Theoretical Economics Letters, 2012, 2, 355-360 http://dx.doi.org/10.4236/tel.2012.24065 Published Online October 2012 (http://www.SciRP.org/journal/tel) Strategic Delegation in Price Competition Werner Güth1, Kerstin Pull2, Manfred Stadler2 1Max Planck Institute of Economics, Strategic Interaction Group, Jena, Germany 2Department of Business and Economics, University of Tübingen, Tübingen, Germany Email: gueth@econ.mpg.de, kerstin.pull@uni-tuebingen.de, manfred.stadler@uni-tuebingen.de Received July 6, 2012; revised August 1, 2012; accepted September 3, 2012 ABSTRACT We study price competition in heterogeneous markets where price decisions are delegated to agents. Principals imple- ment a revenue sharing scheme to which agents react by commonly charging a sales price. The results of our model exemplify the importance of both intra- and interfirm interactions of principals and agents in competition. We show that price delegation can increase or decrease the firms’ surplus depending on the heterogeneity of the market and the num- ber of agents employed by the firms. Keywords: Strategic Delegation; Agency Theory; Revenue Sharing 1. Introduction Whereas principal-agent theory typically restricts itself to the analysis of intrafirm interaction by neglecting inter- firm competition, most models in the theory of Industrial Organization (IO) focus purely on interfirm competition by assuming a unitary decision maker for each of the competing firms. While studying only one of these two interaction types certainly answers many questions, in some cases it may suggest questionable implications for real-world behavior facing typically both types of in- teraction. For instance, a standard principal-agent frame- work (see e.g. Grossman and Hart [1]) neglects interfirm competition and, hence, the influence of market con- ditions on intrafirm compensation schemes. Similarly, assuming a unitary decision maker in IO models of in- terfirm competition ignores the principal-agent relation- ships and thus the decisive reason why firms may abstain from profit maximization. Of course, principals may be the only ones determining both, intrafirm and interfirm interactions. If principals, for instance, confront their agents with piece rates, all what agents have to do is match their efforts with the given piece rates, i.e., agents neither interact strategically with other agents of the same nor with those working in other firms. Thus if only principals are involved in intrafirm and interfirm interaction, the analysis is rather simple and straightforward. Here we focus, however, on situations where not only principals are “running the mill”: in our model principals only determine the in- centives for their agents who then choose their firm’s sales policy. Hence, in this scenario, principals as well as agents are engaged in interfirm competition. Our analysis is related to the strategic delegation analysis of Vickers [2], Fershtman [3], Fershtman and Judd [4], Sklivas [5], Caillaud, Jullien, and Picard [6] and Schmidt [7] who study intrafirm incentives for managers facing a market with interfirm quantity or price competition. In these delegation games, the profit-maximizing principals (the owners) implement an incentive scheme for their agents (the managers) based on a weighted difference of revenue and cost. Fumas [8] and Miller and Pazgal [9] consider an incentive scheme based on a weighted sum of a firm’s own profit and its rival’s profit. Kräkel [10] investigates tournament-like interfirm competition based on a principal-(one) agent framework. These models have in common that they restrict analysis to the dele- gation to manager agents who decide on prices or quan- tities but are not involved in production, i.e. they face no cost of producing. In contrast we are interested in the decisions of worker agents who will anticipate the con- sequences of their price or quantity decisions on their ef- fort. Güth, Pull and Stadler [11] have studied intrafirm and interfirm interaction between principals and agents in an integrative model. They analyzed how revenue sharing affects the behavior and payoffs on a homogeneous oligopoly market with quantity competition1. On most markets firms, however, compete in prices. Therefore, we explore the case where principals implement a re- venue sharing scheme and agents compete via prices. The price decisions of all competing firms in the market determine the quantities to be produced by firms and, 1Quantity competition can be justified by the necessity of firms to set up capacities before engaging in price competition (see e.g. Kreps and Scheinkman [12]). C opyright © 2012 SciRes. TEL  W. GÜTH ET AL. 356 hence, the effort costs of their agents. The remainder of this paper is structured as follows: Section 2 describes a benchmark case with price com- petition between two monolithic firms. Section 3 introduces delegation and price competition by workers allowing for an integrative analysis of strategic intra- and interfirm in- teraction based on the realistic assumptions of price com- petition. Section 4 concludes. 2. The Benchmark: Price Competition between Two Monolithic Firms We consider two competing firms in a heteroge- neous market with firm specific sales amounting to =1,2i , =;= 1,2,= 1,...,, iik k qei k n , where ki denotes the effort level of agent em- ployed in firm . Sales are assumed to serve demand for differentiated products. To keep the model analytically tractable, we rely on linear demand functions of the standardized form e,k i ,=1 ;=1,2, iijij i qpppppii j for the two substitute goods with restrictions where >0,= 1,2, i qi 10, indicates the degree of market heterogeneity. In the limit case =0 there are two coexisting monopoly markets without interfirm competition. In the other extreme case where the market becomes homogeneous since, in the limit, any price difference will not leave (positive) demand for the more expensive seller. Costs of the agents’ sales efforts are private and commonly known. All agents share the same quadratic effort-cost function 2 ,, =2 ik ik cee . n To provide a benchmark solution without intrafirm in- teraction let us first assume that both firms maximize their surplus for example by assuming a unitary decision maker for each firm who dictates effort levels and mone- tarily compensates his agents for their effort costs. Due to the strictly convex cost function, each firm i will impose the same effort level , for all workers . Thus the surplus for each firm can be ex- pressed by n = ik i ee =1, ,k 2 ,=11 112;=1,2,. iij iij ij Spppp p pp nii j From the first-order conditions the equilibrium prices are derived as *1 =, 12 n pn leading to each firm’s output *1 =12 n qn and surplus * 2 112 =. 21 2 nn Sn Some numerical results are summarized in Table 1 for a fixed number of agents per firm and in Table 2 for a fixed intermediate degree of heterogeneity, =2n =1 . A decreasing degree of heterogeneity (an increasing ) lowers equilibrium prices and the firms’ surplus even if agents’ individual efforts and sales increase (see Table 1). For a given degree of heterogeneity (=1 ) all out- come variables react monotonically to an increase of the same number of employees in both firms. Prices de- cline and agents’ individual efforts converge to 0 whereas sales and surplus levels increase monotonically (see Table 2). n Rather than assuming that all members (principal and agents) of each firm are interested in maximizing the firm’s surplus or that only one type of actor (the principal) essentially “runs the mill”, we now include vertical and horizontal interaction by analyzing strategic delegation of price decisions. 3. Strategic Delegation of Price Decisions For the integrative analysis of intrafirm and interfirm interaction, we assume that principals share revenues with their agents. Let i denote the revenue share for all the agents of firm as a whole. Agents are assumed s i Table 1. Numerical solution of the price-competition game with monolithic firms, n = 2. 0 1 ... * 0.600 0.500 ... 0.333 * q 0.400 0.500 ... 0.666 * e 0.200 0.250 ... 0.333 * S 0.200 0.188 ... 0.111 Table 2. Numerical solution of the price-competition game with monolithic firms, =1. n 1 2 3 ... 100 ...n * 0.6000.5000.455 ... 0.338 ...0.333 * q0.4000.5000.555 ... 0.662 ...0.667 * e0.4000.2500.185 ... 0.007 ...0.000 * S0.1600.1880.198 ... 0.221 ...0.222 Copyright © 2012 SciRes. TEL  W. GÜTH ET AL. Copyright © 2012 SciRes. TEL 357 to be identical and to distribute their overall revenue share iii pq proportionally to each agent’s individual contribution ,ik i eq . Agents can observe and control the efforts of the team members. This means that each in- dividual agent in firm chooses the same effort , for all workers and realizes the net utility =1,2i =1,k = ik ei e, delegation game can be solved analogously to the quan- tity-delegation game. Indeed, in the standard principal- agent scenario where and =1n=0 the results for our price-delegation game coincide with those of the quantity-delegation game (Güth, Pull and Stadler [11, p. 372]). n 2 22 ,, =2 =11 112, iii jiiii iii j ij Usppspe e sppp n pp n 3.1. The Delegation Game with a Variable Degree of Market Heterogeneity To study the influence of market heterogeneity on the compensation scheme, we first restrict our analysis to the case of agents in each firm and neglect fixed compensation payments which would leave the strategic decisions as well as the firms’ surplus unchanged. Maxi- mization of agent utility =2n where is the price decision made by the agents of firm , given the rival firm’s price i p =1,2i, j pi j . The analysis of this delegated price competition complements our former analysis of delegated quantity competition (Güth, Pull and Stadler [5]). Both scenarios have in common that agents anticipate the effects of their sales choice (price or quantity) and principals anticipate these decisions when implementing the revenue sharing scheme. Thus, from a technical point of view, the price- 2 ,, =112 118 iii jiiij ij Uspp spp p pp with respect to the price yields the equilibrium prices choices i p 2 222 12 121122123423 (, )=12 121(24)4483 ij iij ij ij ij ss pss ss ss s j (1) for , as functions depending on the com- pensation schemes, i.e. on the strategic variables =1,2,ii , ij s chosen by the two principals. These prices imply the out- put levels 22 222 21 214253 (, )=, 12 121(24)4483 iij ii j ij ij sss qss sss the individual effort levels = ii eq2, and the principals’ profits π,=1= ,=1,2, iiji ii, sspqNDii 22 2 2 =1212124 4483. ij ij Ds ss s j where 2 22 =2(1) (12)(1)2(1)(12 ) 2(1)(23)4(23) [(12)(1)2(253)] ii ij ii Ns j s ss ss The first-order conditions for maximizing π, iij s with respect to , and the obvious symmetry of the solution lead to a sixth-order polynomial equation whose solution is ,=1,2 i si =;=20,n ** s ** ** ss s 1. The equilibrium revenue shares imply the iden- tical prices and 2**** ** 22** (12)(1 )2(1 )(35)4(23) =, (12)(1 )4(1 )(24)4(483) ss pss 2 2**2 output levels 2**2 **2 ** 22** 2**2 21(132)4253 =, 12 141244483 ss qss and effort levels 2** 2**2 ** 22**2*2 11322253 =. 12 141244483 ss e s  W. GÜTH ET AL. 358 Finally, principals' profits are ****** ** π=1 pq. Due to the nonlinearity of the reaction functions the game can in general be solved only by using numerical techniques. An exception is the case of monopoly, i.e. the market structure characterized by two independent markets due to =0 2. In this case agents’ price decisions (1) sim- plify to 12 4812 =14 14 16 ijiji ii i ij ij ssss = ps ss ss and imply the output levels 2 =. 14 i ii i qs Hence, the principals’ profits are 2 2 21 2 π=. 14 iii i i ss ss The symmetric first-order conditions from maximizing the profits with respect to lead to the cubic equation i s 32 8621=0 iii sss , which has the unique real solution ** =0;=2 =14sn . Given this revenue-sharing rule the agents charge the prices **=34p implying output levels ** =1 4q and effort levels ** =18e such that the principals realize the profits ** π=9 64, agents the utility ** =164U, and the firm as a whole the surplus ** =11 64S. Numerical solutions (****** ******** ,,,,π,, pqe US =0 ) for a varying degree of heterogeneity are presented in Table 3. As can be seen, a decreasing degree of heterogeneity induces principals to offer higher revenue shares to their agents. Higher revenue shares imply higher sales efforts by the agents corresponding to lower prices. In the case of two separate markets agents charge the highest prices. Starting from that benchmark case declining prices result from declining heterogeneity Table 3. Numerical solution of the price-delegation game, n = 2. 0 1 ... ** 0.250 0.298 ... 0.366 ** 0.750 0.685 ... 0.577 ** q 0.250 0.315 ... 0.423 ** e 0.125 0.157 ... 0.211 ** π 0.141 0.151 ... 0.155 ** U 0.016 0.020 ... 0.022 ** S 0.172 0.190 ... 0.200 (larger ) thereby increasing the revenues to be shared between principals and agents. The revenue effect domi- nates leading to (slightly) higher profits as a result of a lower market heterogeneity. Agents’ utility and, hence, the firms’ surplus also increase. Compared to the benchmark solution (Table 1) of Sec- tion 2, which neglects intrafirm conflicts, delegation leads to higher prices and lower efforts of agents throughout. The surplus in the delegation game is higher if markets are homogeneous but is lower in case of very heteroge- neous markets. This interesting result suggests that it de- pends on the basic conditions of the market under con- sideration whether a firm as a whole gains from delega- tion. 3.2. The Delegation Game with a Variable Number of Agents To study how the number of agents hired by both prin- cipals affects the market outcome, we set the parameter equal to an intermediate degree of heterogeneity, =1 , and vary the number of agents symmetrically across firms3. Maximization of agent utility n 22 ,, =12122 iiijiii ji j Usppspp p nppn with respect to the prices leads to the equilibrium price choices i p 2 2 12 6105 ,= 12 141415 iji iij ij i nsnsns s pss nsnsns s j j j for =1,2,ii as functions of the strategic variables , ij s, chosen by the two principals. The resulting pro- fits are 12 π,=1 12= =1,2, , iiiij , sspppN iij D where 2 222 2322 23 2 23 222 332 = 27236120 605025 723612060 5025 ii ij ij ij ij iiij i ij ij Nns nsnss nss nssnss j nsnssn s s nss nss and 2 2 =12 141415 ij i Dnsnsns j s. The first-order conditions for maximizing π, iij s 2Note, however, that unlike in Section 2 it maintains intrafirm interac- tion and thus non-monolithic firms. 3Endogenizing the number of agents in both firms would require to study cases with different numbers of agents in the two firms. For such a case, analytic results are very difficult to obtain. We thus restrict ourselves to studying how a symmetric change in the number of agents employed by each firm influences results via comparative statics. Copyright © 2012 SciRes. TEL  W. GÜTH ET AL. 359 with respect to , and the obvious symmetry of the solution again lead to a sixth-order polynomial equa- tion for each number n of a agents hired by both prin- cipals with the solution . Equi- librium prices are ,=1,2 i si ** ** =(;=1)(0,1)ssn **2 **2 **2 **2 5 = 15 nsn s nsn s ** 12 16 12 28,p output levels **2 **2 **2 **2 10 = 15 n s nsn s ** 12 12 28 ns ,q and effort levels ** **2 **2 **2 10 = 15 sns nsn s ** 12 12 28 **** ** ,π,, . e Table 4 illustrates how the solution (****** ** ,,, pqeUS) depends on the number of agents employed by each seller firm. As can be seen, an increasing number of agents inquires principals to offer lower revenue shares to their agents. Declining marginal effort costs of agents imply higher quantities and lower prices. The principals’ profits first increase and later on decrease with more and more agents. A similar inverted-U shaped relationship holds for the firms’ surplus whereas agents’ utility is monotonically decreasing. n A comparison of the results to those of the benchmark case (Table 2) in Section 2 shows that price delegation results in higher prices and lower effort levels. The sur- plus in the delegation game is lower in case of a small number of agents but higher in case of a large number of agents. Of course, in the limit case effort costs go to zero and the solutions coincide. Therefore it de- pends on intrafirm organization (treated as exogenous in our analysis) whether the firm as a whole gains from delegation or not. n 4. Summary and Conclusion Price delegation to sales managers is usual. But managers Table 4. Numerical solution of the price-delegation game, =1. n 1 2 3 ... 100 ... n ** 0.363 0.298 0.259 ... 0.040 ... 0.000 ** 0.765 0.685 0.641 ... 0.429 ... 0.333 ** q 0.235 0.315 0.359 ... 0.571 ... 0.667 ** e 0.235 0.157 0.120 ... 0.006 ... 0.000 ** π 0.115 0.151 0.171 ... 0.235 ... 0.222 ** U 0.038 0.020 0.013 ... 0.000 ... 0.000 ** S 0.153 0.190 0.209 ... 0.235 ... 0.222 do not suffer from the effort of producing what they sell. In our analysis this effect is taken into account by as- suming that the agents who set the sales prices are the same who suffer from exerting effort. Our price-dele- gation model assumes that both, principals and agents, compete with each other. Principals implement a revenue sharing scheme to which agents react by choosing a sales price and by producing what is demanded. We thus com- plement our former investigation of homogeneous markets with quantity competition by an analysis of more or less heterogeneous markets with price competition. Both types of delegation can be observed in markets for specific goods or services. Our study demonstrates how implementing revenue sharing affects intra- and interfirm interaction between principals (the owners) and agents (the workers) who suffer the cost of producing more. Thus low effort cost in case of low output provides an incentive for choosing high prices, an effect which is absent when sales manager neglect producing efforts. Therefore, more intensive com- petition due to a decreasing market heterogeneity or due to an increasing number of agents, hired by both firms, leads to lower prices and higher revenues. Accordingly we derive an inverted U-shaped relationship between the degree of market heterogeneity and the number of agents on the one hand and the firms’ surplus on the other. Whether price delegation increases or decreases the sur- plus compared to the benchmark case of monolithic firms depends decisively on the intrafirm organization and the interfirm (market) structure. The derived results pose quite a challenge for our in- tuition of how complex markets operate. In our view, this alone justifies the attempt to complement our former analysis of homogeneous markets with quantity compe- tition by one of more or less heterogeneous markets with price competition. Both studies together will hopefully help to understand more thoroughly what has to be ex- pected from an integrative analysis of intrafirm delega- tion and interfirm sales competition. REFERENCES [1] S. J. Grossman and O. D. Hart, “An Analysis of the Prin- cipal-Agent Problem,” Econometrica, Vol. 51, No. 1, 1983, pp. 7-45. doi:10.2307/1912246 [2] J. Vickers, “Delegation and the Theory of the Firm,” Eco- nomic Journal, Vol. 95, 1985, pp. 138-147. doi:10.2307/2232877 [3] C. Fershtman, “Managerial Incentives as a Strategic Va- riable in Duopolistic Environment,” International Journal of Industrial Organization, Vol. 3, No. 2, 1985, pp. 245- 253. doi:10.1016/0167-7187(85)90007-4 [4] C. Fershtman and K. L. Judd, “Equilibrium Incentives in Oligopoly,” American Economic Review, Vol. 77, No. 5, 1987, pp. 927-940. Copyright © 2012 SciRes. TEL  W. GÜTH ET AL. Copyright © 2012 SciRes. TEL 360 [5] S. D. Sklivas, “The Strategic Choice of Managerial In- centives,” Rand Journal of Economics, Vol. 18, No. 3, 1987, pp. 452-458. doi:10.2307/2555609 [6] B. Caillaud, B. Jullien and P. Picard, “Competing Vertical Structures: Precommitment and Renegotiation,” Econo- metrica, Vol. 63, No. 3, 1995, pp. 621-646. doi:10.2307/2171910 [7] K. M. Schmidt, “Managerial Incentives and Product Mar- ket Competition,” Review of Economic Studies, Vol. 64, No. 2, 1997, pp. 191-213. doi:10.2307/2971709 [8] V. S. Fumas, “Relative Performance Evaluation of Man- agement: The Effects of Industrial Competition and Risk Sharing,” International Journal of Industrial Organiza- tion, Vol. 10, No. 3, 1992, pp. 473-489. doi:10.1016/0167-7187(92)90008-M [9] N. H. Miller and A. I. Pazgal, “The Equivalence of Price and Quantity Competition with Delegation,” Rand Jour- nal of Economics, Vol. 32, No. 2, 2001, pp. 284-301. doi:10.2307/2696410 [10] M. Kräkel, “Strategic Delegation in Oligopolistic Tour- naments,” Review of Economic Design, Vol. 9, No. 4, 2005, pp. 377-396. doi:10.1007/s10058-005-0136-8 [11] W. Güth, K. Pull and M. Stadler, “Intrafirm Conflicts and Interfirm Competition,” Homo Oeconomicus, Vol. 28, No. 3, 2011, pp. 367-378. [12] D. Kreps and J. Scheinkman, “Quantity Precommitment and Bertrand Competition Yield Cournot Outcomes,” Bell Journal of Economics, Vol. 14, No. 2, 1983, pp. 326-337. doi:10.2307/3003636

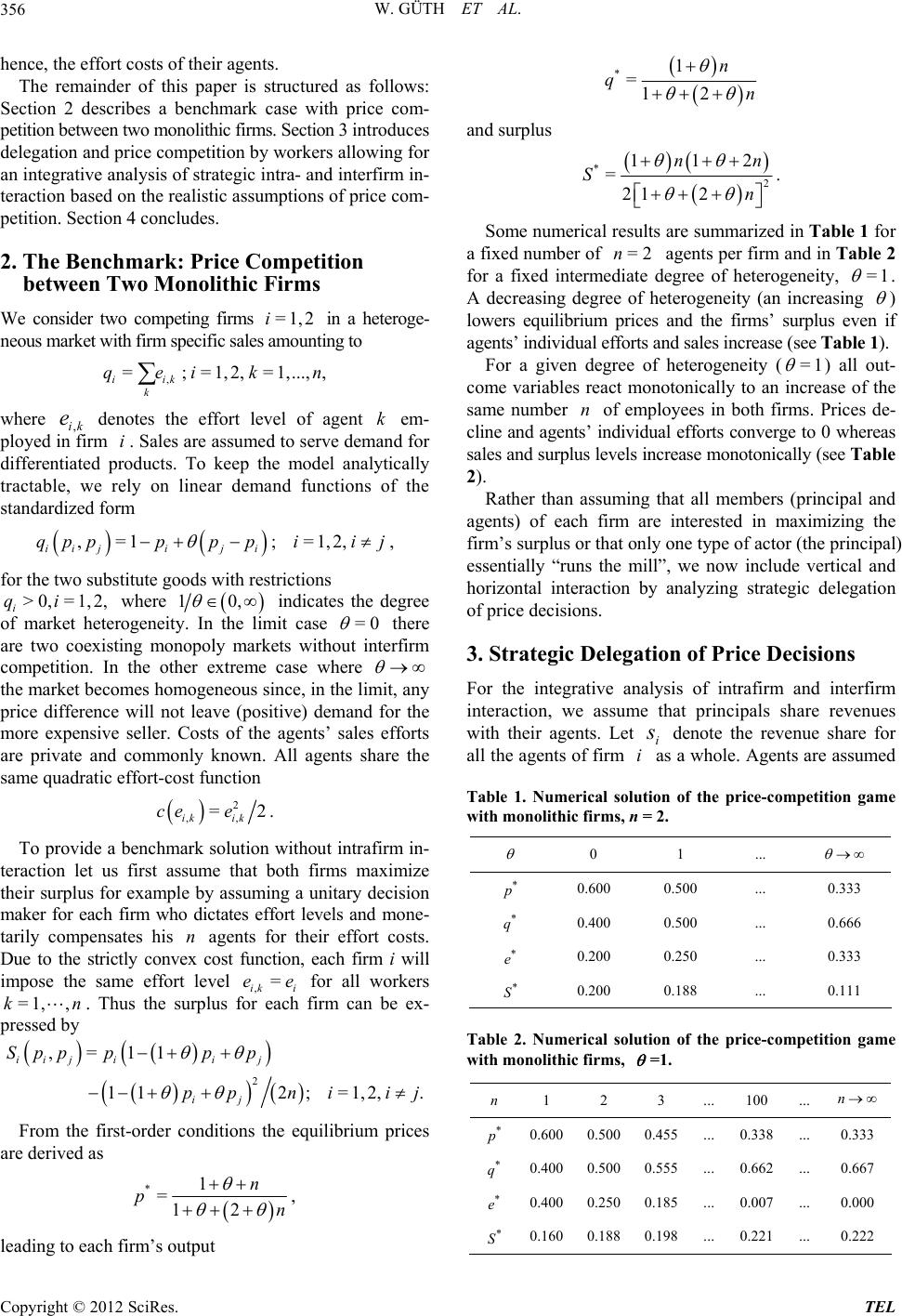

|