J. Service Science & Management, 2010, 3, 336-344 doi:10.4236/jssm.2010.33039 Published Online September 2010 (http://www.SciRP.org/journal/jssm) Copyright © 2010 SciRes. JSSM How Do Companies Adjust their Independent Directors after a Mishap —Evidence from Independent Directors’ Background Xinyi Zhang, Fan Zhou School of Economics and Management Tsinghua University, Beijing, China. Email: zhangxy2.07@sem.tsinghua.edu.cn Received April 23rd, 2010; revised June 6th, 2010; accepted July 10th, 2010. ABSTRACT Selection of independent directors in China’s listed companies is a two-way choice dominated by listed companies. Thereafter, most companies adjust their independent directors after a mishap (e.g. receiving qualified audit opinions or punished by regulatory authorities). This paper investigates the behavior of how companies adjust their independent directors from the perspective of independent directors’ background, by using data of Chinese listed companies to which a mishap happened between 2002 and 2004 as our target sample. Evidence shows that listed companies will in- crease independent directors with accounting background significantly after receiving qualified audit opinions or pun- ished by regulatory authorities, for the purpose of mitigating distress from capital market and medium and minority shareholders, which highlights the supervising role of independent directors with accounting background. Besides, these companies enjoy significantly contemporaneous return after the adjustment. Keywords: Independent Directors, Adjust, Background, Corporate Governance 1. Introduction Independent director system is widely believed as an im- portant action to improve corporate governance and now becomes the common choice among different corporate governance patterns [1]. In China, the system comprised of three parties (i.e. China Securities Regulatory Com- mission, listed companies and independent directors) was enforced as a “life saving straw” in 2001 when reform on non-tradable shares encounters a variety of difficulties. To better protect interests of medium and minority shareholders, China Securities Regulatory Commission (CSRC thereafter), one of the most important regulatory authorities in China’s capital market, issued guidance on establishing independent directors system in listed com- panies (the Guidance thereafter) on August 16, 2001, which gave birth to China’s independent directors sys- tem. In consequence, a huge “blind date” between listed companies and independent directors carries on amid fire and thunder. In reality, listed companies have made suf- ficient comparison and consideration among different candidates before formal invitations and employment. A person who is assigned to be an independent director must have some strength which is favored by companies, such as social status, professional skills, networking re- sources or just easy to be controlled [2]. Meanwhile, in- dependent directors can not only get paid, but also repu- tation, which was deem as the “fame and fortune” ap- pointment. Therefore, selection of independent directors in Chinese listed companies is a two-way choice domi- nated by listed companies. What’s the motivation of listed companies in the selections? Do they have ade- quate incentives to choose independent directors for su- pervising? This is the main question we are going to an- swer first. However, whether the system is perfect designed need further investigation. The collapse of Enron, WorldCom, and similar but less catastrophic disclosure failures viv- idly demonstrated weaknesses in the board governance system produced by the 1990s and pointed the way to- wards new roles for independent directors and standards of independence [3]. At the end of 1997, Zhengbaiwen was operating at a loss, and so falsified its financial re- port to make stockholders believe that the company was doing well. This caused stockholders a 98.79% loss in  How Do Companies Adjust Their Independent Directors after a Mishap 337 1998. Listed companies have autonomies in initial selec- tions; however, they will be challenged by medium and minority shareholders or even punished by law when mishap happens. Besides, mass media functions as a “watch dog” on shareholders’ interest in the whole proc- ess. As we all see that independent director Jiahao Lu was fined RMB 100,000 in “Zhengbaiwen Event”, for failing to take action when the company submitted a false financial report. Thus, the question arises: will listed companies adjust independent directors as a means to mitigate pressures from regulatory authorities, capital market and medium and minority shareholder? How do market participants react to different adjustment of inde- pendent directors? In this paper, we are trying to address these questions. We motivate this work by investigating the behavior of how companies adjust their independent directors from the perspective of independent directors’ back- ground. We find that percentages of independent direc- tors with accounting background increase significantly in mishap companies. We found that 67% of companies’ independent directors have accounting background in the event year, while increasing to 78% in the subsequent year. Besides, adding accounting professionals after a mishap can help companies mitigate distress from capital market and medium and minority shareholders, which highlights the supervising role of independent directors with accounting background. The remaining of this paper is organized as follows. The second section provides institutional background and hypothesis. The third section is data and variables de- scription. The fourth section lists descriptive statistics. The fifth section offers empirical test and explanation. The sixth section concludes the paper. 2. Institutional Background and Hypothesis 2.1. Institutional Background To put forward in order to further improve the corporate governance structures and promote the standardized op- eration of listed companies, on August 16, 2001 CSRC issued the guiding opinion on establishment of inde- pendent director systems by listed companies, which gave birth to China’s independent directors system. The Guidance requires independent directors with strong economics and law background. In particular, one of them should be accounting expert. Nevertheless, little rigid requirement is addressed on the specific back- ground of independent directors; people who can satisfy as an independent director are not rare. Thus, independ- ent directors can be from various industries with different background, playing their own distinct role in companies. The Guidance requires listed companies should establish independent director systems. Besides, CSRS address that an independent director should have the qualifica- tions required to exercise his functions and powers as such a person holding the position of independent direc- tor, independent directors must be independent. The nomination, election and replacement of independent directors should be conducted in a legal and standardized manner [4]. Lou [5] documented foreign researches and found that independent directors work as supervisors, strategy de- signers and politicians in companies. Research Center of Shanghai Security Exchange [6] believed that functions of independent directors are supervision, assistance and networking. Zhou [7] considers independent directors serve as supervisors and consultants for listed companies. Due to the inconsistency of original intention on estab- lishing independent system among CSRC, listed compa- nies and independent directors, whether independent di- rectors are competent and willing to work as a supervisor and consultant need further consideration. This paper uses incentive compatibility theory to analyze incentive incompatibility in initial selections of independent direc- tors and incentive compatibility in adjusting after a mis- hap. 2.2. Incentive Incompatibility: In Initial Selections Incentive incompatibility is a mechanism design in which conflicting objects exists in principal and agent. Under certain circumstance, agents have no incentive working hard to fulfill principal’s goals; what is more serious, agents may choose behaving negligence and profusion in hopes of self-interest maximization. The controller of such [joint-stock] companies, how- ever, being the managers of other people’s money rather than of their own, cannot well be expected, that they should watch over it with the same anxious vigilance with which the partners in a private copartnery frequently watch over their own. Like the stewards of a rich man, they are apt to consider attention to small matters as not for their master’s honor, and very easily give themselves a dispensation from having it. Negligence and profusion, therefore, must always prevail, more or less, in the man- agement of the affairs of such a company [8]. China’s independent directors system was created from a manda- tory institutional change led by CSRC, which gave birth to a special principal-agent relationship — CSRC dele- gate listed companies to employ independent directors. In this case, CSRC is the principal, listed companies are agent. CSRC, listed companies and independent directors, as the main parties in this mechanism, have different incentive and opinions in the implementation, therefore, Qingquan Tang [9] analyze the three incentives. CSRC’s Copyright © 2010 SciRes. JSSM  How Do Companies Adjust their Independent Directors after a Mishap 338 incentive is optimizing board structures in listed compa- nies, protecting interest of medium and minority share- holders, improving information disclosure and interna- tionalization. From the view of listed companies, they induct independent directors in hopes of improving company’s image and decision-making ability, dealing with challenges and conquering financial stress. Speak- ing of independent directors, this invitation means not only get paid and easier to fetch resources, but also repu- tation and self-fulfillment. Obviously, incentive conflictions among CSRC, listed companies and independent directors bring disagreement to the establishment of independent directors system. Referring to the consultant role, incentive confliction doesn’t exist. In detail, independent directors provide listed companies with strategic, political and networking assistance by using “knowledge capital” of their own, which creates promotion to company’s performance. As a result of that, independent directors will enjoy higher reputation and compensation. Here is a “trilateral win contract”, which indicates the realization of incentive compatibility. There are conflict incentives of the three parties in independent director’s “supervision role”. For one thing, there is incentive conflictions originated from the selection mechanism. The reality that independent directors are nominated by majority shareholders in most Chinese listed companies determines that independent directors cannot stand in medium and minority share- holder’s shoes as CSRC expected, otherwise incentive incompatibility will come into being. Secondly, the com- pensation mechanism in independent directors system brings incentive conflictions. It is the listed company controlled by the first majority shareholder and manage- ment who pays for independent directors, but the main duty them is supervising the company. In conclusion, regulatory authorities expect independent directors serve as a compatible supervisor; nevertheless listed companies don’t want to see that condition happens by no means, they hope independent directors are only consultant ra- ther than watchdog, which shows the incentive incom- patible in the selection of independent directors between the principal (regulatory authorities) and agent (listed companies). 2.3. Incentive Compatibility: Adjustment after the Mishap In mechanism design, a process is said to be incentive compatible if all of the participants fare best when they truthfully reveal any private information asked for by the mechanism. As an illustration, voting systems which create incentives to vote dishonestly lack the property of incentive compatibility. In the absence of dummy bidders or collusion, a second price auction is an example of me- chanism that is incentive compatible. Listed companies wish independent directors to be consultant rather than supervisor. This intention is one- sided romance to some degree because the Guidance requires at least one accounting professionals should be presented as an independent director. What’s more, listed companies cannot dominate the selection confronting with pressures from medium and minority shareholders, regulatory authorities and capital market. More and more challenges are heard these days focusing on the issue independent directors are not independent, with little awareness neither. The emergence of independent direc- tors system is to protect medium and minority share- holders, but what we can see is quite different from what we hoped. Lack of independence means independent directors are controlled and manipulated by majority shareholders. Meanwhile, lack of awareness means they cannot satisfy the general public as integrity and compe- tent professionals. Anecdotal evidence shows that inde- pendent directors will not only be challenged medium and minority shareholders, regulatory authorities, but also punished by law in serious circumstance after a mishap. Thus, listed companies will adjust independent directors after a mishap hoping to mitigate distress from capital market and medium and minority shareholders, hence, incentive compatibility happens. 2.4. Hypothesis As the independence of independent directors is difficult to measure, this paper mainly test the awareness of them (i.e. competence and motivation of independent directors). Jensen and Meckling [10] analyze how the cost of trans- ferring specific knowledge encourages the decentraliza- tion of decision rights and how this decentralization gen- erates the rights assignment and control problems. They pointed out that ignoring agency problem, assigning de- cisions rights to individuals who have the decision- relevant knowledge and abilities increases efficiency. Self-interest on the part of individual decision makers, however, requires a control system to motivate individu- als to use their decision rights optimally. This paper uses professional knowledge as a proxy to measure occupa- tional competency of independent directors [7]. We believe that independent directors with accounting background are accomplished in solving financial prob- lems, while management and technical knowledge will provide companies with helpful suggestions on operating performance. A body of foreign researches supports that independent directors with accounting background play a vital role in eliminating earnings management and fraud [11-13]. The Sarbanes-Oxley Act of 2002 and the Guid- ance emphasize the importance of independent directors Copyright © 2010 SciRes. JSSM  How Do Companies Adjust Their Independent Directors after a Mishap Copyright © 2010 SciRes. JSSM 339 with financial background. Johnson [14], Anderson and Bizjik [15] and Zhao et al [16] find independent directors with management background will improve companies operating performance. Therefore, this study empirically tests the following hypothesis: Hypothesis 1: listed companies will increase the num- ber of independent directors with accounting back- ground after a mishap. Fama and Jensen [17] argue that outside directors tend to be more effective monitors of management than inside directors because they are generally key decision makers at other organizations who are concerned about their re- putations in the managerial-labor market. According to their argument, outside directors signal their abilities as key decision makers through their board decisions. This study uses reputation to proxy independent director’s occupational motivation and will empirically tests the following hypothesis: Hypothesis 2: listed companies will increase the num- ber of independent directors with higher reputation after a mishap. Gordon [3] point out that independent directors as de- veloped in the U.S. context solve three different prob- lems: First, they enhance the fidelity of managers to shareholder objectives, as opposed to managerial inter- ests or stakeholder interests. Second, they enhance the reliability of the firm’s public disclosure, which makes stock market prices a more reliable signal for capital al- location and for the monitoring of managers at other firms as well as their own. Third, and more controver- sially, they provide a mechanism that binds the respon- siveness of firms to stock market signals but in a bounded way. The turn to independent directors serves a view that stock market signals are the most reliable measure of firm performance and the best guide to allo- cation of capital in the economy, but that a “visible hand,” namely, the independent board, is needed to bal- ance the tendency of markets to overshoot. How do investors react to adjustment to independent directors after a mishap, to specify, increasing the num- ber of independent directors with accounting background or increasing the number of independent directors with higher reputation? In this paper, we will empirically test this question. Thus, we develop the following hypothesis on firm’s market performance. Hypothesis 3: listed companies will enjoy positive contemporaneous return after adjusting independent directors after a mishap. 3. Data and Variables This part is organized as follows. First of all we will pro- vide an introduction to the types of independent directors listed companies appointed, and then we will empirically test how companies adjust independent directors after a mishap. Different independent directors play various roles due from their functions and positions. Our test focuses on the background of independent directors. 3.1. Sample In this paper, our mishap companies during the year 2002 to 2004 are selected according to companies’ annual re- port, announcement and other information. Independent directors’ background and characters of companies (es- pecially for important bad news) are obtained from WIND and CSMAR database. Other data are collected by hand. 3.2. Variables Our empirical study comprises three groups of variables: independent directors’ specialties, reputation and compa- nies’ mishap. 3.2.1. Variables about Independent Directors’ Specialties Independent directors’ majors can be divided into four categories: economics and management, accounting, law and technique, which correspond to four dummies in our paper. The Guidance requires at least one accounting professionals should be presented as an independent di- rector. To better investigate the adjusting of accounting professionals in listed companies, we design a continu- ous variable to depict percentage of accounting profes- sionals. Panel A in Table 1 presents variables about in- dependent directors’ background. 3.2.2. Reputation Variables of Independent Directors Reputation is hard to be quantified. Some scholars use the average number of companies in which a person serve as an independent director as a proxy for reputation [16,18,19]. Actually, some prestigious independent di- rectors are reluctant to accept more invitations, which highlight the deficiency to this method. To be objective, we use Xia et al. [20] and Wei [21] for reference and add some improvement to the method. We use expert as- sessment to evaluate independent directors’ reputation. Panel B in Table 1 presents variables about independent directors’ reputation. 3.2.3. Mishap Variables Different kinds of mishap can be invasion to medium and minority shareholders interest. This paper chooses pun- ishment from regulatory authorities and qualified audit opinions as proxy for important mishap. The former in dicates fraud in listed companies while the latter means problems in financial reports. Two types of mishap are closely related to companies’ financial reports, which  How Do Companies Adjust their Independent Directors after a Mishap 340 Table 1. Variable definations. Variable Name Abbreviate Definition Panel A: variables about independent directors’ knowledge background Accounting ACCO1 If an accounting professional is appointed, ACCO1=1, otherwise ACCO1=0 Percentage of accounting ACCO2 Number of independent directors with accounting background/Number of independent directors Law LAW If a law professional is appointed, LAW=1, otherwise LAW=0 Economics and management ECON If an economics and management is appointed, ECON=1, otherwise ECON=0 Technical TECON If a technical professional is appointed, TECON=1, otherwise TECON=0 Panel B: variables about independent directors’ reputation Reputation REPUT Average score, calculating process: how many companies a person serves as an independent director (40%), reputation of his afflation (20%), position (20%), professional title (10%) and education degree (10%) Panel C: Definition of conviction events in mishap companies Conviction UNRULE Punished by regulatory authorities or receiving qualified audit opinions have a name “conviction events”. Panel C in Table 1 pre- sents variables about mishap. 4. Descriptive Statistics 4.1. Status Quo of Independent Directors The independent director system in China is basically driven by mandatory rules rather than spontaneous institutional change promoted by listed companies and general public. Therefore, majorities of listed companies carry it into execution by “the last bus”. Table 2 reports the general situation of independent directors in China’s listed companies. Only 325 companies have independent directors in 2001, covering 28.56% of China’s listed companies. From 2002 on majorities of China’s listed companies put the system into practice. On average, Boards are reelected every three years. Table 2 shows that the number of independent directors decreased in 2005 compared to 2004, indicating that a body of listed companies reelected during 2004 and 2005. Therefore, we restricted our target sample mishap companies from 2002 to 2004, corresponding to reelection year. Data Table 2. Status quo of independent directors. Listed companies Independent directors Year Number Appointing independent directors Percentage Number Average1 2001 1140 325 28.56% 741 2.28 2002 1204 1175 97.59% 2679 2.28 2003 1267 1261 99.53% 4035 3.20 2004 1354 1353 99.93% 4506 3.33 2005 1351 1351 100.00% 4461 3.30 Total 6316 5465 86.52% 16422 3.00 related to independent directors’ background spans from 2002 to 2005. 4.2. Statistics Relating to Independent Directors’ Background Our data covers independent directors’ background from 2002 to 2005. 4.2.1. Statistics of Independent Directors’ Specialties Table 3 reports distribution of independent directors’ specialties. Independent directors with economics and management specialties represent 27% of all directors, while technicians cover 23% and 11% for that of law in 2002. Obviously, the phenomenon that independent di- rectors with economics and management majors or with accounting background holding concurrent posts in dif- ferent companies is not rare. Accounting professionals and law experts are increasing year by year; percentage grows from 27% in 2002 to 28% in 2005 for accounting professionals, from 11% in 2002 to 13% in 2003 for law experts respectively. 4.2.2. Statistics of Independent Directors’ Reputation This paper uses expert assessment to evaluate independ- ent directors’ reputation. How many companies a person serves as an independent director, reputation of his own afflation, position, professional title (or education degree) are four proxies for reputation, each of them has their own weight, which are 40%, 20%, 20%,10% and 10% respectively. Full mark is 5 points. Table 4 reports scores of independent directors’ scores. On average all of them are larger than 1, [1,2) covers 8.4% of the whole sample, [2,3) covers 65.0% , [3,4) covers 22.0%, while [4,5] covers 5.7%. Due to strict assessment, few independent directors’ reputation scores [4,5], which doesn’t influence he accuracy of the final result. t Copyright © 2010 SciRes. JSSM  How Do Companies Adjust their Independent Directors after a Mishap 341 Table 3. Independent directors’ specialties. Year 2002 2003 2004 2005 Total Acc 727 27% 1092 27% 1236 27% 1249 28% 4304 27% Law 295 11% 525 13% 582 13% 608 14% 2010 13% Econ 1035 39% 1500 37% 1681 37% 1646 37% 5862 37% Tecon 622 23% 918 23% 1007 23% 958 21% 3505 22% Total 2679 100% 4035 100% 4506 100% 4461 100% 15681 100% Table 4. Distribution of independent directors’ reputation. Year Reputation 2002 2003 2004 2005 Total Missing 11 0.40% 5 0.10% 5 0.10% 5 0.10% 26 0.20% [0,1) 0 0.00% 0 0.00% f0 0.00% 0 0.00% 0 0.00% [1,2) 218 8.1% 335 8.3% 380 8.4% 381 8.5% 1314 8.4% [2,3) 1769 66.1% 2592 64.3% 2884 64.0% 2936 65.8% 10181 65.0% [3,4) 571 21.3% 929 23.0% 1013 22.5% 932 20.9% 3445 22.0% [4,5] 108 4.0% 352 8.7% 221 4.9% 206 4.6% 887 5.7% Total 2677 100% 4033 100% 4503 100% 4460 100% 15673 100% 4.2.3. Statistics of Conviction Event As is known to all, China’s stock market is still in the infancy period and institution investors need great improvement in the days to come. Thus, irregular events are not rare. Punishment from regulatory authorities and qualified audit opinions from public accounting firm can be seen each year in capital market, which indicates serious financial problems in listed companies. Table 5 presents conviction events (i.e. punishment from regula- tory authorities and qualified audit opinions from public accounting firm) in listed companies. 5. Empirical Test and Explanation 5.1. Descriptive Statistics of Adjustment We develop T-test and Z-test to find the difference of independent directors in event year and subsequent year. Panel A of Table 6 reports the results. Percentages of independent directors with accounting background in- crease significantly in mishap companies. 67% of com- panies’ independent directors have accounting back- ground in the event year, while increases to 78% in the subsequent year, which is significant at 1% level. Ac- counting directors covers 26.63% of all external directors in the conviction year, while increases by 2.57% to 29.2% in the subsequent year, significant at 10% level. Results indicate that companies increase accounting professional as independent directors after a mishap. However, empi- Table 5. Conviction event in China’s listed companies. Variable 2002 2003 2004 Total UNRULE 157 111 164 432 rical results indicate that listed companies donot increase independent directors with other background (e.g. eco- nomics and management, law and technology). Account- ing professionals are exerted in figuring out financial problems. Companies appoint them to mitigate distress between regulatory authorities and minority shareholders, providing positive signals to the general public. Actually, foreign and domestic researches emphasize the impor- tance of accounting independent directors. Xie et al. [11], Bedard et al. [12] and Bryan [13] find that independent directors with financial background play a vital role in supervision and restriction of management earnings ma- nagement. Besides, statistics shows that average score of inde- pendent directors’ reputation in mishap companies is 2.5646 in the conviction year, while decreases to 2.55 in the subsequent year. No statistic evidence supports our second hypothesis. The reason listed companies don’t increase the number of independent directors with higher reputation after a mishap is two folded. For one thing, higher reputation doesn’t predict more competence. An- ecdotal events in capital market show that “vase direc- tors” not only means incompetence but also dereliction of duty. Lu Jiahao in “Zhengbaiwen Event” is a persua- sive and vivid example for us. Wang et al. [19] finds independent directors’ reputation improves company’s performance significantly but Zhao et al. [22] supports that independent directors’ reputation doesn’t improve family firm’s performance significantly. No evidence shows that reputation backs up independent directors as a competent supervisor. Zhou [7] and Zhou et al. [23] are otivated by their reputation, rather than restricted. m Copyright © 2010 SciRes. JSSM  How Do Companies Adjust their Independent Directors after a Mishap 342 Table 6. Independent director adjustment in event year and subsequent year. Event year Subsequent year Variable N Mean Median N Mean Median T-test Z-test Panel A: background of specialties ACCO1 432 0.6728 1 423 0.7801 1 –3.54*** 3.51*** ACCO2 432 0.2663 0.33 423 0.2920 0.33 –1.75* 1.83* LAW 432 0.3921 0 423 0.4397 0 –1.41 1.41 ECON 432 0.7517 1 423 0.7683 1 –0.57 0.64 TECON 432 0.4316 0 423 0.4704 0 –1.14 0.57 Panel B: background of Reputation REPUT 432 2.5646 2.55 423 2.5613 2.55 0.12 –0.98 ***, **, and * represent significance levels at the 1%, 5%, and 10% levels, two-tailed, respectively. Independent directors’ specialties data are unavailable for 9 mishap companies. Table 7. Discriptive statistics of accounting independent direcors by year. ACCO1 ACCO2 ACCO1 ACCO2 Year N Mean Median Mean Median T-test Z-test T-test Z-test 2002 1135 0.59 1.0 0.26 0.33 2003 1248 0.76 1.0 0.27 0.33 02&03 –9.15*** –8.99*** 0.02 –0.96 2004 1347 0.79 1.0 0.27 0.33 03&04 –1.42 –1.42 –0.65 –0.35 2005 1329 0.78 1.0 0.28 0.33 04&05 –1.02 1.02 –0.93 0.89 ***, **, and * represent significance levels at the 1%, 5%, and 10% levels, two-tailed, respectively. Secondly, unqualified opinions from external auditors indicate deficient in companies, therefore, there is no reason for prestigious people to accept invitation from mishap companies for the sake of avoiding risk. 5.2. Robust Tests: Is That Resulted from Institutional Change Implementation of independent directors system in China is a progressive process. The Guidance requires inde- pendent directors should be included in the board before July 30, 2002. Besides, at least one third directors in the board should be external directors, one of whom should be accounting expert. Obviously, companies increase accounting directors to meet the mandatory requirement from 2002 to 2003. Does the increase result from institu- tional change? We will develop additional test in the fol- lowing. Table 7 reports descriptive statistics on inde- pendent directors’ accounting background. Result shows that percentage of companies in which accounting ex- perts present as an independent directors are 59% in 2002, while 76%, 79% and 80% for the year 2003, 2004 and 2005 respectively. Besides, empirical evidence point out that percentage of companies in which accounting ex- perts present as an independent directors increases from 2002 to 2003 significantly in 1% level. However, the percentage increases insignificantly by year from 2003 to 2005. Thus, listed companies appoint more accounting expert as independent directors not only because of their own demand, but also consequence from institutional change. Besides, nonparametric test shows that percent- age of independent directors with accounting background in companies doesn’t increase year by year from 2002 to 2005, which indicates that the increase in mishap com- panies are not resulted from institutional change. In con- clusion, our result is robust. 5.3. Adding Accounting Independent Directors is Helpful for Market Performance Empirical evidence shows that China’s listed companies will add accounting professionals as their independent directors, however, whether they can benefit from this choice need further investigation. We use market ad- justed model to calculate cumulated abnormal return (CAR thereafter), which are computed as the stock’s raw return over the interval minus the corresponding equally- weighted market return. We selected 70 companies which add accounting independent directors after the mishap. Table 8 shows that they experienced negative CAR 2 years before the conviction and significant in 1% level, but CAR is negative but insignificant during the convic- Copyright © 2010 SciRes. JSSM  How Do Companies Adjust Their Independent Directors after a Mishap 343 tion year. After the mishap, market performance increase year by year. We may infer that mishap companies enjoy market performance improvement by adding accounting independent directors. Accounting professionals are fa- vored by market participants. Barth et al. [24] developed a cross-sectional model to test whether improvement in company’s market per- formance benefits from increasing in brand value. To investigate correlations between market return and change in brand value, company’s contemporaneous return is regressed on net income, change in net income compare to last year and change in brand value. The coefficient of change in brand value defines the correlation between market return and change in brand value. We are trying to investigate the correlation between market return and whether mishap company adding ac- counting independent directors, so we introduce a new dummy addacco. New model is shown as follows. tiitititit addaccoNINIRETURN ,221 (1) RETURNi,t denotes firm i’s contemporaneous return in year t. The deadline of China’s listed companies’ annual report is April 30th in the subsequent fiscal year, there- fore, we use the first trading day in May in the fiscal year as our beginning date for contemporaneous return. NIi,t is net income per share (extraordinary items are excluded), and NI △ i,t denotes change in net income compare to last year. Adda cco is a dummy, which equals 1 if mishap company adding an accounting independent director, 0 otherwise. Table 9 reports our OLS regression result. Empirical result shows that net income per share (extraordinary items are excluded) is highly correlated with contempo- raneous return, adding accounting independent director help companies improve their market performance sig- nificantly (the coefficient of addacco is 0.2179, signifi- cant at 0.01 level). Accounting professionals can help mishap companies mitigate distress from capital market and medium and minority shareholders, which highlights the supervising role of independent directors with ac- counting background. Table 8. Descriptive statistics of car around the mishap. N Mean Min Max CAR[–750, –500] 70 –0.0739** –1.1414 0.4204 CAR[–500, –250] 70 –0.1837*** –0.9635 0.3005 CAR[–250,0] 70 –0.3021*** –1.0568 0.7177 CAR[0,250] 70 –0.0890 –1.8013 1.8653 CAR[250,500] 70 0.0894* –0.8915 0.9016 CAR[500,750] 70 0.6382*** –0.5249 3.9936 CAR[–750, –500] 70 –0.0739** –1.1414 0.4204 ***, **, and * represent significance levels at the 1%, 5%, and 10% levels, two-tailed, respectively. Table 9. OLS regression examining whether market approves adding accounting independent directors. Dependent Variable Independent Variable Predicted sign Coeff. t-Stat. Intercept ? –.6109 –13.53*** NI + .4665 4.58*** △NI + .0019 1.36 Addacco + .2179 2.63*** Number 417 Adjusted R2 0.24 ***, **, and * represent significance levels at the 1%, 5%, and 10% levels, two-tailed, respectively. 6. Conclusions This paper investigates the behavior of how companies adjust their independent directors from the perspective of independent directors’ background, by using data of Chi- nese listed companies to which a mishap happened be- tween 2002 and 2004 as our target sample. Evidence shows that listed companies will increase independent directors with accounting background significantly after a mishap (i.e. receiving qualified audit opinions or pun- ished by regulatory authorities). Nevertheless, listed com- panies don’t increase the number of independent direc- tors with higher reputation after a mishap. On one hand companies don’t resort to prestigious independent direc- tors for assistance, and on the other hand prestigious in- dependent directors don’t want to work for mishap com- panies. Empirical evidence shows that listed companies will increase independent directors with accounting back- ground after a mishap for the purpose of mitigating agent distress between majority shareholders and minority shareholders, enjoying significantly positive cumulative abnormal return after the adjustment in the long window. Our result indicates that listed companies will increase accounting independent directors for the purpose of mitigating distress from capital market and medium and minority shareholders, which highlights the supervising role of independent directors with accounting background. REFERENCES [1] F. Zhang, “Thoughts on Independent Director System,” Management World, No. 2, 2003. [2] X. D. Ning, “Directors’ Journey,” Ceocio China, No. 5, 2009. [3] J. N. Gordon, “The Rise of Independent Directors in the United States, 1950-2005: Of Shareholder Value and Sto- ck Market Prices,” Stanford Law Review, Vol. 59, No. 6, 2007, p. 1465. [4] CSRC, “Establishment of Independent Director Systems by Listed Companies Guiding Opinion,” China Securities Copyright © 2010 SciRes. JSSM  How Do Companies Adjust their Independent Directors after a Mishap Copyright © 2010 SciRes. JSSM 344 Regulatory Commission, 2001. [5] F. Lou, “Status Quo of Foreign Research on Independent Director System,” Foreign Economies and Management, No. 12, 2001. [6] Research Center of Shanghai Security Exchange, “Survey of Corporate Governance in China’s Listed Companies: Independence and Efficiency of the Board,” Fudan Uni- versity Press, 2004. [7] F. Zhou, “Independent Directors’ Background and Gover- nance Performance: Evidence from China’s Listed Com- panies,” Dissertation of Sun Yat-sun University, 2008. [8] A. Smith, “Wealth of Nations,” W. Strahan and T. Cadell, London, 1776. [9] Q. Q. Tang, “Research on the Motivation of Enforcement in China,” Dissertation of Sun Yat-sun University, 2003. [10] M. C. Jensen, W. H. Meckling and S. Field, “Specific and General Knowledge, and Organizational Structure,” Jour- nal of Applied Corporate Finance, Vol. 8, No. 2, 1995, pp. 4-18. [11] B. Xie, W. N. Davidson III and P. J. DaDalt, “Earnings Management and Corporate Governance: The Role of the Board and the Audit Committee,” Journal of Corporate Governance, Vol. 9, No. 3, 2003, pp. 295-316. [12] J. Bedard, S. M. Chtourou and L. Courteau, “The Effect of Audit Committee Expertise, Independence and Acti- vity on Aggressive Earnings Management,” Journal of Practice & Theory, Vol. 23, No. 2, 2004, pp. 13-35. [13] D. M. Bryan, C. Liu and S. L.Tiras, “The Influence of Independent and Effective Audit Committees on Earings Quality,” Working Paper, 2004. [14] J. L. Johnson, C. M. Daily and A. E. Ellstrand, “Boards of Directors: A Review and Research Agenda,” Journal of Management, Vol. 22, No. 3, 1996, pp. 409-438. [15] R. Anderson and J. Bizjak, “An Empirical Examination of the Role of the CEO and the Compensation Committee in Structuring Executive Pay,” Journal of Banking and Finance, Vol. 27, No. 7, 2002, pp. 1323-1348. [16] C. W. Zhao, Y. K. Tang, J. Zhou and H. Zou, “Independent Directors in Family Firms and Firm’s Value: Test on Rationality of Independent Director System in China’s Companies,” Management World, No. 2, 2008. [17] E. Fama and M. C. Jensen, “Separation of Ownership and Control,” Journal of Law and Economics, Vol. 26, No. 2, 1983, pp. 301-325. [18] R. Bushman, Q. Chen, E. Engel and A. Smith, “Financial Accounting Information, Organizational Complexity and Corporate Governance Systems,” Journal of Accounting and Economics, Vol. 37, No. 2, 2004, pp. 167-201. [19] Y. T. Wang, Z. Y. Zhao and X. Y. Wei, “Does Indepen- dence of the Board Affect Firm Performance?” Economic Research Journal, No. 5, 2006. [20] D. L. Xia and S. Zhu, “The Determinants of Independent Directors Compensation and the Features of Corporate Governance,” Nankai Business Review, Vol. 8, No. 4, 2005. [21] G. Wei, Z. Z. Xiao, N. Travlos and H. Zou, “Background of Independent Directors and Corporate Performance,” Economic Research Journal, No. 3, 2007. [22] C. W. Zhao, Y. K. Tang, J. Zhou and H. Qiu, “Family Firm and Firm Value,” Management World, No. 8, 2008. [23] F. Zhou, J. S. Tan and Y. Y. Jian, “Incentive from Reputa- tion or Money?” China Accounting Review, No. 6, 2008. [24] M. Barth, M. Clement, G. Foster and R. Kasznik, “Brand Values and Capital Market Valuation,” Review of Account- ing Studies, Vol. 3, No. 1-2, 1998, pp. 41-68.

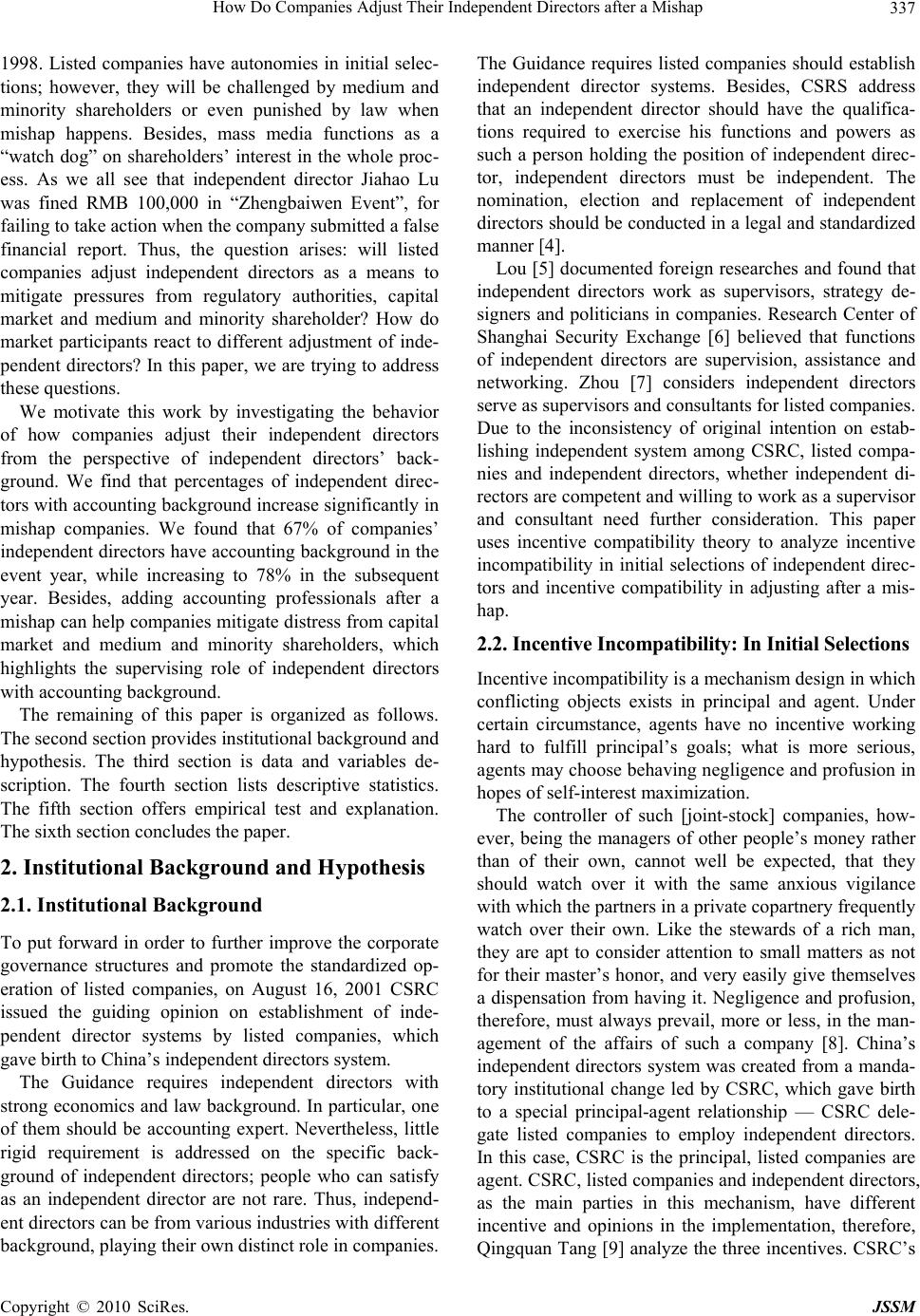

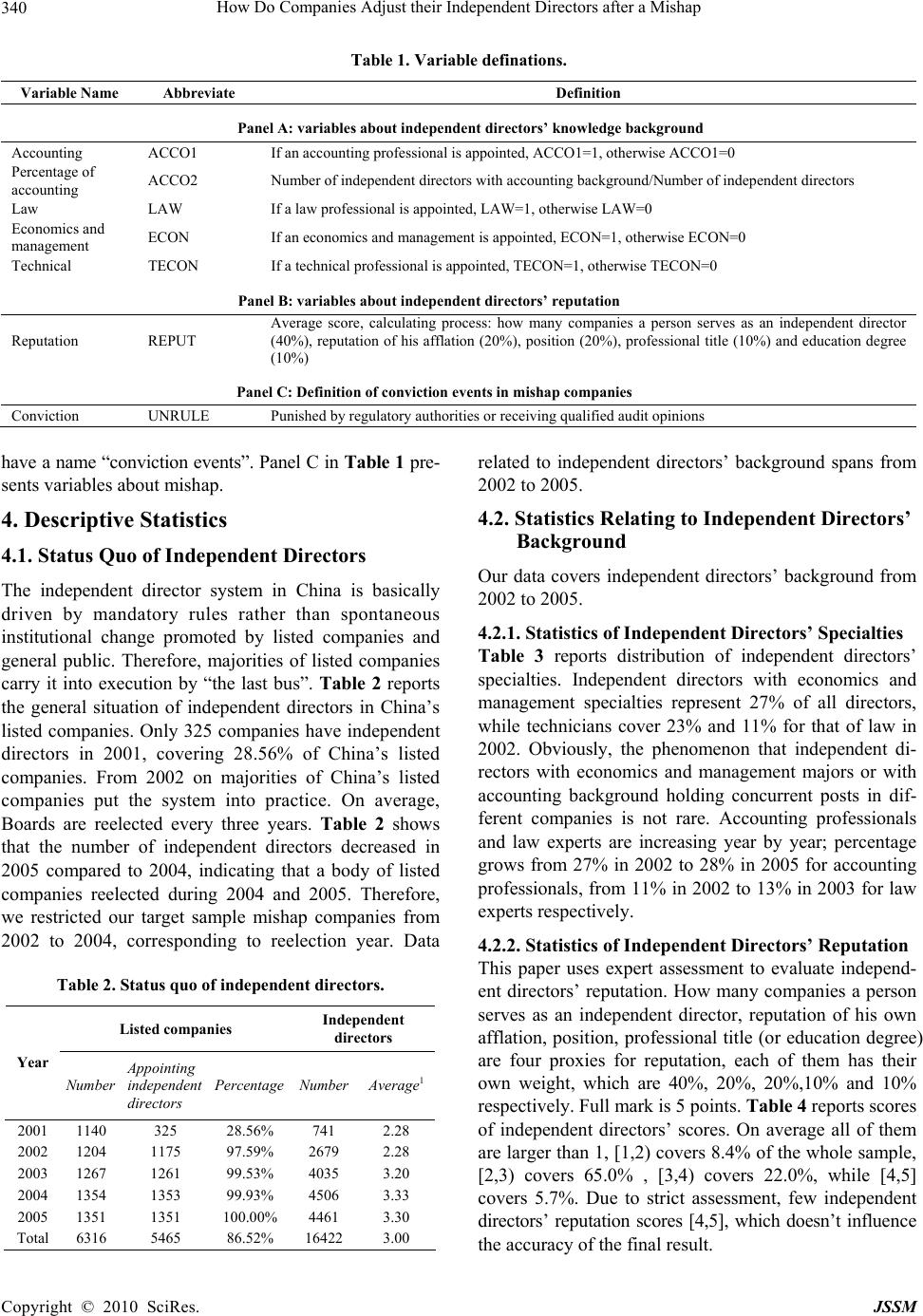

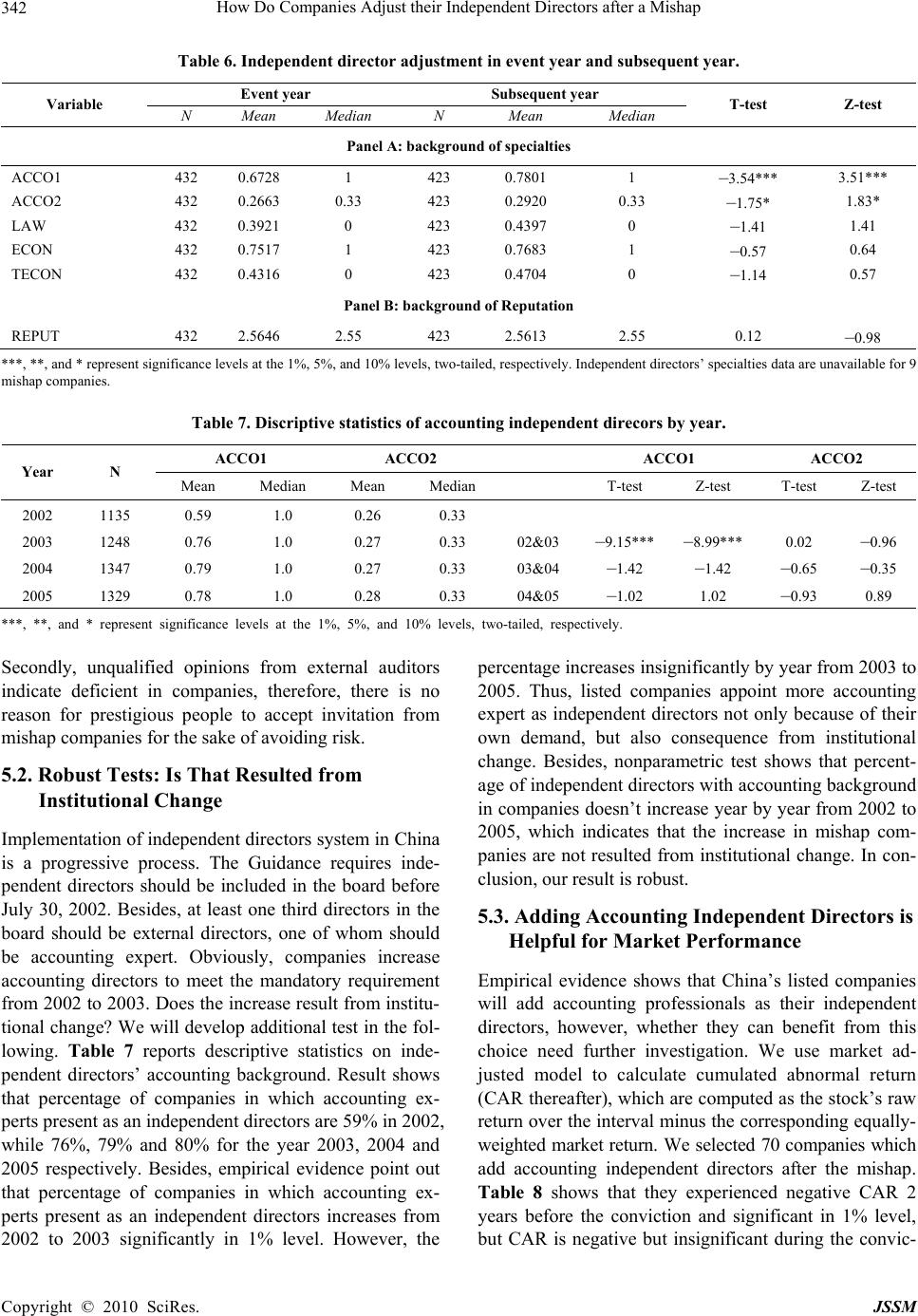

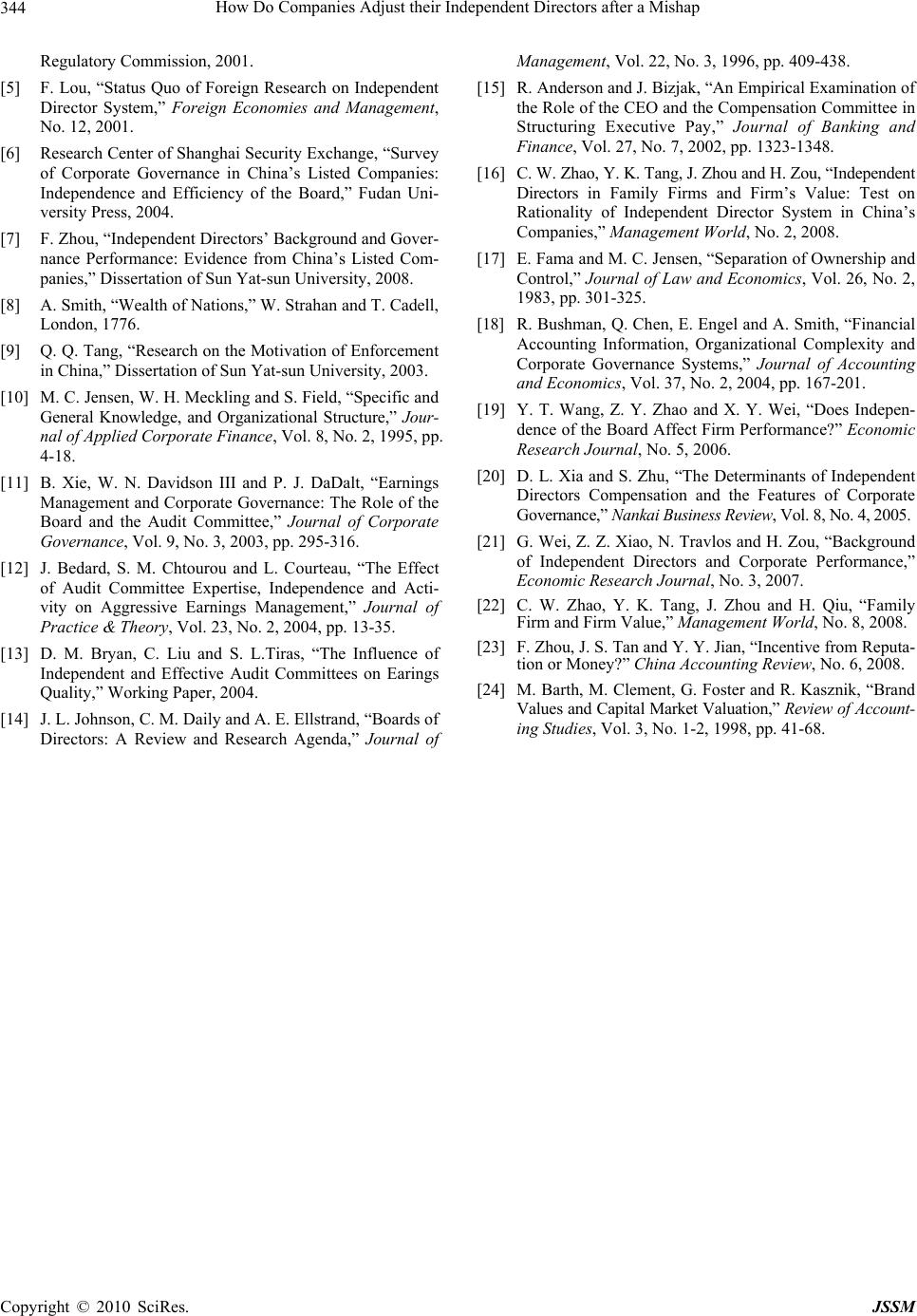

|