Journal of Mathematical Finance

Vol.06 No.05(2016), Article ID:72447,15 pages

10.4236/jmf.2016.65065

Valuation of Game Swaptions under the Generalized Ho-Lee Model

Aki Ebina1, Natsumi Ochiai2, Masamitsu Ohnishi2,3

1SMBC NIKKOSECURITIES INC, Tokyo, Japan

2Graduate School of Economics, Osaka University, Osaka, Japan

3Center for Mathematical Modeling and Data Sciences, Osaka University, Osaka, Japan

Copyright © 2016 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: August 29, 2016; Accepted: November 27, 2016; Published: November 30, 2016

ABSTRACT

A game swaption, newly proposed in this paper, is a game version of usual interest- rate swaptions. It provides the both parties, fixed-rate payer and variable rate payer, with the right that they can choose an exercise time to enter a swap from a set of prespecified multiple exercise opportunities. We evaluate two types of game swaptions: game spot-start swaption and game forward-start swaption, under the generalized Ho-Lee model. The generalized Ho-Lee model is an arbitrage-free binomial- lattice interest-rate model. Using the generalized Ho-Lee model as a term structure model of interest rates, we propose an evaluation method of the arbitrage-free price for the game swaptions via a stochastic game formulation, and illustrate its effectiveness by some numerical results.

Keywords:

Generalized Ho-Lee Model, Game Spot-Start Swaption, Game Forward-Start Swaption, Stochastic Game Formulation, Dynamic Programming Approach

1. Introduction

A game swaption, newly proposed in this paper, is a kind of exotic interest-rate derivatives whose payoff depends on interest rates or bond prices. After the early 1980’s, many financial institutions have served such exotic derivatives to respond various needs of clients. In general, it is commonly known that there is not any analytical solution to the pricing problems of many exotic derivatives due to their structural complexity, and the valuation of these derivatives has to rely on a method of a numerical computation. In order to evaluate such derivatives, tree methods and finite difference methods are widely used in many financial institutions.

In this paper, we propose an evaluation method of exotic interest-rate derivatives via a tree method based on the generalized Ho-Lee model [1] , which is a discrete-time and arbitrage-free term-structure model of interest rates. Since Ho and Lee [2] firstly proposed an arbitrage-free binomial term-structure model of interest rates (Ho-Lee model), several authors have been proposed new discrete-time term-structure models of interest rates in order to extend and/or sophisticate the Ho-Lee model (see e.g. Chapter 13 of van der Hoek and Elliott [3] ). Among them, in the generalized Ho-Lee model recently proposed by Ho and Lee themselves, the stochastic movements of term structure of interest rates are also expressed on a binomial lattice. It seems very promising in the sense that since the volatilities of interest rates on the lattice are dependent on time and states it gives us a very flexible framework of interest-rate processes to express various real term-structure movements. In particular, there is a strong point that the model includes the term structure of interest rates (discount function, yield curve, and/or forward curve) in all nodes on the binomial lattice so that it enables us straightforward valuation of fundamental interest-rate instruments and variables such as prices of fixed and variable coupon bonds, and swap rates, etc.

In this paper, we consider valuation problems of swaptions with game features. Several papers have addressed such valuation problems of interest-rate derivatives with some game structures. Among them, Ben et al. [4] discussed the pricing problem of an option-embedded bond with game characteristics, where they approximately calculated the value of that derivative based on a continuous-time interest-rate model by applying a dynamic programming approach. In contrast, Ochiai and Ohnishi [5] dealt with a similar problem in a discrete-time binomial lattice and applied directly a dynamic programming approach based on the generalized Ho-Lee model. The theory on which we base in this paper is in the spirit of them [5] for valuating exotic interest-rate derivatives via a discrete-time and arbitrage-free term-structure model of interest rates.

A game swaption, newly proposed in this paper, is a game version of usual interest- rate swaptions. A usual swaption provides only one side of the two parties (fixed- rate payer and variable rate payer) with the right to enter a swap at a predetermined future time. In contrast, a game swaption provides the both parties with the right of choosing an exercise time to enter a swap from a set of prespecified multiple exercise opportunities. We evaluate two types of game swaptions: game spot-start swaption and game forward-start swaption. A game spot-start swaption allows us to enter the swap at the next setting time just after the exercise time, while a game forward-start swaption entitles us to enter the swap at a predetermined fixed calendar time regardless of the exercise time. In order to formulate the valuation problem of these two game swaptions, we apply a stochastic game formulation. The theory of stochastic games was originated by the seminal paper of Shapley [6] . Players in a stochastic game play a series of stage games that depend on a time and a state. Using the generalized Ho-Lee model, we can apply the stochastic game theory to formulate our problem as a finite time-horizon and two-person zero-sum stochastic game on a binomial lattice under the risk-neutral probability. Then, the no-arbitrage price of the game swaption is evaluated as the value of the whole game by using a backward induction algorithm based on a dynamic programming principle. Owing to the above mentioned nice feature of the generalized Ho-Lee model, all nodes on the binomial lattice involve fundamental informations about the term structure of interest rates, and accordingly we can execute the backward induction algorithm very effectively.

This paper is organized as follows. We introduce and explain the generalized Ho-Lee model in the next Section 2. In Section 3, we first illustrate the game spot-start swaption and derive the optimality equation to evaluate the no-arbitrage values of the game spot-start swaption. Then, Section 4 provides the valuation for the game forward-start swaption as in the previous Section 3. Some numerical examples for these two game swaptions are shown in Section 5. Finally, we conclude the main contributions in this paper.

2. The Generalized Ho-Lee Model

The generalized Ho-Lee model is an arbitrage-free binomial-lattice interest-rate model, where time is discrete. Let  be a finite time-horizon and

be a finite time-horizon and  be a node on the binomial lattice where n (

be a node on the binomial lattice where n ( ) denotes a time and i (

) denotes a time and i ( ) a state.

) a state.  represents the zero-coupon bond price at node

represents the zero-coupon bond price at node  with a remaining maturity of T (

with a remaining maturity of T ( ) period, which pays 1 at the end of the T-th period. We have

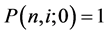

) period, which pays 1 at the end of the T-th period. We have  for any n and i according to the definition of default-free discount bond. Moreover, the zero-coupon bond prices for any remaining maturity T at the initial time,

for any n and i according to the definition of default-free discount bond. Moreover, the zero-coupon bond prices for any remaining maturity T at the initial time,  , can be observed in the initial market, and the set of these prices determines the discount function, yield curve, and/or forward curve at the initial time 0.

, can be observed in the initial market, and the set of these prices determines the discount function, yield curve, and/or forward curve at the initial time 0.

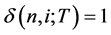

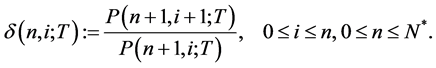

In order to represent the degree of uncertainty of interest rates on the binomial lattice, we introduce the binomial volatilities  (

( ).

). is the proportional decrease in the one-period bond value from i to i + 1 at time n, and

is the proportional decrease in the one-period bond value from i to i + 1 at time n, and  implies that there is no risk. The binomial volatility

implies that there is no risk. The binomial volatility  is defined by

is defined by

(1)

(1)

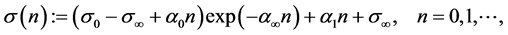

As the binomial volatilities become bigger, the uncertainty of interest rates also increases more. Let  be the term structure of volatilities of interest rates. Ho and Lee [1] assumed that the function

be the term structure of volatilities of interest rates. Ho and Lee [1] assumed that the function  is given by

is given by

(2)

(2)

where

Then, the one-period binomial volatility

where

The generalized Ho-Lee model is an arbitrage-free term-structure model of interest rates. Therefore, the bond prices for all different maturities at each node

under the risk-neutral probability

By using straightforwardly Equations (1) and (4), we can confirm Equation (5) to be an arbitrage-free condition. Thereby, as long as the T-period binomial volatility is defined by Equation (5), the generalized Ho-Lee model is no-arbitrage. Then, the one- period bond prices at node

Similarly, the T-period bond prices at node

Next, we explain the algorithm to derive the one-period bond prices based on the above arguments. The constructions of the generalized Ho-Lee model are decomposed into the following five steps:

Step 1. Derive one-period bond price at node

Step 2. Derive one-period bond price at node

Step 3. Derive one-period yields by one-period bond price:

Step 4. Derive one-period binomial volatilities:

Step 5. Derive T-period binomial volatilities:

3. Valuation of Game Spot-Start Swaption

Game swaptions can be classified into two types with respect to the timing of entering into the underlying swap. A game spot-start swaption allows us to enter the swap at the next setting time just after an exercise, while a game forward-start swaption allows us to enter the swap at a predetermined calender time regardless of the exercise time. First, in this section, we consider the game spot-start swaption.

A (plain vanilla) swap is an agreement to exchange a fixed rate and a variable rate (or floating rate) for a common notional principal over a prespecified period (e.g., Hull [7] , Kolb [8] ). We usually refer LIBOR (London Interbank Offered Rate) as the variable interest rate. A usual swaption is an option on a swap. A payer swaption gives the holder the right to enter a particular swap agreement as the fixed-rate payer. On the other hand, a receiver swaption gives the holder the right to enter a particular swap agreement as the fixed rate receiver. The holder of a European swaption is allowed to enter the swap only on the expiration time. In contrast, the holder of an American swaption is allowed to enter the swap on any time that falls within a range of two time instants. A Bermudan swaption, which we refer in this paper, allows its holder to enter the swap on multiple prespecified times.

In this paper, we consider a game swaption which is an extension of Bermudan swaption. The game swaption entitles both of the fixed-rate side and variable-rate side to enter into the swap at multiple prespecified times. The sequence of setting/payment times is

where N is an agreement time of the swap,

For the following discussions, we further let

Let

Next, we define the exercise rate for a game swaption. If the fixed-rate side exercises at an exercisable time, he will pay the fixed rate

Moreover, the sets

respectively. We let

Now, we apply the theory of two-person and zero-sum stopping game to the valuation of the game swaption. The players of the game are the fixed-rate-payer side and the variable-rate-payer side. We shortly call them fixed-rate player and variable-rate player, respectively. At a jointly exercisable node (n, i) (

Definition 3.1. When the game spot-start swaption is exercised at an exercisable node

If the both players do not exercise at an admissible time, the stochastic game moves to the following node

at the next time, where

Then, the both players face a two-person and zero-sum stage game whose payoff is dependent on a state of interest rates and their strategies at every exercisable nodes

Given a two-person and zero-sum game specified by a payoff matrix

where

Let

Step 0. (Terminal condition) for

Step 1. (Recursion) from

Case 1-1. (When both players can exercise) for

Case 1-2. (When only fixed-rate player can exercise) for

Case 1-3. (When only variable-rate player can exercise) for

Case 1-4. (When neither player can exercise) for

where

In the terminal condition,

At a node

where the fixed-rate side chooses the row as a maximizer and the variable-rate side chooses the column as a minimizer. In general, a saddle point equilibrium of two-person and zero-sum game is known to exist in mixed strategies including pure strategies. However, the following theorem shows that the above game has a saddle point in pure strategies.

Theorem 1. Suppose

where x and y are pure strategies of the fixed-rate player and the variable-rate player, respectively. Furthermore, if we denote E and N the pure strategies “Exercise” and “Not Exercise”, respectively, then the equilibrium-strategy profile

Proof. We suppose the former case

1) If

2) If

3) If

4. Valuation of Game Forward-Start Swaption

A game forward-start swaption entitles the both parties to enter into the swap at a predetermined calender time regardless of the exercise time. It is more practical than the game spot-start swaptions. The solution method is similar to the game spot-start swaptions, thus we discuss only the different points.

In previous section, we suppose that the sequence of setting/payment times of the game spot-start swaption starts

Then, a forward-start swap rate at an agreement time N is given by

Note that

As in the previous section, we apply a stochastic game formulation to the valuation of the game forward-start swaption. At a jointly exercisable node

Definition 4.1. When the game forward-start swaption is exercised at an exercisable node

Let

Step 0. (Terminal condition) for

Step 1. (Recursion) from

Case 1-1. (When both players can exercise) for

Case 1-2. (When only fixed-rate player can exercise) for

Case 1-3. (When only variable-rate player can exercise) for

Case 1-4. (When neither player can exercise) for

where we define a continuation value at node

The following theorem shows that the above game for the forward-start swaption has a saddle point in pure strategies.

Theorem 2. Suppose

Furthermore, the equilibrium strategy profiles

Proof. Since the proof is almost the same as Theorem 1, it is omitted.

5. Numerical Examples

In this section, we show some numerical examples for a game spot-start swaption and a game forward-start swaption. Firstly, we consider a game spot-start swaption with the swaption maturity of 5 years, the protection period of 1 year, and the swap period of 5 years. The both players can choose to exercise at any time in prescribed exercisable time-intervals after the protection period. If either or both players exercise the option, they enter the 5-years swap at the next setting/payment time. We set

The upper surrounded area stands for the exercise area of the fixed-rate player, while the lower surrounded area stands for the one of the variable-rate player. According to the numerical results, we can confirm that the spot-start swap rate

Next, Table 2 shows a (skewed) binomial tree for a Bermudan-type game spot-start swaption. The Bermudan-type swaption permits the both players to exercise at a time every year, namely time

Table 1.The American-type game spot-start swaption prices and the exercise areas.

Table 2.The Bermudan-type game spot-start swaption prices and the exercise areas.

also exercise at any time

Finally, we consider a game forward-start swaption. The game forward-start swap- tion is the agreement where the protection period is 1 year, the swap starts at the 5th year later, and the swap period is 5 years. The both players can exercise the option at any time after the protection period of 1 year to the maturity of the swaption, namely from time 4 to time 20. If either player exercises at a time, the corresponding swap starts from the 5th year regardless of the exercise time, namely from time 21. The numerical results are displayed in Table 3. In contrast to Table 1, the exercise areas in Table 3 are smaller in both the fixed-rate player and the variable-rate player than those in Table 1. The influence is probably caused by an increase in the discount factor of Equation (35) due to the forward-start swaption. Moreover, Table 1 shows that the exercise areas of both players for the forward-start swaption are closed in the following meaning: once the pair

6. Concluding Remarks

This paper newly proposed game swaptions as game versions of a Bermudan swaption. These game swaptions are also considered as generalizations of the receiver swaption and payer swaption. Furthermore, in this paper, with respect to the time to start the underlying swap, we treated two types of game swaptions, that is, game spot-start swaption and game forward-start swaption.

In a plain vanilla interest-rate swap, although, at the agreement time of the contract (ex ante), by setting the fixed exercise rate as the swap rate at that time, the fair value of the contract can be almost zero, it will be possible to become largely positive for one of two parties and largely negative for the other party as time passes (ex post) because of a large change in variable interest rate.

On the other hand, concerning the usual swaptions, since the option (right) to enter the underlying swap is given only to one party, its value continues to be positive for that party regardless of realized changes in variable interest rate, and it will be possible to become largely positive for that party and largely negative for the other party.

In contrast, in the case of our newly proposed game swaptions, like a plain vanilla interest-rate swap, by appropriately setting the three exercise rates

Table 3.The American-type game forward-start swaption prices and the exercise areas.

In this paper, we proposed computational methods for no-arbitrage prices and exercise areas of these game spot-start swaptions under the generalized Ho-Lee model as the term-structure model of interest rate. Although we have confirmed the effectiveness of our proposed algorithms by some numerical examples, further mathematical analysis of the structure of the exercise areas of both players in both game swaptions is remained as our future research.

Acknowledgements

The authors would like to express sincere thanks to an anonymous reviewer for helpful comments on an earlier version of this paper, and they are also grateful to an author assistant of Scientific Research Publishing and an editorial assistant of Journal of Mathematical Finance.

Cite this paper

Ebina, A., Ochiai, N. and Ohnishi, M. (2016) Valuation of Game Swaptions under the Generalized Ho- Lee Model. Journal of Mathematical Fi- nance, 6, 1002-1016. http://dx.doi.org/10.4236/jmf.2016.65065

References

- 1. Ho, T.S.Y. and Lee, S.B. (2007) Generalized Ho-Lee Model: A Multi-Factor State-Time Dependent Implied Volatility Function Approach. The Journal of Fixed Income, 17, 18-37.

http://dx.doi.org/10.3905/jfi.2007.700217 - 2. Ho, T.S.Y. and Lee, S.B. (1986) Term Structure Movements and Pricing Interest Rate Contingent Claims. The Journal of Finance, 41, 1011-1029.

http://dx.doi.org/10.1111/j.1540-6261.1986.tb02528.x - 3. van der Hoek, J. and Elliott, R.J. (2006) Binomial Models in Finance. Springer Finance, Springer, New York and Tokyo.

- 4. Ben-Ameur, H., Breton, M., Karoui, L. and L’Ecuyer, P. (2007) A Dynamic Programming Approach for Pricing Options Embedded in Bonds. Journal of Economic Dynamics & Control, 31, 2212-2233.

http://dx.doi.org/10.1016/j.jedc.2006.06.007 - 5. Ochiai, N. and Ohnishi, M. (2015) Valuation of Game Option Bonds under the Generalized Ho-Lee model: A Stochastic Game Approach. Journal of Mathematical Finance, 5, 412-422.

- 6. Shapley, L.S. (1953) Stochastic Games. Proceedings of the National Academy of Sciences of the United States of America, 39, 1095-1100.

http://dx.doi.org/10.1073/pnas.39.10.1095 - 7. Hull, J.C. (2014) Options, Futures, and Other Derivatives. 9th Edition, Pearson Education, Tokyo.

- 8. Kolb, R.W. (2003) Futures, Options, and Swaps. 4th Edition, Wiley-Blackwell Publishing, Malden.