iBusiness, 2012, 4, 198-207 http://dx.doi.org/10.4236/ib.2012.43025 Published Online September 2012 (http://www.SciRP.org/journal/ib) Empirical Analysis of Interactive Control’s Effectiveness: A Parent-Subsidiary Company’s Interdependence Perspective Biao Luo1, Jie-Jie Yu1, Hong-Mei Ji2 1School of Management, University of Science & Technology of China, Hefei, China; 2School of Business, Anhui University, Hefei, China. Email: yujj@mail.ustc.edu.cn Received July 1st, 2012; revised July 30th, 2012; accepted August 9th, 2012 ABSTRACT Due to the increasingly complex business environment and the principal-agent relationship, the enterprise group should establish a control system to prevent agency risk. Besides traditional system control, the parent company tends to adopt an interactive control including decentralized decision making, process communication and target incentive to guide and govern the subsidiaries. As an elastic control mechanism, the interactive control’s effectiveness could be influenced by the resources dependence relationship which is objective existence between the parent and subsidiary company. Based on the classical literature review, this study analyzes the effects of interaction control to the performance (“inter- active control → performance”) and the interdependence’s regulating role by a total sample and a multiple-group struc- tural equation analysis based on Chinese groups’ data, the results show that the interactive control could improve the subsidiaries’ performance, but different control process has its particular applicable interdependence situation. In the conclusions, we proposed some suggestions to promote the interactive control’s effectiveness in the enterprise group’s management practices. Keywords: Enterprise Group; Interdependence; Interactive Control; Performance 1. Introduction An enterprise group and its subsidiaries can be regard as a “community of interests” based on a common strategic targets and interests, as the management organizations of a enterprise group, the parent company has two basic functions—“loss prevention” and “value creation”, on the one hand, the parent company must keep each sub- sidiary in control for the possible loss which is brought by the subsidiary managers’ self-interested behaviors under the principal-agent risk [1], on the other hand, the parent company should achieve the value appreciation through coordination and integration of the group’s ad- vantage resources [2]. However, there must be a manage- ment control system to support these functions’ realiza- tion, the system control is often used in a bureaucracy, but now, the subsidiary’s position has had a change, for example, many subsidiaries have become the group’s strategic leaders, so as to there also need an interactive control mechanism which takes the interaction between headquarter-subsidiary company’s managers as carrier. As the essential approach for information transfer and collaborative management, interactive control deeply affects resource synergy efficiency and effectiveness [3]. Therefore, it’s a very meaningful research subject to ex- plore how to proper use and dynamic adjustment the in- teractive control mechanisms. In fact, many scholars have recognized the importance of interactive control, but different scholars have differ- ent focus on the question about how to improve its effec- tiveness. There are two main research directions, first, focus only on the effectiveness of different interaction control channels, such as different carriers (electronic or face-to-face interaction) have different results [4]; second, concerns the matching between some interpersonal char- acteristics and interactive control, such as the influence of trust [5]. But it is a pity that the directions both about the subjective relationships among the participants, and the objective relationships between the parent and sub- sidiary company is ignored, that is resource dependency between the parent and subsidiary company (“interde- pendence” for short) [6]. The interdependence is a de- manding relations due to the knowledge, brands, equip- ment and other tangible or intangible advantage re- sources [7]. Indeed, it usually determines the synergetic needs of internal resources, while these needs will affect Copyright © 2012 SciRes. IB  Empirical Analysis of Interactive Control’s Effectiveness: A Parent-Subsidiary Company’s Interdependence Perspective 199 the parent company’s interactive enthusiasm. Meanwhile, the interdependence could determine the position of a certain subsidiary with which as a key reference for the subsidiary managers to take actions or choice a starting point [6], and then will make different responses to the interactive control initiated by the parent company. Thus, the adaption of interactive control must be subject to the regulation of the interdependence, only when the two objective factors are matched each other can the subsidi- ary reach its maximum performance. More recently, the increasing international competition speeds up the diversification process of the enterprise group, the development of information technology leads the inter-organizational boundary obscurity [8], the en- terprise group’s internal relationships become so com- plex and dynamic, this means that what’s the matching rules between interdependence and interaction control must be put forward to research schedule, and this study is a result of trying to build a match mode between in- terdependence and interactive control. 2. Theories and Hypothesis 2.1. Interactive Control and Its Influences on the Performance Interactive control generally come from a certain conver- sation, in which human being is regarded as the subject [9]. Hallahan (2007) divided interactive control process into three parts: decision-making decentralization, proc- ess communication and target incentive according to the strategic management process (strategic formulation, stra- tegic implementation and strategic assessment & feed- back) [10]. As shown in Figure 1, decision-making de- centralization indicates the subsidiary manager’s discour- se right granted by the parent company in the strategic formulation stage. Process communication is a sharing information or auditing plan procedure [11], including the parent company’s managers participate in the formal and informal activities in the process of subsidiary’s stra- tegic implementation stage, such as meetings, training or to visit, etc. [12]. Target incentive refers to the reward given by the parent company on the basis of the comple- tion situation of subsidiary’s strategic targets, which is a mirror of the interactions in evaluation system-design and performance appraisal [13]. In addition, the incen- tive-satisfaction of the manager who is motivated will directly affect his effort level in the next strategic cycle. Therefore, target incentive can be regarded as interactive control of the strategic assessment & feedback stage. Decision-making decentralization, process communi- cation and target incentive achieve the purpose of “loss prevention” and “value creation” from different ways. First, decision-making decentralization responses the degree of being controlled by the parent company through assigns decision rights. Subsidiary managers could par- ticipate in the management of enterprise group more ac- tively with a resource scheduling permissions [14]. Fur- ther more, this participation enhance the managers’ ini- tiative and creativity, this could facilitate innovation ac- tivities, and then they would like be easier to accept the group’s strategic plan [15]. If lack of the right to partici- pate in, the subsidiary managers may reduce the response speed to the market or technological change [16], then inter-organization’s synergistic efficiency will decrease. Second, process communication realizes the purpose of supervision and constraints on the subsidiary manag- ers’ behaviors by auditing the plan’s implementation [16]. Communication could promote information transfer and knowledge sharing [17], make the subsidiary managers recognize the position of both their own subsidiary and other subsidiaries in the group more clearly, and then will improve the understanding and identification of the strategic targets [18], more likely to have cooperative behavior, the inter-organization transaction costs reduced [19]. Process communication is an essential condition of effective cooperation (Minbaeva, 2005) [20], that is to say, it is the basic guarantee of the effective coordination. Third, target incentive is a reward mechanism oriented by strategic targets; its final purpose is to encourage the subsidiary managers to turn external stimuli into internal conscious behavior. Actually, target incentive affects the agents’ risk-taking spirit, coordination and organizational commitment by establishing a common interest (Allen and Kilmann, 2001) [21], so as to limit self-interested be- havior, but to promote cooperation and collaboration. Hypothesis 1: Interactive control from parent to sub- sidiary company could increase subsidiary’s perform- ance; Hypothesis 1a: Decision-making decentralization could increase subsidiary’s performance; Hypothesis 1b: Process communication could increase subsidiary’s performance; Hypothesis 1c: Target incentive could increase sub- sidiary’s performance. 2.2. Interactive Control Effectiveness of Different Interdependence Situations On a broad scale, dependence means “a factor’s depend- ence degree on another factor in order to perform its own tasks or outputs effectively”, Vegt and Vilient (2002) divided dependence into tasks-dependence (tasks) and output-dependence (outcomes) [22]. O’Donnell (2002) extended this conceptualization to the interdependence of multinational organization, and was described as “the state in which the outcomes of a foreign subsidiary of a Copyright © 2012 SciRes. IB  Empirical Analysis of Interactive Control’s Effectiveness: A Parent-Subsidiary Company’s Interdependence Perspective 200 MNC influence or are influenced by the actions of an- other unit within the firm operating” [18], that is degree can be decided by the important resources and knowl- edge. This study defined the interdependence between parent and subsidiary company (“parent-subsidiary in- terdependence” for short) as “the state in which the tasks and outcomes of a subsidiary influence or are influenced by the parent company”. The basic properties of interde- pendence are intensity and asymmetry, in which the in- terdependence intensity is the sum of dependence of both sides, while the interdependence asymmetry is the dif- ference [23,24]. Preliminary studies have shown that the interdependence intensity and interdependence asymme- try would have a differential impact on the interactive control’s effectiveness. 2.2.1. Interactive Control Effectiveness of Different Interdependence Intensity As the interconnections increases, the interdependence intensity will increase. Different intensity can have dif- ferent resources synergetic ability, and need different interactive control to support their synergy. In this part, a comparative analysis of different intensity will be pre- sented to explore the interactive control effectiveness in different situations (that is, “interdependence intensity is high” and “interdependence intensity is low”). First, the parent-subsidiary interdependence intensity could affect the subsidiary’s strategic position. As the parent-subsidiary interdependence intensity increase, the subsidiary’s strategic decisions will have a greater effect on the group, and even affect the enterprise group’s stra- tegic formulation, Ghemawat and Levinthal (2008) called such subsidiary strategy as a tactical choices [25], the parent company would like to coordination overall strat- egy through relatively centralized in the face of such sub- sidiaries. when the parent-subsidiary interdependence in- tensity is low, the subsidiary managers are often more familiar to the subsidiary than the parent company man- agers, at this point, the subsidiary managers’ participa- tion in the subsidiary’s decision-making are more impor- tant. For example, when multinational companies form a global integrated business networks, compared with local subsidiaries, foreign subsidiaries often have lower inter- dependence intensity degree, these subsidiaries should be “encouraged” to developing innovative activities or new strategy, so as to looking for new ways to enhance the overall value [26]. Hypothesis 2a: Decision-making decentralization’s ef- fectiveness must be higher when the parent-subsidiary interdependence intensity is low. Second, the parent-subsidiary interdependence inten- sity could affect the needs of resource sharing, Roth and Nigh (1992) confirmed that there is a positive correlation between interdependence intensity and coordination work [27], that is to say, as the interdependence intensity in- crease, the parent company’s coordination work will in- crease. Similarly, Ambos and Mahnke (2010) put for- ward the Parenting Advantage Theory to explain the parent company should increase process communication when the parent company has a better understanding and an enough ability to support the subsidiary’s operations [28]. On the contrary, when the parent-subsidiary inter- dependence is low, the parent company managers’ active communication behaviors may lead to the subsidiary ma- nagers’ “defense” [29], and then bringing to the market risk or loss risk. Hypothesis 2b: Process communication’s effectiveness must be higher when the parent-subsidiary interdepend- ence intensity is high. Third, the parent-subsidiary interdependence intensity could affect the level of moral risk and the difficulty of individual performance evaluation. When the parent-sub- sidiary interdependence intensity is high, the subsidiary may obtain a stable supply or customer channels within the enterprise group, it will be difficult to find out the subsidiary managers’ true performance information, en- courage rationality become distinguish [30]. Further more, as above, subsidiary’s high strategic position and its available resources will indirectly reduce the level of the subsidiary manager’s moral hazard, yet the opposite when the intensity is low, the subsidiary managers’ self- interested will be more easily achieved due to a high in- formation asymmetry [31], target incentive’s direction function become more important. Hypothesis 2c: Target incentive’s effectiveness must be higher when the parent-subsidiary interdependence in- tensity is low. 2.2.2. Interactive Control Effectiveness of Different Interdependence Asymmetry Interdependence asymmetry reflects the resource capac- ity gaps of both sides. Based on the resource dependence theory, the resource advantage side will form an external control to the resource disadvantage side, so there will be a voluntary compliance of the disadvantage side to the advantage, which may reduce or increase the demand for a certain interactive control process. In this part, a com- parative analysis of different asymmetry will be proposed to explore the interactive control effectiveness in differ- ent asymmetry circumstances (that is, “the subsidiary is more dependent on the parent company” and “the parent company is more dependent on the subsidiary”). First, the parent-subsidiary interdependence asymme- try could affect the subsidiary managers’ agency risk. When the subsidiary is more dependent on the parent company, it will obtain the necessary resources from the Copyright © 2012 SciRes. IB  Empirical Analysis of Interactive Control’s Effectiveness: A Parent-Subsidiary Company’s Interdependence Perspective Copyright © 2012 SciRes. IB 201 havior of subsidiary managers. The subsidiaries which have the advantage resources will retain a dominant posi- tion in the parent-subsidiary company negotiation, and these companies’ managers tend to be more positive. However, to some subsidiaries which have the disadvan- tage resources, subsidiary managers’ initiative tend to be lower but to be a key factor to enhance the performance, so the parent company must take several ways to enhance the managers’ initiative and enthusiasm [37]. In term of the Expectancy Theory, when the importance of a be- havior increases, the superior organization must increase the incentive. parent company, even some resource disadvantage sub- sidiaries must be supported by the parent company in order to survive and make profits [32,33]. The external control determines the subsidiary managers tend to obey the parent company while itself is in a resource disad- vantage, decision-making decentralization can give full play to their individual wisdom, simultaneously enhances their work enthusiasm by enhance the subsidiary man- ager’ involvement. On the contrary, once the parent com- pany is more dependent on the subsidiary, the external control will be very weak or disappear, high level of de- cision-making decentralization may bring more “perfor- mance manipulation” space to the subsidiary managers [26], the parent company managers must be difficult to implement top-down decision-making plan, and even part of the subsidiary may feel be restricted by the parent company [34]. Hypothesis 3c: Target incentive’s effectiveness must be higher when the subsidiary is more dependent on the parent company. According to the above assumptions, this paper con- structs a conceptual model that shown in Figure 2 fol- lowing. Hypothesis 3a: Decision-making decentralization’s ef- fectiveness must be higher when the subsidiary is more dependent on the parent company. 3. Method Second, the parent-subsidiary interdependence asym- metry could affect the cooperative relationship. When the subsidiary at a disadvantage, the process communication could contribute to the knowledge sharing, and promote the parent company and subsidiary to learn from each other [17], thus supporting the subsidiary operation and enhancing the ability of subsidiary managers [35]. How- ever, if the parent company is at a disadvantage, the sub- sidiaries’ dominant position could cause the parent com- pany’s “attention”. Harzing’s research showed that “in order to avoid a loss risk, the parent company will adopt a strict control mechanism to ensure the subsidiary man- agers’ compliance with their companies’ status improve” [36], that is to say, communication at this time tends to care for the parent company rather than the subsidiaries, making it be seen as “interference” by the subsidiary managers, which directly lead to intensify the conflict, then has a adverse effects to the overall benefits. 3.1. Sample In order to obtain the real interdependence and perform- ance information, a mail or a printed questionnaire was sent to the subsidiaries’ managers, who can more prop- erly identify the subsidiary’s industry and competitive environment, as well as the interactive control degree. The samples came from the alumni network of the Uni- versity of Science & Technology of China, including the graduate and on learning EMBA students or their groups’ subsidiaries’ managers, and some other alumni who are suitable for the questionnaire. The samples have covered manufacturing processing, electronic communication and commerce services, pharmaceutical and chemical and some other industries. The total of 430 questionnaires was issued (including 300 copies and 130 invitation mail), and 147 questionnaires were returned in which 140 were valid, the effective rate is 32.56%. Hypothesis 3b: Process communication’s effectiveness must be higher when the subsidiary is more dependent on the parent company. 3.2. Measures The measured variables of the latent variables have been main reference from the original questionnaire of earlier Third, difference parent-subsidiary interdependence asymmetry could have different requirements on the be- Figure 1. Strategic management process and interactive control.  Empirical Analysis of Interactive Control’s Effectiveness: A Parent-Subsidiary Company’s Interdependence Perspective 202 studies. In order to make it easier to answer, we make some local corrections to the original questions by sev- eral face-to-face interviews with some respondents. All questions were described as a five-point Likert scale, and the latent variables were measured as follows. 1) Interdependence was measured with a four-item in- dex based on O’Donnell’s research, including: a) Result dependence; b) Task dependence. Both were questioned from two different directions, i.e. “parent company’s de- pendence on subsidiary” (“parent → subsidiary depend- ence” for short) and “subsidiary’s dependence on parent company” (“subsidiary → parent dependence” for short). The following statement is an example: “my company (i.e. the subsidiary which you are working for, similarly hereinafter) depends on the parent company to effec- tively perform its task in order to continue performing its own tasks effectively” [18], the marking schemes are from “strongly disagree” to “strongly agree”. 2) Decision-making decentralization was measured with a five-item index from Persaud (2005), including: a) Management staff recruitment/dismissal (human resources) or organizational structure change (“HR or organiza- tional change” for short); b) Budget allocation or profits expenditure; c) Production and operation process; d) Market distribution; e) Product pricing strategy, the coef- ficient alpha for the scale was 0.89 in Persaud’s research [38]. 3) Process communication was measured with a three- item index based on Subramaniam’s research, including: a) Formal electronic communication; b) Formal face-to- face communication; c) Informal communication in other ways [6]. 4) Target incentive was measured with a three-item index from Armstrong and Murlis (2005), including: a) Personal financial incentives; b) Personal non-financial incentives; c) Subsidiary incentives (the incentive object is subsidiary as a whole but not the individual) [39]. 5) Subsidiary performance as measured with a three- item index based on Ndofor’s(2011) research, including: a) Market growth; b) Profit margin; c) Return on invest- ment [40]. 3.3. Data Validations Due to the questions was local corrected, we examined the reliability and validity test of our questionnaire re- sults. The data processing tools are SPSS17.0 and AMOS17.0, and the analysis methods was Structural Equation Modeling (SEM). The exploratory analysis showed that the maximum partial coefficient was 0.968; the maximum kurtosis coefficient was 1.346, so we could think of the sample to approximate as a normal distribu- tion. As shown in the Table 1, 1) Reliability test: the mini- mal reliability of these scale (assessed with Cronbach’s alpha) equaled 0.653 (others are higher than 0.7), with reaches the lower limits of acceptability. 2) Validity test: on the one hand, all questions were based on early stud- ies, so we can agree that the questionnaire have a good content validity. On the other hand, the KMO values of each latent variable are higher than 0.6, with reach the acceptability. But the loading values of “management staff recruitment/dismissal or organizational structure change” and “budget allocation or profits expenditure” are lower than 0.5 (others are higher than 0.5 and reach significant level), so we removed these two measured variables in order to improve the questionnaire construct validity. 3.4. Analysis and Results 3.4.1. Step 1: SEM Analysis o f th e Whole Sample A “interactive control → performance” model is de- signed and analyzed to prove the effects of three interac- tive control processes on the subsidiary performance, the path analysis results are shown in Figure 3. The fit indi- ces including absolute fit indices (P > 0.05 and RMSEA < 0.08), incremental fit indices (IFI > 0.9, CFI > 0.9) and parsimonious fit indices (x2/df < 2) are all reach the fit- ting degree, this means the model agrees well with the practice. Figure 3 shows that the interactive control can en- hance the subsidiary performance in a whole. The path coefficient of the “decision-making decentralization → subsidiary performance” is 0.21 (P = 0.049), and reaches the level of significance, so do the other two processes (“process communication → subsidiary performance” is 0.19 (P = 0.095); “target incentive → subsidiary” is 0.26 (P = 0.028)), the conclusion is consistent with Hypothe- sis 1a, 1b and 1c. Again, the conclusion shows that the interactive control process are effective in Chinese en- terprise groups’ practice, as we can see in the theories before, this result can infer that decision-making decen- tralization has enhanced the strategic satisfaction and strategic execution of subsidiary managers, so they can play their personal wisdom more effectively. Similarly, process communication has promoted the resource- shar- ing and formed a common strategic perception, so as to enhance the corporate efficiency, and target incentive has established a common interest between the subsidiary managers and the group. In addition, there is a highly relevant between target incentive satisfaction and decision-making decentraliza- tion/process communication degree. As decision-making decentralization degree increase, the target incentive- satisfaction decrease (correlation coefficient is −0.2, P = Copyright © 2012 SciRes. IB  Empirical Analysis of Interactive Control’s Effectiveness: A Parent-Subsidiary Company’s Interdependence Perspective Copyright © 2012 SciRes. IB 203 Table 1. Reliability and validity test results. Measures Cronbach’s α Loadings KMO Parent → subsidiary dependence 0.653 0.641 Result dependence (RD) 0.555 Task dependence (TD) 0.756 Subsidiary → parent dependence 0.737 0.677 Result dependence (RD) 0.623 Task dependence (TD) 0.777 Decision-making decentralization (DM) 0.704 0.713 HR or organizational change (DM1) 0.312• Budget allocation or profits expenditure (DM2) 0.374• Production and operation process (DM3) 0.735 Market distribution (DM4) 0.702 Product pricing strategy (DM5) 0.675 Process communication (PC) 0.711 0.614 Formal electronic communication (PC1) 0.509 Formal face-to-face communication (PC2) 0.849 Informal communication in other ways (PC3) 0.766 Target incentive (TI) 0.768 0.685 Personal financial incentives (TI1) 0.664 Personal non-financial incentives (TI2) 0.706 Subsidiary’s incentives (TI3) 0.810 Subsidiary performance (SP) 0.845 0.689 Market growth (SP1) 0.644 Profit margin (SP2) 0.889 Return on investment (SP3) 0.892 Note: “•” are the measured variables been deleted in follow analysis. Interactive control processes - Decision-making decentralization - Process communication - Target incentive Interdependence - Interdependence intensity - Interdependence asymmetry Parent company Subsidiary Performance Regulating effect Figure 2. Conceptual model.  Empirical Analysis of Interactive Control’s Effectiveness: A Parent-Subsidiary Company’s Interdependence Perspective 204 DM DM3 DM4 DM5 PC1 PC2 PC3 PC TI TI1 TI2 TI3 SP SP1 SP2 SP3 0.81 0.89 0.89 0.65 0.26 ** 0.21 ** 0.19 ** 0.51 0.72 0.80 0.81 0.70 0.70 0.67 0.71 Standardized estimates Chi-square(x 2 ) = 63.461; P = 0.067; degree of freedom (df) = 48; RMSEA = 0.048; x 2 /df = 1.322; IFI = 0.973; CFI = 0.972 −0.20 * 0.45 ** −0.12 Figure 3. Path analysis results. Note: N = 140. ***P < 0.01; **P < 0.05; *P < 0.1 (two-detail), the same below. 0.074), conversely, as process communication increase, the target incentive-satisfaction increase (correlation co- efficient is 0.45, P = 0.000). Indeed, higher decision- making decentralization degree may increase the infor- mation asymmetry, and then make a negative impact on the establishment of a common perception. However, process communication just plays a role of passing stra- tegic information, and improves the subsidiary managers’ understanding of target incentive indirectly. Thus, al- though decision-making decentralization can improve subsidiary performance, but only a moderate decentrali- zation can improve the group strategy related-perform- ance (i.e. the performance matches with the group strat- egy). 3.4.2. Step 2: Multip l e-Gro up Analysis In order to verify the interactive control effectiveness of different interdependence situations, this part will make the interdependence as a regulating variable, with a mul- tiple-group analysis to test the “interactive control → performance” model. Based on Gundlach and Cadotte’s study, begin by figuring out the standardized value of the original data, then the interdependence intensity value is “parent → subsidiary dependence” add “subsidiary → parent dependence”. We divide the group to “high-inten- sity” and “low-intensity” by K-mean cluster analysis, there are 87 cases in the “high-intensity” group and 53 cases in the “low-intensity” group. Differently, the inter- dependence asymmetry value is “subsidiary → parent dependence” minus “parent → subsidiary dependence”. We divide the interdependence asymmetry groups by the “+” or “−”, that is, “+” is the “subsidiary is more depend on parent company” group (“subsidiary → parent” group for short), and “−” is the “parent company is more de- pend on subsidiary” group (“parent → subsidiary” group for short), there are 84 cases in the “subsidiary → parent” group and 56 cases in the “parent → subsidiary” group. The interdependence intensity and asymmetry groups both have a higher significant in default model by com- paring with parallel model, equal intercept model, this indicates that different interdependence will lead to dif- ferent effectiveness of interactive control , we choose the default model as the comparative analytical object. Table 2 following shows the results of the path coefficients and critical ratio for differences between two parameters (C.R. for differences) of different groups in standardized estimates. According to Table 2, we can draw the following con- clusions: 1) Process communication’s effectiveness is significantly higher when the parent-subsidiary interde- pendence intensity is high, Hypothesis 2b is supported. The path coefficient of “PC → PI” is 0.33 (P = 0.016) in “high-intensity” while it is below the significant level in “low-intensity”, moreover, the C.R. for differences is 1.741 which reaches the significant level (P < 0.1). This result can infer that the connection established by the knowledge or information between the parent and sub- sidiary company could support a better implementation of the group strategy, process communicate set up a bridge of the resource sharing effectively; 2) Target in- centive’s effectiveness is significantly higher when the subsidiary is more dependent on the parent company, Hypothesis 3c is supported. The path coefficient of “TI → PI” is 0.43 (P = 0.002) in “ubsidiary → parent” while s Copyright © 2012 SciRes. IB  Empirical Analysis of Interactive Control’s Effectiveness: A Parent-Subsidiary Company’s Interdependence Perspective 205 Table 2. Results of the multiple-group analysis. Different interdependence intensity groups Different interdependence asymmetry groups High-intensity Low-intensity C.R. for differencesSubsidiary → parentParent → subsidiary C.R. for differences DM → PI 0.13 0.28* −0.789 0.16 0.15 0.011 PC → PI 0.33** 0.06 1.741* 0.17 0.11 0.488 TI → PI 0.17 0.29* −0.09 0.43*** 0.02 1.961** it is below the significant level in “parent → subsidiary”, the C.R. for differences is 1.961 which reaches the sig- nificant level (P < 0.05). this result can infer that target incentive can less the subsidiary managers’ self-interest and improve their work effort much better when the par- ent company is in the resource advantage position; 3) Decision-making decentralization and process commu- nication’s effectiveness are slightly higher when the par- ent-subsidiary interdependence intensity is low, the con- clusion general agree with Hypothesis 2a and 2b. Despite the C.R. for differences are not reach the significant level, the path coefficient of “DM → PI” is 0.28 (P = 0.096) in “low-intensity” reaches the significant level (P < 0.1) while it is below the significant level in low-intensity, so do the path coefficient of “TI → PI”. The result can par- tially demonstrate that low levels of strategic correlation may need the subsidiary’s managers to play their indi- vidual wisdom but not only to accept the parent com- pany’s limited support. Similarly, high levels of strategic correlation can lessen the moral hazard degree, but add the difficulty to identify individual performance, which may lead target incentive to be more important when the correlation is low. 4. Conclusions Nowadays, internal interdependence has become an in- creasingly important tool with which the enterprise groups can achieve and maintain a competitive, and how to manage these subsidiaries within a differentiated in- terdependence effectively is an important research topic. This paper took the influences of interactive control on subsidiary performance as a main line, and future analy- sis the interdependence’s regulating role. The results show that the interactive control can improve the sub- sidiary performance while the interdependence has a regulating effect on the positive effects. For the business practice, we can reveal the following reference meanings. On the one hand, only if rational identify the advan- tage resource of the parent company, and have a clear understanding of the interactive control at the same time, can the parent company’s managers take effective inter- active control. In the enterprise groups’ practice, the in- teractive control’s formulation and later adjust always not completely rational [41], the parent company may have an excessive control but neglect resource coordina- tion, or excessive coordination but increase the costs. Indeed, the parent company should identify interdepend- ence between parent and subsidiary company, in a short term, the interdependence is often in a steady state, the parent company should take interactive control from a match perspective, while in a long term, the relationship is quite complex and dynamic, the parent company should keep a dynamic and timely adjust to the interac- tive control. As indicated in the results of this study, we can see that the basic rules include: when the interde- pendence intensity is low (or become lower), the parent company should adopt a higher (or increase) the degree of decision-making decentralization and target incentive, while adopt a higher (or increase) the degree of process communication under the opposite condition; when a subsidiary is more depend on the parent company (or dependence increases), the parent company should adopt a higher (or increase) the degree of target incentive. On the other hand, the enterprise groups should in- crease competitive and managerial abilities of their par- ent companies to ensure that the parent-subsidiary rela- tionship controllability and interactive control feasibility. The subsidiaries in a enterprise group often have differ- ent ability level, and the parent company must properly handle relations among its own, resource advantage sub- sidiaries and resource disadvantage subsidiaries in good balance, as an important lever, once the parent company lost the controlling power to the subsidiaries, it will lose the regulating ability to ensure the interactive control efficient at the same time, for instance, target incentive effectiveness must be lower while which is face to a re- source advantage subsidiary. In addition, the enterprise groups should improve the matching extent between in- teractive control and strategic targets. If the matching degree is identified or effective matching, it will be eas- ier to avoid excessive centralization or decentralization, and to take a more effective process communication. In the design process of target incentive, the parent com- pany’s managers should have an objective assessment to the subsidiary managers’ individual performance, which Copyright © 2012 SciRes. IB  Empirical Analysis of Interactive Control’s Effectiveness: A Parent-Subsidiary Company’s Interdependence Perspective 206 then can set up an incentive system based on both effi- ciency and fairness. However, the study is not without limitations, with which require future research. First, the research sample possibly has a certain regional characteristic, as most sources are from Beijing, Anhui, Jiangsu or surrounding cities, this may reduce the universality of our conclusions, but a good fitting result reflects the certain research value. Second, this research lacks to analysis of the groups’ basic properties, such as there may exist a different in- fluence on interactive control between the state-owned enterprise and the private enterprise. Thus, there should be some further research on this subject, for example, to increase the survey sample range and size to enhance the applicability of conclusions in the empirical study, or use other research methods (e.g. case study) to verify the reliability of the findings. 5. Acknowledgements This study was supported by the National Natural Sci- ence Foundation of China (No.70802058) and the na- tional innovation research group projects of National Natural Science Foundation (No.70821001). Many thanks to the EMBA students at the University of Science & Technology of China, as well as other managers who filled the questionnaires in Guangzhou, Beijing and other cities. REFERENCES [1] N. Nohria and S. Ghoshal, “Differentiated Fit and Shared Values: Alternatives for Managing Headquarters-Subsi- diary Relations,” Strategic Management Journal, Vol. 15, No. 6, 1994, pp. 491-502. doi:10.1002/smj.4250150606 [2] S. W. Bradley, H. Aldrich, D. A. Shepherd and J. Wik- lund, “Resources, Environmental Change, and Survival: Asymmetric Paths of Young Independent and Subsidiary Organizations,” Strategic Management Journal, Vol. 32, No. 5, 2011, pp. 486-509. doi:10.1002/smj.887 [3] J. Galbraith and D. Nathanson, “Strategy Implementation: The Role of Structure and Process,” West Publishing Company, Saint Paul, 1978. [4] W. P. Tsai, “Social Structure of ‘Coopetition’ with in a Multiunit Organization,” Organization Science, Vol. 13, No. 2, 2002, pp. 179-190. doi:10.1287/orsc.13.2.179.536 [5] T. Yamagishi, “Trust in Social,” Russell Sage Foudation, New York, 2001. [6] M. Subramaniam and S. Watson, “How Interdependence Affects Subsidiary Performance,” Journal of Business Re- search, Vol. 59, No. 8, 2006, pp. 916-924. doi:10.1016/j.jbusres.2005.12.005 [7] J. E. Mc Cann and D. L. Ferry, “An Approach for As- sessing and Managing Inter-Unit Interdependence,” The Academy of Management Review, Vol. 4, No. 1, 1979, pp. 113-119. http://www.jstor.org/stable/257411 [8] B. Keats and H. M. O’Neil, “Organizational Structure: Looking through a Strategy Lens,” In: M. A. Hitt, R. E. Freeman and J. S. Harrison, Eds., The Blackwell Hand- book of Strategic Management, Blackwell Publishing Inc., Malden, 2005. [9] H. D. Jørgensen, “Interactive Process Modes,” Ph.D. Thesis, Norwegian University of Science and Technology, Trondheim, 2004. [10] K. Hallahan, D. Holtzhausen and B. van Ruler, “Defining Strategic Communication,” International Journal of Stra- tegic Communication, Vol. 1, No. 1, 2007, pp. 3-35. doi:10.1080/15531180701285244 [11] R. N. Anthony and W. Govindarajan, “Management Con- trol Systems,” 4th Edition, R.D. Irwin, Chicago, 1980. [12] H. A. Simon, “Administrative Behavior, a Study of Deci- sion-Making Processes in Administrative Organization,” Macmillan, Oxford, 1947. [13] M. J. Gibbs, K. A. Merchant, W. A. Van Der Stede and M. E. Vargus, “Performance Measure Properties and In- centive System Design,” Industrial Relations, Vol. 48, No. 2, 2009, pp. 237-264. doi:10.1111/j.1468-232X.2009.00556.x [14] A. M. Grant, S. Nurmohamed, S. J. Ashford and K. Dekas, “The Performance Implications of Ambivalent Initiative,” Organizational Behavior and Human Decision Processes, Vol. 116, No. 2, 2011, pp. 241-251. [15] S. J. Porth, “Strategic Management: A Cross-Functional Approach,” Prentice Hall, London, 2003. [16] J. P. Kotter, “What Leaders Really Do?” Harvard Busi- ness Rebiew, 2001. http://hbr.org/2001/12/what- leaders-really-do/ar/1 [17] C. Inkpen, “Creating Knowledge through Collaboration,” California Management Review, Vol. 39, No. 1, 1996, pp. 123-140. [18] S. W. O’Donnell, “Managing Foreign Subsidiaries: Agents of Headquarters, or an Interdependent Network?" Strate- gic Management Journal, Vol. 21, No. 5, 2000, pp. 525- 548. doi:10.1002/(SICI)1097-0266(200005)21:5 [19] Pedersen, T. B. Petersen and D. Sharma, “Knowledge Transfer Performance of Multinational Companies,” Ma- nagement International Review, Vol. 43, No. 3, 2003, pp. 69-90. http://www.jstor.org/stable/40835968 [20] D. B. Minbaeva, “HRM Practices and MNC Knowledge Transfer,” Personnel Review, Vol. 34, No. 1, 2005, pp. 125-144. doi:10.1108/00483480510571914 [21] R. S. Allen and R. H. Kilmann, “The Role of the Reward System for a Total Quality Management Based Strategy,” Journal of Organizational Change Management, Vol. 14, No. 2, 2001, pp. 110-132. doi:10.1108/09534810110388036 [22] G. Van der Vegt and E. Van der Vliert, “Intragroup Inter- dependence and Effectiveness: Review and Proposed Di- rections for Theory and Practice,” Journal of Managerial Psychology, Vol. 17, No. 1, 2002, pp. 50-67. Copyright © 2012 SciRes. IB  Empirical Analysis of Interactive Control’s Effectiveness: A Parent-Subsidiary Company’s Interdependence Perspective Copyright © 2012 SciRes. IB 207 doi:10.1108/02683940210415924 [23] G. Cadotte, “Exchange Interdependence and Inter-Firm Interaction: Research in a Simulated Channel Setting,” Journal of Marketing Research, Vol. 31, No. 4, 1994, pp. 516-532. doi:10.2307/3151880 [24] T. Kostova and K. Roth, “Adoption of an Organizational Practice by Subsidiaries of Multinational Corporations,” The Academy of Management Journal, Vol. 45, No. 1, 2002, pp. 215-233. doi:10.2307/3069293 [25] P. Ghemawat and D. Levinthal, “Choice Interactions and Business Strategy,” Management Science, Vol. 54, No. 9, 2008, pp. 1638-1651. doi:10.1287/mnsc.1080.0883 [26] J. Birkinshaw and N. Hood, “Multinational Corporate Evo- lution and Subsidiary Development,” Macmillan Press, New York, 1998. [27] K. Roth and D. Nigh, “The Effectiveness of Headquar- ters-Subsidiary Relationships: The Role of Coordination, Control and Conflict,” Business Research, Vol. 25, No. 4, 1992, pp. 277-301. doi:10.1016/0148-2963(92)90025-7 [28] B. Ambos and V. Mahnke, “How Do MNC Headquarters Add Value?” Management International Review, Vol. 50, No. 4, 2010, pp. 403-412. doi:10.1007/s11575-010-0040-5 [29] F. R. David, “Strategy Management,” 2nd Edition, Pren- tice Hall, Inc., Upper Saddle River, 1997. [30] R. Wageman, “Interdependence and Group Effective- ness,” Administrative Science Quarterly, Vol. 40, No. 1, 1995, pp. 145-180. doi:10.2307/2393703 [31] A. M. Rugman and A. Verbeke, “Extending the Theory of the Multinational Enterprise: Internalization and Strategic Management Perspectives,” Journal of International Bu- siness Studies, Vol. 34, No. 10, 2003, pp. 125-137. doi:10.1057/palgrave.jibs.8400012 [32] Y. Luo, “Market-Seeking MNEs in an Emerging Market: How Parent-Subsidiary Links Shape Overseas Success,” Journal of International Business Studies, Vol. 34, No. 10, 2003, pp. 290-309. [33] S. Tallman and M. P. Koza, “Keeping the Global in Mind: The Evolution of the Headquarters Role in Global Multi- Business Firms,” Management International Review, Vol. 50, No. 4, 2010, pp. 433-448. doi:10.1007/s11575-010-0045-0 [34] Y. Doz and C. K. Prahalad, “Headquarters Influence and Strategic Control in MNCs,” Sloan Management Review, Vol. 23, No. 1, 1981, pp. 15-29. http://search.epnet.com/login.aspx?direct=true&db=buh& an=4014035 [35] L. W. Sargeant, “Strategic Planning in a Subsidiary,” Long Range Planning, Vol. 23, No. 2, 1990. pp. 43-54. doi:10.1016/0024-6301(90)90198-D [36] A.-W. Harzing and N. Noorderhaven, “Knowledge Flows in MNCs: An Empirical Test and Extension of Gupta and Govindarajan’s Typology of Subsidiary Roles,” Interna- tional Business Review, Vol. 15, No. 3, 2006, pp. 195- 214. [37] F. T. Chiang and T. A. Birth, “The Performance Implica- tions of Financial and Non-Financial Rewards: An Asian Nordic Comparison,” Journal of Management Studies, Vol. 10, No. 10, 2011, pp. 1-33. [38] A. Persaud, “Enhancing Synergistic Innovative Capability in Multinational Corporations,” Product Innovation Ma- nagement, Vol. 22, No. 5, 2005, pp. 412-629. [39] M. Armstrong and H. Murlis, “Reward Management: A Handbook of Remuneration Strategy and Practice,” Ko- gan Page, London, 2005. [40] H. A. Ndofor, D. G. Simon and X. M. He, “Firm Re- sources, Competitive Actions and Performance,” Strate- gic Management Journal, Vol. 32, 2011, pp. 640-657. [41] F. Ciabuschi, M. Forsgren and O. M. Martín, “Rationality vs Ignorance: The Role of MNC Headquarters in Subsi- diaries’ Innovation Processes,” Journal of International Business Studies, Vol. 42, No. 9, 2011, pp. 958-997. doi:10.1057/jibs.2011.24

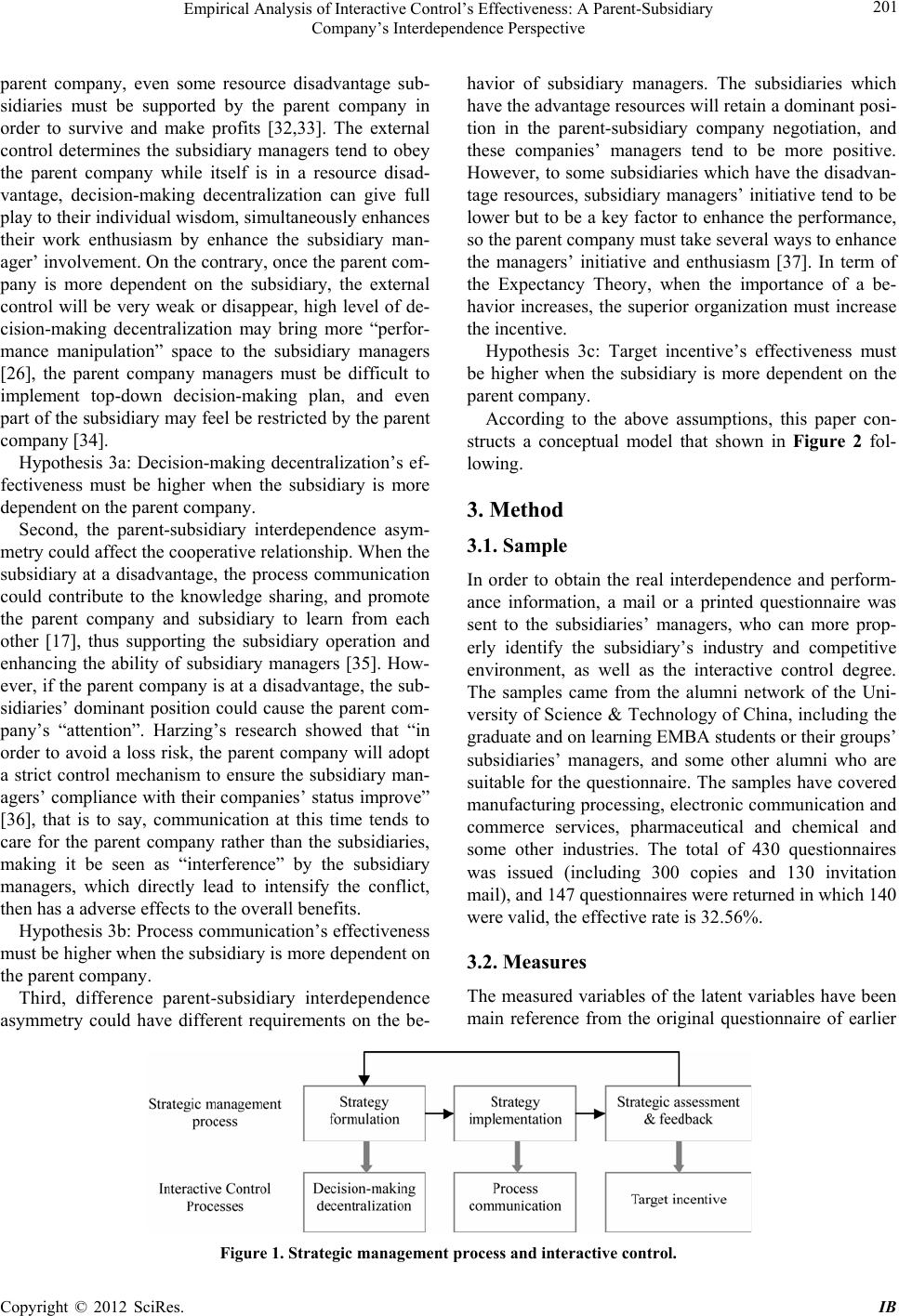

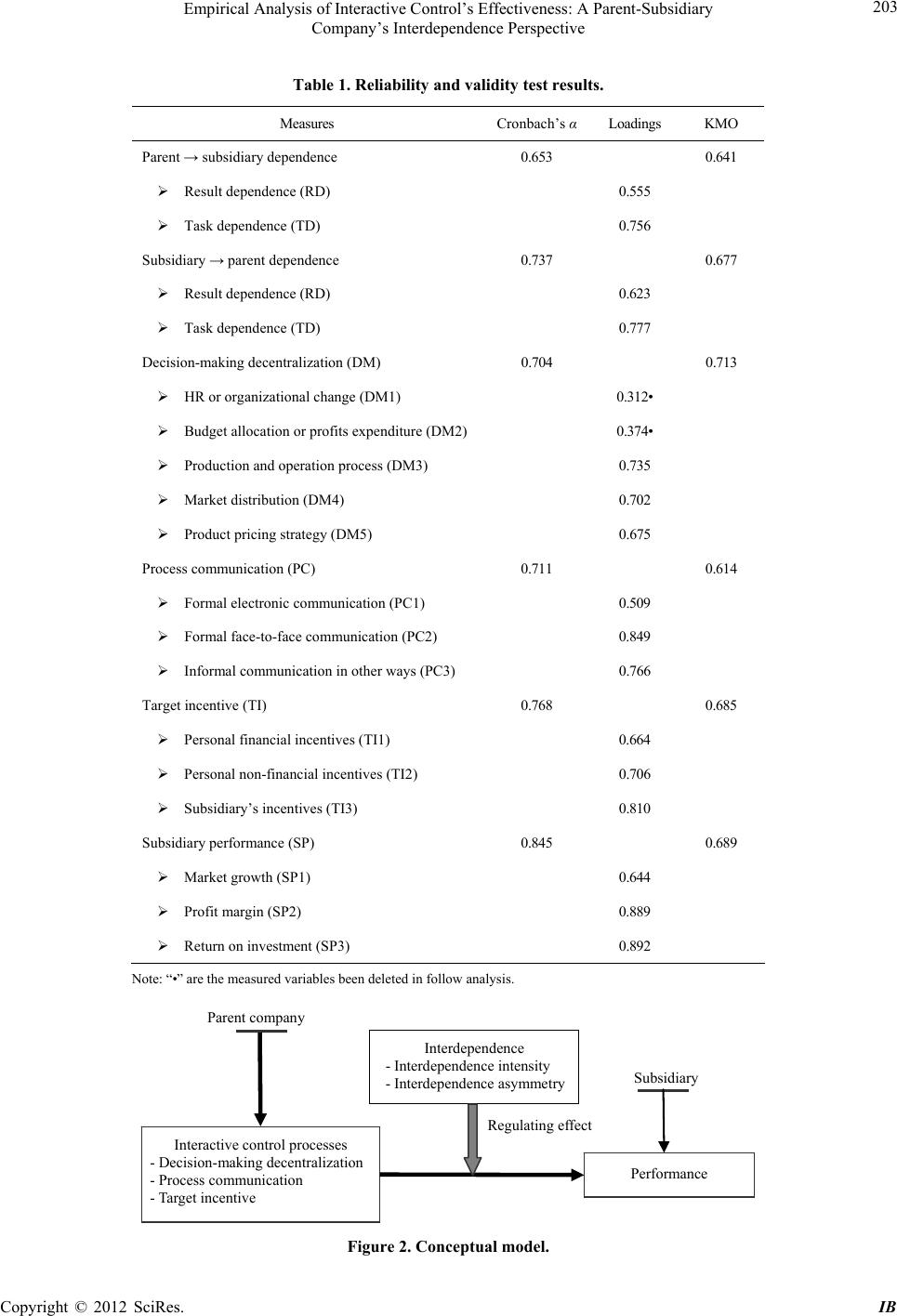

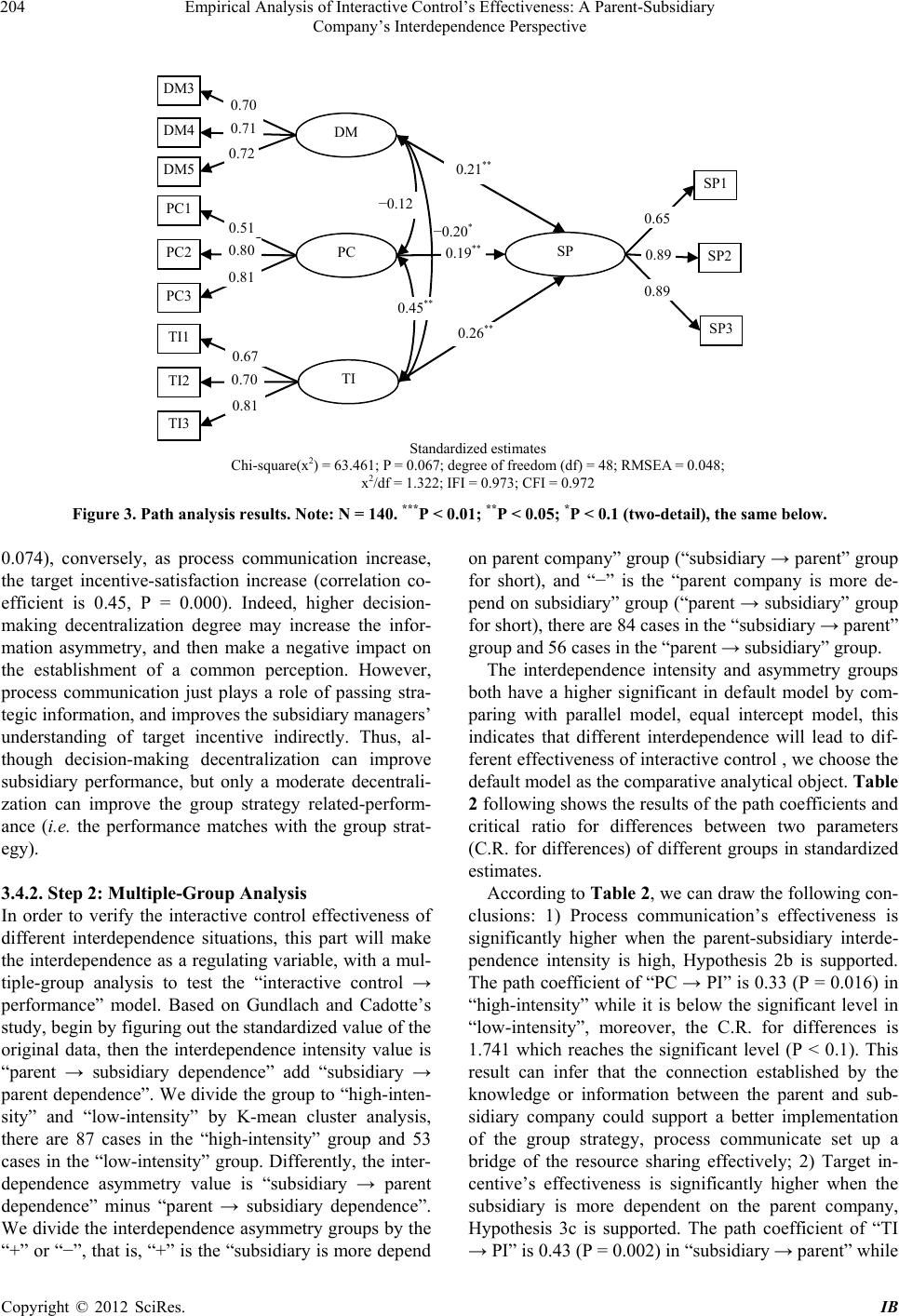

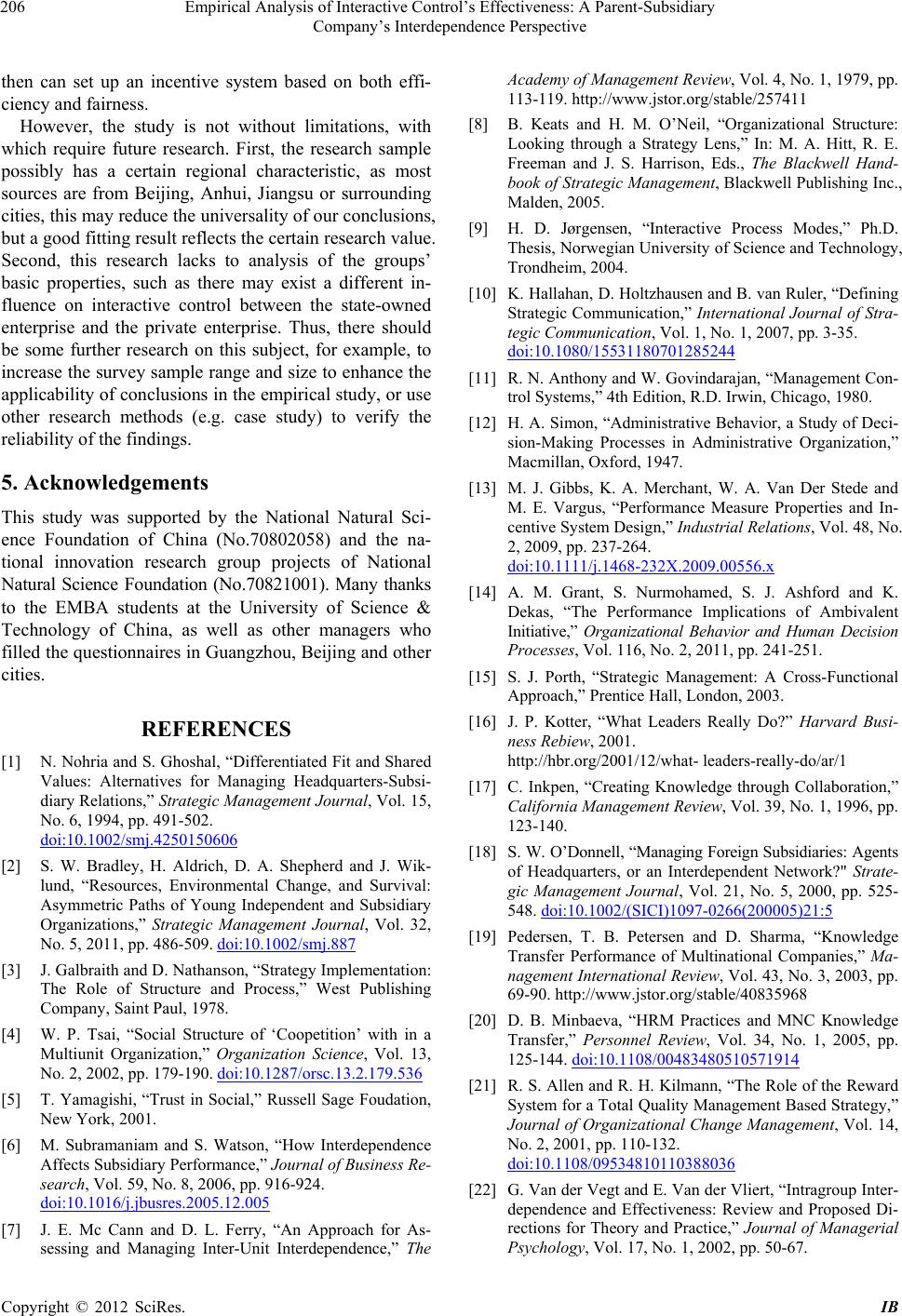

|