American Journal of Industrial and Business Management

Vol.3 No.5(2013), Article ID:36003,8 pages DOI:10.4236/ajibm.2013.35054

Doing Organized Garment Retailing Business in India: A Critical Analysis

![]()

School of Management Studies, Punjabi University, Patiala, India.

Email: rajwindergheer@gmail.com

Copyright © 2013 Rajwinder Singh. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Received June 6th, 2013; revised July 6th, 2013; accepted August 6th, 2013

Keywords: Retail Challenges; Organized Retailers; Sourcing Challenges; Environmental Challenges; Locational Challenges; Customer Challenges; Competitive Advantage; Organizational Performance

ABSTRACT

Garment retailing is a sunrise industry in India. However, the industrial competitiveness has posed many challenges for the organized garment retailers in this sector. In this paper an attempt has been made to identify the challenges based on strong literature support in consultation of practitioners and consultants in this industry. This study has classified the retail challenges for organizing garment retailing into four factors 1) sourcing challenges; 2) locational challenges; 3) environmental challenges and 4) customer challenges. Also we have identified items for organizational performance as well as for competitive advantage. A confirmatory model has been used to test the hypotheses; (H1): Retailers understand the match between competitive advantage and organizational performance; (H2): They understand the match between retail challenges and organizational performance; and (H3): They understand the match between retail challenges and competitive advantage using structural equation modeling. This study shall help the organized garment retailer to know more about the business.

1. Introduction

Retailing is the set of activities that markets products or services reach to the final consumers for their personal or household use. The concept of organized retailing gained momentum in 1980 and got full boom after liberalization in 1991. According to CMIE report the retail growth doubled from 1990 to 1999. In India there are more than 15 million retailers, operating in the form of “mom pop” outlets and spreading over more than 31 million square meters area, generating sales of USD 11 billion in 2007- 2008 [1]. Nowadays the major retail players in this industry are; Reliance Retail, RPG Retail, The Tata Group, K Raheja Corporation, Piramyd Retail, Nilgiris’, Subhiksha Trading Limited, Trinethra, Vishal Group, and BPCL etc. These players have collaborated with many national and international players like Wal-Mart, Tesco, and Metro etc. to harvest the profits.

Supply chain management (SCM) enhances organizational competitiveness by integrating the internal functions within a company and linking them with the external operations of suppliers, customers and other channel members [2]. The organizations need to master the challenges of speed, convenience and reliability. It may help to reduce costs, increase productivity, and reduce risk to gain competitive advantage [3].

The main focus of SCM is on operational cost, time and response, customer services, or profitability or margins [4] and improvement in service levels and reduction in costs to improve organizational performance. It incorporates logistics as a key supply chain focused on function and effective supply chain management and purchasing practices are associated with competitive capabilities of the firm and it has more significant effects on firm performance [5].

The intense market competition and changing customer preferences have made the retailers’ job difficult and challenging. The intense competition has shut down many organized stores. This scenario has attracted the attention of many researchers to find a solution for the same. During discussion with the practitioners in the field of OGR revealed the need to study retail challenges for better organizational performance.

In this paper an attempt has been made to group the retail challenges (RC) and test the hypotheses among RC, competitive advantage (CA) and organizational performance (OP). The first section focuses on literature survey on RC, CA and OP. The second section focuses on research methodology and data analysis. In the last section the paper ends with discussion, limitation and scope for future research. The technique of factor analysis has been applied to classify RC and technique of structural equation modeling has been applied to test the hypotheses.

2. Retail Challenges

Organised retail in India is little decade old industry, facing many challenges. The major RC in consultation of practitioners and consultants and with literature support is shown in Table 1.

The customers’ expectation for a wide product variety has complicated the task to manage the products. Despite the big garment production houses owned by the retailers, still there is a gap for the supply of wide garment variety. It is due the fact that different products have different meaning to the different customers. The product color, size, composition and brand shall quote different meaning to different customers. Efficient Product sourcing helps to arrange and manage inventory for customer satisfaction.

Transparency is also one of the major challenges for the OGR because the class of customers visiting these stores is qualified enough to compare products offered by different retailers. They expect detailed information regarding products displayed with full authentication otherwise they shall churn. Also, the vast variety expectations by the customers need specialized skilled staff to convince and satisfy them. It is due to the fact that same/ different products have different meanings to different customers. The staff should be trained to convince the customers. Otherwise, the sale shall be lost. The organized garment retailers also revealed that highly qualified people are not much interested to join this sector. They leave the job after some experience. Hence, manpower management is also one of the major challenges for this sector.

The unorganized stores are operated by traditional retailers and most of them are either owned or hired at very low rental charges as compared to organized retailers. Also, they are located at very prominent locations near residential areas in large numbers. Acquiring such locations is a big challenge for the organized retailers. Also, the organized retailers have to pay multiple taxes posing more record keeping problems as compared to the unorganized retailers.

Inadequate Infrastructure is also one of the major challenges for the organized fashion retailing. It is due to the fact that the facilities like parking, internet access, and deliveries are not at par with the developed countries like USA, UK etc. Hence, it adversely affects the OGR performance. Also, the real estate cost is very high. It has adversely affected the OGR performance. The traditional retailers have already set the retail stores at the prominent locations in the heart of the cities. Such locations are distant dream for the organized retailers. Hence, to meet both the ends i.e. offering products at lower cost and paying high operational cost is the major threat for the organized fashion retailing.

The vast variety expectations and dynamic market pricing has posed major challenges for quick response to the market. Nowadays, the traditional retailers also offer wide variety at competitive prices. Also, the many producers directly sell their garments in the market at the competitive prices in large volume. It has posed a challenge to the marginal retailers. Also, the customer segments visiting the organized stores are the qualified people from middle and high income groups. They expect a better match for price and quality otherwise churn rate shall be more. The organization can easily duplicate the marketing policies but, customer loyalty can’t be duplicated.

High Connectivity is required to understand the customers’ expectations and means to meet them. The dynamic nature of garment retailing business needs high

Table 1. Retail challenges.

connectivity among customers, markets, and organizations. The failure of which shall result into lost sale and goodwill. Also, the operational cost of organized stores is very high as compared to the traditional retailers. It is due to the fact that the traditional retailers own shops and manage the operations by their own. For traditional retailers the rental charges, manpower cost, and tax burden are very less as compared to organized stores. On the other side all the services need to be paid for the OGR business.

The perfect competition nowadays has resulted into SC vs. SC. Many organizations have collaborated with national and international players to maximized SC performance. This intense competition has made the job of marginal organized retailers challenging. The price fluctuations, seasonal fluctuations, and changing customer preference has complicated the task of demand forecasting. The Government support is also one of the major challenges for the OGR business. Here, the permission of government to allow foreign direct investment (FDI) in organized retailing shall attract more customers by offering wide variety. Also, the presence of multiple nodal points complicates operations management. The OGR organizations need to focus on inefficient operations to improve profits. This shall also, help to improve service levels.

3. Supply Chain Practices and Competitive Advantage

The focus on competitive advantage (CA) plays very important role for the success of business. Vivek and Ravindran [12] in their study on SCM and retailer performance stated that in modern retail the retailers have to deal with intense competition both domestically and globally due to changes in customer expectations. They further added that retail managers focus on three major supply chain trends; global sourcing practices, multi-channel route to market, and relationship based innovation for CA. The major CA items selected in consultations of practitioners and consultants in this field are discussed as follows:

Inventory Management: Inventory shares more than 75% of the operating budget. Hence, organizations search for the ways to minimize inventory levels for CA. Walker et al. [3] highlighted the need to master the challenges of speed, convenience and reliability for better competitiveness.

Customer Satisfaction: The organizations maintain their own production and procurement facilities to satisfy customers for CA. Many researchers [13-15] revealed customer satisfaction as a tool for CA.

Profitability: In this competitive world, industrial houses take CA of bulk production or procurement. The cost reduction process forced the organizations to integrate the SC through cooperation, information sharing and developing effective business processes [16]. Many researchers addressed the benefits of improving profitability and strengthening organizational competitiveness [15,17]. Selldin and Olhager [18] advocated profitability as an important construct for CA.

Identification of Customer Base: The identification of customer base is also one of the CA for organizations. Ramdas and Speakman [19] in their study advocated it as a tool for CA. The accurate identification of customers’ base shall help them to forecast their requirements and accordingly retail facilities shall be developed and filled. Nair [20] revealed that in order to gain CA, companies need to know their customers’ base and financial shape.

However, India lacks significant study on CA for organized garment supply chain. Also, the visibility of these practices is limited [21]. Saad and Patel [22] in their empirical study on the automotive sector, quoted that Indian organization are striving hard to adopt new standards such as TQM, JIT, BPR and, SCM to enhance their performance for CA. Hence, more is needed to be done for CA.

4. Supply Chain Practices and Organizational Performance

The better organizational performance (OP) is one of the major requirements to survive in this competitive world. Crook et al., (2008) focused to reduce unnecessary SC activities. Vivek and Ravinandran, [12] identified; return on investments, market share, growth of ROI, sales, profit margin on sales, and overall competitive position for better OP of small scale industry in India. They further added that supplier performance significantly influences OP. Katou and Budhwar [23] in their empirical study on Greek manufacturing sector found out that OP consists of six variables as; effectiveness, efficiency, development, satisfaction, innovation, and quality. The major items selected in consultation of practitioners and consultants in this industry for CA are explained as follows:

Market Performance: Market performance is one of the most important indicators for OP [12]. The organizations having a good market share shall lead in competition.

Supply Chain Competencies: Nowadays there is SC vs. SC competition. A competent SC can save resources resulting into better OP [24,25].

Stakeholder Satisfaction: Stakeholders are the main actors to develop the financial base of the organization. Satisfied members shall remain attached otherwise they shall depart. Neely et al. [26] considered them as the focal point of the OP measurement process.

Innovation and Learning: It is also an important indicator for the measurement of OP [23]. The history has witnessed many organizations out of the business due to their failure to innovate and learn.

Satisfied Customers: It is also one of the important indicators for OP as satisfied customers shall become loyal to the organization and repurchase shall be assured [23].

Financial Performance: The ultimate objective of all the organizations is to have better financial performance. Many researchers also revealed that financial performance is an important construct for the OP [12,27,28].

5. Theoretical Research Framework

The theoretical framework used in this study is shown in Figure 1. This framework is used to understand the relationship among RC, CA, and OP. This research intends to prove the research framework by developing and testing hypotheses.

H1: Retailers understand the match between competitive advantage and organizational performance

It is observed that organized garment retailers have opened a large number of retail outlets to harvest profits for better organizational performance. These outlets are equipped with modern facilities as expected by the customers and offer products at competitive price and quality. They have been taking competitive advantage of bulk purchase to offer products of better quality at competitive prices. This scenario shows that they understand the CA strategies for better OP. This needs large investments as cost of real estate and taxes are high. Despite this they are taking the challenge to expand business. Hence, it leads to:

H2: They understand the match between retail challenges and organizational performance

The practices they have adopted are based on the strategies for better OP. Hence, it is felt that they understand RC and develop strategies for betterment of the business. It is also observed that they are highly skilled to harvest business profit by selecting prominent locations for CA. Hence, it leads to:

H3: They understand the match between retail challenges and competitive advantage

The dynamic business environment and low operating cost of traditional retailers as compared for organized retailers has posed a major challenge. Despite this they have been opening store outlets in large numbers in the prominent locations. These locations are either in the heart

Figure 1. A conceptual framework for the research.

of the city or mall, where large numbers of customers are visiting. Hence, it shows that despite major challenges they are successful in running the business by developing CA strategies to cope with the challenges.

6. Database and Methodology

This research is based on primary data. The primary data was collected from the OGR organisations with the help of a questionnaire for RC, CA and OP. The questionnaire was developed based on strong literature support in consultation of practitioners and consultants in the field of OGR. The respondents were selected based on: India Retail Report 2007 & 2009, Retail Telephone Directory, PROWESS, and Organization websites etc. The unit of analysis is the OGR organizations operating in the principal cities of Punjab, Chandigarh, and Gurgaon. The reason for selecting this north India belt is due to, good in sale/production and establishment of OGR in large numbers. The pre-pilot and pilot survey was done to improve the questionnaire. Later, large scale survey was done at the top, middle and lower level of OGR organizations by randomly selecting respondents based on telephone addresses. The questionnaires were mailed after telephonic discussion and later, were followed for response. A total of 600 questionnaires were sent with receipt of 384 responses (Top = 50, middle = 100, lower = 134) yielding a response rate of 64%. The technique of factor analysis using principal component analysis with varimax rotation has been applied to classify the factors for retail challenges. The technique of confirmatory factor analysis has been used to test and validate the hypotheses.

Scale Development and Refinement: The eighteenitems for RC were selected based on strong literature support in consultation of practitioners and consultants in the field of OGR. Pre-pilot and pilot survey was done to improve the questionnaire. Based on survey comments one item i.e. “arson” was not found valid for retail challenges in India. Hence, it was deleted yielding the effective RC items to 17. These items were rated on five-point Likert scale on two time horizons to measure the variability in the recorded responses. Later, improved questionnaire was subjected to large scale survey. The questionnaire so developed was tested through pre-pilot and pilot survey. Later, large survey was done. Item and scale reliability analysis was performed to retain and delete the scale items for the purpose of developing a reliability scale. Here, scale reliability (Cronbach’s Alpha), communality, item-to-total correlation and inter-item correlation were applied. The items with low correlation were subject to deletion. The corrected-to-total correlation range from 0.5003 to 0.7198, communality range from 0.601 to 0.988, Cronbach’s Alpha = 0.9040, and KMO = 0.764 (Table 2). The inter-item correlation is more than 0.3. Here, it is pertinent to mention that communality ≥ 0.5, Cronbach’s alpha ≥ 0.7, item-to-total correlation ≥ 0.5 and inter-item correlation ≥ 0.3, and KMO > 0.7 is good enough for conducting research in social sciences [29]. In this phase all the requirements were met for conducting factor analysis. Hence, factor analysis is done as shown in Table 2.

Results of Factor Analysis for Retail Challenges: The item mean for seventeen retail challenges is 70.82. If all the seventeen items were loaded at five the total comes out to be 85. Hence, the challenges covered under the questionnaire explain 83.33% of the constructs. The Bartlett’s Test of Sphericity is also significant (Approx. ChiSquare = 1211.586, df = 136, Sig. = 0.000). The results for factor analysis are shown in Table 2.

The factor analysis has classified the seventeen RC into four groups. These are explained as follows:

Sourcing challenges (f1): This is the first loading factor accounting for 7.134 of the Eigen value and covers 41.96% of the variance. The five items covered here are Forecasting, Product Sourcing, Govt. Support, Service Levels and Operations management. The factor loading varies from 0.911 to 0.687. The scale reliability here is 0.979 and inter-item correlation (Table 2) varies from 0.978 to 0.455.

Table 2. Factor analysis results for retail challenges.

Locational challenges (f2): This is the second leading factor accounting for 4.253 of the Eigen valued covers 25.01% of variance. The four items covered here are Specialized Skills, Unorganized Stores, Transparency, and Manpower Management. The factor loading varies from 0.964 to 0.932. The scale reliability here is 0.984 and inter-item correlation (Table 2) varies from 0.978 to 0.942.

Environmental challenges (f3): This is the third loading factor accounting for 1.909 of the Eigen value and covers 11.22% of the variance. The four items covered here are Multiple Taxes, Quick Response, Inadequate Infrastructure, and Real Estate Cost. The factor loading varies from 0.948 to 0.920. The scale reliability here is 0.902 and inter-item correlation (Table 2) varies from 0.976 to 0.931.

Customer challenges (f4): This is the fourth loading factor accounting for 1.717 of the Eigen value and covers 10.10% of the variance. The four items covered here are SC Performance, Customer Loyalty, Operational Cost, and High Connectivity. The factor loading varies from 0.895 to 0.870. The scale reliability here is 0.905 and inter-item correlation (Table 2) varies from 0.810 to 0.742.

Discussion of Relults for Modified Confirmatory Model

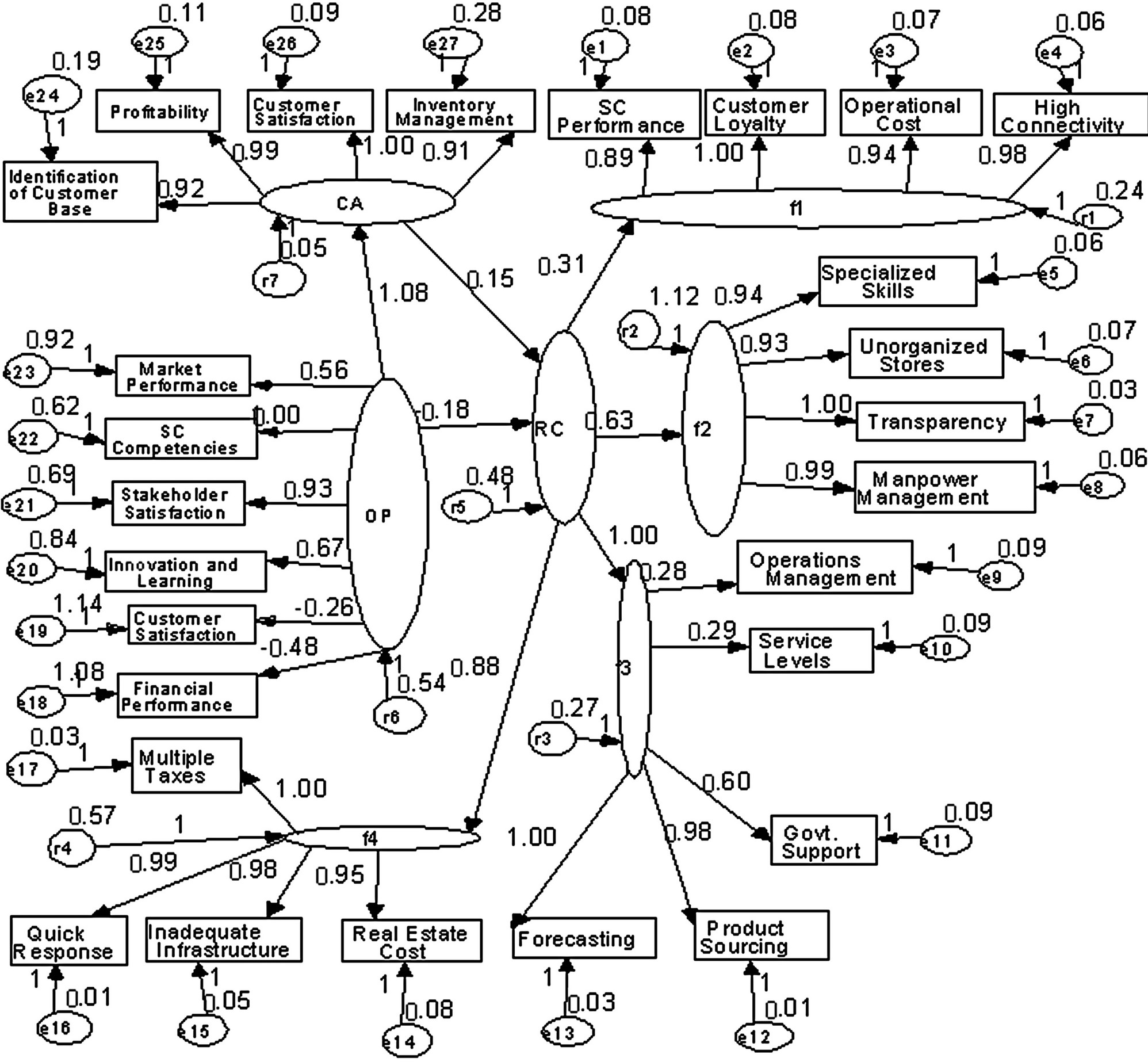

The proposed model is shown in Figure 2.

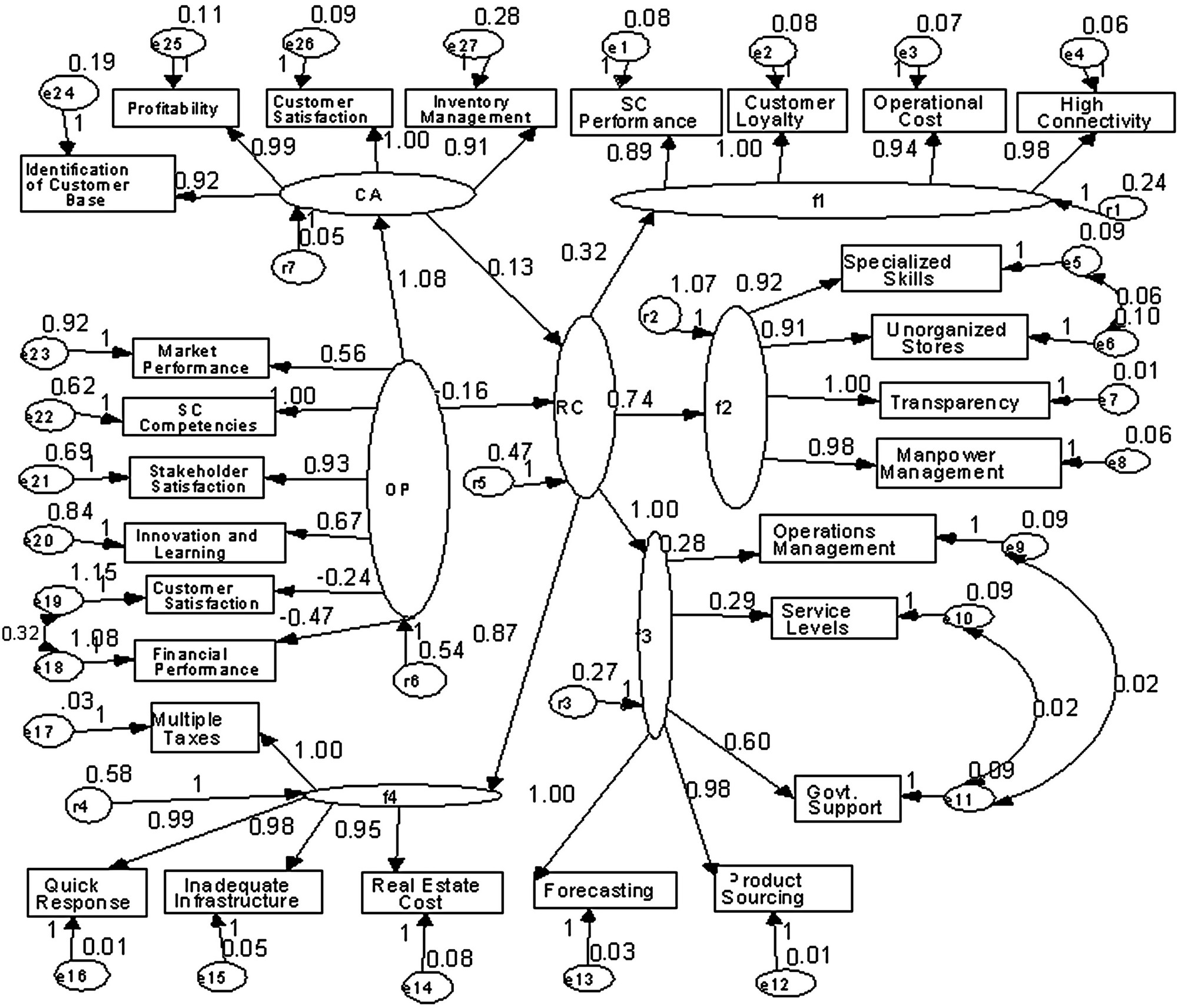

This model is not significant as the fit indices are not within the range. It has been modified based on the Modification Index and Co-Variance Matrix. Here, the error e5 & e6, e11 & e10, and e9 & f11 have been correlated to improve the model. The modified model is shown in Figure 3.

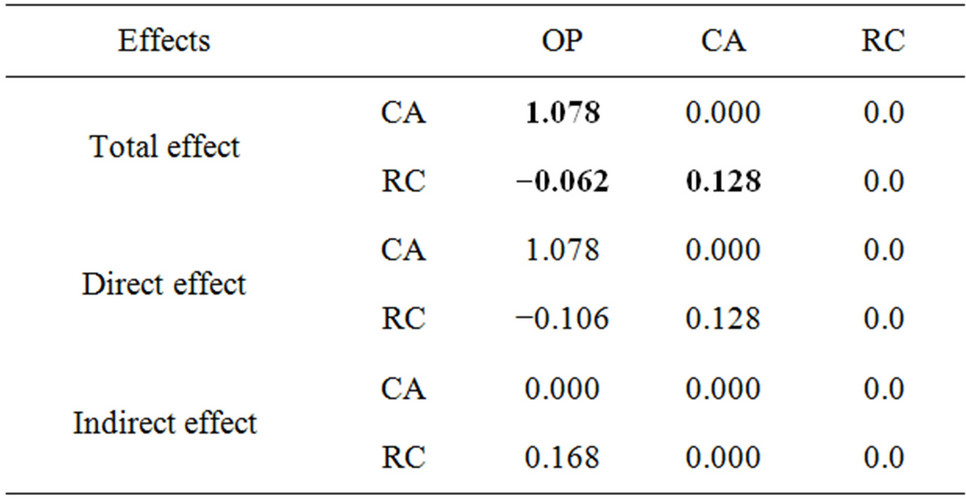

The modified model has Chi-square = 196.863, Df = 313, p = 0.00, RMR = 0.052, RMSEA = 0.518, GFI = 0.872, NFI = 0.880, RFI = 0.853, IFI = 0.890, TLI = 0.882, and CFI = 0.879. All these fit measures are significant [29]. The total effects are shown in the Table 3.

All the factors of RC have significant loading. The loading pattern on RC is; Sourcing Challenges (f1) = 0.32, Locational Challenges (f2) = 0.74, Environmental Challenges (f3) = 1.00 and Customer Challenges (f4) = 0.84. All these loading are more than 0.05 hence are significant [29]. All the loadings of items on f1 are different and significant in the range of 1.0 to 0.89. The loadings of items on f2 differently load from 1.0 to 0.98. The loadings on f3 load in the range of 1.0 to 0.28. Also, the loadings on f4 load differently in the range of 1.0 to 0.98.

The loadings on the CA construct differently range from 1.0 to 0.99. Also, the loading pattern on OP differently ranges from 1.0 to 0.93. All the loadings are different and significant. The total effect estimates (Table 3) shows that Total Effect is significant. The Total Effect of CA on OP (1.078) is significant. It shows that the retail

Figure 2. Proposed model for the study.

ers understand the match between competitive advantage and organizational performance. Hence, H1 is proved to be true. Also the total effect of RC on CA (0.128) is significant. It shows that organized garment retailers understand the match between RC and CA. Hence, H3 is proved to be true. The loading of RC on OP (0.062) is also significant. It shows that the organized garment retailers understand the match between retail challenges and organizational performance. Hence, H2 is proved to be true.

7. Limitations and Scope for Future Research

In this study we fail to contact more respondents from the top as well as middle level. It was due to their highly busy schedule. Also, many respondents hesitate to fill in the questionnaire. It was due to the highly complicated procedure to get sanction for the same. Despite these difficulties we were able to get responses for pre-pilot, pilot and large scale survey. During discussion with the OGR practitioners we felt the need to study RC, CA and OP for organized and unorganized retailers for more gap analysis.

8. Acknowledgements

We are thankful to University Grants Commission India for providing financial help to complete this research. We are also thankful to the Chief-Editor and anonymous

Figure 3. Modified model for the study.

Table 3. The effect estimates.

Chi-square = 196.863, Df = 313, p = 0.00, RMR = 0.052, RMSEA = 0.518, GFI = 0.872, NFI = 0.880, RFI = 0.853, IFI = 0.890, TLI = 0.882, and CFI = 0.879. The model is significant.

reviewers for providing highly valuable insights to see the tunnel end. In the last we are thankful to God almighty for support all the ways.

REFERENCES

- R. Rajmohan, “India Retail Report, 2009,” IMAGES, F&R Research, 2009.

- H. Jiqin, S. W. F. Omta and J. H. Trienekens, “The Joint Impact of Supply Chain Integration and Quality Management on the Performance of Pork Processing Firms in China,” International Food and Agribusiness Management Review, Vol. 10, No. 2, 2007, pp. 67-98.

- B. Walker, D. Bovet and J. Martha, “Unlocking the Supply Chain to Build Competitive Advantage,” International Journal of Logistics Management, Vol. 11, No. 2, 2000, pp. 1-8. doi:10.1108/09574090010806119

- L. Nuthall, “Supply Chain Performance Measures and Systems,” In: J. L. Gattorna, R. Ogulin and M. W. Reynolds, Ed., Handbook of Supply Chain Management, Grower Publishing, Burlington, 2003, pp. 248-266.

- J. R. Carter and R. Narasimhan, “Purchasing and Supply Chain Management: Future Directions and Trends,” International Journal of Purchasing and Materials Management, Vol. 32, No. 2, 1996, p. 2.

- S. Pradhan, “Retailing Management Text and Cases,” 5th Edition, Tata McGraw-Hill Publishing Company Limited, New Delhi, 2007, pp. 21-211.

- A. J. Newman and P. Cullen, “Retailing Environment & Operations,” 2nd Edition, Cengage Learning India Private Limited, New Delhi, 2002.

- P. K. Sinha and D. P. Uniyal, “Managing Retailing,” Oxford University Press, New Delhi, 2007.

- S. Jack, “Challenges of the Future: The Rebirth of Small Independent Retail in America,” IRMA, 2004, pp. 10-22. http//www.retail-revival.com

- G. Kapoor, “Revolutionizing the Retail Industry in India,” 51th World Business Summit, CIES, The Food Business Forum, Shanghai, 20-22 June 2007, pp. 211-235.

- P. Bhatia and A. Sharma, “India’s Organised Retail Players Rethinking Strategy,” The Economic Times, 27 September 2008. http//www.theeconomicstimes.com

- N. Vivek and S. Ravindran, “An Empirical Study on the Impact of Supplier Performance on Organizational Performance: A Supply Chain Perspective,” South Asian Journal of Management, Vol. 61, No. 3, 2009, pp. 61-70.

- D. F. Ross, “Competing through Supply Chain Management: Creating Market-Winner Strategies through Supply Chain Partnerships,” International Thomson Publishing, New York, 1997.

- P. K. Bagchi, “Role of Benchmarking as a Competitive Strategy: The Logistics Experience,” International Journal of Physical Distribution Logistics, Vol. 26, No. 2, 1996, pp. 4-22. doi:10.1108/09600039610113173

- M. L. Fisher, “What Is the Right Supply Chain for Your Product?” Harvard Business Review, Vol. 75, No. 2, 1997, pp. 105-116.

- R. B. Handfield and C. Bechtel, “The Role of Trust and Relationship Structure in Improving Supply Chain Responsiveness,” Industrial Marketing Management, Vol. 31, No. 4, 2002, pp. 367-382. doi:10.1016/S0019-8501(01)00169-9

- M. Christopher, “Logistics and Supply Chain Management: Creating Value-Adding Networks,” 3rd Edition, Prentice-Hall, Harlow, 2005.

- E. Selldin and T. Olhager, “Linking Products with Supply Chains: Testing Fisher’s Model,” Supply Chain Management: An International Journal, Vol. 12, No. 1, 2007, pp. 42-51. doi:10.1108/13598540710724392

- K. Ramdas and R. E. Speakman, “Understanding What Driver-Supply Chain Performance,” Interfaces, Vol. 30, No. 4, 2000, pp. 3-21. doi:10.1287/inte.30.4.3.11644

- M. Nair, “Creating Global Competitive Advantage: Challenges and Strategies,” Management Trends, Vol. 2, No. 2, 2005, pp. 72-79.

- S. K. Srivastava, “Logistics and Supply Chain Practices in India,” The Journal of Business Perspective, Vol. 10, No. 3, 2006, pp. 69-79. doi:10.1177/097226290601000307

- M. Saad and B. Patel, “An Investigation of Supply Chain Performance Measurement in the Indian Automotive Sector,” Benchmarking: An International Journal, Vol. 13, No. 1-2, 2006, pp. 36-53.

- A. A. Katou and P. S. Budhwar, “Casual Relationship between HRM Policies and Organizational Performance: Evidence from Greek Manufacturing Sector,” European Management Journal, Vol. 28, No. 1, 2010, pp. 25-39. doi:10.1016/j.emj.2009.06.001

- S. Chopra, and P. Meindle, “Supply Chain Management: Strategy, Planning, and Operations,” 2nd Edition, Pearson Prentice-Hall, Upper Saddle River, 2004.

- W. G. Kenneth, D. Whitten and R. A. Inman, “The Impact of Logistics Performance on Organizational Performance in the Supply Chain Context,” Supply Chain Management: An International Journal, Vol. 13, No. 4, 2008, pp. 317-327.

- A. Neely, C. Adams and M. Kennerley, “The Performance Prism: The Scorecard for Measuring and Managing Success,” Pearson Education Limited, London, 2002.

- L. Fitzgerald, R. Johnston, S. Brignell, R. Silvestro and C. Voss, “Performance Measurement in Service Business,” CIMA, London, 1991.

- K. W. Green Jr. and R. A. Inman, “Using a Just-in-Time Selling Strategy to Strengthen Supply Chain Linkages,” International Journal of Production Research, Vol. 43, No. 16, 2005, pp. 3437-3453. doi:10.1080/00207540500118035

- J. F. Hair, W. B. Black, B. J. Babin, R. E. Anderson and R. L. Tatham, “Multivariate Data Analysis,” Pearson Eduction Inc., New Delhi, 2009.