Open Journal of Business and Management

Vol.07 No.02(2019), Article ID:91576,17 pages

10.4236/ojbm.2019.72042

The Impact of Economic Policy Uncertainty on Bank Credit Scale

―An Empirical Study Based on Dynamic Panel System GMM Model

Shigui Tao, Mengqiao Xu*

Business School, Nanjing Normal University, Nanjing, China

Copyright © 2019 by author(s) and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: February 27, 2019; Accepted: March 30, 2019; Published: April 2, 2019

ABSTRACT

With the occurrence of international events such as the US election, the Brexit, the Middle East civil war and the intensification of the Sino-US trade war, the global politics and economy will be on the road of deepening adjustment, and the political and economic uncertainty around the world will continue to increase. Faced with an increasingly complex and volatile economic situation and policy environment, China’s economic policy uncertainty is also increasing. Based on unbalanced panel data of 142 commercial banks in China from 2007 to 2016, the paper uses GMM model to examine the impact of economic policy uncertainty on bank credit. The empirical result shows that the increase in uncertainty will lead to conservative banking behavior and suppress the scale of bank credit. At the same time, this uncertainty will have a greater impact on non-state banks and non-listed banks.

Keywords:

Economic Policy Uncertainty, Bank Credit Supply, Dynamic Panel

1. Introduction

In recent years, the global political and economic environment has presented a more complex and volatile trend, and the world economy is still trapped in the subprime crisis and the crisis of the swamp. Along with the occurrence of the American election, the British civil war in Europe, the Middle East, tension in the Taiwan strait, a trade war with China, the global political and economic will be on the path of the deepening adjustment and the world is faced with growing political and economic uncertainty. The international monetary fund has repeatedly mentioned policy uncertainty in the “2012 World Economic Outlook Report”, believing that the level of policy uncertainty in the United States and the European Union reached a record high after 2008. The increase of policy uncertainty will inhibit the investment, employment and consumption of enterprises and households, resulting in the slowdown of global economic recovery. “Fortune” magazine once reported that the high level of uncertainty in the US economic policy resulted in the stagnation of the US economy and the unemployment of millions of workers.

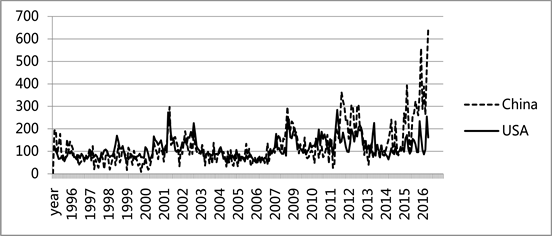

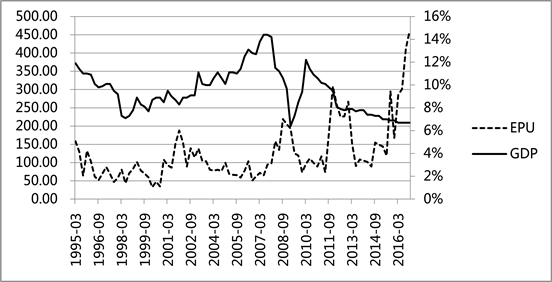

Figure 1 shows that the volatility trend of China’s political uncertainty index is consistent with the US policy uncertainty index, but China’s volatility range and absolute value are larger, so it is of more research value. At the same time, China has a huge market and strong economic transformation momentum, and the government plays an important role in commercial activities. After the 2008 financial crisis, the government proposed and used a series of intensive policies to stimulate the economic development, such as the four-trillion-yuan economic stimulus plan, in order to alleviate the pressure caused by the economic recession. These policy measures have been effective in fighting the recession, but they have also created a “by-product”―policy uncertainty. Figure 2 shows the

Figure 1. Comparison between China’s and America’s political uncertainty index.

Figure 2. Relationship between China’s economic uncertainty index and GDP growth rate.

relationship between China’s economic uncertainty index and GDP growth rate. It can be seen that when the economy goes down and the growth slows down, the economic policy is highly uncertain. In recent years, China’s economy has entered a new normal, with a slowing growth rate and increasing policy uncertainty, which needs urgent attention.

At present, China comes into a key period of economic structure transformation, and the economy comes into the superposition of the third phase of the “New Normal”1, and the early stage of the economic stimulus policies need to digest step by step. At the same time, supply side reform and new financial market regulation spring up, which promotes the adjustment of economic policies. However, the government lacks sufficient transparency and scientificity in formulating specific economic policies. As a result, regulators often test specific economic policies repeatedly to verify their effectiveness, and the regulated enterprises often find it difficult to judge the direction, goal, impact size and sustainability of economic policies. The rollout of the “circuit breaker”2 in China’s stock market, which vanished after just three days, also proves that the Chinese government still has a long way to go in improving the stability and scientificity of its policies in decision-making.

As a crucial link in the financial system, China’s banking sector plays an irreplaceable role in promoting economic development and stabilizing social order. As an important participant in the market, commercial banks have special function of guiding the government’s macroeconomic regulation, and bank credit plays an important role in supporting the development of the real economy. Therefore, it is urgent to study whether policy uncertainty will affect the credit scale of commercial banks.

Most of the existing studies focus on government fiscal and monetary policies (first-order moment), and few scholars study policy uncertainty (second-order moment). Compared with the policy adjustment, the impact mechanism of economic policy uncertainty is hidden and easy to be ignored by the government, but its impact on national economy, politics and social stability cannot be underestimated. At present, few studies on policy uncertainty are mainly based on developed economies, while empirical studies from emerging economies are still scarce. Most studies on the policy uncertainty in China focus on the impact of corporate investment behavior and cash holdings. Theoretically, supply and demand are interdependent and interactive, and economic policy uncertainty can affect a company’s investment and cash holdings, so it will also affect its loan demand, and at the same time promote commercial banks to adjust the supply of credit, thus affecting the real economy. Therefore, this study tries to contribute to the theoretical analysis framework by incorporating policy uncertainty and commercial bank credit supply into a logically consistent analysis framework.

2. Literature Review

Governments must adjust their economic policies in order to ensure the consistency between economic policies and economic development. However, the process of policy adjustment is always accompanied by unpredictability, opacity and ambiguity, which will lead to the increase of the degree of policy uncertainty. Existing studies have shown that policy uncertainty has different impacts on macro-economy, capital market and corporate behavior, and will exert various and multi-level influences on participants, such as policy uncertainty and asset pricing (Pastor and Veronesi, 2013 [1] ; Brogaard and Detzel, 2015 [2] ), and corporate investment decisions (Julio and Yook, 2012 [3] ; Gulen and Ion, 2015 [4] ). As an important part of the financial system, commercial banks are inevitably affected by economic policies and transfer these effects. Therefore, policy uncertainty, as variable affecting participants in economic activities, will affect the credit supply behavior of commercial banks.

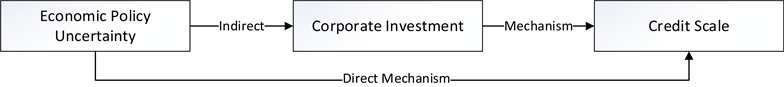

Based on the existing theories and literatures, this paper believes that policy uncertainty will affect the bank credit scale through two ways, one is to directly influence the bank’s own behavior and the other is to indirectly influence the bank through the influence of enterprise behavior. Therefore, this paper proposes the following logical derivation (Figure 3).

Indirect mechanism based on corporate balance sheet: policy uncertainty may ultimately affect bank credit by affecting corporate behavior. Baker et al. (2013) [5] shows that the increase of policy uncertainty indicates the decline of output, employment and investment. Enterprises tend to increase their cash holdings, thus reducing the demand of bank credit, which leads to the reduction of bank credit scale. Bernanke put forward the real option theory in 1983, believing that investment can be regarded as a call option held by enterprises, and the irreversibility of enterprise investment makes it equivalent to the execution of options once invested. The increase of policy uncertainty will increase the waiting value of real options, so enterprises will reduce investment, employment and consumption (McDonald and Siegel, 1986 [6] ). High policy uncertainty often indicates weak growth prospects, that is, policy uncertainty increases the slope of the yield curve while increasing the volatility of asset and option markets (Ulrich, 2012 [7] ) and stock pricing volatility (Pastor and Veronesi, 2013), which may have a huge impact on enterprises. Christiano, Motto and Rostagno, 2010 [8] ; the Arellano, Bai and Mr Kehoe, 2012 [9] ; Panousi and Papanikolaou, 2012 [10] ;

Figure 3. Influence mechanism of economic policy uncertainty on bank credit supply.

Gilchrist, Sim and Zakrajsek, 2014 [11] , from the theory of risk aversion and risk overflow effect, raise that high policy uncertainty may increase the level of risk aversion of senior managers, thus increase the enterprise’s financing costs, which ultimately drives down corporate investment. At the same time, the financing constraint theory presents that the agency relationship between the two sides of borrowing funds, asymmetric information and imperfect contract makes external financing costs higher than the cost of enterprise internal financing. Internal capital is not enough to make up for the needs of enterprises, and the improvement of policy uncertainty increases the bankruptcy risk of the enterprise, and enterprise will defer investment plan and choose more savings to avoid risk (Bernanke, 1983 [12] ; Acharya and Naqvi, 2012 [13] ). Agency cost theory puts forward that the rise of economic policy uncertainty can reduce the measurable level of management due diligence, which leads to information asymmetry between shareholders and management. It will be difficult for shareholders to evaluate and monitor the job of management, and the rise of management agency cost makes management tends to increase the free cash flow to enjoy the “peace” or avoid market regulation. Carrol and Samwick (1998) [14] , Fernández-Villaverde, Guerrón-Quintana, and Rubio-Ramírez (2011) [15] found that uncertainty will reduce the consumption and accelerate savings outflow, which makes insufficient market effective demand and enterprise investment rate drops. Wang et al (2014) [16] found that when policy uncertainty increases, companies tend to hold more cash based on the data of Chinese listed companies. Nguyen and Phan (2017) [17] proposed that policy uncertainty was negatively correlated with the number of M&A transactions and positively correlated with the completion time of M&A transactions. The increase of policy uncertainty will affect the business decisions of enterprises, such as the reduction of investment level (Julio and Yook, 2012; Gulen and Ion, 2015) [3] [4] ; the reduction of corporate debt rating and the increasement of the cost of corporate debt and the reduction of dividend payment. Li and Yang (2015) [18] also proposed that policy uncertainty would inhibit enterprise investment, and the inhibitory effect was more prominent after the 2008 financial crisis. Rao (2017) [19] tested the relationship between economic policy uncertainty and corporate investment behavior by using the “China economic policy uncertainty index” created by Baker, and found that there was a significant negative correlation between the two, and the increase of uncertainty would lead to a significant decline in corporate investment.

Direct mechanism based on bank balance sheet: the uncertainty of economic policy may lead to the noise signal of expected income, making it difficult for banks to predict the economic development prospect of enterprises, thus reducing the loan scale. Baum et al. (2010) [20] used the volatility of industrial products as the proxy variable of economic uncertainty and found that the increase of uncertainty level would lead to the conservative behavior of banks. Bordo, etc. (2016) [21] found that policy uncertainty has significant negative effects on bank credit growth, and the Federal Open Market Committee and the International Monetary Fund proposed that the uncertainty of United States and Europe’s fiscal, regulatory and monetary policy leads to the 2008-2009 economic slump. Calmès, (2014) [22] conducted an empirical test on the Canadian banking industry and found that macroeconomic uncertainty would inhibit the scale of bank loans. Talavera et al. (2012) [23] found that economic uncertainty was negatively correlated with bank credit based on the data of Ukrainian banking industry. Valencia (2017) [24] built a profit model based on the data of the US banking industry from 1984 to 2010, and found that increased economic uncertainty would lead to a significant decline in the growth of bank credit and increase the probability of bank bankruptcy. Based on the annual data of 89 commercial banks, Zhang et al. (2015) [25] constructed the economic uncertainty index with the GARCH model and proved that economic uncertainty was negatively correlated with credit growth.

Combining the indirect mechanism based on corporate balance sheet and the direct mechanism based on bank balance sheet, this paper proposes that:

H1: The increase of economic policy uncertainty will lead to the reduction of bank credit supply.

Chinese commercial banks play a crucial role in stabilizing economic development. The adjustment of bank credit quota will have an impact on the market liquidity of enterprises and the availability of credit resources, and then have a huge impact on the real economy. China’s commercial banking system can be divided into state-owned commercial banks, joint-stock commercial banks, urban commercial banks and rural commercial banks. State-owned commercial banks (Bank of China, Agricultural Bank of China, Industrial and Commercial Bank of China, China Construction Bank, Bank of Communications) mainly refer to large banks directly controlled by the state, among which state-owned shares account for a large proportion, loan decisions are subject to government intervention, and independent decision-making space is limited. The ownership structure of joint-stock banks is relatively decentralized, and the freedom to adjust loan decisions is greater. Compared with state-owned banks, joint-stock banks tend to hold less credit when they are faced with economic policy uncertainty. When there is less uncertainty in government policies, state-owned banks do not have obvious advantages in expanding market share and increasing credit supply. As the level of uncertainty rises, non-state banks reduce the supply of credit to raise margins and security. On the other hand, state-owned banks are less likely to be impacted by adverse policies as they have strong financial strength and more government information. Even the government implements similar adverse policies for all banks, state-owned banks are easier to “land smoothly”. Thus, the paper hypothesizes:

H2: Compared with state-owned banks, economic policy uncertainty has a greater impact on credit decisions than non-state-owned banks.

As the second national financial work conference held in 2002, reform of the shareholding system in China’s state-owned banks was gradually advanced. Large number of joint-stock banks come into the wave of IPO, so it has far-reaching significance to study the influence degree of listed banks and non-listed banks. China has certain requirements on the assets scale of listed banks, and listed banks generally have larger assets scale than non-listed banks. Therefore, this paper proposes:

H3: Compared with non-listed banks, economic policy uncertainty has a smaller impact on listed banks.

3. Research Design

3.1. Data Sources and Sample Selection

The banking data in this paper are mainly from WIND Database, while the macro data are mainly from CEIC Database. The paper selected the non-equilibrium panel data of 142 commercial banks in China from 2007 to 2016 as the research sample (such as Bank of China, China Construction Bank, Agricultural Bank of China, Industrial and Commercial Bank of China). Due to the absence of individual annual data in some banks, the non-equilibrium panel was adopted, which expanded the sample size on the premise of ensuring the authenticity and reliability of the samples, and made the conclusion more representative. The sample mainly includes large state-owned banks, joint-stock commercial banks, urban commercial banks and rural commercial banks. Considering the authenticity and availability of financial data, this paper excluded non-listed rural commercial banks, banks with obvious abnormalities and a large number of data missing, and finally selected 142 commercial banks as the research samples. The 142 banks cover more than 75% of the total assets of China’s banking industry and include all kinds of banking institutions in China’s commercial banking system. The samples are representative and can reflect the main characteristics of China’s commercial banks.

3.2. Variable Selection

1) Explained variables: the paper mainly selects the natural logarithm of loan, loan-to-deposit ratio and loan-to-total asset ratio as explained variables. The larger the variable amount, the larger the bank credit scale.

2) Core explanatory variables: the article selects the economic policy uncertainty index as explanatory variables. The data source is China economic policy uncertainty index (EPU) published by www.policyuncertainty.com. The index created jointly by Stanford university and the university of Chicago. The index is widely used in academic research and government decision-making. In order to prevent endogenous problems, the paper takes the natural logarithm and a first-order lag of the index referring to Baker et al. (2013). When the estimated coefficient of the economic policy uncertainty index is positive, the greater the economic policy uncertainty is, the larger the bank loan scale will be. On the contrary, when the estimated coefficient is negative, the greater the uncertainty index of economic policy is, the smaller the bank credit scale will be.

3) Control variables: In order to control the impact of macro factors and banks’ micro factors, this paper selects real GDP growth rate (GGDP), CPI year-on-year growth rate (CPI), and broad money year-on-year growth rate (M2) as macro proxy variables. Capital adequacy ratio (CAR), ratio of equity to total assets (EA), natural logarithm of total assets (SIZE), return on assets (ROA), liquidity ratio (LR), cost to income ratio (CTI), and non-interest income ratio (NIRR) were selected as the micro agency variables of banks. The variables are defined and explained in Table 1, and the descriptive statistical results of the raw data are shown in Table 2.

Table 1. Variable names and definitions.

Table 2. Descriptive statistics of main variables.

3.3. Model

Considering the dynamic characteristics of economic relations, and the panel data can mine the variable change relations, this paper included the first order lag term of the credit scale into the explanatory variables and constructed the dynamic panel model. The variables of policy analysis usually interact with each other, while GMM method allows the independent variables to be endogenous, so more accurate parameter estimation results can be obtained by using GMM estimation. System GMM is an extension of differential GMM, which overcomes the disadvantages of differential GMM which has limited sample bias and weak instrumental variables, so it can improve the estimation efficiency.

For the three assumptions in this paper, the empirical model equation is set as follows:

(1)

“i” represents different banks and “t” means different years. “Loan” represents bank credit scale, which uses LnLOAN, LTD and LA to analyze respectively. The core explanatory variable is . “Control” represents control variables, which select GGDP, CPI, M2 at macro level and CAR, EA, SIZE, ROA, LR, CTI and NIRR at micro level.

4. Empirical Result

4.1. The Impact of Economic Policy Uncertainty on Bank Credit Scale

The article takes lag effect of economic policy into consideration. The delay dependent variable will lead to the correlation between explanatory variable and random perturbation term, which may also generate endogenous problems. Under the circumstances, the random effects and fixed effects will have estimation error, so this article uses the DIF-GMM proposed by Arellano-Bond (1991) and SYS-GMM proposed by Blundell-Bond (1998) to estimate the model.

The paper uses the SYS-GMM and DIF-GMM to estimate the equation, and the estimation results show that two methods have similar estimation results, but the standard error of SYS-GMM estimation is smaller than that of DIF-GMM, so this paper adopts the SYS-GMM results for analysis. At the same time, through the autocorrelation test and the over-identification test, it can be found that both of them accept the null hypothesis. Therefore, there is no second-order autocorrelation in the model, and the instrumental variables are all valid and conform to the model setting, which represents that the equation can be estimated.

1) The empirical results in Table 3 are basically the same as the theoretical expectation H1, and there is a significant negative correlation between the economic policy uncertainty and the bank credit scale. When the economic policy uncertainty is mounting, the bank will tighten the monetary policy. If the economic policy is relatively stable, banks will ease monetary policy. The influence mechanism is mainly as follows: firstly, economic policy uncertainty affects the investment scale of enterprises, which in turn affects the credit demand of enterprises on

Table 3. Influence of economic policy uncertainty on bank credit scale.

Note: the figures in the table are regression coefficients of explanatory variables, and the numbers in square brackets are standard error. *, ** and *** mean significance at the level of 10%, 5% and 1% respectively.

banks, and results in the reduction of bank credit scale. Secondly, economic policy uncertainty directly affects bank credit supply, and credit supply decreases. The indirect mechanism based on credit demand and the direct mechanism based on credit supply jointly lead to the decline of bank credit scale.

2) Considering the micro factors of bank characteristics, this paper can find following conclusions: Firstly, the higher the CAR, LR and NIRR ratio, the smaller the size of the loan. It may be that when the capital adequacy ratio and liquidity is higher, the bank’s business strategy is more conservative. Faced with economic policy fluctuations, banks will choose relatively conservative lending policies, strengthen credit authorization, and reduce credit supply. According to the “Theory of financial fragility”, confronted with economic policy uncertainty, the banks with higher capital adequacy ratio have lower motivation to expand credit scale, and they tend to reduce the size of the loan to increase flow ratio. Banks with a higher proportion of non-interest income have more means to make profits and can make up for the credit income through other businesses. They are relatively less dependent on the credit business and can turn to other businesses when faced with increased credit issuance risk, thus they have a greater incentive to reduce the scale of credit. Secondly, banks with bigger SIZE, ROA, EA and CTI ratio will have larger loan scale. It is mainly because the banks with bigger size, greater yield rate, and higher equity-to-assets and cost-to-income ratio have better business robustness and stronger risk resistance ability, so they have the ability to extend more loans. Cost is necessary for banks to promote risk management level. Banks are capital intensive industry, in addition to daily currency business, they focus on the investment of banking outlets and construction of advanced information system. These investments lead to higher capital expenditure, depreciation and amortization. The input into infrastructure, operating system of science and technology, and human cost, reduces the moral and operational risks, and lowers the risk of business operations, which can support greater credit scale. At the same time, more network coverage and larger human capital expenditure also reflect a bigger bank size, so the cost income ratio is proportional to the scale of bank credit. It is consistent with the empirical results of the variable of bank size.

3) From the perspective of macro-economic variables, the higher the GDP growth rate, the smaller the size of the loan, there are two possible reasons for this: first of all, bank’s performance is better under a thriving economy, and bank take a conservative attitude to avoid economic bubbles and credit risk. During economic depression, banks’ earnings and their expected revenue will produce bigger difference. Based on “chasing yield mechanism”, banks tend to expand the supply of credit to increase income. Secondly, the economic was booming during the sample period, China experienced a rapid economic growth in this phase. Rapidly widening credit demand and sustained surplus economies excess also lead to liquidity problems. Monetary authorities implemented strict credit control policy on the banking system, to some extent, it makes the bank credit scale reduced. Thirdly, the shadow banking system is pro-cyclical and has a substitution effect on the monetary credit of China’s commercial banks. The credit funds of shadow banks and commercial banks form a competitive relationship and reduce the bank credit supply. The higher the CPI is, the larger the M2 is, which usually means the larger the money supply is. The money supply is the most basic influencing factor of bank credit supply. Under the expansionary monetary policy, the bank credit scale is often larger, which further confirms the fact that the central bank takes bank credit as an important means to adjust the money supply.

4.2. The Impact of Economic Policy Uncertainty on State-Owned and Non-State-Owned Banks

H2 is verified by dividing samples, and non-state-owned bank samples are obtained by excluding the state-owned bank data in the whole sample. The empirical results are shown in Table 4.

Table 4. Influence of economic policy uncertainty on state-owned and non-state-owned banks.

Note: the figures in the table are regression coefficients of explanatory variables, and the numbers in square brackets are standard error. *, ** and *** mean significance at the level of 10%, 5% and 1% respectively.

The empirical results are consistent with the hypothesis H2. In this paper, three proxy variables of credit scale are empirically analyzed. The empirical results show that the coefficient in the sample of non-state-owned banks is larger than that in the full sample, indicating that the uncertainty of economic policy has a greater impact on non-state-owned banks. This is related to the fact that state-owned banks are subject to more government intervention and assume more social responsibilities. They have less decision-making space to independently adjust the credit scale than non-state-owned banks when faced with economic policy uncertainty. State-owned banks are more likely to be supported by the government and have stronger risk diversification ability. Non-state-owned banks are mostly local banks with relatively small scale and weak anti-risk ability. In addition, the central bank and banking supervision departments have stricter supervision over non-state-owned banks, so they are naturally more affected by the uncertainty of economic policies.

4.3. The Impact of Economic Policy Uncertainty on Listed and Non-Listed Banks

As it can be seen in the Table 5, the fluctuation range of coefficient of non-listed banks is larger than that of listed banks, which indicates that the uncertainty of economic policies has a greater impact on unlisted banks than listed banks. The estimated coefficient of listed banks is not significant, indicating that the uncertainty of economic policy has a weaker negative impact on the bank credit scale of listed banks. This may be due to the fact that the capital scale of China’s listed banks is generally larger than that of non-listed banks, and the strength of listed banks is generally stronger than that of non-listed banks. In addition, the listed banks’ corporate governance structure, internal control mechanism and information disclosure mechanism are relatively sound, so they are better able to withstand the impact of risks and uncertainties.

5. Robustness Test

There are many methods to measure the credit scale of banks. In order to prevent the influence of variable selection on the empirical conclusion, this paper selects three explained variables, namely LnLoan, LTD and LA. The latter two variables can replace LnLoan as the robustness test result. At the same time, for H2 and H3, this paper also adopts the method of introducing dummy variables for testing. The paper uses the interaction term of bank type dummy variable (STATE) and economic policy uncertainty index (EPU), and sets the following equation:

(2)

To test the influence of economic policy uncertainty on the credit scale of listed and non-listed banks, the paper uses the interaction term between the dummy variable (List) and the economic policy uncertainty index (EPU), and

Table 5. Influence of economic policy uncertainty on listed and non-listed banks.

Note: the figures in the table are regression coefficients of explanatory variables, and the numbers in square brackets are standard error. *, ** and *** mean significance at the level of 10%, 5% and 1% respectively.

the equation is:

(3)

The results of robustness test are consistent with the empirical results.

6. Conclusions and Suggestions

Faced with increasingly complex economic situation and policy environment, China’s economic policy uncertainty is increasing. Most existing researches focus on fiscal policy and monetary policy, and tend to ignore the second moment of economic policy uncertainty. It is also easy to overlook the fact that the economic policy uncertainty can influence bank credit and ultimately affect the real economy. Based on this, this paper selects the non-equilibrium panel data of 142 commercial banks in China from 2007 to 2016 as the research sample to investigate the impact of economic policy uncertainty on bank credit, and the degree of impact on state-owned and non-state-owned banks, listed and non-listed banks. The empirical results show that the increase of economic policy uncertainty will lead to the conservative behavior of banks and inhibit the scale of bank credit, and the uncertainty will have a greater impact on non-state-owned banks and non-listed banks.

The paper puts forward the following suggestions:

Firstly, government and authorities at all levels should pay attention to and improve the transparency, stability, consistency and enforceability of economic policies. They should formulate policies prudently, avoid the phenomenon of capricious changes, and reduce the harm of economic policy uncertainty to the operation of the economic system.

Secondly, major economic policy adjustments should be fully, scientifically and reasonably demonstrated and recognized, so as to reduce policy uncertainty. At the same time, it should be noted that the policy cannot be published by multi departments, and inter-departmental coordination should be strengthened if several departments are involved, so as not to cause the micro subjects to be at loose ends.

Thirdly, strengthen capital market construction and market information disclosure, reduce the degree of information asymmetry among commercial banks, improve the efficiency of credit resource allocation, avoid noise interference and information distortion, and strengthen the guidance of non-state-owned banks and non-listed banks on the accurate interpretation of economic policies.

Fourthly, commercial banks should pay more attention to the dynamic adjustment of credit decisions based on changes in economic policies, so as to ensure the safety, liquidity and profitability of banks. Meanwhile, banks can increase the ways of making profits and hedge risks by strengthening the innovation of financial products. In the process of expanding scale, non-listed banks including a large number of urban commercial banks and rural commercial banks should pay more attention to the impact of economic policy uncertainty and strengthen corporate governance and risk control, such as establishing and improving risk management system and enhancing business performance.

Fund Project

This paper is funded by Major subjects of philosophy and social science in colleges and universities of Jiangsu province, “research on Chinese banks’ going out against foreign anti-money laundering sanctions under the background of RMB internationalization” (2017ZDAXM009).

Conflicts of Interest

The authors declare no conflicts of interest regarding the publication of this paper.

Cite this paper

Tao, S.G. and Xu, M.Q. (2019) The Impact of Economic Policy Uncertainty on Bank Credit Scale. Open Journal of Business and Management, 7, 616-632. https://doi.org/10.4236/ojbm.2019.72042

References

- 1. Pastor, L. and Veronesi, P. (2013) Political Uncertainty and Risk Premia. Journal of Financial Economics, 110, 520-545. https://doi.org/10.1016/j.jfineco.2013.08.007

- 2. Brogaard, J. and Detzel, A.L. (2015) The Asset Pricing Implications of Government Economic Policy Uncertainty.

- 3. Julio, B. and Yook, Y. (2012) Political Uncertainty and Corporate Investment Cycles. Journal of Finance, 67, 45-83. https://doi.org/10.1111/j.1540-6261.2011.01707.x

- 4. Gulen, H. and Ion, M. (2015) Policy Uncertainty and Corporate Investment. Purdue University Working Paper.

- 5. Baker, S., Bloom, N. and Davis, S. (2013) Measuring Economic Policy Uncertainty. Chicago Booth Research Working Paper.

- 6. McDonald, R. and Siegel, D. (1986) The Value of Waiting to Invest. The Quarterly Journal of Economics, 101, 707-727. https://doi.org/10.2307/1884175

- 7. Ulrich, M. (2012) Economic Policy Uncertainty and Asset Price Volatility. Columbia Business School Working Paper.

- 8. Christiano, L.J., Motto, R. and Rostagno, M. (2010) Financial Factors in Economic Fluctuations. Working Paper.

- 9. Arellano, C., Bai, Y. and Kehoe, P. (2012) Financial Frictions and Fluctuations in Volatility. Staff Report.

- 10. Panousi, V. and Papanikolaou, D. (2012) Investment, Idiosyncratic Risk, and Ownership. Journal of Finance, 67, 1113-1148. https://doi.org/10.1111/j.1540-6261.2012.01743.x

- 11. Gilchrist, S., Sim, J. and Zakrajsek, E. (2014) Uncertainty, Financial Frictions, and Investment Dynamics. Nber Working Papers.

- 12. Bernank, B.S. (1983) Irreversibility, Uncertainty, and Cyclical Investment. Quarterly Journal of Economics, 98, 85-106. https://doi.org/10.2307/1885568

- 13. Acharya, V. and Naqvi, H. (2012) The Seeds of a Crisis: A Theory of Bank Liquidity and Risk Taking over the Business Cycle. Social Science Electronic Publishing, 106, 349-366.

- 14. Christopher, C. and Samwick, A. (1998) How Important is Precautionary Saving? Review of Economics and Statistics, 80, 410-419.

- 15. Fernández-Villaverde, J., Guerrón-Quintana, P., Kuester, K. and Rubio-Ramírez, J.F. (2011) Volatility Shocks and Economic Activity. National Bureau of Economic Research.

- 16. Wang, Y., Chen, C.R. and Huang, Y.S. (2014) Economic Policy Uncertainty and Corporate Investment: Evidence from China. Pacific Basin Finance Journal, 26, 227-243. https://doi.org/10.1016/j.pacfin.2013.12.008

- 17. Phan, H.V., Simpson, T. and Nguyen, H.T. (2017) Tournament-Based Incentives, Corporate Cash Holdings, and the Value of Cash. Journal of Financial and Quantitative Analysis, 52, 1519-1550.

- 18. Li, F.Y. and Yang, M.Z. (2015) Does Economic Policy Uncertainty Reduce Investment of Firms? Evidence from China Economic Policy Uncertainty Index. Finance Research, No. 4, 115-129. (In Chinese)

- 19. Rao, P., Yue, H. and Jiang G. (2017) Economic Policy Uncertainty and Firms’ Investment. Journal of World Economy, No. 2, 27-49.

- 20. Baum, C., Caglayan, M. and Talavera, O. (2010) On the Sensitivity of Firms’ Investment to Cash Flow and Uncertainty. Oxford Economic Papers, 62, 286-306. https://doi.org/10.1093/oep/gpp015

- 21. Michael, B., Duca, J. and Koch, C. (2016) Economic Policy Uncertainty and the Credit Channel: Aggregate and Bank Level US Evidence over Several Decades. NBER Working Paper.

- 22. Calmès, C. and Théoret, R. (2014) Bank Systemic Risk and Macroeconomic Shocks: Canadian and US Evidence. Journal of Banking & Finance, 40, 388-402. https://doi.org/10.1016/j.jbankfin.2013.11.039

- 23. Talavera, O., Tsapin, A. and Zholud, O. (2012) Macroeconomic Uncertainty and Bank Lending: The Case of Ukraine. Economic Systems, 36, 279-293. https://doi.org/10.1016/j.ecosys.2011.06.005

- 24. Valencia, F. (2017) Aggregate Uncertainty and the Supply of Credit. Journal of Banking & Finance, 81, 150-165. https://doi.org/10.1016/j.jbankfin.2017.05.001

- 25. Zhang, L., Lian, Y.H. and Xin, B.H. (2015) Macroeconomic Uncertainty, Banks’ Heterogeneity and Credit Supply. Modern Economic Science, No. 37, 60-71. (In Chinese)

NOTES

1New Normal: It was indicative of the Chinese government’s anticipation of moderate but perhaps more stable economic growth in the medium-to-long term.

2It is a financial regulatory instrument that is in place to prevent stock market crashes from occurring. The “circuit-breaker” mechanism began a test run on January 1, 2016. If the CSI 300 Index rises or falls by 5% before 14:45, stock trading will halt for 15 minutes. If it happens after 14:45 or the Index change reaches 7% at any time, trading will close immediately for the day. “Full breaking” was triggered on January 4 and 7, 2016. From January 8, use of the circuit-breaker was suspended.