Modern Economy

Vol.06 No.09(2015), Article ID:59523,5 pages

10.4236/me.2015.69089

Relationship between Family Care and Public Care Services for the Elderly

Yuko Mihara

Faculty of Informatics, Okayama University of Science, Okayama, Japan

Email: y-miha@soci.ous.ac.jp

Copyright © 2015 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 30 July 2015; accepted 8 September 2015; published 11 September 2015

ABSTRACT

Japan has been experiencing significant changes in its demographics. This study examines the effects of public care services and in doing so, aims to show that it is possible to improve overall welfare level by substituting family care with public care services, particularly when family care and public care services are interchangeable. In addition, we show that instead of reducing family care to zero, further expanding public care services can help achieve welfare optimization.

Keywords:

Family Care, Public Care Services, Overlapping Generations Model

1. Introduction

Japan has been experiencing dramatic changes in its demographics owing to multiple factors. While its elderly population has been increasing because of extended average life expectancy, birth rate has been declining with the growing rate of unmarried individuals and tendencies of late marriages and child birth. Thus, managing the increase in elderly population has become a serious concern. According to the Ministry of Health, Labour and Welfare (2013) [1] , 61.6% of the total caretakers for the elderly are live-in family members, whereas 14.8% provide formal services, indicating the central role played by families in providing care services for the elderly. According to Iwamoto et al. (2001) [2] , a household’s disposable income and total consumption decrease if a member of the household becomes bedridden or is in need of care1. Therefore, the increase in the number of senior citizens needing care and the decrease in the number of caretakers could undermine a family’s capacity to provide care as well as its economic capacity. For a society with a rapidly aging population, establishing a balance between the informal care provided by family members and formal care provided by the public sector has become a critical issue.

Mizushima (2009) [3] and Pestieau and Sato (2008) [4] , among others, investigated the implications of the various heightened risks related to health, family care, and public care services. Mizushima (2009) [3] examined the optimal scale of public care services required to maximize the welfare in a steady state and hypothesized a substitutable relationship between public services and family care for the elderly requiring a high level of care. However, Mizushima (2009) [3] did not clearly discuss the extent of implementation of family care under the optimal conditions of public care and insurance. Pestieau and Sato (2008) [4] considered the earning ability of the children of senior citizens who required care and those who did not and found that parents requiring care made use of either previously acquired private care insurance or financial support from their children. Findings from these studies have helped inform policy decisions regarding public support for elderly care.

In addition to these studies, some studies investigated the effects of subsidies for elderly care on economic growth and social welfare. Tabata (2005) [5] analyzed the effect of population aging on economic growth and welfare and pointed out three effects of public policy on welfare. One is an insurance effect, the second is a subsidy effect, and the last is a tax effect; and these three effects impact the utility of current and subsequent generations differently. In addition, the study showed that public long-term care caused intergenerational conflict between current and future generations. Miyazawa (2010) [6] showed that subsidies for the elderly in kind such as pensions rather than in cash such as public formal care were preferable in terms of economic growth as well as welfare.

In this paper, we examine the case of individuals who may require care in their old age and assume that the elderly receive either informal care provided by family members or formal care funded by the public sector. Further, assuming a substitutable relationship between the two forms of caretaking, the extent to which informal and formal care should be provided is analyzed2.

2. Model

We consider a closed overlapping-generations model. In this model, individuals live in two periods. All individuals have the same probability,  , of becoming dependent at the beginning of the second period. Then, there is a fraction,

, of becoming dependent at the beginning of the second period. Then, there is a fraction,  , of families with a dependent elderly. In the first period, individuals work and take on the role of a caregiver when their parents are in need of care and in the second, they receive nursing care in the case of dependency. The government levies a lump-sum tax on young agents, and provides care service as informal care to unhealthy old agents.

, of families with a dependent elderly. In the first period, individuals work and take on the role of a caregiver when their parents are in need of care and in the second, they receive nursing care in the case of dependency. The government levies a lump-sum tax on young agents, and provides care service as informal care to unhealthy old agents.

2.1. Government

Suppose that the government levies a lump-sum tax  on young agents and employs each young agent to provide public long-term care service

on young agents and employs each young agent to provide public long-term care service  to old agents in need of the service. Since care services are generally labor intensive, we assume public long-term care service is produced by labor input only. For simplicity, the technology of the public long-term care service is assumed to be linear: one unit of labor is transformed into one unit of formal care. In this case, the government’s budget constraint can be written as

to old agents in need of the service. Since care services are generally labor intensive, we assume public long-term care service is produced by labor input only. For simplicity, the technology of the public long-term care service is assumed to be linear: one unit of labor is transformed into one unit of formal care. In this case, the government’s budget constraint can be written as

(1)

(1)

where  is the wage rate.

is the wage rate.

2.2. Individuals

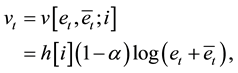

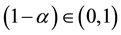

We assume that the parent’s utility depends on the amount of informal care he/she receives from his/her children  and public long-term care provision

and public long-term care provision  in the case of dependency. Thus, the parent’s utility is given by

in the case of dependency. Thus, the parent’s utility is given by

(2)

(2)

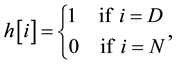

where  is the parameter attached to care provision and

is the parameter attached to care provision and  takes the value of zero or unity3:

takes the value of zero or unity3:

where  is dependent (D) or autonomous (N). A value of zero implies that parents downplay the care services, while that of unity denotes that parents attach importance to care provision. Viewed in this light,

is dependent (D) or autonomous (N). A value of zero implies that parents downplay the care services, while that of unity denotes that parents attach importance to care provision. Viewed in this light,  can be regard as the degree of need for care. For convenience, we assume that the individual does not consume in his/her old age.

can be regard as the degree of need for care. For convenience, we assume that the individual does not consume in his/her old age.

Individuals born in period t care about their parents, and their parents’ utility  directly enters as an argument in their utility function. In addition, each individual’s utility depends on consumption during the working period

directly enters as an argument in their utility function. In addition, each individual’s utility depends on consumption during the working period  and the health status when he/she has attained old age. We assume that the utility function of an individual born in period t and whose parents’ health status is i can be written as follows:

and the health status when he/she has attained old age. We assume that the utility function of an individual born in period t and whose parents’ health status is i can be written as follows:

where

As for the children, their altruism is limited to helping their parents in the case of dependency4. Thus, their utility is as follows:

where

Mizushima (2009) [3] and Tabata (2005) [5] assume that the children care about the parent’s health status, whereas we assume that the children have limited altruism. The Ministry of Health, Labour and Welfare (2014) [9] showed that the proportion of elders living with their children decreased between 1986 and 2014, from 64.3% in 1986 to 40.6% in 2014. Among the elderly, the percentage of persons living with a child increases with age: while this figure is 36.85% for those aged 65 to 74, it increases to 36.85% for those aged over 75. Nishioka (2000) [10] pointed out that the elderly may tend to live with a child when they feel that their health is worsening. This means that the children help their parents only when the parents become dependent, suggesting that the children have limited altruism.

Taking

The optimal condition for children with parents in need of care is as follows:

Given the substitutable relationship between family and public care, any change in the amount of family care is negatively associated with a change in publicly provided care. Therefore, disposable income increases with an increase in labor hours, and thus, the consumption level also increases. Family care provision takes a positive value when (A1) holds:

This also means that public care services are provided within the boundary

An increase in the provision of public care services, which induces a lower marginal utility of family care, decreases the incentives to work and encourages reduced family care provision.

Here,

public care services can result in suppressed consumption in the form of a tax burden. By contrast, for individuals with parents in need of care, public care services can be a substituted for family care, resulting in a greater consumption capacity. In this case, if the scale of public care services is within the boundary of (A1), the tax burden on individuals with healthy parents is not excessive and therefore, the consumption of individuals with healthy parents is greater than that of individuals with parents in need of care.

3. Effects of Public Long-Term Care Services on Individual Welfare

A welfare level in the steady state with public care services is represented by

follows:

where

Figure 1 shows the relationship between public care services and welfare, as represented by Equation (4). A rise in public care services has a positive effect on social welfare through increasing labor income and a negative effect through tax burden. When tax rate is low, the positive effect dominates the negative effect, and social welfare increases. However, when tax rate is sufficiently high, the negative effect outweighs the positive effect, and social welfare decreases.

Proposition: Improved welfare is possible by providing all care for unhealthy parents through public long-term care services.

Figure 1. Relationship between public care services and welfare.

Proof: According to Equation (4),

comes

Public care services can influence welfare through the effects of insecurity about health in one’s old age, parents’ health condition, and variations in consumption depending on parents’ health status. Regardless of the condition of one’s parents, knowing the health condition in one’s old age is not possible. Hence, public care services function as a preventive measure against such insecurities, thus contributing toward a higher quality of life. If parents are in need of care, public care services can also improve overall welfare by increasing the total amount of care available and the consumption level of their children. By contrast, if the parents are healthy, the tax burden could lower the consumption level, thus diminishing the overall positive benefits of welfare services. In this case, provided the scale of public care services is not excessive, the negative effect of lower consumption by individuals with healthy parents can be minimized, leading to an improved overall welfare level.

Corollary: Instead of reducing the level of family care to zero, further expanding public care services can help achieve welfare optimization.

The scale of public care services, which induces family care to be zero, is derived to maximize parent’s utility and one’s consumption, given the uncertainty of future health. On the other hand, the optimal level of public care services, which maximizes welfare in the steady state, internalizes uncertainty regarding future health status. Because public care services can provide insurance against future health concerns, the internalization of an uncertainty positively affects welfare through an increase in utility.

Thus, given the positive effects regarding future health insecurities, which was not considered for the maximization of individuals’ an welfare, expanding the scale of public care services can result in the overall improvement of societal welfare, even if it entails further tax collection.

4. Conclusion

In this paper, our aim was to analyze that to what extent should the public care services provide for parents in need of care. To examine this, we assume that all individuals have the same probability of becoming dependent at the beginning of the second period. Then, we showed that when family care and public care services were interchangeable, it was possible to improve welfare by providing all care for unhealthy parents through public long-term care services. We also showed that instead of reducing family care to zero, further expanding public care services could help achieve welfare optimization, even if it entailed further tax collection.

Acknowledgements

I would like to thank Tetsuya Nakajima, and Yusuke Hirota for their valuable comments on this paper. I am also grateful to anonymous referee for his/her helpful comments and suggestions.

Cite this paper

YukoMihara, (2015) Relationship between Family Care and Public Care Services for the Elderly. Modern Economy,06,948-953. doi: 10.4236/me.2015.69089

References

- 1. Ministry of Health, Labour and Welfare (2013) Comprehensive Survey of Living Conditions.

- 2. Iwamoto, Y., et al. (2001) Shakaifukushi to Kazoku no Keizaigaku. Toyo Keizai Inc.

- 3. Mizushima, A. (2009) Intergenerational Transfers of Time and Public Long-Term Care with an Aging Population. Journal of Macroeconomics, 31, 572-581. http://dx.doi.org/10.1016/j.jmacro.2008.12.009

- 4. Pestieau, P. and Sato, M. (2008) Long-Term Care: The State, the Market and the Family. Economica, 75, 435-454. http://dx.doi.org/10.1111/j.1468-0335.2007.00615.x

- 5. Tabata, K. (2005) Population Aging, the Costs of Health Care for the Elderly and Growth. Journal of Macroeconomics, 27, 472-493. http://dx.doi.org/10.1016/j.jmacro.2004.02.008

- 6. Miyazawa, K. (2010) Old Age Support in Kind. Journal of Pension Economics and Finance, 9, 445-472. http://dx.doi.org/10.1017/S1474747209990096

- 7. Van Houtven, C.H. and Norton, E. (2004) Informal Care and Health Care Use of Older Adults. Journal of Health Economics, 23, 1159-1180. http://dx.doi.org/10.1016/j.jhealeco.2004.04.008

- 8. Charles, K.K. and Sevak, P. (2005) Can Family Caregiving Substitute for Nursing Home Care? Journal of Health Economics, 24, 1174-1190. http://dx.doi.org/10.1016/j.jhealeco.2005.05.001

- 9. Ministry of Health, Labour and Welfare (2014) Comprehensive Survey of Living Conditions.

- 10. Nishioka, H. (2000) Parent-Adult Child Relationships in Japan: Determinants of Parent-Adult Child Coresidence. Journal of Population Problems, 56, 34-55.

NOTES

1Iwamoto et al. (2001) [2] showed that household annual disposable income among families with members in need of care declines by approximately 11% and for those with bedridden members, the average decrease is approximately 15%. As for actual total consumption, the decrease is approximately 24% for households with members in need of care and 34% for those with bedridden members.

2Houtven, Harold and Norton (2004) [7] and Charles and Sevak (2005) [8] showed a substitutable relationship between facility services and informal care.

3Parents’ health condition in their old age does not affect children’s health condition in their old age.

4Pestieau and Sato (2008) [4] make the same assumption.