Open Journal of Social Sciences

Vol.04 No.01(2016), Article ID:63258,7 pages

10.4236/jss.2016.41021

Does Indirect Tax Increase the Income Gap between Urban and Rural Areas?

―Based on the Analysis of Thayer Index

Rong Fu

Jinan University, Guangzhou, China

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 9 December 2015; accepted 25 January 2016; published 29 January 2016

ABSTRACT

In the process of economic and social development, serious income gap exists between urban and rural areas in our country, indirect tax―as our main taxes should play income distribution function to narrow the income gap between urban and rural areas. By using the consumption expenditure data of urban residents, the indirect tax burden of urban residents is estimated. The indirect tax burden of rural residents will be estimated by using the indirect tax data and the rural population. Compared with their respective income levels, we can draw the conclusion that the indirect tax is regressive between urban and rural residents. Using Tal index between 1994 and 2013 to measure urban and rural residents income gap, the empirical analysis of commodity tax shows that value added tax has a negative effect on income gap between urban and rural areas; business tax and consumption tax has a positive effect on income gap between urban and rural areas. However, negative effects brought by the VAT tax are greater than the business tax and consumption tax, indirect tax whose main body is VAT is worsening income distribution as a whole. The reform program to replace the business tax with a value-added tax will be expanded so that the proportion of value added tax will further increase. Combined with the empirical results, we put forward the policy which can perfect the indirect tax’s influence on income gap between urban and rural areas.

Keywords:

Indirect Taxes, Value Added Tax, Regressive Nature, Urban and Rural Income Gap, Thayer Index

1. Introduction

The expansion of income distribution gap is an important problem in the process of rapid economic and social development, the income gap between urban and rural areas is the main form of income distribution gap in China. The continued expansion of the income gap between urban and rural areas will also prevent the further growth of our economy and the sustainable development of the economy. Since the system of tax distribution, China’s tax revenue continues to grow, but direct tax which is mainly composed of personal income tax is far less than indirect tax whose main part is the commodity tax. Communiqué of the Third Plenary Session of the 18th Central Committee of the CPC puts forward a policy that we can gradually increase the proportion of direct taxes to regulate the distribution of income tax policy, the role of the tax revenue in the income distribution is more and more prominent. As a means of economic and governmental regulation, taxation should be able to improve the income distribution. The revenue of indirect tax, as one of our main taxes, in our country has been more than 50%, so the adjustment of indirect tax is higher than that of direct taxes. It has practical significance to adjust the income distribution gap with the indirect tax as far as possible without affecting the financial revenue.

The whole outline of the manuscript is the combination of theory and practice analysis.

2. Literature Review

The impact of indirect taxes on income distribution and income gap has been studied by foreign scholars. Dixon and Rimmer [1] uses the dynamic computable general equilibrium model to analyze the impact of the Australian indirect tax on commodity prices, and the indirect tax levy will result in the price increase of low tax burden goods and the price decrease of high burden goods, which will affect the conclusion of the income distribution. Younger [2] use consumer spending survey data to analysis the role of indirect tax, the tax is rebate and increase the income distribution gap. Saez [3] in the short term, indirect tax can play a larger role in income distribution, but long term, only direct taxes can more effectively promote income distribution. Haughton and Nguyen Hoang Bao [4] make use of the survey data and the input output matrix of different income groups to analyze the tax burden on different groups.

Liu Yi and Nie Haifeng [5] use urban household survey data to prove that the the burden of VAT and consumption tax of low-income families is higher than high income families, the burden of business tax is higher than the low income families, Three tax on the whole has a strong regressive nature and prove that the indirect tax increases the income distribution gap. Liu Qiongzhi [6] use data to estimate the indirect tax regressive index and found the regressivity of value-added tax and consumption tax is relatively strong, the regressivity of business tax is weaker. They increase the income gap on varying degrees. Zhang Yang [7] uses the general equilibrium model to calculate the ratio of the tax burden and the disposable income of the turnover tax. Du Honglin [8] use the empirical analysis of the tax burden from different income groups and draw the conclusion that the indirect tax, which is based on the turnover tax, is a tax which has a. Regressive nature. Yang Senping [9] from the indirect tax as the main structure of the tax system, comprehensive analysis of urban and rural residents to bear the indirect tax burden and the actual tax burden level, pointed out that the reform of the indirect tax can also narrow the gap between urban and rural income. Writers in [10] measure the income gap between urban residents and the income gap of urban residents, the indirect tax is the representative of the tax revenue is too high, is not conducive to play the role of tax adjustment income distribution gap. Based on the perspective of urban residents, the scholars studied the burden level of the commodity tax in different income groups, through the study of the tax burden on different income groups, they draw the conclusion that the indirect tax is regressive in urban residents. Instead there is little research on the calculation of the rural residents because of the relative complexity of the data. Based on the urban residents, the total indirect taxes and indirect taxes are estimated by using the national urban household consumption and income data. On this basis, the indirect tax burden and the proportion of rural residents are estimated by using the indirect tax, the national GDP, and the rural population. Through comparison, we can get the conclusion of the indirect tax in urban and rural residents. At present, the “camp changed to increase” has become the mainstream of the reform direction, VTA as the main component of the indirect tax will further increase the income gap between urban and rural areas. Therefore the respectively analysis of indirect tax the value-added tax, consumption tax and business tax on how to affect the urban-rural income has practical significance, using Theil index to measure the income gap between urban and rural areas and found the empirical analysis of value added tax, consumption tax and business tax respective on the income gap between urban and rural areas.

3. The Impact of Indirect Taxes on the Income Gap between Urban and Rural Areas

The difference between direct and indirect taxes is whether the tax burden can be passed. The most typical feature of indirect taxes is that it is easy to hide the tax burden on the price to the transfer. When we talk about how the indirect tax affects the income gap, we are mainly talking the redistribution of income, where the turnover tax is the main body of indirect tax. There are obvious differences in consumption structure between urban and rural residents in China, which mainly shows in the order of consumption expenditure, the content of expenditure and the elasticity of consumption. The main consumption expenditure of urban residents based on the price elasticity of demand is relatively large commodity, while a major expenditure of rural residents settled in smaller price elasticity of demand of goods. In the process of consumption, the object of the turnover tax is the turnover of goods and services, which makes the burden of turnover tax is very easy to the transfer to consumers by hiding in the price. Thus urban residents and rural residents will need to undertake the rise of commodity prices which is taken by the shifting of burden of turnover tax. The differences in the chosen of the elasticity of consumer goods determines the differences in the reaction of the increases of commodity prices between urban and rural residents. The turnover tax which hidden in the price of goods will affect urban and rural residents’ disposable income and rural residents’ income in different degrees, and then affect the difference between urban and rural incomes. Based on the difference in consumption structure between urban and rural residents, the indirect tax which hidden in the price of goods is bound to affect the income gap between urban and rural areas in a certain extent.

4. Variable Selection, Model Design and Empirical Analysis

Indirect taxes have regressive, and it determines the negative effects of indirect tax on the income gap between urban and rural areas. It is estimated that the proportion of value added tax in our country will reach more than 50% of the proportion of indirect tax after completion of replacing the business tax with a value-added tax. Value-added tax is the main part of indirect taxes, it will further expand the income gap between urban and rural areas. So we should analyze value added tax, consumption tax and business tax’s influence on the income gap between urban and rural areas. Value added tax, consumption tax and business tax is the main part of indirect taxes.

1) Variable Description

Explained variable. This paper selects Theil index as a measure indicators of the income gap between urban and rural areas. The basic structure of the current tax structure is gradually formed after tax reform in 1994. After that, tax structure experienced some changes. But the main body status of indirect tax has not changed in the tax system structure. T represents theil index of the income gap between rural and urban areas in China for each year, Calculated as follows:

The greater theil index, the greater the income gap between urban and rural areas; The smaller theil index, the smaller the income gap between urban and rural areas. In the formula, i = 1, 2 represents urban and rural areas,  represents total revenue of urban and rural areas, Total income of urban areas equal to urban residents’ disposable income multiplied by urban population; Total income of rural areas equal to rural per capita net income multiplied by rural population.

represents total revenue of urban and rural areas, Total income of urban areas equal to urban residents’ disposable income multiplied by urban population; Total income of rural areas equal to rural per capita net income multiplied by rural population.  represents total revenue.

represents total revenue.  represents the number of urban or rural population in period t.

represents the number of urban or rural population in period t.  represents the number of total population. In order to eliminate the impact of price factors, this paper selects 1979 as the base period (i.e. 1979 price index = 100) for data processing. we can see theil index calculation results in Figure 1.

represents the number of total population. In order to eliminate the impact of price factors, this paper selects 1979 as the base period (i.e. 1979 price index = 100) for data processing. we can see theil index calculation results in Figure 1.

Figure 1. 1994-2013 theil index. Data source “China statistical yearbook 2014”.

The explanatory variables. Explanatory variables includes indirect tax revenue accounted for the proportion of tax revenue (X), value-added tax accounted for the proportion of tax revenue (X1), business tax accounted for the proportion of tax revenue accounted for the proportion of tax revenue (X2), consumption tax accounted for the proportion of tax revenue (X3), and urban maintenance and construction tax accounted for the proportion of tax revenue (X4), as shown in Table 1.

2) Empirical Analysis

a) Unit root test of variables

Time series data of economic variables can be smooth, non-stationary time series data will appear spurious regression problems. So we must carry on the variables of stationarity test. We choose ADF test, the results in the following Table 2.

The ADF test shows that theil index, the proportion of value added tax, the proportion of indirect taxes and the proportion of urban maintenance and construction tax are smooth under the first order difference. They are first order single whole sequence. There are cointegration relationship between the three sequences and theil index. However, the proportion of business tax and the proportion of consumption tax are smooth under the second order difference. The proportion of business tax and consumption tax is non-stationary. So we take all variables for log processing, and then conduct stationarity test, ADF test results in the following Table 3.

3) Multiple Linear Regression Model

According to the stationarity test, just some explanatory variables, including proportion of urban maintenance and construction tax, proportion of indirect tax, proportion of value-added tax, logarithm of proportion of value-added tax, logarithm of proportion of urban maintenance and construction tax and logarithm of proportion of

Table 1. The proportion of indirect tax revenue in China. Note: indirect taxes do not include tariffs and resource tax in this article. Data source: “1994-2014 China Taxation Yearbook”.

Table 2. Time series ADF test results. Note: the inspection form is (c, t, k). C, t, K, respectively, containing the constant term, the time trend, the lag order. The critical values are expressed at the level of 5%.

Table 3. Time series ADF test results.

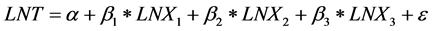

indirect taxes, are suitable for the interpretation of the model variables. In order to study the effect of the value added tax, business tax, consumption tax on the income gap between urban and rural areas in China, we use Eviews software to analyze the effect of indirect tax on the income gap between urban and rural areas. As calculation of the urban maintenance and construction tax is based on value-added tax, consumption tax and business tax, we establish multiple linear regression without taking into account the urban maintenance and construction tax. Therefore, the analysis of the various explanatory variables:

a) as the whole of the proportion of the indirect tax may have a co integration relationship with the Tell index, so that the proportion of all indirect taxes as independent variables, the Tell index as the dependent variable, establish a regression equation:

(1)

(1)

At the same time, according to the above mentioned, the total number of indirect tax in the proportion of the total after the sequence may have a cointegration relationship with the Tell index, the establishment of the regression equation two:

(2)

(2)

b) Because of the co integration relationship between the proportion of value-added tax and the Tell index, the value added tax is the independent variable, and the Tell index is the dependent variable, and the regression equation is established by three:

(3)

(3)

At the same time, according to the above mentioned above, there is a cointegration relationship between the logarithm of the ratio of VAT and the Tell index, and the regression equation is four:

(4)

(4)

c) As a result of VAT, consumption tax, business tax is the most important three taxes, these three taxes on how the gap between urban and rural income is the key point, but also the basis of optimizing tax policy. Although there is no cointegration relationship between the proportion of business tax and the Tell index, this paper will take a number of value-added tax, business tax, consumption tax and the proportion of the number of Tell index after the establishment of the regression equation, in order to understand the impact of commodity tax on the Tell index, and therefore build a regression equation six:

(5)

(5)

We carry out unit root test on the residuals of the regression equation. The test results show that the residual series of model 1, model 2, model 4 exist unit root. So the regression equation is false regression. We need to modify the model. We can see from the regression results of model 5 in the Table 4, the fitting degree of the coefficient of R is 0.74, the adjusted R is 0.69, and the model is statistically tested. According to the regression equation analysis: The increase in the proportion of value added tax will increase the Theil index, which shows that the increase in the proportion of the value added tax will expand the income gap between urban and rural areas. In recent years, the decline in the proportion of value added tax is conducive to narrowing the gap between urban and rural income; The increase in the proportion of consumption tax will make the Theil index decreased, which means that the increase in the proportion of consumption tax is also conducive to narrowing the income gap between urban and rural residents; The increase in the proportion of business tax will make the Theil index decreased, which shows that the increase in the proportion of business tax is not as expected. To a certain extent, it has played a role in narrowing the income gap between urban and rural areas.

5. The Conclusions and Policy Recommendations

The basic conclusion is that the proportion of VAT (value-added tax), and income in urban and rural areas, in our country, present negative correlation, and the increasing of VAT tax revenue proportion increases the income gap between urban and rural areas in our country. Proportion of consumption tax, business tax are positively related with the income gap between urban and rural areas in our country, to a certain extent, the increase revenue of consumption tax and business tax can narrow the income gap between urban and rural areas in our country, the VAT is the largest part in the tax revenue income proportion, the negative effects of the income gap between urban and rural areas which are increased by VAT are greater than the effects of consumption tax and business tax, from the overall effect, indirect taxes which base on VAT are increasing income gap between urban and rural areas.

According to empirical research results, the indirect tax which is represented by VAT is too high, which is not conducive to the adjustment of indirect tax on urban and rural income gap, it is necessary to reduce the tax burden of indirect taxes so that they can have the function of reducing the gap between urban and rural income.

Table 4. Reviews regression results.

1) To reduce the basic rate of VAT.

The proportion of VAT tax revenue was 35.2% in 2013, the increase in the proportion of value-added tax revenue will increase the income gap between urban and rural areas, “business tax to VAT transformation reform” is the main direction of indirect tax reform, which will further increase the tax burden, reduce business tax income, and thus increase the gap between urban and rural incomes. Therefore, we can consider gradually reduce the basic tax rate, recently, the basic rate of value-added tax is divided into two categories, 17% and 13%, which can be considered to be reduced, in order to reduce the residents’ burden of the VAT tax, and to ease urban and rural income gap.

2) To further standardize the scope of consumption tax and tax rates

The scope of China’s VAT on consumption tax is narrow, the implementation of unified tax rate for high- grade and middle-grade goods, and proportional tax rate has restrained the adjustment function of the income of consumption tax. The scope of the consumption tax limits the income distribution function of consumption tax. The increase of the proportion of consumption tax is conducive to narrow the income gap between urban and rural areas, it shows that expanding the scope of the tax is conducive to narrow the income gap between urban and rural areas. As the scope of “business tax to VAT transformation reform” further expands, worsening income distribution effects brought by the indirect tax are more and more obvious, we can break the conventional thinking, and the payment of the consumption tax can be extended to the high-grade entertainment industry, which belongs to the business tax. So on the one hand, we can increase the consumption tax revenue, and on the one hand, we can narrow the income gap between urban and rural areas. From the perspective of tax rate, the elasticity of demand price is small, we can gradually reduce the consumption tax, and reduce the tax burden of lower-income groups, and increase the real income of lower-income groups, which will narrow the income gap. For luxury goods with higher demand elasticity, we can raise taxes.

3) To reduce the proportion of indirect taxes gradually

In recent years, although the proportion of indirect tax have had a downward trend, indirect tax is still the main tax of our country, which has the largest proportion of tax revenue, so the deterioration of income gap between urban and rural areas brought by VAT is the most obvious. As the main tax, indirect tax is widening income gap between urban and rural areas in general, therefore, from a long-term perspective, in order to narrow the income gap between urban and rural areas, we should gradually reduce the proportion of indirect taxes.

Cite this paper

RongFu, (2016) Does Indirect Tax Increase the Income Gap between Urban and Rural Areas?

—Based on the Analysis of Thayer Index. Open Journal of Social Sciences,04,170-176. doi: 10.4236/jss.2016.41021

References

- 1. Dixon, P.B. and Rimmer, M.T. (1999) Changes in Indirect Taxes in Australia: A Dynamic General Equilibrium Analysis. Australian Economic Review, 32, 327-348. http://dx.doi.org/10.1111/1467-8462.00122

- 2. Younger, S.D., Haggblade, S. and Dorosh, P. (1999) Tax Incidence in Madagascar: An Analysis Using Household Data. World Bank Economic Review, 13, 303-331. http://dx.doi.org/10.1093/wber/13.2.303

- 3. Saez, E. (2004) Direct or Indirect Tax Instruments for Redistribution: Short-Run versus Long-Run. Journal of Public Economics, 88, 503-518. http://dx.doi.org/10.1016/S0047-2727(02)00222-0

- 4. Haughton, J., Quan, N. and Bao, N. (2006) Tax Incidence in Vietnam. Asian Economic Journal, 20, 217-239. http://dx.doi.org/10.1111/j.1467-8381.2006.00231.x

- 5. Liu, Y. and Nie, H.F. (2004) Analysis of the Impact of Indirect Tax Burden on the Distribution of Income. Economic Research, 5, 22-30.

- 6. Liu, Q.Z. (2011) The Regressive and Resident Income of Indirect Tax Incidence and the Economic Management of the Inequality of Residents’ Income. Management of the Economy, 1, 166-171.

- 7. Zhang, Y. (2008) China Circulation Tax Incidence Analysis. Financial Journal, 5, 28-33.

- 8. Du, H.L. (2010) The Influence of Indirect Tax on Income Distribution in China. Journal of North China Institute of Water Conservancy and Hydropower (Social Science Edition), 3, 39-41.

- 9. Yang, S.P. and Zhou, M. (2011) Study on the Tax Policy of Adjusting the Income Gap between Urban and Rural Areas —Based on the Perspective of China’s Indirect Tax. Financial Research, 7, 72-74.

- 10. Yang, Y., Du, J. and Lei, B. (2012) The Empirical Analysis of China’s Indirect Tax and Income Distribution Relationship between Tax and Economic. Taxation and Economy, 5, 66-72.

- 11. Liu, Y. and Nie, H.F. (2013) Study on Economics Influence the Incidence of Indirect Tax on the Income Distribution of Urban and Rural Residents. Economic, 1, 287-312.