K.-H. CHOI ET AL.

588

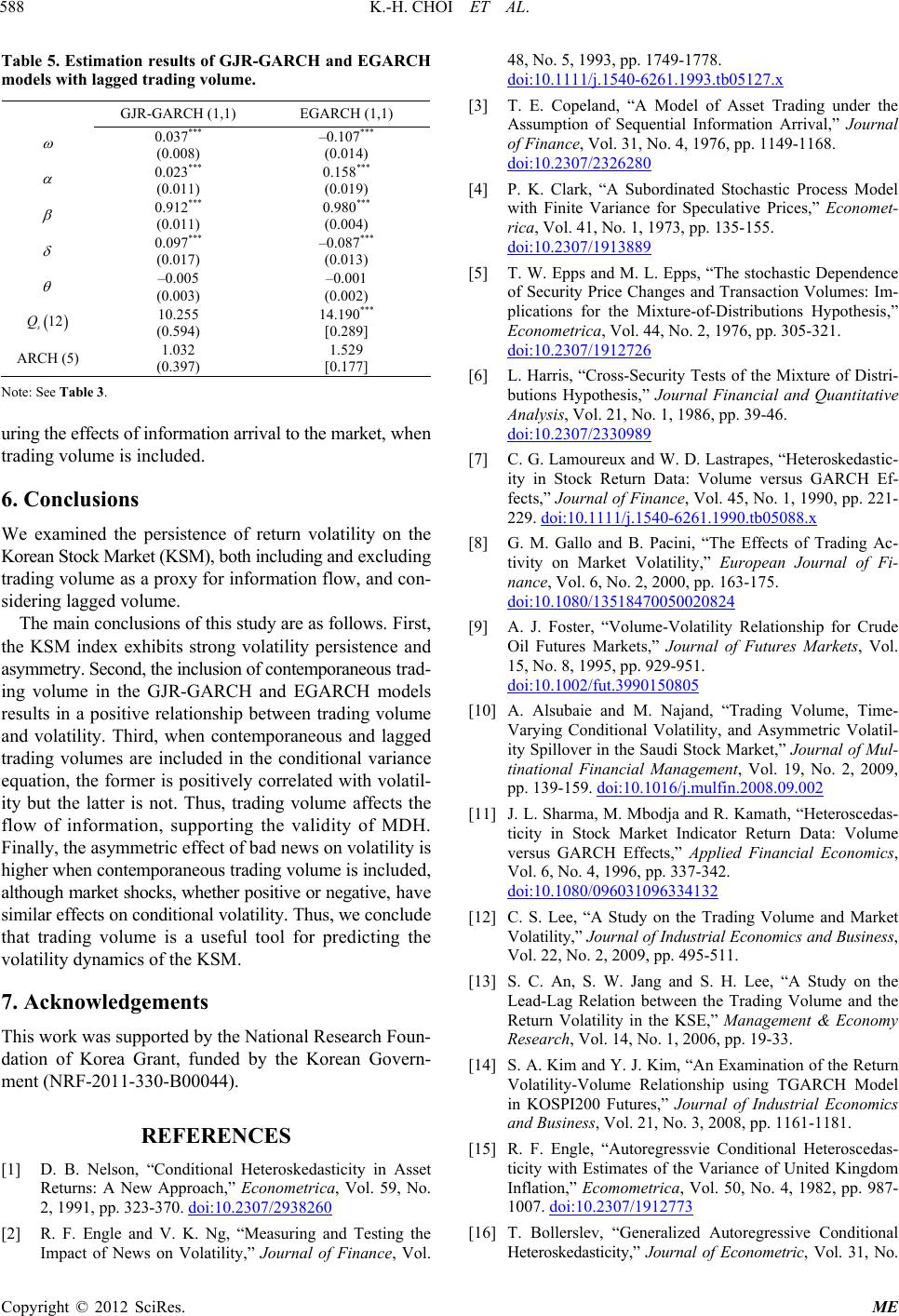

Table 5. Estimation results of GJR-GARCH and EGARCH

models with lagged trading volume.

GJR-GARCH (1,1) EGARCH (1,1)

0.037***

(0.008)

–0.107***

(0.014)

0.023***

(0.011)

0.158***

(0.019)

0.912***

(0.011)

0.980***

(0.004)

0.097***

(0.017)

–0.087***

(0.013)

–0.005

(0.003)

–0.001

(0.002)

12

s

Q 10.255

(0.594)

14.190***

[0.289]

ARCH (5) 1.032

(0.397)

1.529

[0.177]

Note: See Table 3.

uring the effects of information arrival to the market, when

trading volume is included.

6. Conclusions

We examined the persistence of return volatility on the

Korean Stock Market (KSM), both including and excluding

trading volume as a proxy for information flow, and con-

sidering lagged volume.

The main conclusions of this study are as follows. First,

the KSM index exhibits strong volatility persistence and

asymmetry. Second, the inclusion of contemporaneous trad-

ing volume in the GJR-GARCH and EGARCH models

results in a positive relationship between trading volume

and volatility. Third, when contemporaneous and lagged

trading volumes are included in the conditional variance

equation, the former is positively correlated with volatil-

ity but the latter is not. Thus, trading volume affects the

flow of information, supporting the validity of MDH.

Finally, the asymmetric effect of bad news on volatility is

higher when contemporaneous trading volume is included,

although market shocks, whether positive or negative, have

similar effects on conditional volatility. Thus, we conclude

that trading volume is a useful tool for predicting the

volatility dynamics of the KSM.

7. Acknowledgements

This work was supported by the National Research Foun-

dation of Korea Grant, funded by the Korean Govern-

ment (NRF-2011-330-B00044).

REFERENCES

[1] D. B. Nelson, “Conditional Heteroskedasticity in Asset

Returns: A New Approach,” Econometrica, Vol. 59, No.

2, 1991, pp. 323-370. doi:10.2307/2938260

[2] R. F. Engle and V. K. Ng, “Measuring and Testing the

Impact of News on Volatility,” Journal of Finance, Vol.

48, No. 5, 1993, pp. 1749-1778.

doi:10.1111/j.1540-6261.1993.tb05127.x

[3] T. E. Copeland, “A Model of Asset Trading under the

Assumption of Sequential Information Arrival,” Journal

of Finance, Vol. 31, No. 4, 1976, pp. 1149-1168.

doi:10.2307/2326280

[4] P. K. Clark, “A Subordinated Stochastic Process Model

with Finite Variance for Speculative Prices,” Economet-

rica, Vol. 41, No. 1, 1973, pp. 135-155.

doi:10.2307/1913889

[5] T. W. Epps and M. L. Epps, “The stochastic Dependence

of Security Price Changes and Transaction Volumes: Im-

plications for the Mixture-of-Distributions Hypothesis,”

Econometrica, Vol. 44, No. 2, 1976, pp. 305-321.

doi:10.2307/1912726

[6] L. Harris, “Cross-Security Tests of the Mixture of Distri-

butions Hypothesis,” Journal Financial and Quantitative

Analysis, Vol. 21, No. 1, 1986, pp. 39-46.

doi:10.2307/2330989

[7] C. G. Lamoureux and W. D. Lastrapes, “Heteroskedastic-

ity in Stock Return Data: Volume versus GARCH Ef-

fects,” Journal of Finance, Vol. 45, No. 1, 1990, pp. 221-

229. doi:10.1111/j.1540-6261.1990.tb05088.x

[8] G. M. Gallo and B. Pacini, “The Effects of Trading Ac-

tivity on Market Volatility,” European Journal of Fi-

nance, Vol. 6, No. 2, 2000, pp. 163-175.

doi:10.1080/13518470050020824

[9] A. J. Foster, “Volume-Volatility Relationship for Crude

Oil Futures Markets,” Journal of Futures Markets, Vol.

15, No. 8, 1995, pp. 929-951.

doi:10.1002/fut.3990150805

[10] A. Alsubaie and M. Najand, “Trading Volume, Time-

Varying Conditional Volatility, and Asymmetric Volatil-

ity Spillover in the Saudi Stock Market,” Journal of Mul-

tinational Financial Management, Vol. 19, No. 2, 2009,

pp. 139-159. doi:10.1016/j.mulfin.2008.09.002

[11] J. L. Sharma, M. Mbodja and R. Kamath, “Heteroscedas-

ticity in Stock Market Indicator Return Data: Volume

versus GARCH Effects,” Applied Financial Economics,

Vol. 6, No. 4, 1996, pp. 337-342.

doi:10.1080/096031096334132

[12] C. S. Lee, “A Study on the Trading Volume and Market

Volatility,” Journal of Industrial Economics and Business,

Vol. 22, No. 2, 2009, pp. 495-511.

[13] S. C. An, S. W. Jang and S. H. Lee, “A Study on the

Lead-Lag Relation between the Trading Volume and the

Return Volatility in the KSE,” Management & Economy

Research, Vol. 14, No. 1, 2006, pp. 19-33.

[14] S. A. Kim and Y. J. Kim, “An Examination of the Return

Volatility-Volume Relationship using TGARCH Model

in KOSPI200 Futures,” Journal of Industrial Economics

and Business, Vol. 21, No. 3, 2008, pp. 1161-1181.

[15] R. F. Engle, “Autoregressvie Conditional Heteroscedas-

ticity with Estimates of the Variance of United Kingdom

Inflation,” Ecomometrica, Vol. 50, No. 4, 1982, pp. 987-

1007. doi:10.2307/1912773

[16] T. Bollerslev, “Generalized Autoregressive Conditional

Heteroskedasticity,” Journal of Econometric, Vol. 31, No.

Copyright © 2012 SciRes. ME