Theoretical Economics Letters, 2012, 2, 87-93 http://dx.doi.org/10.4236/tel.2012.21017 Published Online February 2012 (http://www.SciRP.org/journal/tel) Controlling the Tax Evasion Dynamics via Majority-Vote Model on Various Topologies* Francisco W. S. Lima Dietrich Stauffer Computational Physics Lab, Departamento de Física, Universidade Federal do Piauí, Teresina, Brazil Email: fwslima@gmail.com Received October 27, 2011; revised November 18, 2011; accepted November 25, 2011 ABSTRACT Within the context of agent-based Monte-Carlo simulations, we study the well-known majority-vote model (MVM) with noise applied to tax evasion on simple square lattices (LS), Honisch-Stauffer (SH), directed and undirected Bara- basi-Albert (BAD, BAU) networks. In to control the fluctuations for tax evasion in the economics model proposed by Zaklan, MVM is applied in the neighborhood of the noise critical qc to evolve the Zaklan model. The Zaklan model had been studied recently using the equilibrium Ising model. Here we show that the Zaklan model is robust because this can be studied using equilibrium dynamics of Ising model also through the nonequilibrium MVM and on various topologies cited above giving the same behavior regardless of dynamic or topology used here. Keywords: Opinion Dynamics; Sociophysics; Majority Vote; Nonequilibrium 1. Introduction The Ising model [1,2] has become a excellent tool for to study other models of social application. The Ising model was already applied decades ago to explain how a school of fish aligns into one direction for swimming [3] or how workers decide whether or not to go on strike [4]. In the Latané model of Social Impact [5] the Ising model has been used to give a consensus, a fragmentation into many different opinions, or a leadership effect when a few people change the opinion of lots of others. To some extent the voter model of Liggett [6] is an Ising-type model: opinions follow the majority of the neighbour- hood, similar to Schelling [7], all these cited models and others can be found out in [8]. Already Föllmer (1974) [9] applied the Ising model to economics. Realistic models of tax evasion appear to be necessary because tax evasion remain to be a major predicament facing governments [10-13]. Experimental evidence provided by Gächter [14] indeed suggests that tax payers tend to condition their decision regarding whether to pay taxes or not on the tax evasion decision of the members of their group. Frey and Torgler [15] also provide empirical evidence on the rele- vance of conditional cooperation for tax morale. Follow- ing the same context, recently, Zaklan et al. [16] devel- oped an economics model to study the problem of tax evasion dynamics using the Ising model through Monte- Carlo simulations with the Glauber and heatbath algo- rithms (that obey detailed-balance equilibrium) to study the proposed model. I have introduced for the first time the use of local majority rules in social systems. I also include a review paper on all my contributions to the field of sociophysics. Another one shows that a unifying paper on all discrete opinion models. I hope you will find these papers of interest. Grinstein et al. [17] have argued that nonequilibrium stochastic spin systems on regular square lattices with up-down symmetry fall into the universality class of the equilibrium Ising model [18]. This conjecture was con- firmed for various Archimedean lattices and in several models that do not obey detailed balance [19-22]. The majority-vote model (MVM) is a nonequilibrium model proposed by M. J. Oliveira in 1992 [20] and defined by stochastic dynamics with local rules and with up-down symmetry on a regular lattice shows a second-order phase transition with critical exponents β, γ, and ν which characterize the system in the vicinity of the phase tran- sition identical with those of the equilibrim Ising model [1] for regular lattices. Lima et al. [23] studied MVM on VD random lattices with periodic boundary conditions. These lattices posses natural quenched disorder in their connections. They showed that presence of quenched connectivity disorder is enough to alter the exponents and from the pure model and therefore that is a relevant term to such non-equilibrium phase-transition with dis- agree with the arguments of Grinstein et al. [17]. Recently, simulations on both undirected and directed scale-free networks [24-30], random graphs [31] and social networks [32-35], have attracted interest of re- *This paper is dedicated to Dietrich Stauffer. C opyright © 2012 SciRes. TEL  F. W. S. LIMA 88 searchers from various areas. These complex networks have been studied extensively by Lima et al. in the con- text of magnetism (MVM, Ising, and Potts model) [35- 39], econophysics models [16,40] and sociophysics model [41]. In the present work, we study the behavior of the tax evasion on two-dimensional LS, BAD and BAU networks, and SH networks using the dynamics of MVM, furthermore add a policy makers’s tax enforcement mechanism consisting of two components: a probability of an audit each person is subject to in everyperiod and a length of time detected tax evaders remain honest. We aim here is to extend the study of Zaklan et al. [16], which illustrates how different levels of enforcement affect the tax evasion over time, to dynamics of MVM as an alternative model of nonequilibrium to the Ising model that is capable of reproduce the same results for analysis and control of the tax evasion fluctuations. Then, we show that the Zaklan model is very robust for equili- bruim and nonequilibrium models and also for various topologies used here. We show that the choice of using the Ising (equilibrium dynamics) or MVM (nonequilib- rium dynamics) used to evolve the Zaklan model is ir- relevant, because the results obtained in this work are about the same for both Ising and MVM. The Zaklan model also is robust, because it works on LS, SH net- work, BAD and BAU networks. We show that for dif- ferent topologies the Zaklan model reaches our objective, that is, to control the tax evasion of a country (Germany and others). This does not occur with other models as Axelrod-Ross model for evolution of ethnocentrism [41], because the results are different depending of the topol- ogy of the network. The Ising model also is not robust, because on directed BA network occur with other models as Axelrod-this no phase transition present as also on directed LS, 3D, 4D and directed hypercubics lattices [42]. As described above, the MVM was proposed by M.J. Oliveira in 1992 [22] in order to improve the crite- rion of Grinstein et al. [17], initially described above. In the order to achieve his goal he used 44 (LS) Archi- medean lattice. However, also with the aim of improve this criterion other researchers studied MVM on several other topologies that are not Archimedeans [39,43-48]. To their surprise all results obtained for the critical ex- ponents are different from results obtained by M. J. Oliveira, and are also different for each topology used. Pereira et al. [49] then concluded that MVM has differ- ent universality classes which depend only on the topol- ogy used, and that all have one thing in common that is their effective dimension, obtained by critical exponents for each topology used, equals Deff = 1. Here, we show that the Zaklan model behavior is identical for all to- pologies or dynamics studied here. Therefore, we believe that this model is very robust, different the other models cited above. Galam [50-53] introduced for the first time local majority rules in social systems to the field of so- ciophysics using discrete opinion models. Here, we also hope to introduce for the first time the use of MVM to the field of sociophysics or econophysics using discrete opinions as in the Zaklan. Therefore, we do not live in a social equilibrium, any rumor or gossip can lead to a government or market chaos and we believe that nothing is better than a nonequilibrium model (MVM) to explain events of nonequilibrium. Stock market generalized to market, in order to include currency exchange. The re- mainder of our paper is organised as follows. In Section 2, we present the Zaklan model evolving with dynamics of MVM. In Section 3 we make an analysis of tax eva- sion dynamics with the Zaklan model on two-dimen- sional square lattices using MVM for their temporal evolution under different enforcement regimes; we dis- cuss the results obtained. In Section 4 we show that MVM also is capable to control the different levels of the tax evasion analysed in Section 3, as it was made by Zaklan et al. [16] using Ising models. We use the en- forcement mechanism cited above on various structures: SL, SH network, BAD and BAU network; we discuss the resulting tax evasion dynamics. Finally in Section 5 we present our conclusions about the study of the Zaklan model using MVM. 2. Zaklan Model On a square lattice each site of the lattice is inhabited, at each time step, by an agent with “voters” or spin vari- ables σ taking the values +1 representing an honest tax payer, or −1 trying to at least partially escape her tax duty. Here is assumed that initially everybody is honest. Each period individuals can rethink their behavior and have the opportunity to become the opposite type of agent they were in previous period. In each time period the system evolves by a single spin-flip dynamics with a probability given by 1 1112 2 i k ii wqS i (1) where Sx is the sign 1 of x if . 0x 0Sx if 0x , and the summation runs over all i nearest- neighbour sites k i of i . In this model an agent as- sumes the value 1 depending on the opinion of the majority of its neighbors. The control noise parameter q plays the role of the temperature in equilibrium systems and measures the probability of aligning antiparallel to the majority of neighbors. Then various degrees of ho- mogeneity regarding either position are possible. An ex- tremely homogenous group is entirely made of honest people or tax evaders, depending the sign Sx of the majority of neighbhors. If of the neighbors is zero the agent Sx i will be honest or evader in the next Copyright © 2012 SciRes. TEL  F. W. S. LIMA Copyright © 2012 SciRes. TEL 89 time period with probability 12. We further introduce a probability of an efficient audit . Therefore, if tax evasion is detected, the agent must remain honest for a number k of time steps. Here, one time step is one sweep through the entire lattice. p q k are triggered in order of to control the tax evasion level. The individual remain honests for a certain number of periods, as explained before in Sections 2 and 3. We also extend our study to other networks as the SH net- work, BAD and and BAU networks with N = 400 sites. As before the initial configurations is with all honest agents (i ) at fixed “Social Temperature” q. Here, we have been performed simulations of 25,000 time steps. 3. Controlling the Tax Evasion Dynamics Here, we first will present the baseline case, i.e., no use of enforcement, for different network structure. We use for LS, BAD and BAU network, and SH network. All simulation are performed over 25,000 time steps, as shown in Figure 1. For very low noises the part of autonomous decisions almost completely disappears. The individuals then base their decision solely on what most of their neighbours do. A rising noise has the opposite effect. Individuals then decide more autonomously. For MVM it is known that for c, half of the people are honest and other half cheat, while for c states dominated by cheating or by correlated changed into dominated; you always have correlations compliance prevail for most of the time. Because this behavior we set some values close to qc, where the case that agents dis- tribute in equal proportions onto the two alternatives is excluded. Then having set the noise parameter, , close to (qc = 0.075) on the square lattice, as suggested in Sec- tion 3, we vary the degrees of punishment (k = 1, 10 and 50) and audit probability rate (p = 0.5%, 10% and 90%). Therefore, if tax evasion is detected, the enforcement mechanism and the period time of punishment q qq q p In Figure 1 we plot the baseline case k = 0, i.e. , no use of enforcement, for the LS (a), SH (b), BAU (c), and BAD (d) for dynamics of the tax evasion over 25,000 time steps. Although everybody is honest initially, it is impossible to predict which level of tax compliance will be reached at some time step in the future. Figure 2 illustrates different simulation settings for square lattice, for each considered combination of degree of punishment (k = 1, 10 and 50) and audit probability rate (p = 0.5%, 10% and 90%), where the tax evasion is plotted over 20,000 time steps. Here we show that even a very small level the enforcement (p = 0.5% and k = 1) suffices to reduce fluctuations in tax evasion and to es- tablish mainly compliance. Both a rise in audit probabil- ity (greater p) and higher penalty (greater k) work to flat- ten the time series of tax evasion and to shift the band of possible non-compliance values towards more comp li- ance. However, the simulations show that even extreme enforcement measures (p = 90% and k = 50) cannot fully solve the problem of tax evasion. Figure 1. Baseline case for different network structure. Where we use q = 0.95qc on different networks. All simulation are performed over 25,000 time steps.  F. W. S. LIMA 90 In Figure 3 we display tax evasion for BAD and BAU networks, SH networks for different enforcement for k = 1, 10, and 50 with the same audit probability p = 1%. We observe for BAD ou BAU network that the tax evasion level decreases with increasing time periods k of punish- ment, similar behavior also occurs for SH network. Figure 2. The square lattice model of tax evasion with various degrees of enforcement q = 0.95qc and 20,000 time steps. Figure 3. Display tax evasion for different enforcement regimes for BA and SH Network and for degrees of punishment k = 1, 10, 50 and audit probability rate pa = 4.5%. Copyright © 2012 SciRes. TEL  F. W. S. LIMA 91 Figure 4. Display of the tax evasion for different enforcement regimes for BA and SH network. Again, we use 25,000 time steps. In Figure 4 we plot tax evasion for BAD and BAU networks, and SH network, again for different enforce- ment k = 1, 10, and 50, but now with audit probability . For BAD and BAU, and SH networks the tax evasion level decreases with increasing audit probability showing that an increase of the audit probability fa- vors the control of tax evasion. In all case studied here, we observed that the time period of punishment is important to control tax evasion. 4.5%p p k 4. Conclusion In summary, tax evasion can vary widely across nations, reaching extremely high values in some developing countries. Wintrobe and Gёrxhani [54] explains the ob- served higher level of tax evasion in generally less de- veloped countries with a lower amount of trust that peo- ple have in governmen tal institutions. To study this problem Zaklan et al. [16] proposed a model, called here call the Zaklan model, using Monte Carlo simula- tions and a equilibrium dynamics (Ising model) on square lat- tices. Their results are good agreement with analytical and experimental results obtained by [9-15,54]. In this work we show that the Zaklan model is very robust for analysis and control of tax evasion, because we use a nonequilibrium dynamics (MVM) to simulate the Zaklan model, that is the opposite of the study done by [16] equilibrium dynamics (Ising model), and also on various topologies used here. Our results are qualitatively and quantitatively identical the results obtained by Zaklan et al. [16] giving the same behavior regardless of dynamic or topology. Here, we also hope to have introduced for the first time the use of MVM to the field of sociophysics and econophysics using discrete opinion model as Zaklan model. As we do not live in a social equilibrium and any rumor or gossip can lead to a government or market chaos, we believe that nothing is better than a nonequi- librium model (MVM) to explain events of nonequilib- rium. Therefore, as the Zaklan model is a sociophysics and econophysics model, we also believe that the best topology used for simulations of this model are social networks of BAD and SH type. 5. Acknowledgements The author thanks D. Stauffer for many suggestion and fruitful discussions during the development this work and also for the reading this paper. We also acknowledge the Brazilian agency FAPEPI (Teresina-Piauí-Brasil) for its financial support. This work also was supported the sys- tem SGI Altix 1350 the computational park CENA-PAD. UNICAMP-USP, SP-BRAZIL. REFERENCES [1] L. Onsager, “Crystal Statistics. I. A Two-Dimensional Copyright © 2012 SciRes. TEL  F. W. S. LIMA 92 Model with an Order-Disorder Transition,” Physical Re- view, Vol. 65, No. 3-4, 1944, pp. 117-149. doi:10.1103/PhysRev.65.117 [2] R. J. Baxter, “Exactly Solved Models in Statistical Me- chanics,” Academic Press, London, 1982. [3] E. Callen and D. Shapero, “A Theory of Social Imita- tion,” Physics Today, Vol. 27, No. 7, 1974, 23 Pages. doi:10.1063/1.3128690 [4] S. Galam, Y. Gefen and Y. Shapir, “Sociophysics: A Mean Behavior Model for the Process of Strike,” Journal of Mathematical Sociology, Vol. 9, 1982. doi:10.1080/0022250X.1982.9989929 [5] B. Latané, “The Psychology of Social Impact,” American Psychologist, Vol. 36, No. 4, 1981, pp. 343-356. [6] T. M. Liggett, “Interacting Particles Systems,” Springer, New York, 1985. doi:10.1007/978-1-4613-8542-4 [7] T. C. Schelling, “Dynamic Models of Segregation,” Journal of Mathematical Sociology, Vol. 1, No. 2, 1971, pp. 143-186. doi:10.1080/0022250X.1971.9989794 [8] D. Stauffer, S. Moss de Oliveira, P. M. C. de Oliveira and J. S. Sá Martins, “Biology, Sociology, Geology by Com- putational Physicists,” Elsevier, Amsterdam, 2006. [9] H. Föllmer, “Random Economies with Many Interacting Agents,” Journal of Mathematical Economics, Vol. 1, 1974, p. 51. doi:10.1016/0304-4068(74)90035-4 [10] K. Bloomquist, “A Comparison of Agent-Based Models of Income Tax Evasion,” Social Science Computer Re- view, Vol. 24, No. 4, 2006, pp. 411-425. doi:10.1177/0894439306287021 [11] J. Andreoni, B. Erard and J. Feinstein, “Tax Compli- ance,” Journal of Economic Literature, Vol. 36, No. 2, 1998, pp. 818-860. [12] L. Lederman, “Interplay between Norms and Enforce- ment in Tax Compliance,” Public Law Research Paper No. 50, 2003. [13] J. Slemrod, “Cheating Ourselves: The Economics of Tax Evasion,” Journal of Economic Perspective, Vol. 21, No. 1, 2007, pp. 25-48. doi:10.1257/jep.21.1.25 [14] S. Gächter, “Moral Judgments in Social Dilemmas: How Bad is Free Riding?” Discussion Papers 2006-03 CeDEx, University of Nottingham, 2006. [15] B. S. Frey and B. Togler, “Managing Motivation, Or- ganization and Governance,” IEW-Working Papers 286, Institute for Empirical Research in Economics, University of Zurich, 2006. [16] G. Zaklan, F. W. S. Lima and F. Westerhoff, “Controlling Tax Evasion Fluctuations,” Physica A, Vol. 387, No. 23, 2008, pp. 5857-5861. doi:10.1016/j.physa.2008.06.036 [17] G. Grinstein, C. Jayaprakash and Y. He, “Statistical Me- chanics of Probabilistic Cellular Automat,” Physical Re- view Letters, Vol. 55, No. 23, 1985, pp. 2527-2530. doi:10.1103/PhysRevLett.55.2527 [18] J. S. Wang and J. L. Lebowitz, “Phase Transitions and Universality in Nonequilibrium Steady States of Stochas- tic Ising Models,” Journal of Statistical Physics, Vol. 51, No. 5-6, 1988, pp. 893-906. doi:10.1007/BF01014891 [19] M. C. Marques, “Nonequilibrium Ising Model with Competing Dynamics: A MFRG Approach,” Physics Letters A, Vol. 145, No. 6-7, 1990, pp. 379-382. doi:10.1016/0375-9601(90)90954-M [20] M. J. Oliveira, “Isotropic Majority-Vote Model on a Square Lattice,” Journal of Statistical Physics, Vol. 66, No. 1, 1992, pp. 273-281. doi:10.1007/BF01060069 [21] F. W. S. Lima, “Majority-Vote Model on (3, 4, 6, 4) and (34, 6) Archimedean Lattices,” International Journal of Modern Physics C (IJMPC), Vol. 17, No. 9, 2006, pp. 1273-1283. doi:10.1142/S0129183106009849 [22] M. A. Santos and S. J. Teixeira, “Universality Classes in Nonequilibrium Lattice Systems,” Statistical Physics, Vol. 78, 1995, p. 963. doi:10.1007/BF02183696 [23] F. W. S. Lima, U. L. Fulco and R. N. Costa Filho, “Ma- jority-Vote Model on a Random Lattice,” Physical Review E, Vol. 71, No. 3, 2005, Article ID 036105. doi:10.1103/PhysRevE.71.036105 [24] M. E. J. Newman, S. H. Strogatz and D. J. Watts, “Ran- dom Graphs with Arbitrary Degree Distributions and Their Applications,” Physical Review E, Vol. 64, No. 2, 2001, Article ID 026118. doi:10.1103/PhysRevE.64.026118 [25] A. D. Sanchez, J. M. Lopez and M. A. Rodriguez, “Non- equilibrium Phase Transitions in Directed Small-World Networks,” Physical Review Letters, Vol. 88, No. 4, 2002, Article ID 048701. doi:10.1103/PhysRevLett.88.048701 [26] G. Palla, I. J. Farkas, P. Pollner, I. Derenyi and T. Vicsek, “Directed Network Modules,” New Journal of Physics, Vol. 9, No. 6, 2007, pp. 186-207. doi:10.1088/1367-2630/9/6/186 [27] A.-L. Barabási and R. Albert, “Emergence of Scaling in Random Networks,” Science, Vol. 286, No. 5439, 1999, pp. 509-512. doi:10.1126/science.286.5439.509 [28] A. Aleksiejuk, J. A. Holyst and D. Stauffer, “Ferromag- netic Phase Transition in Barabasi-Albert Networks,” Physica A, Vol. 310, No. 1-2, 2002, pp. 260-266. doi:10.1016/S0378-4371(02)00740-9 [29] M. A. Sumour and M. M. Shabat, “Monte Carlo Simula- tion of Ising Model on Directed Barabasi-Albert Net- work,” International Journal of Modern Physics C, Vol. 16, No. 4, 2005, pp. 585-589. doi:10.1142/S0129183105007352 [30] M. A. Sumour and M. M. Shabat and D. Stauffer, “Ab- sence of Ferromagnetism in Ising Model on Directed Barabasi-Albert Network,” Islamic University Journal (Gaza), Vol. 14, 2006, p. 209. [31] P. Erd¨os and A. Rényi, “Graphy Theory and Probabil- ity,” Canadian Journal of Mathematics, Vol. 6, 1959, p. 290. [32] D. J. Watts and S. H. Strogatz, “Collective Dynamics of Small-World Networks,” Nature, Vol. 393, 6684, 1998, pp. 440-442. doi:10.1038/30918 [33] S. Wasseman, K. Faust and B. Balobás, “Social Networks Analysis,” Cambridge University Press, Cambridge, 1994. [34] D. Stauffer, M. Hohnisch and S. Pittnauer, “Consensus Copyright © 2012 SciRes. TEL  F. W. S. LIMA Copyright © 2012 SciRes. TEL 93 Formation on Coevolving Networks: Groups’ Formation and Structure,” Physica A, Vol. 370, No. 2, 2006, pp. 734-740. doi:10.1016/j.physa.2006.05.033 [35] F. W. S. Lima, “Majority-Vote on Directed Barabasi- Albert Networks,” International Journal of Modern Physics C, Vol. 17, No. 9, 2006, pp. 1257-1265. [36] F. W. S. Lima, “Ising Model Spin S=1 on Directed Barabási-Albert Networks,” International Journal of Modern Physics C, Vol. 17, 2006, p. 257. [37] F. W. S. Lima, “Potts Model with q States on Directed Barabasi-Albert Networks,” Communications in Compu- tational Physics, Vol. 2, 2007, pp. 522-529. [38] F. W. S. Lima, “Simulation of Majority Rule Disturbed by Power-Law Noise on Directed and Undirected Barabási Albert Networks,” International Journal of Modern Physics C, Vol. 19, 2008, p. 1063. doi:10.1142/S0129183108012686 [39] F. P. Fernandes and F. W. S. Lima, “ Persistence in the Zero-Temperature Dynamics of the Q-states Potts Model on Undirected-Directed Barabási-Albert Networks and Erdös-Rènyi Random Graphs,” International Journal of Modern Physics C, Vol. 19, No. 12, 2008, pp. 1777-1785. doi:10.1142/S0129183108013345 [40] F. W. S. Lima and G. Zaklan, “A Multi-Agent-Based Approach to Tax Morale,” International Journal of Mod- ern Physics C, Vol. 19, 2008, pp. 1797-1822. doi:10.1142/S0129183108013357 [41] F. W. S. Lima, T. Hadzibeganovic and D. Stauffer, “Evolution of Ethnocentrism on Undirected and Directed Barabási Albert Networks,” Physica A, Vol. 388, No. 24, 2009, pp. 4999-5004. doi:10.1016/j.physa.2009.08.029 [42] F. W. S. Lima and D. Stauffer, “Ising Model Simulation in Directed Lattices and Networks,” Physica A, Vol. 359, 2006, pp. 423-429. doi:10.1016/j.physa.2005.05.085 [43] P. R. Campos, V. M. Oliveira and F. G. B. Moreira, “Majority-Vote Model on Small World Network,” Phy- sical Review E, Vol. 67, No. 2, 2003, Article ID: 026104. [44] F. W. S. Lima, “Majority-Vote on Undirected Barabási- Albert Networks,” Communications in Computational Physics, Vol. 2, No. 2, 2007, pp. 358-366. [45] E. M. S. Luz and F. W. S. Lima, “Majority-Vote on Di- rected Small-World Networks,” International Journal of Modern Physics C, Vol. 18, 2007, p. 1251. doi:10.1142/S0129183107011297 [46] F. W. S. Lima, A. O. Sousa and M. A. Sumuor, “Majority- Vote Model on Directed Erdos-Renyi Random Graph,” Physica A, Vol. 387-389, 2008, pp. 3503-3511. doi:10.1016/j.physa.2008.01.120 [47] S. Galam, “Sociophysics: A Review of Galam Models,” International Journal of General Systems, Vol. 17, No. 2, 1990, pp. 191-209. doi:10.1080/03081079108935145 [48] S. Galam, “Social Paradoxes of Majority Rule Voting and Renormalization Group,” Journal of Statistical Physics, Vol. 61, 1990, pp. 943-951. doi:10.1007/BF01027314 [49] L. F. C. Pereira and F. G. B. Moreira, “Majority-Vote Model on Random Graphs,” Physical Review E, Vol. 71, No. 1, 2005, Article ID 016123. doi:10.1103/PhysRevE.71.016123 [50] S. Galam, B. Chopard, A. Masselot and M. Droz, “Emer- gence in Multi-Agent Systems Part II: Axtell, Epstein and Young’s Revisited,” European Physical Journal B, Vol. 4, No. 4, 1998, pp. 529-531. doi:10.1007/s100510050410 [51] S. Galam, “Collective Beliefs versus Individual Inflexi- bility: The Unavoidable Biases of a Public Debate,” Physica A: Statistical Mechanics and Its Applications, Vol. 390, No. 17, 2005, pp. 3036-3054. [52] S. Gekle, L. Peliti and S. Galam, “Opinion Dynamics in a Three-Choice System,” European Physical Journal B, Vol. 45, No. 4, 2005, pp. 569-575. doi:10.1140/epjb/e2005-00215-3 [53] S. Galam, “Sociophysics: A Review of Galam Models,” International Journal of Modern Physics C, Vol. 19, No. 3, 2008, pp. 409-440. doi:10.1142/S0129183108012297 [54] R. Wintrobe and K. G¨erxhani, “Tax Evasion and Trust: A Comparative Analysis,” Proceedings of the Annual Meeting of the European Public Choice Society, 2004.

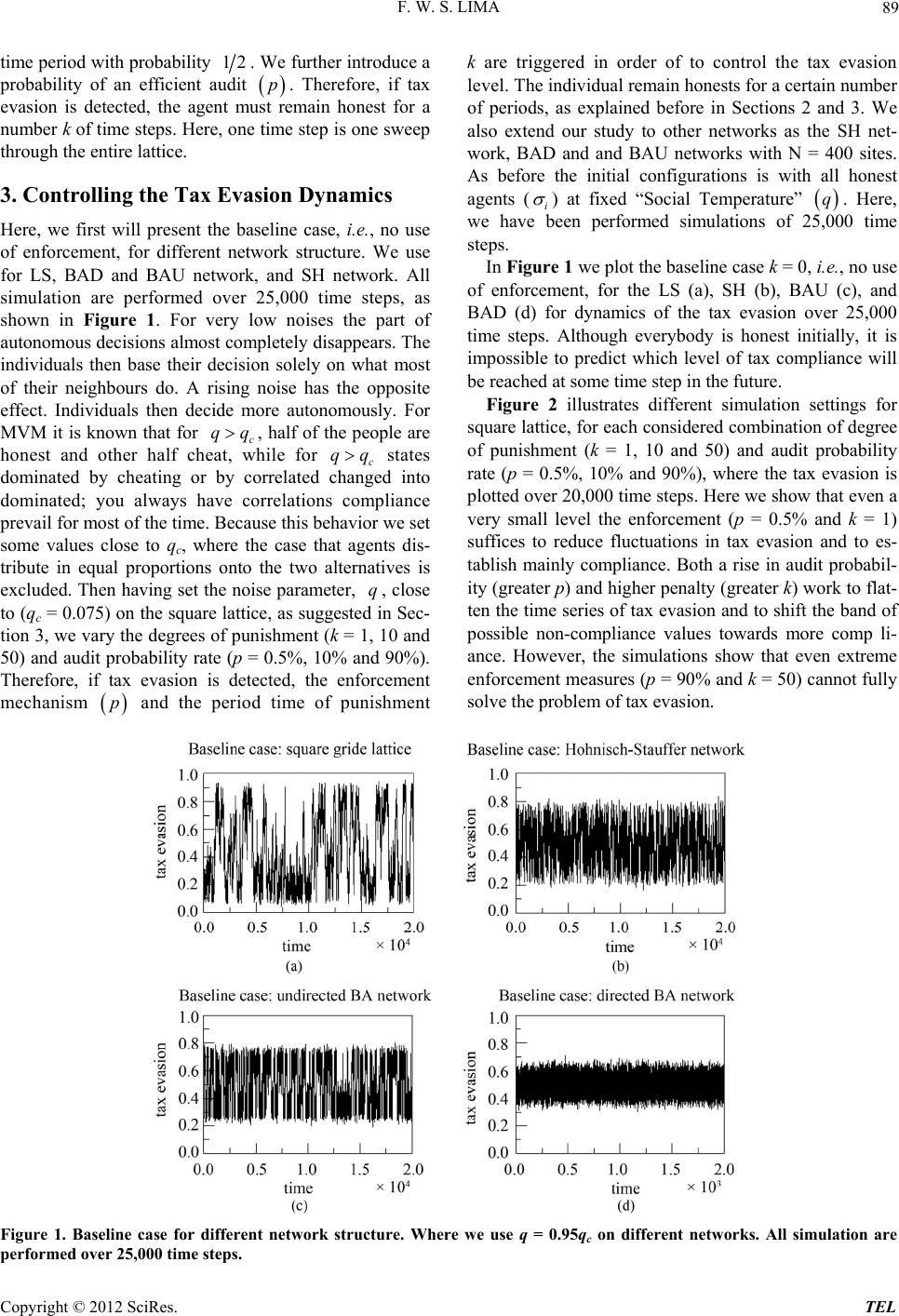

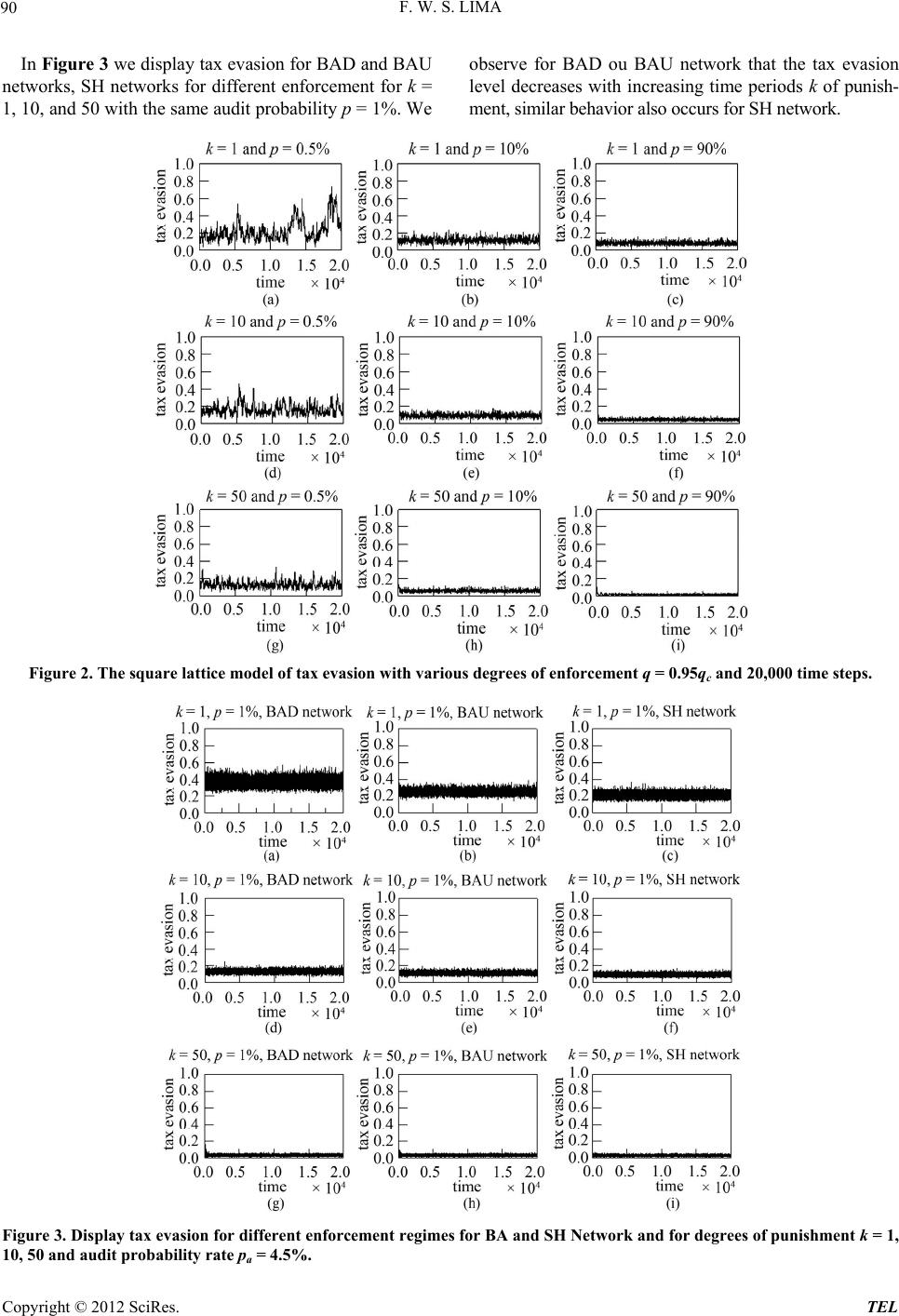

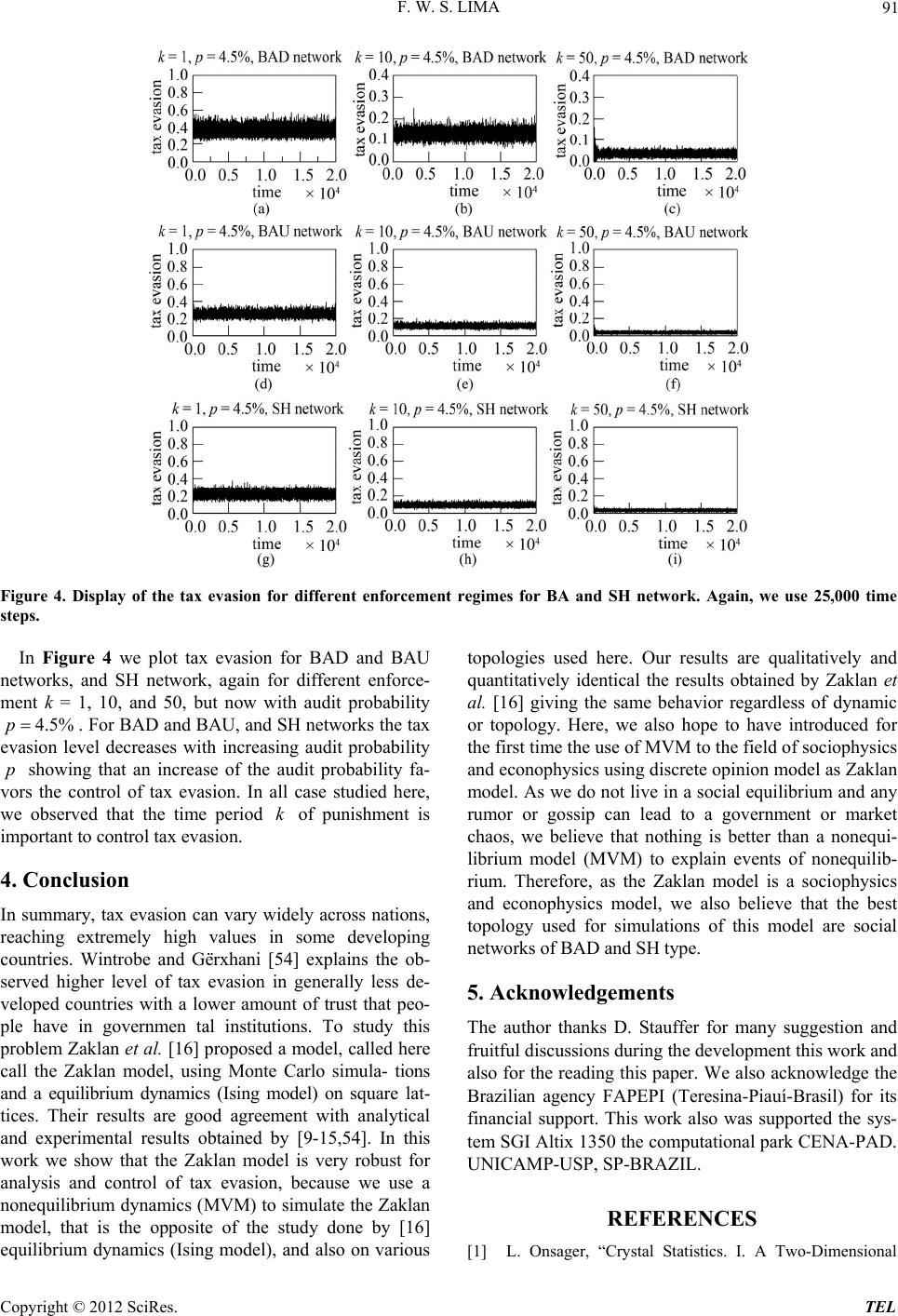

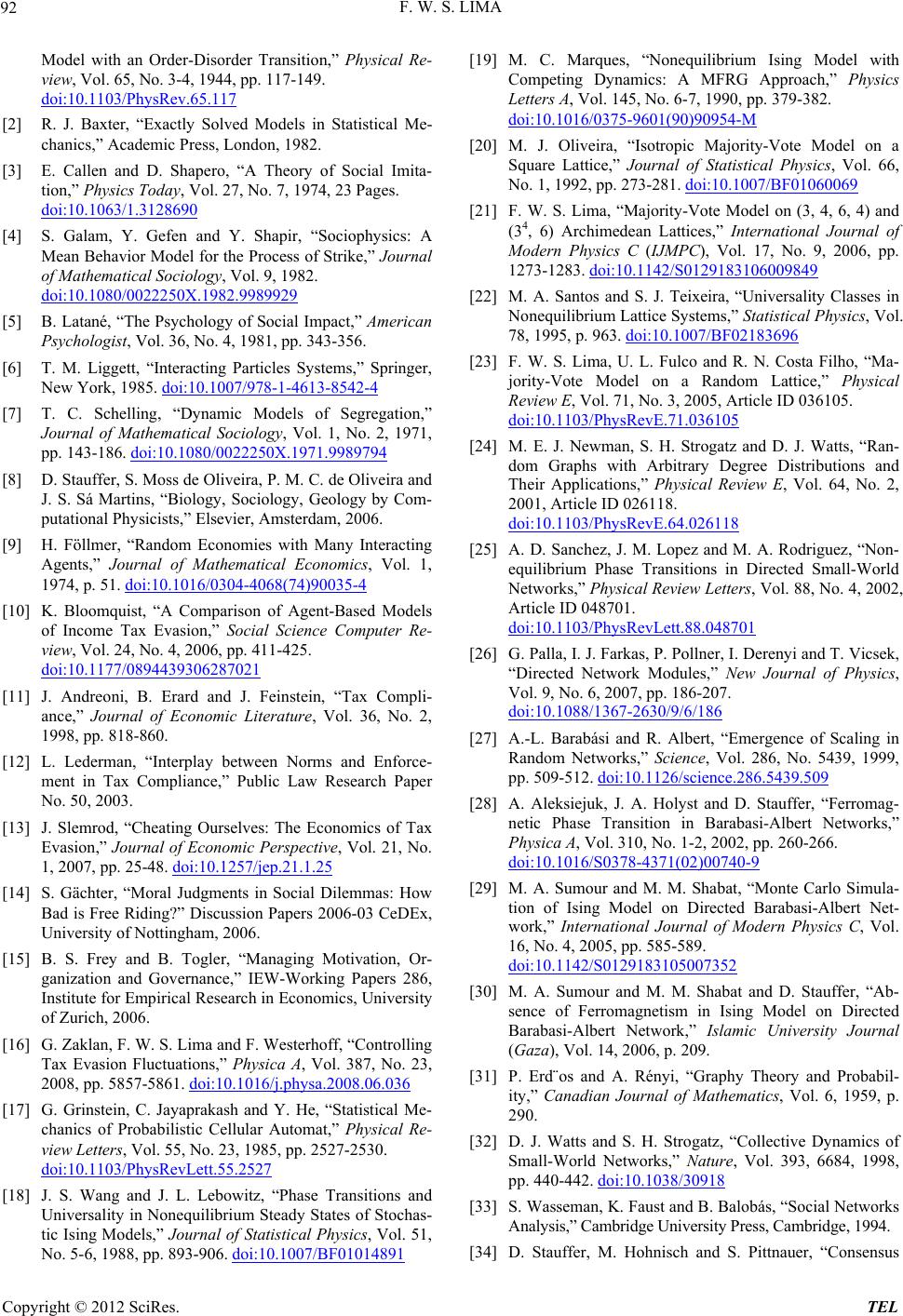

|