M. OTAKI

416

s

,

my

in to

two exogenous variable. Thus, the model is

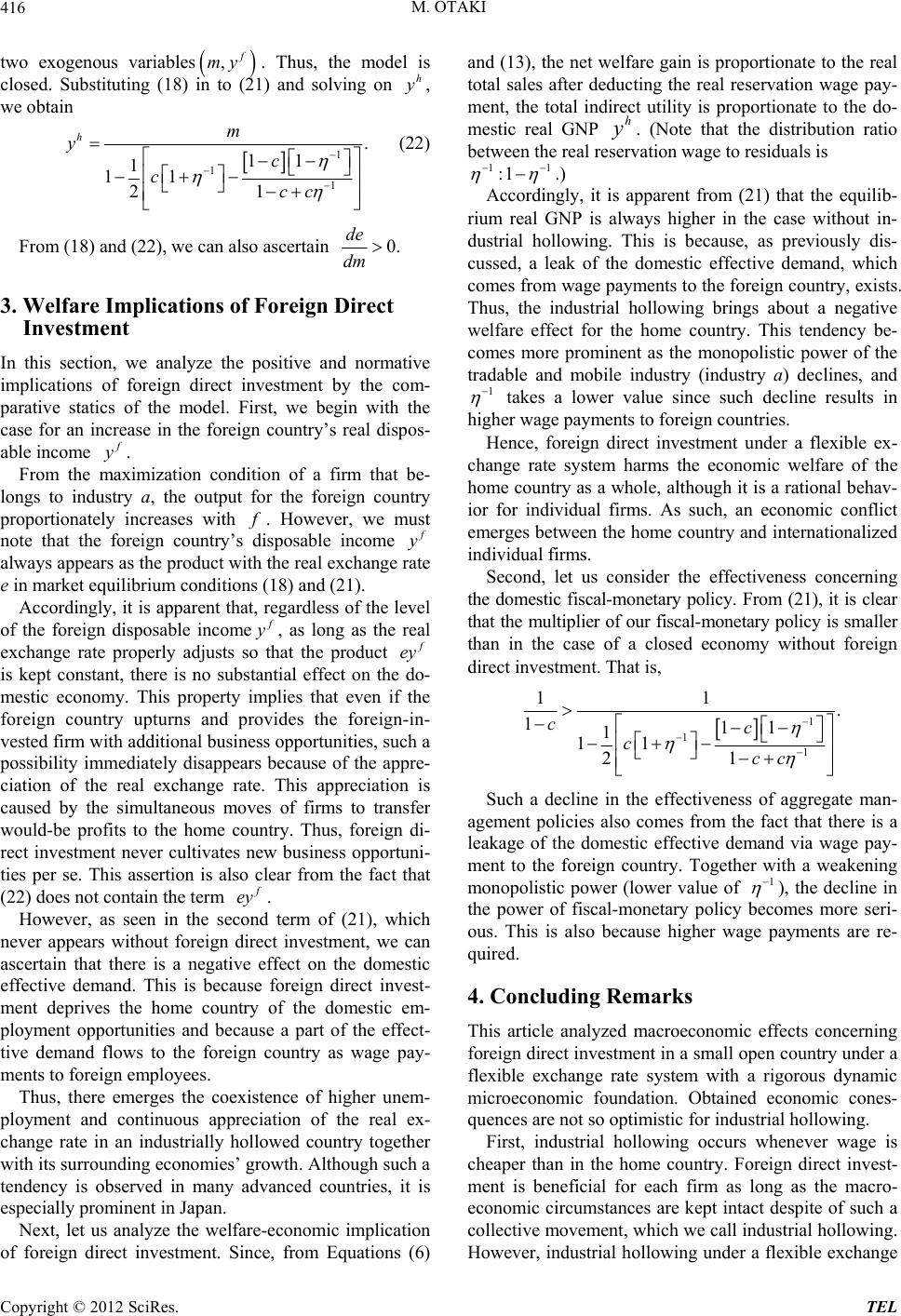

closed. Substituting (18) (21) and solving on h

,

we obtain

1

1

m

1

11

21

ccc

From (18) and (22), we can also ascertain

.

11

1

h

yc

( 22)

0.

de

dm

ative

-

with the

pos-

3. Welfare Implicatoreign Dir

Investment

In this section, we analypositive and norm

implications of foreign ent by the com

pa in

case for a dis

able income

ions of F

ze the

direct investm

ect

rative statics of the model. First, we beg

n increase in the foreign country’s real

.

lon he r the foreign co

From the maximization condition of a firm that

gs to industry a, t

be-

untryoutput fo

proportionately increases with

. However, we must

note that the foreign country’s disposable income

always appears as the product with the real exchange rate

e in market equilibrium conditions (18) and (21).

Accordingly, it is apparent that, regardless of the level

of the foreign disposable income

, as long as the real

exchange rate properly adjusts so that the product

ey

is kept constant, there is no substantial effect on the do-

mestic economy. This property implies that even if the

foreign country upturns and provides the foreign-in-

vested firm with additional business opportunities, such a

possibility immediately disappears because of the appre-

ciation of the real exchange rate. This appreciation is

caused by the simultaneous moves of firms to transfer

would-be profits to the home country. Thus, foreign di-

rect investment never cultivates new business opportuni-

ties per se. This assertion is also clear from the fact that

(22) does not contain the term

ey .

However, as seen in the second term of (21), which

never appears without foreign direct investment, we can

ascertain that there is a negative effect on the domestic

effective demand. This is because foreign direct invest-

ment deprives the home country of the domestic em-

ployment opportunities and because a part of the effect-

tive demand flows to the foreicountry as wage pay-

me

gn

nts to foreign employees.

Thus, there emerges the coexistence of higher unem-

ployment and continuous appreciation of the real ex-

change rate in an industrially hollowed country together

with its surrounding economies’ growth. Although such a

tendency is observed in many advanced countries, it is

especially prominent in Japan.

Next, let us analyze the welfare-economic implication

of foreign direct investment. Since, from Equations (6)

and (13), the net welfare gain is proportionate to the real

total sales after deducting the real reservation wage pay-

ment, the total indirect utility is proportionate to the do-

mestic real GNP h

. (Note that the distribution ratio

between the real reservation wage to residuals is

11

:1

.)

Accordingly, it is apparent from (21) that the equilib-

rium real GNP is always higher in the case without in-

dustrial hollowing. This is because, as previously dis-

cussed, a leak of the domestic effective demand, which

comes from wage payments to the foreign country, exists.

Thus, the industriaollowing brings about a negative

welfare effect for the home country. This tendency

l h

be-

comes more prominent as the monopolistic power of the

tradable and mobile industry (industry a) declines, and

1

takes a lower value since such decline results in

higher wage payments to foreign countries.

Hence, foreign direct investment under a flexible ex-

change rate system harms the economic welfare of the

home country as a whole, although it is a rational behav-

ior for individual firms. As such, an economic conflict

emerges between the home country and internationalized

individual firms.

econd, let us consider the effectiveness concerning

the domestic fiscal-monetary policy. From (21

S

), it is clear

that the multiplier of our fiscal-monetary policy is smaller

than in the case of a closed economy without foreign

direct investment. That is,

1

11

.

1c

1

1

11

21

ccc

11

1c

Such a decline in the effectiveness of aggregate man-

agement policies also comes from the fact that there is a

leakage of the domestic eff

ective demand via wage pay-

ment to the foreign country. Together with a weakening

monopolistic power (lower value of 1

beco

), the decline in

the power of fiscal-monetary policymes more seri-

ous. This is also because higher wage payments are re-

quired.

industrial hollowing occurs whenever wage is

try. Foreign direct invest-

m as long as the macro-

However, industrial hollowing under a flexible exchange

4. Concluding Remarks

This article analyzed macroeconomic effects concerning

foreign direct investment in a small open country under a

flexible exchange rate system with a rigorous dynamic

microeconomic foundation. Obtained economic cones-

quences are not so optimistic for industrial hollowing.

First,

cheaper than in the home coun

ment is beneficial for each fir

economic circumstances are kept intact despite of such a

collective movement, which we call industrial hollowing.

Copyright © 2012 SciRes. TEL