Modern Economy

Vol.07 No.01(2016), Article ID:62697,10 pages

10.4236/me.2016.71002

Financial Development and Regional Innovation Output Growth: Based on Empirical Analysis of Provincial Panel Data in China

Wenfeng Zhao

School of Economics, Jinan University, Guangzhou, China

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 7 December 2015; accepted 10 January 2016; published 13 January 2016

ABSTRACT

The paper conducts empirical analysis of influence of financial development on regional innovation through establishing effect regression model of panel data based on the economic data from 2003 to 2014 in 31 provinces and cities. Because the financial intermediary and security market are the main source of financial capital required in technical innovation, the paper discusses the influence of financial development on regional innovation output from two angles of financial intermediary development and credit market development, and compares the regional differences of the influence on this basis. The results show that in the nationwide respective, whether the development of financial intermediary or security market has obvious positive influence on the regional innovation output, while the influence degree of the former is larger than the latter. In the regional perspective, the development of security market in the eastern region generates more obvious influence on the regional innovation, and the financial intermediary in central and western region generates more obvious effect in driving the growth of regional innovation output, while the development of security market has no obvious effect in the regional innovation output growth in central and western region.

Keywords:

Financial Development, Financial Intermediary, Security Market, Regional Innovation Output

1. Introduction

At present, the economy in China goes into a new normal and economic growth speed turns to middle-high from high. The drive power of economic growth turns to innovation from element and investment, and innovation is being the core drive force of economic growth in China. We may better adapt to the new normal as long as we greatly drive independent innovation and constantly accelerate the construction space of new country. In modern financial development theory, the financial development has promotion effect on the innovation, which may provide better financial service and drive technical innovation. In recent ten years, the regional innovation ability and the level of financial development of our country are increasing rapidly. In the aspect of innovation output, China’s technology market turnover reached 858 billion in 2014 and the average annual growth rate is about 15% in recent ten years; the granted quantity of three kinds of patents reached 1.21 million and the total granted quantity of three kinds of patents aggregated to more than 7.87 million in 2014. In the aspect of financial development, taking financial institutions and stock market as an example, deposit and loan balances of all financial institutions and stock market value are respectively 198 trillion and 37 trillion. But in 2003, they were 39 trillion and 3 trillion, respectively. Although the overall level of China’s financial development is improving rapidly, the regional unbalance is obvious. Significant differences may exist in the financial development in promoting the regional innovation. The existing literatures mainly analyze the influence of financial development on technical innovation from the development perspective of financial intermediary, ignore the influence of security market development on technical innovation, and lack the comparison of two influences and possible regional differences. Therefore, it is necessary to conduct research further. The paper establishes panel data fixed effect model based on the provincial panel data from 2003 to 2014 and analyzes the contribution degree of financial development to regional innovation from two aspects of financial intermediary development and security market, and the regional difference of the contribution degree. The paper finally presents feasible policy suggestions to promote regional innovation from the perspective of financial development.

2. Literature Review

The expression regarding the influence of financial development on technical innovation may be shown in Economic Development Theory written by Joseph Alois Schumpeter one century ago at the earliest. In his opinion (1990), the bank plays an important role in driving technical innovation. The bank should screen and elect the enterprises with most research and development capacity and provide capital to these enterprises to promote innovation [1] . Saint-Paul (1992) held the development of financial market is conductive to scattering the cross- period risks in the face of these enterprises in investment process, thus encourage the enterprises to choose more professional technologies and improve rate in enterprise technical innovation [2] . King and Levine (1993) discovered through researching the internal mechanism of financial system influencing economic growth that a better financial system may improve the possibility of innovation success and promote economic growth [3] . In the opinion of Levine (1997), capital accumulation and technical progress are two main routes of financial development promoting economic growth. Financial development may changes technical innovation efficiency, namely through information screening and investigation, provide capitals to the enterprises which may develop new technologies and products [4] . Li Songtao and Yu Xiaojian (2002) regarded the financial system may be divided into two types, bank-centered and security market-centered. Technical leaders involve more direct financing and technical pursuers involve more indirect financing. They hold China should insist on dual development and pay equal attention to direct financing system and indirect financing system from the perspective of promoting technical progress [5] . In the opinion of Sun Wuqin (2004), the financial system may promote technical innovation by providing risks management functions, information processing functions, mobilization saving and convenient conversion functions. Compared with financial structure led by bank intermediary, the financial structure lead by bank market is more suitable to the financing in high-risk and high-technology industry, which may more promote technical innovation [6] . Zhang Decheng (2007) held the economic entities are willing to assume the huge risks in technical innovation because huge interests exist behind the risks. The reasonability of financial support based on risk interests lies in the financial system has stimulation, risk constraint and avoidance, risk interest transaction and other effects to technical innovation. The theory provides basis for technical innovation financial support and other institutional arrangement [7] . Tang Qing and Li Xiaoxia (2010) analyzed the mechanism of financial intermediary development promoting technical innovation. Financial intermediary promotes technical innovation from such aspects of financing, capital configuration, information screening and transfer, risks management and scattering, monitoring and assessment [8] . Deng Honghui and Su Jirong (2011) analyzed the mechanism of financial development promoting technical progress from the perspective of technical progress. Theoretical research shows that a better financial market may provide technical innovation and drive economic growth from the aspects of screening and monitoring enterprises, mobilization saving, encouraging long-term investment and scattering risks [9] .

In the aspect of empirical research, the foreign scholars also implemented many researches, such as Beck (1999) and Nourzad (2002) confirmed the positive influence of financial intermediary development on technical progress represented by TFP based on the research of transnational data [10] [11] . Tadesse (2007) discovered the industrial technology progress and bank intermediary development present positive relationship, while stock market does not present the positive influence [12] . When it is specific to national conditions, Xiao Wen et al. (2008) utilized the quarterly data in China to conduct empirical analysis on the relevance between financial development and technical innovation. The research shows that the development of stock market and financial intermediary has long-term positive relationship with technical innovation [13] . Yao Yaojun (2010) conducts empirical test on the relationship between financial intermediary development and technical progress based on provincial panel data in China. The conclusions show that the development of financial intermediary has significant positive influence on technical progress [14] . Qian Shuitu and Zhou Yongtao (2011) also drew similar conclusions [15] . Jiang Chengwu (2010) researched the influence of FDI and financial intermediary development on innovation ability. The research shows that the development of financial intermediary has negative influence on the improvement of innovation ability in China. From the perspective of region, the influence is positive in the east and is negative in the west and middle [16] . Xu Yulian and Wang Hongqi (2011) discovered the development of stock market has positive influence on technical innovation upon the empirical inspection of Granger casual from financial development and technical innovation from 1994 to 2008, while the positive influence of bank and security market on technical innovation is not obvious [17] . Deng Honghui and Su Jirong (2011) taking TFP as the measurement of technical progress analyzed the influence of financial development on technical progress. The research results show that the financial development level obviously promotes technical progress rate. The influence is the most obvious in the east, and the next ones are the middle and east [9] . Yao Yaojun and Dong Gangfeng (2013) constructed the measurement index of financial development level with principal component analysis method based on the provincial panel data, and investigated the influence of financial development and financial structure on technical progress. The research shows the promotion of relative position of financial development and middle-small banks in banking industry is conductive to technical progress [18] .

In balance, in the aspect of theoretical research, the influence mechanism of financial development to technical innovation is more definite. Financial development promotes technical innovation via providing direct (security market) or indirect (financial intermediary) financing, management and control and scattering risks. In the aspect of empirical research, although financial intermediary and security market are the important source of technical innovation capital, the empirical research only pays attention to the promotion effect of bank intermediary development on technical progress and innovation, ignores the influence of security market development on technical innovation and lacks the comparison of two influences because the financial structure in China is still dominated by bank. In addition, many scholars measure technical progress with R&D input method or TFP method, rather than measuring the technical innovation ability in each region from the perspective of innovation. Therefore, the paper analyzes the different influences of financial intermediary and security market on regional innovation and compares the regional differences of the influence based on provincial panel data and from the perspective of innovation output.

3. Index Selection, Model Construction and Data Source

3.1. Index Selection

3.1.1. Explained Variables

There are many indexes measuring the regional innovation output, such as new product output, patent application and granted, technical market turnover, etc. patent data are adopted by most scholars because they are easily obtained and better reflect the actual conditions in regional innovation output with objective standard. According to the definition of SIPO, the patent is divided into patent for invention, patent for utility model and patent for appearance design. Among three patents, the invention patent is characterized by highest technical content and application difficulty, thus it may objectively reflect the actual innovation ability in a region (Liu Fengchao, Sun Yutao (2006); Li Jiang, Tan Qingmei and Bai Junhong (2010)) [19] [20] . In addition, compared to the patent applications, patents application granted is the actual output of regional patent, which may better reflect the actual quantity of regional innovation output. The paper chooses the granted quantity of invention patents in 31 provinces and cities to measure to innovation output level in each region. Because it will cost about 2 years to obtain the granting, the data of invention patent in the following empirical research lags behind 2 stages.

3.1.2. Explaining Variables

1) Core explaining variable

The core explaining variable is the main variable that needs to be studied in this paper, that is, financial development. Financial development mainly is embodied in financial intermediary development and security market development. As the deposit money banks are the main part of the financial intermediaries (Zhou Haowen, Zhong Yonghong, 2004) [21] , the efficiency of the bank directly reflects the resource allocation efficiency of financial intermediary in China. Therefore, domestic scholars usually take the deposit money banks to measure the development level of financial intermediary. The paper referring to the practice of Sun Lijun (2008) and Tang Qing, Li Xiaoxia (2010) [8] [22] , selects the rate between loans and deposits balance in financial organization and GDP to measure the development level of financial intermediary in certain region. The higher rate indicates the proportion of financial intermediary asset size accounting for regional economic gross is higher and the financial intermediary provides more sufficient financial services in the whole economy. Therefore, the index may better reflect the development level of financial intermediary in each district. As the security market is dominated by stock market in China, this paper selects the rate (STK) between gross stock value and GDP to measure the development scale of stock market in each district (Shi Wenming (2010); Yao Yaojun (2013)). The higher number indicates the scale of stock market is larger and the development level of security market is higher [18] [23] .

2) Control variables

In addition to the level of financial development, there are some other factors that affect the regional innovation output. This paper mainly selects the R&D investment and foreign direct investment as the control variables.

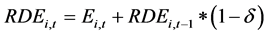

Personnel input (RDP) and capital input (RDE): innovation is a special production process. The amount of input elements directly influences innovation output level. Innovation input mainly includes personnel input and capital input. The paper selects the full-time equivalent (RDP) of research and experimental development personnel in each district as the personnel input of innovation output. The value is the sum of full-time R&D personnel plus part-time personnel in reporting period. The expenditure of R&D and experimental development funds is regarded as the capital input of innovation output. Because the fund input in that period will not only influence the influence output in that period, but also influence the output in future periods. Therefore, the paper referring to the practice of Wu Yanbing (2008) takes perpetual inventory method to calculate the capital stock of experimental and research development funds input in each period [24] . The calculation formula is shown as follows:

(1)

(1)

where,  and

and  are the capital stock in t period and t − 1 period in i district respectively; δ is the depreciation rate (δ = 15%);

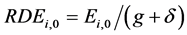

are the capital stock in t period and t − 1 period in i district respectively; δ is the depreciation rate (δ = 15%);  is the expenditure of research and experimental development funds in t period in i district. The value equals the number after deflating the nominal expenditures in each period with deflator taking the year of 2003 as the base period. The deflator in each period = 0.55 × consumer price index in each period + 0.45 × price index of investment in fixed assets in each period. The calculation formula of capital stock in each period of 2003 is:

is the expenditure of research and experimental development funds in t period in i district. The value equals the number after deflating the nominal expenditures in each period with deflator taking the year of 2003 as the base period. The deflator in each period = 0.55 × consumer price index in each period + 0.45 × price index of investment in fixed assets in each period. The calculation formula of capital stock in each period of 2003 is:

(2)

(2)

where,  is the capital stock in 2003;

is the capital stock in 2003;  is the internal expenditure of research and experimental development funds in 2003; g is the average growth rate of actual research and development funds expenditure in the period.

is the internal expenditure of research and experimental development funds in 2003; g is the average growth rate of actual research and development funds expenditure in the period.

Practical use of FDI: FDI has obvious influence on the regional innovation output (Jiang Chengwu (2010); Yao Yaojun (2013)) [16] [18] . The paper selects FDI in each district as the control variable. Because the original value is priced with USD, turn FDI to RMB price with the average exchange rate of RMB-USD in past years. Taking 2003 as a base period, use GDP deflator to deflate and cancel the influence of inflation. GDP deflator equals to the rate of gross nominal production value versus actual gross production value in each district. The actual gross production value in each district is converted based on the index of gross production value in each district taking the year of 2003 as a base year.

3.2. Model Construction

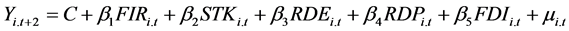

In essence, innovation process is the process of knowledge production. If written to the form of production function, it may be shown by the following formula:

(3)

(3)

where, Y denotes the quantity of regional innovation output; L and K denote the input of manpower and capital; FD denotes the financial development level; Z denotes other factors influencing regional innovation output. According to Cobb-Douglas production function, the model may be set as follows:

(4)

(4)

indicates the granted quantity of invention patent applications in t + 2 period in i district;

indicates the granted quantity of invention patent applications in t + 2 period in i district;  indicates the development level of financial intermediary in t period in i district;

indicates the development level of financial intermediary in t period in i district;  indicates the development level of security market in t period in i district;

indicates the development level of security market in t period in i district;  and

and  respectively denote the personnel input and capital input of experiment and research development in t period in i district;

respectively denote the personnel input and capital input of experiment and research development in t period in i district;  indicates the actual utilization of FDI (RMB) in t period in i district;

indicates the actual utilization of FDI (RMB) in t period in i district;

3.3. Data Source

The paper takes 31 provinces and cities as the sample and researches the influence of financial development on regional innovation output. Patent data, R&D fund expenditure data and R&D personnel full-time equivalent data come from Statistical Yearbook of Science and Technology in China and Statistical Yearbook in 2003-2014. Financial data mainly come from wind database, China economic and social development statistics database and Financial Yearbook in China from 2003 to 2014; individual data come from the statistical yearbook of national economy and social development in each province. The definitions of above indexes and statistical nature are given in Table 1.

4. Empirical Analysis

As for the regression of panel data, we often use fixed effect model (FEM) or random effect model (REM). In FEM, each individual unit has specific intercept item. These specific intercept items reflect the differences of each individual. REM uses the common intercept to represent the average value of unit intercept on all sections. The random deviation value

Table 1. Definition of main variables and descriptive statistics.

generate biased error. So it is vital important to select the model. Which model may be used should be inspected. The paper uses Hausman test to determine choosing FEM or REM. Upon Hausman test, refuse to use the null hypothesis of REM in 1% significant level. Therefore, the paper selects FEM.

The paper takes 31 provinces and cities as the sample and uses the panel data from 2003 to 2014 (among them, the time span of the explaining variables is 2003-2012. As it will cost about 2 years to obtain the granting of invention patent, the data of invention patent lags behind 2 stages, so the time span of the explained variables is 2005-2014). Utilize the fixed effect regression model to estimate the influence of financial development on regional innovation output. The regression results of Stata12.0 are shown as Table 2 below.

The regression results in Table 2 show that in model (1), when other variables are not controlled, the development of financial intermediary and security market will generate obvious positive influence on regional innovation output. The elastic coefficient of financial intermediary and security market is respectively 2.426 and 0.445. Both are positive and obvious on 1% level. Model (2) controls the regression result of R&D capital input. The elastic coefficient of financial intermediary and security market is consistent with model (1). Further add the control variable of RDP, and the regression results are shown in model (3). The elastic coefficient of all explaining variables is positive and obvious on 1% level. In model (4), take FDI as control variable and input into the regression equation. Besides FDI is obvious on 5% level, the remaining variables are obvious on 1% level. The elastic coefficient of financial intermediary and security market is respectively 0.847 and 0.1, namely the development level of financial intermediary and security market increases 1% when other conditions keep constant and the regional innovation output will increase 0.847% and 0.1% respectively.

From the regression results in Table 2, we discover that whether the development of financial intermediary and security market obviously promotes the growth of regional innovation output. The input of FDI, research and development personnel and capital will have positive support role in regional innovation. Through comparing the elasticity coefficient in financial intermediary and security market, we may discover the elasticity coefficient of financial intermediary should be obviously larger than that of security market. At present, the promotion effect of financial intermediary to regional innovation output should be larger than the promotion effect on security market. The main causes are shown from the following aspects: firstly, the financial system in China is still dominated by banking industry and banks and other financial institutions play decisive role in regional financial service; secondly, regardless of rapid development speed, the security market has established for short time and the development is not standard in each aspect. The unreasonable intervention of the government and the immaturity of stock investors are conductive to the healthy development of stock market; thirdly, the regulation mechanism on security market is imperfect and the listed company may use the financing capital to invest in other

Table 2. Regression result of influence of financial development on regional innovation output.

Note: the number in the bracket is standard error; *, **, *** respectively denotes 10%, 5% and 1% significance level.

securities rather than inputting into research and development and expanding reproduction. The regression results show FDI has positive promotion effect on regional innovation. The elasticity coefficient is low, showing the influence of FDI to regional innovation output is limited. The result is consistent with the research result of Wang Peng and Zhang Jianbo (2013) [25] . The elasticity coefficient of scientific research capital input and personnel input is positive obviously on 1% level, showing R&D capital input and personnel input have obvious positive support role in promoting the growth of regional innovation output.

In order to further analyze the regional disparity of influence of financial development on regional innovation output, the paper will divide 31 provinces and cities in the east, middle and west, and tries to compare the regional disparity of influence of financial development on regional innovation output. The regions in the east include Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong and Hainan; the regions in the middle mainly include Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei and Hunan; the regions in the west mainly include Guangxi, Inner Mongolia, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia and Xinjiang. The regression results are shown in Table 3.

Table 3 is the regression result of 31 provinces and cities divided into the east, middle and west. From the regression results in the east, the elasticity coefficient of security market, R&D capital and personnel input is positive on 1% level, while the elasticity coefficient of financial intermediary does not pass the significance inspection, showing the support effect of financial intermediary development on regional innovation output in not obvious in the east. It is not consistent with the previous conclusions. The possible causes are shown as follows: firstly with regard to the eastern part, a majority of large-scale high-tech enterprises is entrenched in the east, and the reliance of modern enterprises on financial intermediary dominated by bank is not strong. They tend to the direct financing on security market further more. It may not only enlarge financing amount, but also save financing cost. The higher elasticity coefficient on stock market in the east obviously proves the point; secondly, the civil financial development level is relatively higher in the east. Under the background of difficulty in financing in SMEs, numerous SMEs may generate higher reliance on civil finance. Model (6) is the regression result in the middle, and the financial intermediary development generates obvious positive influence on regional innovation output, the elasticity coefficient of security market in the middle is not obvious. It shows the development of security market in the middle does not have obvious effect on regional innovation output because the development of security market lags behind and the financial structure is single in the middle, and the enterprises in the middle rely on the financial intermediary dominated by the bank and less enterprises participate in direct financing on security market. Model (7) is the regression result in the west, which is similar to the middle. The elasticity coefficient of financial intermediary is positive and the security market does not pass significance

Table 3. Estimate result of influence of financial development on regional innovation in each district.

Note: the number in the bracket is standard error; *, **, *** respectively denotes 10%, 5% and 1% significance level.

inspection. In addition, the positive effect of scientific and research personnel on regional innovation output does not pass the significance inspection in the west because of lack of colleges, scientific research institutions, scientific research facilities and talent attraction in the west, thus the scientific research personnel suffer from a great loss and the effect on driving local regional innovation output is limited.

Upon the comparison of three districts, we discover that the elasticity coefficient of financial intermediary in the east, middle and west is respectively 0.164, 0.758 and 1.434. The number is largest in the west and lowest in the east, showing the reliance of enterprises in the east and middle on financial intermediary is more obvious and the positive support effect of financial intermediary to regional innovation in the middle and west is stronger than the east. It mainly related to the financial structure in the middle and east. At the same time, we discover that in addition to the middle, the positive influence of FDI on regional innovation output is not obvious in the west and east, showing more innovation results in the east come from independent research and development and the positive effect of FDI to regional innovation is weakened gradually. The west is not enough to attract and digest FDI due to lagging infrastructures and harsh natural environment, causing the effect of FDI in innovation output in the west is limited.

5. Conclusions and Policy Suggestions

The paper researches the influence of financial development on regional innovation output through establishing panel data measurement economic model. Upon the above analysis, we may draw the conclusions as follows:

1) Financial development has obviously positive influence on regional innovation; while the promotion effect of financial intermediary development on regional innovation is far larger than the promotion effect of security market development on regional innovation, in the east, middle and west, the regional innovation output elasticity of financial intermediary is larger than the innovation output elasticity of security market. It shows that at present the security market development has limited effect on regional innovation output, which is related to the imperfection of security market development. The financial intermediary represented by bank is still the important financing channel of enterprises. Financial intermediary plays an important role in regional innovation network.

2) The influence of financial development on regional innovation is different in different regions. Compared to the east, the reliance on financial intermediary is stronger in the west and middle. Financial intermediary plays a higher effect in driving regional innovation. The development of security market in the east has generated stronger positive influence on regional innovation output.

3) R&D input plays fatal effect on driving regional innovation. Whether scientific research personnel input or scientific research funds input plays positive support effect on regional input output.

4) The promotion effect of FDI on regional innovation is limited and different in different regions. FDI has positive influence on regional innovation. Seeing from the empirical effect, the effect is obvious only in the middle because on one hand, the west is not enough to attract and digest FDI and the utilization rate of foreign capital is low; on the other hand, the independent innovation consciousness of enterprises in the east is strong and the government and financial institutions give high support to the technical research and development in the enterprises and scientific research institute, causing the technical level increases and the gap with foreign companies decrease. The competition promotes foreign enterprises pay attention to protecting the core technologies in the process and the technical overflow effect is limited in foreign enterprises.

Aimed at the above conclusions, we mainly present the policies and suggestions from the following points from the perspective of how to promote regional innovation output:

1) Further perfect financial system and financial management system in China promote the financial service level. At present, the financial intermediary system is dominated by bank in China and the proportion of non- bank financial organization is low, causing the diverse financial service limited, financial service required in the enterprise is not met and the ability of financial industry further driving regional innovation is not played. The security market development is imperfect, the regulation mechanism is not sound and the capital in stock market fails to access the actual production process. In addition to the east, the security market does not play the effect in driving regional innovation in the middle and west. Therefore, on one hand, we should accelerate the construction of capital market, construct a multi-level capital market system, drive the joint development of mainboard, SMEs board, GEM and new three boards to meet the diverse capital demand of the enterprise; on the other hand, we should pay attention to the regional balanced development, provide more financial policy support to the middle and east, make the enterprises in the west and middle participate in the capital market and share the development bonus of capital market.

2) Reasonably introduce and utilize foreign capital. After the reform and opening-up policy, due to the lack of national capital, China advocates the introduction of foreign capital while ignoring the quality of foreign capital. A large batch of foreign capital brings a lot of problems regardless of the important drive effect on the economic development. At present, China has become the second economic body in the world and the condition of lacking national capital has been passed. Therefore, we should pay more attention to the quality rather than the quantity of foreign investment. In the process of introducing foreign capital, the east and middle should attach importance to the investment which may bring new technologies and processes to China, and especially introduce more foreign capitals into the technical and scientific research and development of enterprises or scientific research institutions. In order to attract more foreign capitals, the west should accelerate the construction of infrastructures ad create good environment for foreign capital, and also continuously improve the ability in attracting and digesting foreign capital, reasonably allocate resources, improve utilization efficiency of foreign capital, promote the west step over the threshold of FDI technical spillover effect and drive the growth of regional output in the west.

3) Constantly enlarge scientific research personnel input and capital input. R&D personnel and R&D capital input produces obvious effect on regional innovation output. On one hand, the government should increase R&D funds input into the enterprises and scientific research institutions. The enterprises and scientific research institutions should seek for diverse financing channels, reasonably allocate capital and improve the utilization efficiency of capital. On the other hand, we should attach importance to the cultivation and introduction of talents, in order to provide human and capital support to regional innovation.

Cite this paper

WenfengZhao, (2016) Financial Development and Regional Innovation Output Growth: Based on Empirical Analysis of Provincial Panel Data in China. Modern Economy,07,10-19. doi: 10.4236/me.2016.71002

References

- 1. Schumpeter, J. (1990) The Theory of Economic Development. The Commercial Press, Beijing, 78-85.

- 2. Saint-Paul, G. (1992) Technological Choice, Financial Markets and Economic Development. European Economic Review, 36, 763-781. http://dx.doi.org/10.1016/0014-2921(92)90056-3

- 3. King, R.G. and Levine, R. (1993) Finance, Entrepreneurship and Growth. Journal of Monetary Economics, 32, 513-542. http://dx.doi.org/10.1016/0304-3932(93)90028-E

- 4. Levine, R. (1997) Financial Development and Economic Growth: Views and Agenda. Journal of Economic Literature, 35, 688-726.

- 5. Li, S.T. and Yu, X.J. (2002) The Discussion on the Interrelation between Technology Innovation Model and Financial System Model. Soft Science, 16, 5-7.

- 6. Sun, W.Q. (2004) The Discussion on the Influence of Different Financial Structure on Technological Innovation. Economic Geography, 24, 182-186.

- 7. Zhang, D.C. (2007) The Discussion on the Necessity of the Risk and the Benefit Principle of Technological Innovation and Financial Support. Journal of Shanghai Jiao Tong University: Philosophy and Social Sciences Edition, 15, 56-60.

- 8. Tang, Q. and Li, X.X. (2010) Empirical Analysis of the Role of Financial Intermediation Development to Technology Innovation: Based on the Panel Data of Guangdong Province. Scientific and Technological Progress and Countermeasures, 27, 12-15.

- 9. Deng, H.H. and Su, J.R. (2011) Financial Development and Technological Progress: Base on Research on the Provincial Data of China. Journal of Xi’an Electronic and Science University: Social Science Edition, 2, 37-42.

- 10. Beck, T., Levine, R. and Loayza, N. (1999) Finance and Sources of Growth. Journal of Financial Economics, 58, 261-310. http://dx.doi.org/10.1016/S0304-405X(00)00072-6

- 11. Nourzad, F. (2002) Financial Development and Productive Efficiency: A Panel Study of Developed and Developing Countries. Journal of Economics and Finance, 26, 138-149.

http://dx.doi.org/10.1007/BF02755981 - 12. Tadesse, S. (2007) Financial Development and Technology. William Davidson Institute (WDI) Working Paper.

- 13. Xiao, W., Wang, Z.H., Xie, Y.Y. and Fu, B.L. (2009) Empirical Analysis of the Correlation between Financial Development and Technological Innovation in China. Contemporary Economy, 22, 114-116.

- 14. Yao, Y.J. (2010) Financial Intermediary Development and Technology Progress—From the Evidence of the Chinese Provincial Panel Data. Finance and Trade Economics, No. 4, 26-31.

- 15. Qian, S.T. and Zhou, Y.T. (2011) Financial Development, Technological Progress and Industrial Upgrading. Statistical Research, 28, 68-74.

- 16. Jiang, C.W. (2010) FDI, Study on the Impact of Financial Development on the Innovation Capability in China. Jiangxi University of Finance and Economics, Nanchang.

- 17. Xu, Y.L. and Wang, H.Q. (2011) Empirical Analysis of the Effect of Financial Development on Technological Innovation in China. Statistics and Decision, 21, 144-146.

- 18. Yao, Y.J. and Dong, G.F. (2013) Financial Development, Financial Structure and Technological Progress—Empirical Evidence of Chinese Provincial Panel Data. Contemporary Finance and Economics, No. 11, 56-65.

- 19. Liu, F.Z. and Sun, Y.T. (2006) Comparison of Regional Distribution of Patents for Inventions in the United States and China. Contemporary Finance, No. 4, 14-17.

- 20. Li, J., Tan, Q.M. and Bai, J.H. (2010) Spatial Econometric Analysis of Regional Innovation Production in China: Based on the Empirical Research on Static and Dynamic Spatial Panel Model. Management World, No. 7, 43-55.

- 21. Zhou, H.W. and Zhong, Y.H. (2004) China’s Financial Intermediation Development and Regional Economic Growth: Analysis of Multivariable VAR Systems. Journal of Financial Research, No. 6, 130-137.

- 22. Sun, L.J. (2008) Financial Development, FDI, Economic Growth. The Journal of Quantitative & Technical Economics, 25, 3-14.

- 23. Shi, W.M. and Wang, Y.H. (2010) The Threshold Effect of the Impact of Financial Development on Technological Progress: Based on Empirical Evidence of Chinese Provincial Panel Data. Journal of Shanxi University of Finance and Economics, 32, 38-45.

- 24. Wu, Y.B. (2008) Chinese Industry R&D Calculation on Output Elasticity (1993-2002). Economics Quarterly, 7, 869-890.

- 25. Wang, P. and Zhang, J.B. (2013) Foreign Direct Investment, Government-Business-University-Research Cooperation and Regional Innovation Output: Based on the Empirical Study of the Panel Data of China’s Thirteen Provinces. Economists, 1, 58-66.