Journal of Mathematical Finance, 2012, 2, 121-131 http://dx.doi.org/10.4236/jmf.2012.21014 Published Online February 2012 (http://www.SciRP.org/journal/jmf) Forecasting Volatility of Gold Price Using Markov Regime Switching and Trading Strategy Nop Sopipan1, Pairote Sattayatham1, Bhusana Premanode2 1School of Mathematics Suranaree, University of Technology, Nakhon Ratchasima, Thailand 2Institute of Biomedical Engineering, Imperial College South Kensington Campus, London, UK Email: {nopsopipan, bhusana}@gmail.com, pairote@sut.ac.th Received October 24, 2011; revised December 1, 2011; accepted December 15, 2011 ABSTRACT In this paper, we forecast the volatility of gold prices using Markov Regime Switching GARCH (MRS-GARCH) mod- els. These models allow volatility to have different dynamics according to unobserved regime variables. The main pur- pose of this paper is to find out whether MRS-GARCH models are an improvement on the GARCH type models in terms of modeling and forecasting gold price volatility. The MRS-GARCH is best performance model for gold price volatility in some loss function. Moreover, we forecast closing prices of gold price to trade future contract. MRS- GARCH got the most cumulative return same GJR model. Keywords: Forecasting; Volatility; Gold Price; Markov Regime Switching 1. Introduction The characteristic that all financial markets have in com- mon is uncertainty, which is related to their short and long- term price state. This feature is undesirable for the investor but it is also unavoidable whenever the financial market is selected as the investment tool. The best that one can do is to try to reduce this uncertainty. Financial market forecasting (or Prediction) is one of the instruments in this process. The financial market forecasting task divides researchers and academics into two groups: those who believe that we can devise mechanisms to predict the market and those who believe that the market is efficient and when- ever new information comes up the market absorbs it by correcting itself, thus there is no space for prediction. Fur- thermore they believe that the financial market follows a random walk, which implies that the best prediction you can have about tomorrow’s value is today’s value. In time series, a financial price transformated to log return series for stationary process which look like white noise. Mehmet [1] said financial returns have three characteristics. First is volatility clustering that means large changes tend to be followed by large changes and small changes tend to be followed by small changes. Second is fat tailedness (excess kurtosis) which means that financial returns often display a fatter tail than a standard normal distribution and the third is leverage effect which means that negative returns result in higher volatility than positive returns of the same size. The generalized autoregressive conditional heteroske- dasticity (GARCH) models mainly capture three charac- teristics of financial returns. The development of GARCH type models was started by Engle [2]. Engle introduced ARCH to model the heteroskedasticity by relating the conditional variance of the disturbance term to the linear combination of the squared disturbances in the recent past. Bollerslev [3] generalized the ARCH (GARCH) model by modeling the conditional variance to depend on its lagged values as well as squared lagged values of disturbance. The Exponential GARCH (EGARCH) model proposed by Nelson [4] to cope with the skewness of ten encoun- tered in financial returns, led to GJR-GARCH which was introduced independently by Glosten, Aganathan, and Runkle [5] to account for the leverage effect. Hamilton and Susmel [6] stated that the spurious high persistence problem in GARCH type models can be solved by combining the Markov Regime Switching (MRS) model with ARCH models (SWARCH). The idea behind regime switching models is that as market conditions change, the factors that influence volatility also change. Nowaday some researchers have development of GARCH model, as well as the benefit of using GARCH model [1, 7-9]. Gold is a precious metal which is also classed as a commodity and a monetary asset. Gold has acted as a mul- tifaceted metal through the centuries, possessing similar characteristics to money in that it acts as a store of wealth, a medium of exchange and a unit of value. Gold has also played an important role as a precious metal with sig- C opyright © 2012 SciRes. JMF  N. SOPIPAN ET AL. 122 nificant portfolio diversification properties. Gold is used in industrial components, jewellery and as an investment asset. The quantity of gold required is determined by the quantity demanded for industry investment and jewellery use. Therefore an increase in the quantity demanded by the industry will lead to an increase in the price of the metal. The changing price of gold can also be the result of a change in the Central Bank’s holding of these precious metals. In addition, changes in the rate of inflation, cur- rency markets, political harmony, equity markets, and producer and supplier hedging, all affect the price equi- librium. Gold futures is an alternative investment tool which relies on the gold price movement. The investors can benefit from the gold futures investment by making profit from both directions, either up or down, which is like stock index futures trading. In addition, gold futures can also hedge against gold price fluctuations or stock market volatility due to the negative correlation to the stock market. This will provide a greater opportunity to make profit when the stock market declines during an economic downturn. Gold futures in Thailand are futures contracts which rely on gold bullion with a purity of 96.5% due its popu- larity among buyers nationwide for gold physical trading. Gold futures trade in implement cash settlement method with no need of physical delivery. Edel Tully, et al. [10] has investigated the Asymmmetric power GARCH model has to capture the dynamics of the gold market. Results suggest that the APGARCH model provides the most adequate description for the gold price. In this paper, we use GARCH, EGARCH, GJR-GARCH and MRS-GARCH models to forecast the volatility of gold prices and to compare their performance. Moreover we shall use this estimated volatility to forecast the closing price of gold. Finally, we apply the forecasting price of gold to trading in gold future contracts with a maturity date of August 2011 (GF10Q11). In the next section, we present the MRS-GARCH model. Estimation and in-sample evaluation results are given in Section 3. In Section 4, statistical loss functions are described and out-of-sample forecasting performance of various models is discussed. In Section 5 we apply the forecasting price to the gold price for trading in future contracts. The conclusion is given in Section 6. 2. Markov Regime Switching of GARCH Model Let denote the series of the financial price at time t and 0 tt rbe a sequence of random variables on a pro- bability space ,F index t den tes the daily closing observations and tR sample period consists of an estimation (or in-sample) period with R obseations (tR t P ,. Foro n. The rv ) 1, , 1,,0 n evolu- tion (or out-of-sample) period with n observations , and a )(1,tn, , let t be the logarithmic return (in percent) on the financial price at time t, i.e. r 1 100 lnt t P P t r (1) The GARCH (1,1) model for the series of the returns can be written as t r ttt rh t 1t 2 0111tt hh where 01 1 0,0 and 0 are assumed to be nonnegative real constants to ensure th0. t We assume t at h is an i.i.d. process with zero mean and unit variance. The parameters of the GARCH model are generally considered as constants. But the movement of financial returns between recession and expansion is different, and may result in differences in volatility. Gray [11] extended the GARCH model to the MRS-GARCH model in order to capture regime changes in volatility with unobservable state variables. It was assumed that those unobservable state variables satisfy the first order Markov Chain proc- ess. The MRS-GARCH model with only two regimes can be represented as follows: , = tt t tSttS rh 1 tS , (2) and 2 ,01,11, tttt SS tS t hh tS 2 . where t1 orS , t S is the mean and ,t tS is the volatility under regime t on h S1t , both are measure- able functions of t for 1t . In order to ensure easily the positive of conditional variance we impose the restrictions t 0,S0 , 1, t S0 1, and t S 0 . The sum 1, 1, tt SS measures the persistence of a shock to the conditional variance. The unobserved regime variable t is governed by a first order Markov Chain with constant transition prob- abilities given by S 1 for , 1,2 tt ji SiSjpij Pr P (3) In matrix notation, 11 21 12 22 1 1 pp p pp pq q (4) 2.1. Forecasting Volatility In MRS-GARCH model with two regimes, Klaassen [12] forecast volatility for k-step-ahead by using the recursive method as in the standard GARCH model where is a k Copyright © 2012 SciRes. JMF  N. SOPIPAN ET AL. 123 positive integer. In order to compute the multi-step-ahead volatility forecasts, we firstly compute a weighted aver- age of the multi-step-ahead volatility forecasts in each regime where the weights are the prediction probability ( 1 Pr TT SiF ). Since there is no serial correlation in the returns, the k-step-ahead volatility forecast at time T depends on information at time T − 1. Let ,TT k h denote the time T aggregated volatility forecasts for the next k steps. It can be calculated as follows: (See, for example Marcucci [9], page 8) ,, 1 2 ,, 1 11 Pr . T k TT kTT k TT Si TT i h iFh h S (5) where ,, T TT Si h indicates the -step-ahead volatile- ity forecast in regime i made at time T and can be calcu- lated recursively as follows: ,, 1 2 0,1,1 1 1, 1 2 0,1,1 111 1, 1 0, 1 1 1 1, 1, = =[] = T TT T TT T TTT T T T TT siTT SiSiT TT SiT T SiSiTT TTT SiT T SiSi SiT Ei Ei Ei EE Si hhS S h E S S hi E S 1,1 . TT T Sih (6) Also, in generally the prediction probability in (5) is computed as 11 1 11 Pr1Pr 1 Pr2Pr 2 TT TT TT TT FFSS P FFSS 1 1 , where P defined in (4) and 11 Pr will be discussed in (11). Lastly, we compute expectation part TT SiF 1,1TTT T EhS i in (6) as follows: 1,11 1 2 11 1 2 11 11 2 11 11 2 11 11 , =, ,, =[,] , [,], TTTTT TT TT T TTT TT TTTT T TTT TT EhSiEh SiF EEr SjF Er SjFSiF EErSjF SiF EEr SjFSiF where (7) 2 11 11 22 11 1 1 11 22 11 11 1 11 22 1111 [ TT EEr ,], , Pr, , Pr, 2 TT T TT T j TTT TT TT j TTT TTTT SjFSiF Er SjF SjSiF ESjF SjSiF E 11 2 11 1 11 22 , 11,1, 1 , Pr, =TT TT j TTT jiTT SjT Sj j SjF SjSiF ph (8) where ,1 11 11 1 Pr , Pr Pr ji TTTT TT TT ji SS S S pj pjF iF iF . (9) Similarly, we computed in the second term of right hand side in (7) such that 1 2 11 1 22 1, ,1 1 1 ,], =T TTT TT TS j ji T j FSiF p [EEr Sj (10) substitutes both (8) and (10) to (7) such that 11 1 ,1 1() TT TT 22 , 11,1, 1 22 ,1 1, 1 . TT T iTT SjTSj j ji TTSj j ph p EhS i In the next step, we will compute those regime prob- abilities 1 Pr ittt pSiF for 1, 2i in (9). Note that whenlities are based on informa- tion up to time t, we describe this as filtered probability ( the regime probabi Pr tt SiF). compute the regime probabilities, we de- no In order to te 11 1:, tttt Sffr F , 21 2:, tttt Sffr F . Then, n- comes a mixture-of-distribution model in which mixing variables is regime probability it p. That is conditional distributio of return series be t r 1 (1,) witrobability ttt frSF1 1 121 h p (2,) with probability 1, t tt tt ttt p rF rS Fpp where 1 , tt t frSF denotes one of the assumed condi- Copyright © 2012 SciRes. JMF  N. SOPIPAN ET AL. 124 tional dor errors: Normal Distribution (N), Student-t Distribution with only single degree of freedom (t) or double degree of freedom (2t) and Generalized er- ror distributions (GED). We shall compute reg istributions f ime probabilities recursively by following two steps (Kim and Nelson, [13], page 63): Step 1: Given Pr SjF at the end of the ti 11tt me probabilities 1, the regimet Pr it SiF are uted as 1tt p comp 2 11 1 PrPr , tttt t j SiFSiS jF 1 . Since the current regime) only depends on the re- gi (t S enme one period ago (1t S), th 1 2 111 1 2 11 1 Pr Pr =Pr tt t t j ji tt j Si jSSjF pSjF . Step 2: At the end of the time t, when observed return at Pr tt SiF time t (t r) the information at time t set 1, ttt Fr , the Pr tt SiF is calculated as follows: 1 1 1 Pr Pr,= tt t tt ttt tt iF SiF SirFfrF , where ,frS 1 , ttt frS iF is joint density of returns and rved regime at sunobsetate i for 1, 2i variables can be written as follows: 111 11 ,P r tt ttttt t tttt t frS iFfS iF frSiFS iF and ,,frS iF 1tt frF is marginal density function of returns e construccan bted as follows: 2 11 1 2 11 1 , ,Pr. tttt t i tttt t i frFfrS iF frSiFS iF We use Bayesian arguments 1 1 11 2 11 1 2 1 , Pr ,Pr = ,Pr =. tt t tt tt tt ttt tt ttt i it it it it i frS iF SiF frF frSiFS iF frSiFS iF fp fp (11) Then, all regime probabilities can be computed by iterating these two steps. Howe at the beginning of iteration it p ver, 00 Pr SiF for are necessary to start iteration. Hamilton ([14,gest we should use unconditional regime probabilof 1, ) su ities instead 2i 15] g 00 Pr SiF. These are given by 100 200 1 πPr 1, 2 1 πPr 22 q SF pq p SF pq n and conditiorance g-likeliursively similar to that in 2.2. Forecasting Price We forecast financial price at k-step-ahead with MRS- GARCH models. Denote is k-step-ahead fore- ca Given initial values for regime probabilities, condi- tional meanal va i in each regime, the parameters of the MRS-GARCH model can be obtained by maximizing numerically the log-likelihood function. The lohood function is constructed rec GARCH models , ˆ tt k r sting logarithm return of financial price at time t de- pend on 1t . We compute as: 2 ,1 1,, 1 ˆˆ Pr tk ttkttktktttkSi i rEr SiFr (12) where ,, 1 1 11 2 = = tk tt kk ttk ttktk ES i ESiE Si 11 1 2 ,1 1 r , = tk tk tk t tktktSi j Si ji t j i SjSiF p ˆ ttkSittk rErS =P Forecasting financial price one-step-ahead, we use (12) and (1) combine in log-return of financial price is 1 22 11 ,1 11 1 Pr ˆexp 100 t tt jitS ij tt SiF p PP i . (3) 3. Empirical Methodology and Model Estimation Results 3. prices of gold price 1 1. Data The data set used in this study is the daily closed t P over the period 4/01/2007 through Copyright © 2012 SciRes. JMF  N. SOPIPAN ET AL. 125 31/08/2011 (t = 1, ···, 1213 observations). The data set is obtained from the basis of the London Gold Market Fix- ing Limited on day and the foreign exchange ra Baht to US dollars announced by TFEX (The Thailand Futures Exchange) on day, after conversion for weight R = serva- tio log returns series te for and fineness. The data set is divided into in-sample ( 1192 observations) and out-of-sample (n = 21 ob ns). The plot of t P and ; (1) t r lays usual , volatility is kurtosis are given i properties of fi n Figure . Plot and disp na seexcted the 1 ncial data t P ries. As t r pe not constant over time and exhibits volatility clustering with large changes inindices often followed by large changes, and small changes often followed by small changes. Descriptive statistics of t r are represented in Table 1. As Table 1 shows, t r has a positive average return of 0.074%. The daily standard deviation is 1.537%. The series also displays a negative skewness of −0.102 and an excess kurtosis of 9.457. These values indicate that the returns are not normally distributed, namely it has fatter tails because skewness does not equal zero and is greater than 3. Also, the Jarque-Bera test1 statistic of 2107.620 confirms the non-normality of t r. And the (a) Pt) and (b) 07 through 30/ (b) Figure 1. Graph of plosedices ( log returns series (rtthe pd 08/2011. Augmented Dickey-Fuller test2 of −35.873 indicates that is stationary. The autocorrelation functions (ACF) test the signifi- cance level of autocorrelation in Table 2, when we apply Ljung and Box Q-test. The null hypothesis of the test is that there is no serial correlation in the return series up to the specified lag. Serial correlation in the is confirmed as non-stationary but is stationary. Because the serial correlation in the squaeturns is non-stary this sug- gests conditional heteroskedasticity. Therefre, we ana- lyze the significance of autocorrelation in the square mean adjusted return (a) Gold ) for rice c erio pr 4/01/20 t r t P ation o t r red r t r d 2 series bg-Box Q- ogy G imation y Ljun test3. And apply Engle’s ARCH test4. 3.2. Empirical Methodol This empirical part adopts GARCH type and MRS- ARCH (1,1) models to estimate the volatility of the t P. GARCH type models that will be considered as GARCH (1,1), EGARCH(1,1) and GJR-GARCH (1,1). In order to account for the fat tails feature of financial returns, we consider three different distributions for the innovations: Normal (N), Student-t (t) and Generalized Error Distri- butions (GED). 3.2.1. GARCH Type Models Table 3 presents an estof the results for GARCH type models. It is clear from the table that almost all pa- rameter estimates including in GARCH type models wever, the asymmetry are highly significant at 1%. Ho effect term in EGARCH models is significantly dif- ie Table 1. Summary statistics of Gold price log returns sers (rt). Statistic Return (%) Min −10.823 Max 10.71 Mean 0.074 Standard deviation 1.537 Skewness −0.102 Kurtosis 9.457 Jarque-Bera Normality test 2107.620 (P-value = 0.000) Augmented Dickey-Fuller test −35.873 (P-value = 0.000) 2Augmented Dickey-Fuller test is a test for a unit root in a time series sample, the null hypothesis of ADF test is that the series is non- stationary. 3Ljung-Box Q-test is a type of statistical test of whether any of a group of autocorrelations of a time series are different from zero. 4ARCH test is test with null hypothesis that, in the absence of ARCH components, we have αi = 0 for all i = 1, 2, ···, q. The alternative hypothesis is that, in the presence of ARCH components, at least one of the estimated αicoefficients must be significant. 1Jarque-Bera Normality test is a goodness-of-fit measure of departure from normality and can be used to test the null hypothesis that the data are from a normal distribution. Copyright © 2012 SciRes. JMF  N. SOPIPAN ET AL. Copyright © 2012 SciRes. JMF 126 eries (rt), squesults for Engle’s Test. ACF of Gold price closed price. ACF of Gold price log return.ACF of quare return. Results for Engle’s ARCH test Table 2. ACF of gold price closed price (Pt), log returns sare return and rARCH Gold price s Lags ACF LBQ Test P-value ACF LBQ TestP-valueACF LBQ stP-value ARCH TeP-value Te st 1 0.994 1202.126 0.000 473 0.2250 −0.035 1.0.236 67.585 0.0067.675 0.000 2 0.988 2391.372 0.000 0.5.370 0.068 3 0.3567.530 0.000 5.410 0.1440.050 73.579 0.000 69.796 0.000 6 − 057 0.049 70.550 0.00067.735 0.000 982 0.006 4 0.977 4732.067 0.000 0.028 6.336 0.1750.047 76.324 0.000 70.644 0.000 5 0.972 5885.596 0.000 0.022 6.948 0.2250.029 77.340 0.000 70.695 0.000 0.966 7026.176 0.000 0.062 11.578 0.072 0.074 83.996 0.000 75.784 0.000 7 0.960 8152.993 0.000 −0.023 12.206 0.094 0.022 84.561 0.000 76.115 0.000 8 0.954 9267.290 0.000 0.070 18.159 0.0200.045 87.058 0.000 78.019 0.000 9 0.948 10368.939 0.000 −0.024 18.893 0.026 0.050 90.053 0.000 78.693 0.000 10 0.943 11458.607 0.000 0.010 19.025 0.0400.006 90.102 0.000 79.005 0.000 22 0.885 23713.861 0.000 −0.046 34.412 0.0450.056 178.444 0.000 126.931 0.000 pe models. CRC G CH6 Table 3. Summary results of GARCH ty GARH EGAH5 JR-GAR Peter N Gt G aram tED N ED N t GED 0.1012*9*11* 67*0.130.* *** 0.122** 0.64*** 0.1341**0.13**08***1083**0.1259*** 0.1191** Std.err. 3436 0.0337 0. 0.07 0.03 0315 0.0358 0.0320 0.0368 0.0338 0.0318 0 0.0567*** 0.0686*** 0.0629*** −0.0974***−0.0725*** −0.0844***0.0546*** 0.0640*** 0.0598*** Std.err. 0.0099 0.0174 0.0097 0.0159 0.0156 0.0165 0.0099 0.0178 0.0178 1 0.0818*** 0.0779*** 0.1429*** 0.1240***0.0611*** 0.0583*** 0.8 0.0177 0.6 0.0255 0.3 0.07 0.0757*** 0.1092***0.0558*** Std.err. 0080.0168 0130.0249 012190.0206 1 0.8906*** 0.8897*** 0.8893*** 0.0459*** 0.0491***0.0461***0.8939*** 0.8946*** 0.8934*** Std.err. 0.0091 0.0184 0.0175 0.0106 0.0172 0.0172 0.0092 0.0176 0.0172 0.7175*** 0.4317***0.6245***0.0993*** 0.0914*** 0.0941*** Std.err. 0.0040 0.0053 0.0059 0.0134 0.0252 0.0242 5.1878*** 1.2350*** 5.4135***1.2694*** 5.2868*** 1.2408*** Std.err. 0.7608 0.0534 0.8081 0.0568 0.7766 0.0530 Log() P LBQ(2) 32.2 32.2 32.2 (0.0672) (0.0672) (0.0672) LBQ 182 188 1888 (0.0000) ((0.0000) (0.0000) ( L−2087.32 −2033.89 −2038.22 −2370.03 −2160.38 −2185.16 −2086.68 −2033.63 −2037.92 ersistence0.9724 0.9654 0.9672 0.0459 0.0491 0.0461 0.9741 0.9682 0.9696 263663663632.6362 32.6362 32.6362 32.6362 32.6362 32.6362 (0.0672) (0.0672) (0.0672) (0.0672) (0.0672) (0.0672) 2(22)9.9190.07 189.83 9.6189.66 189.72 9.189.76 189.81 0.0000) (0.0000) (0.0000) (0.0000) 0.0000) (0.0000) ***fer tce a5%vey, Lung-inno22, is L of sqvation and BQrentheerr is starror. 5M and ** rehe significant 99% and 9 confidence lel respectivelBQ(22) is LjBox test of vation at lag LBQ2(22) jung-Box test uared innot lag 22 aP-value for L test in pases. Std.ndard e odel of EGARCH(1,1) is 1 ln t 1t 0t11 ln t where 1 1t h 1t h hh is the asymmetry parampture leverage effect. eter to ca 6MR-G is odel of GJARCH(1,1) } wher 1 { 1t I 1t I e ual ton 2 110}11{0t 2 1tt h 0t h 1 { t I 0} is eq one whe is greater than zero and 1t another is zero.  N. SOPIPAN ET AL. 127 ferent from zeh innexega presented in Table 4. Most parameter esti- MCHnifiiffe ro, whicdicates upected ntive re- turns implying higher conditional variance as compared o same size positive returns. All models display strong zero at least at 95% confidence level. But 0 t persistence in volatility ranging from 0.9654 to 0.9741 unless EGARCH models are very low, that is, volatility is likely to remain high over several price periods once it increases. 3.2.2. Markov Re gi me Switching GARCH Models Estimation results and summary statistics of MRS-GARCH models are mates inRS-GAR are sigcantly drent from and 1 are insignificant in some states. All models display strong n esian Information Criteria s of M persistence in volatility, that is, volatility is likely to re- main high over several price periods once it increases. 3.2.3. In-Sample Evaluation We use various goodness-of-fit statistics to compare volatility models. These statistics are Akaike Informatio Criteria (AIC) Schwarz Bay (SBIC) and Log-likelihood (LOGL) values. In Table 5, MRS-GARCH models. RS-GARCH Table 4. Summary result Parameters N t 2t GED State i Low volatility regime High volatility regime Low volatility regime High volatility regi Low volatility me High volatility regime Low volatility regime High volatility regime me regi ()i 0.0830** 0.1800** 0.1136*** 0.1699** 0.1135*** 0.1699** 0.1708** *** 0.1088 Std.err. () 0.0404 0.0934 0.0388 0.0766 0.0389 0.0766 0.0776 0.0369 0 i 0.0137* 2 1 1 1 Std.er. 0.0075 .1786***0.0111 .6163***0.0111 .6152***.8421*** 0.0126 r0.3353 0.0086 0.513 0.0086 0.531 0.487 0.0096 ()i 1 0.04630.0380 0.31700.03800.3244 0.0418 Std.err. 0.0127 *** 0.3654*** ** *** ** 0.3170*** *** ** 0.1029 0.016 0.1154 0.0161 0.1167 0.1258 0.018 ()i 1 0.94360.95350.1844 0.0.1015 0.9485 Std.err. 0.0151 *** 0 *** 9535*** 0.1859 *** 0.1115 0.0175 0.1771 0.0175 0.1798 0.1403 0.02 0.9975*** 0.9981*** 0.9983*** 0.9981*** Std.err. 0.0023 0.0024 0.0024 0.0029 q 0.9976*** 0.9983*** 0.9981*** 0.9983*** Std.err. 0.0021 0.0024 0.0024 0.0023 ()i 6.0789*** *** 1.4119 Log(L) −2050.44 6.0583*** 6.01341.3234*** Std.err. 0.9544 1.6734 0.0598 −2013.2 −2017.57 −2013.22 2 1.3564 3.433 1.3059 3.2417 3.2087 1.3 0.5103 0.4897 0.4722 0.4722 0.5278 0.5278 Persistence 0.9899 0.3654 0.9903 LBQ( 34.9963 34.9963 34.9963 34.9963 (0.0388) (0.0388) (0.0388) (0.0388) LBQ2(22) 178.7254 178.6977 178.7734 178.7132 .0000) (0.0000) 1.3059 3.2492 π 0.5278 0.4722 0.9915 0.5014 0.9915 0.5029 0.4259 22) (0(0.0000) (0.0000) *** and ** refer the significance at(22) is Lox test of innovation at la LBQ2 (22) is Ljung-Box test of squared inn 99% and 95% confidence level respectively, LBQjung-Bg 22, ovation at lag 22 and P-value for LBQ test in parentheses. Std.err is standard error. Copyright © 2012 SciRes. JMF  N. SOPIPAN ET AL. 128 Table 5. In-saaluatio. s N PIC R SBIC R RMSE1RMSEIKER MAD2 R MAMSER mple evn results ModelERS ALOGL 2RQLD1 RH GARCH-N 4 0.9724 089 9 3.5260 9 101.381112 50.114678.4461 13 2.7123.5 −2087.3251 81.66378 120.8701 GARCH-t 5 210 4 3.4423 1 51.3298848.2359 108.4433 12 2.6.861111 GARCH-GED 5 0.9672 282 6 3.4496 5 71.333710 48.50529 8.3971 9 2.69 EGARCH-t 6 0.0491 3.6349 11 3.662.1317 117.1359 2 2.1939 1 0.73841 EGAD 3 − G G-t G M M2t M 0.9654 3.4−2033.8919 21.66606 6 0 3.4 −2038.2205 61.66654 7 0.8589 EGARCH-N 5 0.0459 3.9850 13 4.0063 13−2370.03131.1555 148.14331 2.1364127.1405 3 2.1949 3 0.73893 05 11−2160.3811 1.15842 48.3600 5 RCH-GE6 0.0461 .676412 3.7020 122185.16121.1608 348.35393 2.1563137.1297 1 2.1945 2 0.73882 JR-GARCH-N5 0.9741 3.5095 10 3.5309 10−2086.6891.389613 50.550191.663558.4406 11 2.7520 130.870613 JR-GARCH6 0.9682 3.4222 5 3.4478 3 −2033.6341.33289 48.3546 41.664788.4319 10 2.6658 8 0.860410 JR-GARCH-GED 6 0.9696 3.4294 7 3.4550 7 −2037.9261.338111 48.668271.664168.3906 8 2.6733 9 0.85888 RS-GARCH-N 10 0.9911 3.4571 8 3.4998 8 −2050.4481.3002451.2119 101.6149 2 8.2523 5 2.6546 4 0.84275 RS-GARCH-12 0.9920 3.3980 2 3.4492 4 −2013.211.3254655.5689 121.615238.2603 7 2.6913 100.84657 MRS-GARCH-t 11 0.9910 3.4036 3 3.4506 6 −2017.5731.3047552.8737 111.6148 1 8.2246 4 2.6602 5 0.84134 RS-GARCH-GED 11 0.9921 3.3963 1 3.4433 2 −2013.2221.3268756.0621131.6157 4 8.2578 6 2.6917 110.84616 N e s f fd , MRS-GARCH-GED is the best. GARCH-t is the best in S RL –N MSE1RCH- be the f t ctions. nd Forecast Price o t o- tions in our strategy are not longer than one day as de- We applied the Bollinger band indicator and we used samples of 21 days from 1 to 30 August 2011 (We trade one contract in GF10Q11 series is future contract in gold ne = Number of Paramters, PERS = Persistence, R = Rank. the results of goodness-of-fit statistic and loss unctions7 or all volatility models are presented. Accoring to AIC BIC, MRS-GACH-2t is the best in LOG, EGARCH is the best in st in QLIKE. EGA and RCH-GED i MSE2. s MRS-GAt is the andbest in MAD2 EGARCH-t is the best in MAD1 and HMSE. We ound tha different models were suitable for various loss fun 4. Forecasting Volatility in Out-of-Sample In this section, we investigate the ability of MRS-GARCH and GARCH type models to forecast volatility of Gold prices from out-of-sample. In Table 6, we present the result of loss function of out-of-sample with forecasting volatility for one day ahead, and we found the EGARCH and MRS-GARCH models perform best. 5. Trading Future Contract with Forecast Volatility a The aim apply of thi g differ s study is t ent evaluate t o the v he profitability of tility oin models olaf gold prices. We assumed the market is a perfect market and the psi scribed below. price with maturity date at August 2011) to trade in o contract with day by day and we did not include settle- ment, return do not include cost price i.e. margin, fee charged. The net daily rate of return for long position is computed as follows: 11 11tt tt RC Omh where 1 ,, tt RCO 1t1 are the return, close, open price, 1t h is forecasting volatility at next day 1t and m is constants. The net daily rate of return on close position is com- puted as follows: 11 11tt tt ROmhC Table 7 shows that the cumulative of return with Markov Regime Switching the GARCH-N model and the JR-N model give cumulative of return more than the G 7Loss functions: 22 2 1,2 11 2 , 1, 2 1,2 11 2 2 1, 11 ,, 1ln( ), 11 ,, 11 nn t KtKtKtK tt n tK tK ttK nn t KtKt KtK tt n tK ttK MSEh MSEh nn QLIKE h nh MADh MADh nn HMSE nh , , Copyright © 2012 SciRes. JMF  N. SOPIPAN ET AL. 129 Table 6. Result loss function of out-of-sampl Model MSE1 R MSE2 R orecasting volatility for one day ahead. e with f QLIKE R MAD1 R MAD2 R HMSE R GARCH-N 0.063 6 0.681 6 1.53 0.529 6 0.185 1054 13 0.179 GARCH-t 0.055 5 0.566 4 GARCH-GED 1.538 11 0.170 2 0.493 4 0.181 8 0.056 3 0.585 5 1.539 EGARCH-N 0.057 4 0 3 1.5 EGARCH-t 1.5 EGARCH-GE0.220 12 GJR-N G GJRED M Mt M M 12 0.167 1 0.488 3 0.182 9 37 10 0.217 7 0.519 5 0.240 13 25 6 0.183 4 0429 1 0.218 11 0.33 0.047 1 0.266 1 . D 0.049 2 0.269 2 1.529 8 0.201 5 0.470 2 -GARCH0.124 10 1.306 10 1.532 9 0.298 12 0.896 12 0.129 7 JR-GARCH-t 0.105 8 1.070 8 1.523 5 0.275 10 0.815 10 0.117 5 -GARCH-G0.109 9 1.127 9 1.525 6 0.279 11 0.830 11 0.120 6 RS-GARCH-N0.156 13 1.766 13 1.491 3 0.326 13 0.998 13 0.080 4 RS-GARCH-20.132 11 1.595 11 1.487 1 0.250 8 0.763 8 0.079 3 RS-GARCH-t 0.133 12 1.606 12 1.487 1 0.250 8 0.765 9 0.071 1 RS-GARCH-GED0.086 7 0.915 7 1.492 4 0.213 6 0.625 7 0.073 2 ulativrn adiure cracld price wi 30 een0 Aust GARCH EGARCH GJR MRS-GARCH Table 7. Cume Retuof trng futontt of goth m =betw 1 to 3ug 2011. Date with Tr GED t GEDN GEDNt 2t GED ading. N t N t 1/8/ −40. −40 −−40. −4−40. − −40. −5−50. −5−50.2011 −40.0 0 .0 40.0 00.00 40.000.0 0 0.00 2/8/ −90. −90 −−90. −9−90. − −90. −11110. −11 −11 3/8/630.630.6630. 62630.63630. 60600. 60600 4/710.710.7710. 69710.71710. 67670. 67680 5/8/20710.0 8/8/2011 1470.0 1490.0 1480.0 1490.0 1490.01470.0 1500.0 1500.01500.01420.0 1420.0 1420.0 1430.0 2530.0 2540.0 2530.0 2510.0 2560.0 2502560.02480.0 242480.0 10/8/2011 250 2530.0 250 2502250 2560.02240 2430.0 240 2 11/21222221 222 15/171717 11 16/14141413 11113131 2011 −100.0 0 .0 80.0 00.00 90.000.0 −0 0.00.0 2011 620.0 0 0 30.0 0 0.00 0.000.0 0 0.0.0 8/2011 700.0 0 0 10.0 00.00 0.00 0.0 0 0.0.0 11 740.0 750.0 750.0 750.0 750.0730.0750.0 750.0750.0700.0 700.0 700.0 9/8/2011 2550.0 2530.060.60.0 2460.0 10.20.0 2520.00.480.060.560.060.30.460.0 8/2011 90.0 10.0 00.0 2180.0 70.0150.0 2260.0 2260.0260.02180.0 2120.0 2120.0160.0 8/2011 1750.0 70.0 50.0 1710.0 00.0680.0 1830.0 1830.0 830.01760.0 1670.0 1670.0 1710.0 8/2011 40.0 60.0 40.0 1370.0 60.0340.0520.0 1520.0 520.01460.0 50.0 50.0400.0 17/8/2011 1670.0 1690.0 1660.0 1570.0 1560.01540.0 1750.0 1750.01750.01700.0 1570.0 1570.0 1620.0 18/8/2011 1770.0 1790.0 1760.0 1640.0 1640.01610.0 1860.0 1850.01850.01820.0 1670.0 1670.0 1720.0 19/8/2011 2670.0 2690.0 2660.0 2520.0 2520.02490.0 2770.0 2760.02760.02730.0 2570.0 2570.0 2620.0 22/8/2011 3510.0 3530.0 3500.0 3340.0 3360.03310.0 3620.0 3610.03610.03590.0 3410.0 3410.0 3460.0 23/8/2011 3840.0 3850.0 3820.0 3650.0 3670.03610.0 3960.0 3950.03950.03930.0 3740.0 3740.0 3780.0 24/8/2011 2870.0 2880.0 2850.0 2710.0 2680.02630.0 3030.0 3020.03020.03000.0 2800.0 2800.0 2830.0 25/8/2011 5220.0 5230.0 5200.0 5040.0 5000.04950.0 5430.0 5410.05420.05420.0 5220.0 5220.0 5220.0 26/8/2011 4390.0 4400.0 4370.0 4120.0 4080.04050.0 4590.0 4570.04580.04640.0 4450.0 4450.0 4410.0 29/8/2011 5240.0 5240.0 5210.0 4900.0 4870.04820.0 5450.0 5420.05430.05460.0 5270.0 5270.0 5220.0 30/8/2011 4920.0 4920.0 4890.0 4520.0 4470.04420.0 5150.0 5110.05120.05150.0 4960.0 4960.0 4900.0 Copyright © 2012 SciRes. JMF  N. SOPIPAN ET AL. 130 ols we= 6. Conclusions Inerrelat gin Markov RegimRSd emlloatihfy nor unede e n e opapo he MRSH ms are aimprovemente GARCH s ncR1)R,1 modeling and fore- casting gold price closed price volatility. We compare models with GARCH (1,1), EGARCH .g. EGARCH, GJR. In addition, the per- fo SCdned fur ldps 7.ogt Th y refu G E C [1] e“s ther mode when use m 30. this pap, we fo e Switch cast vo ing GARC ility of H (M old pr -GARC ces usi H) mo g - ls. These odels aw vollity to ave diferent d- amics accding toobserv regimvariabls. The maipurposf this er is tfind out whetr -GARC pe model odel which i n lude GA on th , EGAtyCH (1,CH (1) and GJR-GARCH (1,1) in terms of MRS-GARCH (1,1) (1,1), GJR-GARCH (1,1) models. All models are esti- mated under three distributional assumptions which are Nor- mal, Student-t and GED. Moreover, Student-t distribu- tion which takes different degrees of freedom in each re- gime is considered for MRS-GARCH models. We first analyze in-sample performance of various volatility models to determine the best form of the vola- tility model over the period 4/01/2007 through 30/08/2011. As expected, volatility is not constant over time and ex- hibits volatility clustering showing large changes in the price of an asset often followed by large changes, and small changes often followed by small changes. Descriptive statistics of return series are represented by returns with fatter tails. The Augmented Dickey- Fuller test indicates gold price log returns are stationary. Serial correlation in the gold price confirms it is non- stationary but serial log returns of gold price are station- ary. Serial correlation in the squared returns suggests condi- tional heteroskedasticity. This empirical part adopts GARCH type and MRS-GARCH models to estimate the volatility of the gold price. In order to account for fat tailed features of financial returns, we consider three dif- ferent distributions for the innovations. Almost all pa- rameter estimates in GARCH type models are highly sig- nificant at 1%. Most parameter estimates in MRS-GARCH are significantly different from zero at least at 95% confi- dence level. However, the results of goodness-of-fit statis- tics and loss functions for all volatility models show dif- ferent results. The trading details we have used describe forecasts of closed price of gold price between 1/08/2011-30/08/2011 and trading in gold future contract (GF10Q11). We found the cumulative returns with the Markov Regime Switch- ing GARCH-N (MRS-GARCH-N) model and the GJR-N model give us higher cumulative returns than the other models when we use m = 30. For further study, three or four volatility regimes set- ting can be considered rather than two-volatility regimes. Also, using Markov Regime Switching with other vola- tility models e rmance of MR -GARH moels ca be hged in ture foong an short osition. Acknwledemens is research is (partially) supported b the Thailand search nd BR. REFRENES A. Mhmet, Analysiof Turkish Financial Market with Markov Regime Switching Volatility Models,” The Mid- dle East Technical University, Ankara, 2008. [2] R. Engle, “Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Infla- tion,” Econometrica, Vol. 50, No. 4, 1982, pp. 987-1008. doi:10.2307/1912773 [3] T. Bollerslev, “Generalized Autoregressive Conditional Heteroscedasticity,” Journal of Econometrics, Vol. 31, No. 3, 1986, pp. 307-327. doi:10.1016/0304-4076(86)90063-1 [4] D. B. Nelson, “Conditional Heteroskedasticity in Asset Returns: A New Approach,” Econometrica, Vol. 59, No. 2, 1991, pp. 347-370. doi:10.2307/2938260 [5] L. R. Glosten, R. Jagannathan and D. Runkle, “On the Relation between the Expected Value and the Nominal Excess Return on Financials,” Journal of Finance, Vol. 801. doi:10.2307/232906748, No. 5, 1993, pp. 1779-1 ics, Vol. 64, No. 1-2, 1994, pp. 307-333. doi:10.1016/0304-4076(94)90067-1 [6] J. D. Haminton and R. Susmel, “Autoregressive Condi- tional Heteroskedasticity and Change in Regime,” Jour- nal of Econometr [7] Z. F. Guo anransition GARCH Model with Asases,” Proceedings CE2011_pp JAM/issues_v41/issue_4/IJAM_41 Uni- ity of Dublin, d L. Cao, “A Smooth T ymmetric Transition Ph of International Conference of Financial Engineering, Lon- don, 6-8 July 2011. http://www.iaeng.org/publication/WCE 2011/W 439-441.pdf [8] Z. F. Guo and L. Cao, “An Asymmetric Smooth Transi- tion GARCH Model,” IAENG Journals, 2011. http://www.iaeng.org/I _4_10.pdf [9] J. Marcucci, “Forecasting Financial Market Volatility with Regime-Switching GARCH Model,” Working Paper, versity of California, San Diego, 2005. [10] T. Edel and M. Brian, “APGARCH Investigation of the Main Influences on the Gold Price,” Univers Dublin, 2005. [11] S. Gray, “Modeling the Conditional Distribution of Inte- rest Rates as a Regime-Switching Process,” Journal of Fi- nancial Economics, Vol. 42, No. 1, 1996, pp. 27-62. doi:10.1016/0304-405X(96)00875-6 [12] F. Klaanssen, “Improving GARCH Volatility Forecasts with Regime-Switching GARCH,” Empirical Economics, Vol. 27, No. 2, 2002, pp. 363-394. doi:10.1007/s001810100100 [13] C. J. Kimand and C. R. Nelson, “State-Space Models with Regime Switching: Classical and Gibbs-Sampling Approa- Copyright © 2012 SciRes. JMF  N. SOPIPAN ET AL. 131 ches with Applications [14] J. D. Hamilton, “A New Approach to the Economic Ana- lysis of Nons ,” MIT Press, Cambridge, 1999. tationary Time Series and the Business Cy- cle,” Econometrica, Vol. 57, No. 2, 1989, pp. 357-384. doi:10.2307/1912559 [15] J. D. Hamilton, “Analysis of Time Series Subject to Change in Regime,” Journal of Econometrics pp. 39-70. , Vol. 45, No. 1-2, 1990, 76(90)90093-9doi:10.1016/0304-40 Copyright © 2012 SciRes. JMF

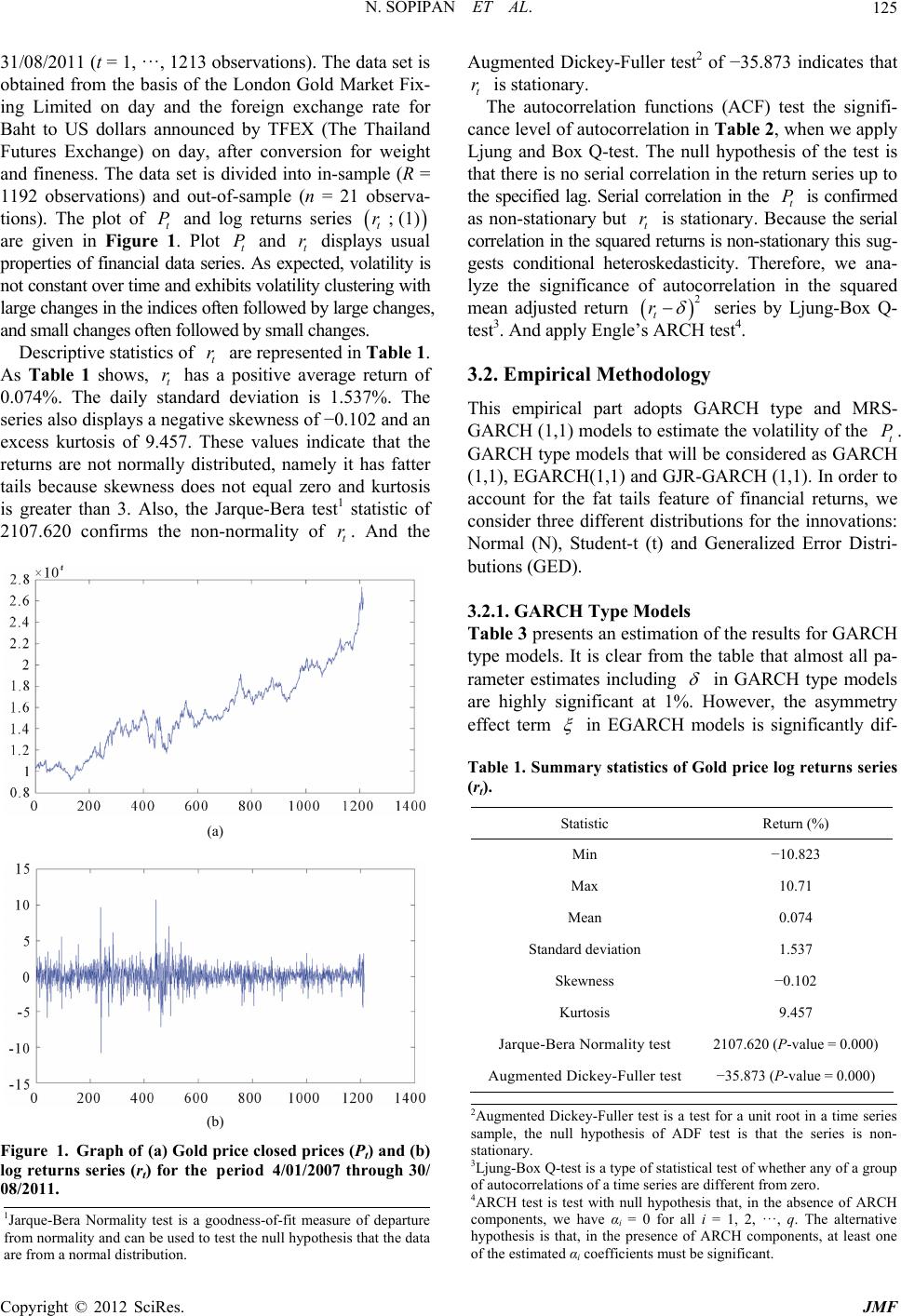

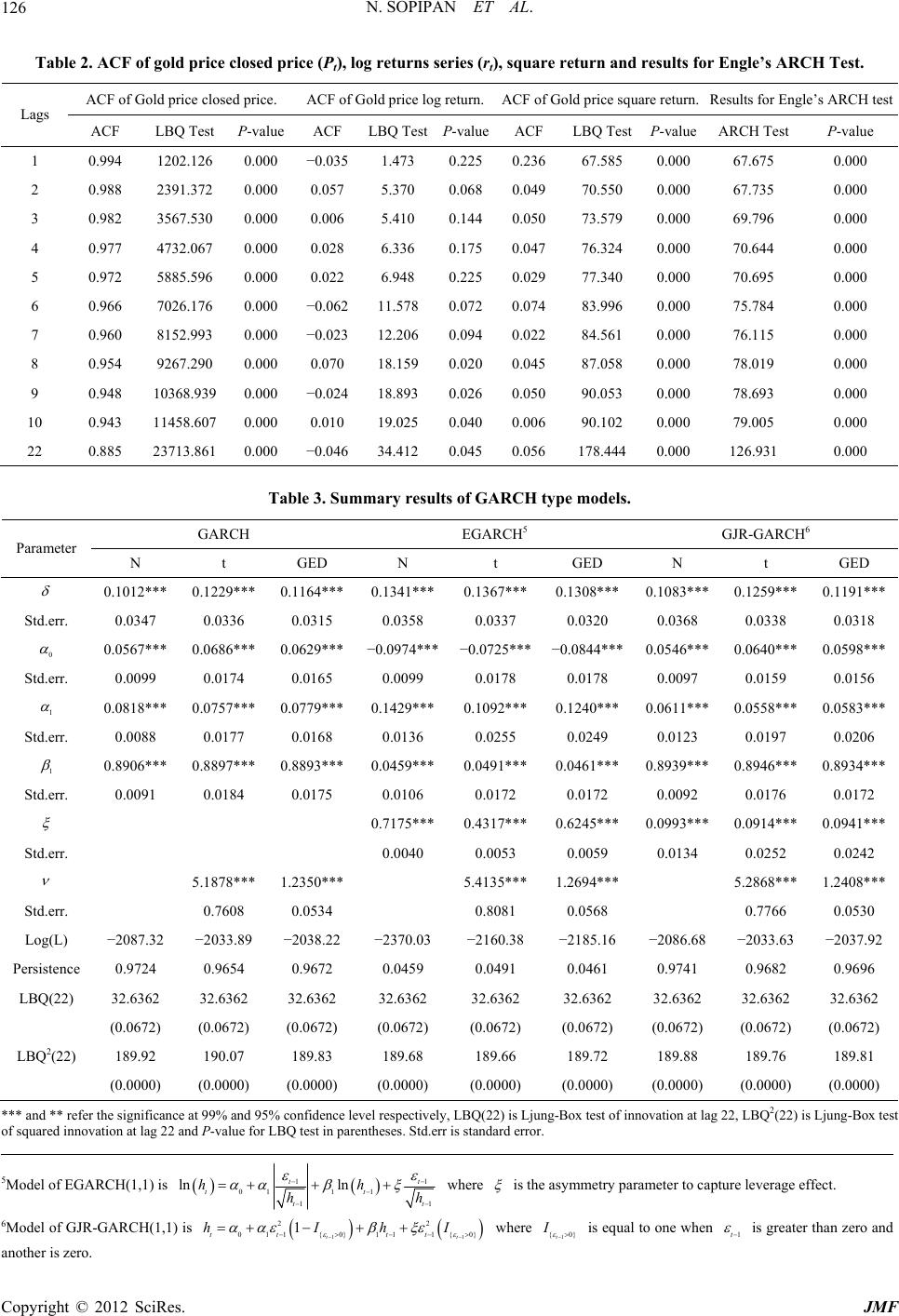

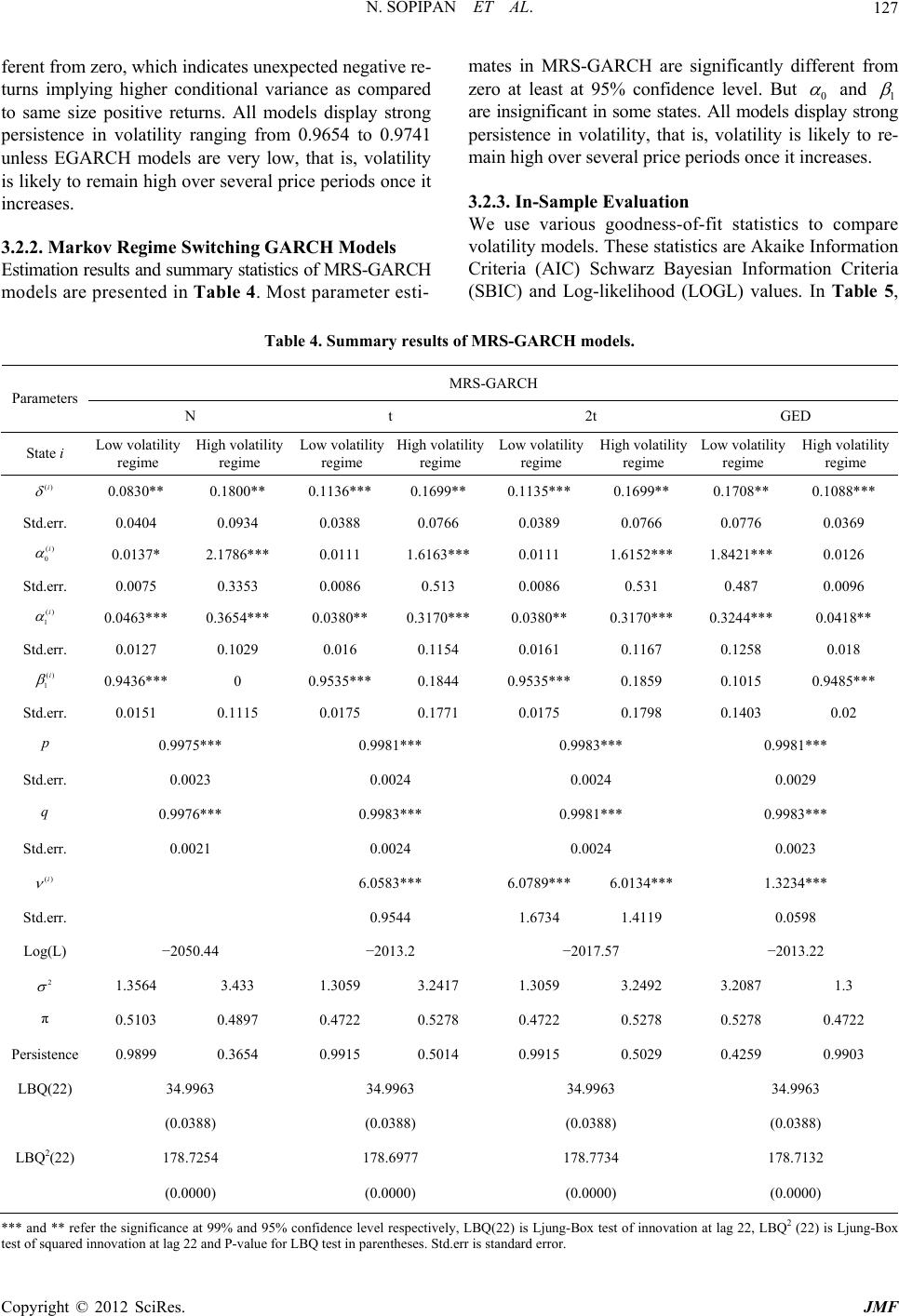

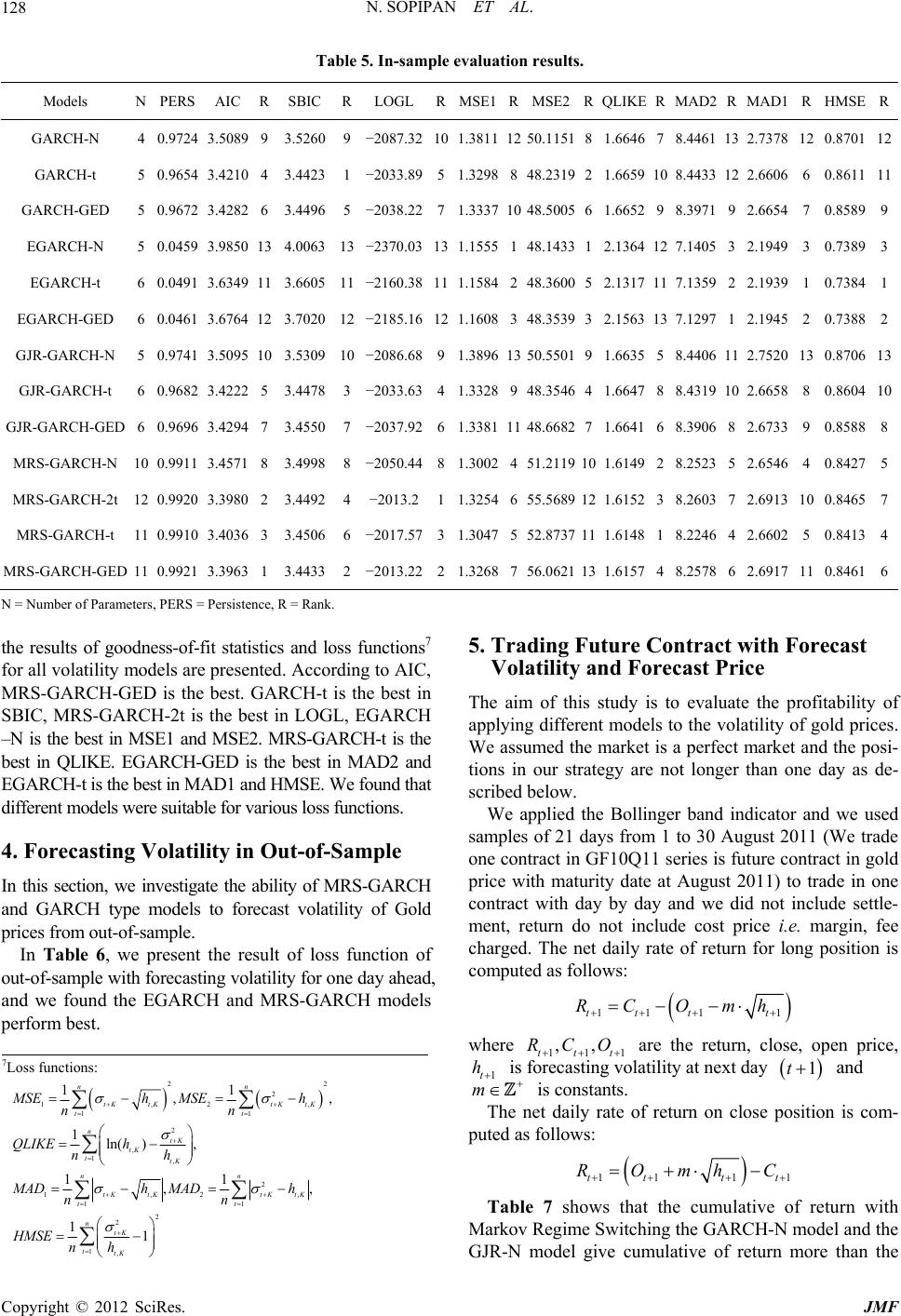

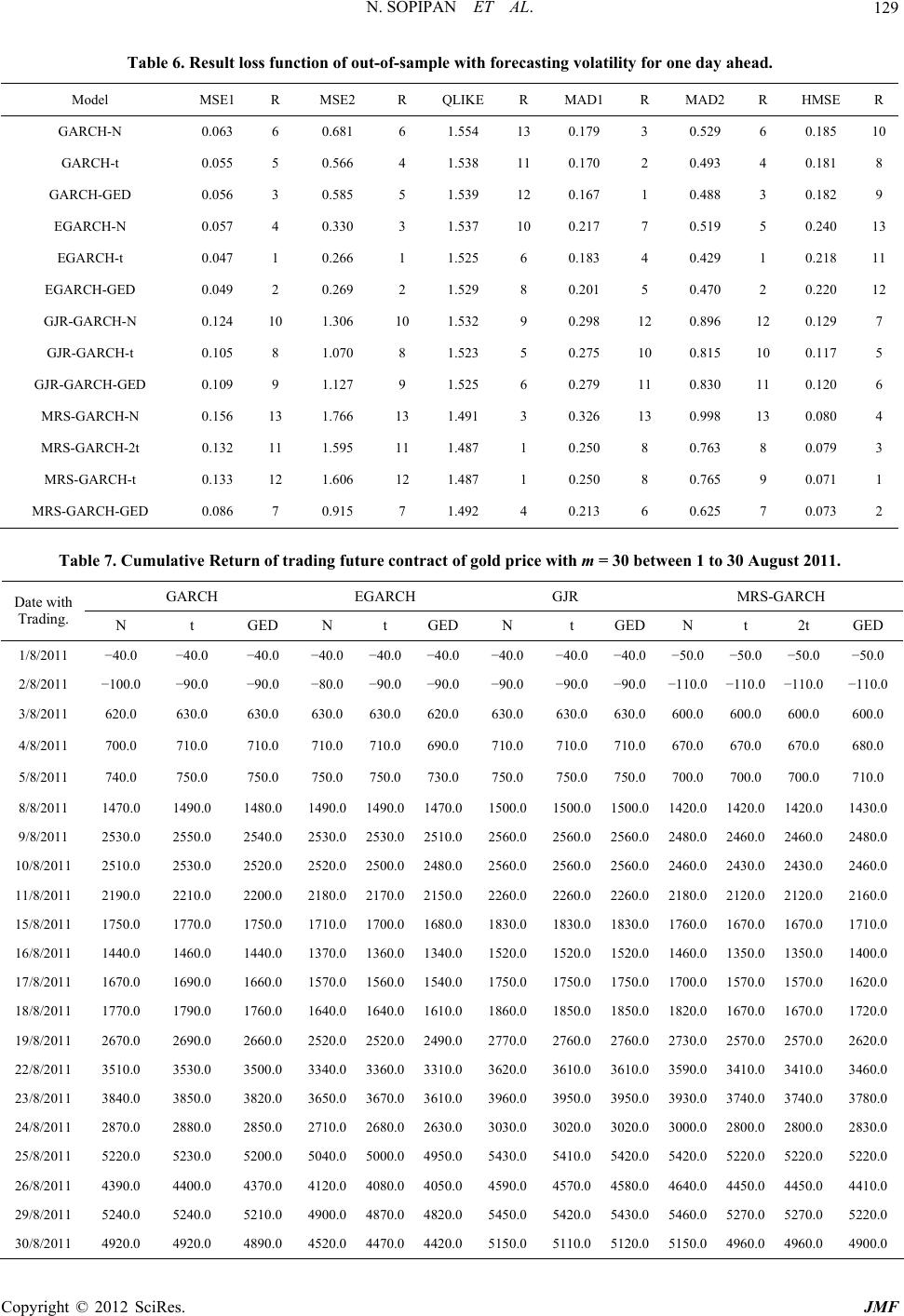

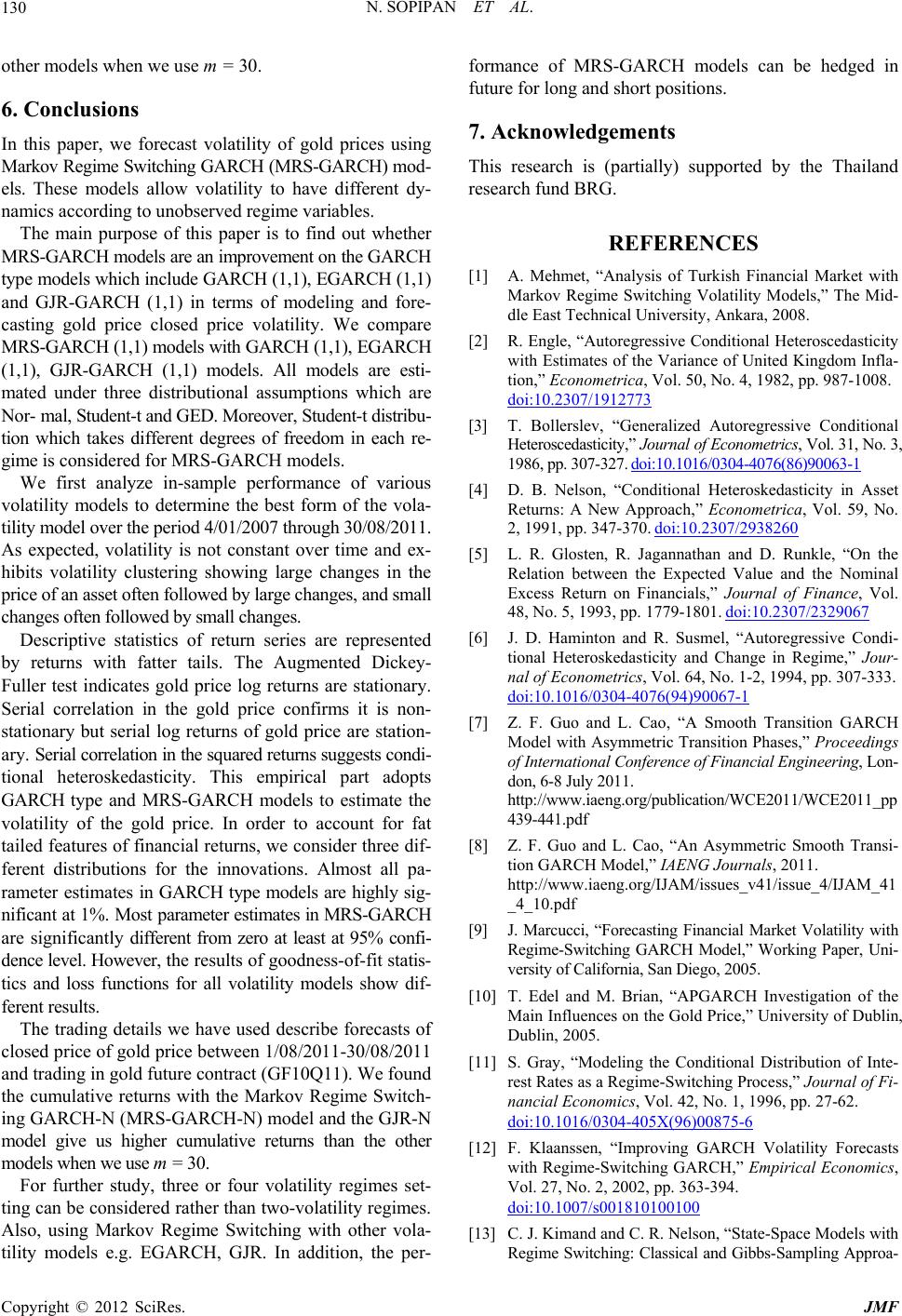

|