Open Journal of Social Sciences

Vol.04 No.04(2016), Article ID:65857,7 pages

10.4236/jss.2016.44018

Analysis of Total Factor Productivity in China’s Commercial Banks

―Based on Hicks-Moorsteen TFP Indicators

Long Yi

Graduate School of Education, Jinan University, Guangzhou, China

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 15 March 2016; accepted 23 April 2016; published 26 April 2016

ABSTRACT

The paper uses Hicks-Moorsteen TFP indicator to measure the changes of total factor productivity in China’s commercial banks from 2010 to 2014 on the basis of big data in BankScope database. By analyzing the sample data and total factor productivity, the paper finds out in-depth motives of the dynamic changes of TFP. At present, domestic commercial banks are at the stage of deepening reforms. Thus, exploring into the motives that drive the efficiency of commercial banks in recent years and affecting factors is of great instructive roles for national supervision institutions’ formulating relevant monitoring policies, improving banks’ efficiency in resource allocation, and launching profound reforms in banks.

Keywords:

Total Factor Productivity, Hicks-Moorsteen TFP Indicator, Commercial Banks

1. Introduction

The studies on the efficiency of commercial banks in China are always the focus in the academic field. From a micro perspective, commercial bank’s efficiency reflects the degree and effects of one bank’s own utilization of its resources. It is an important symbol that indicates the bank’s competitiveness. From a macro perspective, the entire banking industry’s efficiency implies domestic industries’ outcome of economic resource application to a certain extent.

According to the ranking list of 1000 banks in the world that was issued by Britain’s The Banker in 2015, 117 were China-funded banks; 16 ranked top 100; and 4 of top 10 banks were domestic ones. Industrial and Commercial Bank of China and China Construction Bank consecutively ranked top two in the whole world in 2014 and 2015. Domestic and foreign banking sectors’ attitude to the Chinese banking industry has changed so that its view of the Chinese banking industry is gradually transformed into recognition and approval. However, the promotion of China’s banking industry in the global is to rely on the scale or efficiency? Is it because of the total factor productivity enhancement? Which is the key to the future’s competition?

At present, domestic commercial banks are at the stage of profound reforms. Thus, exploring into the motives that drive the efficiency of commercial banks in recent years and affecting factors is of huge help for figuring out the status and core competitiveness of domestic banks as well as great instructive roles for guiding the new in-depth reforms.

2. Literature Review

At early time, domestic and foreign scholar’s studies on commercial banks’ efficiency generally focused on the scale efficiency and scope efficiency. Subsequently, with the development of empirical studies and measurement models, scholars began to concentrate on frontier efficiency.

Alhadeff (1954) [1] was one of the scholars that delved into the efficiency of commercial banks from the perspective of scale economy at an early time. He made use of the method of accounting ratio to elaborate on the input-output in more than 210 commercial banks in California, the US from 1938 to 1950. The conclusions showed that the banking industry demonstrated increasing output scale efficiency and decreasing cost scale efficiency. Later, a series of researches indicated that commercial banks had scale economy (Bell et al., 1969) [2] . Nevertheless, each commercial bank differed from others in terms of the critical point of scale economy in different regions and at different time (Tseng, 1999) [3] . Moreover, domestic scholars also enumerated on the important effects of scale and scope economy on banks’ efficiency (Wang Cong and Zou Pengfei, 2003) [4] .

After the 1990s, the studies on efficiency of commercial banks gradually shifted to the researches on frontier efficiency. Such studies are mainly classified into two categories: Parametric method and non-parametric method. The former one requires that a clarified production function should be set up and production frontier should be confirmed. Furthermore, according to the difference of stochastic error term, they can be classified into SFA, TFA and DFA. The latter one does not require a specific production function, mainly including DEA and FDH. Some scholars (Wang Cong, Tan Zhengxun, 2007) [5] adopted SFA method to analyze the cost efficiency, profit efficiency and X-efficiency in commercial banks. At the meanwhile, some experts (Yang Daqiang, Zhang Ai’wu, 2007) [6] deployed DEA method to delve into the same contents. Cai Yuezhou and Guo Haijun (2009) [7] delved into the total factor productivity in listed commercial banks on the basis of DEA’s Malmquist productivity indicator method. Jiang Yonghong and Jiang Weijie (2014) [8] used Luenberger indicator to measure the total factor productivity in commercial banks with and without bad loan restrictions. If bad loan restrictions were found, total factor productivity was indeed overestimated.

In conclusion, domestic and foreign scholars have made a lot of studies on the efficiency of commercial banks. Major methods include translog function method, SFA method and DEA-based Malmquist productivity indicator method. In particular, Hicks-Moorsteen TFP indicator had many advantages, solving existing methods’ breakage in delving into commercial banks’ efficiency without any price information, well distinguishing the effects of scale economy and scope economy on the changes of total factor productivity in commercial banks, etc.

3. Theories and Methodologies

Hicks-Moorsteen TFP indicator was proposed under O’Donnell’s framework of aggregate analysis (2008). The analysis of the framework implied that for the manufacturers with singular input and output, the productivity could be defined as the ratio of output to input. Then, if a proper indicator could be found to stand for multiple kinds of input and output, total factor productivity could be regarded as the ratio of output indicator to input indicator, while input aggregate function and output aggregate function could treated as the indicators measuring multiple kinds of input and output. Next, according to O’Donnell’s method (2008), the paper makes a simple introduction of the method with the data of N decision-making units (DMUs) during the time span T. First of all, supposing that decision-making unit its input and output vector during t is respectively  and

and . Set

. Set  and

and  as the aggregate function of input and output respectively. Then, the decision-making unit’s TFP can be defined as:

as the aggregate function of input and output respectively. Then, the decision-making unit’s TFP can be defined as:

(1)

(1)

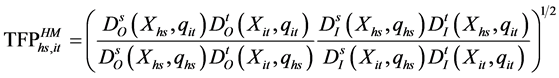

If TFP is defined as the ratio of aggregate output to aggregate input. Then, the productivity ratio of TFP ratio of decision-making unit i’s TFP during t to decision-making unit h’s TFP during s can be written as:

(2)

(2)

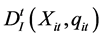

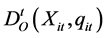

In the formula, the indicator of output quantity is  and the indicator of input quantity is

and the indicator of input quantity is . Different forms of aggregate functions are selected,

. Different forms of aggregate functions are selected,  and

and . Different multiplier-type pure indicators can be concluded. Shephard distance function is adopted (input distance function

. Different multiplier-type pure indicators can be concluded. Shephard distance function is adopted (input distance function , output distance function

, output distance function ) stand for technology during t. TFP indicator in the definition is Hicks-Moorsteen TFP indicator;

) stand for technology during t. TFP indicator in the definition is Hicks-Moorsteen TFP indicator;

(3)

(3)

Formula (2) is re-written as . Then, Formula (3) can be decomposed in the following form:

. Then, Formula (3) can be decomposed in the following form:

(4)

(4)

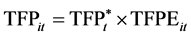

The first term on the right side of Formula (5) shows the changes of technology through the maximal TFP during t and s, while the second term shows the change of the entire efficiency. Furthermore, they can be decomposed to the change of technology, scale and mixed efficiency. Formula (5) can be written as:

In this sense, the changes of TFP can be decomposed to three terms: change of technology that represents the movement of production frontier (Tech), i.e., the first term on the right side of Formula (6), the change of technological efficiency that represents the movement of observation point toward the frontier side (ITE), i.e., the second term on the right side, and the change of scale mixed efficiency of the movement toward the frontier side so as to obtain scale and scope economy, i.e., the third term on the right side. Commercial banks’ scale economy and scope economy have always aroused great concerns in the academic field. For this reason, the third term on the right side of Formula (6) is decomposed to be scale efficiency (ISE) that represents scale economy and residual mixed efficiency (RME) that represents scope economy for the purpose of distinguishing the effects on scale economy and scope economy on change of total factor productivity in commercial banks.

In all, Hicks-Moorsteen TFP indicator (2008) that was proposed under the framework of O’Donnell’s (2008) aggregate analysis, overcame the incompleteness that existed in traditional Malmquist indicator method’s decomposition of TFP, i.e., Malmquist indicator method could not distinguish mixed efficiency and scale efficiency. However, Malmquist indicator method’s advantage of not introducing price information is still kept. More importantly, technological progress, change of efficiency and scale efficiency in the decomposition of the method have clearer connotations.

4. Description of Data and Variables

4.1. Selection of Samples

Considering the accessibility, comparability and other factors of data, the paper selects samples from 38 domestic commercial banks, including five major state-owned commercial banks, Industrial and Commercial Bank of China, Construction Bank of China, Agricultural Bank of China, Bank of China and Bank of Communications. All 12 shareholding commercial banks in China, China Citic Bank, China Everbright Bank, Hua Xia Bank, China Minsheng Banking, China Merchants Bank, Industrial Bank, Guangdong Development Bank, Ping’an Bank, Shanghai Pudong Development Bank, Evergrowing Bank, China Zheshang Bank and Bohai Bank. There are 21 representative city commercial banks both in terms of influence and scale: Bank of Beijing, Bank of Tianjin, Bank of Hebei, Chongqing Rural Commercial Bank, Bank of Nanjing, Guangzhou Agricultural and Industrial Bank, Xiamen International Bank, Bank of Guangzhou, Bank of Jinzhou, Tianjin Agricultural and Commercial Bank, Bank of Changsha, Bank of Zhengzhou, Bank of Suzhou, Bank of Qingdao, Bank of Jiujiang, Bank of Wenzhou, Nanhai Agricultural and Commercial Bank, Bank of Taizhou, Jiangyin Agricultural and Commercial Bank, Bank of Yingkou and Bank of Fuxin. In terms of the selection of time, the samples from 2010 to 2014 are chosen. During the interval, the effects of financial crisis on samples are avoided. Besides, they better reflect the development and reform of commercial banks in China in recent years, indicating the development and changes of efficiency of domestic commercial banks.

4.2. Selection of Indicators

The paper comprehensively considers the accessibility of indicators, matching, etc. Finally, interest income, non-interest income and total amount of loans are chosen as the output indicators, while interest expense, business expense and total amount of deposit are chosen as input indicators.

Table 1 is the statistical description of input-output indicators.

Shown in Table 1, from 2010 to 2014, the entire commercial banking industry maintained a high deposit-loan scale. Interest income was the major source of banks’ earnings, accounting for over 86.74%. However, in terms of expenses, non-interest expense still occupied about 30%. By comparing samples with different stock structures, it can be found that state-owned commercial banks’ input and output is far larger than shareholding commercial banks’ and city commercial banks’. From the perspective of standard variance, domestic commercial banks had the largest standard variance, implying the larger fluctuations in the operation.

Table 1. Statistical description of each indicator from 2010 to 2014 (unit: hundred million Yuan).

5. Empirical Analysis

5.1. Analysis of Static Efficiency

First of all, the paper conducts a static efficiency measurement of 38 commercial banks in the samples. By calculating total factor productivity (TFP), technological progress (Tech), technological efficiency (ITE), scale technology efficiency (ISE) and residual mixed efficiency (RME), the paper evaluates the efficiency from a static angle. The overall measurement result is shown in Table 2.

From the Table 2, it can be seen that domestic commercial banks’ TFP demonstrated the trend of “first increase and later decline” from 2010 to 2014. Specifically speaking, from 2010 to 2011, it increased largely. Then, after 2012, there was a subtle declination. From 2012 to 2013, it decreased by a little. Later, it kept stable. From the decomposition efficiency, TFP’s large increase from 2010 to 2011was mainly attributed to technological improvement, while RME declined greatly during this period. It indicated that in 2011, domestic commercial banks’ TFP increased largely, which was driven by the technological progress in banks. However, the reduction of RME implied that shrinkage of business scope in banks. During this period of time, banks’ business mode was quite singular. However, due to the improvement of specialty of banking business the overall efficiency improved correspondingly.

5.2. Analysis of Dynamic Productivity

The paper makes use of Hicks-Moorsteen TFP indicator method proposed by O’Donnell to measure the samples’ dynamic TFP and decomposition efficiency. The final results are shown as Table 3.

For the sake of direct and comparable measurement results, they are classified into three groups, state-owned commercial banks, shareholding commercial banks, and city commercial banks. Besides, their mean values (geometric mean values are regarded as mean values because Hicks-Moorsteen indicator is a multiplier-type indicator) are calculated. The results are:

Table 2. Measurement of static efficiency of domestic commercial banks from 2010 to 2014.

Table 3. Hicks-Moorsteen TFP indicator and decomposition in domestic commercial banks.

Shown in the Table 3, among domestic commercial banks, the annual mean value of dynamic TFP is 0.991, i.e., 0.9% efficiency loss happens. To analyze the decomposition factors, it can be found that the main reason for reduction lies in the reduction of technological progress (mean value is 0.940, meaning that technological progress reduces by 6%). In other words, technological progress slows down, while the increase of technological efficiency (annual increase by 0.5%), scale efficiency (annual increase by 0.3%) and residual mixed efficiency (annual increase by 4.6%) contributes to the increase of TFP. The main motive is the residual mixed efficiency in scope economy. The increasing range of technological efficiency that represents inter-bank technological chasing and scale efficiency that represents scale economy is quite small.

From the angle of economics, in recent years, although banking industry demonstrates technological improvement, the improvement has slowed down. The diversity of business income is also accelerating. In the future, under the background of interest rate marketization, the traditional interest margin earnings’ effect of driving banks’ efficiency will be gradually weakened. Finally, the key of improving commercial banks’ efficiency lies in business innovation and diverse development.

In the observation of the change of TFP every year, it can be found that the overall TFP in domestic commercial banks from 2011 to 2013 was below 1. The technological retrogression was respectively 6.2%, 0.5% and 0.19% respectively. From the angle of decomposition efficiency, in 2011, technological progress, technological efficiency and scale efficiency reduced (technological progress decreased by 11.4%, while technological efficiency and scale efficiency also reduced by 0.1% subtly). In 2012 and 2013, technological retrogression was caused by the reduction of technological progress. In 2014, technological progress increased obviously (reaching 10.5%). It facilitated the improvement of the overall TFP.

Considering the effects of property structure, by making a horizontal comparison of state-owned, shareholding and commercial banks, it can be found that the changes and driving motives generally kept consistent with domestic commercial banks. The annual TFP of state-owned commercial banks was 1, i.e., annual change ratio was 0. Although TFP efficiency declined by a little in 2011 and 2012, the increase in 2013 and 2014 made up for the fluctuation. The main factors of change came from the reduction of technological progress and improvement of scale efficiency. Shareholding commercial banks’ annual TFP was 1.019, i.e., TFP increased by 1.9% every year on average, which mainly contributed to the improvement of scale efficiency and the slow-down of reduction of technological progress (annual ratio was only 0.11%. State-owned commercial banks reached 4% and city commercial banks reached 9.3%). City commercial banks’ TFP was the worst, reaching 0.974, which implied an annual reduction by 2.6%. The main factor was the annual reduction by 9.3% of technological progress.

6. Conclusions

The paper selects big data from BankScope database. Commercial banks are divided into state-owned, shareholding and city commercial banks. Moreover, Hick-Moorsteen TFP is chosen to analyze the static and dynamic efficiency. The paper overcomes the deficiencies of traditional efficiency measurement methods, and excavates the factors that facilitate efficiency. The following conclusions are thus drawn:

1) The overall TFP of domestic commercial banks reduced by 0.9% every year. The main reason was the reduction of technological progress. During the period, technological efficiency, scale efficiency and residual mixed efficiency supported the improvement of TFP to a certain degree. In particular, the efficiency improvement brought by residual mixed efficiency that represents scale efficiency is the most obvious. Technological efficiency that represents technological chasing and scale efficiency that represents scale efficiency increase subtly.

2) From the angle of property structure, it can be found that shareholding commercial banks’ TFP increased in a large range. Commercial banks’ improvement was not evident, while city commercial banks’ TFP reduced. The main reason was the combined effect of the reduction of technological progress and improvement of residual mixed efficiency. Relatively speaking, the reduction of shareholding commercial banks’ technological progress was the minimal, while the improvement of residual mixed efficiency reached the maximum, indicating that the reliance on interest margin income weakened. The intermediate business income and profit of diversity were accelerating. Under the background of interest marketization, shareholding commercial banks will have a larger development space and potentials of efficiency improvement in the future.

Cite this paper

Long Yi, (2016) Analysis of Total Factor Productivity in China’s Commercial Banks

—Based on Hicks-Moorsteen TFP Indicators. Open Journal of Social Sciences,04,131-137. doi: 10.4236/jss.2016.44018

References

- 1. Alhadeff, D.A. (1954) Monopoly and Competition in Commercial Banking of California. University of California Press, California.

- 2. Bell, R.W. and Murphy, N.B. (1968) Costs in Commercial Banking: A Quantitative Analysis of Bank Behavior and Its Relation to Bank Regulation. Research Report No. 41, Federal Reserve Bank of Boston, Boston.

- 3. Tseng, K.C. (1999) Bank Scale and Scope Economies in California. American Business Review, 17, 79.

- 4. Wang, C. and Zou, P.F. (2003) Empirical Analysis of Scale Economy and Scope Economy in China’s Commercial Banks. China Industrial Economics, 10, 21-28.

- 5. Wang, C. and Tan, Z.X. (2007) A Study on Domestic Commercial Bank’s Efficiency Structure. Economic Research, 7, 110-123.

- 6. Yang, D.Q. and Zhang, A.W. (2007) Efficiency Evaluation of Commercial Banks China from1996 to 2005—Based on Empirical Analysis of Cost Efficiency and Profit Efficiency. Journal of Financial Research, 12, 102-112.

- 7. Cai, Y.Z. and Guo, H.J. (2009) An Empirical Analysis on Total Factor Productivity of China’s Listed Commercial Banks. Economic Research Journal, No. 9, 52-65.

- 8. Jiang, Y.H. and Jiang, W.J. (2014) A Study on Listed Commercial Banks’ TFP in China with Bad Loan Restrictions: An Analysis Based on Luenberger Indicator. South China Journal of Economics, 32, 62-79.