Modern Economy

Vol.08 No.12(2017), Article ID:80840,14 pages

10.4236/me.2017.812094

The Impact of Low-Cost Carriers’ Expansion on Hub-and-Spoke Networks: Evidence from the US Airline Industry

Chi-Yin Wu

Department of Economics, Feng Chia University, Taiwan

Copyright © 2017 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: October 29, 2017; Accepted: December 1, 2017; Published: December 4, 2017

ABSTRACT

Legacy carriers operate hub-and-spoke networks because they believe that such networks offer demand and cost advantages, which allow the hub carrier to charge a higher price. However, some empirical studies have found that the hub premium has declined in recent years. This study examines hub-and-spoke networks to assess the change in the hub premium over time. It uses a structural model to jointly estimate the demand and supply parameters. Then, a counterfactual exercise is carried out to capture the impact of low-cost carriers (LCCs) on hub carriers’ premiums under different economic conditions. The major finding is that, on average, consumers respond differently when facing a price change by a legacy carrier and by an LCC. However, this price sensitivity reduces in the later years of the study period. Further, we show that legacy carriers dominated airfares in the late 1990s. Nevertheless, the growing expansion of LCCs is significantly harming the economies of density of legacy carriers.

Keywords:

Hub-and-Spoke Network, Hub Premium, Differentiated Air Travel Products, Counterfactual Experiment

1. Introduction

The rapid changes in demand and market structure over the past two decades have challenged the premium on hub-and-spoke networks.1 Legacy carriers operate hub-and-spoke networks because they believe that such networks offer demand and cost advantages.2 From the demand-side perspective, passengers are more likely to choose itineraries offered by hub carriers and thus pass through the carrier’s hub. Passengers also believe that hub carriers offer superior flight schedules and more convenient gate access (Berry, 1990 [1] ; Proussaloglou and Koppelman, 1995 [2] ).

From the perspective of the costside, airlines can normally better exploit economies of density in their hub airports. Passengers from different origins and with different destinations can be boarded on a single large plane for a segment of the trip, meaning that itineraries that include a hub airport may increase spoke density and reduce costs (Brueckner and Spiller, 1994) [3] . For example, United Airlines operates the itinerary New York-Chicago-San Diego, which shares a spoke with New York-Chicago-Seattle. Hence, an increase in demand for the airline’s New York-San Diego market increases traffic on its New York-Chicago leg. Since the New York-Seattle route also passes through Chicago, the airline can thus utilize services on its New York-Chicago route. As such, economies of density allow the airline to reduce its marginal cost of providing services in the New York-Seattle market.

Borenstein and Rose (2013) [4] suggested that the benefits of providing hub operations can expand to the frequent-flyer service. Hubs generally increase the available flight options for passengers, even when demand is insufficient to support frequent nonstop services at relatively low prices. As a result, passengers are more willing to choose services by hub carriers and enroll in a program to accumulate frequent-flyer miles. Because of the increased density of operations in hub services, airlines are allowed to offer frequent services on a segment while maintaining high load factors. At the same time, competition at hub airports is typically limited because of the airport’s capacity constraints. This limitation yields a demand advantage and substantial market power for airlines in their own hubs compared with competitors that operate routes outside the hub. Therefore, hub-and-spoke networks drive up markup and increase entry barriers (Borenstein, 1991) [5] .

However, the revolution of low-cost carriers (LCCs) has steadily placed downward pressure on airfares.3 Since Southwest Airlines started to provide low-fare regional services in the 1970s, LCCs have had a growing impact on the air travel business. Dresner et al. (1996) [6] were one of the first groups to examine how the entry of LCCs influenced competitive routes, while Morrison (2001) [7] focused on the impact of Southwest Airlines on incumbent airlines’ fares. Both studies suggest that the presence of LCCs has placed downward pressure on airfares. Hence, LCCs force legacy carriers to lower fares by offering competing services, especially in regional markets. Goolsbee and Syverson (2008) [8] further indicated that incumbent airlines cut fares in response to the threat of entry by Southwest Airlines, while Brueckner et al. (2013) [9] investigated the impact of potential competition from several LCCs and found similar results. These empirical findings, focusing on price regressions, suggest that the price premiums of legacy carriers at hub airports have declined in recent years. In addition, LCCs have lower labor costs (Mozdzanowska, 2004 [10] ; Borenstein and Rose, 2013 [4] ).

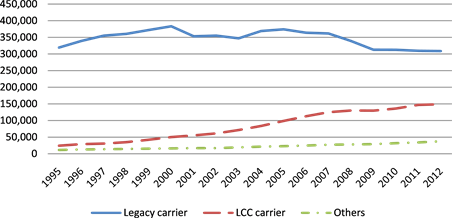

As a consequence, legacy carriers experienced a significant loss of market share from 90.4% in 1995 to 68.3% in 2009 (Hüschelrath and Müller, 2012) [11] as well as lower profitability. Figure 1 shows the domestic revenue passenger miles in the US airline industry, highlighting that the gap between legacy carriers and LCCs has closed markedly over the past two decades.

On the contrary, Berry et al. (2006) [12] used a differentiated products supply-and-demand framework to analyze the role of hub-and-spoke operations and found that different levels of willingness to pay by consumers could lead hub carriers to increase their markups on hub-originating flights. This study found that the so-called hub premium allows hub carriers to raise prices, especially to those passengers who are relatively inelastic to price changes. Nonetheless, improvements in Internet transaction processes mean that air travel consumers became 8% more price sensitive from 1999 to 2006 (Berry and Jia, 2010) [13] . Moreover, stricter security regulations have lengthened average travel time, which may cause flight delays and airport congestion. Indeed, Ater (2012) [14] found a statistically significant relationship between hub-and-spoke networks and congestion, which could lower consumers’ preferences for products from legacy carriers.

The evidence presented thus far suggests that the challenge to legacy carriers is a complicated combination of two major factors: 1) the expansion of LCCs and 2) rapid changes in demand and market structure. Therefore, this study reexamines hub-and-spoke operations over time to understand the degree to which such networks have been disturbed by LCCs based on changes in legacy carriers’ airfares. Because a legacy carrier needs to hold the equilibrium price in

Figure 1. US airline domestic revenue passenger miles.

the face of competition from LCCs, its pricing strategy depends on the degree of market disturbance caused by these low-cost rivals.

To capture the correct hub premium effect in each particular market circumstance during the past 20 years, three periods are selected: 1998 (to represent the pre-9/11 period), 2005 (the post-9/11 period), and 2012 (the post-financial crisis period)). This study first compares the demand and supply behaviors under different economic conditions in these three time periods. Second, it carries out counterfactual experiments to examine the hubbing effect in each year by removing LCCs’ products from each sample market. Assuming the estimated econometric framework is unchanged, predicted equilibrium prices for legacy carriers’ products can then be estimated. The results from the counterfactual experiments thus show the full trend of the hub premium over time. In summary, this study can provide pricing implications for those legacy carriers under threat by low-cost competitors in the current recessionary period.

2. Data

The quarterly dataset comes from the Origin and Destination Survey (DB1B Market) collected by the Bureau of Transportation Statistics in the United States. These data constitute a 10% sample of airline tickets from reporting carriers. Each observation is a flight itinerary that includes information such as the identity of the airline, airfare, number of passengers that purchase the specific itinerary, miles flown on the trip itinerary, and origin and destination airports.

In this study, an air travel product is defined as the combination of trip itinerary and airline. A market is defined as directional air travel between the origin and destination city. Note that the city-pair definition of a market in this study differs from that in Berry and Jia (2010) [13] . As the present research aims to identify the effect of LCCs on the performance of legacy carriers, it is necessary to consider local competitors, especially in a large city.4 Brueckner et al. (2013) [9] stated, for example, that LCCs have a significant impact on pricing regardless of whether the competition occurs on the airport-pair or at adjacent airports.

The data in this study are focused on US domestic flights offered and operated by US carriers in the first quarters of 1998, 2005, and 2012. Observations with missing airfares and airfares less than $50 and over $3000 are omitted because of the high probability that they may be data entry coding errors or discounted fares that may be related to passengers using accumulated frequent-flyer miles to offset the full travel cost. Meanwhile, a product needs to have at least five passengers purchasing it during the quarter and a market needs to include products provided by both legacy carriers and LCCs to be included in the analysis. To collapse the data based on the definition of a product in this study, the mean price is used for each distinct itinerary-carrier combination, while the quantity variable is the sum of those passengers that purchase the product.

Table 1 defines all the variables used in this study, while the summary statistics of the sample data are reported in Table 2. The final dataset has a sample size of 8150 products spread across 274 origin/destination markets in 1998, while there are 11,456 products across 411 markets in 2005 and 10,429 products across 398 markets in 2012.

Overall, the average airfare is about $249 in 1998, with fares subsequently decreasing because of the financial pressure caused by the 9/11 terrorist attacks and airline bankruptcies in the early 2000s. The number of products provided by LCCs is growing over time, while legacy carriers provide fewer products in 2012 compared with in 1998. Figure 2 displays the price density for the products offered by both legacy carriers and LCCs. Compared with 1998, the airfares of these two types of carriers are closer in 2012. This evidence shows that the presence of LCCs affected air travel competition between 1998 and 2012.

3. Model

The differentiated products framework allows us to draw conclusions about how prices relate to costs compared with the less precise estimates derived from reduced form regressions. The challenge in using such an aggregated dataset is the lack of information about passengers’ travel purpose. A business traveler is less price sensitive compared with a leisure traveler (Gillen et al., 2003) [15] and may

Table 1. Variable definitions.

Table 2. Descriptive statistics in 1998, 2005, and 2012.

Figure 2. Product price dispersion by legacy carriers and LCCs.

thus be more likely to pay a higher airfare owing to time constraints. Thus, passengers’ choice behavior in this market can influence the corresponding product markup. In the spirit of the input of Nevo (2000) [16] , Berry et al. (2006) [12] , and Berry and Jia (2010) [13] on differentiated products demand, I use the following structural econometric model to capture passengers’ changing preferences in 1998, 2005, and 2012:

(1)

where is the indirect utility of consumer i purchasing product j in market m and is a vector of the non-price observable product characteristics, such as the number of intermediate stops in a product, a measure of itinerary convenience, hub size, and other variables related to the hub premium. is a vector of the preference coefficients for consumers of type t (either leisure or business) associated with product characteristics in , is the product price, and is the marginal utility for consumers of type t associated with a change in price. Here, captures the components of product characteristics observed by consumers but unobserved by researchers. is a random component of utility common across all products within the same group/airline, whereas the term is an independently and identically distributed random error term across products, consumers, and markets. Note that indexes product groups within a market and one outside alternative (g = 0). The outside alternative is the option not to purchase one of the air travel products considered in the model. The parameter lies between 0 and 1 and measures the correlation of consumer utility across products belonging to the same group/airline g. The correlation of preferences increases as approaches 1. In the case where is 0, the model collapses to a standard logit model where products compete symmetrically.

The market share for type t consumers, , of product j is simply the multiplication of the group share by the within-group share, which is given by

(2)

where and is the set of products belonging to group g.

Then, the market share of product j is the weighted average across the two types of consumers:

(3)

where is the proportion of leisure (type L) consumers in the population and is the proportion of business (type B) consumers. is the vector of the demand parameters to be estimated.

Demand for product j can be expressed as , where POP is the geometric mean of the population in the origin and destination cities, which is a measure of market size in this study.

As for the supply side, carriers are assumed to set prices according to a static Nash-Bertrand game. Each carrier f offers a set of Kf products for sale. Carrier f has the variable profit function in market m:

(4)

where , , and are the respective price, marginal cost, and quantity of product j sold by carrier f. In equilibrium, the amount of product j a carrier sells equals demand, that is, . Thus, the Nash-Bertrand equilibrium is characterized by the following system of J first-order equations:

,

which can be rearranged to compute the product markups:

(5)

where is the product markup function that depends exclusively on the demand-side variables and parameter estimates. With these computed product markups, the product’s marginal costs can be recovered by

(6)

where w is the matrix of the observed marginal cost-shifting variables, including Itinerary Distance, Distance Squared, Hub Dummy, the operating carrier dummies, and the other relative cost-shifting variables. is a vector of the cost parameters to be estimated, while is a vector of the cost shocks unobserved by researchers.

While the demand and marginal cost parameters can be estimated jointly by GMM, the price elasticity of demand can be computed as well. As such, we can compare consumers’ sensitivity to price changes according to their type for the different hub premiums and years. Having estimated the demand and marginal cost parameters for each year, we can compute the predicted markup and marginal cost and then the counterfactual experiments can be carried out.

4. Empirical Results

4.1. Parameter Estimates

Table 3 reports the parameter estimates of the demand and marginal cost equations in each sample period. The random coefficients logit demand model is used to disentangle the choice behavior for the two types of consumers by using the Price and Interstop variables. In 1998, the price coefficient of type L consumers is significantly negative, which indicates that their utility tends to decrease as airfare increases. Compared with the price coefficient of type B consumers, the result suggests that type L consumers are much more sensitive to price changes. The Interstop coefficients are significantly negative for both types of consumers, implying that all consumers prefer nonstop flights in their itinerary.

Table 3. Joint estimation of the demand and marginal cost equations.

*represents statistical significance at the 0.05 level. Ticketing (operating) carrier dummy variables are included in the demand (marginal cost) model for the estimation even though the associated coefficient estimates are not reported in the table.

The negative coefficient estimates for the Inconvenience and Slot-control variables suggest that consumers’ utility tends to decrease with a longer route or a slot-controlled airport in the itinerary. On the contrary, consumers usually believe that choosing a hub as the origin airport leads to better departure options or gate access (Berry et al., 2006) [12] . Consistent with the findings of previous studies, the positive HUB_Origin coefficient indicates that a consumer’s utility tends to increase if the origin airport is the carrier’s hub. In addition, the significant coefficient estimate for the Tour dummy captures the relatively high traffic volume in Florida and Las Vegas, which cannot be abstracted. Further, the estimates of Legacy_mkt and LCC_mkt are insignificant. This finding suggests that consumers may feel indifferent about the number of product options regardless of whether the offer is provided by legacy carrier or an LCC. Moreover, the coefficient of

As for the supply side, the coefficient estimates for Distance and Distance2 are insignificant. Other things being equal, the negative coefficient estimate of HUB_MC suggests that economies of density occur substantially in the air travel market, which leads to downward pressure on marginal cost. In addition, marginal cost is higher if the route passes through a slot-controlled airport, as expected.

The results for 2005 and 2012 show that the coefficients of the variables are roughly similar in magnitude to those in 1998. Note that the coefficient of is relatively large, which means that more type L consumers are considered to be price sensitive over time. In addition, the coefficient estimate for HUB_MC becomes positive in 2012. Since the HUB_MC estimate includes other opposing pressures on marginal cost, such as the expense of incurring flight delays and congestion, this estimate could be positive or negative depending on the circumstances.

4.2. Price Elasticity of Demand

Table 4 reports the summary statistics on the price elasticity estimates across all products and by the different categories. Starting the specification in 1998, the mean price elasticity estimate generated by our demand model is −1.6338. This result means that a 1% increase in the price of one product would result in a 1.6338% decrease in its demand. The mean price elasticity estimated for type L and type B consumers is −5.35 and −0.67, respectively. As expected, type L consumers are relatively more price sensitive.

On average, consumers respond differently when facing price changes by legacy carriers and LCCs. Overall, a 1% increase in price causes consumers to decrease their demand for a legacy carrier’s product and an LCC’s product by 1.57% and 1.78%, respectively. However, the price sensitivity gap reduces in 2005 and 2012 compared with 1998. Further, consumers are less price sensitive in long-haul markets compared with short-haul and mid-haul markets, perhaps because they may not easily find an alternative option for a long-haul itinerary. This finding is consistent throughout the study period.

4.3. Markup and Marginal Cost

The joint estimates in the demand-and-supply structure framework allow us to compute the product-level markups and marginal costs precisely. The mean estimates of the markups and marginal costs are presented in Table 5. The results show that a product has a larger markup and a smaller marginal cost in 2012

Table 4. Summary statistics for the price elasticity estimates.

* represents statistical significance at the 0.05 level.

Table 5. Summary statistics for the markup and marginal cost (in Dollars).

compared with 1998. Specifically, a legacy carrier’s product, on average, faces a higher marginal cost and a higher markup compared with an LCC’s product. However, the markup on an LCC’s products grows at a faster rate compared with that of the legacy carrier’s products.

4.4. Counterfactual Exercise

The counterfactual exercise is carried out to assess the impact of LCCs’ products on the pricing of legacy carriers’ products and evaluate the extent of the threat to hub-and-spoke networks. To disclose the effect, we remove the LCCs’ products from each sample market to allow the predicted equilibrium prices for legacy carriers’ products to be estimated by assuming a 5% increase in marginal cost. This increase is based on the fact that the marginal cost of transferring passengers from a legacy product should increase if the market has fewer products. For example, a legacy carrier needs to provide more flights to accommodate passengers’ needs, which require extra costs such as labor and fuel.

The findings of the comparison between the actual prices and predicted equilibrium prices of legacy carriers’ products are summarized in Table 6. In 1998, the predicted equilibrium price, on average, increases by $128 if the LCCs’ products are counterfactually removed. This positive power suggests that legacy carriers dominate airfares in that year. If the market lacks LCCs’ products, the degree of market power on the legacy’s products rises. Specifically, the degree of market power seems to grow in long-haul distance markets compared with short-haul markets.

However, the opposing pressure exists in 2005, and this negative magnitude becomes larger in 2012, perhaps sowing to economies of density. If the markets remove LCCs’ products counterfactually, the existing airline should be able to better arrange passengers from different origins and with different destinations on a single large plane for a segment of the trip, which has a downward effect on pricing. In practice, however, because LCCs’ products exist in the markets, legacy carriers cannot fully exploit this density power. Since 2012, the competition between legacy carriers and LCCs has become more intense, gradually

Table 6. Summary statistics for the predicted price differences in the counterfactual exercise.

hampering hub-and-spoke networks. As such, legacy carriers need to raise their airfares in order to retain the anticipated markup. Therefore, a legacy carrier may consider reforming its hubbing network as an efficient way in which to overcome the pricing pressure from the rise of LCCs.

5. Conclusions

Recent research has highlighted the hubbing effect of hub-and-spoke networks, which should give carriers sufficient competitive advantage to increase their share of products at the hub and create airport dominance. However, while passengers still find it more convenient to choose itineraries offered by hub airlines and benefit from frequent-flyer membership with a hub airline, this study investigates the extent to which the presence of LCCs has influenced the dominance of network carriers.

To capture the hub premium effect in each particular market over the past 20 years, three periods are selected: 1998 (pre-9/11 period), 2005 (post-9/11 period), and 2012 (post-financial crisis period). The results of this counterfactual exercise find that legacy carriers dominated airfares in 1998, especially in long-haul distance markets; however, the opposing pressure existed in 2005 and this negative magnitude rose in 2012. This downward pressure indicates that the competition between legacy carriers and LCCs since 2005 has been becoming more intense in practice. Therefore, legacy carriers actually need to raise their airfares in order to retain the anticipated markup.

The empirical results imply pricing strategies and solutions for legacy carriers. Their competitive advantage has declined compared with LCCs in recent years. Hence, LCCs gradually limit legacy carriers’ ability to realize the benefits of hub-and-spoke networks. To counter the aggressive expansion of LCCs, legacy carriers should thus reform their hubbing networks in an efficient way to exploit economies of density fully.

Acknowledgements

I thank the anonymous referees for their useful suggestions. Also, I thank the Ministry of Science and Technology for providing project funding (grand no. NSC 103-2410-H-035-002) to support this research.

Cite this paper

Wu, C.-Y. (2017) The Impact of Low-Cost Carriers’ Expansion on Hub-and-Spoke Networks: Evidence from the US Airline Industry. Modern Economy, 8, 1400-1413. https://doi.org/10.4236/me.2017.812094

References

- 1. Berry, S. (1990) Airport Presence as Product Differentiation. American Economic Review, 80, 394-399.

- 2. Proussaloglou, K. and Koppelman, F. (1995) Air Carrier Demand: An Analysis of Market Share Determinants. Transportation, 22, 371-388. https://doi.org/10.1007/BF01098165

- 3. Brueckner, J.K. and Spiller, P.T. (1994) Economies of Traffic Density in the Deregulated Airline Industry. Journal of Law and Economics, 37, 379-415. https://doi.org/10.1086/467318

- 4. Borenstein, S. and Rose, N.L. (2013) How Airline Markets Work … or Do They? Regulatory Reform in the Airline Industry. In: Economic Regulation and Its Reform: What Have We Learned? University of Chicago Press, Chicago.

- 5. Borenstein, S. (1991) The Dominant-Firm Advantage in Multiproduct Industries: Evidence from the U.S. Airlines. Quarterly Journal of Economics, 106, 1237-1266. https://doi.org/10.2307/2937963

- 6. Dresner, M., Lin, J.C. and Windle, R. (1996) The Impact of Low Cost Carriers on Airport and Route Competition. Journal of Transport Economics and Policy, 30, 309-328.

- 7. Morrison, S.A. (2001) Actual, Adjacent, and Potential Competition: Estimating the Full Effect of Southwest Airlines. Journal of Transport Economics and Policy, 32, 239-256.

- 8. Goolsbee, A. and Syverson, C. (2008) How Do Incumbents Respond to the Threat of Entry? Evidence from the Major Airlines. Quarterly Journal of Economics, 123, 1611-1633. https://doi.org/10.1162/qjec.2008.123.4.1611

- 9. Brueckner, J.K., Lee, D. and Singer, E. (2013) Airline Competition and Domestic U.S. Airfares: A Comprehensive Reappraisal. Economics of Transportation, 2, 1-17. https://doi.org/10.1016/j.ecotra.2012.06.001

- 10. Mozdzanowska, A.L. (2004) Evaluation of Regional Jet Operating Patterns in the Continental United States. Master Dissertation, Massachusetts Institute of Technology, Cambridge.

- 11. Hüschelrath, K. and Müller, K. (2012) Low Cost Carriers and the Evolution of the Domestic U.S. Airline Industry. Competition and Regulation in Network Industries, 13, 133-159. https://doi.org/10.1177/178359171201300202

- 12. Berry, S., Carnall, M. and Spiller, P.T. (2006) Airline Hubs: Costs, Markups and the Implications of Customer Heterogeneity. Advances in Airline Economics: Competition Policy and Antitrust, 1, 183-214.

- 13. Berry, S. and Jia, P. (2010) Tracing the Woes: An Empirical Analysis of the Airline Industry. American Economic Journal: Microeconomics, 2, 1-43. https://doi.org/10.1257/mic.2.3.1

- 14. Ater, I. (2012) Internalization of Congestion at US Hub Airports. Journal of Urban Economics, 72, 196-209. https://doi.org/10.1016/j.jue.2012.05.004

- 15. Gillen, D.W., Morrison, W.G. and Stewart, C. (2003) Air Travel Demand Elasticities: Concepts, Issues and Measurement. Department of Finance, Government of Canada.

- 16. Nevo, A. (2000) Mergers with Differentiated Products: The Case of the Ready-to-Eat Cereal Industry. RAND Journal of Economics, 31, 395-421. https://doi.org/10.2307/2600994

NOTES

1In a hub-and-spoke network, a hub refers to an airport in which a carrier concentrates its operations and services, while the spoke airports from other cities in the network have non-stop flights only to the hub.

2The major legacy carriers in the domestic US airline industry are American Airlines, Continental Airlines, Delta Air Lines, Northwest Airlines, United Airlines, and US Airways.

3The major LCCs in the domestic US airline industry are AirTran Airways, Allegiant Air, Frontier Airlines, JetBlue Airways, Southwest Airlines, Spirit Airlines, Sun Country Airlines, and Virgin America.

4For example, the O’Hare International Airport is a major hub for United Airlines in Chicago, while Southwest provides services at the Chicago Midway International Airport in the same city.