Journal of Mathematical Finance

Vol.04 No.03(2014), Article ID:45112,11 pages

10.4236/jmf.2014.43014

Identification and Estimation of Gaussian Affine Term Structure Models with Regime Switching

Gang Wang1,2

1School of Finance, Shanghai University of Finance and Economics, Shanghai, China

2Shanghai Key Laboratory of Financial Information Technology, Shanghai, China

Email: delta9527@gmail.com

Copyright © 2014 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 16 February 2014; revised 19 March 2014; accepted 3 April 2014

ABSTRACT

We establish that [1] ’s parameters are universally unidentified and a subset of their parameteri- zation is over identified. As a solution to the problem with the identifiability, we propose a new representation of double-regime three-factor GDTSMs whose parameters are just-identified when the number of the pricing-with-error yields equals 2. This new parametrization has another ad- vantage over [2] in that we can back out  parameters and

parameters and  parameters separately and make the estimation of structural parameters easier. Finally, we show that regime-switching three-factor arbitrage-free dynamic Nelson-Siegel model is a restricted special case of our model.

parameters separately and make the estimation of structural parameters easier. Finally, we show that regime-switching three-factor arbitrage-free dynamic Nelson-Siegel model is a restricted special case of our model.

Keywords:

Regime Switching, GDTSMs, Identification, Estimation

1. Introduction

After [2] proposed the single factor Gaussian affine term structure model. The class of Gaussian affine term structure models (GDTSMs) has been generalized and developed by, [3] [4] , and [5] and has become the basic workhorse in macroeconomics and finance for purposes of using a no-arbitrage framework for studying the rela- tions between yields on assets of different maturities. [4] and [5] find the Gaussian form of three-factor affine term structure model describes US treasury yields better than other forms. However, there is an extensive em- pirical literature on bond yields (particularly short-term rates) that suggests that “switching-regime” models de- scribe the historical interest rate data better than single-regime models (see, for example, [1] [6] and [7] ).

[1] develop a discrete-time multi-factor DTSM with the following features: 1) within each regime the short-term interest rate follows a three-factor Gaussian model with state-dependent market prices of factor risks; 2) there are two regimes characterized by low (L) and high (H) volatility, and the transitions between these re- gimes under the historical measure P are governed by a Markov process with regime-shift probabilities that depend on the risk factors underlying changes in the shape of the yield curve; and 3) re- gime-shift risks are priced. This model yields exact closed-form solutions for bond prices, and an analytic re- presentation of the likelihood function that they use in their empirical analysis of US. Treasury zero-coupon bond yields. Expected excess returns are decomposed into two components, which are associated with re- gime-shift and factor risks, respectively.

that depend on the risk factors underlying changes in the shape of the yield curve; and 3) re- gime-shift risks are priced. This model yields exact closed-form solutions for bond prices, and an analytic re- presentation of the likelihood function that they use in their empirical analysis of US. Treasury zero-coupon bond yields. Expected excess returns are decomposed into two components, which are associated with re- gime-shift and factor risks, respectively.

But in the practical experience of those who have used DSY model are tremendous numerical challenges in estimating the necessary parameters from the data due to highly non-linear and badly behaved likelihood sur- faces. For example, [1] reported:

… Even with these normalizations/constraints, the resulting maximally flexible  model (with restric- tions for analytical pricing) involves a high dimensional parameter space…

model (with restric- tions for analytical pricing) involves a high dimensional parameter space…

Another problem with DSY model is its identification. We find that DSY model parameters are universally unidentified. If there are some parameters in the model that are unidentified, then it will be wrong to make con- clusions from its parameters’ estimate, let us say about how regime-shift risks are priced.

This paper proposes solution to them and other problems with regime-switching affine term structure model of [1] based on what we will refer to as their reduced-form representation. For a popular class of re- gime-switching Gaussian affine term structure models―namely, those for which the model is claimed to price exactly a subset of  linear combinations of observed yields, where

linear combinations of observed yields, where  is the number of unobserved pricing factors―this reduced form is a restricted regime-switching multivariate linear regression in the observed set of yields.

is the number of unobserved pricing factors―this reduced form is a restricted regime-switching multivariate linear regression in the observed set of yields.

One implication is that the parameters of these reduced-form representations contain all the observable impli- cations of [1] regime-switching Gaussian affine term structure model for the sample of observed data, and can therefore be used as a basis for assessing identification. If more than one value for the parameter vector of inter- est is associated with the same reduced-form parameter vector, then the model is unidentified at that point and there is no way to use the observed data to distinguish between the alternative possibilities. [8] has applied this idea to affine term structure models with single regime. In this paper, we use it to demonstrate that [1] is in fact unidentified, an observation that our paper is the first to point out. This issue of identification is one factor that contributes to the numerical difficulties for conventional methods.

A second and completely separate contribution of the paper is that we propose our canonical representation of GDTSMs, which is then used in double-regime environment as a new form of regime-switching GDTSMs. Us- ing this form of representation, it is possible for the parameters of interest to be inferred directly from estimates of the reduced-form parameters themselves. This is a very useful result because the latter are often simple re- gime-switching OLS coefficients. Although translating from reduced-form parameters into structural parameters involves a mix of analytical and numerical calculations, the numerical component is far simpler than that asso- ciated with the usual approach of trying to find the maximum of the likelihood surface directly as a function of the structural parameters.

There have been several other recent efforts to use new development in GDTSMs for multi-regime considera- tion. [9] developed a no-arbitrage representation of a dynamic Nelson-Siegel model of interest rates that gives a convenient representation of level, slope and curvature factors. For example, [10] presents an affine, arbi- trage-free, regime-switching dynamic Nelson-Siegel model of the term structure (Regime-Switching AFNS). We show that it is a special case of our new form of regime-switching GDTSMs.

The chief difference between this paper and other relevant papers is that they focus on how the re- gime-switching GDTSMs should be represented, whereas we also examine how the parameters of the regime- switching GDTSMs are to be estimated.

The rest of the paper is organized as follows. Section 2 describes [1] regime-switching Gaussian affine term structure model. Section 3 investigates the mapping from structural to reduced-form parameters. We establish that the canonical forms of [1] are universally unidentified and a subset of their parameterization is over identi- fied. In Section 4, we propose a new representation. We establish when this representation is just-identified and how the parameters are to be estimated. In Section 5, we examine Regime-Switching AFNS’s representation. We establish that it is the constrained special case of our representation. Section 6 concludes.

2. Regime-Switching Gaussian Affine Term Structure Model

In this section, we just briefly describe the model set by [1] . Given the time t + 1 regime , under the risk-neutral measure (hereafter denoted by

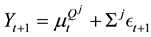

, under the risk-neutral measure (hereafter denoted by ), [1] assumes that the N-dimensional state (factor) vector Y fol- low the process

), [1] assumes that the N-dimensional state (factor) vector Y fol- low the process

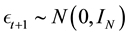

where ,

,  is a volatility matrix that is regime-dependent but not dependent on time, and

is a volatility matrix that is regime-dependent but not dependent on time, and  is standard normal.

is standard normal.

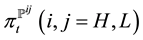

The regime-switching  probabilities

probabilities  is state-independent.

is state-independent.  is the (j, k) element of

is the (j, k) element of , denot- ing the

, denot- ing the

The continuously compounded yield on a one-period zero-coupon bond in regime j is assumed to be the affine function of

Letting

where,

with initial conditions:

where

The market prices of factor (MPF) risks in regime j,

Given the time t + 1 regime

where

and

The regime-switching P probabilities

where j ≠ k. And then, the market price of regime-shift (MPRS) risk from

3. Identification of [1] ’s Model

[1] assumes that the yields on a collection of

[1] belongs to the class of state space models. Any regime-switching Gaussian affine term structure model in which exactly

Given the time t regime

where

Inverting (2) results in

Then,

where,

The remaining

where,

The P-measure regime-switching probability

where,

Letting

gime-switching affine pricing and

regime-switching multivariate linear regression model.

However, which kind of mapping it may be is not inherent in the model but depends on the data structure used. For example, if the dimension of

[1] estimates a two-regime, three-factor

Firstly, let us look at the flexibility of [1] ’s empirical model. They set

in their model. Consequently,

and

ers, and

unrestricted full matrix,

tion

Secondly, let us look at the total number of parameters for both models. Table 1 lists the number of free pa- rameters contained in

duce the total number of free parameters in

4. A New Representation and Its Estimation

Due to the problems with identifiability of [1] parameters, we develop our “HW” canonical representation of re- gime-switching GDTSMs. Here, we use “HW” to represent [8] , because they first propose this normalization for three-factor GDTSMs. However, they do not further examine this form of normalization.

In [8] , they have proposed that for any 3 × 3 real-valued matrix:

there exist

with

Although, as is pointed out in [8] , this form cannot be extended to higher dimension, it has an advantage over others in that it can deal with the situation of

Table 1. The number of free parameters in

Table 2. The number of free parameters in

study regime-switching three-factor GDTSMs. Next, we propose an alternative normalization in the following Theorem.

Theorem 1. Every three-factor canonical GDTSM is observationally equivalent to the three-factor canonical GDTSM with

where,

Proof:

Assuming some three-factor canonical GDTSM takes the following form:

For ease of exposition, we assume we have found

Then, letting

factor, because the mapping from

where,

Likewise, the

where,

cause we do not impose any restriction on either

Finally, we can transform the short rate as an affine function of the new state variables as follows,

where,

By Theorem 1, we will establish the reparametrization of [1] regime-switching three-factor GDTSM as fol- lows.

Given the time t regime

where

pendent on time, and

Like [1] , the regime-switching

Unlike [1] , the continuously compounded yield on a one-period zero-coupon bond in regime j is assumed to

be a different affine function of

Then, given the time t regime

where,

with initial conditions:

where

Given the time t regime

where

Like [1] , the regime-switching

And then, the market price of regime-shift (MPRS) risk from

Like [1] , we could set the market prices of factor risks in regime j,

not set

del. Consequently,

A distinctive feature of this reparametrization is that, in estimation, there is an inherent separation between the parameters of the

As in [1] , we assume that the yields on a collection of three zero-coupon bonds are priced without error, and the yields on a collection of

Let

Given the time t regime

where

Inverting (2) results in

Then,

where,

The remaining 2 yields can be expressed as follows,

where,

The

where,

In summary, we can use the method proposed in [13] to estimate the parameters

Step 1. The estimate of the 6 unknowns in

Step 2. The estimate of

Step 3. The estimate of the 4 unknowns in

and,

Step 4. The estimate of

Step 5. The estimate of

that is

Step 6. The estimate of

Step7. The estimate of

is

In every step, the solving processes can be invertible, so we can also obtain

When M = 1, the situation is different. In Step 1, there are still 6 unknowns in

ations in

only 2 equations in

ti-to-one and so the parameters of our normalization are unidentified.

When

× 2 = 6 equations in

of our normalization are over identified.

The next question is how to obtain the standard error for these state-space parameters

Within [1] ’s parametrization, the

5. Regime-Switching Three-Factor Arbitrage-Free Nelson-Siegel Model.

In this section, we will show that the regime-switching extension on the AFNS model of [9] is a constrained spe- cial case of our representation.

By [9] , under

where

First, we let

where

Second, let

where

where

Comparing (10) with (3), we find that the regime-switching AFNS model is the constrained special case of

the our normalization with

Sometimes, we want to test if these constraints are valid. We could set regime-switching AFNS model as the null model and our representation as the alternative model, and then, under a desired statistical significance level, we compare likelihood ratio to the chi squared value with degrees of freedom equal to 5.

6. Conclusions

[1] ’s regime-switching three-factor affine term structure model, when we assume that the yields on a collection of three zero-coupon bonds are priced without error, is simply a restricted regime-switching linear regression. We use this correspondence to demonstrate that [1] ’s parameters are in fact universally unidentified and a subset of their parameterization is over identified. As a solution to the problem with the identifiability, we propose a canonical representation of GDTSMs based on [8] ’s proposal, which is then used in double-regime environment as a new form of regime-switching GDTSM. We also demonstrate that the parameters of our new form of re- gime-switching GDTSM are just-identified when the number of the pricing-with-error yields M equals 2. Our model’s parametrization has another advantage over [1] in that we can back out

Besides, due to the tremendous numerical challenges in estimating the necessary parameters, we hope that our method will help to make these models a more effective tool for research in better describing the historical in- terest rate data.

Acknowledgements

This work is supported by Research Innovation Foundation of Shanghai University of Finance and Economics under Grant No. CXJJ-2013-321. And I am especially grateful to Professor Hong Li for his support and encou- ragement. All errors are my own.

References

- Dai, Q., Singleton, K.J. and Yang, W. (2007) Regime Shifts in a Dynamic Term Structure Model of US Treasury Bond Yields. Review of Financial Studies, 20, 1669-1706. http://dx.doi.org/10.1093/rfs/hhm021

- Vasicek, O. (1977) An Equilibrium Characterization of the Term Structure. Journal of Financial Economics, 5, 177- 188. http://dx.doi.org/10.1016/0304-405X(77)90016-2

- Duffie, D. and Kan, R. (1996) A Yield-Factor Model of Interest Rates. Mathematical Finance, 6, 379-406. http://dx.doi.org/10.1111/j.1467-9965.1996.tb00123.x

- Dai, Q. and Singleton, K. (2000) Specification Analysis of Affine Term Structure Models. Journal of Finance, 55, 1943-1978. http://dx.doi.org/10.1111/0022-1082.00278

- Duffee, G.R. (2002) Term Premia and Interest Rate Forecasts in Affine Models. Journal of Finance, 57, 405-443. http://dx.doi.org/10.1111/1540-6261.00426

- Garcia, R. and Perron, P. (1996) An Analysis of the Real Interest Rate Under Regime Shifts. The Review of Economics and Statistics, 78, 111-125. http://dx.doi.org/10.2307/2109851

- Ang, A. and Bekaert, G. (2002) Short Rate Nonlinearities and Regime Switches. Journal of Economic Dynamics and Control, 26, 1243-1274. http://dx.doi.org/10.1016/S0165-1889(01)00042-2

- Hamilton, J. and Wu, J. (2012) Identification and Estimation of Gaussian Affine Term Structure Models. Journal of Econometrics, 168, 315-331. http://dx.doi.org/10.1016/j.jeconom.2012.01.035

- Christensen, J.H.E., Diebold, F.X. and Rudebusch, G.D. (2011) An Arbitrage-Free Class of Nelson-Siegel Term Structuremodel. Journal of Econometrics, 164, 4-20. http://dx.doi.org/10.1016/j.jeconom.2011.02.011

- Bandara, W. and Munclinger, R. (2011) Term Structure Modeling with Structural Breaks: A Simple Arbitrage-Free Approach. http://ssrn.com/abstract=1974033 http://dx.doi.org/10.2139/ssrn.1974033

- Ang, A. and Piazzesi, M. (2003) A No-Argitrage Vector Autoregression of Term Structure Dynamics with Macroeco- nomic and Latent Variables. Journal of Monetary Economics, 50, 745-787. http://dx.doi.org/10.1016/S0304-3932(03)00032-1

- Pericoli, M. and Taboga, M. (2008) Canonical Term-Structure Models with Observable Factors and the Dynamics of Bond Risk Premia. Journal of Money, Credit and Banking, 40, 1471-1488. http://dx.doi.org/10.1111/j.1538-4616.2008.00167.x

- Hamilton, J. (1989) A New Approach to the Economic Analysis of Non-Stationary Time Series and the Business Cycle. Econometrica, 57, 357-384. http://dx.doi.org/10.2307/1912559