T. Q. YUN

524

respectively; nS and nP are the numbers of selling and

purchasing shares respectively; f is dealing fee per share.

s is the price of selling shares, which, for SMaP-

Mii, has a maximum changing rate at time t = 0; while

p is the price of purchasing shares, which, for

SMaPMi, has a minimum changing rate at time t = 0.

,0px

,0px

,pxt

,pxt

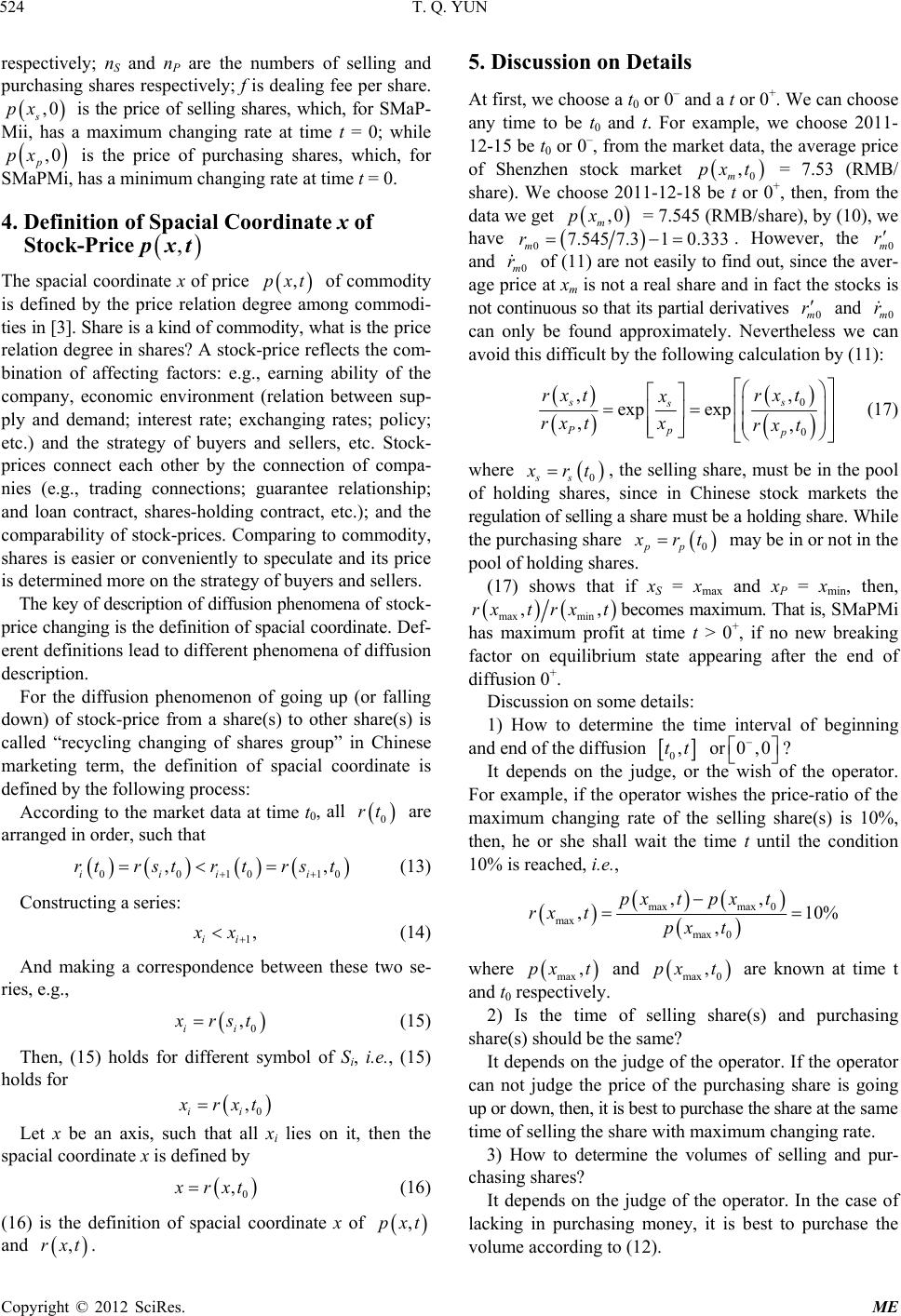

4. Definition of Spacial Coordinate x of

Stock-Price

The spacial coordinate x of price of commodity

is defined by the price relation degree among commodi-

ties in [3]. Share is a kind of commodity, what is the price

relation degree in shares? A stock-price reflects the com-

bination of affecting factors: e.g., earning ability of the

company, economic environment (relation between sup-

ply and demand; interest rate; exchanging rates; policy;

etc.) and the strategy of buyers and sellers, etc. Stock-

prices connect each other by the connection of compa-

nies (e.g., trading connections; guarantee relationship;

and loan contract, shares-holding contract, etc.); and the

comparability of stock-prices. Comparing to commodity,

shares is easier or conveniently to speculate and its price

is determined more on the strategy of buyers and sellers.

The key of description of diffusion phenomena of stock-

price changing is the definition of spacial coordinate. Def-

erent definitions lead to different phenomena of diffusion

description.

For the diffusion phenomenon of going up (or falling

down) of stock-price from a share(s) to other share(s) is

called “recycling changing of shares group” in Chinese

marketing term, the definition of spacial coordinate is

defined by the following process:

According to the market data at time t0, all

0

rt are

arranged in order, such that

1010

,

i i

rs t

1,

ii

00

,

ii

rtrstrt (13)

Constructing a series:

x

0

,

ii

(14)

And making a correspondence between these two se-

ries, e.g.,

rs t (15)

Then, (15) holds for different symbol of Si, i.e., (15)

holds for

0

,

ii

rxt

0

,

Let x be an axis, such that all xi lies on it, then the

spacial coordinate x is defined by

rxt (16)

(16) is the definition of spacial coordinate x of

5. Discussion on Details

,pxt

and

,rxt

,pxt

.

At first, we choose a t0 or 0– and a t or 0+. We can choose

any time to be t0 and t. For example, we choose 2011-

12-15 be t0 or 0–, from the market data, the average price

of Shenzhen stock market 0m = 7.53 (RMB/

share). We choose 2011-12-18 be t or 0+, then, from the

data we get

,0

m

px = 7.545 (RMB/share), by (10), we

have

7.545 7.310.333

m

r r

0. However, the 0m

and 0m of (11) are not easily to find out, since the aver-

age price at xm is not a real share and in fact the stocks is

not continuous so that its partial derivatives 0m and 0m

can only be found approximately. Nevertheless we can

avoid this difficult by the following calculation by (11):

r

&

rr

&

0

0

,,

exp exp

,,

ss

s

Pp p

rxt rxt

x

rx txrx t

(17)

0ss

where rt

0pp

, the selling share, must be in the pool

of holding shares, since in Chinese stock markets the

regulation of selling a share must be a holding share. While

the purchasing share

rt may be in or not in the

pool of holding shares.

(17) shows that if xS = xmax and xP = xmin, then,

maxmin becomes maximum. That is, SMaPMi

has maximum profit at time t > 0+, if no new breaking

factor on equilibrium state appearing after the end of

diffusion 0+.

,,rxtrxt

Discussion on some details:

1) How to determine the time interval of beginning

and end of the diffusion

0

It depends on the judge, or the wish of the operator.

For example, if the operator wishes the price-ratio of the

maximum changing rate of the selling share(s) is 10%,

then, he or she shall wait the time t until the condition

10% is reached, i.e.,

,tt 0,

0

or?

maxmax 0

max

max 0

,,

,10%

,

px tpx t

rx tpx t

,px t

max and

where

max 0

,pxt are known at time t

and t0 respectively.

2) Is the time of selling share(s) and purchasing

share(s) should be the same?

It depends on the judge of the operator. If the operator

can not judge the price of the purchasing share is going

up or down, then, it is best to purchase the share at the same

time of selling the share with maximum changing rate.

3) How to determine the volumes of selling and pur-

chasing shares?

It depends on the judge of the operator. In the case of

lacking in purchasing money, it is best to purchase the

volume according to (12).

Copyright © 2012 SciRes. ME