Journal of Mathematical Finance

Vol.3 No.1(2013), Article ID:28126,23 pages DOI:10.4236/jmf.2013.31002

Some Explicitly Solvable SABR and Multiscale SABR Models: Option Pricing and Calibration

1Department of Mathematics and Information Technology, University of Camerino, Camerino, Italy

2Department of Economics, University of Verona, Verona, Italy

3Department of Management, University Politecnica Marche, Ancona, Italy

4Department of Mathematics, “G. Castelnuovo”, University of Rome “La Sapienza”, Rome, Italy

Email: lorella.fatone@unicam.it, francesca.mariani@univr.it, m.c.recchioni@univpm.it, f.zirilli@caspur.it

Received September 20, 2012; revised November 16, 2012; accepted November 29, 2012

Keywords: Multiscale Stochastic Volatility Models; Option Pricing; Calibration Problem; FX Data

ABSTRACT

A multiscale SABR model that describes the dynamics of forward prices/rates is presented. New closed form formulae for the transition probability density functions of the normal and lognormal SABR and multiscale SABR models and for the prices of the corresponding European call and put options are deduced. The technique used to obtain these formulae is rather general and can be used to study other stochastic volatility models. A calibration problem for these models is formulated and solved. Numerical experiments with real data are presented.

1. Introduction

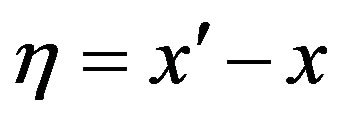

In this paper a multiscale SABR model that describes the time dynamics of forward prices/rates is presented. This model generalizes the well known SABR model introduced in 2002 by Hagan Kumar, Lesniewski, Woodward in [1]. Under some hypotheses on the correlation structure of the model studied when we restrict our attention to the normal and lognormal multiscale SABR models it is possible to derive explicit (closed form) formulae to express the transition probability density functions of the stochastic processes implicitly defined by the models and of the prices of the corresponding European call and put options. Using the technique developed to derive the transition probability density function of the multiscale SABR model we deduce new explicit formulae for the transition probability density function of the normal and lognormal SABR models presented in [1]. Specifically we show that the transition probability density functions of the normal and lognormal SABR models (with no assumptions on the correlation structure of the models) can be written as the inverse Fourier transform of explicitly known kernels. Moreover we show that for the multiscale models (under some assumptions on the correlation structure of the models) the corresponding multiscale transition probability density functions can be expressed as the inverse Fourier transform of the product of two copies of these kernels. This property is interesting since it can be used to define easy to solve multiscale versions of other stochastic volatility models.

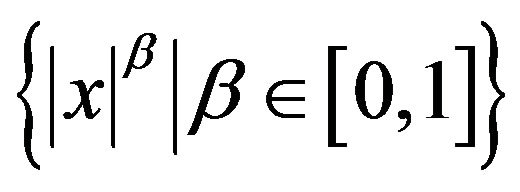

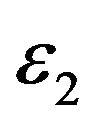

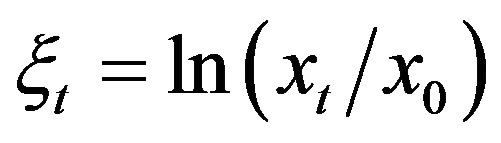

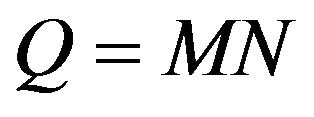

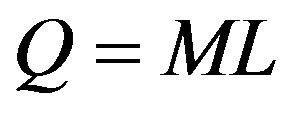

The multiscale SABR model introduced in this paper is motivated by the behaviour in the financial markets of equity prices, interest rates and currency exchange rates. In several circumstances empirical studies have shown that the dynamics of these quantities is described more satisfactorily by models that use at least two factors to describe the volatility dynamics than by models that use only one factor (see, for example, [2-4] and the reference therein). In [5-7] it has been shown that a generalized Heston model, that uses two stochastic volatilities varying on two different time scales, leads to satisfactory forecasts of the asset prices and of the corresponding European option prices. The prices considered in [5-7] are the S&P 500 index, the associated European call and put option prices and some spot electric power prices. These findings motivate the use in the multiscale SABR model of two factors (i.e. two stochastic volatilities) varying on two different time scales to describe the volatility of the forward prices/rates variable. We limit our attention to “normal” and “lognormal” SABR and multiscale SABR models. In these models the instantaneous variation of the forward prices/rates depends only on the volatility or on the volatilities (“normal” models) or on the volatility or on the volatilities times the prices/rates itself (“lognormal” models). These models are special cases of more general SABR models where the variation of the forward prices/rates depends on the product between a sufficiently smooth function of the forward prices/rates and the volatility or the volatilities. Usually this function is chosen in the family of functions  where

where  is a real variable and

is a real variable and  is a parameter. That is the SABR models considered depend on the parameter

is a parameter. That is the SABR models considered depend on the parameter ,

,  , the normal models correspond to the choice

, the normal models correspond to the choice  and the lognormal models correspond to the choice

and the lognormal models correspond to the choice .

.

Let  and

and  be respectively the sets of real and of positive real numbers and let

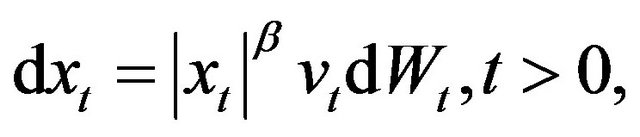

be respectively the sets of real and of positive real numbers and let  be a real variable that denotes time. Let us define the multiscale SABR model. To the forward prices/rates described by the stochastic process

be a real variable that denotes time. Let us define the multiscale SABR model. To the forward prices/rates described by the stochastic process ,

,  , we associate two stochastic volatilities given by the stochastic processes

, we associate two stochastic volatilities given by the stochastic processes ,

,  ,

, . The dynamics of the stochastic process

. The dynamics of the stochastic process ,

,  ,

,  ,

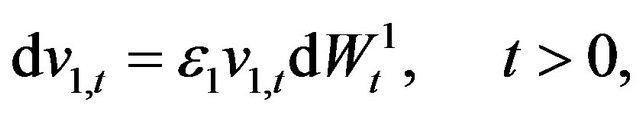

,  , is defined by the following system of stochastic differential equations:

, is defined by the following system of stochastic differential equations:

(1)

(1)

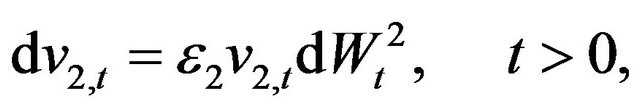

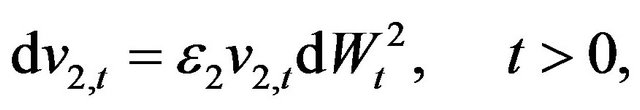

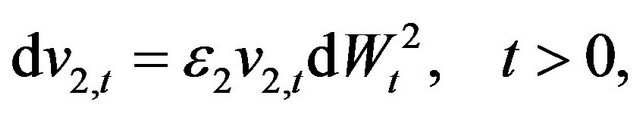

(2)

(2)

(3)

(3)

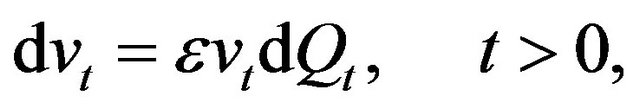

where the quantities ,

,  , and

, and  are real positive constants such that

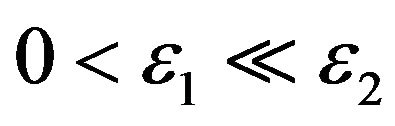

are real positive constants such that  and

and . The fact that

. The fact that ,

,  ,

,  , vary on different time scales is expressed by the condition

, vary on different time scales is expressed by the condition . When the condition

. When the condition  holds it is likely to observe abrupt changes in the forward rates/prices variable. The processes

holds it is likely to observe abrupt changes in the forward rates/prices variable. The processes

,

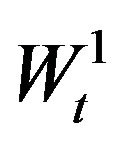

,  ,

,  ,

,  , are standard Wiener processes such that

, are standard Wiener processes such that , and

, and ,

,  ,

,  ,

,  ,

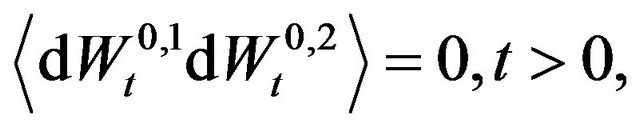

,  , are their stochastic differentials. The correlation structure of the model is defined by the following assumptions:

, are their stochastic differentials. The correlation structure of the model is defined by the following assumptions:

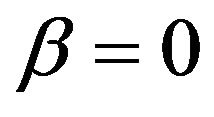

(4)

(4)

(5)

(5)

(6)

(6)

(7)

(7)

(8)

(8)

(9)

(9)

where  denotes the expected value of

denotes the expected value of  and the quantities

and the quantities  are constants known as correlation coefficients. The autocorrelation coefficients of the previous stochastic differentials are equal to one. When the model is multiscale (i.e. when

are constants known as correlation coefficients. The autocorrelation coefficients of the previous stochastic differentials are equal to one. When the model is multiscale (i.e. when ) the meaning of the assumptions (4)-(9) is that the stochastic differentials on the right hand side of (1)-(3) associated to the two (long and short) time scales are independent.

) the meaning of the assumptions (4)-(9) is that the stochastic differentials on the right hand side of (1)-(3) associated to the two (long and short) time scales are independent.

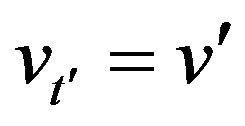

The Equations (1)-(3) are equipped with the initial conditions:

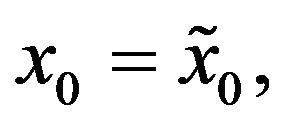

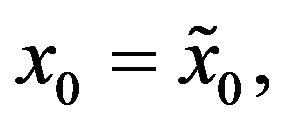

(10)

(10)

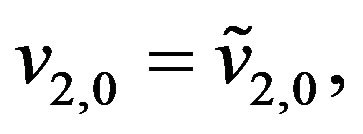

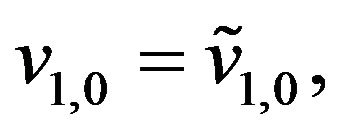

(11)

(11)

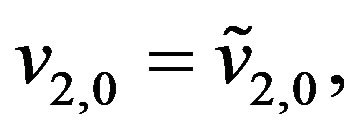

(12)

(12)

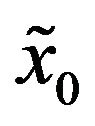

where ,

,  ,

,  , are random variables that we assume to be concentrated in a point with probability one. For simplicity we identify the random variables

, are random variables that we assume to be concentrated in a point with probability one. For simplicity we identify the random variables ,

,  ,

,  , with the points where they are concentrated. We assume

, with the points where they are concentrated. We assume ,

, .

.

The stochastic differential Equations (1)-(3), the initial conditions (10)-(12), the assumptions on the correlation coefficients (4)-(9) and the conditions on the coefficients ,

,  ,

,  , define the multiscale SABR model. This model generalizes the SABR model introduced in 2002 by Hagan, Kumar, Lesniewski, Woodward [1] that is defined by the following stochastic differential equations:

, define the multiscale SABR model. This model generalizes the SABR model introduced in 2002 by Hagan, Kumar, Lesniewski, Woodward [1] that is defined by the following stochastic differential equations:

(13)

(13)

(14)

(14)

where  and

and . The coefficients

. The coefficients  and

and  of (13), (14) are known respectively as

of (13), (14) are known respectively as  -volatility and as volatility of volatility. Moreover

-volatility and as volatility of volatility. Moreover ,

,  ,

,  , are standard Wiener processes such that

, are standard Wiener processes such that

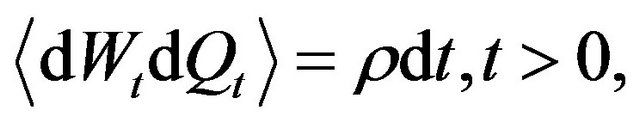

,

,  ,

,  , are their stochastic differentials and we have:

, are their stochastic differentials and we have:

(15)

(15)

where  is a constant called correlation coefficient. The Equations (13) and (14) are equipped with the initial conditions:

is a constant called correlation coefficient. The Equations (13) and (14) are equipped with the initial conditions:

(16)

(16)

(17)

(17)

where  and

and  are random variables that we assume to be concentrated in a point with probability one and that, for simplicity, we identify with the points where they are concentrated. Moreover we assume that

are random variables that we assume to be concentrated in a point with probability one and that, for simplicity, we identify with the points where they are concentrated. Moreover we assume that .

.

Note that for  the assumption

the assumption  with probability one implies that

with probability one implies that  with probability one for

with probability one for . A similar statement holds for

. A similar statement holds for  and

and ,

, .

.

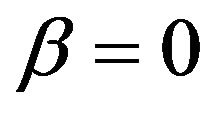

We consider the normal and the lognormal SABR and multiscale SABR models. These models are obtained from the previous ones choosing respectively in Equations (13) and (1)  (normal models) or

(normal models) or  (lognormal models). When we consider the lognormal models we assume that

(lognormal models). When we consider the lognormal models we assume that . In the lognormal models the assumption

. In the lognormal models the assumption  with probability one implies that

with probability one implies that  with probability one for

with probability one for . Under the assumptions (4)-(9) for the normal and lognormal SABR and multiscale SABR models the transition probability density functions associated to the state variables of these models are expressed via integral formulae with explicitly known integrands. In this sense the normal and lognormal models are explicitly solvable. The SABR and multiscale SABR models with

. Under the assumptions (4)-(9) for the normal and lognormal SABR and multiscale SABR models the transition probability density functions associated to the state variables of these models are expressed via integral formulae with explicitly known integrands. In this sense the normal and lognormal models are explicitly solvable. The SABR and multiscale SABR models with ,

,  can be studied using the following approaches: numerical methods, series expansions in the parameter

can be studied using the following approaches: numerical methods, series expansions in the parameter  or hybrid methods. The last approach combines series expansions and numerical methods. The SABR models with

or hybrid methods. The last approach combines series expansions and numerical methods. The SABR models with ,

,  can be studied using integral formulae involving hypergeometric functions for their transition probability density functions [8]. The models with

can be studied using integral formulae involving hypergeometric functions for their transition probability density functions [8]. The models with  deserve special attention. These models will be studied elsewhere.

deserve special attention. These models will be studied elsewhere.

We begin our analysis with the study of the normal multiscale SABR model (see Section 2) for three reasons. The first reason is that under the previous hypotheses on its correlation structure the normal multiscale SABR model can be solved explicitly. The second reason is that the normal multiscale SABR model can be considered as an improvement not only of the normal SABR model but also of SABR models with  different from zero, sufficiently small. In fact the use of two volatilities makes the normal multiscale model more “flexible” than the SABR models. For example the normal multiscale SABR model reproduces both balanced and skewed probability distributions of prices/rates and can forecast satisfactorily the option prices even when the options considered have strike price near to zero and are at the money. In these circumstances the normal SABR model fails to explain the observed prices. The third reason is that in the class of SABR models parametrized by

different from zero, sufficiently small. In fact the use of two volatilities makes the normal multiscale model more “flexible” than the SABR models. For example the normal multiscale SABR model reproduces both balanced and skewed probability distributions of prices/rates and can forecast satisfactorily the option prices even when the options considered have strike price near to zero and are at the money. In these circumstances the normal SABR model fails to explain the observed prices. The third reason is that in the class of SABR models parametrized by ,

,  , the normal models are the simplest ones and their study is useful to understand the other models. For example in Section 3 we use the results obtained in the study of the normal models to study the lognormal models.

, the normal models are the simplest ones and their study is useful to understand the other models. For example in Section 3 we use the results obtained in the study of the normal models to study the lognormal models.

The explicit formulae of the transition probability density functions associated with the normal and lognormal models are one (SABR models) or three dimensional (multiscale SABR models) integrals of explicitly known integrands. The formulae are closed form and “easy to use” in the sense that their numerical evaluation can be done with elementary methods. These formulae are used to derive explicit (closed form) formulae for the corresponding prices of European call and put options. The option pricing formulae are integrals of explicitly known integrands. Due to the special form of the integrands the numerical evaluation of the multi-dimensional integrals involved in the formulae of the transition probability density functions and of the option prices can be done very efficiently with ad hoc quadrature rules.

Moreover from the formula for the normal multiscale SABR transition probability density function we derive a formula for the transition probability density function of the normal SABR model. This formula is expressed as a one dimensional integral of a (regular) explicitly known integrand, is an elementary formula that can used instead of the formula deduced in [9] (Formula (120) in [9]). This last formula (Formula (120) in [9]) is based on the McKean formula for the heat kernel of the Poincaré plane. In a similar way a new formula for the transition probability density function of the lognormal SABR model is deduced. This last formula is a special case of an explicit, “easy to use” formula for the transition probability density function of the stochastic process implicitly defined by the Hull and White model [10] when there is a possibly nonzero correlation between the stochastic differentials appearing on the right hand side of the forward prices/rates and volatility equations. These are two interesting formulae since up to now in the case of nonzero correlation for the transition probability density functions of the lognormal SABR model and of the Hull and White model only asymptotic expansions in the correlation coefficient were known (see for example [10,11] and the references therein). The results relative to the Hull and White model will be presented elsewhere. The formulae presented in this paper are obtained using the Fourier transform, the method of separation variables and the results of Yakubovic [12] about the Lebedev Kontorovich Transform.

A calibration problem for the normal and lognormal SABR and multiscale SABR models is considered. These models are calibrated using option price data, the option pricing formulae mentioned above and the least squares method. The calibration problem is formulated as a constrained optimization problem for the least squares error function. Given the forward prices/rates the calibrated models are used to forecast option prices. We discuss some numerical experiments with real data where observed and forecast option prices are compared. These experiments confirm the validity of the procedure used to forecast option prices, of the calibration procedure and of the models presented. In particular they make possible a comparison between SABR and multiscale SABR models that shows when the use of the multiscale SABR models is justified.

The real data used in the calibration problem and in the forecasting experiments are discrete time observations of the euro/US dollar (EUR/USD) exchange rate (futures prices), of the futures prices of the USA five year interest rate swap and of the prices of the corresponding European put and call options (i.e. European foreign exchange options on EUR/USD futures prices and options on USA five year interest rate swap futures). That is we consider Foreign eXchange (FX) data and interest rates data. Note that forward/futures prices are quantities stated in the contracts stipulated to buy or to sell currencies in a future date and that they remain unchanged during the life time of the contracts. For the convenience of the reader let us recall some facts about the derivatives mentioned above. A foreign exchange option is a derivative that gives to the owner the right but not the obligation to exchange a given quantity of money denominated in one currency into money denominated in another currency in a specified date at a pre-agreed exchange rate. Exchange rate derivatives are widely traded and serve different needs, for example, they serve the needs of firms active in the international trade arena that want to reduce their exposure to exchange rate variations. The USA five year interest rate swap exchanges semiannual interest rate payments at the fixed rate of 4% per floating interest rate payments based on 3-month LIBOR interest rate. These swaps are widely traded. In fact they are excellent tools for duration management and asset/ liability gap management for bank treasuries, insurers and financial services companies. Note that the use of futures prices/rates instead of forward prices/rates in our numerical experiments is due to the fact that only the latter ones are over the counter prices. Moreover recall that when during the time period considered the risk free interest rates are deterministic forward and futures prices/ rates coincide (see [13], Proposition 3.1 and [14]).

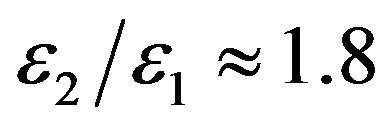

The numerical experiment on the EUR/USD exchange rate shows that, once calibrated using call and put option prices relative to a given date, the normal multiscale SABR model, given the asset price at the time of the forecast, is able to produce forecasts of call and put option prices that outperform those obtained with the normal SABR model. Note that the values of the parameters  and

and  of the normal multiscale model obtained in the calibration differ of approximately a factor two. This means that the calibrated multiscale model has really a multiscale behaviour and as a consequence the interpretation of the data benefits from the presence of the second time scale.

of the normal multiscale model obtained in the calibration differ of approximately a factor two. This means that the calibrated multiscale model has really a multiscale behaviour and as a consequence the interpretation of the data benefits from the presence of the second time scale.

In the next experiment the lognormal models are used to interpret interest rate swaps data. In this case the futures price has abrupt changes so that the improvement in the data interpretation obtained introducing the multiscale model is significant. In particular when the lognormal multiscale SABR model is considered the values of the parameters  and

and  obtained in the calibration differ for about a factor two. The results obtained on the interest rate swap data with the lognormal models confirm the findings of the experiments on the EUR/ USD exchange rate data with the normal models. Finally the stability of the parameter values obtained in the calibration is investigated. It is shown that calibrating the models daily with the option price data collected in one day during a period of about two months (that is calibrating the models approximately forty times) the models parameters obtained remain substantially unchanged during the two months period. Recall that there are approximately twenty trading days in a month.

obtained in the calibration differ for about a factor two. The results obtained on the interest rate swap data with the lognormal models confirm the findings of the experiments on the EUR/ USD exchange rate data with the normal models. Finally the stability of the parameter values obtained in the calibration is investigated. It is shown that calibrating the models daily with the option price data collected in one day during a period of about two months (that is calibrating the models approximately forty times) the models parameters obtained remain substantially unchanged during the two months period. Recall that there are approximately twenty trading days in a month.

The website: http://www.econ.univpm.it/recchioni/ finance/w14 contains some auxiliary material including animations that help the understanding of this paper. A more general reference to the work of the authors and of their coauthors in mathematical finance is the website: http://www.econ.univpm.it/recchioni/finance.

The remainder of the paper is organized as follows. In Section 2 we study the normal SABR and multiscale SABR models. In Section 3 we study the lognormal SABR and multiscale SABR models. In Section 4 we formulate a calibration problem for these models and we present a numerical method to solve it. In Section 5 a procedure that, given the asset prices at the time of the forecast, forecasts option prices using the calibrated models is presented. The calibration and forecasting procedures are applied to study real data. Currency exchange rates and interest rates derivatives data and the corresponding option price data are studied. The forecast option prices are compared with the prices actually observed. The comparison shows the relevance of the multiscale SABR models. Finally in Section 6 some conclusions are drawn.

2. The Normal SABR and Multiscale SABR Models

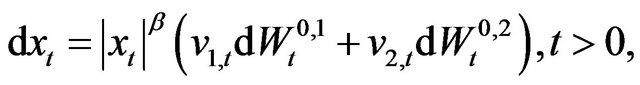

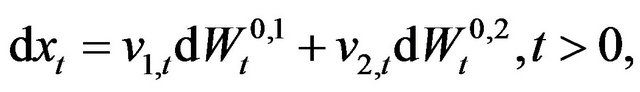

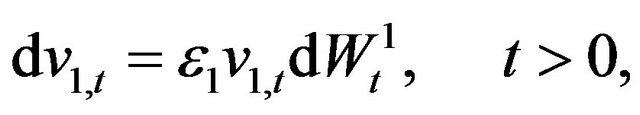

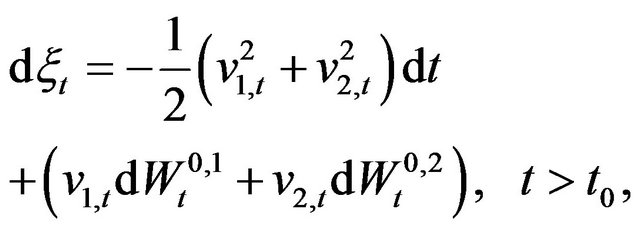

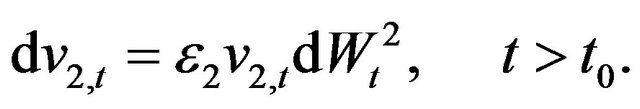

Let us consider the normal multiscale SABR model. This model is obtained choosing  in (1), (2), (3) and is given by the following stochastic differential equations:

in (1), (2), (3) and is given by the following stochastic differential equations:

(18)

(18)

(19)

(19)

(20)

(20)

with the initial conditions:

(21)

(21)

(22)

(22)

(23)

(23)

where ,

,  ,

,  , are random variables that we assume to be concentrated in a point with probability one. The quantities

, are random variables that we assume to be concentrated in a point with probability one. The quantities ,

,  , are positive constants such that

, are positive constants such that . Moreover we assume that conditions (4)-(9) hold. In a similar way starting from (13), (14), (16), (17) and choosing

. Moreover we assume that conditions (4)-(9) hold. In a similar way starting from (13), (14), (16), (17) and choosing  in (13) we can write the normal SABR model.

in (13) we can write the normal SABR model.

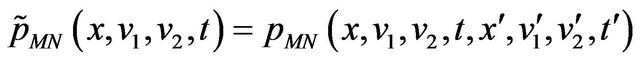

Let us consider the transition probability density function of the stochastic process ,

,  ,

,  ,

,  , implicitly defined by (18)-(23), that is the probability density function of having

, implicitly defined by (18)-(23), that is the probability density function of having ,

,  ,

,  given the fact that

given the fact that ,

,  ,

,  , when

, when ,

,  ,

,  , and

, and . Note that when

. Note that when  we must choose

we must choose ,

,  ,

, . This transition probability density function is denoted with

. This transition probability density function is denoted with

,

, . Note that the values

. Note that the values ,

,  of the forward prices/rates vary on the real axis, and that they can be negative. We denote with

of the forward prices/rates vary on the real axis, and that they can be negative. We denote with  ,

,  ,

,  , the function

, the function

, considered as a function of the variables

, considered as a function of the variables . The function

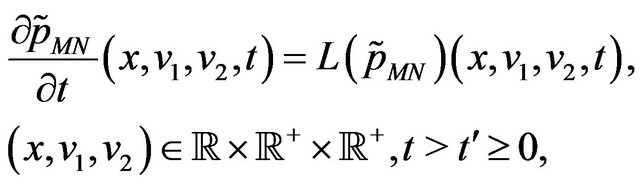

. The function  is the solution of the Fokker Planck equation:

is the solution of the Fokker Planck equation:

(24)

(24)

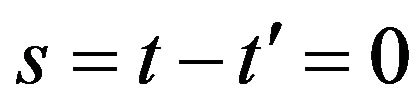

with the initial condition:

(25)

(25)

and appropriate boundary conditions. The symbol  denotes the Dirac’s delta and in (25) the operator

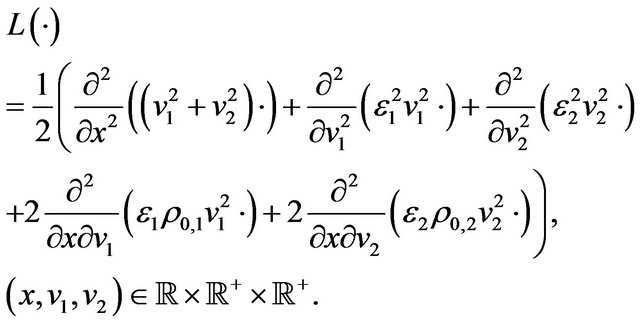

denotes the Dirac’s delta and in (25) the operator  is given by:

is given by:

(26)

(26)

The operator  defined in (26) depends on the assumptions (4)-(9). The Fokker Planck Equation (24) is a linear parabolic partial differential equation whose elliptic part is degenerate on the boundary of its domain of definition, that is it is degenerate when

defined in (26) depends on the assumptions (4)-(9). The Fokker Planck Equation (24) is a linear parabolic partial differential equation whose elliptic part is degenerate on the boundary of its domain of definition, that is it is degenerate when  or

or  and

and . Problems (24), (25) are completed with appropriate boundary conditions. The degeneracy of the elliptic part of the Fokker Planck equation implies that boundary conditions must be specified with care. For simplicity we omit these boundary conditions. Note that the transition probability density function

. Problems (24), (25) are completed with appropriate boundary conditions. The degeneracy of the elliptic part of the Fokker Planck equation implies that boundary conditions must be specified with care. For simplicity we omit these boundary conditions. Note that the transition probability density function

,

,

,

,

defined as the unique solution of (24), (25) with appropriate boundary conditions is the fundamental solution of the Fokker Planck equation with the boundary conditions omitted.

defined as the unique solution of (24), (25) with appropriate boundary conditions is the fundamental solution of the Fokker Planck equation with the boundary conditions omitted.

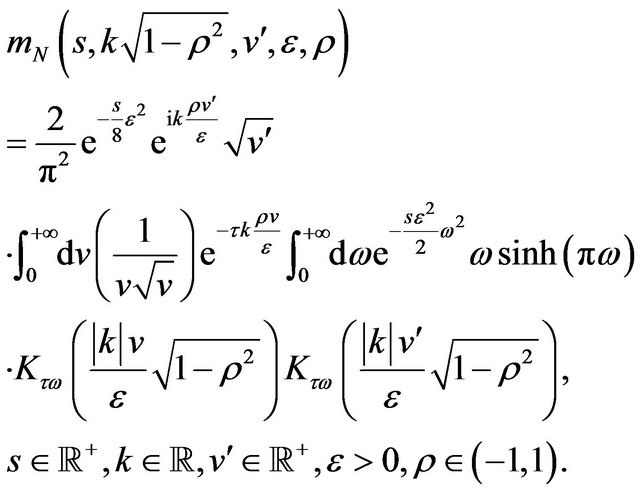

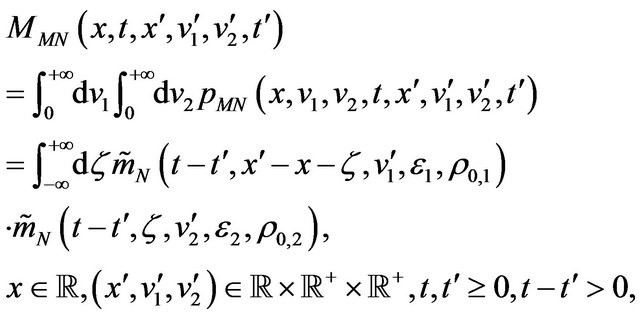

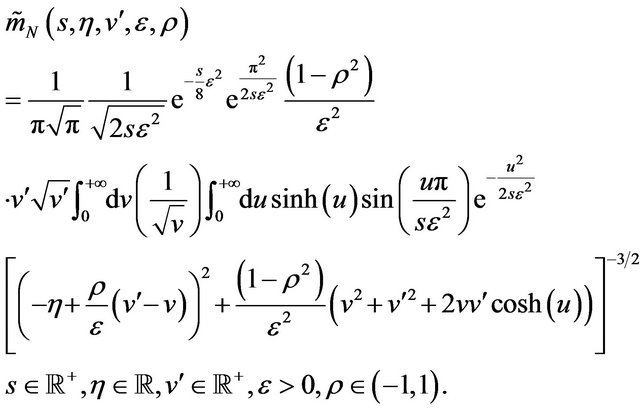

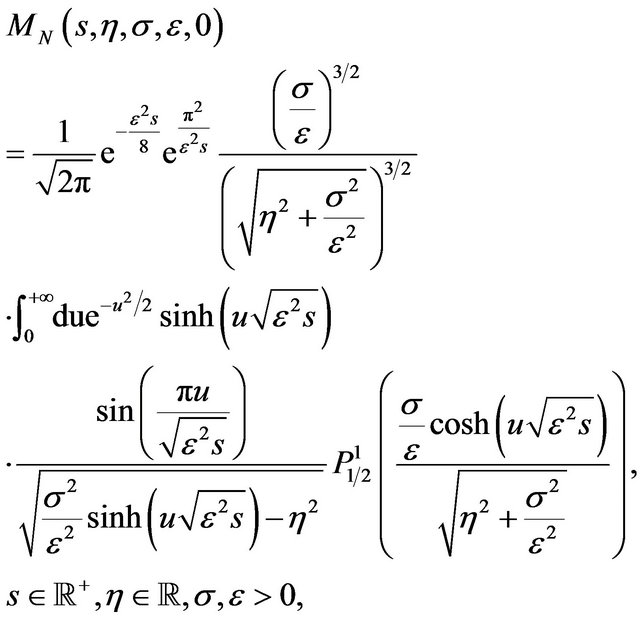

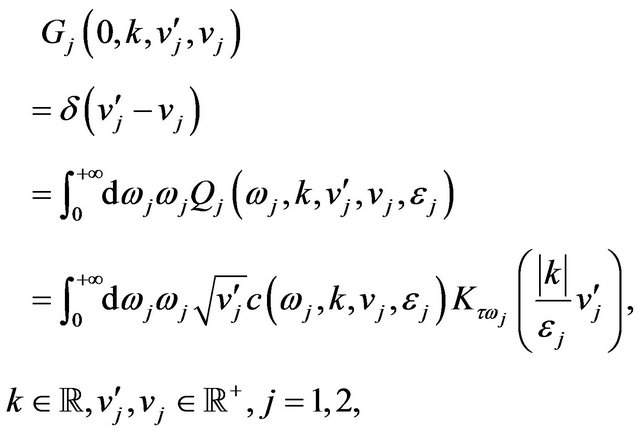

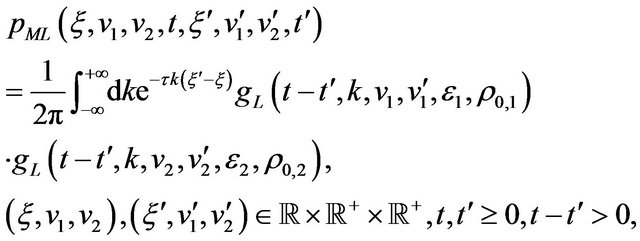

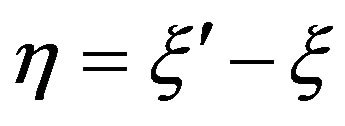

The main result of this Section is the following formula:

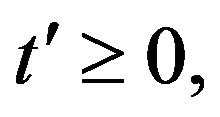

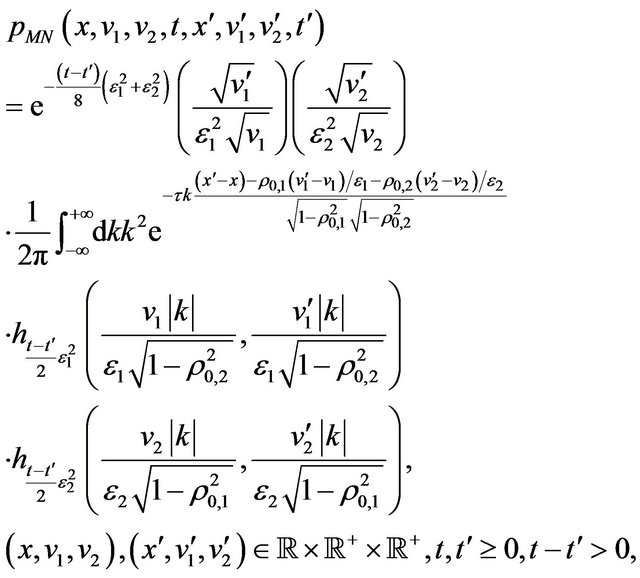

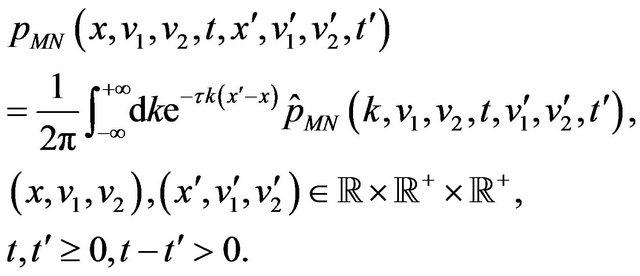

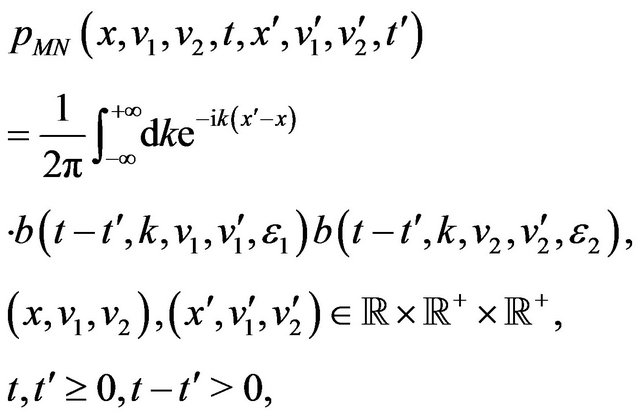

(27)

(27)

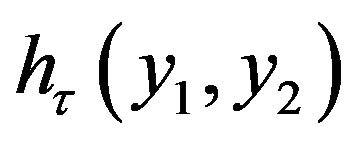

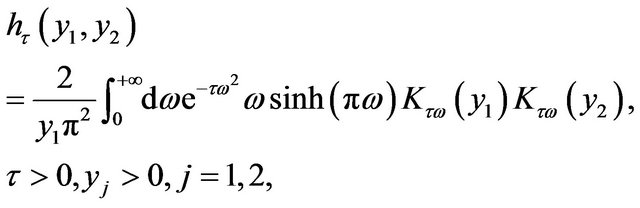

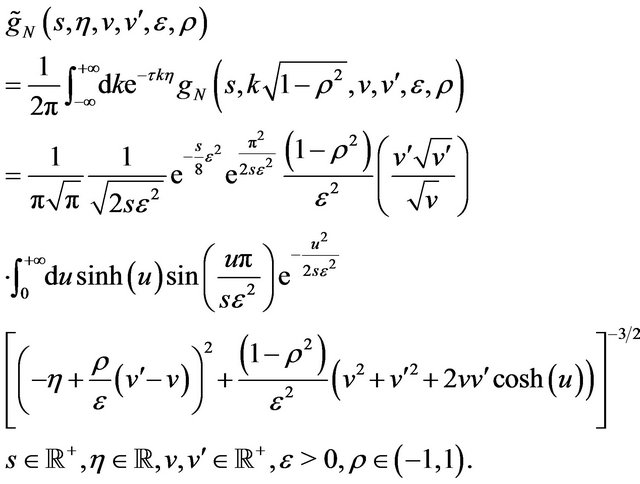

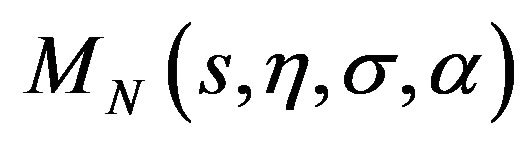

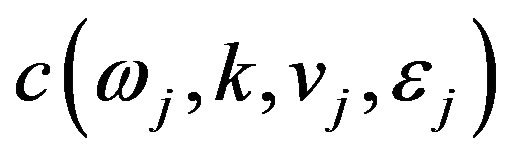

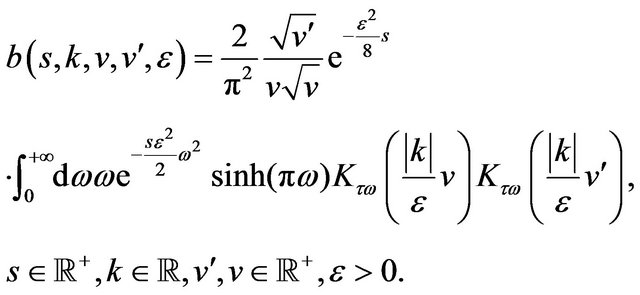

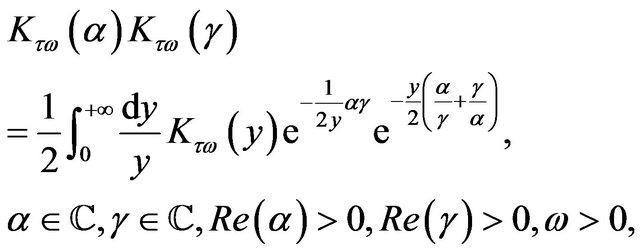

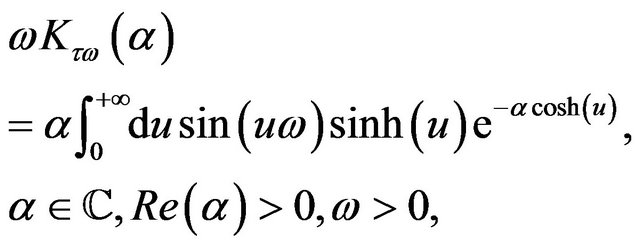

where τ is the imaginary unit and the function  is the “heat kernel for the Kontorovich-Lebedev transform” (see [12] p. 748). That is:

is the “heat kernel for the Kontorovich-Lebedev transform” (see [12] p. 748). That is:

(28)

(28)

where  and

and  denote respectively the hyperbolic sine and the second type modified Bessel function of order

denote respectively the hyperbolic sine and the second type modified Bessel function of order  (see [15] p. 5). With a simple change of variables Formula (27) can be rewritten as follows:

(see [15] p. 5). With a simple change of variables Formula (27) can be rewritten as follows:

(29)

(29)

where

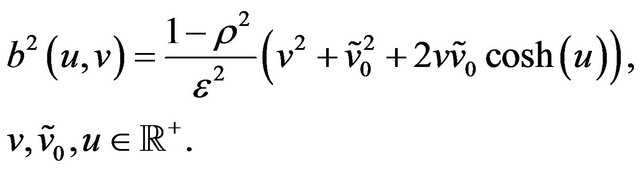

(30)

(30)

Let  be the Fourier transform of

be the Fourier transform of  with respect to the

with respect to the  variable, we have:

variable, we have:

(31)

(31)

Using (29), (31) and the properties of the Fourier transform we have:

(32)

(32)

where  is the Fourier transform of

is the Fourier transform of  with respect to the

with respect to the  variable, that is:

variable, that is:

(33)

Note that Formula (27) and similarly Formulae (29), (32) give the transition probability density function  as a one dimensional Fourier integral of a known integrand. The integrand has a special form, in fact it contains the product of two copies of a function evaluated in two different points. This function, defined in (30) or in (33), is a one dimensional integral of an explicitly known integrand. That is Formulae (27), (29), (32) are three dimensional integrals. However the special form of their integrands mentioned above implies that the evaluation of these three dimensional integrals with an elementary quadrature rule can be done at the computational cost of a two dimensional integral.

as a one dimensional Fourier integral of a known integrand. The integrand has a special form, in fact it contains the product of two copies of a function evaluated in two different points. This function, defined in (30) or in (33), is a one dimensional integral of an explicitly known integrand. That is Formulae (27), (29), (32) are three dimensional integrals. However the special form of their integrands mentioned above implies that the evaluation of these three dimensional integrals with an elementary quadrature rule can be done at the computational cost of a two dimensional integral.

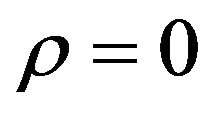

Note that the function  defined in (33) when

defined in (33) when ,

,  ,

,  and

and  is the transition probability density function of the normal SABR model. This can be seen proceeding as done at the end of this Section to deduce (27) or simply verifying that

is the transition probability density function of the normal SABR model. This can be seen proceeding as done at the end of this Section to deduce (27) or simply verifying that  satisfies the Fokker Planck equation associated to (13), (14) when

satisfies the Fokker Planck equation associated to (13), (14) when  with the appropriate initial and boundary conditions.

with the appropriate initial and boundary conditions.

Formula (33) for the transition probability density function of the normal SABR model is a new and useful formula that can substitute the formula commonly used in the mathematical finance literature, that is Formula (120) of [9], that is based on the McKean formula for the heat kernel of the Poincaré plane. The integral that appears in (33) is a one dimensional integral of a smooth function whose numerical evaluation is easier than the evaluation of the integral of a singular function contained in Formula (120) of [9]. Moreover Formulae (27) and (33) are deduced using elementary tools, that is: the Fourier transform, the method of separation of variables and the results of [12] on the Kontorovich Lebedev transform. The McKean formula is derived using the differential geometry of the Poincaré plane. That is Formula (33) and its elementary derivation simplify the study of the normal SABR model.

Formula (27) can be used to deduce some useful consequences. For example from Formula (27) it is possible to deduce an explicit formula for the marginal probability distribution  of the forward prices/rates stochastic process defined by (18)-(23) under the assumptions (4)- (9), that is:

of the forward prices/rates stochastic process defined by (18)-(23) under the assumptions (4)- (9), that is:

(34)

(34)

where  is given by:

is given by:

(35)

(35)

The function  can be rewritten as follows:

can be rewritten as follows:

(36)

(36)

where  is given by:

is given by:

(37)

(37)

An alternative expression of the marginal probability distribution (34) can be obtained using Formula (32), that is:

(38)

(38)

where  is given by:

is given by:

(39)

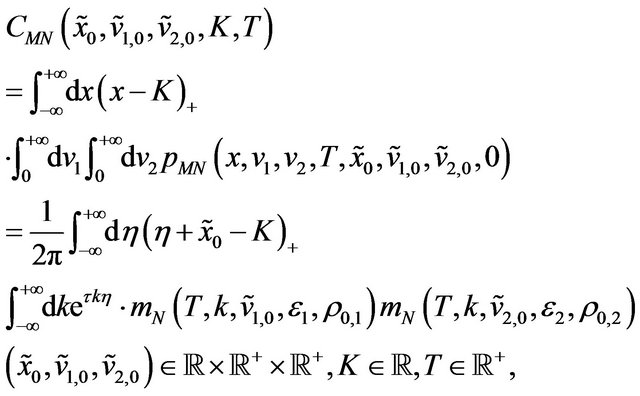

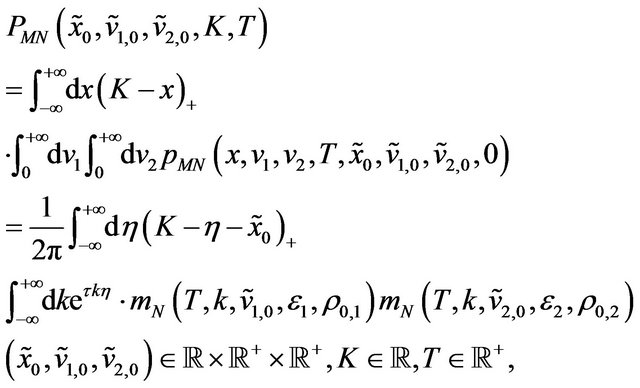

From (27) using the no arbitrage pricing theory formulae to price in the normal multiscale SABR model European call and put options can be derived. The assumption that the risk free interest rate is deterministic during the life time of the priced option implies that the forward prices/rates coincide with the futures prices/rates. In fact the forward price is a martingale under the (forward) measure associated to (18)-(23) and the futures price is a martingale under the risk-neutral measure. However if the risk free interest rate is deterministic the forward measure and the risk neutral measure coincide (see [13], Proposition 3.1). Hence we can assume that we are working with futures prices/rates instead of with forward prices/rates and we can exploit the fact that these prices/rates are martingales under the risk-neutral measure. That is the risk neutral measure used to compute the option prices and the “physical” measure used to describe the underlying dynamics defined by (18)-(23) are the same (see [13], Proposition 3.1).

Under the previous assumption on the risk free interest rate manipulating Formulae (27), (34) and using the results contained in [12] we obtain formulae to price European call and put options in the normal multiscale SABR model. That is the formulae for the prices  and

and  at time

at time  of respectively European call and put options with strike price

of respectively European call and put options with strike price  and maturity time

and maturity time  (i.e. time to maturity

(i.e. time to maturity  since

since  is assumed to be “today”) when the forward price of the underlying and the values of the stochastic volatilities at time

is assumed to be “today”) when the forward price of the underlying and the values of the stochastic volatilities at time  (that is today) are respectively

(that is today) are respectively ,

,  ,

,  are:

are:

(40)

(40)

(41)

(41)

where .

.

Note that since in the normal multiscale SABR model the forward prices/rates can be negative we have chosen  instead of

instead of  as it is done when models with positive asset prices are considered. Moreover in (40), (41) we have chosen the discount factor equal to one, that is we have chosen the risk free interest rate equal to zero. This choice is due to the desire of keeping the expression of Formulae (40), (41) simple and can be easily removed.

as it is done when models with positive asset prices are considered. Moreover in (40), (41) we have chosen the discount factor equal to one, that is we have chosen the risk free interest rate equal to zero. This choice is due to the desire of keeping the expression of Formulae (40), (41) simple and can be easily removed.

Formulae (40), (41) can be rewritten as follows:

(42)

(42)

(43)

(43)

where  is given by:

is given by:

(44)

(44)

when  Formula (44) reduces to:

Formula (44) reduces to:

(45)

(45)

where  is the Legendre function of the first kind of parameters

is the Legendre function of the first kind of parameters ,

,  (see [15] p. 180). From (45) it follows that Formulae (40), (41) can be simplified when

(see [15] p. 180). From (45) it follows that Formulae (40), (41) can be simplified when .

.

In the case of the normal SABR model Formulae (40) and (41) reduce respectively to the following formulae:

(46)

(46)

(47)

(47)

where  is the stochastic volatility at time

is the stochastic volatility at time  (see (17)). Moreover in (46) the integral with respect to the

(see (17)). Moreover in (46) the integral with respect to the  variable can be computed explicitly, we have:

variable can be computed explicitly, we have:

(48)

where

(49)

(49)

A formula analogous to (48) can be obtained for the put option price  integrating (47) with respect to the

integrating (47) with respect to the  variable.

variable.

Note that also the integrals in the  variable appearing in Formulae (40) and (41) can be done explicitly. However in the case of Formulae (40) and (41) this integration leads to formulae computationally useless. In fact in Formulae (40) and (41) the evaluation of the functions

variable appearing in Formulae (40) and (41) can be done explicitly. However in the case of Formulae (40) and (41) this integration leads to formulae computationally useless. In fact in Formulae (40) and (41) the evaluation of the functions  in a point of the

in a point of the  grid implies the computation of a two dimensional integral, however these function are independent of

grid implies the computation of a two dimensional integral, however these function are independent of ,

,  and

and , the value of these functions on a grid in the

, the value of these functions on a grid in the  variable can be computed out of the

variable can be computed out of the ,

,  ,

,  loops. Note that the double integral coming from the integration with respect to the

loops. Note that the double integral coming from the integration with respect to the  variable couples

variable couples ,

,  and

and  variables.

variables.

In Formulae (46)-(48) for simplicity the discount factor has been chosen equal to one. This assumption can be easily removed.

Let us derive Formula (27). The reader not interested in this derivation can move to Section 3. We begin deducing Formula (27) when . Under the assumptions (4)-(9), when

. Under the assumptions (4)-(9), when

let us consider the backward Kolmogorov equation associated to the stochastic differential Equations (18)-(20) satisfied by the function

let us consider the backward Kolmogorov equation associated to the stochastic differential Equations (18)-(20) satisfied by the function  as a function of the variables

as a function of the variables , we have:

, we have:

(50)

(50)

Equation (50) must be equipped with an initial condition in , that is:

, that is:

(51)

(51)

and appropriate boundary conditions.

Let  be the conjugate variable in the Fourier transform of the

be the conjugate variable in the Fourier transform of the  variable, it is easy to see that the Fourier transform

variable, it is easy to see that the Fourier transform  of

of  with respect to

with respect to  is the solution of the following problem:

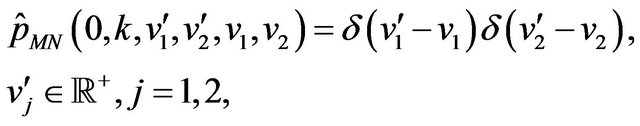

is the solution of the following problem:

(52)

(52)

with the initial condition:

(53)

(53)

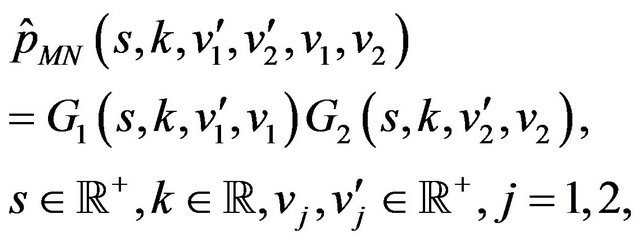

and the appropriate boundary conditions. To solve Problem (52) and (53), we proceed by separation of variables, that is we assume:

(54)

(54)

where ,

,  , are functions to be determined. Substituting (54) in (52) we have:

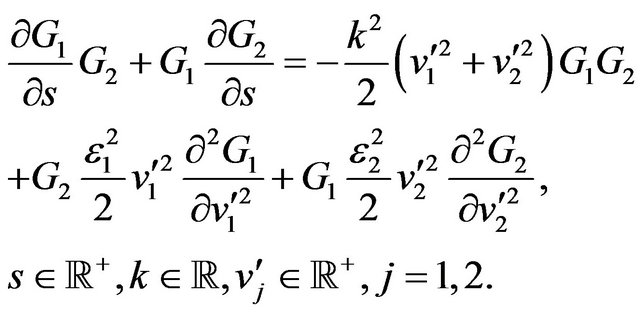

, are functions to be determined. Substituting (54) in (52) we have:

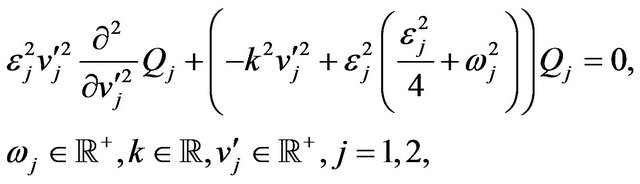

(55)

(55)

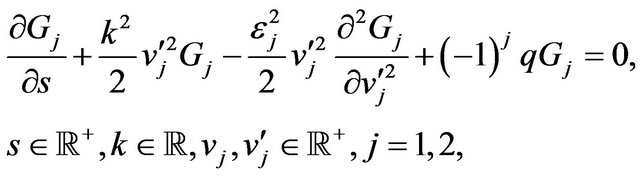

That is the assumption (54) reduces the solution of (52) and (53) to the solution of the following initial value problems:

(56)

(56)

(57)

(57)

with the appropriate boundary conditions. The constant  appearing in (56) comes from the separation of variables.

appearing in (56) comes from the separation of variables.

To solve problems (56) and (57) we assume that the functions ,

,  , have the following form:

, have the following form:

(58)

(58)

(59)

(59)

where ,

,  , are functions to be determined. Note that for

, are functions to be determined. Note that for  the function

the function  depends on

depends on , however the product

, however the product  does not depend on

does not depend on . Equations (58) and (59) imply that Equation (56) reduce to the following linear ordinary differential equations satisfied by

. Equations (58) and (59) imply that Equation (56) reduce to the following linear ordinary differential equations satisfied by ,

, :

:

(60)

(60)

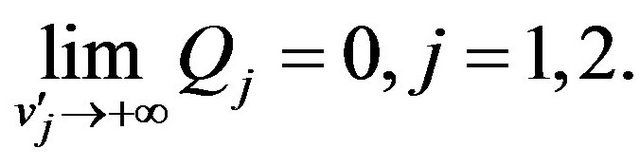

with the boundary condition:

(61)

(61)

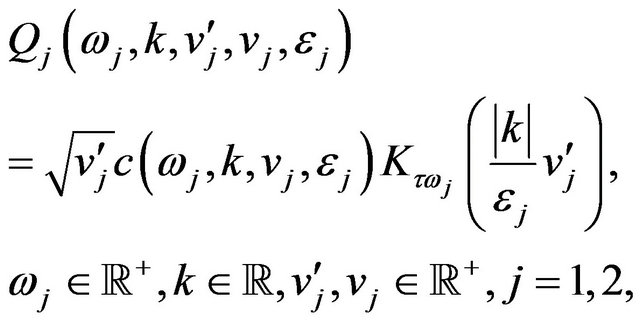

The boundary condition (61) is derived from the boundary conditions imposed to the solution of (50) (and as a consequence to the solution of (56)) and follows from the fact that we are looking for solutions of (56) that are probability density functions. Imposing the boundary condition (61) to the general solution of (60) we have:

(62)

(62)

where for  the function

the function  is an “arbitrary constant” of the solution of (60), that is

is an “arbitrary constant” of the solution of (60), that is  is independent of

is independent of , that can be determined through (58), (59) imposing the initial conditions (57) to the parabolic Equation (56). In fact we have:

, that can be determined through (58), (59) imposing the initial conditions (57) to the parabolic Equation (56). In fact we have:

(63)

(63)

using the inversion formula of the Kontorovich Lebedev Transform (see Formula (3) of [12] and the references therein) we have:

(64)

(64)

Using (63) and (64) we obtain the following formula for the function :

:

(65)

(65)

where

(66)

(66)

When the boundary conditions are chosen appropriately the solution (65) of the backward Kolmogorov Equation (50) with  in the “past” variables

in the “past” variables ,

,  ,

,  ,

,  with the final condition (51) is the solution of the Fokker Planck Equation (24) with

with the final condition (51) is the solution of the Fokker Planck Equation (24) with  (also known as forward Kolmogorov equation) in the “future” variables

(also known as forward Kolmogorov equation) in the “future” variables ,

,  ,

,  ,

,  with the initial condition (25). Formula (65) is deduced assuming that

with the initial condition (25). Formula (65) is deduced assuming that , when

, when  replacing in (65),

replacing in (65),  ,

,  ,

, respectively with

respectively with

,

,  and

and

we obtain (27) and it is easy to verify that (27) satisfies the Fokker Planck Equation (24) with initial condition (25) and the appropriate boundary conditions.

we obtain (27) and it is easy to verify that (27) satisfies the Fokker Planck Equation (24) with initial condition (25) and the appropriate boundary conditions.

Note that the change of variables used to go from the  case to the

case to the ,

,  case generalizes to the multiscale context the change of variables used in [9] in the study of the normal SABR model to go from the

case generalizes to the multiscale context the change of variables used in [9] in the study of the normal SABR model to go from the  case to the

case to the  case. Recall that the McKean formula for the heat kernel of the Poincaré plane gives the transition probability density function of the normal SABR model when

case. Recall that the McKean formula for the heat kernel of the Poincaré plane gives the transition probability density function of the normal SABR model when .

.

Note that (39) can be derived with elementary computations from (30) using the following representation formulae that can be deduced from Formula (46) p. 35 of [16], Formula (9) p. 176 of [17], and Formula (1.1) of [18]:

(67)

(67)

(68)

(68)

where  denotes the set of the complex numbers and

denotes the set of the complex numbers and  denotes the real part of the complex number z. Formulae (67) and (68) generalize to complex arguments respectively Formula (15), p. 747 of [12] and Formula (32) p. 99 of [19].

denotes the real part of the complex number z. Formulae (67) and (68) generalize to complex arguments respectively Formula (15), p. 747 of [12] and Formula (32) p. 99 of [19].

It is easy to see that Formula (33) for the normal SABR model can be deduced proceeding as done to deduce Formula (27) for the normal multiscale SABR model.

3. The Lognormal SABR and Multiscale SABR Models

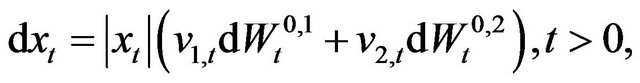

Let us consider the lognormal multiscale SABR model, those are Models (1)-(3) when , we have:

, we have:

(69)

(69)

(70)

(70)

(71)

(71)

with the initial conditions:

(72)

(72)

(73)

(73)

(74)

(74)

where, as already said,  ,

,  ,

,  , are random variables that we assume to be concentrated in a point with probability one. To the assumption

, are random variables that we assume to be concentrated in a point with probability one. To the assumption ,

,  , done previously we add the assumption

, done previously we add the assumption . Moreover we assume that the quantities

. Moreover we assume that the quantities ,

,  , are positive constants such that

, are positive constants such that  and that the conditions (4)-(9) hold. Recall that when

and that the conditions (4)-(9) hold. Recall that when  is positive with probability one it follows that

is positive with probability one it follows that  solution of (69)-(74) is positive with probability one for

solution of (69)-(74) is positive with probability one for . We can conclude that when

. We can conclude that when  with probability one the absolute value in (69) can be dropped.

with probability one the absolute value in (69) can be dropped.

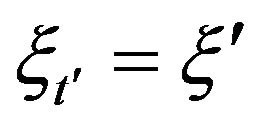

Let us derive a formula for the transition probability density function of the stochastic process defined implicitly by (69)-(74).

Let  be a constant such that

be a constant such that  is positive with probability one, we define the variable

is positive with probability one, we define the variable

,

, . Using the variable

. Using the variable ,

,  , the stochastic differential Equations (69)-(71) for

, the stochastic differential Equations (69)-(71) for  can be rewritten as follows:

can be rewritten as follows:

(75)

(75)

(76)

(76)

(77)

(77)

Let us choose  the previous change of variables transforms the Equations (69)-(71) into the Equations (75)-(77) for

the previous change of variables transforms the Equations (69)-(71) into the Equations (75)-(77) for  and the initial conditions (72)-(74) into the initial conditions:

and the initial conditions (72)-(74) into the initial conditions:

(78)

(78)

(79)

(79)

(80)

(80)

The variable ,

,  , is called log-return of the forward prices/rates. Note that the differential Equation (75) in the log return variable

, is called log-return of the forward prices/rates. Note that the differential Equation (75) in the log return variable ,

,  , of the lognormal multiscale SABR model differs from the corresponding equation (18) in the forward prices/rates variable

, of the lognormal multiscale SABR model differs from the corresponding equation (18) in the forward prices/rates variable ,

,  , of the normal multiscale SABR model only for the presence of the drift term

, of the normal multiscale SABR model only for the presence of the drift term

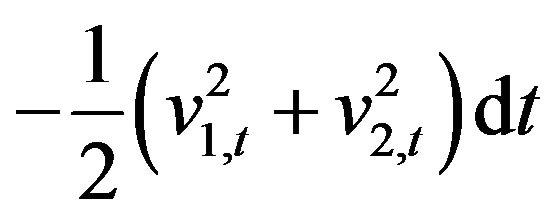

that appears in (75) and is absent in (18). For this reason under the previous assumptions it is possible to derive a formula for the transition probability density function  associated to the process

associated to the process ,

,  , implicitly defined by (75)-(77) when

, implicitly defined by (75)-(77) when  with the initial conditions (78)-(80) arguing as done in Section 2 to study the normal multiscale SABR model. Proceeding in this way we obtain the following formula:

with the initial conditions (78)-(80) arguing as done in Section 2 to study the normal multiscale SABR model. Proceeding in this way we obtain the following formula:

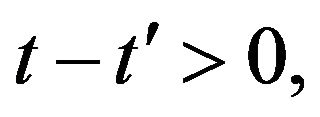

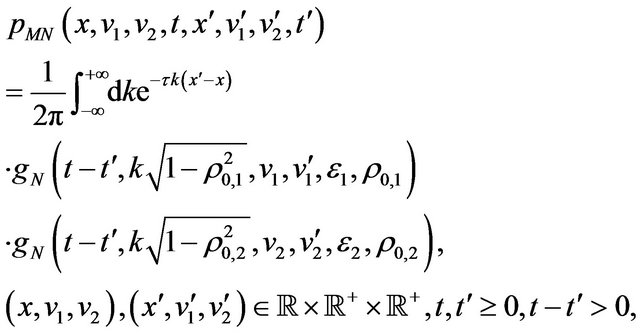

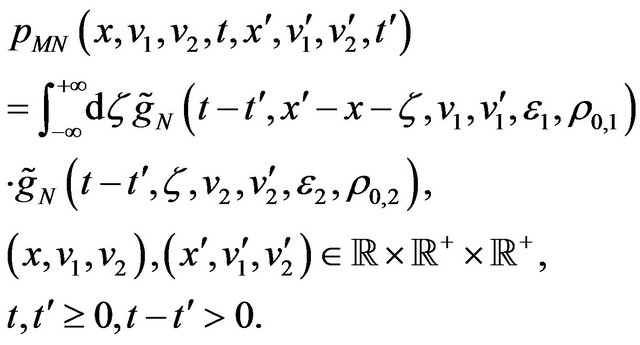

(81)

(81)

where ,

,  ,

,  ,

,  ,

,  , and the remaining notation is the one used in Section 2. The function

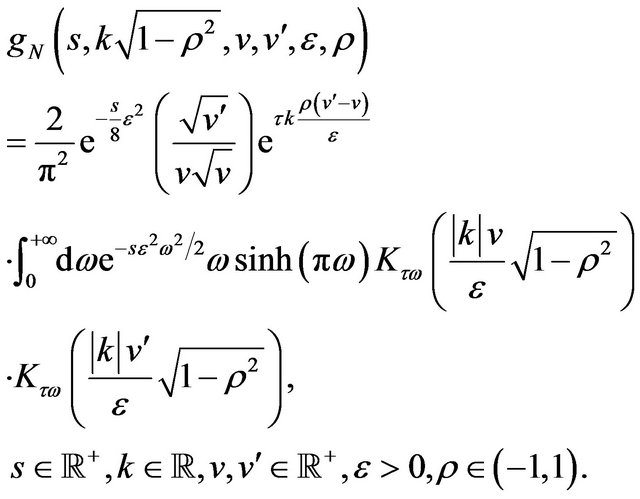

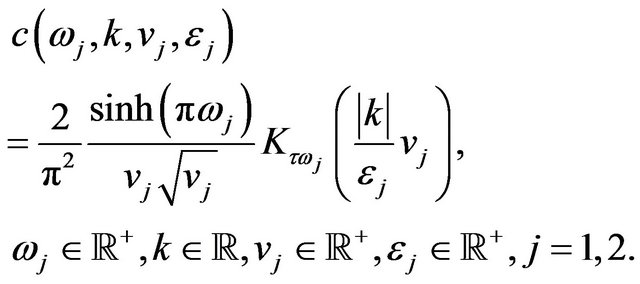

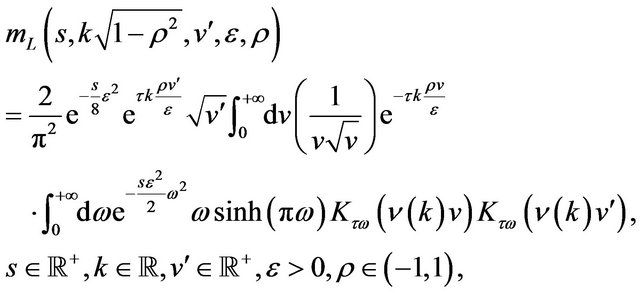

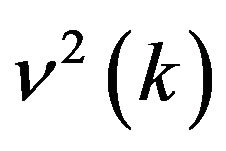

, and the remaining notation is the one used in Section 2. The function  is given by:

is given by:

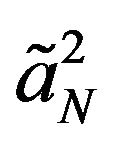

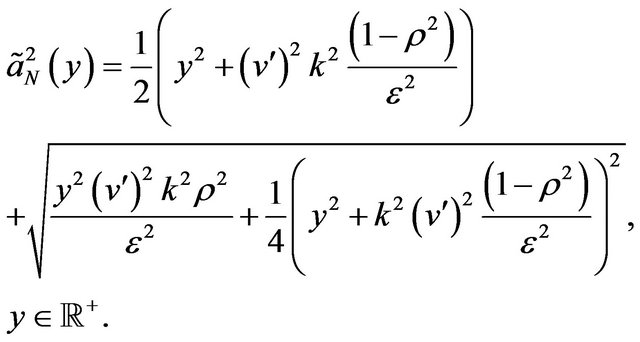

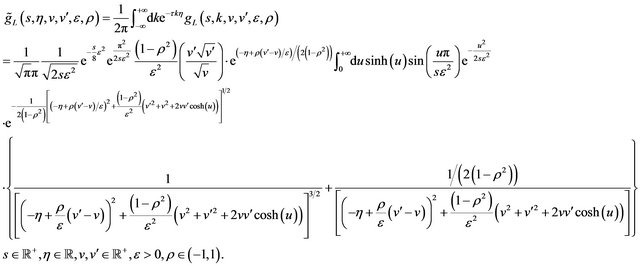

(82)

(82)

where

(83)

(83)

Note that when  in (81) we must choose

in (81) we must choose ,

,  ,

, . From (81) and the properties of the Fourier transform we have:

. From (81) and the properties of the Fourier transform we have:

(84)

(84)

where  is the Fourier transform with respect to the

is the Fourier transform with respect to the  variable of

variable of  and

and  is the conjugate variable in the Fourier transform of the

is the conjugate variable in the Fourier transform of the  variable. Using Formulae (67) and (68) an elementary computation gives:

variable. Using Formulae (67) and (68) an elementary computation gives:

(85)

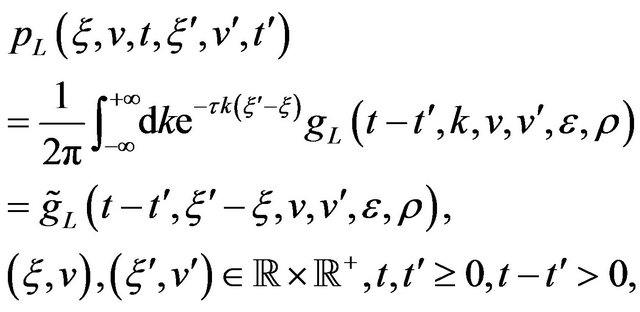

Note that Formula (81) gives the transition probability density function  of the lognormal multiscale SABR model using the log-return of the forward prices/rates variable, that is:

of the lognormal multiscale SABR model using the log-return of the forward prices/rates variable, that is:

(86)

(86)

where we assume ,

,  ,

,  ,

,  ,

,  ,

, . Note that when

. Note that when  we must choose

we must choose ,

, . Note that Formula (86) holds when

. Note that Formula (86) holds when . This (closed form) formula when

. This (closed form) formula when  is a new formula, in fact up to now when

is a new formula, in fact up to now when  only series expansions in powers of

only series expansions in powers of  with base point

with base point  have been known for

have been known for  (see, for example, [10], [11] and the references therein).

(see, for example, [10], [11] and the references therein).

Note that the lognormal SABR model is a special case of the Hull and White stochastic volatility model. It is easy to see that the analysis presented here for the lognormal SABR model can be extended to the study of the Hull and White model in presence of a nonzero correlation coefficient between the stochastic differentials of the Wiener processes of the model. In this way it is possible to obtain new (closed form) formulae for the transition probability density function of the Hull and White model and for the corresponding European call and put option prices. These formulae will be presented elsewhere.

The previous formulae for the transition probability density functions  and

and  written using the logreturn variable

written using the logreturn variable ,

,  , can be easily rewritten in the original forward prices/rates variable

, can be easily rewritten in the original forward prices/rates variable ,

, .

.

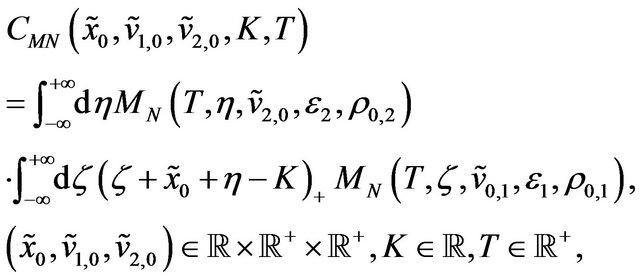

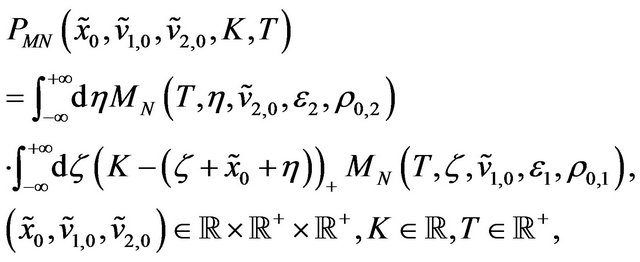

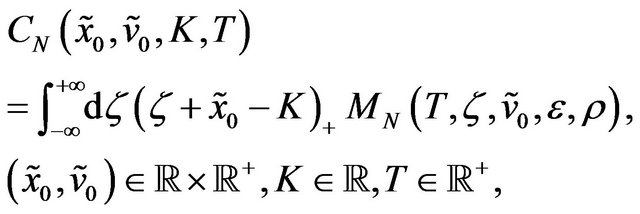

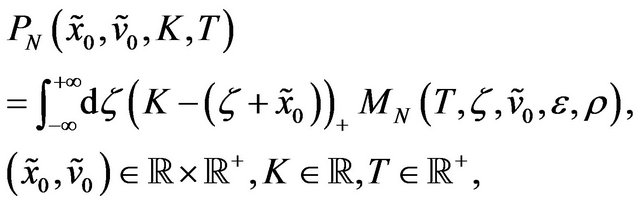

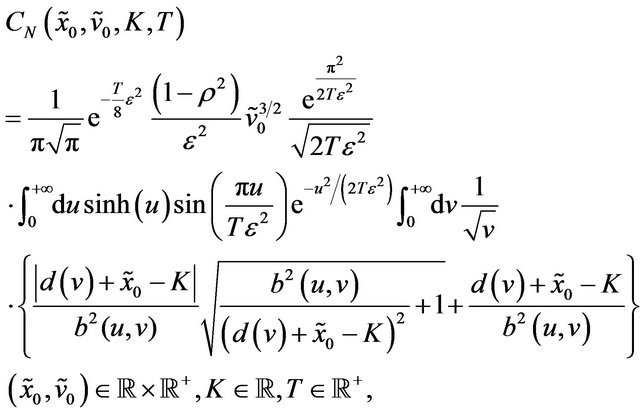

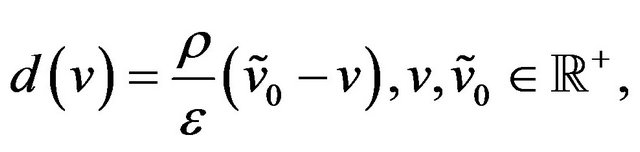

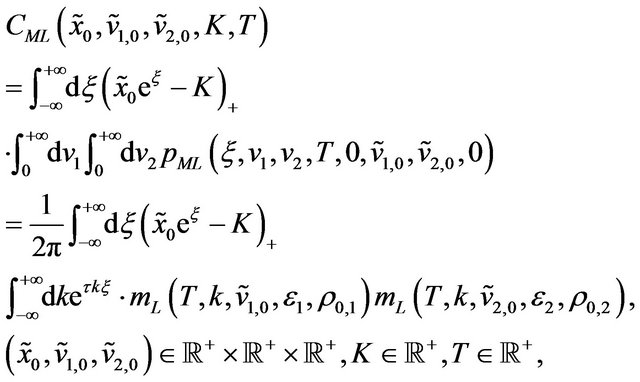

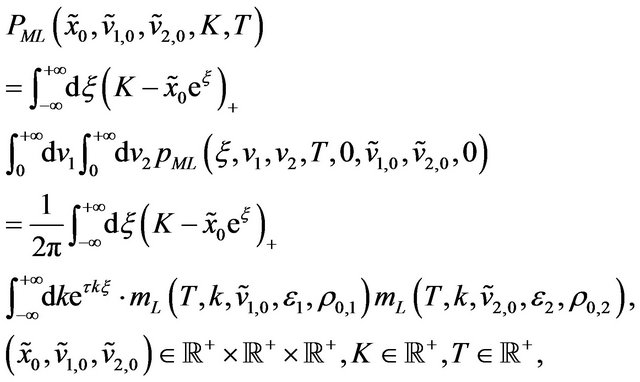

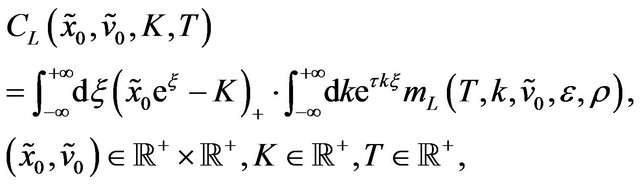

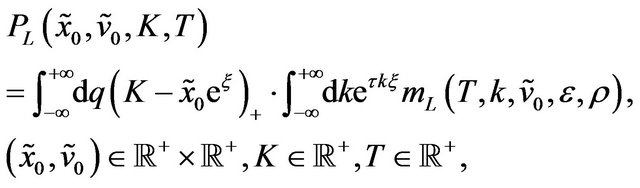

Finally starting from (84) and proceeding as done in Section 2 we obtain the following formulae for the prices  and

and  in the lognormal multiscale SABR model at time

in the lognormal multiscale SABR model at time  of respectively European call and put options with strike price

of respectively European call and put options with strike price , maturity time

, maturity time  when the price of the underlying and the values of the stochastic volatilities at time

when the price of the underlying and the values of the stochastic volatilities at time  (that is today) are given respectively by

(that is today) are given respectively by ,

,  ,

, :

:

(87)

(88)

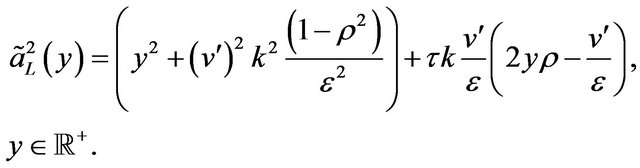

where the function  is given by:

is given by:

(89)

and ,

,  , is given by (83). Formula (89) can be rewritten as follows:

, is given by (83). Formula (89) can be rewritten as follows:

(90)

(90)

where  is given by:

is given by:

(91)

(91)

The numerical experience presented in Section 5 has shown that in the evaluation of Formula (90) the complex square root that defines  must be computed very accurately. For this purpose in the numerical experiments we have found useful to exploit the results of [20].

must be computed very accurately. For this purpose in the numerical experiments we have found useful to exploit the results of [20].

Note that the integrands of the integrals appearing in Formulae (87) and (88) have the same special form of the integrands of Formulae (40) and (41). This implies that evaluating Formulae (87) and (88) has the same computational cost than evaluating Formulae (40) and (41). This last cost has been discussed in Section 2.

In the case of the lognormal SABR model Formulae (87) and (88) reduce respectively to the following formulae:

(92)

(92)

(93)

(93)

where ,

,  are respectively the prices at time

are respectively the prices at time  of European call and put options in the lognormal SABR model when the initial conditions (16) and (17) hold and

of European call and put options in the lognormal SABR model when the initial conditions (16) and (17) hold and  is given by (90). In the option pricing formulae (87), (88), (92), (93) the risk free interest rate has been chosen equal to zero and as a consequence the discount factor has been chosen equal to one. This choice is made to simplify the formulae and can be removed easily.

is given by (90). In the option pricing formulae (87), (88), (92), (93) the risk free interest rate has been chosen equal to zero and as a consequence the discount factor has been chosen equal to one. This choice is made to simplify the formulae and can be removed easily.

4. A Calibration Problem for the Normal and Lognormal SABR and Multiscale SABR Models

Let  be a positive integer and

be a positive integer and  be the

be the  - dimensional real Euclidean space. We formulate a calibration problem for the models studied in Section 2 and 3.

- dimensional real Euclidean space. We formulate a calibration problem for the models studied in Section 2 and 3.

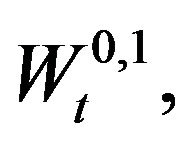

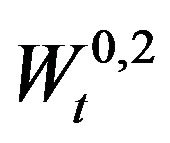

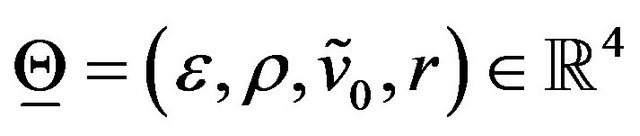

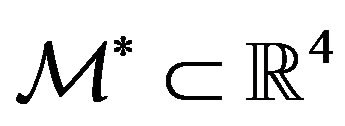

Under the assumptions (4)-(9) the normal and lognormal multiscale SABR models (18)-(20) and (69)-(71) together with the associated option pricing Formulae (40), (41) and (87), (88) are parameterized by six real quantities, that is: the parameters ,

,  , the correlation coefficients

, the correlation coefficients ,

,  , and the initial stochastic volatilities

, and the initial stochastic volatilities ,

, . These quantities are the unknowns that must be determined in the calibration problem. In this Section and in the numerical experiments presented in Section 5 we consider as a parameter that must be determined in the calibration problem also the risk free interest rate

. These quantities are the unknowns that must be determined in the calibration problem. In this Section and in the numerical experiments presented in Section 5 we consider as a parameter that must be determined in the calibration problem also the risk free interest rate . The risk free interest rate

. The risk free interest rate  appears in the option pricing formulae when we consider the discount factor that, for simplicity, has been omitted in Formulae (40), (41), (87), (88). That is all together when we consider the normal and lognormal multiscale SABR models there are seven real parameters that must be determined in the calibration problem. We introduce the vector

appears in the option pricing formulae when we consider the discount factor that, for simplicity, has been omitted in Formulae (40), (41), (87), (88). That is all together when we consider the normal and lognormal multiscale SABR models there are seven real parameters that must be determined in the calibration problem. We introduce the vector  and the set

and the set  defined as follows:

defined as follows:

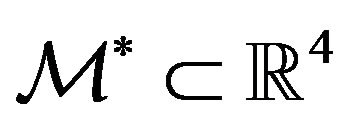

(94)

(94)

In the calibration problem for the (normal and lognormal) multiscale SABR models the vector  is the unknown that must be determined and

is the unknown that must be determined and  defines the set of the “feasible” vectors of the calibration problem. That is

defines the set of the “feasible” vectors of the calibration problem. That is  is the set of vectors that satisfy the “physical” constraints that follow from the meaning of the parameters in the model equations.

is the set of vectors that satisfy the “physical” constraints that follow from the meaning of the parameters in the model equations.

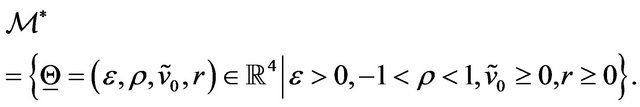

Similarly when we consider the (normal and lognormal) SABR models the unknown of the calibration problem is the vector  and the set

and the set  of the “feasible” vectors of the calibration problem is defined as follows:

of the “feasible” vectors of the calibration problem is defined as follows:

(95)

To keep the notation simple in the formulation of the calibration problems for the SABR and multiscale SABR models we denote with the same symbol  a vector belonging to

a vector belonging to  or to

or to .

.

The calibration problems considered use as data a set of option prices observed at a given observation time. The option price data are fitted in the least squares sense with the option pricing formulae deduced in Sections 2 and 3 (completed with the discount factors) imposing the constraints defined in (94) or (95). That is the calibration problem is formulated as a nonlinear constrained least squares problem.

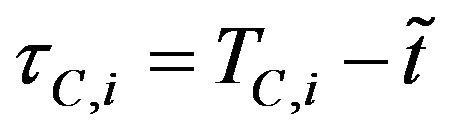

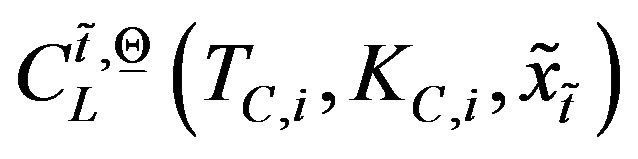

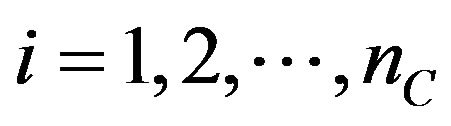

Let ,

,  be positive integers,

be positive integers,  be the observation time and

be the observation time and  be the forward prices/rates observed at time

be the forward prices/rates observed at time . Let

. Let ,

,

,

,  ,

,  , be respectively the observed prices at time

, be respectively the observed prices at time  of the European call options having maturity time

of the European call options having maturity time  and strike price

and strike price ,

,  , and of the European put options having maturity time

, and of the European put options having maturity time  and strike price

and strike price ,

, . Note that the values

. Note that the values ,

,  ,

,  , and

, and ,

,  ,

,  , are not necessarily distinct. For example options having the same maturity time and several strike prices can be considered, in this case in the previous sets some of the maturity times are repeated. Moreover let

, are not necessarily distinct. For example options having the same maturity time and several strike prices can be considered, in this case in the previous sets some of the maturity times are repeated. Moreover let  and let

and let ,

,  ,

,

,

,  ,

,  ,

,

, be the prices as a function of

, be the prices as a function of  of the European call and put options obtained evaluating, respectively, Formulae (40), (41) and (87), (88) completed with the discount factors when

of the European call and put options obtained evaluating, respectively, Formulae (40), (41) and (87), (88) completed with the discount factors when  (i.e. the maturity time),

(i.e. the maturity time),  , or

, or ,

,  , and

, and . Note that when

. Note that when  Formulae (40), (41) and (87), (88) give the option prices at time

Formulae (40), (41) and (87), (88) give the option prices at time  and that we are computing the prices at time

and that we are computing the prices at time . Some obvious changes in the interpretation of the formulae derived in Sections 2 and 3 are necessary to handle this situation. For example the initial stochastic volatilities

. Some obvious changes in the interpretation of the formulae derived in Sections 2 and 3 are necessary to handle this situation. For example the initial stochastic volatilities ,

,  that in (40), (41) and (87), (88) denote the volatilities at time

that in (40), (41) and (87), (88) denote the volatilities at time  must be interpreted as the volatilities at time

must be interpreted as the volatilities at time . Similarly when the SABR models are considered let

. Similarly when the SABR models are considered let ,

,  ,

,  ,

,  ,

,

,

,  , be the corresponding prices of the European call and put options obtained using Formulae (40), (41) and (87), (88) completed with the discount factors. Note that when we consider

, be the corresponding prices of the European call and put options obtained using Formulae (40), (41) and (87), (88) completed with the discount factors. Note that when we consider

,

, ,

,  ,

,  , and

, and ,

,  ,

,  ,

,  , the vector

, the vector  is a vector belonging to

is a vector belonging to . In general

. In general  and

and  are functions of the observation time

are functions of the observation time , however, to simplify the notation, we omit this dependence. For notational convenience we define the following sets

, however, to simplify the notation, we omit this dependence. For notational convenience we define the following sets ,

, .

.

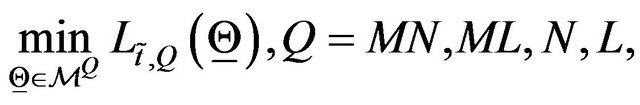

The calibration problem considered is formulated as follows:

(96)

(96)

where the objective function  is given by:

is given by:

(97)

(97)

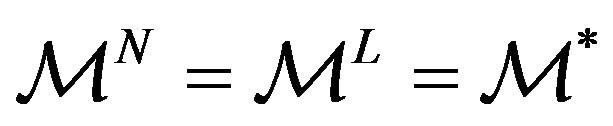

Problem (96) is a nonlinear constrained least squares problem. Note that when in (97) we choose  or

or  we calibrate respectively the normal and lognormal multiscale SABR model and when we choose

we calibrate respectively the normal and lognormal multiscale SABR model and when we choose  or

or  we calibrate respectively the normal and lognormal SABR model. The solution of the calibration problem is the vector

we calibrate respectively the normal and lognormal SABR model. The solution of the calibration problem is the vector  that solves problem (96). Problem (96) is only a formulation of the calibration problem between many other possible formulations.

that solves problem (96). Problem (96) is only a formulation of the calibration problem between many other possible formulations.

In the numerical experiments presented in Section 5 Problem (96) is solved with a local minimization method that is explained below. For  we choose the initial guess of the minimization procedure used to solve Problem (96) exploring the feasible region

we choose the initial guess of the minimization procedure used to solve Problem (96) exploring the feasible region . This is done taking a set of random points belonging to

. This is done taking a set of random points belonging to  and evaluating the objective function on this set of points. The initial guess of the minimization method is chosen among these points using a heuristic rule. The minimization method used is a variable metric steepest descent method (see [21]). This method is an iterative procedure that, given an initial vector

and evaluating the objective function on this set of points. The initial guess of the minimization method is chosen among these points using a heuristic rule. The minimization method used is a variable metric steepest descent method (see [21]). This method is an iterative procedure that, given an initial vector  , generates a sequence

, generates a sequence ,

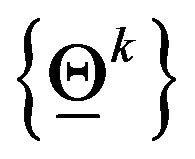

,  , of vectors,

, of vectors,  ,

,  , obtained making a step in the direction of minus the gradient with respect to

, obtained making a step in the direction of minus the gradient with respect to  of

of  computed in a suitable metric that depends on the constraints defined in

computed in a suitable metric that depends on the constraints defined in . The procedure stops when the following criterion is satisfied:

. The procedure stops when the following criterion is satisfied:

(98)

(98)

where ,

,  are given positive constants. Details of the implementation of the variable metric steepest descent method used to solve the calibration problem can be found in [6].

are given positive constants. Details of the implementation of the variable metric steepest descent method used to solve the calibration problem can be found in [6].

5. Some Numerical Experiments Using Real Data

In the numerical experiments presented in this Section the option prices computed evaluating with numerical quadratures the integrals contained in Formulae (40), (41), (46), (47), (87), (88), (92), (93) and completing the results obtained with the appropriate discount factors are compared with the option prices actually observed. The numerical quadratures are performed using the composite midpoint quadrature rule with 1000 nodes in each coordinate direction. These choices guarantee approximately six significant digits correct in the option prices.

We present two numerical experiments based on the calibration problem of Section 4. The stopping parameters of the minimization algorithm introduced in (98) have been chosen as follows: ,

,  .

.

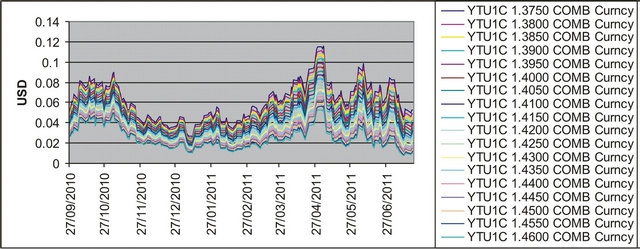

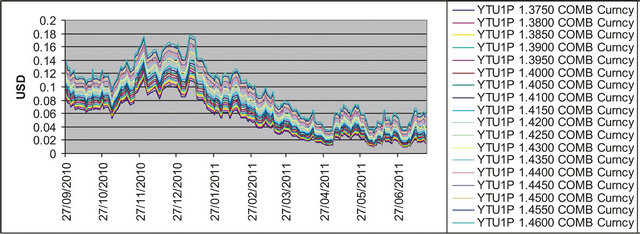

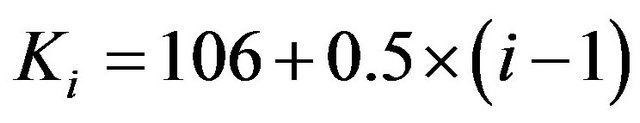

In the first experiment we consider the daily values of the futures price on the EUR/USD currency’s exchange rate having maturity September 16th, 2011, (the third Friday of September 2011) and the daily prices of the corresponding European call and put options with expiry date September 9th, 2011 and strike prices  ,

, . The strike prices

. The strike prices ,

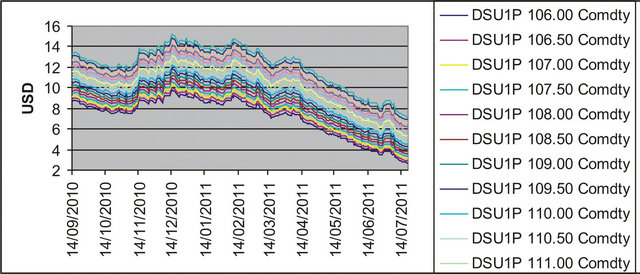

,  , are expressed in USD. These prices are observed in the time period that goes from September 27th, 2010, to July 19th, 2011. The observations are made daily and the prices considered are the closing prices of the day. Recall that a year is made of about 250 - 260 trading days and a month is made of about 21 trading days. Figure 1 shows the futures price EUR/USD (ticker YTU1 Curncy) (blue line) and the EUR/USD currency’s exchange rate (pink line) as a function of time. Figures 2 and 3 show respectively the prices (in USD) of the corresponding call and put options with maturity time September 9th, 2011 and strike price

, are expressed in USD. These prices are observed in the time period that goes from September 27th, 2010, to July 19th, 2011. The observations are made daily and the prices considered are the closing prices of the day. Recall that a year is made of about 250 - 260 trading days and a month is made of about 21 trading days. Figure 1 shows the futures price EUR/USD (ticker YTU1 Curncy) (blue line) and the EUR/USD currency’s exchange rate (pink line) as a function of time. Figures 2 and 3 show respectively the prices (in USD) of the corresponding call and put options with maturity time September 9th, 2011 and strike price ,

,  , as a function of time.

, as a function of time.

The computation of thirty-six option prices using the midpoint quadrature rule as specified previously requires three and half seconds on the Intel CORE Duo CPU T6400 2 GHz processor.

In the first experiment we use the normal SABR and multiscale SABR models to interpret these data. In par-

Figure 1. YTU1 (blue line) and EUR/USD currency’s exchange rate (pink line) versus time.

Figure 2. Call option prices on YTU1 with strike price ,

,  , and expiry date T = September 9th, 2011 versus time.

, and expiry date T = September 9th, 2011 versus time.

Figure 3. Put option prices on YTU1 with strike price ,

,  , and expiry date T = September 9th, 2011 versus time.

, and expiry date T = September 9th, 2011 versus time.

ticular for these models we solve the calibration problem posed in Section 4. We solve Problem (96) when ,

,  and

and  for

for ,

,  , where

, where ,

,  , using as data the futures prices (YTU1 ticker of Figure 1) and the prices of the previously mentioned eighteen call and eighteen put options available at

, using as data the futures prices (YTU1 ticker of Figure 1) and the prices of the previously mentioned eighteen call and eighteen put options available at ,

,  , (Figures 2 and 3). The choice of the dates

, (Figures 2 and 3). The choice of the dates ,

,  , exploits the fact that the formulae deduced in Sections 2 and 3 are closed form formulae that have no limitations. In particular they can be used when the products

, exploits the fact that the formulae deduced in Sections 2 and 3 are closed form formulae that have no limitations. In particular they can be used when the products ,

,  ,

,  , are not small. This is the case when we consider the dates chosen previously. Recall that the option pricing formulae for the SABR models contained in [1], [9] are asymptotic formulae that hold when

, are not small. This is the case when we consider the dates chosen previously. Recall that the option pricing formulae for the SABR models contained in [1], [9] are asymptotic formulae that hold when  is small.

is small.

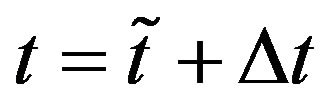

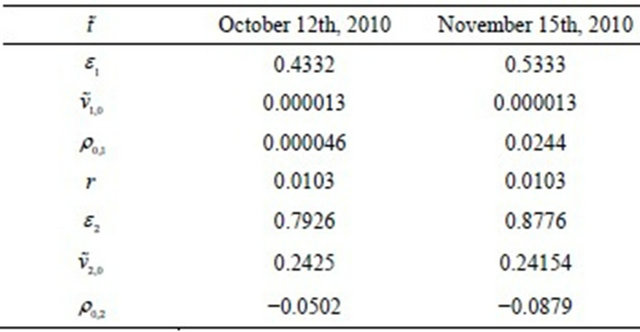

Tables 1 and 2 show respectively the parameter values obtained as solution of the calibration problems (96) for the normal SABR and multiscale SABR models when we consider the data relative to ,

, .

.

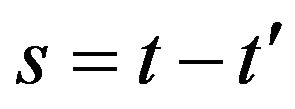

The calibrated models, that is those with the parameter values given in Tables 1 and 2, are used to forecast option prices one day ahead of the current date, that is ahead of the observation day of the prices used to calibrate the model. The forecasts are made evaluating formulae (40) and (41) when  and evaluating formulae (46) and (47) when

and evaluating formulae (46) and (47) when  multiplied by the appropriate discount factors. These formulae are evaluated using as futures price the futures price observed the day of the forecast. The volatilities

multiplied by the appropriate discount factors. These formulae are evaluated using as futures price the futures price observed the day of the forecast. The volatilities  and

and  obtained from the calibration problem are taken as proxies of the volatilities the day of the forecast.

obtained from the calibration problem are taken as proxies of the volatilities the day of the forecast.

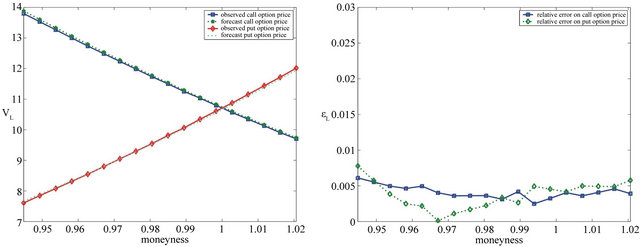

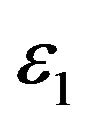

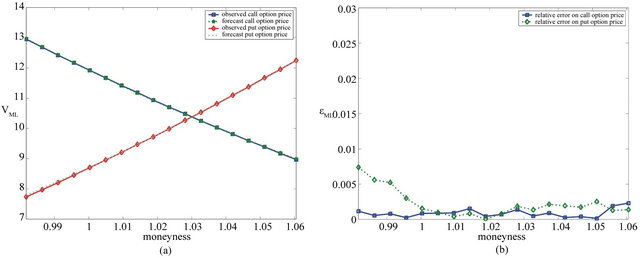

Let us define the moneyness of an option a given day as the ratio between the strike price of the option and the futures price on the EUR/USD exchange rate of that day. Figures 4 and 5 show the forecast option prices one day in the future (i.e. at time  with

with  equal one day) the observed option prices and the relative errors of

equal one day) the observed option prices and the relative errors of

Table 1. Solution of the calibration problem: Normal SABR model (FX experiment).

Table 2. Solution of the calibration problem: Normal multiscale SABR model (FX experiment).

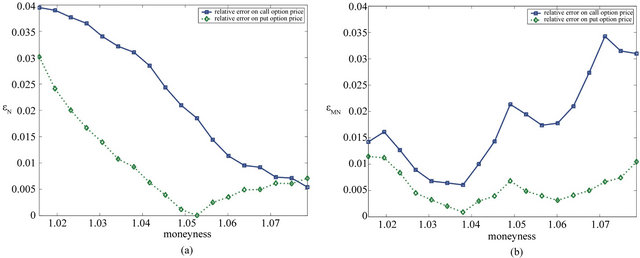

the forecast option prices one day in the future compared with the observed prices as a function of the moneyness of the day of the forecast (i.e. ). We consider the relative error obtained using the normal SABR model (Figures 4(a) and 5(a)) and the normal multiscale SABR model (Figures 4(b) and 5(b)) calibrated using the option prices of

). We consider the relative error obtained using the normal SABR model (Figures 4(a) and 5(a)) and the normal multiscale SABR model (Figures 4(b) and 5(b)) calibrated using the option prices of  (Figure 4), and

(Figure 4), and  (Figure 5). The futures prices used in the forecasts are

(Figure 5). The futures prices used in the forecasts are  and

and  where

where  .

.

Figures 4 and 5 show that in this experiment the normal multiscale SABR model outperforms the normal SABR model. This is probably due to the fact that the use of two volatilities in the multiscale SABR model captures efficiently the “smile” effect contained in the option prices. In fact the values of the constants  and

and  resulting from the solution of the calibration problem

resulting from the solution of the calibration problem

Figure 4. Relative errors obtained using the normal SABR (a) and multiscale SABR (b) models calibrated at  September 27th, 2010 versus moneyness (FX experiment).

September 27th, 2010 versus moneyness (FX experiment).

Figure 5. Relative errors obtained using the normal SABR (a) and multiscale SABR (b) models calibrated at  November 4th, 2010 versus moneyness (FX experiment).

November 4th, 2010 versus moneyness (FX experiment).

shown in Table 2 differ approximately of a factor two showing that the presence of the second volatility is really useful to interpret the data. Note that the values of  and

and  shown in Table 2 do not differ of one or more orders of magnitude as found for similar constants in previous studies [6,7]. In [6] and [7] a multiscale Heston model has been used to study electric power prices. Electric power prices show severe spikes and abrupt changes that justify the huge difference in the

shown in Table 2 do not differ of one or more orders of magnitude as found for similar constants in previous studies [6,7]. In [6] and [7] a multiscale Heston model has been used to study electric power prices. Electric power prices show severe spikes and abrupt changes that justify the huge difference in the ,

,  values (two orders of magnitude) while the futures price of EUR/USD currency’s exchange rate is a much more well behaved quantity. However also the factor two that separates approximately the values of

values (two orders of magnitude) while the futures price of EUR/USD currency’s exchange rate is a much more well behaved quantity. However also the factor two that separates approximately the values of  and

and  shown in Table 2 corresponds to a relevant difference in the forecasting ability of the normal SABR and multiscale SABR models as shown in Figures 4 and 5.

shown in Table 2 corresponds to a relevant difference in the forecasting ability of the normal SABR and multiscale SABR models as shown in Figures 4 and 5.

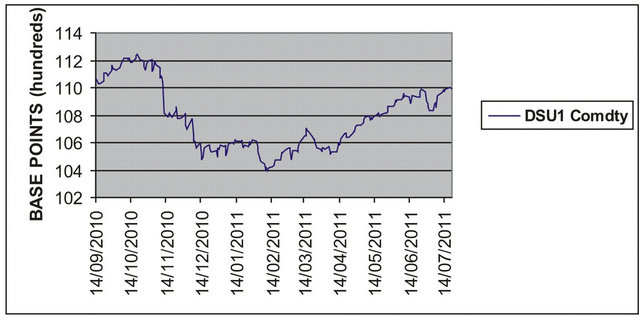

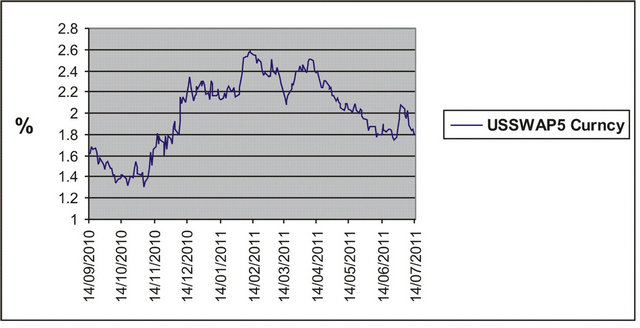

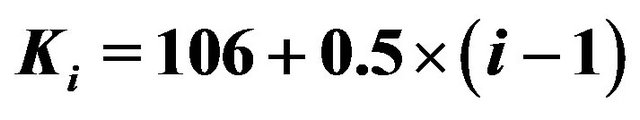

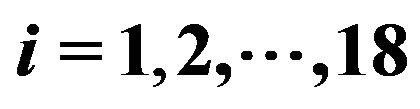

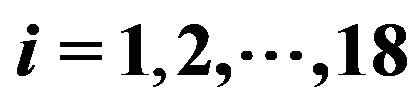

In the second experiment we consider the daily observed values of the USA five-year interest rate swap (see Figure 6(a)), the corresponding futures prices having maturity September 30th, 2011 (the ticker DSU1 in Figure 6(b)) and the prices of the corresponding European call and put options with expiry date September 19th, 2011 and strike prices

,

, . These prices are observed in the period going from September 14th, 2010, to July 20th, 2011. The strike prices

. These prices are observed in the period going from September 14th, 2010, to July 20th, 2011. The strike prices ,

,  , are expressed in hundreds of base points that is, for example,

, are expressed in hundreds of base points that is, for example,  corresponds to an interest rate 106 −

corresponds to an interest rate 106 −

(a)

(a) (b)

(b)

Figure 6. Observed USA five-year interest rate swap (a) and the corresponding futures price DSU1 having maturity September, 2011 (b) versus time.

100 = 6 that is 600 base points, this corresponds to an interest rate of  per year (see Figures 7 and 8).

per year (see Figures 7 and 8).

We consider two dates  and

and , where the values of the corresponding futures prices (ticker DSU1 Figure 6(b)) are

, where the values of the corresponding futures prices (ticker DSU1 Figure 6(b)) are  and

and . That is we consider two dates the first one

. That is we consider two dates the first one  selected in a period where the oscillations of the futures price are small and the second one

selected in a period where the oscillations of the futures price are small and the second one  selected at the beginning of the fall of the futures price (see Figure 6(b)). Note that from November 12th, 2010 to December 15th, 2010 the futures price goes from the value of 110 to the value of 104. Recall that these futures prices are expressed in hundreds of base points.

selected at the beginning of the fall of the futures price (see Figure 6(b)). Note that from November 12th, 2010 to December 15th, 2010 the futures price goes from the value of 110 to the value of 104. Recall that these futures prices are expressed in hundreds of base points.

Tables 3 and 4 show the parameter values obtained calibrating the lognormal SABR and multiscale SABR models on the data discussed above relative to the USA five-year interest rate swap futures price and its options observed at ,

, . In particular Table 4 shows that the values of the parameters

. In particular Table 4 shows that the values of the parameters  and

and  of the lognormal multiscale model resulting from the calibration differ of approximately a factor two.

of the lognormal multiscale model resulting from the calibration differ of approximately a factor two.

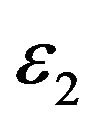

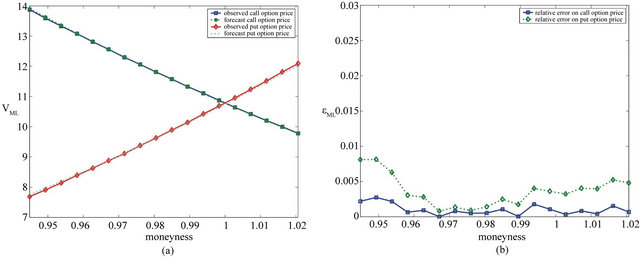

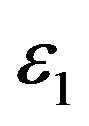

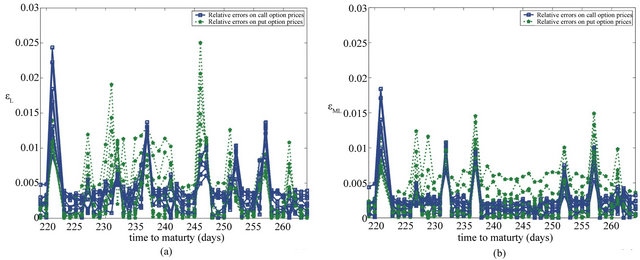

Figures 9(a), 10(a), 11(a) and 12(a) show the observed option prices and the forecast option prices as a function of the moneyness at the date  (Figures 9(a) and 10(a)) and

(Figures 9(a) and 10(a)) and  (Figures 11(a) and 12(a)). The forecast option prices are obtained using the lognormal SABR model (see Figures 9(a) and 11(a)) and the multiscale SABR models (see Figures 10(a) and 12(a)).

(Figures 11(a) and 12(a)). The forecast option prices are obtained using the lognormal SABR model (see Figures 9(a) and 11(a)) and the multiscale SABR models (see Figures 10(a) and 12(a)).

Figures 9(b), 10(b), 11(b) and 12(b) show the the relative errors committed on the forecast option prices one day ahead of the current day as a function of the moneyness. In particular we use the values of the model parameters obtained calibrating the model using the data at  to forecast the option prices at