American Journal of Industrial and Business Management, 2012, 2, 136-144 http://dx.doi.org/10.4236/ajibm.2012.24018 Published Online October 2012 (http://www.SciRP.org/journal/ajibm) Services Trade and Labor-Demand Elasticities of Service Sector: Empirical Evidence from China Hao Wei, Qiang Fu, Sui Yang School of Economics and Business Administration, Beijing Normal University, Beijing, China. Email: weihao1006@gmail.com Received May 26th, 2012; revised June 25th, 2012; accepted July 23rd, 2012 ABSTRACT This paper analyses the impact of services trad e on th e labor-demand elasticities o f service secto r with the da ta of China from 1982 to 2009. We find that: 1) First, no matter in the long run or in the short term, China’s services export dis- tinctly impacts on the labor-demand elasticities of service sector. In the long-term influence, the substitution effect is much more powerful than the output effect, howeve r, as to the short period, the output effect is a little stronger than the substitution effect; 2 ) Seco nd, in th e long run, we cannot rej ect th e hypo thesis of no relation ship between serv ice import openness and the labor-demand elasticities of service sector. Whereas, studying the result of the short term, trade liber- alization of services import does affect the service sector labor-demand elasticity weakly. Keywords: Trade Liberalization; Labor-Demand Elasticities; Service Sector; Substitution Effect; Output Effect 1. Introduction From the Reform and Open, China’s service sector has been developing quickly and the growth of services trade accelerate rapidly. With the increase of proportion in the China’s foreign trade, services trade’s average growth rate is higher than that of goods trade, however, from the 1990s the deficit emerges in the service trade. Consider- ing the elastic labor-demand of service sector, various forms of service trade, huge employment supply of ser- vice business and the inevitable tendency of liberaliza- tion, boosting the service trade is an effective way to promote employment. Through exporting of labor service and undertaking foreign contracted projects, service ex- port could offer more jobs; accompanying by the inflow of foreign funds and advanced technology, service im- port could also create more employment. At present, different from most studies which focus on service trade’s impact on the employment and wage, this paper concentrates itself on the labor-demand elasticities, and by utilizing the data of China’s services trade and service sector from 1982 to 2009, the empirical analysis dedicates to revealing the relationship of China’s services trade liberalization and the service sector’s labor-demand elasticities, which indicates that through labor-demand elasticities services trade is able to influence the em- ployment. Starting from Cobb-Douglas model and other theories, the paper deduces a basic model and further works out optimization ones to estimate the substitution effect and the output effect. In the empirical analysis part, three tests—the tests of stationarity, cointegration analy- sis and the error correction model tests are carried out. Lastly, the conclusion an d some deduction are reached. 2. Literature Review In the study field concerning the trade’s impact on labor market, abundant literature once just focused on the in- fluence exerted by trade on employment and wage. Until 1990s, some scholars have started to promote this re- search from the perspective of labor-demand elasticity. In the theory research, Hamermesh (1993) [1] summa- rizes that an industry’s equilibrium own-price labor-de- mand elasticity is determined by its labor share in the total revenue, constant-output elasticity of substitution between labor and all other factors of production, and product-demand elasticity for industry’s output market, in which labor-demand elasticity rises along with the increase of factors substitution elasticity and prod- uct-demand elasticity. Rodrik (1997) [2 ] believes that the impact of trade on labor market in developed countries manifests in the following two aspects. Firstly, trade re- sults in an inward shift in the demand curve for low- skilled labor in advanced countries (the effect of trade is small). Secondly, trade and foreign investment flatten the demand curve for labor at home and increases the elas- ticity of demand for labor. Since developing countries tend to export low-skilled-intensive products, in devel- Copyright © 2012 SciRes. AJIBM  Services Trade and Labor-Demand Elasticities of Service Sector: Empirical Evidence from China 137 oped countries the demand for unskilled labor decreases and domestic workers could be substituted by foreign workers more easily. The degree of substitution means labor-demand elasticity. Slaughter (2001) [3] establishes the labor-demand elasticity model composed by substitu- tion effect and output effect on the basis of “fundamental law of factor demand” proposed by Hamermesh (1993) [1]. In the empirical research, trade’s impact on labor-de- mand elasticity is not so significant as the theories shown, and due to the difference on sample selection and spe- cific model building, different empirical studies yield different conclusion. By using the manufacturing industries data of US from 1961 to 19 91, Slaughter (2001) [3] estimates th e demand elasticity of production-labor and non-production labor and finds that trade or technology could influence wage model weakly, and factor price change and factor-de- mand elasticity are still largely unexplained, thus the hypothesis that international trade could increase labor- demand elasticity just could be proved partly. By using India’s industry-level data (1980-1997) dis- aggregated by states and across industries, Hasan, Mitra and Ramaswamy (2003) [4] find that labor-demand elas- ticities are not only higher for Indian states with more flexible labor regulations, they are also impacted to a larger degree by trade reforms. By using data (1971-1996) for 6 sectors in manufac- turing industries in Tunisia, Haoua and Yagoubi (2004) [5] perform empirical test on the effects of trade liberali- zation on labor-demand elasticities. They find that labor demand elasticity is large for contract workers while for permanent workers labor demand seems to be inelastic. This supports the conclusion that in liberalization periods labor markets have become more flexible, and that em- ployers prefer recruiting cont ract workers. Fajnzylber and Maloney (2005) [6] conduct empirical analysis on the trade liberalization’s impact on labor- demand elasticities concerning to blue- and white-collar workers for Chile (1979-1995), Colombia (1977-1991) and Mexico (1984-1990). They find that periods of greater openness to trade do not coincide with those of higher labor-demand elasticities in both Chile and Co- lombia; in Mexico, trade liberation would reduce white-collar labor-demand elasticities, but there are only limited effects on blue-collar elasticities. In brief, the results do not strongly support the hypothesis that trade liberalization has a direct impact on own-wage elastic- ities. Zhou Shen (2006) [7] estimates the trade’s impact on the labor-demand elasticities of China’s manufacturing industries by utilizing panel data across 34 industries from 1993 to 2002. He find that the liberalization of China’s manufacturing export could increases the labor- demand elasicities in manufacture sector, and the effect of that is significant statistically and big in de- gree. From the literature review, we could conclude that the research on the relationship of service trade and service sector’s labor-demand elasicities is in shortage. Whereas, with the rapid development of service trade, its impact on the service sector labor market would increase gradually. Maybe not through the direct channel, service trade could exert influence on wage and employment through la- bor-demand elasiticities. Consequently, this paper con- centrates its attention on service trade and service sector labor-demand elasiticities. 3. Theory and Estimation Framework Supposing in China’s service sector, only labor and capital are used. To simply the analysis, this paper as- sumes that the function of service sector to be a Cobb- Douglas type (C-D model): 1 QALK (1) Where A denotes total factor productivity, and 1 denotes the coefficient of labor output elasticity and capital output elasticity respectively. is between 0 and 1. Greenway, Hine and Wright (1999) [8] discov- ered, in open economy, parameter A is correlated with trade changes and varies with time in the production function as the following manner: 012 012 =e,, ,0 T jjj AMX (2) where j denotes the import penetration of industry j, X denotes the export penetration of industry j, T is the time tend and 01 , and 2 are parameters. To dem- onstrate theoretically how changes in trade policy result- ing in greater product market competition and larger product market elasticities, and to establish theoretical underpinnings for the empirical work to follow, Haoua and Yagoubi (2004) [5] propose to work with a model of monopolistic competition, where each firm faces its own less than infinitely elastic demand curv e and where there is assumed to be no strategic interaction between firms. Thus, any firm i in industry j is assumed to face an in- verse demand curve of the type: 1/ ijj ij PpQ (3) where ij denotes own price, P p denotes industry av- erage price, is parameter, is a scaling factor, ij denotes firm output, and Q denotes the (constant) price elasticity of demand The firm is assumed to face given factor prices. Par- tially differentiating profits with respect to the Lth input and Kth input gives us firm’s profit maximization condi- tions just as the following first order conditions: Copyright © 2012 SciRes. AJIBM  Services Trade and Labor-Demand Elasticities of Service Sector: Empirical Evidence from China 138 1 1 1 ij ijj pQ Lw (4) 1 1 (1) (1)jij ijj QK r (5) where denotes labor input, ijij L denotes capital input, w denotes the price of the Lth input, r de- notes the price of the Kth input. By employing Equ ations (1), (2), (4) and (5), we could get the following equation: 11 111 11j1 ji j j w j pL r w (6) In log form, Equation (6) can be rewritten as: 11 11 lnln1 ln 11ln11ln ij j j j LA w p j j r p (7) Unite Equation (7) with the Equation (2), we get: 11 01 2 11 ln ln 11ln 1ln1 1ln 11ln ij j j j j L TM w Xp r p (8) In this paper’s empirical analysis part, the metric equations are based on the Equation (8). And from Equa- tion (8), the own price elasticity of labor input is given by: 1 ln 11 ln ij j j L w p (9) The partial derivative of the ab solute value of the own price elasticity of labor input demand with respect to the product demand elasticity is given by: 111 0 d d dd (10) Equation (10) shows the higher the product demand elasticity could lead to the increase of the own price elas- ticity of labor factor. Furthermore, if the completion triggered by the trade liberalization could make the product demand elasticity in domestic service sector in- crease, the own price elasticity of labor factor would also ascend (Zhou Shen, 2006) [7]. 4. Variables Selection and Optimization Models In Equitation (8), we make 11 0 11 ln and here 0 stands for the intercept, 10 1 , 21 1 , 32 1 , 11 4 , , 51 1 t is the random error, so we get: jt0 12 345 lnL ln lnln ln j jj jt jj wr Xpp TM (10) Considering the time tend could arouse to the un- steadiness, we remove the time tend and get the estimat- ing equation: 01 2 34 lnln ln ln ln jtj j jj t jj LM wr pp X (11) The equation above is the static model , whic h means the employment in current period is affected by the export, import, wage and rate of current period. However, in real- ity, lots of economic phenomena are dynamic. As a result, we take a time-lag into consideration and therefore th e em- ployment in current p e riod is a f fected by the e mployment of prior period. The following is the dynamic equation. 01 ,123 45 lnlnln ln ln ln tjtj jj jt jj LLM wr pp j X (12) On the basis of Equation (12), including the factor measuring the trade liberalization, we could estimate the labor-demand elasticities with respect to export and im- port respectively according to the following equations: 01 ,12 34j lnln ln lnln ln j jtj tj j jj j w LL p w XX P t (13) 01 ,12 34j lnln ln lnln ln j jtj tj j jt j w LCCLC p w CMCM p (14) Copyright © 2012 SciRes. AJIBM  Services Trade and Labor-Demand Elasticities of Service Sector: Empirical Evidence from China 139 where denotes the labor demand of industry j in time t, ij L ,1 t L denotes the labor demand of industry j in time t – 1 and represent the time-lag; w p denotes the real wage of industry j, and could be calculated by the nominal wage against the consumer price index; 2 or stands for the labor-demand elasticities of industry j; 2 C ln , which is reflected the log form of the export penetration of industry j, is the indicator of the export openness; ln , which is reflected the log form of the import penetration of industry j, is the indicator of the import openness; 3 shows the export penetration’s influence on the demand of labor, and correspondently 3 shows the import penetration’s influence on the de- mand of labor; 4 C measures the impact of export open- ness on the demand of labor, and 4 weighs the impact of import openness on the demand of labor similarly, both of which are the focus of the estimation part; C t is the random error. Since the capital price is usually measured by the central bank’s benchmark interest rate, which could not mirror the market level, we do not in- clude the rate into the metric equation. According to the research conducted by Slaughter (2001) [3], the international trade determines the la- bor-demand elasticities through the substitution effect and the output effect. Therefore, to estimate the impact of the substitution effect or the output effect on the labor- demand elasticities, we establish the equations con- cerned to labor-demand elasticities with respect to the output (15) (17) and labor-demand elasticities with re- spect to the capital: 01 ,123 4j 5 lnln lnln ln lnln j tjt j jjjt j w LL p w XQ p j X (15) 01 ,123 4j 5 lnln lnln ln lnln j tjt j jjjt j w LL p w XK p j X (16) 01 ,123 4j 5 lnlnlnln ln lnln j tjt j jjjt j w LCCL CCM p w CM CQ p j (17) where the basic variables’ meaning is the same with those in Equations (13) and (14); Q is the real output of industry j, which can be got through the industry j’s gross output against GDP index; is th e real input of fixed assets, which could be figured out according to the results of the industry j’s nominal input of fixed assets against the price index of investment in fixed assets. 5. Data Due to the limited statistical data, the empirical analysis part just adopts the related data of China’s services trade and service sector from 1982 to 2009. To get the import penetration and the export penetration, the data of the services trade is assembled from the statistics results from the WTO website concerning to commercial ser- vices. And because of the units used there is billion dol- lars, we employ the average exchange rate of the yuan against dollar and g et the value measured by the units of yuan. To simplify the research, we regard the service sector as the tertiary industry. As to the employment number of the service sector, we utilize the statistics of the tertiary industry’s employment from the China Statis- tical Yearbook as substitution. The average wage of the service sector is got from the results of the total wage of tertiary industry divided by the total employment of ter- tiary industry. However, considering the lack of the sta- tistics of the total wage of tertiary industry, we use the result of the national total wage minus the sum of the total wage of the primary industry and the second indus- try. Owing to the change of the statistic scope in 2003, to collect the fixed assets investment of service sector, we use the capital investment data from 1982 to 2002 and the urban fixed assets investment data from 2003 to 2009. The consumer price index, GDP index and the price in- dex of investment in fixed assets are assembled from the China Statistical Yearbook. The CPI and the GDP index are based on the year 1978, while the price index of in- vestment in fixed assets is based on the year 1991 and the previous years’ indexes are assumed to be 100. 6. Empirical Analysis 6.1. Tests of Stationarity 01 ,123 lnlnlnln j 4j 5 ln ln ln tjt j j w LCCL CCM p jjj t j w CM CK p (18) According to the theories of econometrics, if empirical study aims to set up time series’ regression models, the tests of stationarity are required to avoid the spurious regression. A test of stationarity that has become popular widely over the past several years is the unit root test. And the usual methods to conduct the unit root test are DF test, ADF test and PP test. This paper adopts the for- mal one—ADF test, and utilizes Eviews 6.0 to test the steadiness of the level data and the data after the first order difference. The results of the ADF test indicates Copyright © 2012 SciRes. AJIBM  Services Trade and Labor-Demand Elasticities of Service Sector: Empirical Evidence from China 140 that unit roots exist in all level data, which reveals the original data are un steady. Howev er, the ADF test for the data after the first order difference shows the null hy- pothesis that unit root exists could be rejected. As a result, all the variables are qualified with the cointegration of the first order, and therefore live up to the requirement of cointegration analysis. 6.2. Cointegration Analysis The cointegration analysis is the popular method to deal with the nonstationary time series, and could clearly demonstrate the equilibrium relationship in the long run. So we utilize the Engle-Granger cointegration test to judge whether the independent variables are cointegrated with the dependent ones in Equations (13)-(18), and use ADF test to examine the estimated residual series. The test results show that each model’s estimated residual series are significant on the level of 1%. Hence, we can assert that those estimated residual series are steady and the dependent variables are in cointegration relationship with the independent variables. 6.2.1. Service Export’s Impact on Labor-Demand Elasticities 6.2.1.1 . E x port’s Gross Es t imate On the basis of the model (13), we estimate the gross impact of export on labor-demand elasticities. We get the estimated results in Table 1. On the basis of the results above, we could get the equation of cointegration regression: 1 ln4.390 0.877ln0.645ln 1.135ln0.234ln ln tt w LL P w XX P As the Table 1 shown, without regard to the influence of export, the service sector’s labor-demand elasticity is about –0.644. Export’s impact on the labor-demand elas- ticity is remarkable on the significant level of 10%. The every 10% increase of export penetration rate (in log form)) could result in the 2.33% increase of labor-de- mand elasticity (absolute value), whose effect is power- ful. The labor demand of precious period has distinctly positive impact on the labor demand in current period, and the degree of the impact is up to 0.877. The mortal inertia on the service employment demonstrates the ne- cessity of including the time lag. The export penetration also throws conspicuously positiv e influence on the labo r demand, which indicates the increase of the service ex- port could raise the employment of service sector. 6.2.1.2. Export’s Estimate with the Output Constraint Table 2 is the estimate result of service export’s impact Table 1. Export’s gross estimate. Variable CoefficientStd. Error t-Statistic Prob. 1 ln t 0.8774230.026165 33.53438 0.0000 ln w P –0.6437420.365323 –1.762118 0.0919 ln X 1.1346110.564561 2.009724 0.0569 lnln w XP –0.2325590.121795 –1.909430 0.0693 R2 0.996415 Mean Dependent Var 9.646432 Adj-R2 0.995763 S.D. Dependent Var 0.416269 S.E. 0.027097 F-Statistic 1528.510 D.W. Stat2.156893 Prob(F-sta tisti c) 0.000000 Table 2. Export’s estimate with the output constraint. Variable CoefficientStd. Error t-Statistic Prob. 1 ln t 0.6171460.112046 5.507952 0.0000 ln w P –0.7517350.335017 –2.243872 0.0357 ln X 1.3097720.518210 2.527494 0.0196 lnln w XP –0.2669210.111600 –2.391774 0.0262 Qln 0.0796600.033512 2.377059 0.0270 R2 0.997175 Mean Dependent Var 9.646432 Adj-R2 0.996502 S.D. Dependent Var 0.416269 S.E. 0.024619 F-Statistic 1482.418 D.W. Stat2.167449 Prob(F-statistic) 0.000000 on service sector’s labor-demand elasticities with the output constraint. On the basis of the results above, we could get the equation of cointegration regression: 1 ln6.6530.617ln0.752ln 1.310ln0.267ln ln0.080ln tt w LL P w XQ P As Ta ble 2 shown, with the output constraint, export’s impact on the labor-demand elasticity is remarkable on the significant level of 5%. The every 10% increase of export penetration rate (in log form) could result in the 2.67% increase of labor-demand elasticity (absolute value), whose effect is powerful. Because when output is restrained the trade could only change the labor-demand elasticities through influencing the constant-output elas- ticity of substitution between labor and all other factors of production, the measurement results manifest that the export openness could increase the elasticity of factors’ Copyright © 2012 SciRes. AJIBM  Services Trade and Labor-Demand Elasticities of Service Sector: Empirical Evidence from China 141 substitution effectively, and thus raise the labor-demand elasticities of service sector. 6.2.1.3. Export’s Estimate with the Capital Constraint Table 3 is the estimate result of service export’s impact on service sector’s labor-demand elasticities with the capital constraint. On the basis of the results above, we could get the equation of cointegration regression: 1 j ln6.5260.965ln1.263ln 2.163ln0.446lnln0.227ln tt w LL P w X P K As Table 3 shown, with the capital constraint, export’s impact on the labor-demand elasticity is remarkable on the significant level of 1%. The every 10% increase of export penetration rate (in log form) could result in the 4.46% increase of labor-demand elasticity (absolute value), whose effect is powerful. And the real input of capital throws significant effect on labor-demand elastic- ity. Because when capital is restrained the trade could only change the labor-demand elasticities through influ- encing the product-demand elasticity, the measurement results manifest the export openness could increase product-demand elasticity effectively and thus raise the labor-dem a nd el ast i ci ti es of s ervi ce sect or . The result indicates that the export openness could in- crease the labor-demand elasticity significantly through the substitution effect and the output effect from 1982 to 2009. The above analysis indicates that from 1982 to 2009 the export openness could increase the labor-de- mand elasticity significantly through the substitution effect and the output effect. In this period, if Chinese service sector’s export penetration (in log form) increases 10%, the trade’s substitution effect would make la- bor-demand elasticity (absolute value) increase 2.67% Table 3. Export’s estimate with the capital constraint. Variable Coefficient Std. Error t-Statistic Prob. 1 ln t 0.965397 0.034555 27.93826 0.0000 ln w P –1.263034 0.357954 –3.528483 0.0020 ln X 2.162685 0.564901 3.828431 0.0010 lnln w XP –0.446228 0.120512 –3.702782 0.0013 ln 0.022652 0.006908 3.279267 0.0036 R2 0.997629 Mean Dependent Var 9.646432 Adj-R2 0.997064 S.D. Dependent Var 0.416269 S.E. 0.022554 F-Statistic 1767.085 D.W. Stat 1.712048 Prob(F-statistic) 0.000000 and trade’s output effect would make labor-demand elas- ticity (absolute value) increase 4.46%. The substitution effect is almost twice stronger than the output effect, and through those two effects, labor-demand elasticity of service sector (absolute value) could increase 7.13%. According to statistic material, the average export pene- tration rate (in log form) of China’s service sector is 6.09%, and on the basis of the results above, export lib- eration could increase labor-demand elasticities (abso lute value) of China’s service sector about 4.34% from 1982 to 2009, which indicates that trade could exert some power on labor-demand elasticities of China’s service sector. 6.2.2. Service Import’s Impact on Labor-Demand Elasticities 6.2.2.1. Import’s Gross Estima t e Table 4 is the estimate result of service import’s impact on service sector’s labor-demand elasticities with the Gross Estimate. On the basis of the results, we could get the equation of cointegration regression: 1 ln3.071 0.887ln0.376ln 0.552ln0.106ln ln tt w LL P w MM P As the Table 4 shown, whether it is the labor-demand elasticities without regard to the influence of import, the import’s impact on the labor-demand, or the import openness’ impact on the labor-demand elasticities, all of them are insignificant on the test level of 10%. Conse- quently, we couldn’t reject the h ypothesis of no relation- ship between service import openness and labor-demand elasticities of the service sector. That is to say, the re- search results are unable to support the assumption that the service import could increase the labor-demand elas- ticities of the service sector. Table 4. Import’s gross estimate. Variable CoefficientStd. Error t-Statistic Prob. 1 ln t 0.8871440.026545 33.42060 0.0000 ln w P –0.3761440.245474 –1.532320 0.1397 ln 0.5523270.323774 1.705901 0.1021 lnln w XP –0.1055300.068826 –1.533288 0.1395 R2 0.996224 Mean Dependent Var 9.646432 Adj-R2 0.995537 S.D. Dependent Var 0.416269 S.E. 0.027808 F-Statistic 1451.053 D.W. Stat2.320243 Prob(F-statistic) 0.000000 Copyright © 2012 SciRes. AJIBM  Services Trade and Labor-Demand Elasticities of Service Sector: Empirical Evidence from China 142 6.2.2.2. Import’s Estimate with the Capital Constraint Table 5 is the estimate result of service import’s impact on service sector’s labor-demand elasticities with the Capital Constraint. On the basis of the results, we could get the equation of cointegration regression: 1 ln3.155 0.939ln4.899ln 0.710ln0.135ln ln0.012ln tt w LL P w MK P As Table 5 shown, with capital constraint, import’s impact on the labor-demand elasticity is remarkable on the significant level of 10%. The every 10% increase of export penetration rate (in log form) could result in the 1.35% increase of labor-demand elasticity. 6.2.2.3. Import’s Estimate with the Output Constraint Table 6 is the estimate result of service import’s impact on service sector’s labor-demand elasticities with the Output Constraint. On the basis of the results, we could get the equation of cointegration regression: 1 ln4.394 0.677ln0.356ln 0.515ln0.945ln ln0.645ln tt w LL P w MQ P As Table 6 shown, lnln w MP does not pass the test on the significant level of 10%, which means that service import could not remarkably increase the la- bor-demand elasticities of the service sector through sub- stitution effect. 7. Error Correction Model The cointegration analysis could clearly demonstrates the Table 5. Import’s estimate with the capital constraint. Variable Coefficient Std. Error t-Statistic Prob. 1 ln t 0.939281 0.039341 23.87545 0.0000 ln w P –0.488838 0.243763 –2.005382 0.0580 ln 0.709941 0.322933 2.198413 0.0393 lnln w XP –0.134665 0.067982 –1.980885 0.0609 ln 0.012284 0.007077 1.735840 0.0972 R2 0.996698 Mean Dependent Var 9.646432 Adj-R2 0.995912 S.D. Dependent Var 0.416269 S.E. 0.026617 F-Statistic 1267.669 D.W. Stat 2.098845 Prob(F-statistic) 0.000000 Table 6. Import’s estimate with the output constraint. Variable CoefficientStd. Error t-Statistic Prob. 1 ln t 0.6769030.119619 5.658810 0.0000 ln w P –0.3558150.234160 –1.519534 0.1435 ln 0.5149340.309192 1.665418 0.1107 lnln w XP –0.0947560.065850 –1.438960 0.1649 ln Q 0.0645760.035911 1.798237 0.0865 R2 0.996728 Mean Dependent Var 9.646432 Adj-R2 0.995949 S.D. Dependent Var 0.416269 S.E. 0.026495 F-Statistic 1279.349 D.W. Stat2.312158 Prob(F-statistic) 0.000000 equilibrium relationship in the long run, however, in short term, variables often diverge the equilibrium state and gradually adjust to the long-run equilibrium. After the empirical analysis of the cointegration rela- tionships, to learn the export trade’s impact on the labor-demand elasticities in short period, we establish the error correction model (ECM) in which the error correction term is included. Get the ECM for (13)-(18) as t h e following: 01 123 41 lnln lnln ln lnln ttt ttt t w LL P w XEC P t X (19) 01 123 41 lnln lnln ln lnln ttt ttt t w LL P w MEC P t M (20) 01 12 34 51 lnln ln lnln lnln ln ttt tt t ttt w LL P w XX P QEC (21) 01 12 34 51 lnln ln lnln lnln ln ttt tt t ttt w LL P w XX P KEC (22) 01 12 34 51 lnln ln lnln lnln ln ttt tt t ttt w LL P w MM P QEC (23) Copyright © 2012 SciRes. AJIBM  Services Trade and Labor-Demand Elasticities of Service Sector: Empirical Evidence from China Copyright © 2012 SciRes. AJIBM 143 pact on the labor-demand elasticities is much stronger. What’s more, with the output constraint and the capital 01 12 34 51 lnln ln lnln lnln ln ttt tt t ttt w LL P w MM P KEC (24) constraint, the coefficients of lnlnw XP are both sig nificant on the level of 1%, but the output effect is much stronger than the substitution effect, which is quite different with the conclusion of the long term. Table 7 is the estimate results of error correction model. We can find that: In ECM of the import’s impact on the labor-demand elasticities, lnlnw XP passes the test on the sig- In ECM of the export’s impact on the labor-deman- delasticities, lnln w XP passes the test on the sig- nificant level of 5%, indicting the service import has di- rect influence on the service sector’s labor-demand elas- ticities, which is obviously different from the results of the cointegration analysis. The coefficient of error cor- rection term passes the test on the significant level of 1% and the rate of adjustment is 1.358%, which reflects the long-term equilibrium could adjust the short-term fluc- tuation effectively. But in short term, import penetration (in log form) increase 10% could just result in about 0.925% increase of labor-demand elasticity (absolute value), which shows the service import openness’s im- pact on the service sector’s labor-demand elasticities is nificant level of 1%, which indicates that in short run service openness could remarkablely increase the service sector’s labor-demand elasticities. The every 10% in- crease of export penetration rate (in log form) could re- sult in about 3% increase of labor-demand elasticity (ab- solute value), whose effect is powerful. Besides, the co- efficient of error correction term passes the test on the significant level of 1% and the rate of adjustment is 1.103%, which reflects the long-term equilibrium could adjust the short-term fluctuation effectively. Compared to the long-term one, in short term the service export’s im- Table 7. Estimate results of error correction model. Explanatory Variable Model(19) Model(20) Model(21) Model(22) Model(23) Model(24) C 0.002533 (0.206875) 0.007690 (0.496499) 0.003714 (0.301735) –0.001818 (–0.143259) 0.007143 (0.458574) –0.002721 (–0.206123) 1 ln t 0.838548*** (4.326182) 0.964177*** (3.229528) 0.868645*** (4.424883) 0.931067*** (4.590453) 1.176797*** (3.675410) 0.927554*** (4.468316) ln w P –0.851663*** (–2.888481) –0.874167*** (–2.887797) –0.954209*** (–3.051547) –0.374318*** (–2.270063) –0.436917*** (–2.473867) –0.374549*** (–2.221755) ln X 1.474111*** (3.082964) 1.522215*** (3.080960) 1.635835*** (3.235571) lnln w XP –0.300258*** (–2.925990) –0.310459*** (–2.928933) –0.334494*** (–3.087129) ln 0.516877*** (2.273383) 0.624628*** (2.478206) 0.521634*** (2.240623) lnln w MP –0.092493** (–1.926950) –0.115021*** (–2.165445) –0.093604** (–1.903806) lnQ –0.068532 (–0.560556) –0.127550 (–0.992132) ln 0.010294 (0.989072) –0.003578 (–0.366685) t1 C –1.103303*** (–3.445943) –1.174804*** (–3.357658) –0.837646** (–2.003706) –1.358452*** (–4.315011) –1.480467*** (–4.378735) –1.441716*** (–3.660105) R2 0.633473 0.639436 0.651421 0.632880 0.650962 0.635460 Adj-R2 0.541842 0.525574 0.541343 0.541100 0.540740 0.520342 D.W. Stat 1.807238 1.721977 2.016680 1.816729 1.705330 1.801549 F-Statistic 6.913258 5.615879 5.917831 6.895614 5.905896 5.520070 Prob(F-statistic) 0.000676 0.001699 0.001272 0.000687 0.001286 0.001865 Note: stands for the first order difference. ***,**,* respectively denote that the test passes under the s ignificance level of 1%, 5%, 10%.  Services Trade and Labor-Demand Elasticities of Service Sector: Empirical Evidence from China 144 considerably limited. And different from the export’s effect in short term, in the short run the import’s substi- tution effect is much stronger than the output effect. 8. Conclusions This paper analyses the impact of services trade on the labor-demand elasticities of service sector with the data of China from 1982 to 2009. We find that: 1) In long run, China’s service export exerts distinctly simulative impact on the service sector labor-demand elasticities, which is significant statistically and big in degree. Export openness could increase the labor-demand elasticity remarkably through the substitution effect and the output effect, but the substitution effect is much stronger than the output effect. In short term, the service export also throws distinctly positive impact on the ser- vice sector’s labor-demand elasticities, which is more powerful than the influence in the long run, but the out- put effect is stronger than the substitution effect. 2) In long run, the service import doesn’t have direct influence on the service sector’s labor-demand elastic- ities, thus the research results couldn’t reject the hy- pothesis of no relationship between service import open- ness and labor-demand elasticities of the service sector. In short run, the service import could increase the la- bor-demand elasticities in some deg ree. That is to say, as to the short term, trade liberalization of service import does affect the service sector labor-demand elasticity weakly. The increase of the labor-demand elasticities indicates the status of the labor suppliers is weakened relatively, and meanwhile the shocks brought by the labor demand would arouse the lager fluctuation of wage and employ- ment. Just as the conclusions above shown, no matter in the long run or in the short term, China’s services expo rt exerts distinctly stimulative impact on the service sector labor-demand elasticities, therefore even the service ex- port has no direct influence on the wage and employment in service sector, through the labor-demand elasticities service export could exert pressure on the labor market. And as to the service import, in long run its impact on labor-demand elasticities hasn’t been proved, but in short run it would aggravate the fluctuation of wage and em- ployment. So China government should pay more atten- tion to the changes of labor-demand elasticities with trade. 9. Acknowledgements This research is supported by “Research Fund of Na- tional Social Science” (No.10zd & 017,No.11AJL005 and No.11FJL008), “The Fundamental Research Funds for the Central University” (No.105563GK), “Scientific Research Fund of Education Ministry of China” (No.10- YJC-790272), and “The Fundamental Research Funds for 985 Projects”. REFERENCES [1] D. S. Hamermesh, “Labor Demand,” Princeton University Press, Princeton, 1993. [2] D. Rodrik, “Has Globalization Gone too Far?” Institute for International Economics, Washington DC, 1997. [3] M. J. Slaughter, “International Trade and Labor Demand Elasticities,” Journal of International Economics, Vol. 54, No. 1, 2001, pp. 27-56. doi:10.1016/S0022-1996(00)00057-X [4] R. Hasan, D. Mitra and K. V. Ramaswamy, “Trade Re- forms, Labor Regulations and Labor Demand Elasticities: Empirical Evidence From India,” Working Paper 9879, NBER, 2003. [5] I. Haouas and M. Yagoubi, “Trade Liberalization and Labor-Demand Elasticities: Empirical Evidence from Tu- nisia,” IZA Discussion Paper, No. 1084, 2004. [6] P. Fajnzylber and W. F. Maloney, “Labor Demand and Trade Reform in Lat in America,” Journal of International Economics, Vol. 66, No. 2, 2005, pp. 423-446. doi:10.1016/j.jinteco.2004.08.002 [7] S. Zhou, “Empirical Research on Trade Liberalization’s Impact on Industry Sector Labor-Demand Elasticities,” World Economy, Vol. 29, No. 2, 2006, pp. 31-40. [8] D. Greenway, R. C. Hine and P. Wright, “An Empirical Assessment of the Impact of Trade on Employment in the United Kingdom,” European Journal of Political Econ- omy, Vol. 15, No. 3, 1999, pp. 485-500. doi:10.1016/S0176-2680(99)00023-3 Copyright © 2012 SciRes. AJIBM

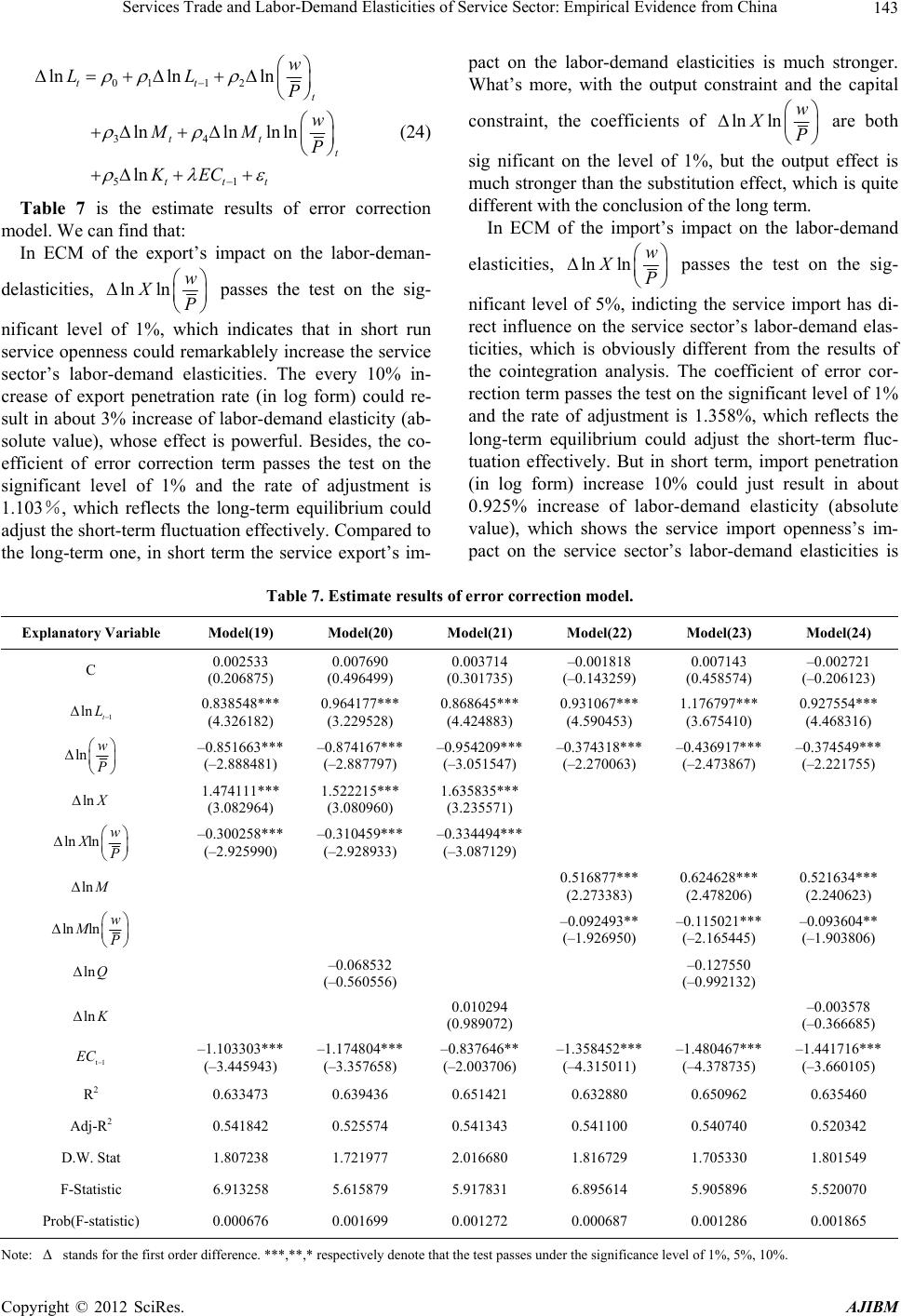

|