Journal of Mathematical Finance

Vol.06 No.02(2016), Article ID:64348,9 pages

10.4236/jmf.2016.62022

Markov-Dependent Risk Model with Multi-Layer Dividend Strategy and Investment Interest under Absolute Ruin

Bangling Li, Shixia Ma

School of Sciences, Hebei University of Technology, Tianjin, China

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 1 February 2016; accepted 6 March 2016; published 9 March 2016

ABSTRACT

In this paper, we consider the Markov-dependent risk model with multi-layer dividend strategy and investment interest under absolute ruin, in which the claim occurrence and the claim amount are regulated by an external discrete time Markov chain. We derive systems of integro-differential equations satisfied by the moment-generating function, the nth moment of the discounted dividend payments prior to absolute ruin and the Gerber-Shiu function. Finally, the matrix form of systems of integro-differential equations satisfied by the Gerber-Shiu function is presented.

Keywords:

Markov-Dependent Risk Model, Absolute Ruin, Multi-Layer Dividend Strategy, Gerber-Shiu Function, Investment Interest

1. Introduction

The dividend problem has long been an important issue in finance and actuarial sciences. Due to the importance of the dividend problem, the study of the risk model with dividend strategy has received more and more at- tention. Most of the strategies considered are of two kinds: one is the barrier strategy; another is the threshold strategy. For more recent studies about dividend problems, see [1] -[4] . In these papers, they extend the threshold dividend strategy to the multiple case, and make in-depth study of the model by the probabilistic and differential equation approaches. Under such a dividend strategy, many authors have extensively studied the Gerber-Shiu function for both the classical and the renewal risk model.

In classical insurance theory, we usually say that ruin occurs when the surplus is below zero. But in reality, the insurer could borrow an amount of money equal to the deficits at a debit interest rate to continue his business when the surplus falls below zero. Meanwhile, the insurer will repay the debts from his premium income. If debts are reasonable, the negative surplus may return to a positive level. However, when the negative surplus is below some certain level, the insurer is no longer allowed to run his business and absolute ruin occurs at this situation.

Absolute ruin probability has been frequently considered in recent research works. Dassios and Embrechts considered the absolute ruin, and by a martingale approach they derived the explicit expression for the probability of absolute ruin in the case of exponential individual claim in [5] . Cai defined Gerber-Shiu function at absolute ruin and derived a system of the integro-differential equations satisfied by the Gerber-Shiu function in [6] .

Most of the literature in finance is based on the assumption that the inter-arrival time between two successive claims and the claim amounts are independent. However, the independence assumption can be inappropriate and unrealistic in practical contexts. So in recent years, the risk model with dependence structure between inter- arrival times and claim sizes has got more and more attention. For example, see [7] - [9] . Yu and Huang [8] studied the dividend payments prior to absolute ruin in a Markov-dependent risk process. Zhou et al. [9] proposed a Markov-dependent risk model with multi-layer dividend strategy.

To the best of our knowledge, Markov-dependent risk model with multi-layer dividend strategy and investment interest under absolute ruin has not been investigated. This motivates us to investigate such a risk model in this work. Generally, the authors only extensively consider Gerber-Shiu function in risk models with multi-layer dividend strategy. In this paper, we study not only Gerber-Shiu function, but also the moment-generating func- tion and the nth moment of the discounted dividend payments prior to absolute ruin.

The rest of the paper is organized as follows. In Section 2, the model is described and basic concepts are introduced. In Sections 3, we get integro-differential equations for the moment-generating function of the dis- counted dividend payments prior to absolute ruin and boundary conditions. In Section 4, the integro-differential equations satisfied by higher moment of the discounted dividend payments prior to absolute ruin and boundary conditions are derived. In Section 5, we obtain the systems of integro-differential equations for the Gerber-Shiu function and its matrix form. Section 6 concludes the paper.

2. The Model

In this section, we investigate the Markov-dependent risk model with multi-layer dividend strategy and investment interest under absolute ruin, in which the claim occurrence and the claim amount are regulated by an external

discrete time Markov chain . First, let

. First, let  be an irreducible discrete time Markov chain with finite state space

be an irreducible discrete time Markov chain with finite state space  and transition matrix

and transition matrix . Similar to Albrecher and Boxma [7] , we define

. Similar to Albrecher and Boxma [7] , we define

the structure of a semi-Markov dependence type insurance problem as follows. Let  denote the time be- tween the arrival of the

denote the time be- tween the arrival of the  and the ith claims and

and the ith claims and  a.s., then

a.s., then

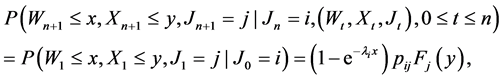

(2.1)

(2.1)

where  is the amount of the nth claim. Thus at each instant of a claim, the Markov chain jumps to a state j and the distribution

is the amount of the nth claim. Thus at each instant of a claim, the Markov chain jumps to a state j and the distribution  of the claim depends on the new state j, and has a positive mean

of the claim depends on the new state j, and has a positive mean . Then, the next interarrival time is exponentially distributed with parameter

. Then, the next interarrival time is exponentially distributed with parameter . Note that given the states

. Note that given the states  and

and , the quantities

, the quantities  and

and

In our risk model, we assume that the insurer could borrow money with the amount equal to the deficit at a debit interest force

define N layers

grows to the next higher layer. Meanwhile, the premium will be collected with rate

where

where

Note that the surplus is no longer able to become positive when the negative surplus attains the level

time of the model (2.3) by

where

and the

with

where,

For fix

3. Integro-Differential Equations for

In this section, we give the integro-differential equations for the moment-generating function

For notational convenience, let

Theorem 3.1. For

and, for

Proof. Fix

Thus conditioning on the time and the amount of the first claim, we obtain,

By Taylor's expansion, we have

Substituting (3.5) into (3.4), and then dividing both sides of (3.4) by t and letting

Similarly, when

By Taylor’s expansion, we have

Substituting (3.7) into (3.6), and then dividing both sides of (3.6) by t and letting

Theorem 3.2. For

Proof.

1) If

2) For

Similarly, we have

where

When

3) For Eq. (3.10), the method is similar to Equation (3.9), so we omit it here.

4) If

5) For

The proof of Theorem 3.2 is complete.

4. Integro-Differential Equations for

In this section, we get the integro-differential equations for

with

Using the representation

we have the following integro-differential equations.

Theorem 4.1. For

and, for

Proof. Substituting (4.1) into (3.1), and then equating the coefficients of

Theorem 4.2. For

Proof. This method is similar to Theorem 3.2.

5. The Gerber-Shiu Function

In this section, systems of integro-differential equations for the Gerber-Shiu function are presented. For

Theorem 5.1. For

and, for

with boundary conditions

where

Proof. Fix

By Taylor’s expansion, we have

Substituting (5.7) into (5.6), and then dividing both sides of (5.6) by t and letting

Similarly,when

By Taylor’s expansion, we have

Substituting (5.9) into (5.8), and then dividing both sides of (5.8) by t and letting

Integro-differential Equations (5.1) and (5.2) can be rewritten in matrix form.

Let

and

where T denoting transpose. We have the following theorem.

Theorem 5.2.

with boundary conditions

where

are all

are all d-dimensional vector, in which

6. Conclusions

In this paper, we investigate the Markov-dependent risk model with multi-layer dividend strategy and investment interest under absolute ruin. This complex model is more realistic. We derive systems of integro-differential equations satisfied by the moment-generating function, the nth moment of the discounted dividend payments prior to absolute ruin and the Gerber-Shiu function. Generally, many authors only extensively consider Gerber- Shiu function in risk models with multi-layer dividend strategy. However, due to the importance of the dividend problem, the problems considered by this paper are more important and interesting.

In addition that, we only obtain systems of integro-differential equations. As far as we know, it is not easy to derive the explicit expressions for the moment-generating function, the nth moment of the discounted dividend payments prior to absolute ruin and the Gerber-Shiu function. But, maybe we find some numerical method which can solve these equations. We leave it for the further research topic.

Acknowledgements

We would like to thank the referees for their constructive comments and suggestions which have improved the paper. This work was supported by the the Natural Sciences Foundation of China (grants 11301133 and 11471218).

Cite this paper

BanglingLi,ShixiaMa, (2016) Markov-Dependent Risk Model with Multi-Layer Dividend Strategy and Investment Interest under Absolute Ruin. Journal of Mathematical Finance,06,260-268. doi: 10.4236/jmf.2016.62022

References

- 1. Albrecher, H. and Hartinger, J. (2007) A Risk Model with Multilayer Dividend Strategy. North American Actuarial Journal, 11, 43-64.

http://dx.doi.org/10.1080/10920277.2007.10597447 - 2. Chadjiconstantinidis, S. and Papaioannou, A.D. (2013) On a Perturbed by Diffusion Compound Poisson Risk Model with Delayed Claims and Multi-Layer Dividend Strategy. Journal of Computational and Applied Mathematics, 253, 26-50.

http://dx.doi.org/10.1016/j.cam.2013.02.014 - 3. Lin, X.S. and Sendova, K.P. (2008) The Compound Poisson Risk Model with Multiple Thresholds. Insurance: Mathematics Economics, 42, 617-627.

http://dx.doi.org/10.1016/j.insmatheco.2007.06.008 - 4. Yang, H. and Zhang, Z. (2008) Gerber-Shiu Discounted Penalty Function in a Sparre Andersen Model with Multi-Layer Dividend Strategy. Insurance: Mathematics Economics, 42, 984-991.

http://dx.doi.org/10.1016/j.insmatheco.2007.11.004 - 5. Dassios, A. and Embrechts, P. (1989) Martingales and Insurance risk. Stochastic Models, 5, 149-166.

http://dx.doi.org/10.1080/15326348908807105 - 6. Cai, J. (2007) On the Time Value of Absolute Ruin with Debit Interest. Advances in Applied Probability, 39, 343-359.

http://dx.doi.org/10.1239/aap/1183667614 - 7. Albrecher, H. and Boxma, O.J. (2005) On the Discounted Penalty Function in a Markov-Dependent Risk Model. Insurance: Mathematics and Economics, 37, 650-672.

http://dx.doi.org/10.1016/j.insmatheco.2005.06.007 - 8. Yu, W. and Huang, Y. (2011) Dividend Payments and Related Problems in a Markov-Dependent Insurance Risk Model under Absolute Ruin. American Journal of Industrial and Business Management, 1, 1-9.

http://dx.doi.org/10.4236/ajibm.2011.11001 - 9. Zhou, Z., Xiao, H. and Deng, Y. (2015) Markov-Dependent Risk Model with Multi-Layer Dividend Strategy. Applied Mathematics and Computation, 252, 273-286.

http://dx.doi.org/10.1016/j.amc.2014.12.016