Energy and Power Engineering

Vol. 4 No. 1 (2012) , Article ID: 17045 , 11 pages DOI:10.4236/epe.2012.41002

Energy Systems Maintenance

Department of Electrical and Electronics Engineering, Eastern Mediterranean University, Famagusta, Northern Cyprus

Email: opeyemi_oyelami@yahoo.com

Received October 12, 2011; revised November 10, 2011; accepted November 24, 2011

Keywords: Preventive Maintenance; Life Cost Analysis; LCC; HVAC; CMMS; ROI

ABSTRACT

The subject of maintenance is of much importance in the implementation of projects in today’s industries. Maintenance is carried on energy systems to keep their performance within acceptable standards and to maintain their average life expectancy. The cost associated with maintenance work is largely dependent on how often maintenance routines are carried out and the extent the work are done. Current maintenance work are usually carried out in accordance with the equipment manufacturer’s guide line and modified by experts as maintenance experience is gained. This paper discusses the various maintenance schemes and the impact of maintenance on the life cycle costs of a system.

1. Introduction

Maintenance has been more popular in principle than in practice over the years.

Maintenance is of much importance in today’s world. The idea of keeping equipment well maintained to extend its expected life and to avoid future repair cost is often misunderstood.

Life cycle costs (LCC) of both dynamic and static (assets) of energy systems are greatly influenced by the maintenance activities performed on them during their life cycle [1].

The relationship between the cost of maintenance and returns such projects can be expected to deliver is sometimes unclear.

The HVAC (small unit for home use) was the test bed for this study. The study included the cost of:

1) Maintenance deemed necessary as suggested by the manufacturer.

2) The cost of installation/cost of maintenance.

3) The cost associated with systems breakup or system failure.

We investigate these relationships by describing the process of assessing the value of maintenance programs and activities, by analyzing them in key financial ratio. The results of the analysis of maintenance practices allowed us to evaluate the importance of maintenance in feasibility studies.

2. Maintenance

Maintenance is defined as the combination of all technical and administrative actions including supervision actions intended to retain an item, or restore it, in a state in which it can perform a required function (British Standards 3811, 1993).

Its objectives includes the following

• Reducing breakdown and emergency shutdowns.

• Reduction of down time.

• Minimizing the energy usage.

• Optimizing Resources utilization.

Maintenance of energy systems can be divided into the two maintenance actions.

• Scheduled maintenance.

• Unscheduled maintenance.

2.1. Scheduled Maintenance

The energy system manufacturer determines the initial maintenance requirements through the Operation and Maintenance Handbook. The requirements are initially treated as mandatory. However there comes a variation to the tasks or task scheduled as experience is developed within the operational environment.

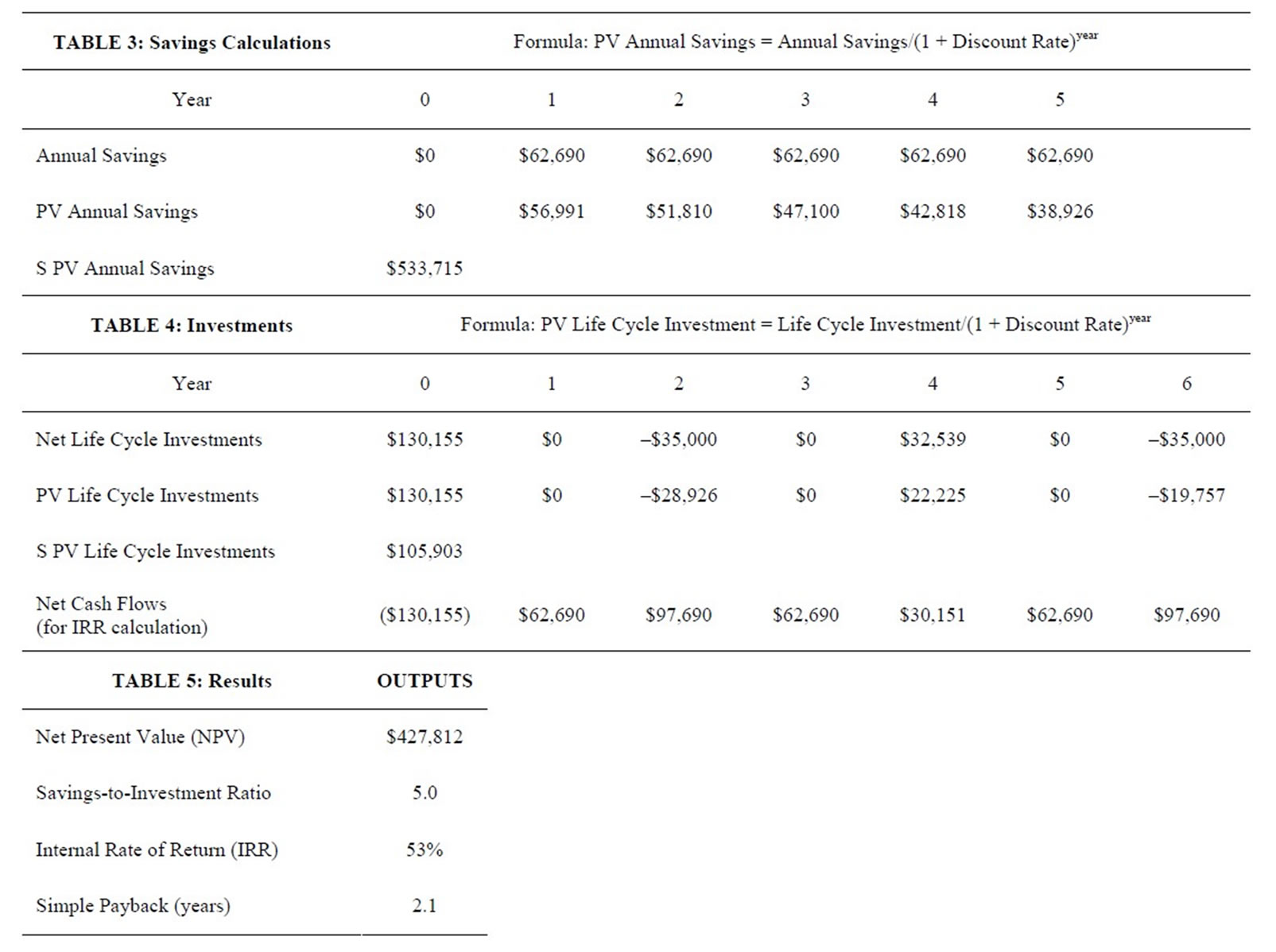

The costs of performing the tasks, manpower material costs, as well as the costs of any extra work arising from the scheduled task are also considered [1]. The Figure 1 below, shows the major task performed under scheduled maintenance.

Scheduled Maintenance can be divided into:

• Preventive Maintenance;

• Corrective Maintenance;

• Improvement Maintenance;

• Predictive Maintenance.

Figure 1. Major components of scheduled tasks [1].

2.1.1. Preventive Maintenance

This is the type of maintenance carried out before failures occur. This can be subdivided into scheduled and condition based preventive maintenance.

Scheduled preventive maintenance in energy systems includes replacements, adjustments, major overhauls, inspections and lubrications, adjustment or calibrations, cleaning and replacement of certain components [2].

Preventive Maintenance can also be subdivided into

• Routine maintenance;

• Running maintenance;

• Opportunity maintenance;

• Window maintenance;

• Shutdown preventive maintenance.

All these depend on the manufacturer guideline, availability of the machine as not to halt the process of production (machine is working or not) and cost of maintaining the system/machine at that particular period [1].

2.1.2. Corrective Maintenance

Corrective maintenance is subdivided into.

2.1.2.1. Remedial Maintenance

These are activities performed to eliminate the source of system failure without altering the continuity of the production process.

2.1.2.2. Deferral Maintenance

These are corrective maintenance activities that are not immediately initiated after the occurrence of a failure, but delayed in such a way that will not affect the process of production line [2].

Corrective maintenance includes the following steps

• Fault detection.

• Fault isolation.

• Fault elimination and verification of fault elimination In fault elimination, however, several steps are taken in order that fault eliminations can be carried out effectively. This includes

• Identification of incipient problems;

• Proper repair procedures;

• Effective planning (depends on the skills of planner, availability of well developed maintenance database about standard time to repair, complete repair procedures, required labour skills, specific tools, parts and equipments.

• Verification of repair;

• Adequate time to repair.

2.1.3. Improvement Maintenance

This is always used in reducing the need or to completely eliminate the need for maintenance.

Improvement maintenance could be in the form of:

2.1.3.1. Design-Out Maintenance

These are set of improved maintenance activities used to eliminate the cause of maintenances, reduce maintenance tasks and to increase the performances of machines/systems by redesigning those parts of the machine vulnerable to frequent occurrence of failures.

2.1.3.2. Engineering Services

This includes construction modifications, installations and rearrangement of facilities.

2.1.3.3. Shutdown Improvement Maintenance

Here, the production processes are put on hold, to perform some improvement maintenance activities on the system.

2.1.4. Predictive Maintenance

Predictive maintenances are set of activities performed on a system to detect the physical condition of the equipment in order to carry out the appropriate maintenance works to maximizing the life span of the equipment without increasing the risk of failure [2].

Predictive maintenance is subdivided into two categories:

• Condition-based predictive maintenance.

This type of maintenance schedule specifies maintenance tasks as they are required by the system involved. It depends on the continuous and periodic condition monitoring of the equipment to detect any sign of failure.

• Statistical-based predictive maintenance.

This depends on the information and statistical data gathered as a result of the careful and cautious recording of the stoppages of parts of the system and its components, in order to develop models for predicting failures.

The main advantage of predictive maintenance is the early discovery of faults and failures, due to continuous monitoring of the system.

However, its main setback is that it depends solely on the information gathered over a period of time, and the correct interpretation of this information.

It is sometimes classified as a form of preventive maintenance.

2.2. Unscheduled Maintenance

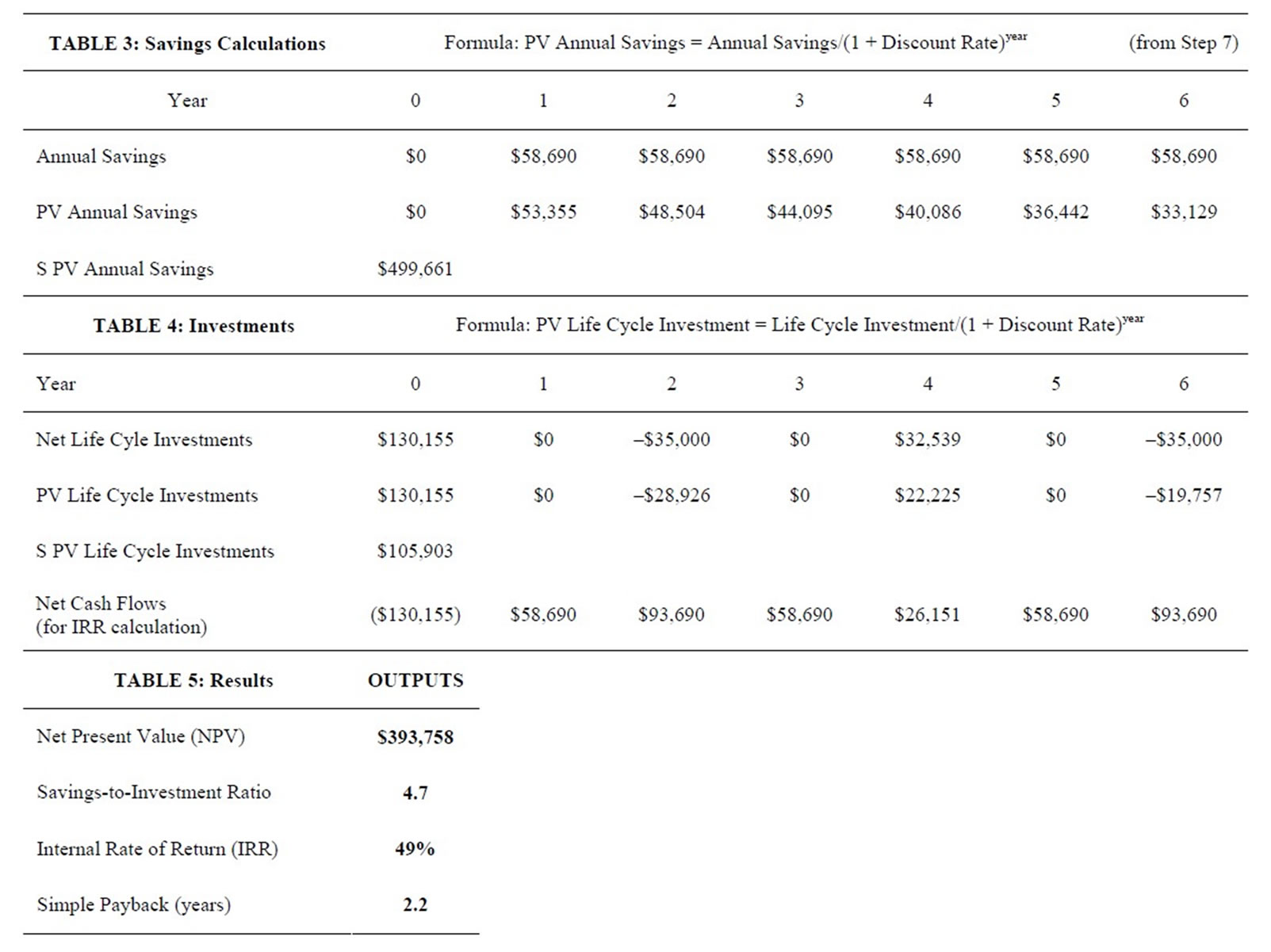

The unscheduled maintenance has to do with unplanned maintenance works, carried out on energy systems in the case of emergency or breakdowns. The cost of a system failure includes cost of repair, deferral cost of that repair (if applicable) and cost of operational disruption as a result of the failure. Figure 2 shows the major components of the unscheduled maintenance.

2.2.1. Repair Cost

Repair costs include manpower required to remove the associated components as well as shipping, administration and shop repair costs [1]. Repairs may be performed on energy systems in which case, the manpower and materials will contribute to the costs.

2.2.2. Deferral Cost

Sometimes it will be acceptable with some of the system inoperative. Details of these systems are usually given in the manufacturer handbook. Costs of deferral accounts for the resources required to take the action detailed, and must also account for operational restrictions due to inoperative systems.

2.2.3. Operational Disruption Cost

Operational disruption cost can vary significantly in the type of system involved, production process involved and the location where the system is situated.

3. CMMS (Controlled Maintenance)

With the advent of new technologies, the CMMS is introduced to enhance maintenance of energy systems.

A computerized maintenance management system (CMMS) is a type of management software that performs functions in support of management and tracking of O & M activities [3].

It involves some software in tracking the energy sys-

Figure 2. Major components of unscheduled tasks [1].

tem installed in a company or building. It is usually managed by experts from maintenance companies.

3.1. How CMMS Works

A CMMS system automates most of the logistical functions performed by maintenance staff and management [3]. Some of its many functions include the following:

• Production of work orders, prioritization, and tracking of equipments/systems.

• Historical tracking of all work orders generated which become sortable by equipment, date, person responding, etc. [3].

• The tracking of scheduled and unscheduled maintenance activities.

CMMS programs are in such a way that they have interface with the existing energy management and control systems (EMCS).

3.2. Benefits and Shortcomings of CMMS

The benefits of the CMMS include the following:

• Earlier detection of impending problems before a failure.

• Allow a higher level of planned maintenance activities that lead to a more efficient use of staff resources.

• Affects inventory control, enabling a better spare parts forecasting to minimize existing inventory and reduce shortage.

CMMS has its own shortcomings. These include the following:

• Having an improper selection of a CMMS vendor.

• Inadequate O & M and administrative staff training on proper use of the CMMS.

4. Preparing a Maintenance Plan of an Energy System

The steps and format of preparing a maintenance plan will vary depending on the application and design of maintenance systems [4]. The key steps in preparing a typical maintenance plan will include the following:

• Prepare an asset inventory;

• Identify maintenance activity and tasks;

• Identify the frequency of the task;

• Develop an annual work schedule;

• Prepare and issue a work order.

4.1. Case Study: The Maintenance of HVAC Systems

The HVAC system not only makes the building comfortable, healthful, and livable for its occupants, it manages a substantial portion of energy usage and related costs for the building. In maintaining the building’s air quality, the HVAC system must respond to a variety of conditions inside and outside the building (including weather, time of day, different types of spaces within a building and building occupancy), while simultaneously optimizing its operations and related energy usage.

The reasons to properly maintain a HVAC system, include the following;

• Lower utility costs;

• Increase the service life of the HVAC equipment (reduces replacement cost);

• To create a greater comfort for the building’s occupants.

HVAC systems can be very complex, consisting of many components. The major components include boilers, chillers, air-handling units (AHUs), air terminal units (ATUs), and variable air volume equipment (VAV).

Hence these are some of the needed maintenance works on HVAC.

4.1.1. Steady State Test

At each servicing, a steady state efficiency test should be performed with proper efficiency testing equipment. The testing performances are always within the range recommended by the manufacturer [5].

4.1.2. Filters

1) It is important to ensure that the correct filter size is installed. If this is not done, the air will escape around and without it being filtered (air bypass).

2) The filter media should be checked for damages regularly.

3) The filter compartments should be kept air tight fitted.

The use of differential pressure drop meter provides the reading on the meter [5] and helps to know when there is a need to change the filter.

4.1.3. Air-Handler Blow Vane

Dirt building up on the blower vanes will greatly reduce the air flow. They need to be cleaned as necessary.

4.1.4. Controls

It is important to verify the operation of all controls, including thermostat anticipators and furnace blower fan and limit control.

4.1.5. Burner Orifices

There is a need for the burner orifice to be properly sized for the gas type and burner input.

4.2. Effect of Maintenance on the Life Cycle Cost of a System

The HVAC system used as a case study consists of a 17-yr old chiller whose estimated expectancy is 20 years.

Both preventive and corrective maintenances were carried out on the system.

We investigated the effect of these maintenance works on the system. Three scenarios were considered:

• Full recommended maintenance (as from the Manufacturer’s handbook);

• Half of the recommended maintenance work;

• No maintenance work carried out.

The energy analysis was carried out by taking note of all expenses spent on the installation, energy consumed, and the cost of carrying out maintenance works on the HVAC.

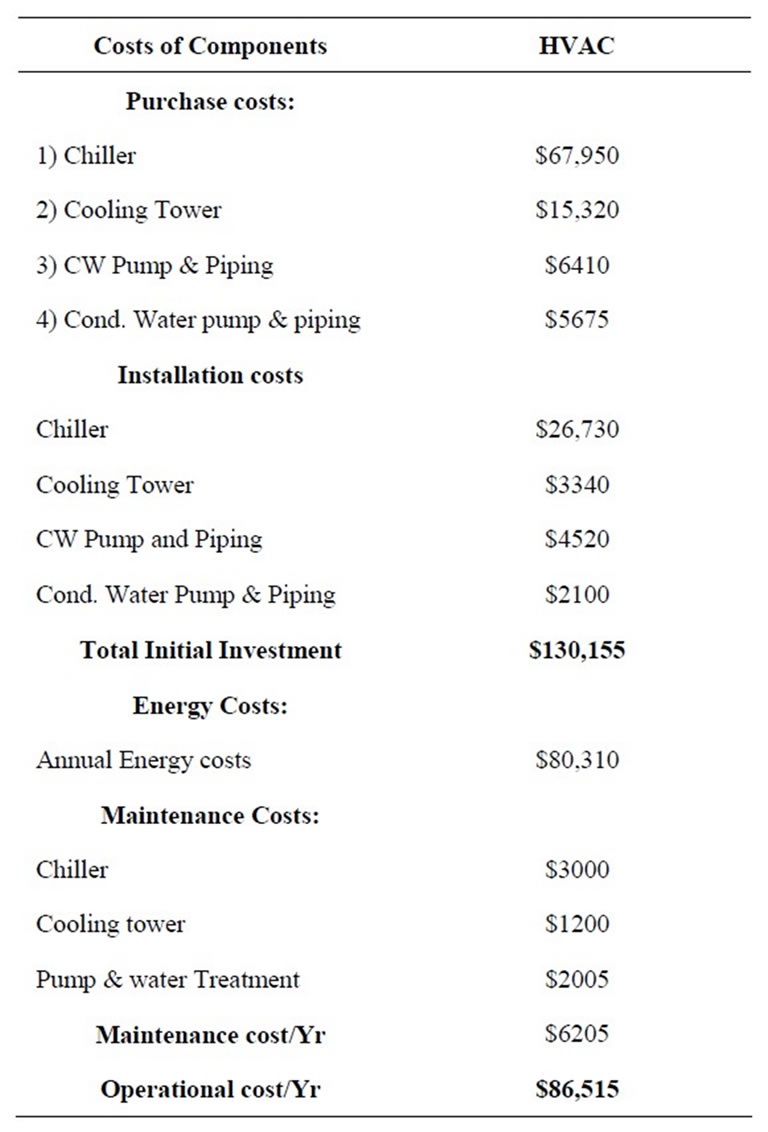

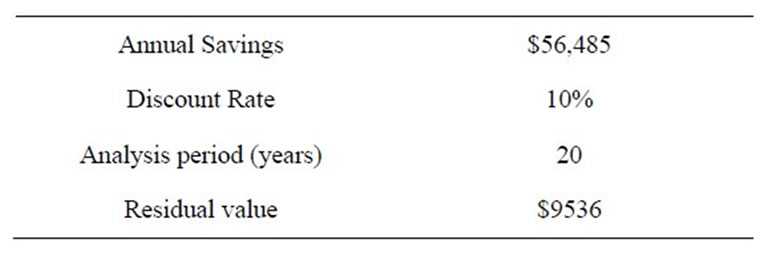

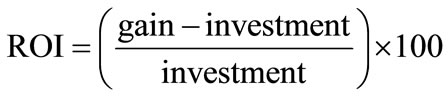

Table 1 shows the purchase cost, installation cost and the initial investments (in terms of the energy and maintenance cost) on the HVAC.

To make the analyses simpler, we only considered the purchase cost, installation cost and operation and maintenance cost of the Chiller, Cooling tower, chilled-water pump and pipes. All other system components are assumed to be the same for the Chiller.

The operational cost is comprised of the energy costs and maintenance costs.

Table 1. Cost data for HVAC Installation [6].

The energy cost was calculated from the energy simulations run with the Carrier HAP (Hourly Analysis Program) with an assumption of 0.60 kW/ton (0.17 kW/kW) [6].

Discount Rate = 10%

Analysis years = 20 yr

Assuming,

Old re-investment costs = $35,000 (every 4 yr)

Old annual energy cost = $140,000/yr

(Previous energy Audit)

Old Operation and Maintenance = $3000

From Table 1,

New Investment = $130,155

New Re-investment (replacement)

= $32,539 (25% of Investment)

New Annual Energy cost

= $80,310/yr (From Table 1)

New Operation and Maintenance cost

= $6205/yr

Residual Value = 10% of purchase price

= $9535.5

Scenerio 1: No maintenance work in Place

Annual energy = (old Energy cost – New energy cost)

+ (old O/M – New O/M)

= (140,000 – 80,310) + (3000 – 0)

= 62,690

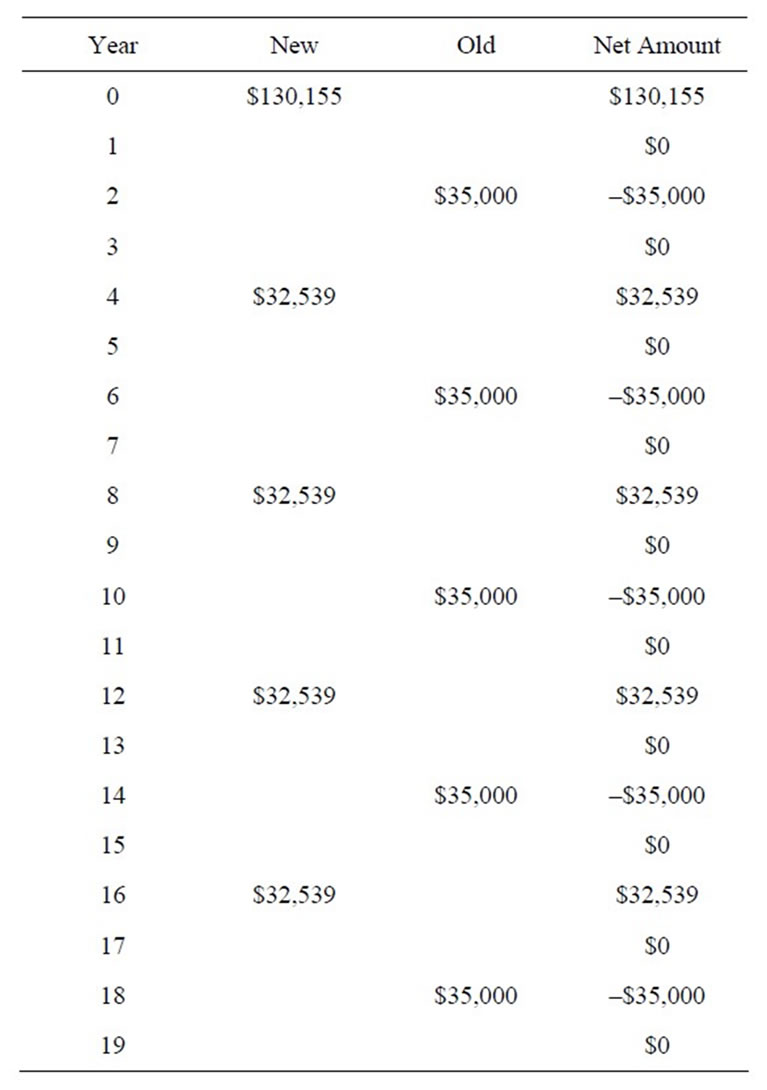

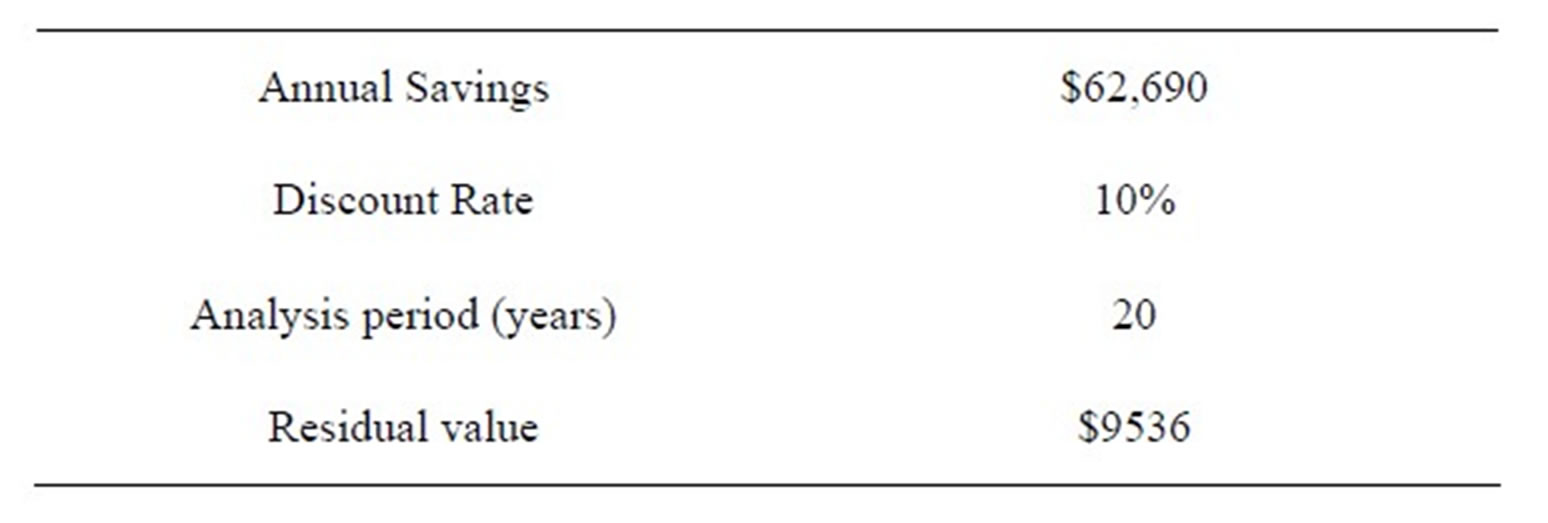

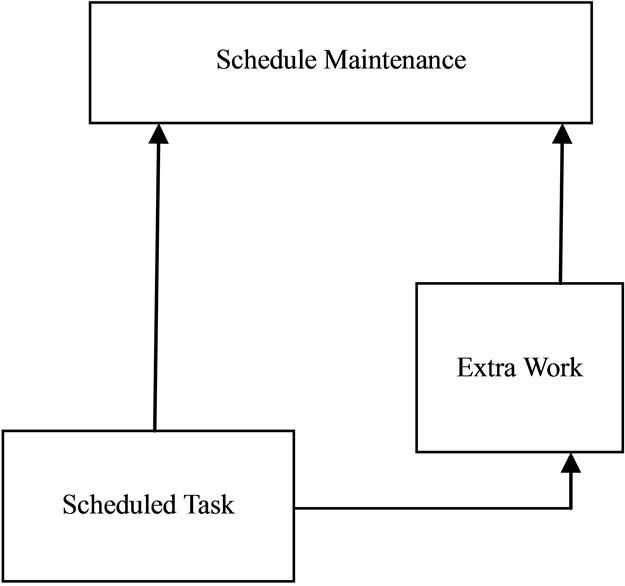

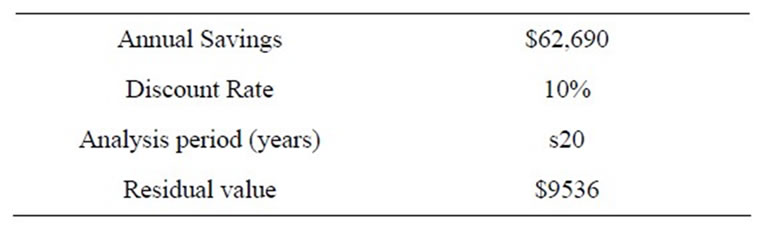

Using the life cycle analysis tool Table 2 above shows the analysis of the investments on the HVAC for a period of 20 yr.

The result obtained from the available data, given in Table 3 for Scenario 1, is given below:

The Net Present Value, NPV = $427,812

Internal Rate of return = 53%

Savings to Investment ratio = 5.0

Payback years = 2.1 yr

Return on Investment (ROI) = 403.96%

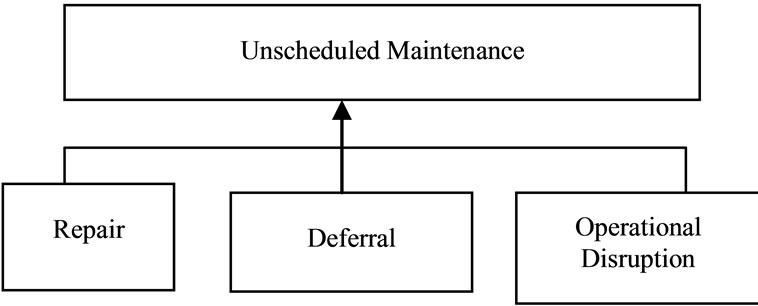

Scenario 2: Half of the recommended maintenance work

New Investment O/M = $4000

Annual energy = (old Energy cost – New energy cost)

+ (old O/M – New O/M)

= (140,000 – 80,310) + (3000 – 4000)

= 58,690

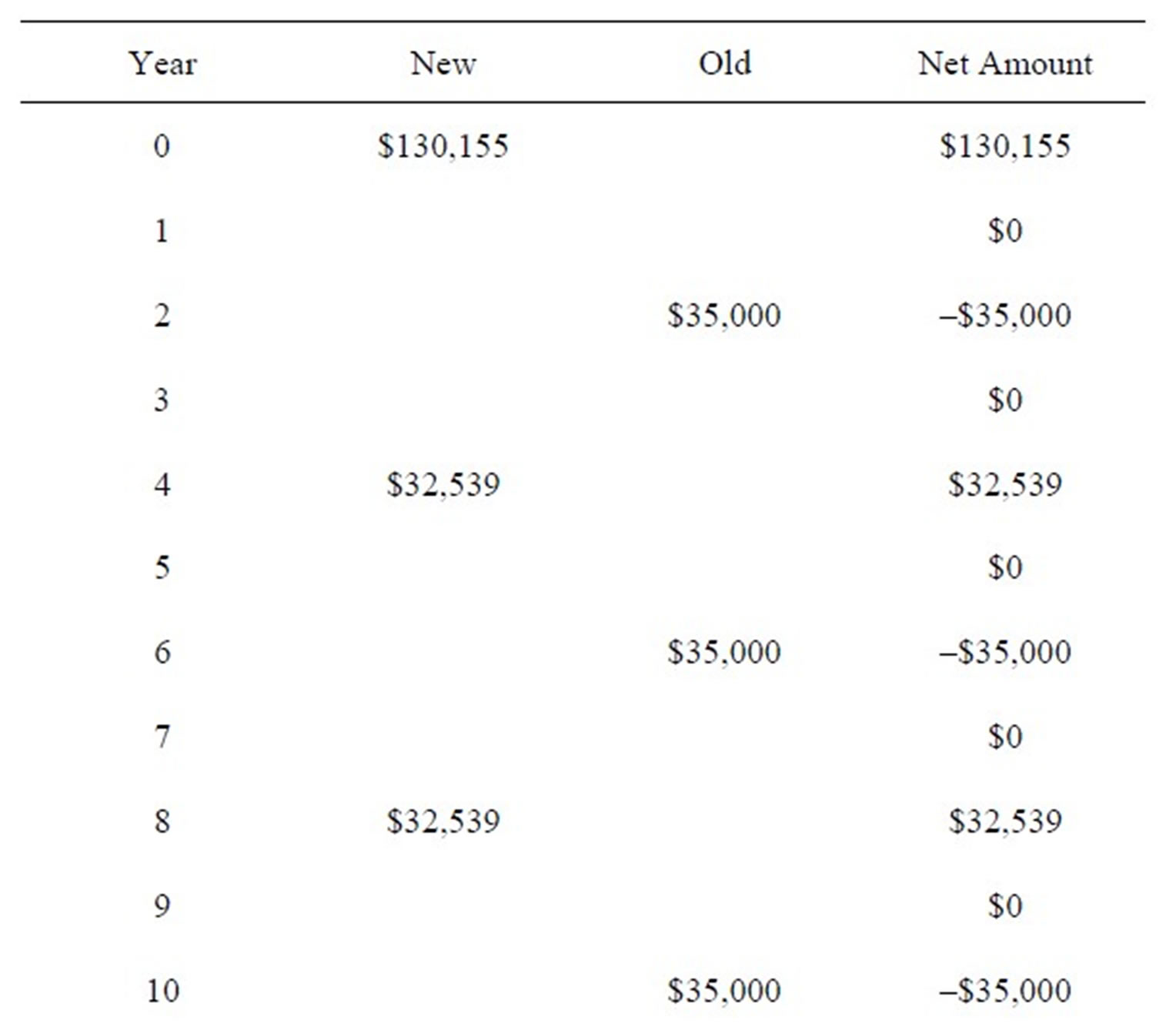

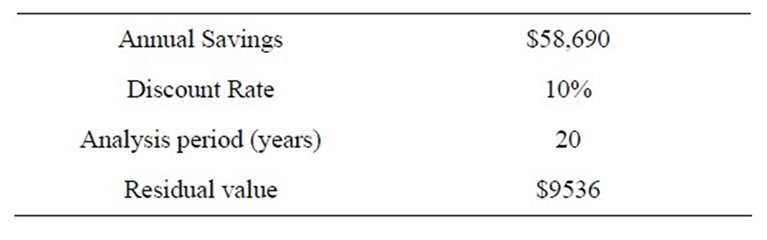

The life cycle investment schedule from Table 2 is still in use.

The result obtained from the available data, given in Table 4 for Scenario 2, is given below;

Net Present Value, NPV = $393,758

Internal Rate of return = 49%

Savings to Investment ratio = 4.7

Payback years = 2.2 yr

Table 3. Available data for life cycle analysis for scenario 1.

Table 4. Available data for life cycle analysis for scenerio 2.

Return on Investment (ROI) = 372%

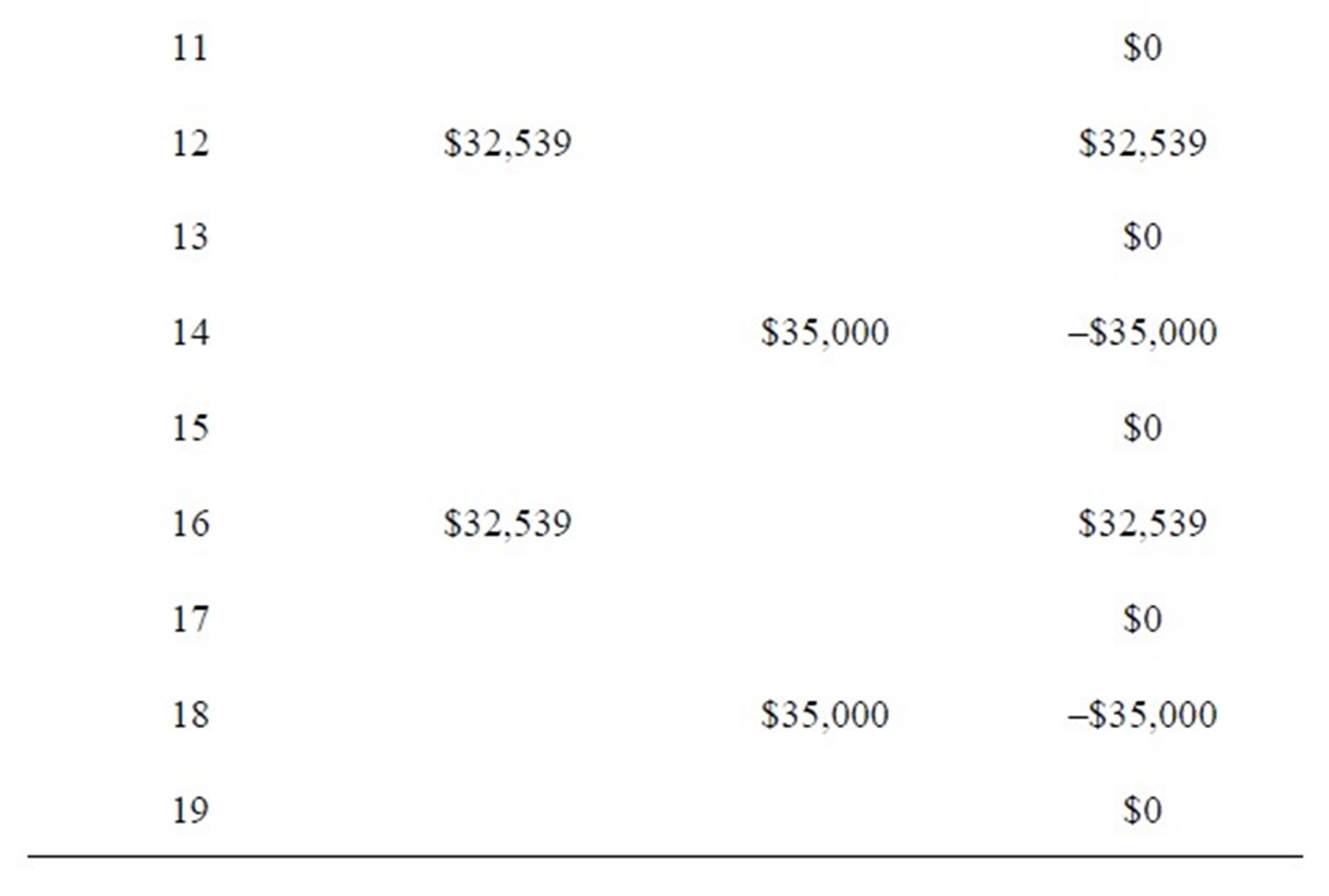

Scenario 3: Full recommended maintenance

New Investment on O/M = $6205

Annual energy = (old Energy cost – New energy cost)

+ (old O/M – New O/M)

= (140,000 – 80,310) + (3000 – 6205)

= $56,485

The result obtained from the available data, given in Table 5 for Scenario 3, is given below:

Table 5. Available data for life cycle analysis for scenario 3.

Net Present Value, NPV = $374,985

Internal Rate of return = 48%

Savings to Investment ratio = 4.5

Payback years = 2.3 yr

Return on Investment (ROI) = 354.0%

The detailed life cycle analysis calculation is given in the Appendix.

From the analysis above, the expected (ROI) when weak or no maintenances were put in place seems high. This could look good but the explanation is given in the next section.

4.2.1. Scenario 1: No Maintenance in Place

Scenario 1 assumes that nothing is spent on maintenance. Therefore the cost of preventive maintenance will be zero in this case. The cost of repairs, the cost of energy, and the frequency of equipment replacement will increase, because the equipment is assumed not to be maintained [7]. The frequency of repairs increases in an amount similar to the expected-life degradation [7]. For example, even with proper maintenance, a compressor would need to undergo minor repair every four years [7]. This scenario assumes that the repair frequency will increase by 20 percent. A 403.96% ROI seems like a huge return, and it is.

Consider, however, the cost of just one piece of equipment: A chiller. The chillers would cost an average of $67,950 to replace. Maintaining the chiller costs $3000 per year, and proper maintenance adds years to the equipment’s life, avoiding the extremely expensive capital outlay needed to replace it [7].

4.2.2. Scenario 2: Half of the Recommended Maintenance

In Scenario 2, a lesser value of PM was being invested on the HVAC against the recommendations from the manufacturer. For example, if the expected life of a Chiller will decrease by 20 percent if not maintained and proper maintenance will cost $3000 per year. Therefore if $1500 (half the recommended amount) is spent on chiller maintenance, the expected life would decrease by 10 percent instead of 20 percent.

4.2.3. Scenario 3: Recommended PM (From Manufacturer)

In Scenario 3, the manufacturer’s recommended amount of preventive maintenance was considered. The equipment is assumed to last its expected life and that energy performance will not degrade over the life of the equipment [7].

If the average age of the chiller is 17 years, the expected useful life of the chiller is 20 years, so in years 3 and 23 of the Scenario 3 analysis (from the manufacturer), the chiller needed to be replaced. In Scenario 1, the expected useful life of the chiller would be 16 years, and it needs to be replaced in years 1 and 17 of the analysis.

This analysis indicates that the expense spent or to be spent can be pushed out over time by properly maintaining the equipment.

5. Conclusions

The effect of maintenance on energy systems cannot be underestimated. It has valuable effects on the life cycle cost of a system and as well as on the energy utilization with improvement on the life span of the system.

The results obtained from this research has shown that maintenance has a way of improving the ROI of the amount invested in installing and building of a system, especially the HVAC system used in homes. It is ideal that more preventive maintenance should be carried out on the HVAC as compared to the corrective maintenances.

Finally, following a strict and comprehensive maintenance schedule will prolong a building’s HVAC systems, save cost of replacements, reduce the loss of energy and increase the comforts of the building occupants.

6. Acknowledgements

The authors are grateful to Prof. Dr. Osman Kukrer who took his time to go through the manuscript and offered many advices.

REFERENCES

- A. Yabsley and Y. Ibrahim, “Study on Maintenance Contribution to Life Cycle Costs: Aircraft Auxiliary Power Unit Example,” School of Applied Sciences and Engineering, Monash University, Churchill, 2008.

- Anonymous, “General Maintenance,” 2009. http://www.slideshare.net/pradhyot05/general-maintenance

- G. Sullivan, R. Pugh, A. P. Melendez and W. D. Hunt, “O & M Best Practices Guide, Release 3.0,” Federal Energy Management Program, US Department of Energy, Pacific Northwest National Laboratory, August 2010.

- R. Suttell, “Preventive HVAC Maintenance is a Good Investment,” The Source for Facility Decision Makers Buildings, 2006. www.buildings.com

- R. Karg and J. Krigger, “Specification of Energy-Efficient Installation and Maintenance Practices for Residential HVAC Systems,” Consortium for Energy Efficiency, Boston, 2000.

- C. J. Gann, “Computer Applications in HVAC System Life Cycle Costing,” Communication White Carrier Corporation, Syracuse.

- W. L. Koo and T. Van Hoy, “Determining the Economic Value of Preventive Maintenance,” Jones Lang LaSalle, 2003.

Appendix

The tables below show the life cost analysis of the HVAC considered in this paper.

Scenario 1. No Maintenance Work Carried Out

In this case,

Annual energy = (old Energy cost – New energy cost) + (old O/M – New O/M)

= (140,000 – 80,310) + (3000 – 0)

= 62,690

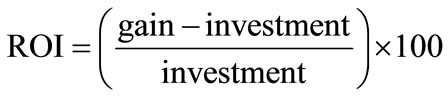

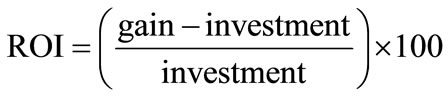

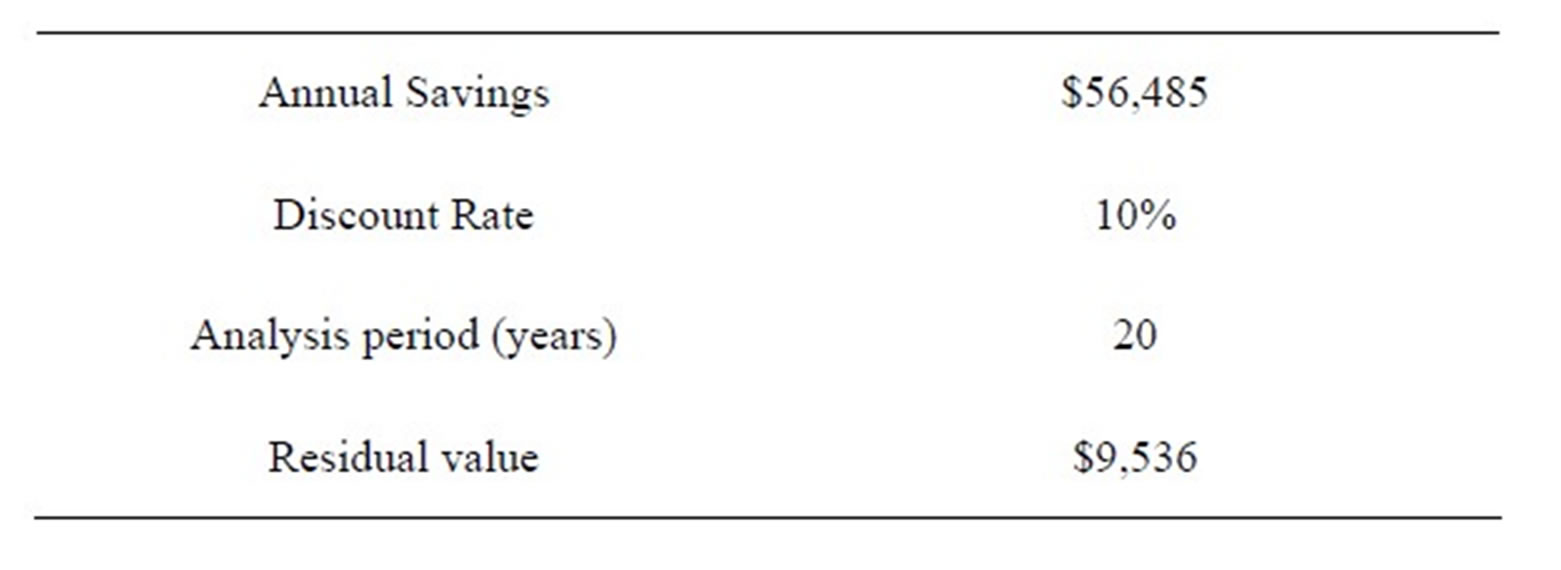

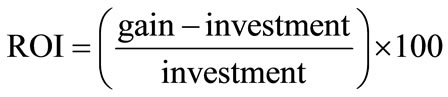

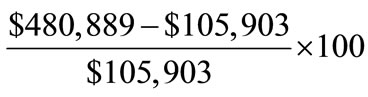

Therefore ROI =  = 403.96%

= 403.96%

Scenerio 2. Half of the Recommended Maintenance

Annual energy = (old Energy cost – New energy cost) + (old O/M – New O/M)

= (140,000 – 80,310) + (3000 – 4000)

= 58,690

Therefore ROI =  = 372%

= 372%

Scenario 3. Recommended Maintenance

Annual energy = (old Energy cost – New energy cost) + (old O/M – New O/M)

= (140,000 – 80,310) + (3000 – 6205)

= $56,485

Life cycle investment schedule for Scenario 3.

Therefore ROI =  = 354%

= 354%