Journal of Applied Mathematics and Physics

Vol.03 No.12(2015), Article ID:62460,16 pages

10.4236/jamp.2015.312197

General Theory of Antithetic Time Series

Pierre Ngnepieba1, Dennis Ridley2,3*

1Department of Mathematics, Florida A&M University, Tallahassee, USA

2SBI, Florida A&M University, Tallahassee, USA

3Department of Scientific Computing, Florida State University, Tallahassee, USA

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 6 November 2015; accepted 27 December 2015; published 30 December 2015

ABSTRACT

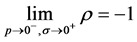

A generalized antithetic time series theory for exponentially derived antithetic random variables is developed. The correlation function between a generalized gamma distributed random variable and its pth exponent is derived. We prove that the correlation approaches minus one as the exponent approaches zero from the left and the shape parameter approaches infinity.

Keywords:

Antithetic Time Series Theory, Antithetic Random Variables, Bias Reduction, Gamma Distribution, Inverse Correlation, Serial Correlation

1. Introduction

Serially correlated random variables arise in ways that both benefit and bias mathematical models for science, engineering and economics. In one widespread example, a mathematical formula is used to create uniformly distributed pseudo random numbers for use in Monte Carlo simulation. The numbers are serially correlated because they are generated by a formula. The benefit is that the same pseudo random numbers can be recreated at will, and two or more simulation experiments can be compared without regard to the pseudo random numbers. The correlation is designed to be very small so as not to bias the results of a simulation experiment. Still, some bias is unavoidable when using serially correlated numbers (Ferrenberg, Lanau, and Wong [1] ).

Another wide spread example is a regression model in which the dependent variable is serially correlated. The result is biased model parameter estimates because the independence assumption of the Gauss-Markov theorem is violated (see Griliches [2] , Nerlove [3] , Koyck [4] , Klein [5] ). Similarly, the independence assumption of Fuller and Hasza [6] and Dufour [7] would not apply. The absence of any relevant information from a model will express itself in the patterns of the error term. If complete avoidance of bias requires normally distributed data, then the absence of normality is like missing information. Bias may also be due to missing data points (Chandan and Jones [8] , Li, Nychka and Amman [9] ). Assume that a perfect model is postulated for a given application in which the population to which the data belong is known exactly. The model must be fitted to a sample of data, not the population. However, once the sample is taken, the distribution is automatically truncated and distorted, and the fitted model is biased. Regardless of the method of fitting, however small, sampling bias is unavoidable. One approach aimed at improving model performance is to combine the results from different models. For an extensive discussion and review of traditional combining see Bunn [10] , Diebold [11] , Clemen [12] , Makridakis et al. [13] , and Winkler [14] .

Economics researchers have commented on serial correlation bias. Hendry and Mizon [15] and Hendry [16] considered common factor analysis (Mizon [17] ) and suggested that serial correlation is a feature for re- presenting dynamic relationships in economic models. This in turn implies that economics allows for serial correlation (see Pindyck and Rubinfield [18] ). Time domain methods for detecting the nature and presence of serial correlation were considered by Durbin and Watson [19] and Durbin [20] . Spectral methods were con- sidered by Hendry [16] , Osborn [21] and Espasa [22] . Even if serial correlation can be a tool for studying the nature of economics, it is detrimental to long range forecasting models. Whatever the source of bias may be, the only possibility for long range forecasting is to completely eliminate the bias.

1.1. Background

Inversely correlated random numbers were suggested by Hammersley and Morton [23] for use in Monte Carlo computer simulation experiments. In that application, a single computer simulation is replaced by two simula- tions. One simulation uses uniformly distributed  random numbers in r. The other simulation uses

random numbers in r. The other simulation uses . The expectation is that the average of the results of these two simulations has a smaller variance than for either one. In practice, the variance sometimes decreases, but sometimes it increases. See also Kleijnen [24] .

. The expectation is that the average of the results of these two simulations has a smaller variance than for either one. In practice, the variance sometimes decreases, but sometimes it increases. See also Kleijnen [24] .

The theory of combining antithetic lognormally distributed random variables that contain negatively cor- related components was introduced by Ridley [25] . The Ridley [25] antithetic time series theorem states that “if  is a discrete realization of a lognormal stochastic process, such that

is a discrete realization of a lognormal stochastic process, such that ,

,

then if the correlation between  and

and  is

is , then

, then .” Antithetic variables can be com-

.” Antithetic variables can be com-

bined so as to eliminate bias in fitted values associated with any autoregressive time series model (see the Ridley [25] antithetic fitted function theorem, and antithetic fitted error variance function theorem). Similarly, antithe- tic forecasts obtained from a time series model can be combined so as to eliminate bias in the forecast error. Ridley [26] applied combined antithetic forecasting to a wide range of data distributions. Ridley [27] demon- strated the methodology for optimizing weights for combining antithetic forecasts. See also Ridley and Ngne- pieba [28] and Ridley, Ngnepieba, and Duke [29] . The antithetic variables proof in Ridley [25] was for the special case of  lognormally distributed.

lognormally distributed.

The implication for using a biased mathematical model to investigate economic, engineering and scientific phenomena is that estimates obtained from the model are biased. Estimates of future values extrapolated from the model are also biased. As the forecast horizon increases, the bias accumulates and the extrapolations diverge from the actual values. This is most pronounced in the case of investigations into global warming phenomena. There, the horizon is by definition very far into the future. The smallest bias will accumulate, so much so that conclusions may be as much an artifact of the mathematical model as they are about climate dynamics. Com- bining antithetic extrapolations can dynamically remove the bias in the extrapolated values.

1.2. Proposed Research

The antithetic gamma variables discussed in this research are defined as follows.

Definition 1. Two random variables are antithetic if their correlation is negative. A bivariate collection of random variables is asymptotically antithetic if its limiting correlation approaches minus one asymptotically (see antithetic gamma variables theorem below).

Definition 2.  is an ensemble of random variables, where

is an ensemble of random variables, where  belongs to a sample space and t belongs to an index set representing time, such that

belongs to a sample space and t belongs to an index set representing time, such that  is a discrete realization of a gamma stationary stochastic process from the ensemble,

is a discrete realization of a gamma stationary stochastic process from the ensemble,  , and

, and  are serially correlated.

are serially correlated.

In this paper, we extend the discovery by Ridley [25] beyond the lognormal distribution. The gamma distribution is very important for technical reasons, since it is the parent of the exponential distribution and can explain many other distributions. That is, a wide range of distributions can be represented by the gamma distribution. We will explore these possibilities by examining the correlation between X and  when X is gamma distributed. Of particular interest is the correlation between X and

when X is gamma distributed. Of particular interest is the correlation between X and

One purpose of this paper is to derive an analytical function for the correlation between X and

The paper is organized as follows. In Section 2 we review the gamma distribution. In Section 3 we derive the analytic function for the correlation. In Section 4 we prove its limiting value. In Section 5 we use MATLAB [30] to compute correlations for a wide range of values generated from the gamma distribution. In Section 6 we outline the method for using antithetic variables to dynamically remove bias from the fitted and forecast values obtained from a time series model. Examples include computer simulated data. Section 7 contains conclusions and suggestions for further research.

2. The Gamma Distribution

The gamma distribution is very important for technical reasons, since it is the parent of the exponential distribution and can explain many other distributions. Its probability distribution function (pdf) (see Hogg and Ledolter [31] ) is:

where

A graph of the gamma probability density function for

Figure 1. Behavior of r as p approaches 0.

Figure 2. Exploring the effect of varying parameter values in the pdf of the gamma distribution.

3. Correlation between X and Xp

Let

Therefore, since

the second moment is

and the variance is

Let

and

Using Equation (3)

Therefore, using Equations (3) and (6), Equation (5) becomes

Since

From Equation (4)

or

The gamma function

be satisfied when

4. Antithetic Gamma Variables Theorem

Theorem 1. If

See proof in Appendix B.

5. Correlation versus p

The effect of p on the correlation is demonstrated by calculating the correlation coefficient from Equation (8) for various values of

Figure 3.

Figure 4.

that are more symmetrical. Also, as

To validate Equation (8), the MATLAB [30] random number generator GAMRND (

The results are shown in Table 2. The coefficients are almost identical to the theoretical values obtained from Equation (8) and listed in Table 1. In practice, the data may include relatively few observations. To investigate the small sample correlation coefficient, the correlation coefficient is calculated for

6. Bias Reduction

Consider an autoregressive time series

tively correlated. The antithetic component

Table 1. Behavior of

Table 2. Values of

where the exponent of the power transformation is set to the small negative value

A shift parameter

antithetic time series is rewritten and computed from

Of the terms p,

Computer Simulation

To illustrate, consider a model fitted to computer simulated data based on stationary autoregressive processes, containing 1060 observations generated from

The results are shown in Table 3. As

7. Conclusion

The correlation between a gamma distributed random variable and its pth power was derived. It was proved that the correlation approaches minus one as p approaches zero from the left and the shape parameter approaches infinity. This counterintuitive result extends a previous finding of the similar result for lognormally distributed random variables. The gamma distribution was modified so as to emulate a range of distributions, showing that

Table 3. Fitted mean square error (mse) for gamma distributed autoregressive processes of length

Table 4. Fitted mean square error (mse) and one thousand period forecast mean square error (mse) for gamma distributed autoregressive processes of length n,

Table 5. Forecast mean square error (mse) for gamma distributed autoregressive processes of length

antithetic time series analysis can be generalized to all data distributions that are likely to occur in practice. The gamma distribution is unimodal. A suggestion for future research is to investigate the correlation between a random variable and its pth power when its distribution is multimodal. Another suggestion is to compare the effectiveness of the Hammersley and Morton [23] antithetic random numbers with antithetic random numbers constructed from the method described in this paper. Combining antithetic extrapolations can dynamically reduce bias due to model misspecifications such as serial correlation, non-normality or truncation of the dis- tribution due to data sampling. Removing bias will eliminate the divergence between the extrapolated and actual values. In the particular case of climate models, removing bias can reveal the true long range climate dynamics. This will be most useful in models designed to investigate the phenomenon of global warming. Beyond the examples discussed here, antithetic combining has broad implications for mathematical statistics, statistical process control, engineering and scientific modeling.

Acknowledgements

The authors would like to thank Dennis Duke for probing questions and good discussions.

Cite this paper

PierreNgnepieba,DennisRidley,11, (2015) General Theory of Antithetic Time Series. Journal of Applied Mathematics and Physics,03,1726-1741. doi: 10.4236/jamp.2015.312197

References

- 1. Ferrenberg, A.M., Lanau, D.P. and Wong, Y.J. (1992) Monte Carlo Simulations: Hidden Errors from? Good Random Number Generators? Physical Review Letters, 69, 3382-3384.

http://dx.doi.org/10.1103/PhysRevLett.69.3382 - 2. Griliches, Z. (1961) A Note on Serial Correlation Bias in Estimates of Distributed Lags. Econometrica, 29, 65-73.

http://dx.doi.org/10.2307/1907688 - 3. Nerlove, M. (1958) Distributed Lags and Demand Analysis for Agricultural and Other Commodities. U.S.D.A Agricultural Handbook No. 141, Washington.

- 4. Koyck, L.M. (1954) Distributed Lags and Investment Analysis. North-Holland Publishing Co., Amsterdam.

- 5. Klein, L.R. (1958) The Estimation of Distributed Lags. Econometrica, 26, 553-565.

http://dx.doi.org/10.2307/1907516 - 6. Fuller, W.A. and Hasza, D.P. (1981) Properties of Predictors from Autoregressive Time Series. Journal of the American Statistical Association, 76, 155-161.

http://dx.doi.org/10.1080/01621459.1981.10477622 - 7. Dufour, J. (1985) Unbiasedness of Predictions from Estimated Vector Autoregressions. Econometric Theory, 1, 381-402. http://dx.doi.org/10.1017/S0266466600011270

- 8. Chandan, S. and Jones, P. (2005) Asymptotic Bias in the Linear Mixed Effects Model under Non-Ignorable Missing Data Mechanisms. Journal of the Royal Statistical Society: Series B, 67, 167-182.

http://dx.doi.org/10.1111/j.1467-9868.2005.00494.x - 9. Li, B., Nychka, D.W. and Ammann, C.M. (2010) The Value of Multiproxy Reconstruction of Past Climate. Journal of the American Statistical Association, 105, 883-911.

http://dx.doi.org/10.1198/jasa.2010.ap09379 - 10. Bunn, D.W. (1979) The Synthesis of Predictive Models in Marketing Research. Journal of Marketing Research, 16, 280-283.

http://dx.doi.org/10.2307/3150692 - 11. Diebold, F.X. (1989) Forecast Combination and Encompassing: Reconciling Two Divergent Literatures. International Journal of Forecasting, 5, 589-592.

http://dx.doi.org/10.1016/0169-2070(89)90014-9 - 12. Clemen, R.T. (1989) Combining Forecasts: A Review and Annotated Bibliography. International Journal of Forecasting, 5, 559-583.

http://dx.doi.org/10.1016/0169-2070(89)90012-5 - 13. Makridakis, S., Anderson, A., Carbone, R., Fildes, R., Hibon, M., Lewandowski, R., Newton, J., Parzen, E. and Winkler, R. (1982) The Accuracy of Extrapolation (Times Series) Methods: Results of a Forecasting Competition. Journal of Forecasting, 1, 111-153.

http://dx.doi.org/10.1002/for.3980010202 - 14. Winkler, R.L. (1989) Combining Forecasts: A Philosophical Basis and Some Current Issues. International Journal of Forecasting, 5, 605-609.

http://dx.doi.org/10.1016/0169-2070(89)90018-6 - 15. Hendry, D.F. and Mizon, G.E. (1978) Serial Correlation as a Convenient Simplification, Not a Nuisance: A Commentary on a Study of the Demand for Money by the Bank of England. The Economic Journal, 88, 549-563.

http://dx.doi.org/10.2307/2232053 - 16. Hendry, D.F. (1976) The Structure of Simultaneous Equations Estimators. Journal of Econometrics, 4, 551-588.

http://dx.doi.org/10.1016/0304-4076(76)90017-8 - 17. Mizon, G.E. (1977) Model Selection Procedures. In: Artis, M.J. and Nobay, A.D., Eds., Studies in Modern Economic Analysis, Basil Blackwell, Oxford.

- 18. Pindyck, R.S. and Rubinfeld, D.L. (1976) Econometric Models and Economic Forecasts. McGraw-Hill, New York.

- 19. Durbin, J. and Watson, G.S. (1950) Testing for Serial Correlation in Least Squares Regression: I. Biometrika, 37, 409-428.

- 20. Durbin, J. (1970) Testing for Serial Correlation in Least-Squares Regression When Some of the Regressors Are Lagged Dependent Variables. Econometrica, 38, 410-421.

http://dx.doi.org/10.2307/1909547 - 21. Osborn, D.R. (1976) Maximum Likelihood Estimation of Moving Average Processes. Journal of Economic and Social Measurement, 5, 75-87.

- 22. Espasa, D. (1977) The Spectral Maximum Likelihood Estimation of Econometric Models with Stationary Errors. 3, Applied Statistics and Economics Series. Vanderhoeck and Ruprecht, Gottingen.

- 23. Hammersley, J.M. and Morton, K.W. (1956) A New Monte Carlo Technique: Antithetic Variates. Mathematical Proceedings of the Cambridge Philosophical Society, 52, 449-475.

http://dx.doi.org/10.1017/S0305004100031455 - 24. Kleijnen, J.P.C. (1975) Antithetic Variates, Common Random Numbers and Optimal Computer Time Allocation in Simulations. Management Science, 21, 1176-1185.

http://dx.doi.org/10.1287/mnsc.21.10.1176 - 25. Ridley, A.D. (1999) Optimal Antithetic Weights for Lognormal Time Series Forecasting. Computers & Operations Research, 26, 189-209.

http://dx.doi.org/10.1016/s0305-0548(98)00058-6 - 26. Ridley, A.D. (1995) Combining Global Antithetic Forecasts. International Transactions in Operational Research, 4,387-398.

http://dx.doi.org/10.1111/j.1475-3995.1995.tb00030.x - 27. Ridley, A.D. (1997) Optimal Weights for Combining Antithetic Forecasts. Computers & Industrial Engineering, 2, 371-381.

http://dx.doi.org/10.1016/s0360-8352(96)00296-3 - 28. Ridley, A.D. and Ngnepieba, P. (2014) Antithetic Time Series Analysis and the CompanyX Data. Journal of the Royal Statistical Society: Series A, 177, 83-94.

http://dx.doi.org/10.1111/j.1467-985x.2012.12001.x - 29. Ridley, A.D., Ngnepieba, P. and Duke, D. (2013) Parameter Optimization for Combining Lognormal Antithetic Time Series. European Journal of Mathematical Sciences, 2, 235-245.

- 30. MATLAB (2008) Application Program Interface Reference, Version 8. The Math Works, Inc.

- 31. Hogg, R.V. and Ledolter, J. (2010) Applied Statistics for Engineers and Physical Scientists. 3rd Edition, Prentice Hall, Upper Saddle River, 174.

- 32. Box, G.E.P. and Cox, D.R. (1964) An Analysis of Transformations. Journal of the Royal Statistical Society: Series B, 26, 211-252.

- 33. Abramowitz, M. and Stegun, I.A. (1964) Handbook of Mathematical Functions. Dover Publications, New York, 260 p.

- 34. Bernado, J.M. (1976) Algorithm AS 103: Psi (Digamma) Function. Journal of the Royal Statistical Society: Series C (Applied Statistics), 25, 315-317.

- 35. Fuller, W.A. (1996) Introduction to Statistical Times Series. Wiley, New York.

Appendix

Appendix A: pth Order Moment for the Gamma Distribution

The pth moment of the gamma distribution is derived as follows:

Multiplying and dividing by

Since

and equation (A.2) becomes

Appendix B: Proof of the Antithetic Gamma Variables Theorem

By applying the Taylor expansion around

where

The combination of equations (B.1)-(B.3) reduces Equation (8) to

Therefore,

By using the polygamma function (see Abramowitz and Stegun [33] )

Equation (B.4) is transformed into

The digamma function for real

(see also Bernado [34] ).

Its derivative is the polygamma function

And,

From which,

Appendix C: Inverse Correlation and Bias Elimination

Consider a gamma distributed time series

where

As p approached zero from the left, near perfect correlation between

Now, suppose that

is a time series model. If there is any bias due either to serial correlation in

To remove this bias, we power transform

where

Denoting sample standard deviation by s and correlation coefficient by

(see also the Ridley [25] antithetic fitted function theorem).

Both estimates

where

Consider the error in

respect to

The steps for obtaining the combined antithetic fitted values are outlined as follows:

Step 1: Estimate the model parameters and fitted values

Step 2: Set

Step 3: Calculate

Step 4: Calculate

Likewise, the unbiased combined estimate of a future value at time

Appendix D: Antithetic Fitted Error Variance Reduction

Consider a gamma distributed time series

Therefore, as

(see also Fuller [35] , p. 404). Consider

where

due only to errors resulting from serial correlation. Therefore,

Next, consider another fitted value

Substituting for

where

is the antithetic error due to the serial correlation, but corresponding to

The expansion of

contain the constant

Now

Substituting from Equation (D.2) and (D.6) and since

Substituting for

Substituting from (D.3) and factoring out

and since

ways in which the combined error variance can be less than the original error variance in Equation (D.3). In

particular when

vanishes. The only error variance remaining will be due purely to random error unexplained by the original model.

NOTES

*Corresponding author.