Theoretical Economics Letters

Vol.05 No.02(2015), Article ID:56001,6 pages

10.4236/tel.2015.52038

Quasi-Hyperbolic Discounting and Delayed Retirement

James A. Feigenbaum1, T. Scott Findley1,2

1Department of Economics and Finance, Utah State University, Logan, USA

2Netspar, Tilburg, The Netherlands

Email: j.feigen@aggiemail.usu.edu, tscott.findley@usu.edu

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 10 March 2015; accepted 21 April 2015; published 28 April 2015

ABSTRACT

We study the active retirement choice in a simple three-period life-cycle setting and demonstrate that time-inconsistent delayed retirement becomes a theoretical possibility. This helps to align theory with the intuition that delaying the date of retirement can be a reasonable response to spending too much and saving too little for retirement.

Keywords:

Quasi-Hyperbolic Discounting, Retirement, Life-Cycle Consumption and Saving

1. Introduction

Motivated by research findings in psychology and experimental economics, hyperbolic (or quasi-hyperbolic) discounting has become a conventional way to model and represent a divergence between earlier intentions and later choices1,2. Some prominent economic topics that have been studied through the lens of hyperbolic discounting are delayed saving for retirement and the overaccumulation of debt. However, existing theoretical research about the effects of hyperbolic discounting on life-cycle saving behavior has largely ignored decision making with respect to labor supply margins of choice. Abstracting from labor supply margins, especially from the retirement decision, plausibly biases predicted savings outcomes since the decision of how much to save for retirement likely depends on when one intends to be retired, and when one intends to be retired likely depends on how much savings one plans to accumulate for retirement.

A few studies which do examine the consumption, saving, and retirement decisions in a three-period life- cycle setting are the studies by Diamond and Kőszegi [19] , Holmes [20] , and Findley and Feigenbaum [21] . The Diamond and Kőszegi [19] paper explores the conflict in retirement choice across the time-dated selves of a sophisticated individual with time-inconsistent preferences, while Holmes [20] and Findley and Feigenbaum [21] focus on time inconsistency in the retirement decision of a naive individual. A key feature of these studies is the assumption that the individual works during the first period and is retired in the third period, leaving an active retirement choice over the second period only. Findley and Feigenbaum [21] employ generalized assumptions about initial income and assets and document the possibility of time-inconsistent early retirement but also demonstrate that delayed retirement is impossible in this setting, meaning that the individual will never reverse his original, first-period intention to be retired during the second period by alternatively choosing to work when the second period arrives. The result that delayed retirement is impossible lines up with a finding in Holmes [20] and it stems from the fact that the individual has not yet had the opportunity to deviate from his original saving plan after only one period has elapsed. From the perspective of the first period, if the individual plans on retirement during the second period, then he will not feel the need to instead work during the second period once the second period has arrived since he still has the resources to follow through with his original plan to be retired in the second period.

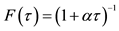

3Findley and Caliendo [22] establish the possibility of delayed retirement in a high-frequency continuous-time setting using the hyperbolic discount function  with

with  for a delay of length

for a delay of length .

.

Because intuition suggests that delaying retirement can be a logical response to saving insufficiently for retirement, the finding by Holmes [20] and Findley and Feigenbaum [21] that delayed retirement is impossible in this three-period setting has left a modest need to determine what assumptions can be made about the timing of the retirement period so that time-inconsistent delayed retirement is able to be represented using this three-pe- riod life-cycle model3. In this paper, we demonstrate how to modify the above setting so that time-inconsistent delayed retirement is a theoretical possibility. If the individual has choice over retirement during the last of the three periods, then he can initially intend to be retired during the third period from the perspective of the first period, but then reverse his original intention by actually working during the third period and never retiring. The reason that time-inconsistent delayed retirement is possible in this setting is due to the fact that the individual can choose at the start of the second period to deviate from his original plan about how much to save and consume during the second period. Reversing the original retirement intention, thereby choosing to work during the last period instead of being retired, sets up the individual to consume more during the second period than originally planned from the perspective of the first period. The possibility of time-inconsistent delayed retirement in a three-period life-cycle setting helps to align theory with the idea that delaying retirement is a reasonable response to saving too little for retirement.

2. Model

An individual lives for three periods and derives utility from consumption,  , and from leisure,

, and from leisure,  , in periods

, in periods . Period utility from consumption is

. Period utility from consumption is . We modify the three-period setting in Findley and Feigenbaum [21] , which was itself a generalization of Diamond and Kőszegi [19] and Holmes [20] , such that full-time work in periods 1 and 2 is now exogenously imposed, so

. We modify the three-period setting in Findley and Feigenbaum [21] , which was itself a generalization of Diamond and Kőszegi [19] and Holmes [20] , such that full-time work in periods 1 and 2 is now exogenously imposed, so  and

and . The individual has a discrete choice over leisure in period 3, specifically

. The individual has a discrete choice over leisure in period 3, specifically  where

where  is the utility of not working in period 3. From the perspective of the first period, the intertemporal utility function is

is the utility of not working in period 3. From the perspective of the first period, the intertemporal utility function is

, (1)

, (1)

where ,

,  are the short-term and long-term discount factors, respectively. From the perspective of the second period, the intertemporal utility function is

are the short-term and long-term discount factors, respectively. From the perspective of the second period, the intertemporal utility function is

. (2)

. (2)

If

4Diamond and Kőszegi [19] investigate and focus on the conflict in retirement choice across the time-dated selves of a sophisticated individual with time-inconsistent preferences.

5

The individual earns income

where

2.1. Optimization in Period 1

With the superscript on the choice variables denoting the period of planning, the individual intends to consume according to

given the individual’s period-1 intention of his period-3 leisure choice,

The individual will choose in period 1 an intention of his period-3 leisure,

where

2.2. Optimization in Period 2

Given

It is important to note that (11) and (12) respectively specify the actual period-2 and period-3 consumption allocations since no time inconsistency remains at this point. Note also that these allocations are both dependent on the individual’s choice to actually work or to be retired during period 3, meaning that the individual will choose

where

2.3. Time-Inconsistent Delayed Retirement

We examine whether or not the possibility can exist for the individual to initially intend to be retired during period 3 from the perspective of period 1, and then reverse his original intention by actually working during period 3. The retirement intention will occur if

where

From (10) and (14),

meaning that there exists

A simple numerical example helps to illustrate the point that time-inconsistent delayed retirement easily exists for a variety of assumptions, including larger values of e. If e = 1.62, β = 0.7, δ = 0.9, then

It is of interest to see how the consumption allocations are altered when the individual is time-inconsistent in his retirement timing. Given (7), the individual selects

if he intends to be retired during period 3 from the perspective of period 1. With

It is clear to see in (17) that the individual will end up consuming more in period 2 than originally planned from the perspective of period 1. This is independent of whether or not the individual actually follows through with being retired during period 3. Yet, if the individual abandons the original plan by deciding to actually work during period 3, then this will have the effect of increasing consumption in period 2 even more.

Consumption in period 3 will be

If the individual sticks to his plan to be retired in period 3, then time inconsistency in the saving decision will cause the individual to consume less in period 3 than he had originally intended from the perspective of period 1, given that the coefficient on

which is predicated on the presence of time inconsistency in the retirement decision. Using the example above with the parameter values of

In sum, the individual may choose in period 2 to forego retirement during period 3 so as to increase his consumption during period 2 even more than originally planned. Moreover, it is often the case that foregoing retirement has the effect of increasing consumption during period 3 as well, compared to what was originally planned. Of course, increases in utility from unequivocally higher consumption in period 2 and possibly higher consumption in period 3 come at the sacrifice of forgone leisure utility in period 3 that would otherwise be enjoyed.

3. Summary

Evidence indicates that people often save insufficiently for retirement due to a present bias in consumption. Common intuition and observation suggest that delaying the date of retirement can be a logical way for an individual to cope with having saved too little. Yet there exists a disconnect between this common intuition and existing economic theory, given that recent research documents that time-inconsistent delayed retirement is theoretically impossible in a particular three-period life-cycle setting. In this paper, we demonstrate how to modify that setting such that time-inconsistent delayed retirement is possible theoretically. This helps to align theory with the idea that delaying retirement can be a reasonable response to spending too much and saving too little for retirement.

We conclude by mentioning an interesting related topic to study in this literature: examining a life-cycle model in which an individual chooses the intensity of labor-leisure in each period, in addition to selecting the age at which to retire. A failure by an individual to follow through with plans about how intensely to work each period could be an additional reason (aside from spending too much and saving too little) to delay the date of retirement. Yet, we acknowledge that it might be possible for the presence of time-inconsistent decision making along the intensive margin to somehow counteract the need to delay retirement. We believe that examining these possibilities deserves more attention, and we have therefore placed this topic on the agenda for future research.

Acknowledgements

We acknowledge and thank an anonymous reviewer for helpful suggestions.

References

- Rachlin, H., Raineri, A. and Cross, D. (1991) Subjective Probability and Delay. Journal of the Experimental Analysis of Behavior, 55, 233-244. http://dx.doi.org/10.1901/jeab.1991.55-233

- Kirby, K.N. and Maraković, N.N. (1995) Modeling Myopic Decisions: Evidence for Hyperbolic Delay-Discounting within Subject and Amounts. Organizational Behavior and Human Decision Processes, 64, 22-30. http://dx.doi.org/10.1006/obhd.1995.1086

- Cairns, J. and van der Pol, M. (2000) Valuing Future Private and Social Benefits: The Discounted Utility Model versus Hyperbolic Discounting Models. Journal of Economic Psychology, 21, 191-205. http://dx.doi.org/10.1016/S0167-4870(99)00042-2

- Frederick, S., Loewenstein, G. and O’Donoghue, T. (2002) Time Discounting and Time Preference: A Critical Review. Journal of Economic Literature, 40, 351-401. http://dx.doi.org/10.1257/jel.40.2.351

- Ainslie, G. (2005) Précis of Breakdown of Will. Behavioral and Brain Sciences, 28, 635-650. http://dx.doi.org/10.1017/S0140525X05000117

- Harrison, G.W. and Lau, M.I. (2005) Is the Evidence for Hyperbolic Discounting in Humans Just an Experimental Artefact? Behavioral and Brain Sciences, 28, 657. http://dx.doi.org/10.1017/S0140525X05290118

- Andreoni, J. and Sprenger, C. (2012) Estimating Time Preferences from Convex Budgets. American Economic Review, 102, 3333-3356. http://dx.doi.org/10.1257/aer.102.7.3333

- Dohmen, T., Falk, A., Huffman, D. and Sunde, U. (2012) Interpreting Time Horizon Effects in Inter-Temporal Choice. CESifo Working Paper Series, Working Paper No. 3750, Unpublished.

- Sutter, M., Kocher, M.G., Glätzle-Rüetzler, D. and Trautmann, S.T. (2013) Impatience and Uncertainty: Experimental Decisions Predict Adolescents’ Field Behavior. American Economic Review, 103, 510-531. http://dx.doi.org/10.1257/aer.103.1.510

- O’Donoghue, T. and Rabin, M. (1999) Procrastination in Preparing for Retirement. In: Aaron, H., Ed., Behavioral Dimensions of Retirement Economics, Brookings Institution Press and Russell Sage Foundation, Washington DC, 125- 160.

- O’Donoghue, T. and Rabin, M. (1999) Incentives for Procrastinators. Quarterly Journal of Economics, 114, 769-816. http://dx.doi.org/10.1162/003355399556142

- O’Donoghue, T. and Rabin, M. (2000) The Economics of Immediate Gratification. Journal of Behavioral Decision Making, 13, 233-250. http://dx.doi.org/10.1002/(SICI)1099-0771(200004/06)13:2<233::AID-BDM325>3.0.CO;2-U

- O’Donoghue, T. and Rabin, M. (2003) Self-Awareness and Self-Control. In: Loewenstein, G., Read, D. and Baumeister, R.F., Eds., Time and Decision: Economic and Psychological Perspectives on Intertemporal Choice, Russell Sage Foundation Publications, Washington DC, 217-243.

- Caillaud, B. and Jullien, B. (2000) Modelling Time-Inconsistent Preferences. European Economic Review, 44, 1116- 1124. http://dx.doi.org/10.1016/S0014-2921(99)00061-6

- Prelec, D. (2004) Decreasing Impatience: A Criterion for Non-stationary Time Preference and “Hyperbolic” Discounting. Scandinavian Journal of Economics, 106, 511-532. http://dx.doi.org/10.1111/j.0347-0520.2004.00375.x

- Beshears, J., Choi, J.J., Laibson, D. and Madrian, B.C. (2008) How Are Preferences Revealed? Journal of Public Economics, 92, 1787-1794.

- D’Orlando, F. and Sanfilippo, E. (2010) Behavioral Foundations for the Keynesian Consumption Function. Journal of Economic Psychology, 31, 1035-1046. http://dx.doi.org/10.1016/j.joep.2010.09.004

- Herweg, F. and Müller, D. (2011) Performance of Procrastinators: On the Value of Deadlines. Theory and Decision, 70, 329-366. http://dx.doi.org/10.1007/s11238-010-9195-6

- Diamond, P. and Kőszegi, B. (2003) Quasi-Hyperbolic Discounting and Retirement. Journal of Public Economics, 87, 1839-1872. http://dx.doi.org/10.1016/S0047-2727(02)00041-5

- Holmes, C. (2010) Quasi-Hyperbolic Preferences and Retirement: A Comment. Journal of Public Economics, 94, 129- 130. http://dx.doi.org/10.1016/j.jpubeco.2009.10.008

- Findley, T.S. and Feigenbaum, J.A. (2013) Quasi-Hyperbolic Discounting and the Existence of Time-Inconsistent Retirement. Theoretical Economics Letters, 3, 119-123. http://dx.doi.org/10.4236/tel.2013.32019

- Findley, T.S. and Caliendo, F.N. (2015) Time Inconsistency and Retirement Choice. Economics Letters, 129, 4-8. http://dx.doi.org/10.1016/j.econlet.2015.01.027

- Angeletos, G.-M., Laibson, D., Repetto, A., Tobacman, J. and Weinberg, S. (2001) The Hyperbolic Consumption Model: Calibration, Simulation, and Empirical Evaluation. Journal of Economic Perspectives, 15, 47-68. http://dx.doi.org/10.1257/jep.15.3.47

NOTES

1Research in psychology and experimental economics typically finds evidence of hyperbolic discounting (e.g., Rachlin, Raineri, and Cross [1] ; Kirby and Maraković [2] ; Cairns and van der Pol [3] ; Frederick, Loewenstein, and O’Donoghue [4] ; Ainslie [5] ). Yet, some studies find very little empirical support for hyperbolic discounting (e.g., Harrison and Lau [6] ; Andreoni and Sprenger [7] ; Dohmen, Falk, Huffman, and Sunde [8] ; Sutter, Kocher, Glätzle-Rüetzler, and Trautmann [9] ).

2A divergence between intentions and actual behavior requires that individuals naively fail to account for their own time inconsistency (O’Donoghue and Rabin [10] -[13] ; Caillaud and Jullien [14] ; Prelec [15] ; Beshears, Choi, Laibson, and Madrian [16] ; D’Orlando and Sanfilippo [17] ; Herweg and Müller [18] ).