K. HASHIMOTO

Copyright © 2012 SciRes. TEL

394

[2] R. Crinò, “Offshoring, Multinationals and Labour Market:

A Review of the Empirical Literature,” Journal of Eco-

nomic Surveys, Vol. 23, No. 2, 2009, pp. 197-249.

doi:10.1111/j.1467-6419.2008.00561.x

0dgd

1as

0dg d

0dg d

[3] B. Ito, E. Tomiura and R. Wakasugi, “Dissecting Off-

shore Outsourcing and R & D: A Survey of Japanese Ma-

nufacturing Firms,” Discussion Paper 07-E-060, Research

Institute of Economy, Trade, and Industry, 2007.

[4] A. J. Glass and K. Saggi, “Innovation and Wage Effects

of International Outsourcing,” European Economic Re-

view, Vol. 45, No. 1, 2001, pp. 67-86.

doi:10.1016/S0014-2921(99)00011-2

[5] R. C. Feenstra and G. H. Hanson, “Foreign Investment,

Outsourcing and Relative Wages,” In: R. C. Feenstra, G.

M. Grossman and D. A. Irwin, Eds., The Political Econ-

omy of Trade Policy: Papers in Honor of Jagdish Bhag-

wait, MIT Press, Cambridge, 1996, pp. 89-127.

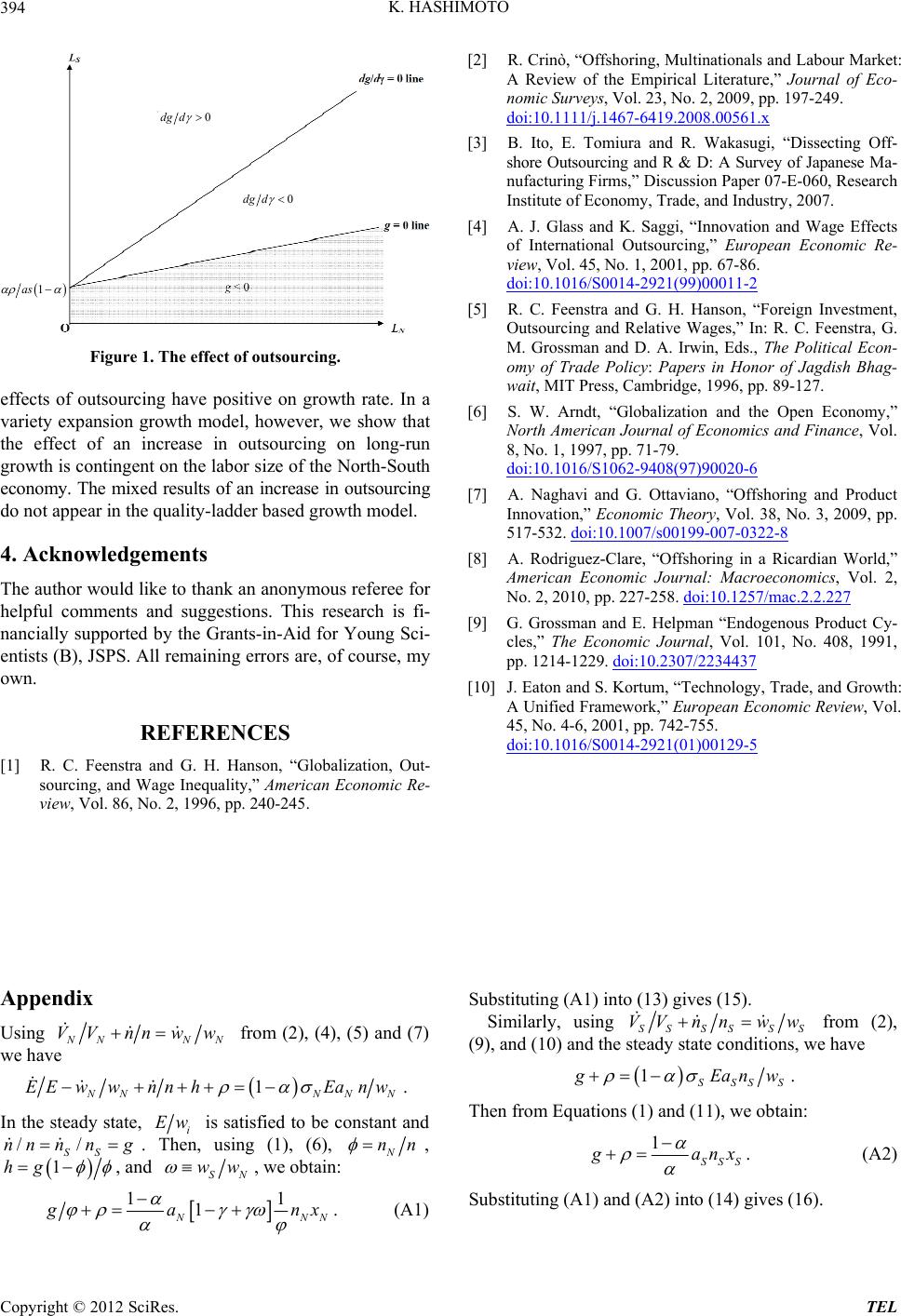

Figure 1. The effect of outsourcing.

ffects of outsourcing have positive on growth rate.

4. Acknowledgements

k an anonymous referee for

REFERENCES

[1] R. C. Feenstrlobalization, Out-

eIn a [6] S. W. Arndt, “Globalization and the Open Economy,”

North American Journal of Economics and Finance, Vol.

8, No. 1, 1997, pp. 71-79.

doi:10.1016/S1062-9408(97)90020-6

variety expansion growth model, however, we show that

the effect of an increase in outsourcing on long-run

growth is contingent on the labor size of the North-South

economy. The mixed results of an increase in outsourcing

do not appear in the quality-ladder based growth model. [7] A. Naghavi and G. Ottaviano, “Offshoring and Product

Innovation,” Economic Theory, Vol. 38, No. 3, 2009, pp.

517-532. doi:10.1007/s00199-007-0322-8

[8] A. Rodriguez-Clare, “Offshoring in a Ricardian World,”

American Economic Journal: Macroeconomics, Vol. 2,

No. 2, 2010, pp. 227-258. doi:10.1257/mac.2.2.227

The author would like to than

helpful comments and suggestions. This research is fi-

nancially supported by the Grants-in-Aid for Young Sci-

entists (B), JSPS. All remaining errors are, of course, my

own.

[9] G. Grossman and E. Helpman “Endogenous Product Cy-

cles,” The Economic Journal, Vol. 101, No. 408, 1991,

pp. 1214-1229. doi:10.2307/2234437

[10] J. Eaton and S. Kortum, “Technology, Trade, and Growth:

A Unified Framework,” European Economic Review, Vol.

45, No. 4-6, 2001, pp. 742-755.

doi:10.1016/S0014-2921(01)00129-5

a and G. H. Hanson, “G

sourcing, and Wage Inequality,” American Economic Re-

view, Vol. 86, No. 2, 1996, pp. 240-245.

Appendix

Using

NNN

nnww

from (2), (4), (5) and (7)

e

VV

we hav

1

NNNN

wwnnhEanw

.

In the steady state,

EE

i

Ew is satisfied to be constant

en

and

//

SS

nn nng

. Th, using (1), (6), N

nn

,

1hg

, and SN

ww

, we obtain:

11

1

NN

an

(A1)

Substituting (A1) into (13) gives (15).

x

.

SS SS

VV nnw

Similarly, using S S

w from (2),

(9tate conditions, w), and (10) and the steady se have

1SSSS

Ea nw

.

Then from Equations (1) and (11), we obtain:

1

SSS

anx

.

(A2)

Substituting (A1) and (A2) into (14) gives (16).