Open Journal of Social Sciences

Vol.07 No.03(2019), Article ID:91164,17 pages

10.4236/jss.2019.73022

The Game of Monetary Policy, Inflation and Economic Growth

Gladys Wauk*, Gideon Adjorlolo

School of Public Affairs and Administration, University of Electronic Science and Technology of China, Chengdu, China

Copyright © 2019 by author(s) and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: January 20, 2019; Accepted: March 12, 2019; Published: March 15, 2019

ABSTRACT

Ghana has been confronted with series of economic problems to the extent of calling on the IMF for a bailout after every eight years. This situation has persisted in spite of various monetary authority stabilization policies. This paper therefore focuses on investigating the games of monetary policy, inflation and economic growth of the Ghanaian economy for the period of 1982-2017. Using Autoregressive Distributed Lag (ARDL) to cointegration model, it was revealed from the study that in the long run interest rate significantly influences economic growth but in a negative direction, implies that a higher interest rate has the tendency to restrained economic growth and inflationary pressures. In relation to exchange rate, the long run result indicates an insignificant negative effect on economic growth. The general results suggest that macroeconomic variable which influences economic growth is interest rate and exchange rate. This is evidence that macroeconomic instabilities have significant effect on economic growth. This therefore calls for fiscal discipline and autonomy power to the Bank of Ghana with less interreference from the government to enable the smooth implementation of monetary policies without any string of politics attached.

Keywords:

Monetary Policy, Inflation, Economic Growth, ARDL, Ghana

1. Introduction

Stabilization of a nation’s economy is the priority of every government. In any case, the soundness of every economy revolves around its economic and financial performance. Monetary policy alludes to the procedure by which the monetary experts of a country pedal the supply of money, regularly focusing on a rate of interest for the purpose of encouraging economic growth and stability. Countries depend heavily on their monetary policies as it serves as a key driver of economic growth through its impact on economic variables. Monetary development is crucial in any economy as it lessens poverty, which enhances the livelihoods of households. Researchers from different purviews have widely explored the connection between macroeconomic factors and their impacts on economic growth. The attractive ingredient luring these various investigations is the instability of economic activities, different policies and different regulations that influence economic growth and economic development. The central bank monetary policies influence every single business activity in an economy hence the standard of living of citizens is determined by monetary policies. Folawewo and Osinubi, [1] , clarified monetary policy as a mix of measures that intended to manage the value, supply and cost of money in an economy, in concordant with the expected level of economic activity. For most economies, the targets of monetary policy include price stability, maintenance of balance of payments equilibrium, promotion of employment and output growth, and sustainable development.

According to Precious and Palesa [2] , the main goal of monetary policy is to guarantee that money supply is at a dimension that is steady with the development focus of real income, to such an extent that non-inflationary development will be certain. Monetary policy influences economic growth through aggregate spending. The amount of money that circulates in an economy attracts interest rates which impact consumers spending. Literature has exposed two exciting cases concerning the capability of monetary policy influencing economic growth (Precious and Palesa, [2]). These two theories have diverse perspectives. For instance, the Keynesian theory proposes that “money does not matter”, hence unable to impact on economic growth. They suggest that the association between the monetary sector and the real sector of the economy is very weak, and therefore suggest that there is an indirect relationship (Khabo, [3] ). On the other hand, the Monetarist theory also believes that “money matters”, thereby encouraging for the use of monetary policy in influencing economic growth. They contend that there is a direct relationship between the monetary sector and the real sector of the economy.

Researchers over the years have examined the efficiency and stabilization role of monetary policy as an imperative tool for achieving a desirable macroeconomic position in both developing and developed countries. The scholars have agreed to the fact that monetary policy can have a significant impact on the growth of the economy through price stability. However, these studies including Tobin [4] ; Sidrauski [5] ; Stockman [6] ; Barro [7] ; Mallik and Chowdhury [8] ; Kigume [9] ; Bernanke et al. [10] ; Falawewo and Osinubi [1] , Rafiq and Mallick [11] ; Fasanya et al. [12] ; are inconsistent with their results on the relationships between macroeconomic variables such as inflation, exchange rate, interest rate and money supply. Most recently, Anowor and Okorie [13] ; Nasko [14] portrayed that there is a significant influence of monetary policy on Nigeria economy. These controversies are in line with the conflicting views between the Keynesians and the Monetarists economists concerning the impact of monetary policy on economic growth.

It is amazing up to date the convergence between monetary policy and various macroeconomic variables still differ between policymakers and economist withstanding the essential roles that monetary tools play to warrant effective regulations of the economy (Owolabi & Adegbite) [15] , admitting the fact that every economy has different tactics of regulating, allocating and sustaining productivity with a view to a great extent poor standard of living. But over the years, most developing nations specifically Ghana, have been confronted with low living standard due to the persistent rise in poverty level notwithstanding central bank roles. This situation has persisted in spite of various monetary authority stabilization policies. With the current state of the Ghanaian economy where prices of goods keep on increasing every now and then, policymakers have to pay critical attention to monetary policies proposed by Bank of Ghana to sustain and maintain price stability. The arguments raised on the effectiveness and impact of monetary policy joined with the state of the Ghanaian economy in recent times despite regular application of monetary policy induce the demand for this study. The paper is structured into five (5) sections. The first section concentrated on the background of the study. The second section delves into previous empirical works relating to the aforementioned topic and section three displays the employment of econometric model thus the ARDL model designed to ascertain the objective the study in question. The section four presents the results and discussion of the paper and the final section provides policy recommendations.

2. Previous Studies Reviews

Bawumia and Abradu-Otoo [16] , explore the relationship between monetary growth, exchange rates and inflation in Ghana using an error correction mechanism. The empirical results show the occurring of a long-run equilibrium relationship between inflation, money supply, the exchange rate, and real income. In line with theory, the outcome portrays that in the long-run, inflation in Ghana is positively related to the money supply and the exchange rate, while it is negatively related to real income with inflation modifying to its equilibrium value fairly rapidly. The study also showed that the effect of exchange rate on inflation is transmitted with a one-month lag, while the effect of real income and money on inflation talks of 2 and 4 month lag, respectively.

Starr [17] investigated the relationships between monetary-policy variables and both output and prices in the post-stabilization period, in four core CIS countries (Russia, Ukraine, Kazakhstan and Belarus) using quarterly data from 1995 to 2003 of which Granger causality test was employed. The outcome of the study provided a weak evidence of the real effects of monetary policy in the four core CIS countries with an exception that interest rates have a strong influence on output in Russia. The findings combined the study of Uhlig [18] , whose studies reviled that contractionary monetary policy shocks have no clear effect on real GDP in the United States.

Dele [19] used the generalized least squares (GLS) method in his study of monetary policy and economic performance of West African Monetary Zone Countries (Gambia, Ghana, Guinea, Nigeria and Sierra Leone) from 1991-2004. In the study, he considered money supply (M2), Minimum Rediscount Rate, banking system credit to private sector, banking system credit to central Government and exchange rate of the national currency to the US dollar as variables. The result of the study indicate that monetary policy was a source of impediment which damages the real domestic output of these countries.

Rafiq and Mallick [11] carried out a study on the impacts of monetary policy on output of Germany, France and Italy using the new VAR identification method. Quarterly observations from 1981-2005 were used. The findings of the study suggest that monetary policy innovations are at their most effective only in Germany. Apart from Germany, it remains unclear as to whether an increase in interest rates ends with a fall in output, thereby showing a lack of homogeneity in the responses. Berument and Dincer [20] on the other hand examined the effects of monetary policy of Turkey through structural VAR (SVAR) technique covering the period 1986-2000. Empirical results revealed that a firm’s monetary policy has a short-term effect on output, causing an output to reduce for three months statistically significant in fashion. The findings are in line with the previous studies such as (Sousa and Zaghini, [21] ; Sims, [22] ; Eichenbaum and Evans, [23] ).

Fasanya, Onakoya and Agboluaje [12] also studied the influence of monetary policy on economic growth using time-series data from 1975-2010. The effects of stochastic shocks of each of the endogenous variables were explored using the Error Correction Model (ECM). It was revealed that there is a long run relationship among the variables and was also disclosed that inflation rate, exchange rate and external reserve are important monetary policy instruments that drive economic growth in the Nigerian economy.

Chiaraah and Nkegbe [24] , observe the implications of exchange rate, GDP growth and monetary policies for inflation in Ghana. Although in their study domestic money supply has a significant effect on the behavior of the inflation rate, in the long run, the short run dynamics based on an error correction model indicate that money supply has little influence on the domestic price level.

Nchor, Darkwah and Lubo Sstrelec [25] , investigated the implication of exchange rate depreciation and nominal interest rates on inflation in Ghana. In the study autoregressive distributed lag model and an unrestricted error correction model was employed. The research shows that in the short run a percentage point rise in the level of depreciation of the Ghana cedi leads to an increase in the rate of inflation by 0.2%. They went further to indicate that a percentage point increase in the level of nominal interest rates will lower the result of inflation by 0.98%. In this case 1.67% inflation increases will occur at every percentage point increase in the nominal interest rate in the long run. In the study, the significant long-run relationship between exchange rate depreciation and inflation was not established.

Awan and Asalam [26] examined the impact of monetary policy on Pakistan’s economic growth. This paper used time series data for the period 1972-2015. In the study, real gross domestic product (GDP), developed labor force, gross capital formation, foreign direct investment, broad money, GDP deflator and exports were the variables that were considered. Applied multiple regression method was used to analyze the data and draw the results and correlation technique to study the relationship between variables. The Long-run relationship between monetary policy and the selected variables investigated which monetary policy had an impact on the inflation rate, money supply, employment, gross capital formation, foreign direct investment, saving and other macroeconomic variables. Now considering the outcome we suggest that the central banks should be given free autonomy to formulate and execute monetary policy but it must have coordination with fiscal policy.

Most recently, Ayodeji and Oluwole [27] , examined the impact of monetary policy on economic growth in Nigeria by developing a model that is able to examine how monetary policy of the government has influenced the economic growth by the use of multi-variable regression analysis. In the study, Money Supply (MS), Exchange Rate (ER), Interest Rate (IR), and Liquidity Ratio (LR) were the variables of monetary policy instruments. Unit root test was conducted in this study and all the variables estimated were stationary at first difference except the component of interest rate. The study portrayed that there are two variables (money supply and exchange rate) that had positive but fairly insignificant impact on economic growth. On the other breath interest rate and liquidity ratio had a negative but highly significant impact on economic growth which supports the assertion of Busari et al. [28] that monetary policies can perform well when benchmark against inflation rather than a mere stimulation of economic growth.

Summary

It is obvious from literature that as previous studies have pursued to effectively analyze in terms of variable measurements and choice of model, there are still gaps. This study therefore is further into the roles of inflation, exchange rate, money supply and interest rate on economic growth of Ghana.

3. Methodology

This paper makes use of time series data from the period of 1982 to 2017. Data has been gathered from World Bank and Bank of Ghana annual report. In order to determine the game played by monetary policy and inflation on economic growth of the Ghanaian economy, this paper employed and modify the model in the work of Ayodeji and Oluwole [27] . The model specifies the endogenous variable (Gross Domestic Product) as a function of the money supply, inflation, exchange rate and interest rate. From the above the model is specified as follows:

(1)

where, denotes the Gross Domestic Product, represent inflation which is Ghana’s general consumer price levels, denotes exchange rate, represents money supply which is broad money (M2); as interest rate representing the monetary policy rate and e as the stochastic error term that captures all relevant potential variables that were omitted from the model. The model is transformed into an econometric model as;

(2)

is the constant intercept and are the parameter elasticity coefficients. Again, to enable the interpretation of the partial elasticities, which addresses the degree of responsiveness of the dependent variable to the respective economic independent variable, it is essential to introduce log into the model. This will transform the model into;

(3)

3.1. Theoretical and a Priori Assumption

Gross Domestic Product (GDP) there are several ways to determine the growth pace of an economy. Gross domestic product is one of the basic methods to used and most preferred as its influence attributes to one’s ability to command goods and services. This paper adopts GDP as the proxy to measure the economic growth and used as the dependent variable.

Inflation (INF) in this paper is an independent variable and it’s measured by consumer price index. With high inflation the cost of goods and services increase thereby leading to an increase in hardship for the consumers. This paper expects inflation to be positive on economic growth of Ghana.

Exchange Rate (EXR) the appreciation of domestic currency in the international market enables export to be expensive and hence leading a low demand for exports and on the other hand imports become cheaper hence discouraging the desire for domestic products. This paper anticipates both positive and negative impact on the economic growth.

Money Supply (MS) according to the simple theoretical monetary model an increase in money supply (broad money) reflects an expansionary monetary policy that leads to an increase in output but associated with inflationary effect (Ofori-Abebrese et al., [29] . The sign of MS can either be positive or negative.

Interest Rate (IR) is also an independent variable which represents the monetary policy rate of Ghana. A lower interest rate creates a ripple effect of increase spending in an economy. Citizens will be willing to purchase and borrow more with a low interest rate and opposite when interest rate is high. The sign of IR can either be positive or negative.

3.2. Estimation Techniques

In this paper, Augmented Dickey-Fuller (ADF) was employed to warrant the consistency of exploring the study by evaluating the stationary properties of the variables mentioned above in order to avoid biased, false and misleading results. In order to examine the long-run relationship between gross domestic product and the independent variables, the ARDL bound testing approach developed by Pesaran and Shin [30] was employed. According to Pesaran et al., [31] the ARDL also permits for cointegration estimation by the OLS after recognizing the lag of the model. In testing the long run relationship between GDP and the exogenous variable, the bound test approach was used for cointegration by estimating the following conditional version of the ARDL model.

(4)

where is the difference of the exogenous variables are the short run multipliers/dynamics of the model to be estimated through ECM and represents the long run multipliers. The term is the constant and the denotes the error term.

The ARDL bound test consists of three stages. The initial stage is the testing for the presence of long run correlation among the variables by estimating Equation (4) by the use of OLS. The F-Test is conducted for couple significance of the numerical values of the lagged levels of the variables to enable the testing for the presence of long rung correlation among variables. The following hypothesis has been deduced;

A test for cointegration is provided by two asymptotic critical values where the exogenous variables are I(m) (where ). The explanatory variables are assumed to be integrated of order zero, I(0) by the lower bound values and integrated of order I(1) by the upper bound values. The null hypothesis of no cointegration will be rejected if the F-statistics is above the upper bound and accepted if it falls below the lower bound.

The second step is to test for the long run correlation after establishing the presence of cointegration. The conditional version of the ARDL model order is presented below;

(4)

The lag length of the variables was selected based on the Schwarz Bayesian criterion.

The short run dynamics is employed by the error correction model. This is the final stage of the ARDL model estimation. The model is as follows;

(5)

where is the short run coefficient of model’s dynamic adjustment to equilibrium. term is Error Correction factor. It portrays the estimate of short run disequilibrium adjustment of the long run equilibrium error term. measures speed of adjustment to ascertain equilibrium is the problem of shock.

4. Empirical Analysis

This section of the paper consists of analyzed estimation of different tests. Figures 1-4 display the trends of the variables. Table 1 portrays the descriptive statistics of the various variables used for the study. In Table 2, the result of Augmented Dickey-Fuller (ADF) unit root test is displayed this is followed by the estimation result of ARDL Bound Test in Table 3. Respectively, Table 4 and Table 5 portray the outcomes of long-run model and the short-run Error Correction Model.

Figure 1. The trend of the variables used in the study.

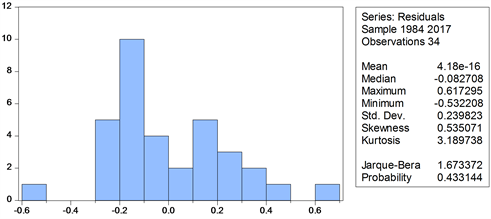

Figure 2. Jarque-Bera Test. Source: Eviews 9 software generated results.

Figure 3. Plot of cumulative sum of recursive residuals.

Figure 4. Plot of cumulative sum squares recursive residuals. Source: Eviews 9 software generated results.

Table 1. Descriptive statistics.

Source: By Authors, 2019.

Table 2. Results of augmented Dickey-Fuller unit root test.

Source: By Authors, 2019. ***at 1 percent level of significance **at 5 percent level of significance *at 10 percent level of significance.

Table 3. Result of ARDL bound test.

Source: By Authors, 2019. ***at 1 percent level of significance **at 5 percent level of significance *at 10 percent level of significance.

Table 4. Long run model result.

Source: By Authors, 2019.

Table 5. Shor run error correction result.

Source: Eviews 9 software generated results.

4.1. Descriptive Statistics and Graphical Analysis

Table 1 portrays the mean, median, maximum and minimum values coupled with the standard deviation for the variables employed in the study. The average value of LGDP as at 2017 was 2.639057 and a minimum of 1.193922 as at 1982. The average of LBroad_Money as at 2017 was 3.540959 and a minimum of 2.468100 as at 1982. Figure 1 also displays the trends in the variables over the period of 1982 to 2017 in Ghana. The figure displays a gradual decrease in GDP from 1985 to 1994 and then main a slow upwards increment between 1995 to 2006. GDP from 2007 begins to see upward and downward movement until 2011 where it drops down drastically and begin to rise again. The rest of the variable also had similar inconsistency movements. The inconsistency in the movement of the variable could be as a result of various monetary policies created.

4.2. Test for Stationarity

Table 2 displays the results of the Augmented Dickey-Fuller (ADF) test and Philip Perron (PP) unit root tests as it is essential to check the order of integration of the variables being studied. The stationarity status of the variables specified for the study was determined prior to the long run relationship between GDP and its dynamic regressors. GDP, and Inflation are stationary at level while Broad Money, Exchange rate and Interest rate are stationary at 1st difference. Results of the ADF displayed GDP and Inflation (consumer price index) are integrated in order (0). Broad Money, Exchange rate and Interest rate are integrated in order (I). As a result of the different integration order of the variables, the ARDL method was preferred to be the best method for the study.

4.3. Test for Long-Run Relationship

The null hypothesis of the long run relationship could not be rejected because of the decision criteria which states that, the null hypothesis can be rejected when the F-statistic is lower than the lower bound. Evidence from table three indicates that the F-statistic which has it value as 3.642379 is greater than the upper bound value of 3.52 at 10% significant level. Based on this evidence, the null hypothesis of no co-integration is rejected. These results display that there is robust relationship amongst the variables such as GPD, Inflation, Broad Money, Exchange rate and Interest rate.

4.4. Long Run Results

The results in Table 4 portray the long run relationship between GDP as the dependent variable and as a proxy for economic growth and its respective exogenous variables.

In the long-run, it was revealed from Table 4 that the coefficient of interest rate and inflation revealed a negative impact on economic growth with interest rate having a significant influence on economic growth in the long run whereas inflation does not influence economic growth in the long run. This discovery falls in line with previous studies including Taiwo [32] , Ogunmuyiwa [33] and a most recently Gatawa, Abdulgafar and Olarinder [34] . The implication of this revelation is that inflation does not encourage economic growth in the long run. Inflation in the long-run creates distortion and also serve as a threat to economic growth since there is a deteriorating impact on value of money. Inflation may make it increasingly troublesome for families and firms to settle on right choices in light of the signs from market price. Thus, when inflation continues to increase in the long run there will be similar rise in most prices as well since inflation is the rise in price of commodities in terms of definition, and particularly in the event that households and firms are unstable. In the case of interest rate, the negative impact implies that a high rate of interest will discourage borrowing among households and firms since interest rate is an imperative factor to borrowing; thus, increasing the cost of borrowing. A higher interest rate has the tendency to restrained economic growth and inflationary pressures. In relation to exchange rate, the long run result indicates a negative coefficient coupled with insignificant statistics. Exchange rate portrays a negative impact on economic growth of the Ghanaian economy in the long run. This implies that, 1% increase in the exchange rate of the Ghanaian economy will lead to a rise in relative prices for selling outside the country. Firms that export may choose to reduce their prices in order to reduce output when there is slow growth in exportation. Finally, the variable broad money as a proxy for money supply also indicates an insignificant negative impact on economic growth. The finding is in line with Adusei [35] who found that financial development (including money supply) weakens economic growth. Gatawa, Abdulgafar and Olarinde [34] , also posit in their study that broad money supply is negatively related to economic growth. In the works of Ihsan and Anjum [36] , they discovered statistically insignificant and negative impact of money supply on economic growth.

4.5. Short Run Error Correction Results

The outcomes of the short run estimates of this study are not that different from the long run estimates in exception of one variable. Thus, the exchange rate portrayed a significant influence on the economic growth but in negative direction. This implies that a unit increase in foreign exchange rate will cause a decrease in the economic growth of the country and in the inverse is also true, ceteris paribus. The short run effect of inflation on economic growth is inverse and insignificant as reveled in the long run analysis. By implication, a unit increase in inflation will cause a decrease in the economic growth of the country. Theoretically, Awan and Asalam [26] opined rise in inflation is evidence to hinder economic growth of most countries especially African countries. Interest rate which has a negative impact but significant in the long run analysis maintain the negative impact but was however insignificant in the short run. In relation to macroeconomic hypothesis, an expansion in the supply of money should lead to a reduction in interest rate in the economy, prompting consumption, borrowing and lending. In the short run, this should, yet does not constantly, link to an expansion in total output and spending and, apparently, GDP. Hence, inflation, interest rate, and broad money insignificantly affect economic growth negatively and do not influence economic growth in the short run. The error correction coefficient (CointEq (−1)) was negative and statistically significant at −0.906475, suggesting that a change in the process of the system or monetary policy would restore equilibrium quickly and effectively. Therefore, it will take 91% of any shock on the dependent variable caused by the independent variables to be corrected within a year and based on the figure attained; the convergence to equilibrium would be fast to ensure long run equilibrium.

4.6. Diagnostic Test of ARDL Model

From Table 6 and Figure 2, the ARDL model employed for the paper has passed all necessary diagnostic tests. The results of the diagnostic test propose that there is absence of model correlation, non-normality and heteroskedasticity errors in the residuals. Again, the CUSUM and CUSUMQ portray the stability of the ARDL model at 5% significant level. Refer to Table 6 and Figure 2.

5. Conclusion and Policy Recommendations

The study investigated the game of monetary policy, inflation, and economic growth in Ghana. The study used secondary data from Bank of Ghana annual reports and International Monetary Fund (IMF) database to assess the impact of monetary policy which was proxied as Broad Money, Exchange rate, interest rate and Inflation. It was essential to perform unit root test and it was evidence that all variables estimated were stationary at first difference in exception of GDP and inflation which made the model a preferred method to be adopted for the study as there existed a relationship between the explained and explanatory variables. It revealed that inflation has negative impact on economic growth with interest rate having a significant influence in the long run whereas inflation does not influence economic growth in the long run. The study found out that exchange rate has a negative impact on economic growth of the Ghanaian economy in the long run. Finally, broad money as a proxy for money supply also shows an insignificant negative impact on economic growth. The finding is in line with (Adusei, [35] ; Gatawa, Abdulgafar and Olarinde, [34] ; Ihsan and Anjum, [36] ). The study recommends the government should develop mechanisms

Table 6. Results of Normality Tests.

Source: Eviews 9 software generated results.

that could help mitigate the interest rate. The Bank of Ghana can control the interest rate and true the proper medium such as the open market, thus, the purchasing of government securities. Banks will raise their prices of the securities on the open market that will result in the reduction of their rates and will then have an influence on the interest rate at large. Also, the government should minimize its interference into the dealings of Bank of Ghana and allow 90% autonomy to the Bank of Ghana.

Conflicts of Interest

The authors declare no conflicts of interest regarding the publication of this paper.

Cite this paper

Wauk, G. and Adjorlolo, G. (2019) The Game of Monetary Policy, Inflation and Economic Growth. Open Journal of Social Sciences, 7, 255-271. https://doi.org/10.4236/jss.2019.73022

References

- 1. Folawewo, A.O. and Osinubi, T.S. (2006) Monetary Policy and Macroeconomic Instability in Nigeria: A Rational Expectation Approach. Journal of Social Sciences, 12, 93-100. https://doi.org/10.1080/09718923.2006.11978375

- 2. Precious, C. and Makhetha-Kosi, P. (2014) Impact of Monetary Policy on Economic Growth: A Case Study of South Africa. Mediterranean Journal of Social Sciences, 5, 76. https://doi.org/10.5901/mjss.2014.v5n15p76

- 3. Khabo, V. and Harmse, C. (2005) The Impact of Monetary Policy on the Economic Growth of a Small and Open Economy: The Case of South Africa: Economics. South African Journal of Economic and Management Sciences, 8, 348-362. https://doi.org/10.4102/sajems.v8i3.1201

- 4. Tobin, J. (1965) Money and Economic Growth. Econometrica: Journal of the Econometric Society, 33, 671-684. https://doi.org/10.2307/1910352

- 5. Sidrauski, M. (1967) Rational Choice and Patterns of Growth in a Monetary Economy. The American Economic Review, 57, 534-544.

- 6. Stockman, A.C. (1981) Anticipated Inflation and the Capital Stock in a Cash In-Advance Economy. Journal of Monetary Economics, 8, 387-393. https://doi.org/10.1016/0304-3932(81)90018-0

- 7. Barro, R.J. (1995) Inflation and Economic Growth (No. w5326). National Bureau of Economic Research. https://doi.org/10.3386/w5326

- 8. Mallik, G. and Chowdhury, A. (2001) Inflation and Economic Growth: Evidence from Four South Asian Countries. Asia-Pacific Development Journal, 8, 123-135.

- 9. Kigume, R.W. (2011) The Relationship between Inflation and Economic Growth in Kenya, 1963-2003. Doctoral Dissertation.

- 10. Bernanke, B.S., Boivin, J. and Eliasz, P. (2005) Measuring the Effects of Monetary Policy: A Factor-Augmented Vector Autoregressive (FAVAR) Approach. The Quarterly Journal of Economics, 120, 387-422.

- 11. Rafiq, M.S. and Mallick, S.K. (2008) The Effect of Monetary Policy on Output in EMU3: A Sign Restriction Approach. Journal of Macroeconomics, 30, 1756-1791. https://doi.org/10.1016/j.jmacro.2007.12.003

- 12. Fasanya, I.O., Onakoya, A.B. and Agboluaje, M.A. (2013) Does Monetary Policy Influence Economic Growth in Nigeria. Asian Economic and Financial Review, 3, 635-646.

- 13. Anowor, O.F. and Okorie, G.C. (2016) A Reassessment of the Impact of Monetary Policy on Economic Growth: Study of Nigeria. International Journal of Developing and Emerging Economies, 4, 82-90.

- 14. Nasko, A.M. (2016) Impact of Monetary Policy on the Economy of Nigeria. Journal of Business and Finance Management Research, 2, 163-179.

- 15. Owolabi, A.U. and Adegbite, T.A. (2014) Money Supply, Foreign Exchange Regimes and Economic Growth. Research Journal of Finance and Accounting, 5, 121-129.

- 16. Bawumia and Abradu-Otoo (2003) Monetary Growth, Exchange Rates and Inflation in Ghana: An Error Correction Analysis.

- 17. Starr, M.A. (2005) Does Money Matter in the CIS? Effects of Monetary Policy on Output and Prices. Journal of Comparative Economics, 33, 441-461. https://doi.org/10.1016/j.jce.2005.05.006

- 18. Uhlig, H. (2005) What Are the Effects of Monetary Policy on Output? Results from an Agnostic Identification Procedure. Journal of Monetary Economics, 52, 381-419. https://doi.org/10.1016/j.jmoneco.2004.05.007

- 19. Balogun, E.D. (2007) Monetary Policy and Economic Performance of West African Monetary Zone Countries.

- 20. Berument, H. and Dincer, N.N. (2008) Measuring the Effects of Monetary Policy for Turkey. Journal of Economic Cooperation, 29, 83-110.

- 21. Sousa, J. and Zaghini, A. (2008) Monetary Policy Shocks in the Euro Area and Global Liquidity Spillovers. International Journal of Finance & Economics, 13, 205-218. https://doi.org/10.1002/ijfe.320

- 22. Sims, C.A. (1992) Interpreting the Macroeconomic Time Series Facts: The Effects of Monetary Policy. European Economic Review, 36, 975-1000. https://doi.org/10.1016/0014-2921(92)90041-T

- 23. Eichenbaum, M. and Evans, C.L. (1995) Some Empirical Evidence on the Effects of Shocks to Monetary Policy on Exchange Rates. The Quarterly Journal of Economics, 110, 975-1009. https://doi.org/10.2307/2946646

- 24. Chiaraah, A.N.T.H.O.N.Y. and Nkegbe, P.K. (2014) GDP Growth, Money Growth, Exchange Rate and Inflation in Ghana. Journal of Contemporary Issues in Business Research, 3, 75-87.

- 25. Nchor, D. and Darkwah, S.A. (2015) Inflation, Exchange Rates and Interest Rates in Ghana: An Autoregressive Distributed Lag Model. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis, 63, 969-977. https://doi.org/10.11118/actaun201563030969

- 26. Aslam, M. and Awan, A.G. (2018) Impact of Monetary Policy on Economic Growth: Evidence from Pakistan. Global Journal of Management, Social Sciences and Humanities, 4, 89-109.

- 27. Ayodeji, A. and Oluwole, A. (2018) Impact of Monetary Policy on Economic Growth in Nigeria. Open Access Library Journal, 5, 1. https://doi.org/10.4236/oalib.1104320

- 28. Busari, D., Omoke, P. and Adesoye, B. (2002) Monetary Policy and Macroeconomic Stabilization under Alternative Exchange Rate Regime: Evidence from Nigeria. CBN Bullion, 6, 15-24.

- 29. Ofori-Abebrese, G., Kamasa, K. and Pickson, R.B. (2016) Investigating the Nexus between Stock Exchange and Economic Growth in Ghana.

- 30. Pesaran, M.H. and Shin, Y. (1998) An Autoregressive Distributed-Lag Modelling Approach to Cointegration Analysis. Econometric Society Monographs, 31, 371-413.

- 31. Pesaran, M.H., Shin, Y. and Smith, R.J. (2001) Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometrics, 16, 289-326. https://doi.org/10.1002/jae.616

- 32. Muritala, T. and Taiwo, A. (2011) Government Expenditure and Economic Development: Empirical Evidence from Nigeria.

- 33. Ogunmuyiwa, M.S. and Ogunleye, O.J. (2012) Measuring the Impact of FDI on Economic Growth in Nigeria.

- 34. Gatawa, N.M., Abdulgafar, A. and Olarinde, M.O. (2017) Impact of Money Supply and Inflation on Economic Growth in Nigeria. IOSR Journal of Economics and Finance, 8, 26-37. https://doi.org/10.9790/5933-0803042637

- 35. Adusei, M. (2013) Financial Development and Economic Growth: Evidence from Ghana. The International Journal of Business and Finance Research, 7, 61-76.

- 36. Ihsan, I. and Anjum, S. (2013) Impact of Money Supply (M2) on GDP of Pakistan. Global Journal of Management and Business Research.