Paper Menu >>

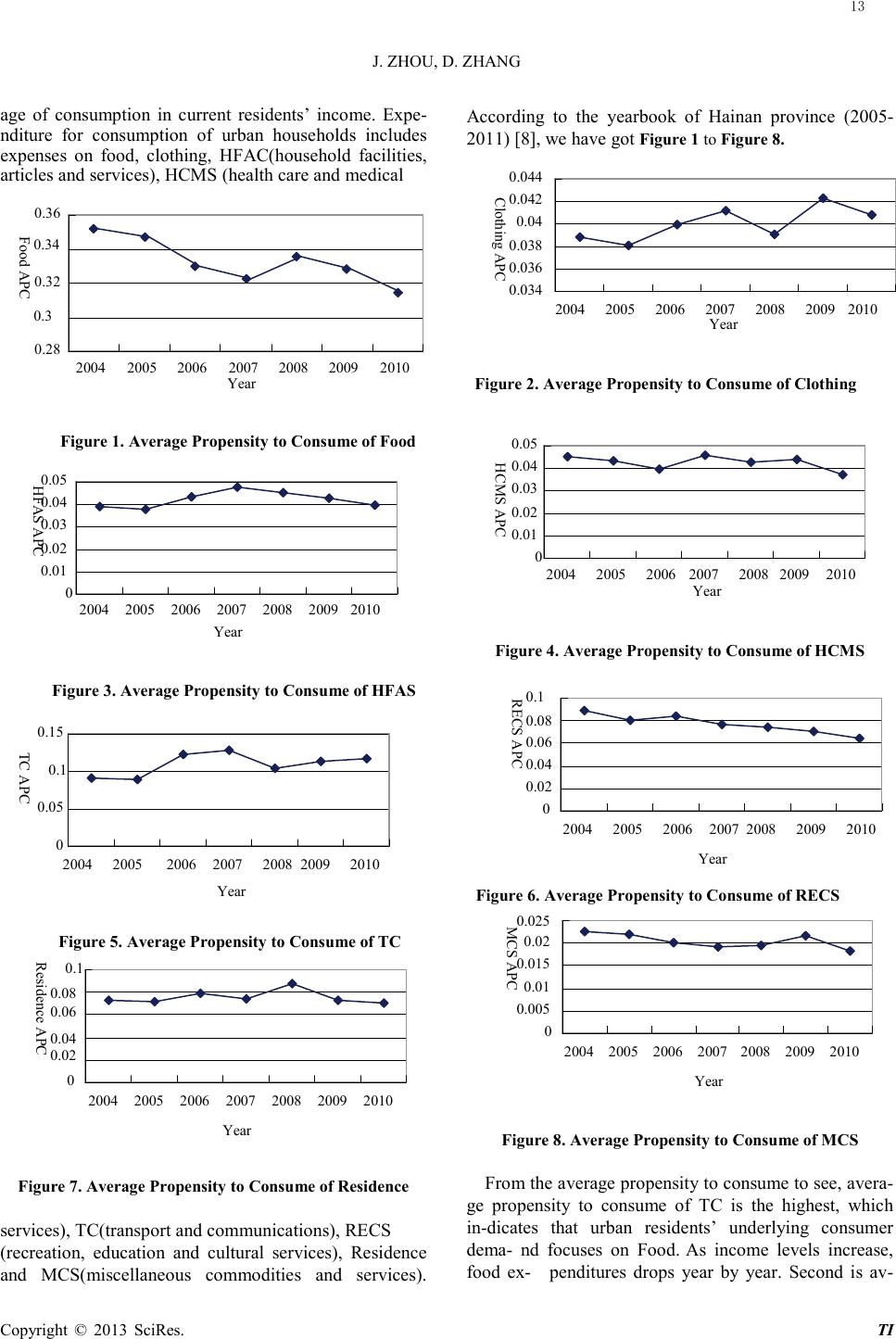

Journal Menu >>

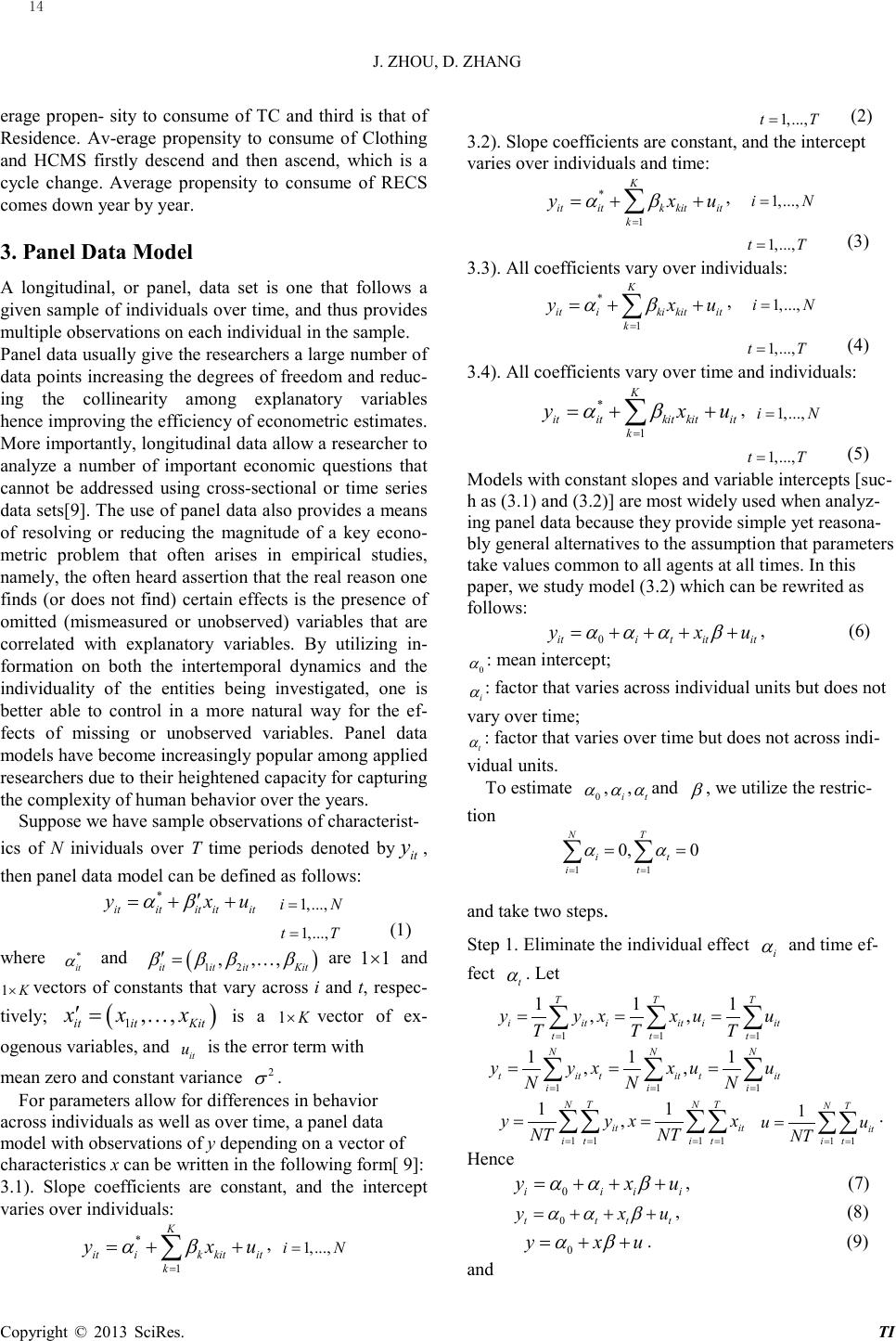

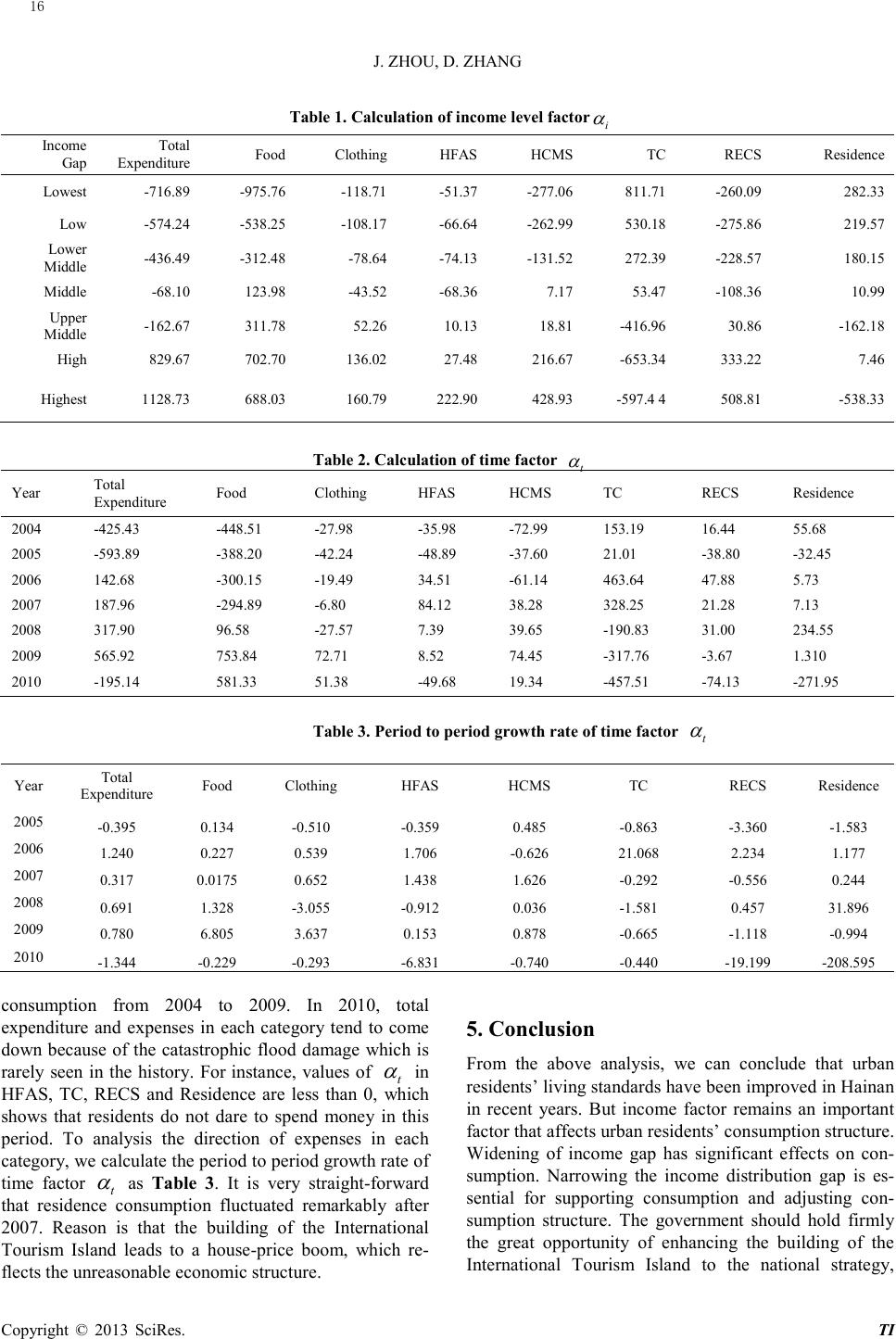

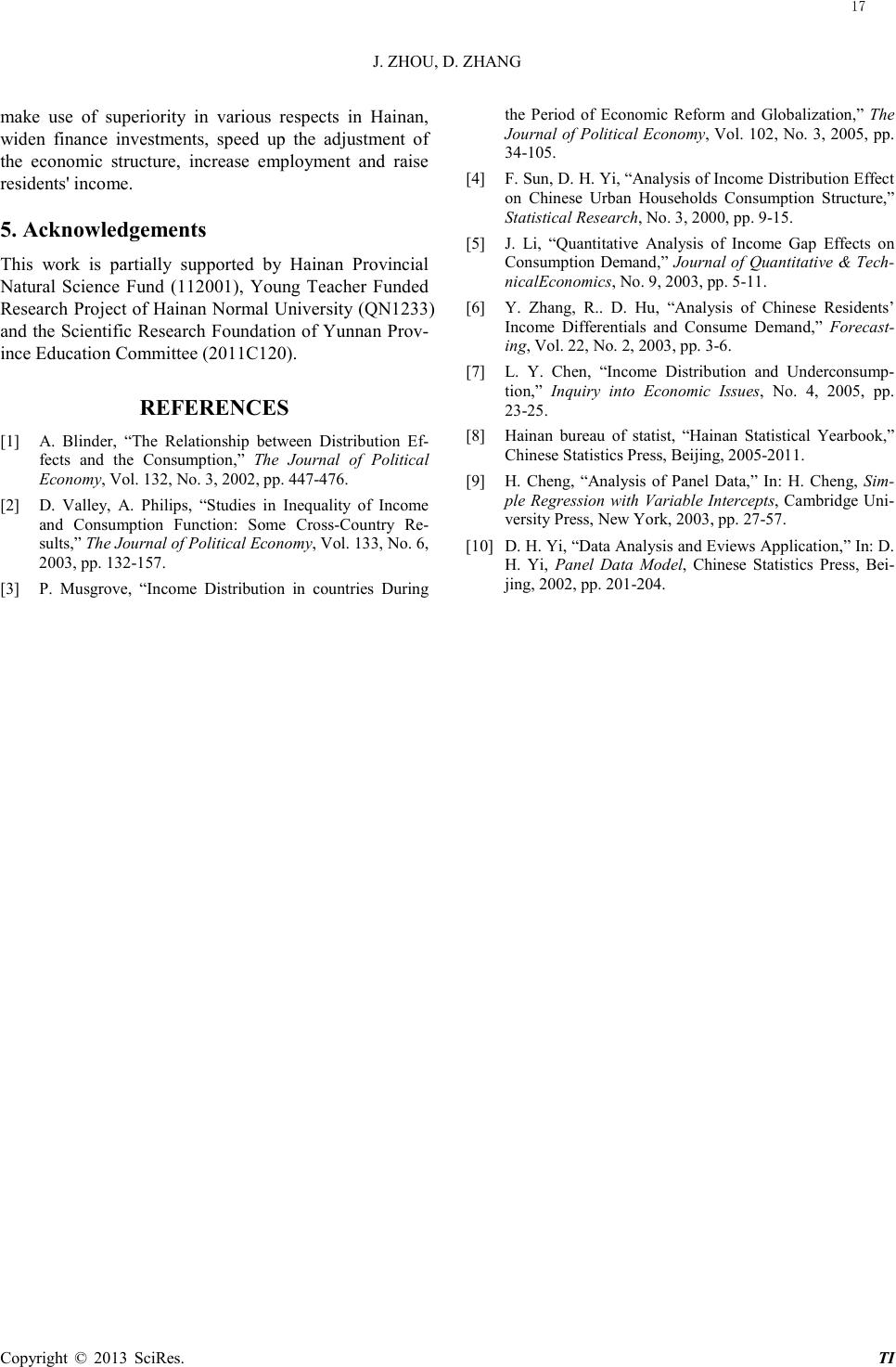

Technology and Investment, 2013, 4, 12-17 Published Online February 2013 (http://www.SciRP .org/journal/ti) Copyright © 2013 SciRes. TI A Research on the Relationship between Urban Households’ Income and Expenditure in Hainan Junmei Zhou, Defei Zhang School of Mathematics and Statistics, Hainan Normal University, Haikou, China Department of Mathematics, Honghe University, Mengzi, China Email: hnzhoujunmei@163.com, zhdefei@163.com Received 2012 ABSTRACT APC (Average Propensity to Consume) refers to the ratio of dividing consumption by income during the same period, which reflects the percentage of consumption in current residents’ income. This paper analys es the APC and builds up models about the dynamic relationships between urban residents’ income and consumption expenditure in Hainan, with panel data model, choosing per capita annual disposable income as explanatory variable, per capita living annual ex- penditure as response variable, and data from the year of 2004 to 2010. The research shows that different income levels bring different impacts on consumption, and provides theories of adjusting the consumption structure, expanding do- mest i c demand and promoting the economy development. Keywords: Panel Data Model; Income; Cons u mp t io n; Urban Resi d ent 1. Introduction With the great opportunity of enhancing the International Tourism Island to the national strategy, it is important for Hainan to promote further the policies of reform and ope ni ng -up, emphasize on the transformation of the economic development mode, speed up the adjustment of the economic structure and create a new situation in scientific development. Research on urban residents’ consumer behavior helps to know consumption informa- tion of the province, make relevant policy promoting consumption and drive the development of the economy in Hainan. Both domestic and overseas academicians made large amounts of researches about the relationship between in come gap and consumer demand. Blinder(2002): narrowing the income gap will not increase consumption [1]. Valley, Philips (2003): consumption, levels of economic development and income inequality may be of relevance [2]. Musgrove(2005): while urban income gap affects consumption markedly in high-income countries, it does not happen in low-income countries [3]. Sun Feng, Yi Danhui(2000): utilizes the panel-data model to discuss the effects which income distribution and expectation have exerted on Chinese urban households consumption structure. Results show that income level has a great influence on the spending structure of urban residents, and the difference of consumer behavior at different ranks is large[4]. Li Jun(2003): both income gap and income level are important factors that affect consumption[5]. Zhang Yi ,Hu Ridong(2003): urban residents’ yawning income gap has significant effects on inhibiting general consumption trend[6]. Chen Leyi(2005): income gap is the main reason of lack of consumer demand.The premise of inecreasing consumption demand and level is doing everying to raise income of common urban and rural residents, especially of low income households[7]. The next parts of this paper are as follows: the second part analyzes the current situation of income gap and consumer structure in Hainan, the third part introduces panel data model, the fourth part is empirical analysis and some conclusions are obtained; the fifth part is con- clusion. 2. Analysis of Current Situation In 2010, the per capita disposable income of urban households is RMB 15581 with an increase of 13.3 per- cent over the previous year in Hainan. The per capita living expenditure of urban residents is RMB 10927 with an increase of 8.3 percent. The overall level of local comsumer price indices increased by 4.8 percent over the previous year. All residence price indices of building, decoration materials, renting, water, electricity and fuel advanced noticeably, taking its gains for the year to 9.7 percent. The food price increased by 7.6 percent and re- tail price rose by 4.6 percent. APC refers to the ratio of dividing consumption by in- come during the same period, which reflects the percent-  J. ZHOU, D. Z HANG Copyright © 2013 SciRes. TI age of consumption in current residents’ income. Expe- nditure for consumption of urban households includes expenses on food, clothing, HFAC(household facilities, articles and services), HCMS (health care and medical Figure 1. Average Propensity to Consume of Food Figure 3. Average Propensity to Consume of HFAS Figure 5. Average Propensity to Consume of TC Figure 7. Average Propensity to Consume of Residence services), TC(transport and communicatio ns), RE CS (recreation, education and cultural services), Residence and MCS(miscellaneous commodities and services). According to the yearbook of Hai nan province (2005- 2011) [8], we have got Figure 1 to Fi gure 8. Figure 2. Average Propensity to Consume of Clothing Figure 4. Average Propensity to Consume of HCMS Figure 6. Average Propensity to Consume of RECS Figure 8. Average Propensity to Consume of MCS From the average propensity to consume to see, avera- ge propensity to consume of TC is the highest, which in-dicates that urban residents’ underlying consumer dema- nd focuses on Food. As income levels increase, food ex- penditures drops year by year. Second is av- 0.034 0.036 0.038 0.04 0.042 0.044 2004 2005 2006 2007 2008 2009 2010 Year Clothing APC 0 0.005 0.01 0.015 0.02 0.025 2004 2005 2006 2007 2008 2009 2010 Year MCS APC 0 0.02 0.04 0.06 0.08 0.1 2004 2005 2006 2007 2008 2009 2010 Year Residence APC 0 0.02 0.04 0.06 0.08 0.1 2004 2005 2006 2007 2008 2009 2010 Year RECS APC 0 0.01 0.02 0.03 0.04 0.05 2004 2005 2006 2007 2008 2009 2010 Year HCMS APC 0 0.01 0.02 0.03 0.04 0.05 2004 2005 2006 2007 2008 2009 Year HFAS APC 2010 0 0.05 0.1 0.15 2004 2005 2006 2007 2008 2009 2010 Year TC APC 0.28 0.3 0.32 0.34 0.36 2004 2005 2006 2007 2008 2009 2010 Food APC Year 13  J. ZHOU, D. Z HANG Copyright © 2013 SciRes. TI erage propen- sity to consume of TC and third is that of Residence. Av-erage propensity to consume of Clothing and HCMS firstly descend and then ascend, which is a cycle change. Average propensity to consume of RECS comes down year by year. 3. Panel Data Model A longitudinal, or panel, data set is one that follows a given sample of individuals over time, and thus provides multiple observations on each individual in the sample. Panel data usually give the researchers a large number of data points increasing the degrees of freedom and reduc- ing the collinearity among explanatory variables hence improving the efficiency of econometric estimates. More importantly, longitudinal data allow a researcher to analyze a number of important economic questions that cannot be addressed using cross-sectional or time series data sets[9]. The use of panel data also provides a means of resolving or reducing the magnitude of a key econo- metric problem that often arises in empirical studies, namely, the often heard assertion that the real reason one finds (or does not find) certain effects is the presence of omitted (mismeasured or unobserved) variables that are correlated with explanatory variables. By utilizing in- formation on both the intertemporal dynamics and the individuality of the entities being investigated, one is better able to control in a more natural way for the ef- fects of missing or unobserved variables. Panel data models have become increasingly popular among applied researchers due to their heightened capacity for capturing the complexity of human behavior over the years. Suppose we have sample observations of characterist- ics of N inividuals over T time periods denoted byit y, then panel data model can be defined as follows: * ititit itit y xu αβ ′ =++ 1,...,iN= 1,...,tT= (1) where * it α and ( ) 12 , ,, itit itKit β βββ ′= are 11× and 1K× vectors of constants that vary across i and t, respec- tively; ( ) 1 ,, it itKit xx x ′= is a 1K× vector of ex- ogenous variables, and it u is the error term with mean zero and constant variance 2 σ . For parameters allow for differences in behavior across individuals as well as over time, a panel data model with observations of y depending on a vector of characteristics x can be written in the following form[ 9]: 3.1). Slope coefficients are constant, and the intercept varies over individuals: * 1 K itik kitit k y xu αβ = =++ ∑ , 1,...,iN= 1,...,tT= (2) 3.2). Slope coefficients are constant, and the intercept varies over individuals and time: * 1 K ititk kitit k y xu αβ = =++ ∑ , 1,...,iN= 1,...,tT= (3) 3.3). All coefficients vary over individuals: * 1 K itiki kitit k y xu αβ = =++ ∑ , 1,...,iN= 1,...,tT= (4) 3.4). All coefficients vary over time and individuals: * 1 K ititkit kitit k y xu αβ = =++ ∑ , 1,...,iN= 1,...,tT= (5) Models with constant slopes and variable intercepts [suc- h as (3.1) and (3.2)] are most widely used when analyz- ing panel data because they provide simple yet reasona- bly general alternatives to the assumption that parameters take values common to all agents at all times. In this paper, we study model (3.2) which can be rewrited as follows: 0itit itit y xu ααα β = ++++ , (6) 0 α : mean intercept; i α : factor that varies across individual units but does not vary over time; t α : factor that varies over time but does not across indi- vidual units. To estimate 0 α , i α , t α and β , we utilize the restric- tion 11 0, 0 NT it it αα = = = = ∑∑ and take two steps. Step 1. Eliminate the individual effect i α and time ef- fect t α . Let 111 111 ,, TTT iit iit iit ttt yyxxu u TTT == = == = ∑∑∑ 111 111 ,, N NN tit tit tit iii yyxxu u NNN == = === ∑∑∑ 11 11 11 , NT NT it it it it yyx x NT NT = == = = = ∑∑ ∑∑ 11 1 NT it it uu NT = = = ∑∑ . Hence 0iii i y xu αα β = +++ , (7) 0ttt t y xu αα β = +++ , (8) 0 y xu αβ =++ . (9) and 14  J. ZHOU, D. Z HANG Copyright © 2013 SciRes. TI ( ) ( ) ititit i t it i t yyyyx xxx u uuu β − − +=−−++ −−+ . (10) Then the OLS(ordinary least squares) estimator of β is ()( ) ( ) 11 2 11 ˆ NT ititit i t it NT it i t it yy yyxx x x x xxx β = = = = −−+ −−+ = −−+ ∑∑ ∑∑ , and 0 ˆ ˆyx αβ = − . Step 2. By subtracting (9) from (7) we have ( ) ˆ i ii yy xx αβ −= +− , Then () () ˆ ˆ iii yy xx αβ = −−− . By subtracting (9) from (8) we get ( ) ˆ t tt yyxx αβ −= +− , then () () ˆ ˆtt t yy xx αβ = −−− . 4. Empirical Analysis This paper will build up panel data models between in- come gap and various consumer spending as follows: 0itititit y xu ααα β = ++++ 1,...,iN= 1,...,tT= , (11) it y: per capita consumption expenditure of residents in income group i at time t with the unit of currency RMB; it x : per capita income of residents in income group i at time t with the unit of currency RMB; i α : parameter that varies across income gap but does not vary over time; t α : parameter that varies over time but does not across income level; it u : the error term. According to the income standard, we divide urban households into seven income groups: lowest, low, lower middle, middle, upper middle, high and highest. All the statistics is from the year book of Hainan(2005-2011) and adjusted by consumer price indices by category in order to remove the effects of higher prices. Eight consu- mption models are established as follows by using the Eviews software[10]. 4.1) Total Expenditure Model ( )( )( ) 1 11 1834.67 0.582 itit it yx αα = + ++ (7.084) 4.2) Food Consumption Model ( )( )( ) 2 22 2480.70 0.101 itit it yx αα =+ ++ (4.925) 4.3) Clothing Consumption Model ( )( )( ) 3 33 139.89 0.029 ititit yx αα = +++ ( 6.558) 4.4) HFAS Consumption Model ( )( )( ) 4 44 34.58 0.040 itit it yx αα = +++ (3.446) 4.5) HCMS Consumption Model ( )( )( ) 5 55 355.62 0.014 itit it yx αα = +++ (1.85 4) 4.6 ) TC Consumption Model ( )( )( ) 6 66 1409.12 0.237 itit it yx αα =− +++ (4.985) 4.7) RECS Consumption Model ( )( )( ) 7 77 306.84 0.056 itit it yx αα = +++ (3.68 7) 4.8) Residence Consumption Model ( )( )() 8 88 246.066 0.094 itit it yx αα =−+++ (3.436) The calculation of i α is in Table 1, and t α in Table 2. From Table 1, it is clear that income level produces a great influence on the consumption structure of urban residents. In term of total e xpenditure, values of i α in high and highest income households are more than 0 while others less than 0, which shows that high-income group residents have stronger buying motives than low-income group residents. By the look of various exp- enditure category, values of i α in lowest, low and lower middle income households are less than 0, which indicates that their basic needs can not be satisfied. However, food needs in income households above middle have been satisfied. The same situation holds for HCMS expenditure. For people in lowest, low, lower middle and middle income households, values of i α related to TC and Residence expending are more than 0. In this case, their basic needs cannot be satisfied, their expenditure elasticity of luxuries is very small, their exp- enditure elasticity of luxuries is very small, compared to people in high and highest income group. According to Table 2, there were sharply increase trend s in total expenditure, food, clothing and HCMS 15  J. ZHOU, D. Z HANG Copyright © 2013 SciRes. TI Table 1. Calculation of income level factor i α Income Gap Total Expenditure Food Clothing HF AS HCMS TC RECS Residence Lowe st -716.89 -975.76 -118.71 -51.37 -277.06 811.71 -260.09 282.33 Low -574.24 -538.25 -108.17 -66.64 -262.99 530.18 -275.86 219.57 Lower Midd le -436.49 -312.48 -78.64 -74.13 -131.52 272.39 -228.57 180.15 Midd le -68.10 123.98 -43.52 -68.36 7.17 53.47 -108.36 10.99 Upper Midd le -162.67 311.78 52.26 10.13 18.81 -416.96 30. 86 -162.18 High 8 29.67 702.70 136 .02 27.48 216.67 -653.34 333.22 7.46 Highest 1128.73 688.03 160.79 222.90 428.93 -597.4 4 508.81 -538.33 Table 2. Calculation of time factor t α Year Total Expenditure Food Clothing HF AS HCMS TC RECS Residence 2004 -425.43 -448.51 -27.98 -35.98 -72.99 153.19 16.44 55.68 2005 -593.89 -388.20 -42.24 -48.89 -37.60 21.01 -38.80 -32.45 2006 142.68 -300.15 -19.49 34.51 -61.14 463.64 47.88 5.73 2007 187.96 -294.89 -6.80 84.12 38.28 328.25 21.28 7.13 2008 317.90 96.58 -27.57 7.39 39.65 -190.83 31.00 234.55 2009 565.92 753.84 72.71 8.52 74.45 -317.76 -3.67 1.310 2010 -195.14 581.33 51.38 -49.68 19.34 -457.51 -74.13 -271.95 Table 3. Period to period growth rate of time factor t α Year Total Expenditure Food Clothing HFAS HCMS TC RECS Residence 2005 -0.395 0.134 -0.510 -0.359 0.485 -0.863 -3.360 -1.583 2006 1.240 0.227 0.539 1.706 -0.626 21.068 2.234 1.177 2007 0.317 0.0175 0.652 1.438 1.626 -0.292 -0.556 0.244 2008 0.691 1.328 -3.055 -0.912 0.036 -1.581 0.457 31.896 2009 0.780 6.805 3.637 0.153 0.878 -0.665 -1.118 -0.994 2010 -1.344 -0.229 -0.293 -6.831 -0.740 -0.440 -19.199 -208.595 consumption from 2004 to 2009. In 2010, total expenditure and expenses in each category tend to come down because of the catastrophic flood damage which is rarely seen in the history. For instance, values of t α in HFAS, TC, RECS and Residence are less than 0, which shows that residents do not dare to spend money in this period. To analysis the direction of expenses in each category, we calculate the period to period growth rate of time factor t α as Table 3. It is very straight-forward that residence consumption fluctuated remarkably after 2007. Reason is that the building of the International Tourism Island leads to a house-price boom, which re- flects the unreasonable economic structure. 5. Conclusion From the above analysis, we can conclude that urban residents’ living standards have been improved in Hainan in recent years. But income factor remains an important factor that affects urban residents’ consumption structure. Widening of income gap has significant effects on con- sumption. Narrowing the income distribution gap is es- sential for supporting consumption and adjusting con- sumption structure. The government should hold firmly the great opportunity of enhancing the building of the International Tourism Island to the national strategy, 16  J. ZHOU, D. Z HANG Copyright © 2013 SciRes. TI make use of superiority in various respects in Hainan, widen finance investments, speed up the adjustment of the economic structure, increase employment and raise residents' income. 5. Acknowledgements This work is partially supported by Hainan Provincial Natural Science Fund (112001), Young Teacher Funded Research Project of Hainan Normal University (QN1233) and the Scientific Research Foundation of Yunnan Prov- ince Education Committee (2011C120). REFERENCES [1] A. Blinder, “The Relationship between Distribution Ef- fects and the Consumption,” The Journal of Political Economy, Vol. 132, No. 3, 2002, pp. 447-476. [2] D. Valley, A. Philips, “Studies in Inequality of Income and Consumption Function: Some Cross-Country Re- sults,” The Journal of Political Economy, Vol. 133, No. 6, 2003, pp. 132-157. [3] P. Musgrove, “Income Distribution in countries During the Period of Economic Reform and Globalization,” The Journal of Political Economy, Vol. 102, No. 3, 2005, pp. 34-105. [4] F. Sun, D. H. Yi, “Analysis of Income Distribution Effect on Chinese Urban Households Consumption Structure,” Statistical Research, No. 3, 2000, pp. 9-15. [5] J. Li, “Quantitative Analysis of Income Gap Effects on Consumption Demand,” Journal of Quantitative & Tech- nicalEconomics, No. 9, 2003, pp. 5-11. [6] Y. Zhang, R.. D. Hu, “Analysis of Chinese Residents’ Income Differentials and Consume Demand,” Forecast- ing, Vol. 22, No. 2, 2003, pp. 3-6. [7] L. Y. Chen, “Income Distribution and Underconsump- tion,” Inquiry into Economic Issues, No. 4, 2005, pp. 23-25. [8] Hainan bureau of statist, “Hainan Statistical Yearbook,” Chinese Statistics Press, Beijing, 2005-2011. [9] H. Cheng, “Analysis of Panel Data,” In: H. Cheng, Sim- ple Regression with Variable Intercepts, Cambridge Uni- versity Press, New York, 2003, pp. 27-57. [10] D. H. Yi, “Data Analysis and Eviews Application,” In: D. H. Yi, Panel Data Model, Chinese Statistics Press, Bei- jing, 2002, pp. 201-204. 17 |