S. LIM

672

a local currency and mF denotes a fraction of private agents

who are endowed with a foreign currency. So it follows

that M = mL + mF. mG is the fraction of agents who are

goods producers. Hence, at any point in time, the total po-

pulation can be written as:

1

Lt Ft

mmm

π

max

max π

GL LG

Gt (1)

A key feature of the model is that the government has

a policy tool in the exchange market. There is a fraction

of money changers which are set up by the government

in the market so that private agents can exchange their

currency from one to another. We can think of this as the

government establishes exchange booths throughout the

economy or the government licenses exchange businesses

which will operate in a perfectly competitive market. We

assume that the exchange spread between the two curren-

cies is zero1. That is, the two currencies are exchanged

one for one with no extra cost incurred by the private agents.

F is the fraction of money changers who hold foreign

currency and exchange for local currency.

L is the faction

of local currency changers. Once exchange occurs, a for-

eign currency changer becomes a local one and, vice versa.

We also can think of these fractions as the probabilities

that a private agent can get her currency converted so 0

i 1 where i = L, F. Assume that money changers do not

enter the goods market, so they do not trade with the goods

holders.

History of each agent is private information. Informa-

tion that a good holder values a local or foreign currency

is private to the money holders; therefore, currency ex-

changes do not take place before the matching process.

On the other hand, because of the availability of instant

exchange with no cost in the market, it is deemed unnec-

essary for a money holder to exchange his currency be-

fore the matching process. The matching process follows

Poisson with constant arrival rate of α.

The acceptability of currency is determined endogenou-

sly. Π where 0 Π 1 is probability that a random goods

holder accept the foreign currency in trade and π repre-

sents the best response of individual goods holder to an

offer of the foreign currency. Φ where 0 Φ 1 is prob-

ability that a random goods holder accepts the local cur-

rency in trade and

represent the best response of indi-

vidual goods holder to an offer of the local currency. Given

symmetry, the Nash equilibrium is π = Π and

= Φ.

The analysis focused here is restricted to steady-state

equilibria where strategies and all aggregate variables are

constant over time. In such equilibria, all agents are hold-

ing either one unit of money or nothing (i.e. being able to

produce one unit of consumption goods), at the end of each

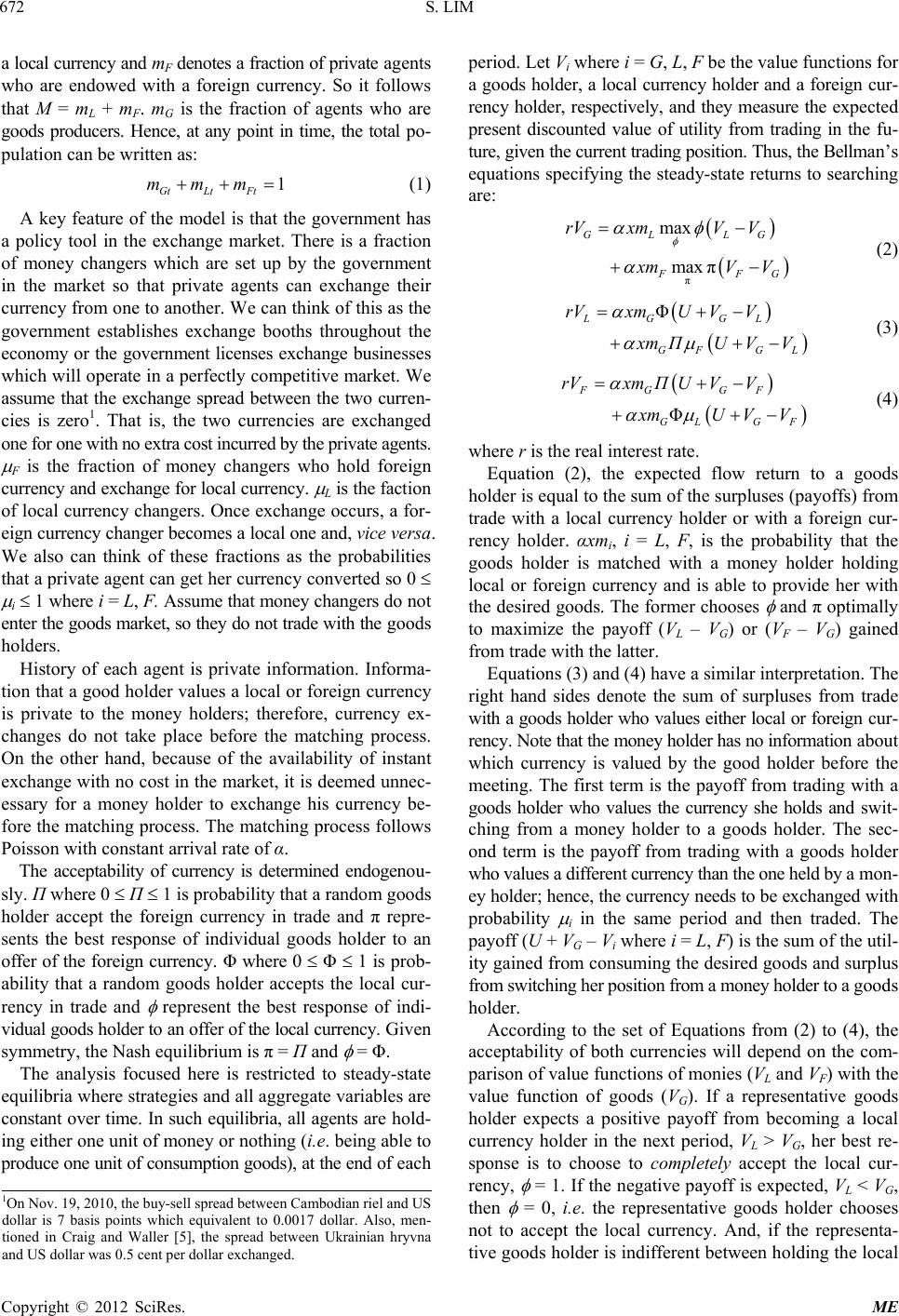

period. Let Vi where i = G, L, F be the value functions for

a goods holder, a local currency holder and a foreign cur-

rency holder, respectively, and they measure the expected

present discounted value of utility from trading in the fu-

ture, given the current trading position. Thus, the Bellman’s

equations specifying the steady-state returns to searching

are:

FG

rVxmV V

mVV

(2)

Φ

LG GL

GF GL

rVxmU VV

xm ΠUV V

(3)

Φ

FG GF

GLG F

rVxm ΠUV V

mUVV

(4)

where r is the real interest rate.

Equation (2), the expected flow return to a goods

holder is equal to the sum of the surpluses (payoffs) from

trade with a local currency holder or with a foreign cur-

rency holder. αxmi, i = L, F, is the probability that the

goods holder is matched with a money holder holding

local or foreign currency and is able to provide her with

the desired goods. The former chooses

and π optimally

to maximize the payoff (VL – VG) or (VF – VG) gained

from trade with the latter.

Equations (3) and (4) have a similar interpretation. The

right hand sides denote the sum of surpluses from trade

with a goods holder who values either local or foreign cur-

rency. Note that the money holder has no information about

which currency is valued by the good holder before the

meeting. The first term is the payoff from trading with a

goods holder who values the currency she holds and swit-

ching from a money holder to a goods holder. The sec-

ond term is the payoff from trading with a goods holder

who values a different currency than the one held by a mon-

ey holder; hence, the currency needs to be exchanged with

probability

i in the same period and then traded. The

payoff (U + VG – Vi where i = L, F) is the sum of the util-

ity gained from consuming the desired goods and surplus

from switching her position from a money holder to a goods

holder.

According to the set of Equations from (2) to (4), the

acceptability of both currencies will depend on the com-

parison of value functions of monies (VL and VF) with the

value function of goods (VG). If a representative goods

holder expects a positive payoff from becoming a local

currency holder in the next period, VL > VG, her best re-

sponse is to choose to completely accept the local cur-

rency,

= 1. If the negative payoff is expected, VL < VG,

then

= 0, i.e. the representative goods holder chooses

not to accept the local currency. And, if the representa-

tive goods holder is indifferent between holding the local

1On Nov. 19, 2010, the buy-sell spread between Cambodian riel and US

dollar is 7 basis points which equivalent to 0.0017 dollar. Also, men-

tioned in Craig and Waller [5], the spread between Ukrainian hryvna

and US dollar was 0.5 cent per dollar exchanged.

Copyright © 2012 SciRes. ME