Modern Economy, 2012, 3, 726-737 http://dx.doi.org/10.4236/me.2012.36093 Published Online October 2012 (http://www.SciRP.org/journal/me) Are Foreign and Public Investment Spending Productive in the Argentine Case? A Single Break Unit Root and Cointegration Analysis, 1960-2010. Miguel D. Ramirez Department of Economics, Trinity College, Hartford, USA Email: miguel.ramirez@trincoll.edu Received June 3, 2012; revised July 5, 2012; accepted July 15, 2012 ABSTRACT This paper addresses the important question of whether public investment spending and inward foreign direct invest- ment (FDI) flows enhance economic growth and labor productivity in Argentina. The paper estimates a dynamic labor productivity function for the 1960-2010 period that incorporates the impact of public and private investment spending, the labor force, and export growth. Single break (Zivot-Andrews) unit root and cointegration analysis suggest that (lagged) increases in public investment spending on economic and social infrastructure have a positive and significant effect on the rate of labor productivity growth. In addition, the model is estimated for a shorter period (1970-2010) to capture the impact of inward FDI flows. The estimates suggest that (lagged) inward FDI flows have a positive and sig- nificant impact on labor productivity growth, while increases in the labor force have a negative effect. From a policy standpoint, the findings call into question the politically expedient policy in many Latin American countries, including Argentina during the 1990s and early 2000s, of disproportionately reducing public capital expenditures to meet reduce- tions in the fiscal deficit as a proportion of GDP. The results give further support to pro-growth policies designed to promote public investment spending and attract inward FDI flows. Keywords: Argentina; Complemetarity Hypothesis; Endogenous Growth; Foreign Direct Investment; Labor Productivity Growth; Public Investment; Zivot-Andrews Unit Root Tests 1. Introduction After the onset of the debt crisis in the early eighties, major Latin American countries such as Brazil and Mex- ico adopted an outward-oriented, market-based strategy of economic growth by liberalizing their trade and finan- cial sectors, as well as dismantling and privatizing their state-owned enterprises. Argentina began this process of economic stabilization and structural reform in earnest following the country’s adoption of the Convertibility Plan, a currency board system introduced in 1991 under the administration of Carlos Saul Menem.1 The essential feature of this plan was to tie a new Ar- gentinean peso to the dollar on a one-to-one basis, thus eliminating the ability of the government to finance budget deficits via money creation while, at the same time, restricting the amount of pesos in circulation to the inflow of foreign exchange. One of the most important accomplishments of the stabilization plan was to reduce dramatically the rate of inflation from 2.314 percent in 1990 to 4.1 percent in 1994, and less that 1 percent in 1998! The stabilization of the economy and the with- drawal of the state from key sectors of its economy, such as airlines, banking, electricity, gas, mining, steel, rail- ways, telecommunications and petroleum, was welcomed by both domestic and (particularly) foreign investors, as well as free trade advocates, economists, and government officials working for the multilateral agencies. For ex- ample, FDI flows to the country surged during the 1990s, from US$1.84 billion to an all-time high of US$23.9 bil- lion in 1999, before falling to US$11.7 billion in 2000, and precipitously to 1.6 billion in 2003 as a result of the economic and financial debacle the economy experi- enced following the collapse of the currrency board in 2002 [3]. The stabilization of the Argentine economy during the nineties, however, was not achieved without significant economic and social costs, particularly in view of the impact of several external shocks that paved the way for the economic and financial debacle associated with the collapse of the Convertibility Plan in 2001-2002. First, the country was buffeted by the contagion effects of the Tequila crisis in 1995-1996 which generated massive 1Argentina’s privatization, liberalization, and deregulation program is discussed and analyzed in Baer et al. [1] and Weisbrot et al. [2]. C opyright © 2012 SciRes. ME  M. D. RAMIREZ 727 capital flight, a liquidity crisis, and high real interest rates with their knock-on effects on the balance sheets of the banks and the real economy. Second, the Asian and Rus- sian crises led to a significant flight of capital and, once again, a substantial rise in real interest rates and their adverse effects. Third, the devaluation of the Brazilian currency (the real) in 1999 had a severe effect on the Argentine economy because close to 30 percent of its exports were destined to that country (see [2]). This de- velopment is all the more significant in view of the fact that the government’s promotion of outward-oriented policies has significantly increased the relative impor- tance of its exports in fueling economic growth as at- tested by the following figures: exports of goods and services averaged 9.4 percent of GDP during the 1990- 2001 period as compared to 8.6 percent during the 1980- 1990 period [4]. Finally, the economic situation was fur- ther exacerbated by the fact that the dollar continued to appreciate in real terms relative to the Euro and the Yen, thus further undermining the competitiveness of the Ar- gentine economy given its hard peg to the dollar and its policy of unrestricted mobility of capital (see [1]). In addition to these external shocks, several prominent investigators have focused on the long-term economic (negative) effects associated with the severe IMF-spon- sored stabilization and adjustment measures implemented by the Argentine government, as well as other countries in Latin America and the Caribbean (see [5-10]). These programs often call for across-the-board cuts in public spending and tight restrictions on credit creation in order to meet stringent fiscal deficit targets, reduce the rate of inflation, and free resources to service the external debt.2 In practice, critics contend that these stabilization and adjustment measures further undermine investor and con- sumer confidence because of their contractionary effect on the real economy and the rate of capital formation. Nowhere is this more evident than in the disappointing and erratic behavior of Argentine private capital forma- tion during the past two and a half decades. Table 1 be- low shows that Argentina’s private investment as a pro- portion of GDP fell dramatically during the lost decade of the 1980s, reaching a low of 9.4 percent in 1990 which amounted to less than half its level in 1980. Following the adoption of the Convertibility Plan it rose to a high of 19.1 percent in 1994, from which it fell again to 9.2 per- cent in 2002 and a dismal 7.6 percent in 2003 as a result of the country’s economic crisis following the collapse of the currency board. What is particularly worrisome about these figures is that most economists believe that it is absolutely essential for Argentina—and other countries Table 1. Argentina: Investment as a share of GDP (in per- cent), 1980-2010. Year Private Investment Public Investment 1980 19.2 6.1 1982 16.6 5.2 1984 14.9 5.0 1986 13.2 4.3 1988 14.4 4.3 1990 9.4 4.6 1992 14.9 1.8 1994 19.1 0.8 1996 16.1 2.0 1998 17.9 2.0 2000 15.4 1.0 2001 12.1 0.9 2002 9.2 0.7 2003 7.6 0.8 2004 10.5 1.3 2005 12.9 1.9 2006 13.2 2.5 2007 14.8 3.3 2008 15.1 3.3 2009 13.5 3.5 2010 14.9 3.5 Average 1970-1979 13.6 9.1 1980-1989 15.0 4.9 1990-1999 15.7 1.6 2000-2010 12.7 2.1 Source: IFC, Trends in Private Investment in Developing Countries, Statis- tics for 1970-2000. Washington DC, The World Bank, 2001; M.E.P., Ar- gentina: Sustainable Output Growth After the Collapse. Buenos Aires, Min- isterio De Economia Argentina, 2003, Tables 1 and 2 pp. 7-11; and ECLAC (2010). of Latin America—to significantly improve and sustain its investment performance if it is going to lay the groundwork for rapid and sustained economic growth, as well as create future employment opportunities for its rapidly expanding labor force (see [10]). A number of investigators have cited the dramatic fall in public investment in economic and social infrastruc- ture, brought about by the need to meet the stringent fis- cal deficit targets of the stabilization program, as one 2Weisbrot et. al. ([2]: p. 3) reports that in 2002 the IMF demanded that the Argentine government enact spending cuts of 10 percent across- the-board, in addition to a 30 percent reduction in outlays for goods and services and a 13 percent cut in salary and pensions for government employees. Copyright © 2012 SciRes. ME  M. D. RAMIREZ 728 possible factor in explaining the poor investment per- formance of Argentina and other Latin American coun- tries. Table 1 shows that public investment spending in economic and social infrastructure as a proportion of GDP fell precipitously from 4.6 percent in 1990 to barely 1 percent in 1994, only to rise to 2 percent during the 1995-1999 period before falling again in the 2001-2003 period to less than 1 percent. Moreover, the average pub- lic investment spending on economic infrastructure for the 1990s and early 2000s is only a third of that of the 1980s and barely one fifth of the average level recorded during the 1970s. However, Table 1 also reveals that under the pro-growth policies of the Kirschner admini- stration (2003-2010) public investment as percentage of GDP has risen dramatically since 2005, recording levels well above 3 percent since 2007. The basic idea is that public investments in highways, bridges, sewerage systems, water supplies, and education and health services often generate substantial positive spillover benefits for the private sector by reducing the direct (and indirect) costs of producing, transporting, and delivering goods and services to consumers (see [11-14]). If the complementarity hypothesis is correct, then the steep reductions in public capital formation experienced in Argentina and elsewhere in Latin America during the past decade and a half may further depress private in- vestment spending and productivity growth. Moreover, it may also undermine some or all of the long-term effi- ciency gains anticipated from the implementation of market-based, outward-oriented reforms such as privati- zation of state-owned firms and the liberalization of trade and finance (see [15]). After all, the newly privatized firms in liberalized (open) markets will need adequate and reliable economic infrastructure in order to produce, transport, and market their goods and services at home and abroad in a cost-effective manner. In view of the importance and controversial nature of this topic, this paper analyzes the impact of public in- vestment spending, inward FDI flows, and export growth on the economic growth and labor productivity of the Argentine economy. The choice of Argentina is war- ranted for a number of reasons. First, Argentina is a large and strategically important country in Latin America. This is a situation that promises to continue as a result of the country’s participation in the important regional trade agreement named Mercosur. Second, beginning with the Menem administration (1989-1999) and continuing under the ill-fated administrations of Fernando De La Rua and Duhalde (2000-2002), Argentina pursued a far-reaching market-based strategy of economic growth and develop- ment, while under both Kirschner administrations (2003- 2010), the Argentine government has reversed itself and pursued a more activist set of growth policies.3 An econometric study of the impact of public investment spending, FDI inflows, and export growth in a major Latin American nation under these different regimes should prove both interesting and useful to development scholars and policymakers as they decide where to allo- cate scarce public funds to maximize the country’s growth potential. Finally, Argentina is one of the few countries in Latin America that has reliable and disag- gregated time-series data on public investment spending on economic and social infrastructure going as far back as the decade of the sixties. This data set thus enables researchers to test whether increases in government in- vestment spending on economic infrastructure per se, rather than overall public investment expenditures, dis- place or promote private investment spending, economic growth, and (labor) productivity. The paper is organized as follows. Section 2 provides a conceptual framework for incorporating the public or FDI capital stock in a modified neoclassical production function. The model presented in this section is intended solely to motivate the ensuing discussion and although the relevant parameters cannot be estimated directly given the inherent data limitations present in the Argen- tine case, the discussion highlights how researchers might proceed if the relevant data becomes available. Next, the paper introduces a rough empirical counterpart to the model presented in the previous section, and dis- cusses the nature and limitations of the data used in this study. Section 4 presents single break (Zivot-Andrews) unit root tests and the estimates for the dynamic produc- tion relationship. Using cointegration analysis, this sec- tion tests whether there is a stable long-term relationship among the relevant regressors of the modified production function. In so doing, this paper goes beyond other em- pirical studies of the complementarity hypothesis by ad- dressing the important question of spurious correlation among the model variables. The section is brought to a close by generating several error-correction (EC) models that are used to track the historical data on the growth rate of output for the period under review. The last sec- tion summarizes the paper’s major findings. 2. The Model On the supply side, the positive externalities generated by additions to the public (or FDI) capital stock can be formalized by incorporating them in an augmented Cobb-Douglas production function of the following form 3Under both Kirschner administrations, the economy has grown at average annual rates exceeding 8 percent and levels of poverty and unemployment have experienced a dramatic fall from their crisis levels in 2001-2002; there has also been a huge increase in government spending on housing, health, and economic infrastructure, as well as a significant extension of social security coverage and a substantial rise in real wages (see [16]: pp. 8-12). Copyright © 2012 SciRes. ME  M. D. RAMIREZ 729 [17]: 1 ALKE ,, p YALKE ,, pg ELKK (1) where Y is real output, Kp is the private capital stock, L is labor, and E denotes the externality generated by addi- tions of the public capital stock or FDI capital stock (α and β are the shares of domestic labor and private capital respectively, and A captures the efficiency of production. Initially, it is assumed that α and β are less than one, such that there are diminishing returns to the labor and capital inputs. The externality, E, can be represented by a Cobb- Douglas function of the type: 1 pg K (2) where γ and θ are, respectively, the marginal and the in- tertemporal elasticities of substitution between private and public (FDI) capital. Let γ > 0, such that a larger stock of public (or FDI) capital generates a positive ex- ternality to the economy. If θ > 0, intertemporal com- plementarity prevails and, if θ < 0, additions to stock of public (FDI) capital crowd out private capital over time (see [18]). Combining Equations (1) and (2), we obtain, 11 YAL K (3) A standard growth accounting equation can be derived by taking logarithms and time derivatives of Equation (3) to generate the following dynamic production function: 1 1 1 AL Kp Kg gg g g pt t eLtdt 11 (4) where gi is the growth rate of i = Y, A, L, Kp, and Kg. Equation (4) states that (provided γ and θ > 0) additions to the stock of public (FDI) capital will augment the elas- ticities of output with respect to labor and capital by a factor θ(1 – α – β). The demand side of the economy can be included into the model via the following intertemporal utility maxi- mization framework: max o ut uc (5) s.t. pg p AK K c k , and 00 p K . where, for convenience, lower-case letters are defined in per capita terms and ρ is the discount rate, L(t) is the size of the family, c(t) is per capita consumption, and δ represents the rate of depreciation. For convenience, the initial population is normalized to 1 so that the analysis in aggregate and per capita terms is the same. The in- stantaneous utility function of the representative con- sumer is assumed to exhibit constant relative risk and can be written in the following general form: 111uct ct (6) σ denotes the relative risk aversion coefficient or the in- verse of the elasticity of substitution between current and future consumption; i.e., σ is an index of the representa- tive consumer’s willingness to exchange current con- sumption for future consumption. Letting u(c) = lnc, for simplicity, and solving the standard optimal control problem in Equation (5), we obtain the following equa- tion: 11 1 11 pg cc AKK (7) Equation (7) can be interpreted as follows in the pre- sence of intertemporal complementarity between public (FDI) and private capital (i.e., θ > 0): the economy grows at a positive rate whenever the marginal product of capi- tal, net of depreciation, can be kept above the rate of time preference (discount). The marginal productivity of pri- vate capital, in turn, is augmented and kept above the discount rate by additions to the stock of public (or FDI) capital. Finally, the larger the intertemporal elasticity of substitution of current consumption for future consump- tion, as captured by the inverse of the relative risk coeffi- cient, σ, the higher the rate of growth of the economy. Put differently, the sacrifice of current consumption is less costly to the representative consumer when present and future consumption are good substitutes 3. Empirical Model In the development literature it is often not possible to generate estimates of Equations (3) and (4) above be- cause of the poor quality of existing data for public and private investment spending, as well as the actual paucity of data on the labor force over a sufficiently long period of time. Instead, investigators have used proxies for key variables such as the labor force and/or the stocks of pri- vate and public capital such as population data rather than labor force data, or substituted investment data (as a proportion of GDP) for capital stock data (see [19,20]). Alexander [21] has shown, however, that models using these proxies have to impose unduly restrictive assump- tions (e.g., such as a fixed capital-output ratio) or unreal- istic assumptions (a constant labor force participation rate) that can generate both misspecified relationships and significant measurement errors. In the case of Argentina we are fortunate to have labor force data going as far back as 1960, but we do not have consistent estimates of the public and private capital stock series, or for that matter, reliable estimates of the rate of depreciation from which such a series could be Copyright © 2012 SciRes. ME  M. D. RAMIREZ 730 generated. Researchers in the field of economic deve- lopment have circumvented this problem by estimating a dynamic production which defines the relevant variables in terms of percentage growth rates, thus permitting them to generate proxies for the percentage growth rates in the respective capital stocks. Following their lead, this study includes the ratio of public and private investment spend- ing to gross domestic product as alternative proxies. Fi- nally, for reasons explained in Section IV, the empirical model was estimated with changes in the investment ra- tios because these ratios were determined to be nonsta- tionary in level form. This study thus extends previous empirical work by estimating a rough empirical counter- part of the dynamic production function in Equation (4) for the 1960-2010 period without the FDI variable and between 1970 and 2010 with the FDI variable.4 The most general formulation of the growth equation is given below, 12 3 567 4 182 gf ii DD g yli cx (8) lower case letters denote natural logarithms, and Δ de- notes the change in the variable in question; y is real GDP (1993 pesos); l, as indicated above, refers to the labor force (thousands occupied); ip denotes the ratio of private investment to GDP, while ig represents public investment spending on economic and social infrastruc- ture as a proportion of GDP, viz., roads, bridges, and education5—it therefore excludes investment expendi- tures by state-owned enterprises which are more likely to crowd out private investment spending and output; if the ratio of foreign direct investment to GDP and it is ex- pected to have a positive effect because increased FDI flows are associated with a greater transfer of technology and managerial knowhow, learning-by-doing, and greater market discipline; however, FDI flows may also have a negative effect on the growth rate of a country if they give rise to substantial reverse flows in the form of re- mittances of profits and dividends and/or if the TNCs obtain substantial tax and other concessions from the host country (see [22]); cg is real government consump- tion expenditures as a proportion of GDP, and may di- rectly or indirectly (via output taxes) crowd out private expenditures and thus affect output in a negative fashion; x denotes exports of goods and services and, as suggested by the export promotion hypothesis, its growth rate is expected not only to have a direct effect on economic growth, but also indirectly via the increased investment and realization of economies of scale by the exporting firms, and the concomitant diffusion of technological and managerial knowhow throughout the economy generated by the export sector; D1 is a dummy variable that takes a value of one for the crisis years, and 0 otherwise, while D2 equals 1 for the impact of the currency board, and 0 otherwise. Data The data used in this study were obtained from official government sources such as the Direccion Nacional de Politicas Macroeconomica, Ministerio de Economia y Produccion (Ministry of Economy and Production, vari- ous issues) and the Instituto Nacional De Estadistica y Censos de la Republica Argentina (National Institute of Statistics and Census of Argentina). Other relevant eco- nomic data have been obtained from ECLAC, Statistical Yearbook for Latin America and the Caribbean, 2010, and the International Finance Corporation [23]. In this study we focused on labor productivity so the dependent variable was estimated as the growth rate in labor productivity by subtracting the growth rate in the labor force from the percentage change in GDP in Equa- tion (8). Defining the dependent variable in this manner reverses the expected sign of the labor variable because of diminishing returns to the labor input. The sign of β1 is anticipated to be positive in the GDP formulation while, as indicated above, it is expected to be negative in the labor productivity specification. β2 is expected to be positive, while the sign of β3 can be positive or negative depending on whether increases in public in public in- vestment complement or substitute for private capital formation. Lags were included for this variable to ad- dress both the delayed impact of government investment spending on private output growth, as well as reverse causation.6 The sign of β4 is also indeterminate because govern- ment expenditures on collective consumption goods such as food, housing, and salaries of public employees may directly or indirectly (via output taxes and subsidies) crowd out private consumption expenditures and thus 6To test for reverse causality, a Granger-causality test was performed with four lags. The results show that the null hypothesis that private investment does not “Granger cause” real GDP (labor productivity) can be rejected at the 5 percent level (p-value: 0.04), but not the other way around (p-value: 0.07). Similarly, the null that government investment does not “Granger cause” real GDP (labor productivity) is strongly rejected at the 5 percent level (p-value: 0.01), but not the other way around (p-value: 0.82). In the case of the labor force the null can only be rejected at the 10 percent level, while it cannot be rejected in the reverse direction (p-value: 0.31); finally, in the case of the export vari- able the null cannot be rejected in either direction (p-values: 0.13 and 0.15, respectively). Of course, this test says nothing about “causation” e se, it only provides information about whether changes in one vari- able precede changes in another. 4Data for the FDI ratio were not available for Argentina prior to 1970 [6]. 5Government investment data (and government consumption data) contains a portion that is devoted to health and education expenditures, and should be treated separately as public (human) capital investment. However, to my knowledge, there are no disaggregated government expenditures on education or enrollment ratios for the period under review which I could use as proxies for the human capital variable. Copyright © 2012 SciRes. ME  M. D. RAMIREZ 731 affect output in a negative fashion. β5 is expected to have a positive sign, but for reasons alluded to above, its sign could also be negative. β6 is expected to be positive for reasons alluded to above, while β7 is anticipated to be negative for obvious reasons; finally, β8 is expected to be positive. 4. Unit Roots, Structural Breaks, and Cointegration Analysis Initially, conventional unit root tests (without a structural break) were undertaken for the variables in question given that it is well-known that macro time series data tend to exhibit a deterministic and/or stochastic trend that renders them non-stationary; i.e., the variables have means, variances, and covariances that are not time in- variant (see [24])). This study tested the variables in question for a unit root (non-stationarity) by using an Augmented Dickey-Fuller test (ADF) with a lag length automatically determined by the Schwarz Information Criterion (SIC). Before reporting the unit root tests, it is important to acknowledge that when dealing with historical time se- ries data for developing countries such as Argentina or Chile investigators are often constrained by the relatively small number of time series observations (usually in an- nual terms). This is the case in this study where the sam- ple size is just at the threshold level of 50 observations recommended by Granger and Newbold [25], which may compromise the power of the unit root (and cointegration) tests—not to mention distort the size or significance of the tests as well (see [26]). However, a growing literature contends that the power of unit root (and cointegration) tests depends on the length or time span of the data more than the mere number of observations in the sample. That is, for a given sample size n, the power of the test is greater when the time span is large. Thus, unit root or cointegration tests based on 45 observations over 45 years have considerable more power than those based on 100 observations over 100 days (see [27,28]).7 Table 2 presents the results of running an ADF test (one lag) for the variables in both level and differenced form under the assumption of a stochastic trend only, i.e., the test is run with a constant term and no time trend. It can be readily seen that all the variables in level form are nonstationary; i.e., they appear to follow a random walk with (positive) drift. In the case of first differences, Table 2. Argentina: Unit root tests for stationarity, sample period 1960-2010. Variables LevelsFirst Difference 5% Critical Value1 1% Critical Value ln(Y) –0.15 –5.39** –2.92 –3.57 ln(Y/L) –2.15 –5.07** –2.92 –3.57 lnL 1.30 –6.19** –2.92 –3.57 lnIp –1.54 –5.64** –2.92 –3.57 lnIg –1.52 –6.34** –2.92 –3.57 lnCg –1.66 –4.19** –2.92 –3.57 lnIf2 –2.51 –6.67** –2.92 –3.57 lnX –0.64 –6.89** –2.92 –3.57 1MacKinnon critical values for rejection of hypothesis of a unit root. 2Unit root tests for the FDI variable were undertaken for the 1970-2010 period. *Denotes significant at the 5 percent level; **denotes significance at the 1 percent level. Estimations undertaken with Eviews 7.2. however, the null hypothesis of non-stationarity is re- jected for all variables (except one) at least at the 5 per- cent level. Thus, the evidence presented suggests that the variables in question follow primarily a stochastic trend as opposed to a deterministic one, although the possibil- ity that for given subperiods they follow a mixed process cannot be rejected. Although suggestive, the conventional results reported in Table 2 may be misleading because the power of the ADF test may be significantly reduced when the station- ary alternative is true and a structural break is ignored (see [29]); that is, the investigator may erroneously con- clude that there is a unit root in the relevant series. In order to test for an unknown one-time break in the data, Zivot and Andrews [29] developed a data dependent al- gorithm that regards each data point as a potential break- date and runs a regression for every possible break-date sequentially. The test involves running three regressions (models): model A which allows for a one-time change in the intercept of the series; model B which permits a one-time change in the slope of the trend function; and model C which combines a one-time structural break in the intercept and trend [30]. Following the lead of Perron, most investigators report estimates for either models A and C, but in a relatively recent study Sen [31] has shown that the loss in test power (1 – β) is considerable when the correct model is C and researchers erroneously assume that the break-point occurs according to model A. On the other hand, the loss of power is minimal if the break date is correctly characterized by model A but in- vestigators erroneously use model C. In view of this, Table 3 reports the Zivot-Andrews (Z-A) one-break unit root test results for model C in level form along with the endogenously determined one-time break date for each time series. 7Hakkio and Rush ([28]: p. 579) contend that in nearly non-stationary time series “the frequency of observation plays a very minor role” in cointegration [and unit root] analysis because “cointegration is a long- run property, and thus we often need long spans of data to properly test it”. Similarly, Bahmani-Oskooee ([27]: p. 481) observes that in cointe- gration (and unit root) analysis using ann ual data over 30 years “is as good as using quarterly data over the same period”. To some degree, this addresses the strong analytical and policy inferences drawn from a relatively small sample size. Copyright © 2012 SciRes. ME  M. D. RAMIREZ 732 Table 3. Zivot-Andrews one-break unit root test, sample period 1960-2010. Variables Levels Break Year5% Critical Value 1% Critical Value Ln(Y) –3.37 1980 –5.08 –5.57 In(Y/L) –2.96 1980 –5.08 –5.57 lnL –4.36 2000 –5.08 –5.57 lnIp –4.43 1979 –5.08 –5.57 lnIg –3.28 1991 –5.08 -5.57 lnCg –2.69 1980 –5.08 –5.57 lnIf –4.38 1995 –5.08 –5.57 lnX –4.08 1973 –5.08 –5.57 Estimations undertaken with Eviews 7.2. As can be readily seen, the estimates reported in Table 3 for the series in level form are consistent with those in Table 2. For all of the series in question, Table 3 shows that the null hypothesis with a structural break in both the intercept and the trend cannot be rejected at the 5 percent level of significance. In addition, the Z-A test identifies endogenously the single most significant structural break in every time series. In view of space constraints, Figure 1 below shows the endogenously determined break-date for the labor productivity (lprod) series.8 Having shown that the variables are integrated of order one, I(1), it is necessary to determine whether there is at least one linear combination of these variables that is I(0). In other words, does there exist a stable and non-spurious (cointegrated) relationship among the regressors in each of the relevant specifications? This was done by using the cointegration method proposed by Johansen and Juselius [33]. The Johansen method was chosen over the one originally proposed by Engle and Granger [25] be- cause it is capable of determining the number of cointe- grating vectors for any given number of non-stationary series (of the same order), its application is appropriate in the presence of more than two variables, and more im- portant, the likehood ratio tests used in the procedure (unlike the ADF tests) have well- defined limiting distri- butions (see [34]). Table 4 below shows that the Johansen test for both the output and labor productivity equations show that the null hypothesis of no cointegrating vector can be rejected at least at the one percent level; i.e., there exists a unique linear combination of the I(1) variables that links them in a stable and long-run relationship.9 The signs of the Zivot-Andrews unit root test Date: 06/01/12 Time: 15:06 Sample: 1960-2010 Included observations: 51 Null hypothesis: LPROD has a unit root with a structural Break in both the intercept and trend Chosen lag length: 1 (maximum lags: 4) Chosen break point: 1980 t-Statistic Prob.* Zivot-Andrews test statistic –2.958391 0.117365 1% critical value: –5.57 5% critical value: –5.08 10% critical value: –4.82 * Probability values are calculated from a standard t-distribution. Figure 1. Break-date for labor productivity series. cointegrating equation are reversed because of the nor- malization process and they suggest that, in the long run, the private and government investment variables have a positive and highly significant effect on Argentine labor productivity. The relatively high private capital (invest- ment) elasticity reported in Table 4 is consistent with the extant empirical literature for developing (and developed) countries, and may be explained by FDI-induced or edu- cational externalities in the form of better managerial know-how and the transfer of superior technology that “inflate” the private investment elasticity estimate by a positive factor θ (see [17]). For example, a Ceteris pari- bus 10 percent increase in the ratio of private investment to GDP raises output per worker by an estimated 5.6 percent in the long run. Admittedly, the relatively high coefficient for the labor variable may also be due to measurement error, omitted variables such as human capital, and/or simultaneity bias. 8In a relatively recent paper, Lee and Stazicich [32] show that when there are, in fact, two structural breaks in the data, assuming errone- ously that there is only one can result in a loss of power of the test. 9Dummy variables were treated as exogenous variables in the cointe- gration test. The variables in question are also cointegrated with the inclusion of the export variable. There is only one unique cointegrating vector. The Max-eigenvalue test also reveals one cointegrating vector at the 5 percent level. Copyright © 2012 SciRes. ME  M. D. RAMIREZ 733 Table 4. Johansen cointegration rank test (Trace), 1960- 2010. A. Series: lnY, lnL, LnIg, and lnIp. Test assumption: No Linear deterministic trend in the data. Eigenvalue Likelihood Ratio 5% Critical Value No. of CE(s) 0.490 58.293 54.08 None 0.330 25.291 35.19 At most 1 0.088 5.633 20.26 At most 2 0.022 1.132 9.17 At most 3 B. Series: ln(Y/L), lnL, lnIg, and lnIp. Test assumption: No linear deterministic trend in the data. Eigenvalue Likelihood Ratio 5% Critical Value No. of CE(s) 0.534 66.786 54.08 None 0.363 30.193 35.19 At most 1 0.128 8.477 20.26 At most 2 0.039 1.912 9.17 At most 3 Normalized cointegrating vector; coefficients normalized on ln(Y/L) in parenthesis. Vector ln(Y/L) lnL lnIg lnIp Constant 1. 1.000 1.217 –0.557 –0.082 –4.407 (0.627) (0.104) (0.026) Note: Standard errors are in parenthesis. Estimation undertaken with Eviews 7.2. The lagged residual (error correction (EC) term) from the cointegrating equation, measuring the deviation be- tween the current level of output (labor productivity) and the level based on the long-run relationship, was included in a set of EC models. For simplicity, consider the EC model without lags (and dummy variables) given in Equation (6) below: 12 3 56 EC 4 1 gg ic ft yli ix (9) The coefficients (β = s) of the changes in the relevant variables represent short-run elasticities, while the coef- ficient, δ (< 0), on the lagged EC term obtained from the cointegrating equation in level form denotes the speed of adjustment back to the long-run relationship among the variables. To conserve space, Table 5 below presents results only for the labor productivity growth rate rela- tionship. The results for Equations (1)-(3) (for the longer time period without the FDI variable but with the inclu- sion of the export variable) suggest that the immediate impact of changes in the growth rate of the private in- vestment ratio is positive and statistically (and economi- Table 5. Argentina: Error correction model; Dependent variable is: (ΔlnYt - ΔlnLt), 1960-2010. OLS Regressions Variables(1) (2) (3) (4) (5) Constant 0.01 0.01 0.01 0.02 0.08 (1.10) (1.20) (1.55)* (1.91)*(1.94)* ΔlnLt–1 –0.42 –0.31 –0.43 –0.21 –0.23 (–3.69)** (–2.10)** (–3.26)* (–1.30)(–1.34) Δln(Ip/Y)t–1 0.07 0.08 0.07 0.12 0.11 (2.36)** (5.56)** (2.36)** (3.68)**(4.36)** Δln(Ig/Y)t–2 0.02 0.02 0.02 0.03 0.02 (2.82)** (1.94)** (3.22)** (2.15)**(2.12)** Δln(If/Y)t–3 --- --- --- 0.01 0.01 (3.36)**(2.77)** ΔlnXt–1 0.05 0.06 0.06 --- --- (2.26)** (2.21)** (2.22)** Δln(C/Y)t–1 --- –0.01 --- --- --- (1.13) ECTt–1 –0.18 –0.19 –0.15 –0.17 –0.11 (–2.20)** (–3.15)** (–2.20)** (–2.17)** (–2.33)** DUM1 --- –0.03 –0.04 --- –0.04 (–2.38)** (–4.66)** (–4.07)** DUM2 --- --- 0.03 --- --- (4.52)** Adj R2 0.64 0.70 0.73 0.70 0.75 S.E. 0.026 0.029 0.026 0.028 0.021 D.W. 1.88 2.09 2.05 1.90 2.02 Ramsey Test (p:0.26) (p:0.71) (p:0.87) (p:0.33) (p:0.97) AIC –4.26 –4.06 –4.30 –3.91 –4.02 SIC –3.89 –4.78 –3.92 –3.46 –3.53 Note: Figures in parentheses are t-ratios; asterisks denotes significance as follows: *at the 10 percent level and **at least at the 5 percent level. AIC denotes Akaike Information Criterion and SIC is the Schwarz Information Criterion. cally) significant, while lagged changes in employment growth have an (expected) negative impact on the growth rate in labor productivity. Turning to the public invest- ment variable, it can be readily seen that this variable has a positive and statistically significant effect when lagged one to two periods. This result is not altogether surpris- ing because the positive externalities generated from ad- ditions to the stock of roads, bridges and ports are likely Copyright © 2012 SciRes. ME  M. D. RAMIREZ 734 to affect labor productivity with a lag. The estimate for the government consumption variable, on the other hand, has a small negative and statistically insignificant effect on the rate of labor productivity growth, while the lagged export variable is positive and statistically significant, thus consistent with the export promotion hypothesis. The estimates for the dummy variables in Equations (2) and (3) suggest that the eco- nomic and financial crises that have buffeted Argentina have had a highly adverse effect on labor productivity growth, while the implementation of the Convertibility Plan had a highly positive and significant impact. The lagged EC terms are negative and statistically significant, suggesting, as in Equation (3), that a deviation from long-run labor productivity growth this period is cor- rected by 15 percent in the next year. The results in Ta- ble 5 are also robust to the exclusion and inclusion of the dummy variables. The Chow breakpoint test suggested that the null hypothesis of no structural break could not be rejected for the economic crises years of 1981 (p-value = 0.3762), 1989 (p-value = 0.6821), and 1995 (p-value = 0.9127). Finally, all equations were tested for serial correlation via the Breusch-Godfrey LM test and were found not to exhibit first order correlation at the 5 percent level of significance. In addition, the EC regres- sions were tested for specification error such as omitted variables and/or functional form via Ramsey’s Regres- sions Specification Error Test (RESET) and, as can be seen from the p-values reported in Table 5, we were un- able to reject the null hypothesis of no specification error at the 5 percent level of significance. Turning to the results with the FDI variable in Equa- tions (4) and (5), they suggest that inflows of FDI have a positive (lagged) and significant effect on labor produc- tivity growth (The export variable was excluded from these regressions because it is highly correlated with in- ward FDI flows, with a simple correlation coefficient of 0.854, thus essentially capturing the same effect). The other variables retain their statistical significance both with and without the dummy variables. Dummy variable 2 was excluded from Equation (5) because its effect is already being captured, in part, by the inclusion of the FDI variable; the consumption variable was excluded from these specifications as well because it was statisti- cally insignificant and, when it was included, it did not affect the estimates and significance of the other vari- ables, but it did lower somewhat the performance of the overall model, as measured by the Adj. R2 and AIC crite- rion. The EC models were also used to track the historical data on labor productivity growth in Argentina. Table 6 below reports selected Theil inequality coefficients ob- tained from historical simulations of the productivity growth Equations (3) and (5). In general, the predictive Table 6. Argentina: In-sample forecast evaluation for error correction models. Equation (3) Equation (5) Sample: 1960-2010 Sample: 1970-2010 Root Mean Squared Error (RMS) 0.0214 0.0231 Mean Absolute Error (MAE) 0.0170 0.0193 Theil Inequality Coefficient (TIC) 0.2530 0.2285 Bias Proportion (BP) 0.0000 0.0000 Variance Proportion (VP) 0.0619 0.0396 Covariance Proportion (CP) 0.9380 0.9630 Sample: 1960-1999 RMS 0.0242 --- MAE 0.0193 --- TIC 0.2743 --- BP 0.0089 --- VP 0.0057 --- CP 0.9853 --- Sample: 1970-2010 RMS 0.0220 --- MAE 0.0170 --- TIC 0.2609 --- BP 0.0000 --- VP 0.0689 --- CP 0.9310 --- Note: In-sample forecast evaluation estimates generated with EVIEWS 7.2. power of the model is considered to be relatively good if the coefficient is at or below 0.3. The results reported in Table 6 meet this performance criterion, particularly for Equation (5) (the root mean squared errors (RMS) are relatively low as well). The sensitivity analysis on the coefficients shows that changes in the initial or ending period did not alter appreciably the predictive power of Equation (3) (it was not possible to conduct a similar analysis for Equation (5) because of insufficient data points). Figures 2 and 3 corresponding to Equations (3) and (5), respectively, provide further visual evidence of the models’ ability to track the turning points in the ac- tual series. (DLPROD) refers to the actual data and DLPRODF denotes the forecast.) They show that the rate of labor productivity growth was, in general, positive during the decade of the nineties, highly erratic in the Copyright © 2012 SciRes. ME  M. D. RAMIREZ 735 Figure 2. Historical forecast of labor productivity growth, 1960-2010. Figure 3. Historical forecast of labor productivity growth, 1970-2010. seventies, and mostly negative during the lost decade of the eighties. In fact, during the first half of the nineties there was a sharp upward turn in output (labor productiv- ity) growth, punctuated by a sharp drop in 1995 as a re- sult of the tequila effect associated with the Mexican peso crisis of 1994-1995, followed, in turn, by three years of positive growth, only to culminate in a sharp contraction during the economic crisis years of 1999- 2002. Figure 2 also shows that since 2003 there has been an upward surge in labor productivity growth (with the ex- ception of the recession year of 2009) associated with both the administrations of Nestor Kirschner (2003-2007) and Cristina Fernandez de Kirschner (2007-2011). Weis- brot and Sandoval [10] attribute this favorable turn of events to a number of factors, not the least of which is the abandonment of the currency board, which had be- come a “strait-jacket with regard to monetary policy,” and the adoption of a stable and competitive real ex- change rate which has stimulated both the growth of ex- ports and import-competing industries. In addition, they contend that the government’s adoption of unorthodox (pro-growth) policies, in the form of an accommodating monetary policy and a boost in public investment spend- ing, have stimulated both internal demand and private capital formation (see Table 1). Finally, Weisbrot and Sandoval [10] emphasize the Kirschner administration’s firm stance vis-à-vis the IMF in negotiating and restruc- turing Argentina’s defaulted external debt in 2005, which has significantly reduced the country’s debt-service ratio from 52.2 percent of GDP in 2005 to 36.9 percent in 2008, thus freeing up scarce resources for its pro-growth policies (including public investment in economic and social infrastructure which, as revealed by Table 1, has grown steadily since 2004 as a proportion of GDP (see [16]: pp. 9-11; and [10]: pp. 14-16). 5. Conclusion Following the lead of the endogenous growth literature, this paper developed a simple model that explicitly in- cludes the impact of the public (or FDI) capital stock on the supply and demand sides of the economy. The dis- cussion showed that if significant complementarities are present between public (or FDI) and private capital (i.e., if a positive externality is present), then diminishing re- turns to the private inputs can be prevented or postponed indefinitely. The conceptual model laid the groundwork for the empirical analysis of labor productivity growth in the Argentine case for the 1960-2010 period in Sections 3 and 4. Several key findings were obtained. First, Zivot-Andrews unit root tests in the presence of one-time structural breaks indicate that the null hypothe- sis of non-stationarity cannot be rejected for the relevant series in level form, but can be rejected in first differ- ences. This represents a significant contribution to the extant literature which does not address the low power of conventional unit root tests in the presence of structural breaks. Second, the Johansen cointegration method re- vealed that the null hypothesis of no cointegration can be rejected at the five percent level, thus suggesting that the I(1) variables have a unique and stable relationship that keeps them in proportion to one another in the long run. This is an important finding because previous empirical studies have applied the OLS method directly to nonsta- tionary variables in level form, thus generating spurious or misspecified regressions. Third, the cointegrating equations were used to generate a set of EC models of the variables included in the output and labor productiv- ity relationships. As the theory predicts, the EC models have negative and statistically significant error correction terms, suggesting that short-run deviations from long-run labor productivity (output) growth are corrected in sub- sequent periods. Fourth, the EC estimates indicated that the growth rate of private and public investment as a Copyright © 2012 SciRes. ME  M. D. RAMIREZ 736 proportion of GDP, as well as the growth rate in exports and the FDI ratio, have a positive and statistically sig- nificant effect on the growth rate of labor productivity, while the growth rate in the labor force has a negative impact. Fifth, the reported Theil inequality coefficients for the selected EC models suggested that they were able to track and simulate the turning points of the historical series in labor productivity relatively well. Finally, the EC model estimates showed that during the decade of the nineties the rate of labor productivity growth was mostly positive, while during the decade of the seventies the annual estimated rate of output growth became erratic, culminating in a marked decrease (often negative rates) during the decade of the eighties—the so-called lost decade of development. The labor produc- tivity growth estimates for the first half of the nineties did reveal a robust increase, thereby suggesting that the currency board’s taming of inflationary pressures and the opening of the economy to foreign direct investment had a positive effect. During the second half of the 2000s, there has been an upsurge in labor productivity growth which has coincided with the promotion by both Kir- schner administrations of pro-growth policies, including a significant increase in public investment as a propor- tion of GDP which averaged 3 percent during the 2005- 2010 period—more than triple its average during the 2000-2004 interval. From a policy standpoint, the findings in this paper are important because they suggest that cash-strapped gov- ernments of Latin America, such as the Argentine one, can maximize the growth potential of their economies by directing scarce resources to investments in economic and social infrastructure and away from collective con- sumption goods that compete directly with those pro- vided by the private sector. The findings also suggest that attracting bolted down capital in the form of FDI inflows, as well as promoting exports, are likely to have a benefi- cial effect on labor productivity growth. These invest- ments, through a positive externality effect, are likely to increase the marginal productivity of the private inputs directly (as well as indirectly), thereby increasing private investment, output, and labor productivity. REFERENCES [1] B. Werner, P. Elosegui and A. Gallo, “The Achievements and Failures of Argentina’s Neo-Liberal Economic Poli- cies,” Working Paper, University of Illinois, Urbana, 2002. [2] M. Weisbrot, A. Cibils and D. Kar, “Argentina Since Default: The IMF and the Depression,” Briefing Paper, Center for Economic and Policy Research, 2002, pp. 1- 25. [3] United Nations, “World Investment Report, 2007,” United Nations, Geneva, 2007. [4] ECLAC, “Statistical Yearbook for Latin American and the Caribbean,” United Nations, Santiago, 2010. [5] J. L. Calva, “Market and the State in the Mexican Econ- omy: A Retrospective and Future Trends,” Challenges of Economic Development, Vol. 28, 1997, pp. 71-102. [6] J. L. Maitan and M. Keitel, “Argentina: Sustainable Out- put Growth after the Collapse,” Working Paper, Buenos Aires: Direccion Nacional de Politicas Macroeconomicas, Ministerio de Economia, 2003. [7] J. Stiglitz, “Whither Reform? Towards a New Agenda for Latin America,” Cepal Review, Vol. 80, 2003, pp. 7-38. [8] M. Pastor, “Current Account Deficits and Debt Accumu- lation in Latin America Debate and Evidence,” Journal of Development Economics, Vol. 31, No. 1, 1989, pp. 77-97. doi:10.1016/0304-3878(89)90032-1 [9] L. Taylor, “The Revival of the Liberal Creed—The IMF and the World Bank in Globalized Economy,” World Development, Vol. 25, 1997, pp. 145-152. doi:10.1016/S0305-750X(96)00117-9 [10] M. Weisbrot and L. Sandoval, “Argentina’s Economic Recovery: Policy Choices and Implications,” Briefing Paper, Center for Economic and Policy Research, 2007, pp. 1-20. [11] J. M. Albala-Bertrand and E. C. Mamatzakis, “Is Public Infrastructure Productive? Evidence from Chile,” Applied Economic Letters, Vol. 8, 2001, pp. 195-199. doi:10.1080/13504850150504595 [12] E. Cardoso, “Private Investment in Latin America,” Eco- nomic Development and Cultural Change, Vol. 41, No. 4, 1993, pp. 833-848. doi:10.1086/452050 [13] R. Ram, “Productivity of Public and Private Investment in Developing Countries: A Broad International Perspec- tive,” World Development, Vol. 24, No. 8, 1996, pp. 1373- 1378. doi:10.1016/0305-750X(96)00036-8 [14] M. D. Ramirez, “Does Public Investment Enhance Pro- ductivity Growth in Mexico? A Cointegration Analysis,” Eastern Economic Journal, Vol. 24, No. 1, 1998, pp. 63- 82. [15] T. Killick, “IMF Programmes in Developing Countries,” Routledge, London, 1995. doi:10.4324/9780203400357 [16] M. Weisbrot, “The Argentine Success Story and Its Im- plications,” Briefing Paper, Center for Economic Policy and Research, 2011, pp. 1-23. [17] L. R. De Mello Jr., “Foreign Direct Investment in Devel- oping Countries and Growth: A Selective Survey,” Jour- nal of Development Studies, Vol. 34, No. 1, 1997, pp. 1- 34. doi:10.1080/00220389708422501 [18] C. I. Jones, “Introduction to Economic Growth,” W. W. Norton & Company, Inc., New York, 1998. [19] J. Green and D. Villanueva, “Private Investment in De- veloping Countries: An Empirical Analysis,” IMF Staff Papers, Vol. 38, No. 1, 1991, pp. 33-58. doi:10.2307/3867034 [20] A. Lin and Y. Steven,. “Government Spending and Eco- nomic Growth,” Applied Economics, Vol. 26, No. 4, 1994, pp. 83-85. doi:10.1080/00036849400000064 [21] W. Roberts and J. Alexander, “The Investment-Output Copyright © 2012 SciRes. ME  M. D. RAMIREZ Copyright © 2012 SciRes. ME 737 Ratio in Growth Regressions,” Applied Economic Letters, Vol. 1, No. 5, 1994, pp. 74-76. doi:10.1080/135048594358177 [22] R. Ram and K. H. Zhang, “Foreign Direct Investment and Economic Growth: Evidence from Cross Country Data for the 1990s,” Economic Development and Cultural Change, Vol. 51, No. 1, 2002, pp. 205-215. doi:10.1086/345453 [23] S. S. Everhart and M. A. Sumlinski, “Trends in Private Investment Spending in Developing Countries: Statistics for 1970-2000,” Working Paper No. 44, The World Bank, International Finance Corporation, Washington, 2001. [24] R. F. Engle and C. W. J. Granger, “Cointegration and Error Correction: Representation, Estimation, and Test- ing,” Econometrica, Vol. 55, No. 2, 1987, pp. 251-276. doi:10.2307/1913236 [25] C. W. J. Granger and P. Newbold, “Spurious Regression in Econometrics,” Journal of Econometrics, Vol. 2, No. 2, 1974, pp. 111-120. doi:10.1016/0304-4076(74)90034-7 [26] W. W. Charemza and D. F. Deadman, “New Directions in Econometric Practice: General to Specific Modelling, Cointegration and Vector Autoregression,” Edward Elgar Publishers, Cheltenham, 1997. [27] M. Bahmani-Oskooee, “Decline in the Iranian Rial during the Post-Revolutionary Period: A Productivity Approach,” Journal of Developing Areas, Vol. 30, No. 4, 1996, pp. 477-492. [28] C. S. Hakkio and M. Rush, “Cointegration: How Short Is the Long Run?” Journal of International Money and Fi- nance, Vol. 10, No. 4, 1991, pp. 571-581. doi:10.1016/0261-5606(91)90008-8 [29] E. Zivot and D. Andrews, “Further Evidence on the Great Crash, the Oil Price Shock, and the Unit Root Hypothe- sis,” Journal of Business and Economic Statistics, Vol. 10, 1992, pp. 251-252. [30] M. Waheed, A. Tasneen and G. Saghir, “Structural Breaks and Unit Roots: Evidence from Pakistani Macroeconomic Time Series,” Paper No. 1797, Munich Personal RePec Archive, 2006, pp. 1-18. [31] A. Sen, “On Unit Root Tests When the Alternative Is a Trend Break Stationary Process,” Journal of Business and Economic Statistics, Vol. 21, No.1, 2003, pp. 174-184. doi:10.1198/073500102288618874 [32] J. Lee and M. C. Strazicich, “Minimum Lagrange Multi- plier Unit Root Test with Two Structural Breaks,” The Review of Economics and Statistics, Vol. 85, No. 4, 2003, pp. 1082-1089. doi:10.1162/003465303772815961 [33] S. Johansen and K. Juselius, “Maximum Likelihood Es- timation and Inference on Cointegration with Applica- tions to the Demand for Money,” Oxford Bulletin of Economics and Statistics, Vol. 52, No. 2, 1990, pp. 169- 210. doi:10.1111/j.1468-0084.1990.mp52002003.x [34] R. Harris, “Using Cointegration Analysis in Econometric Modelling,” Prentice-Hall, New York, 1995.

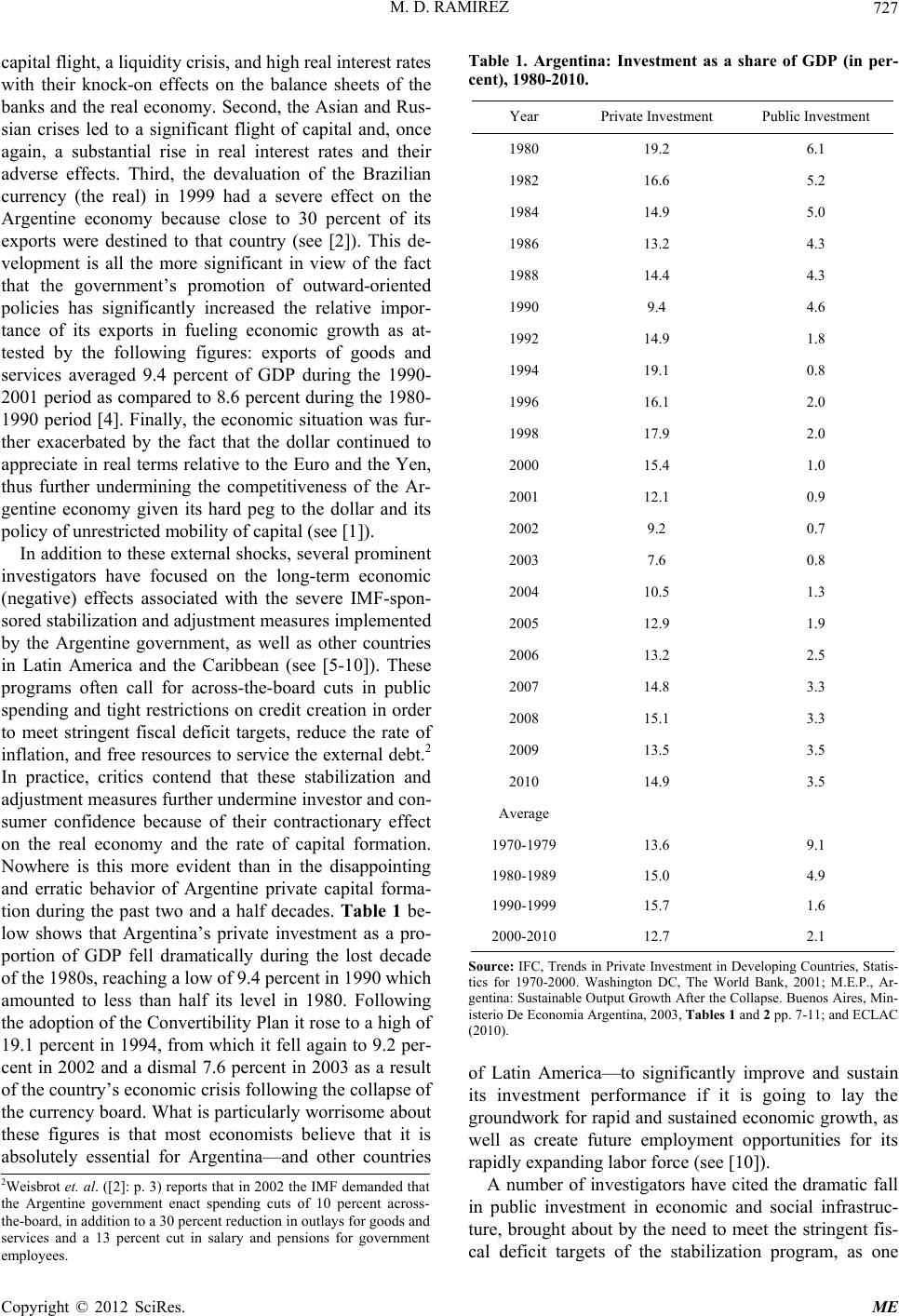

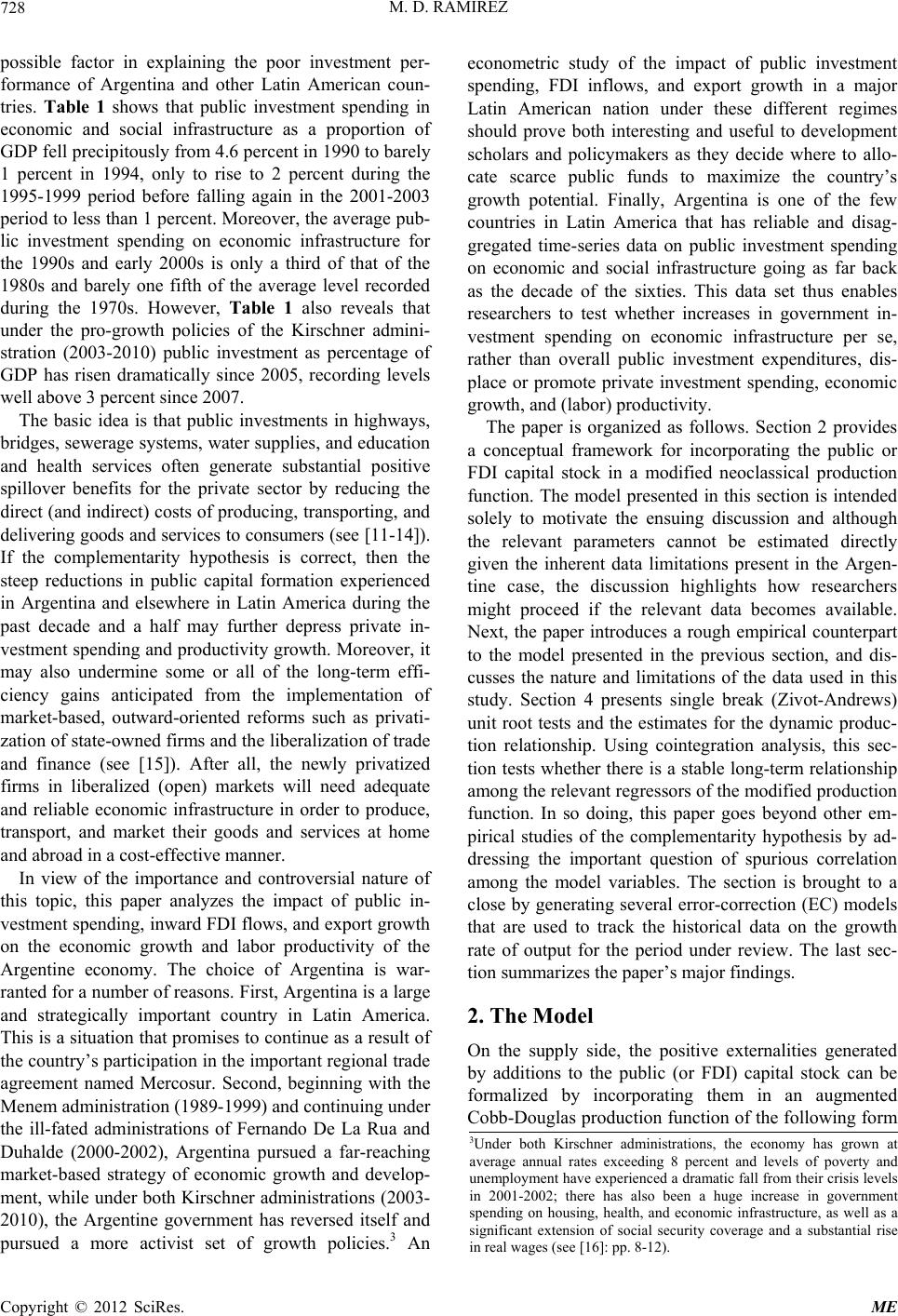

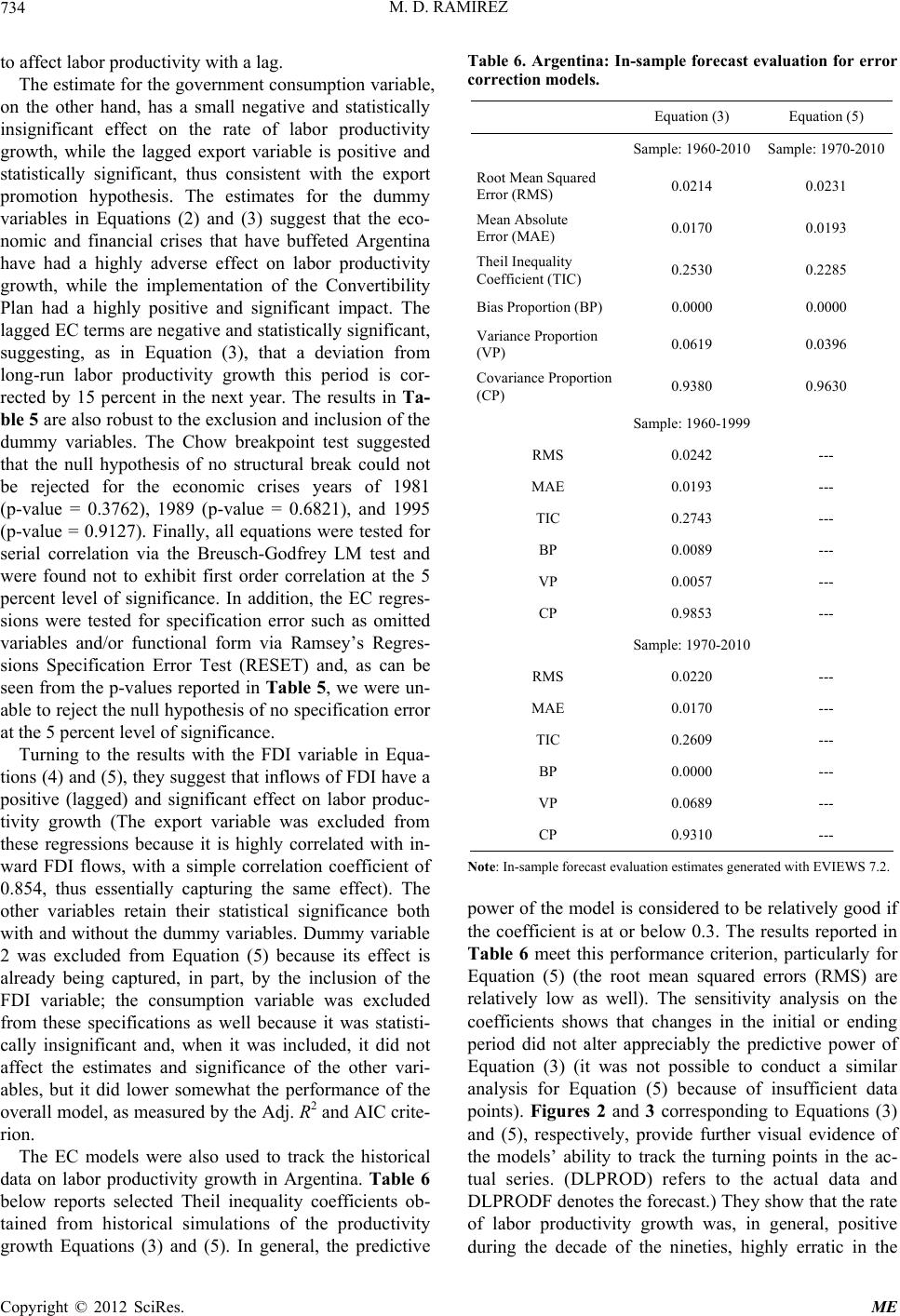

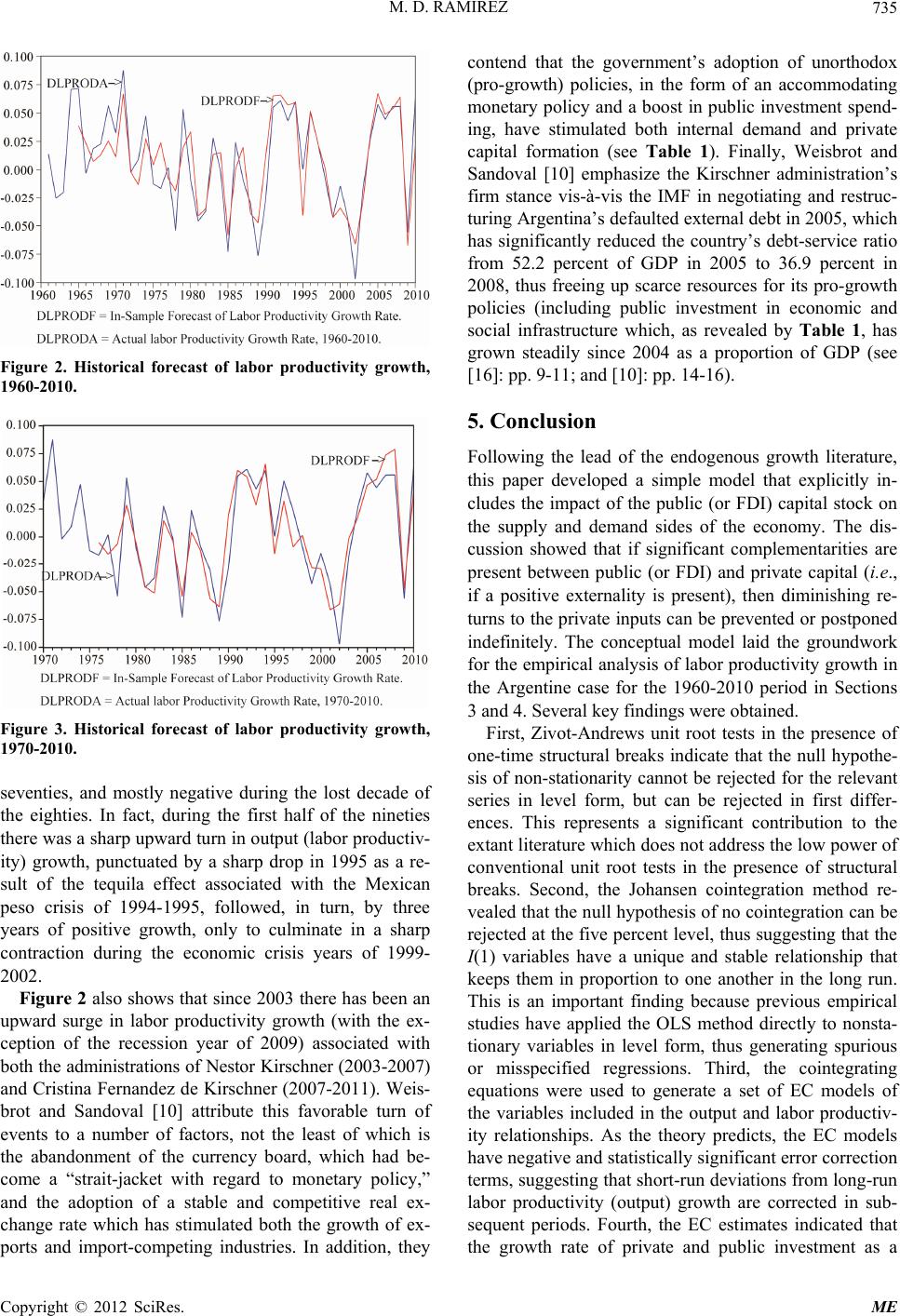

|