domi- nated by the key component suppliers; the R&D resources of the ODMs also play a critical role in developing applications and solutions. WLAN is not the only example of collaborative innovation. Many developments and applications for key components share this feature, including the most standardized hard drives. From the preliminary design by the key component suppliers to the applications of the ODMs, the process consists of a series of knowledge exchanges. Again, the ODMs play the role of the relevant technology integrator. They integrate parts and solu- tions from a variety of key component suppliers into comer- cialized technologies; then they provide feedback on future technology development to these suppliers. The ODMs provide valuable tacit knowledge for the key component suppliers and influence their technology paths. From the above observation, we learn that the initial speci- fications of component suppliers need to undergo a complex process of modification to be applied in system design, and that the process involves intense knowledge exchanges between component suppliers and the ODMs. Their relationships are far from what is defined as the arm’s length transactions. On the contrary, their relationships should be regarded as “technical partnerships of co-design” that are beneficial to both parties. We will further demonstrate this point by examining the role of several Taiwan branch offices of overseas key component suppliers. We take the TI WLAN chip as an example. The company’s WLAN chip design team is located in France, while the field application engineers (FAE) and the associate engi- neers of its marketing and technical support departments are located in Taipei. The goal of its Taipei office is to relay cus- tomer needs to the TI headquarters. Another example is the major video chip company ATI, which has its Asia-Pacific headquarters in Taipei. ATI’s R&D centers are located in To- ronto, Silicon Valley, and on Route 128 in Boston, with around 60 technical support engineers in Taipei playing the important role of giving the feedback learned from the co-design process with the ODMs to the headquarter. An executive from the com- pany remarked: The biggest benefit in setting up our Asia-Pacific headquar- ters in Taiwan is taking our partners into consideration. Our headquarters, of course, will launch new product roadmaps every quarter, and we will then give feedback on products that cater to local demand, making for reciprocal product planning. Though the primary function of AMD Taipei is to promote Copyright © 2013 SciRes. 75  D. Y.-R. YANG, Y.-C. CHEN its CPU, it also has a design department called TATS (Taiwan Application and Technical Support). AMD’s headquarters re- tains large control over the CPU design, while TATS partici- pates in some aspects of product design and specification plan- ning. Intel Taipei is similar in this respect. The interviewees from these two companies considered the Taipei branches as development centers, as they both assist their customers to de- velop products based on their technical platforms and then give feedback on the future demands of Taiwanese customers to headquarters. Hence, the functions of the Taipei branch offices would have extensive influence on further technology deve- lopments for these two platform providers. Co-Evolution in Practice: The Routine We’d like to illustrate the technological-organizational fea- tures of the mutual dependence and co-evolution discussed above by exploring the practices of Taiwanese research team- work from the perspective of “search R&D” and “search rou- tine” (Dosi & Nelson, 1994). According to the real world prac- tice, we make a basic distinction between product/project man- agers (PM) and those staffs who work in first line research and development (RD). The main responsibility of a PM is to search for technical resources provided by suppliers, as well as feasible solutions. In the beginning, PM needs to research on the technical resources, the primitive definition and integration. Most PMs of Taiwan- ese ODMs have the R&D backgrounds; it’s usually the senior RD engineers have sufficient knowledge to be the PMs. The PMS spend most of their time researching technological trends and technical resources, and must communicate with the com- pany’s marketing department and their component suppliers. In particular, a PM would research new technical resources and suggest primitive solutions for further execution by RD. The RD engineers test potential solutions for features such as com- patibility, electronics and heating ability. The RDs usually communicate with the FAEs (field application engineers) of their component suppliers in order to solve more detailed prob- lems. PMs are the important agents of innovation for Taiwanese ODMs, as they provide the window for technology exchanges among companies. When component suppliers sell products to the ODMs, they contact the ODMs’ PMs, who then carry out a routine business interaction. The routine is not merely one-way communication for component suppliers to provide technical information; the suppliers also gather knowledge about future technology development planning and learn the market accep- tance of their products from the ODMs. Computer systems, for example, have thousands of compo- nents, and the RD engineer’s role is to make them work to- gether to reach expected performance. This requires sufficient knowledge of each component’s characteristics and their inte- grated functions, as well as the ability to perform cost-per- formance evaluations. Hence, RDs often need to try different combinations of components, and decide on the best solution based on actual testing results. Therefore, the real “modulariza- tion” takes place at the internal design stage performed by ODMs. In other words, those solutions require RD engineers to integrate them into a system. A primitive design can also be re-modularized after the R&D process. In other words, although the key component suppliers such as INTEL did offer complete reference designs, including recommended system layout and software, large amounts of modification and customization were regarded often as necessary for the ODMs with internal expertise to finish a competitive product innovation. With regard to the “iterated collaboration” (Sable & Zeitlin, 2004), we categorize the process into intra-firm and extra-firm learning. With the intra-firm learning, most companies arrange training courses for RD engineers; however, the majority of technical learning happens through “on-site traini ng” and “learn- ing by doing”. In other words, senior engineers in a company are important because they pass on the tacit knowledge inter- nally. The accumulation of tacit knowledge becomes the “own- ership advantage” of each company. Such experience is diffi- cult to codify and require new personnel to become accustomed through experimental trial and error. We observed that a mature R&D engineer must have three years of hands-on experience in order to independently lead new product development. Through the “learning by doing” teamwork, each company can produce many different solutions for a problem instead of just one. Even though the key compo- nent suppliers provide a detailed design guide or circuit map, or even with Intel’s detail “data sheet”, not many ODMs’ RDs do their job by following these given information. For example, a RD manager at Asustek said, Aggressive RD engineers try to solve problems on their own and making something good out of something ordinary. The most difficult part is to create the best performance at the low- est cost. On the other hand, the extra-firm learning for ODMs’ RDs is often based on the occupation-based social networks, most fre- quently on social exchange with key component suppliers’ FAEs for the object of “debugging”. A “bug” is a problem that arises when a component proves incompatible with the system designed by ODMs or interferes with certain functions. Bugs often occur in the development of a new product, and the ODMs will refuse a supplier’s components if the supplier can- not solve the problem, unless it is client-appointed. The trou- ble shooting interaction between ODMs’ RDs and key compo- nent suppliers’ FAEs is mutually beneficial for technical learn- ing. For example, a chipset may all show the same performance under the Intel framework, but the system design might differ among the ODMs. When a bug occurs, the FAEs usually work together with the RDs firstly to modify the ODM’s system de- sign before changing their original chipset design. For the ODMs, FAEs provide the equivalent of technology support, and are even considered as part of the ODMs’ R&D team. Moreover, the key component suppliers usually feel they better understand the features and market potential of their products through the direct interactions with the ODMs’ RDs. In brief, those “learning by searching” and “learning by de- tection” behaviors within the production networks are essential elements for the ODM model. Institutionalized learning net- works are created through both formal organizational arrange- ment (such as periodical roadmap updates in conjunction with component suppliers) and informal social networks. These “pragmatic collaborations” (Helper, MacDuffie, & Sabel, 2000) have developed into routines among the technical teamwork between the key component suppliers and the ODMs. Conclusion Whether there were limits to global sourcing? This research explores one of the limitations with the perspective of organiza- Copyright © 2013 SciRes. 76  D. Y.-R. YANG, Y.-C. CHEN tional co-evolution. We argue the mutual dependence among the lead firms and ODMs does not decrease during the process of technological modularization in the notebook PC industry. The process of new product development requires plenty of technical interaction and tacit knowledge exchanges among lead firms, key component suppliers and ODMs. The mode of inter-firm governance is far beyond the “arm’s length transac- tions”. Moreover, Taiwanese ODMs play an irreplacable role in system and component specifications due to the rapid technol- ogy chang and the inherited complexity of system integration in the notebook PC industry. Furthermore, the “strong modularity thesis” fails to explain the competitiveness of the ODMs. The ODMs’ innovative pat- tern drives the widely organizational and technological interac- tion in order to avoid the bottleneck of system innovation with standardized technical interface and the limitation of an out- dated industrial structure. The knowledge exchanges occurring through single modular and inter-modular integration have become an important mechanism for mutual technical learning and developing core competences. Taiwanese ODMs are able to serve as important sources of information and knowledge for specifications formulation through their system integration and technological development abilities. Under this circumstance, key component suppliers such as Intel would have to rely more on the intensive collaborations with the ODMs. This article contributes to update the understanding of East Asia’ ODM development7, an upgrading pattern for the late- comers besides the branding strategy (Chu, 2009) and differs from South Korea’s experience (Cyhn, 2002; Hobday, 2003). The implication for world development is the latecomers might get engaged in the technology development through the inte- gration of absorptive capacity, cumulative innovation and de- sign capability as well as participating in the global production networks; while the “value chain modularity” would not auto- matically contribute to the learning opportunity for latecomers (Frigant & Layan, 2009). The organizational co-evolution, mu- tual dependence and the need for intensive face-to-face in- teraction in the “modular” design process further explain the territorialization of the industry in the “design cluster” in Nor- thern Taiwan Region. The region has developed routines from intense learning networks and become a crucial technology district in bridging the United States and Mainland China (Hsu & Saxenian, 2000; Saxenian & Hsu, 2001). Finally, we have to notice the ODM model has its limitation in catching-up for the small economy without significant do- mestic ma rket: the weak brandi ng capabilities, weak bargaining power with the TNCs, the “IP barriers” that constraint the de- velopment of home-made intellectual property rights (Ernst, 2010) and the job loss owing to the relocation of manufacturing activities. In addition, the national innovation system in Taiwan does not have integrated promotion strategy for industry spe- cifications. Contributions from investing in fundamental re- search and human resources, initiating the standard-setting col- laboration as well as promoting the own-brand strategy that complement the ODM production networks would be the dy- namic forces for upgrading the technology district in the future. Acknowledgements Daniel You-Ren Yang acknowledges the funding provided by National Science Council of Taiwan ROC (NSC 101-2628- H-029-002-MY2). REFERENCES Amsden, A. H., & Chu, W. W. (2003). Beyond late development: Tai- wan’s upgrading policies. Cambridge, MA: MIT Press. Baldwin, C. Y., & Clark, K. B. (2000). Design rules: The power of modularity. Cambridge, MA: MIT Press. Berggren, C., & Bengts so n, L. (2004). Rethinking outsourcing in ma nu- facturing: A tale of two telecom firms. European Management Jour- nal, 22, 211-223. doi:10.1016/j.emj.2004.01.011 Borrus, M. (2000). The resurgence of US electronics: Asian production networks and the rise of Wintelism. In: M. Borrus, D. Ernst, & S. Haggard (Eds.), International production networks in Asia: Rivalry or riches (pp. 57-79). London and New York: Rout l e d g e . Borrus, M., & Zysman, J. (1997). Globalization with borders. Industry and Innovation, 4, 141-166. doi:10.1080/13662719700000008 Brusoni, S., & Prencipe, A. (2001). Unpacking the black box of modu- larity: Technologies, products and organizations. Industrial and Cor- porate Change, 10, 179-205. doi:10.1093/icc/10.1.179 Campagnolo, D., & Camuffo, A. (2010). The concept of modularity in management studies: A literature review. International Journal of Management Reviews, 12, 259-283. Chandler, A. (1962). Strategy and structure: Chapters in the history of american industrial enterprise. Cambridge, MA: Harvard University Press. Chandler, A. (1977). The visible hand: The managerial revolution in american business. Cam bridge, MA: Harvard University Press. Chandler, A. (1990). Scale and scope: The dynamics of industrial capi- talism. Cambridge, MA: Harvard University Press. Chen, S. H. (2002). Global production networks and information tech- nology: The case of Taiwan. Industry and Innovation, 9, 249-265. doi:10.1080/1366271022000034480 Chu, W. W. (2009). Can Taiwan’s second movers upgrade via branding? Research Policy, 38, 1054-1065. doi:10.1016/j.respol.2008.12.014 Cyhn, J. W. (2002). Technology transfer and international production: The development of the electronics industry in Korea. Cheltenham: Edward Elgar. Dedrick, J., & Kraemer, K. L. (1998). Asia’s computer challenge: Threat or opportunity for the United States and the world? New York: Oxford University Press. Dedrick, J., Kraemer, K. L., & Linden, G. (2010). Who profits from innovation in global value chains? A study of the iPod and notebook PCs. Industrial and Corporate Change, 22, 1-36. Dosi, G., & Nelson, R. R. (1994). An introduction to evolutionary the- ories in economics. Journal of Evolu t i on a r y Economics, 4, 153- 172. doi:10.1007/BF01236366 Ernst, D. (2005). Limits to modularity: Reflections on recent develop- ments in chip design. Industry and Innovation, 12, 303-335. doi:10.1080/13662710500195918 Ernst, D. (2010). Upgrading through innovation in a small network eco- nomy: Insights from Taiwan’s IT industry. Economics of Innovation and New Technology, 19, 295-324. doi:10.1080/10438590802469560 Frigant, V., & Layan, J. B. (2009). Modular production and the new division of labour within Europe: The perspective of French automo- tive parts suppliers. European Urban and Regional Studies, 16, 11- 25. doi:10.1177/0969776408098930 Gereffi, G., Humphrey, J., & Sturgeon, T. J. (2005). The governance of global value chains. Review of International Political Economy, 12, 78-104. doi:10.1080/09692290500049805 Helper, S., MacDuffie, J. P., & Sabel, C. (2000). Pragmatic collabora- tions: Advancing knowledge while controlling opportunism. Indus- trial and Corporate Change, 9, 443-488. doi:10.1093/icc/9.3.443 Hobday, M. (1995). East Asian latecomer firms: Learning the technol- ogy of electronics. World Development, 23, 1171-11 93. doi:10.1016/0305-750X(95)00035-B Hobday, M. (2003). Innovation in Asian industrialization: A Gerschen- kronian perspective. Oxford Development Studies, 31, 293-314. Hoetker, G. (2006). Do modular products lead to modular organizations? Strategic Management Journal, 27, 501-51 8. doi:10.1002/smj.528 7For the development of the earlier OEM stage, please refer to Chen (2002). Copyright © 2013 SciRes. 77  D. Y.-R. YANG, Y.-C. CHEN Copyright © 2013 SciRes. 78 Hsu, J. Y., & Saxenian, A. (2000). The limits of guanxi capitalism: Transnational collaboration between Taiwan and the USA. Environ- ment and Planning A, 32, 1991-2005. doi:10.1068/a3376 Kawakami, M. (2011). Inter-firm dynamics in notebook PC value chains and the rise of Taiwanese original design manufacturing firms. In: M. Kawakami, & T. J. Sturgeon (Eds.), The dynamics of local learning in global value chains: Experiences from East Asia (pp. 16-42). Basingstoke & New York: Palgrave Macmi l l an. Lamoreaux, N. R., Raff, D. M. G., & Temin, P. (2003). Beyond mar- kets and hierarchies: Toward a new synthesis of American business history. American Historical Review, 108, 404-433. doi:10.1086/533240 Langlosi, R. N. (2002). Modularity in technology and organization. Journal of Economic Behavior and Corporate Change, 49, 19-37. doi:10.1016/S0167-2681(02)00056-2 Langlosi, R. N. (2003). The vanishing hand: The changing dynamics of industrial capitalism . Industrial an d Corporate Change, 12, 351-385. doi:10.1093/icc/12.2.351 Langlosi, R. N. (2004). Chandler in a larger frame: Markets, transaction costs, and organizational form in history. Enterprise and Society, 5, 355-375. doi:10.1093/es/khh055 Nelson, R., & Winter, S. (1982). An evolutionary theory of economic change. Cambridge, MA: Beknap Press. Sabel, C. F., & Zeitlin, J. (2004). Neither modularity nor relational contracting: Inter-firm collaboration in the new economy. Enterprise and Society, 5, 388-403. doi:10.1093/es/khh057 Saxenian, A., & Hsu, J. Y. (2001). The Silicon Valley-hsinchu connec- tion: Technical communities and industrial upgrading. Industrial and Corporate Change, 10, 893-920. doi:10.1093/icc/10.4.893 Steinle, C., & Schiele, H. (2008). Limits to global sourcing? Strategic consequences of dependency on international suppliers: Cluster the- ory, resource-based view and case studies. Journal of Purchasing & Supply Management, 14, 3-14. doi:10.1016/j.pursup.2008.01.001 Storper, M. (1997). The regional world: Territorial development in a global economy. New York: Guilford Press. Sturgeon, T. J. (2002). Modular production networks: A new American model of industrial organization. Industrial and Corporate Change, 11, 451-496. doi:10.1093/icc/11.3.451 Sturgeon, T. J. (2003). What really goes on in Silicon Valley? Spatial clustering and dispersal in modular production networks. Journal of Economic Geography, 3, 199-225. doi:10.1093/jeg/3.2.199 Sturgeon, T. J., & Kawakami, M. (2011). Global value chains in the electronics industry: Characteristics, crisis, and upgrading opportuni- ties for firms from developing countries. International Journal of Technological Learning, Innovation and Development, 4, 120-147. doi:10.1504/IJTLID.2011.041902 Sturgeon, T. J., & Lee, J. R. (2005). Industrial co-evolution: A com- parison of Taiwan and north American electronics contract manu- facturers. In: S. Berger, & R. K. Lester (Eds.), Global Taiwan: Build- ing competitive strengths in a n ew international economy (pp. 33-75). Armonk: An East Gate Book. Sturgeon, T. J., Biesebroeck, V., & Gereffi, G. (2008). Value chains, networks and clusters: Reframing the global automotive industry. Journal of Economic Geog rap hy , 8, 297-321. doi:10.1093/jeg/lbn007 Wen, H., & Yang, D. Y. R. (2010). The missing link between techno- logical standards and value-chain governance: The case of patent-dis- tribution strategies in the mobile-communication industry. Environ- ment and Planning A, 42, 2109-2130. doi:10.1068/a41203 Yang, Y. R., & Hsia, C. J. (2007). Spatial clustering and organizational governance of trans-border production networks: A case study of Taiwanese information-technology companies in the Greater Suzhou Area, China. Environment and Planning A, 39, 1346-1363. Yang, D. Y. R., & Coe, N. M. (2009). The governance of global pro- duction networks and regional development: A case study of Tai- wanese PC production networks. Growth and Change, 40, 30-53. doi:10.1111/j.1468-2257.2008.00460.x Yung, I. S., Lee, H. W., & Lai, M. H. (2009). Competitive advantages created by a cluster collaboration network for supplier management in notebook PC production. T ot a l Q uality Management, 20, 763-775. doi:10.1080/14783360903037358

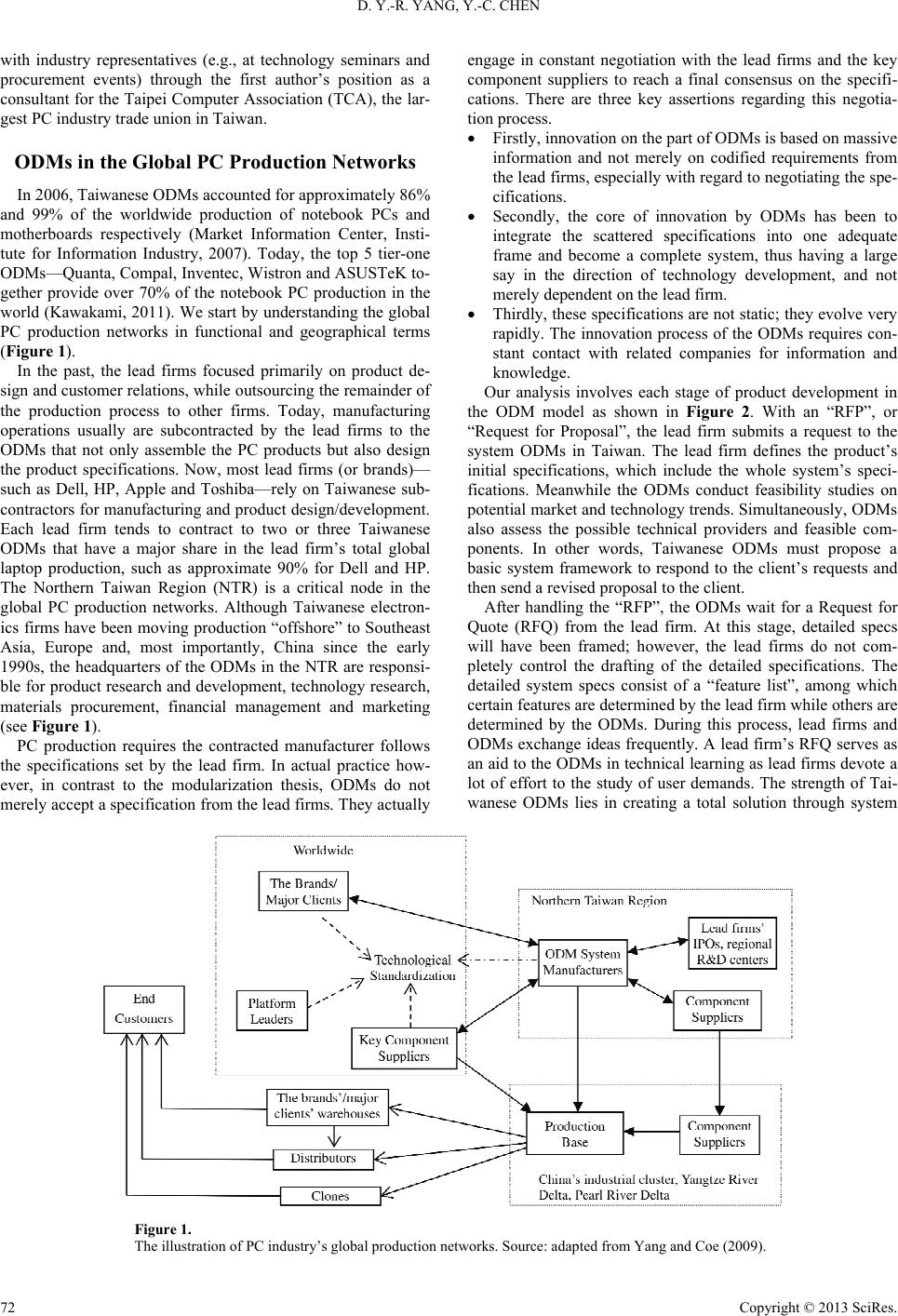

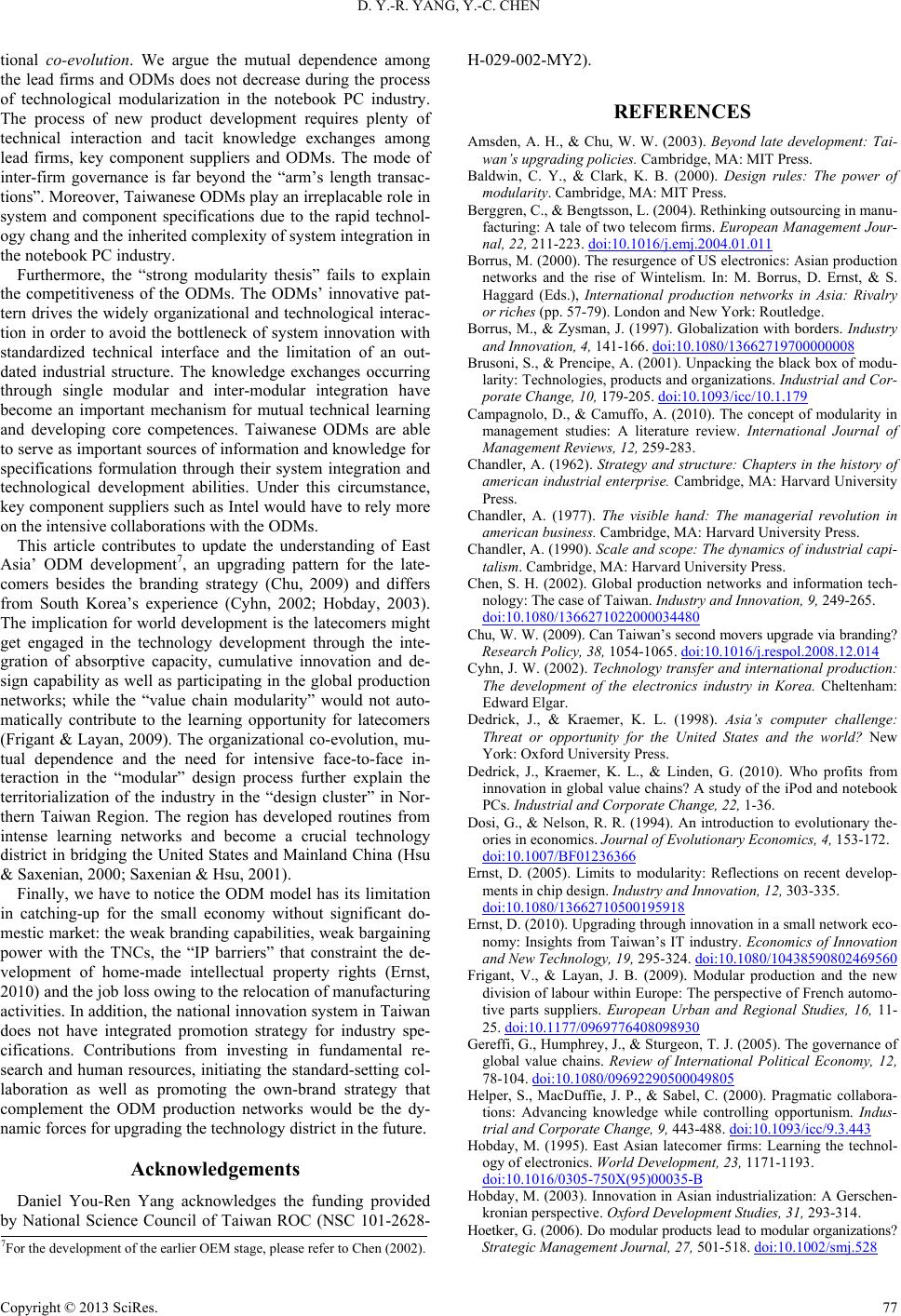

|