J. DOGBEY

Copyright © 2012 SciRes. TEL

560

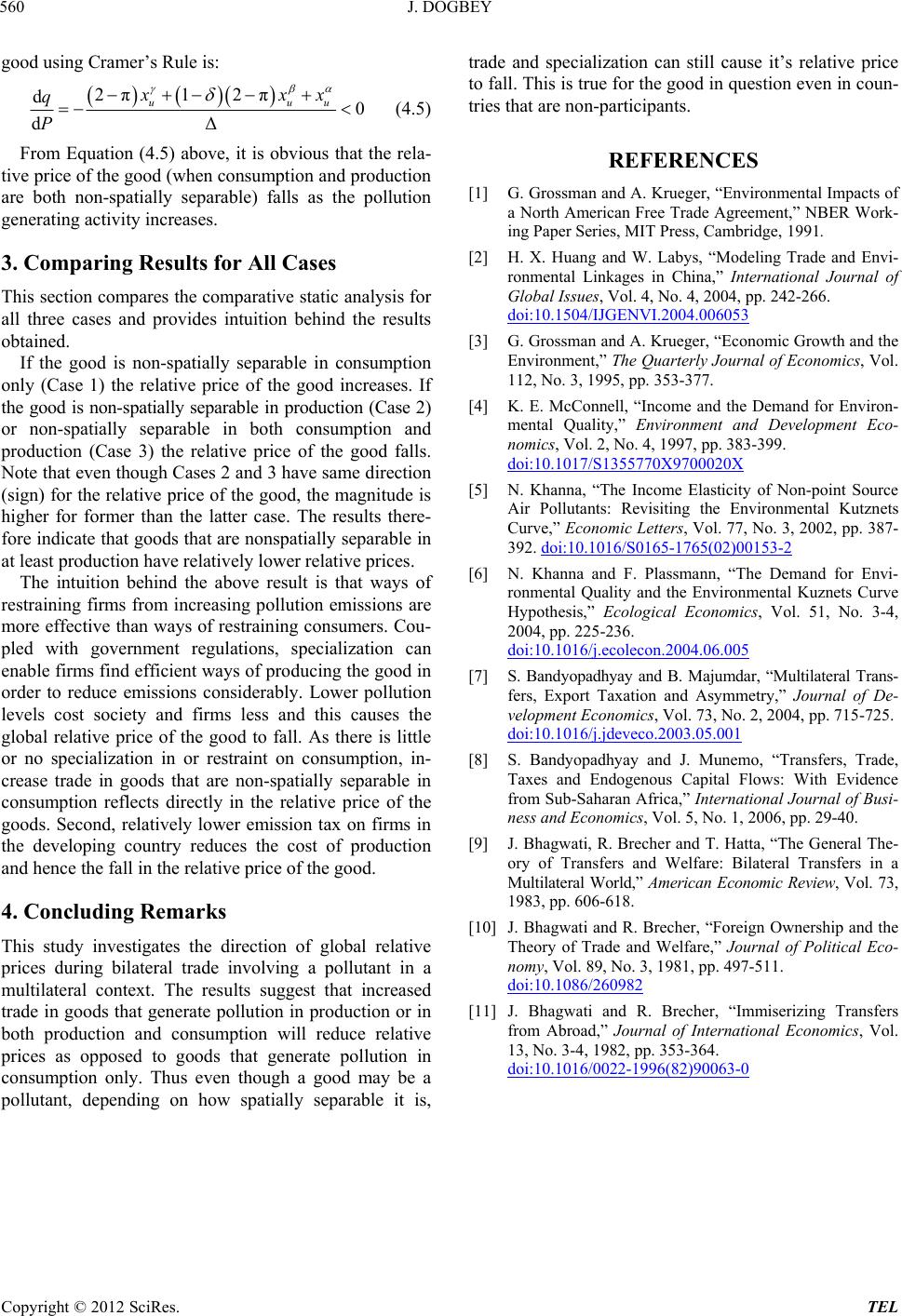

good using Cramer’s Rule is:

2π12π

d0

dΔ

uu

xx

q

P

u

x

(4.5)

From Equation (4.5) above, it is obvious that the rela-

tive price of the good (when consumption and production

are both non-spatially separable) falls as the pollution

generating activity increases.

3. Comparing Results for All Cases

This section compares the comparative static analysis for

all three cases and provides intuition behind the results

obtained.

If the good is non-spatially separable in consumption

only (Case 1) the relative price of the good increases. If

the good is non-spatially separable in production (Case 2)

or non-spatially separable in both consumption and

production (Case 3) the relative price of the good falls.

Note that even though Cases 2 and 3 have same direction

(sign) for the relative price of the good, the magnitude is

higher for former than the latter case. The results there-

fore indicate that goods that are nonspatially separable in

at least production have relatively lower relative prices.

The intuition behind the above result is that ways of

restraining firms from increasing pollution emissions are

more effective than ways of restraining consumers. Cou-

pled with government regulations, specialization can

enable firms find efficient ways of producing the good in

order to reduce emissions considerably. Lower pollution

levels cost society and firms less and this causes the

global relative price of the good to fall. As there is little

or no specialization in or restraint on consumption, in-

crease trade in goods that are non-spatially separable in

consumption reflects directly in the relative price of the

goods. Second, relatively lower emission tax on firms in

the developing country reduces the cost of production

and hence the fall in the relative price of the good.

4. Concluding Remarks

This study investigates the direction of global relative

prices during bilateral trade involving a pollutant in a

multilateral context. The results suggest that increased

trade in goods that generate pollution in production or in

both production and consumption will reduce relative

prices as opposed to goods that generate pollution in

consumption only. Thus even though a good may be a

pollutant, depending on how spatially separable it is,

trade and specialization can still cause it’s relative price

to fall. This is true for the good in question even in coun-

tries that are non-participants.

REFERENCES

[1] G. Grossman and A. Krueger, “Environmental Impacts of

a North American Free Trade Agreement,” NBER Work-

ing Paper Series, MIT Press, Cambridge, 1991.

[2] H. X. Huang and W. Labys, “Modeling Trade and Envi-

ronmental Linkages in China,” International Journal of

Global Issues, Vol. 4, No. 4, 2004, pp. 242-266.

doi:10.1504/IJGENVI.2004.006053

[3] G. Grossman and A. Krueger, “Economic Growth and the

Environment,” The Quarterly Journal of Economics, Vol.

112, No. 3, 1995, pp. 353-377.

[4] K. E. McConnell, “Income and the Demand for Environ-

mental Quality,” Environment and Development Eco-

nomics, Vol. 2, No. 4, 1997, pp. 383-399.

doi:10.1017/S1355770X9700020X

[5] N. Khanna, “The Income Elasticity of Non-point Source

Air Pollutants: Revisiting the Environmental Kutznets

Curve,” Economic Letters, Vol. 77, No. 3, 2002, pp. 387-

392. doi:10.1016/S0165-1765(02)00153-2

[6] N. Khanna and F. Plassmann, “The Demand for Envi-

ronmental Quality and the Environmental Kuznets Curve

Hypothesis,” Ecological Economics, Vol. 51, No. 3-4,

2004, pp. 225-236.

doi:10.1016/j.ecolecon.2004.06.005

[7] S. Bandyopadhyay and B. Majumdar, “Multilateral Trans-

fers, Export Taxation and Asymmetry,” Journal of De-

velopment Economics, Vol. 73, No. 2, 2004, pp. 715-725.

doi:10.1016/j.jdeveco.2003.05.001

[8] S. Bandyopadhyay and J. Munemo, “Transfers, Trade,

Taxes and Endogenous Capital Flows: With Evidence

from Sub-Saharan Africa,” International Journal of Busi-

ness and Economics, Vol. 5, No. 1, 2006, pp. 29-40.

[9] J. Bhagwati, R. Brecher and T. Hatta, “The General The-

ory of Transfers and Welfare: Bilateral Transfers in a

Multilateral World,” American Economic Review, Vol. 73,

1983, pp. 606-618.

[10] J. Bhagwati and R. Brecher, “Foreign Ownership and the

Theory of Trade and Welfare,” Journal of Political Eco-

nomy, Vol. 89, No. 3, 1981, pp. 497-511.

doi:10.1086/260982

[11] J. Bhagwati and R. Brecher, “Immiserizing Transfers

from Abroad,” Journal of International Economics, Vol.

13, No. 3-4, 1982, pp. 353-364.

doi:10.1016/0022-1996(82)90063-0