Modern Economy

Vol.3 No.2(2012), Article ID:18158,7 pages DOI:10.4236/me.2012.32034

Market Structure Formation Mechanism of Bit Product

School of Economics and Management, Beijing University of Posts and Telecommunications, Beijing, China

Email: yedan420@139.com

Received November 8, 2011; revised December 28, 2011; accepted January 13, 2012

Keywords: Bit Product; Digital Economy; Market Structure; Technological Innovation

ABSTRACT

Bit products are those which are expressed in binary 0 and 1, they are distributed over data networks and stored in the form of bit stream. And the market structure of bit product differs from traditional physical products very much; there exist a widely popular phenomenon of “winner takes all” and long-tail market. This paper discusses what strengths the monopoly tendency while compelling the market environment becomes more competitive and why the structure is unstable. It’s the positive feedback of a synthetic function of economy of scale, network effect, lock-in effect and economy of scope that makes the market favor monopolization. At the same time, the short lifespan of bit product and differentiation guarantees the fierce competition. What’s more, technological innovations bring changes to market structures and accelerate the dynamic evolution.

1. Introduction

Bit products are those which are expressed in binary 0 and 1, they are distributed over data networks and stored in the form of bit stream. Examples of bit products are music files, electronic books, websites and standardized software. They are infinitely expansible, discrete, aspatial (at once everywhere and nowhere), and recombinant [1-3]. With completely different characteristics from the traditional physical products, it displays many specialties in the scope of market structure. On one hand, there is a widespread discipline that “winner takes most” or even “winner takes all” and it’s easy for us to distinguish the main stream product in every niche market. On the other hand, the term long tail also works when turn to describe the distribution of companies’ market share. What’s more, the stability of market structure seems to be very fragile and is constantly changing, especially when compared with that of traditional product market.

Recently, more and more researchers have paid their intention to the market structure of information goods, especially those with strong network externality and their abundant achievements contribute much to explaining the new market dynamics. For example, Huai Li & Liangmou Gao(2001) suggested a new form of market structure—competitive monopoly to emphasize the unique characteristics [4]. Others investigated the consequences to market structure of network effect, positive feedback, technological innovation and standardization, from theory to application, such as Qianlong Zhu (2007), Kun Pi (2009), (Lifang Zhang and Minghong Zhang, 2009)

[5-7]. And from the two-sided market perspective, people well illustrated why some platform-based market in areas such as system software, instant communication, video games and so on would make a difference by measuring cross-side network effect [8]. To sum up, previous studies are of great importance to summarize and explain the new characteristics of bit product market structure. However, we can also see that they primarily focus on the concentrated and monopolistic aspect of the market structure and little attention is paid to the competitive aspect or the dynamic evolution. So in this paper, we aim to reconsider the market structure formation mechanism from a systematic view and find out the key factors that strengthen both the monopoly and competition and shorten the transforming cycle.

2. Market Structure Formation Mechanism

Market structure is one of the basic topics in bit economy research; it is the concept reflecting the relations between market competition and the monopoly and refers to enterprises in quantity, share, scale relations, as well as the form of this competition in the specific market.

2.1. Factors in Favor of Monopolization

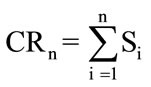

Most researchers hold the point of view that the economic characteristics of digital goods and networks may favor monopolization. Concentration ratios are usually used to show the extent of market control of the largest firms in the industry and to illustrate the degree to which an industry is oligopolistic. The standard tools of competition economists and competition authorities to measure market concentration are the Herfindahl-Hirschman Index (HHI) and the concentration ratios CRn. Here we use CR1, CR2 and CR4 to measure some main bit product market. CRn is expressed as:

(1)

(1)

where Si is the market share and n defines the ith firm.

The practical data shows that many bit products have a very high concentration rate, especially, the cases of operation system (OS), searching engine, browser, and instant message (IM) support this argument very well, no matter in the global area or just in China, see Tables 1 and 2. According to Bain’s standard, an industry with its CR4 higher than 80% can be considered to be high concentration, and the result computed in the table can prove that almost all the bit products have a very concentrated market structure.

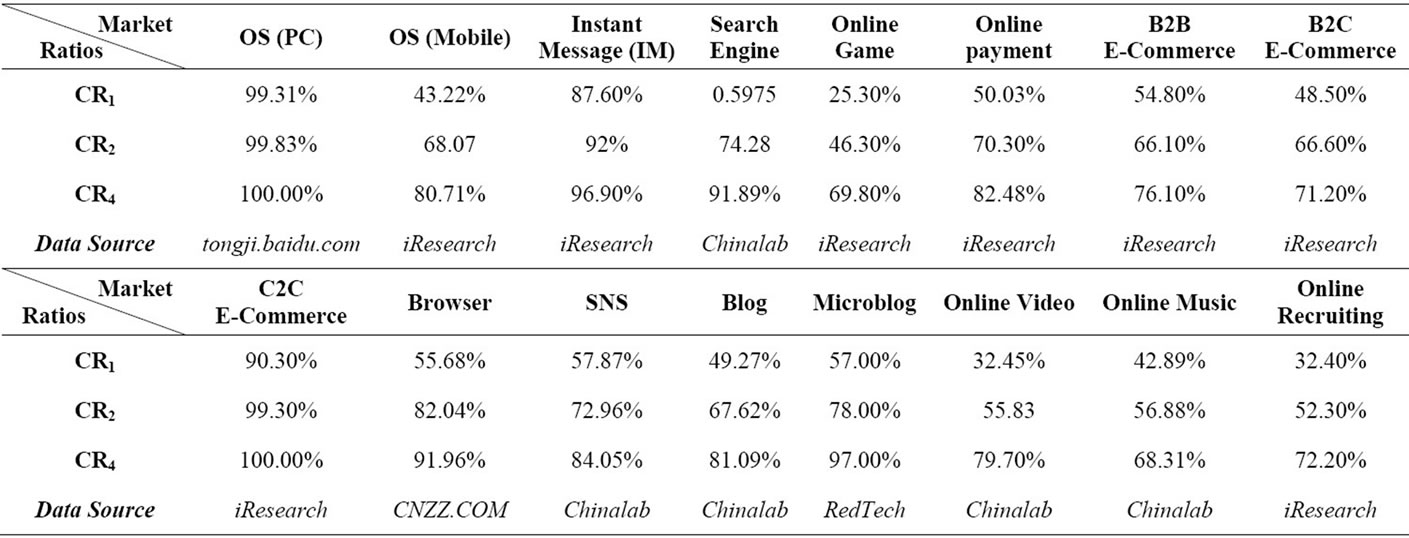

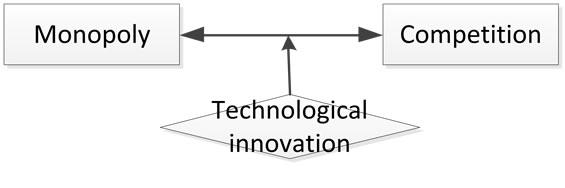

So, it’s interesting to find the reason behind this common phenomenon. Here, by looking into the fundamental characteristics of bit product, we list the most important factors and their relationship, which are shown in the Figure 1.

2.1.1. The Supply-Side Economies of Scale

Natural monopoly theory believes that the long-term average cost curve plays a decisive role to the form of market structure. For a single product, when the longterm average costs trends to decline all the time, the market share will gradually be occupied by the company [9].

The cost curve feature of bit product has a great impact on the appearing of a highly monopolistic market. Since it takes little to copy a bit product (which means the marginal cost is very low), although there will be increasing cost comes along with the expansion of production, the increasing speed is very slow, so the average

Table 1. Global market share of some bit products and their CR2 and CR4 by October 2011.

Table 2. Market concentration rate of main bit products in China by 2010.

Figure 1. Factors that makes bit product market in favor of monopolization.

cost curve is showing a unilateral decreasing trend. Under this circumstance, the company can get increasing returns, and if we do not take management and coordination costs into account, the company’s cost advantage based on increasing returns can make the economies of scale tend to infinity for the supply side and result in a company dominating the market. Meanwhile, only by expanding the production, can the company apportion the huge fixed costs effectively, thus achieving the economies of scale. And opposed to the traditional manufactured products whose economy of scale is limited, the economy of scale for bit product creation is infinite.

2.1.2. Network Effects

Most bit product has network externality, which is commonly defined as the increasing utility that a user derives from consumption of a product as the number of other users who consume the same product increases. Depending on the network type, network effects can be direct or indirect. Direct network effects are generated through the direct effects of the number of consumers using the same product. In contrast, indirect network effects are not directly related to the total number of users, but rather depend on the availability and the variety of complementtary goods or services. Network effect brings the forming of demand-side economies of scale in bit product market directly. As everyone’s utility of consuming will have an influence upon each other, which specifically means more users, higher utility, there will be an obvious bandwagon effect in the market. So, there will be an invisible hand—market selection mechanism, making the market tends to accept only the best or main product or technology, and becomes monopoly [10-12].

2.1.3. Lock-In

Lock-in effect of bit product consumption usually come along with switching cost, which may contains learning cost and searching cost and so on. Due to this switching cost, customers are easily bound to systems they choose. As we known, most bit products are high-tech products; it takes time to get familiar with operation and if the customers want to change a system, not only will they confront new learning cost, but also the risk of high complexity and uncertainty. What’s worse, since many bit products functioned similarly are not compatible to each other, when a customer decides to leave, all the resources he accumulates on the former product will be gone, too. So, a rational customer considering whether staying at the old system or changing to a new one, it depends on the trade-off between his costs and benefits.

As for the company who has gained an advantage in the competition, his profitability gets enhances with the continuously expansion of the market share, so the ability to invest more resources to increase the performance of its product quality, technical superiority will develop faster than his competitors [3]. So users are more willing to stay in existing products or systems, rather than to seek other alternatives. Therefore, the role of lock-in effect helps the monopolists sustain their market statues.

2.1.4. The Economy of Scope

The recombinant characteristic of bit products favors economies of scope, on one hand, they may go along with versioning (a free version plus several paid versions), on the other hand, bit product can be bound or enveloped with other product (it can be physical product or other bit product) to achieve the economies of scope. Commonly, the products bound together are not functional unrelated, but complemented. In the case of software, economies of scope arise when Windows operation system, Office and Internet Explorer are bound together by the provider, since Office and Internet Explorer are complementary products to operation system. As for the companies, by bounding a portfolio of products, they can reduce the total cost and add the probability to offer a lower price for their customers, thus creating a larger competitive advantage.

So, the economies of scope may result in the survival of only one network among the conceivable alternatives and greater the danger of monopolization.

2.1.5. Standard Competition and Standardization

When two kinds of incompatible technologies compete against each other to become the de facto standard, we say that they carrying out standard war. From macroscopic view, standard competition is a competing form and from microscopic view, it is a business competition strategy, the driver behind the phenomenon is the popularity of standardizing trend which mainly lies in two aspects: one is about the standardization of technology development and the other is about the customers’ leaning towards standard products.

It has been argued that the development of technology has a feature of path-dependent, which means the tendency of a past or traditional practice or preference to continue even if better alternatives are available. So, the technological innovations are more likely to appear within those companies who have accumulative advantage. Meanwhile, network effects emphasize the importance of customers’ expectation for future which makes it conventional that customer think their best choice is to accept the products that most likely to become the standard. So, customers’ choices become more and more concentrated and convergent, which in turn will accelerate the evolution of standardization.

2.1.6. A Summary

In a systematic view, multi-factors involving the supply-side economies of scale, network effects, lock-in, economies of scope and standardization mingle together and function in a synergetic that generates a self-reinforcing positive feedback mechanism, thus making the market more and more concentrated. The market’s equilibrium inclines to one product or technology (the standard one), and this finally leads the structure to the statue of monopoly or oligopolistic. As bit products are of hightech and innovation element, the initial investment is doomed to be comparatively high since R & D activities is very costly. But after the first piece of bit product having been created, to copy bunches of it or reproduce is very cheap, so it’s possible for companies to supply on demand and customers’ need becomes the determinant factor. The product with larger market share is more valuable to consumers and the positive feedback mechanism results in even more sales, not to mention the technological barrier caused by intellectual property rights’ protection for the privatization of a de facto technology standard. In all, the competitive advantage of the leading company grows quickly and is easier to lock-in its customers by increasing their switching costs thus keeping its monopoly position sustained.

2.2. Factors in Favor of Competition

In contrast to former factors, there also exist factors which may favor competition. The most important are as follows:

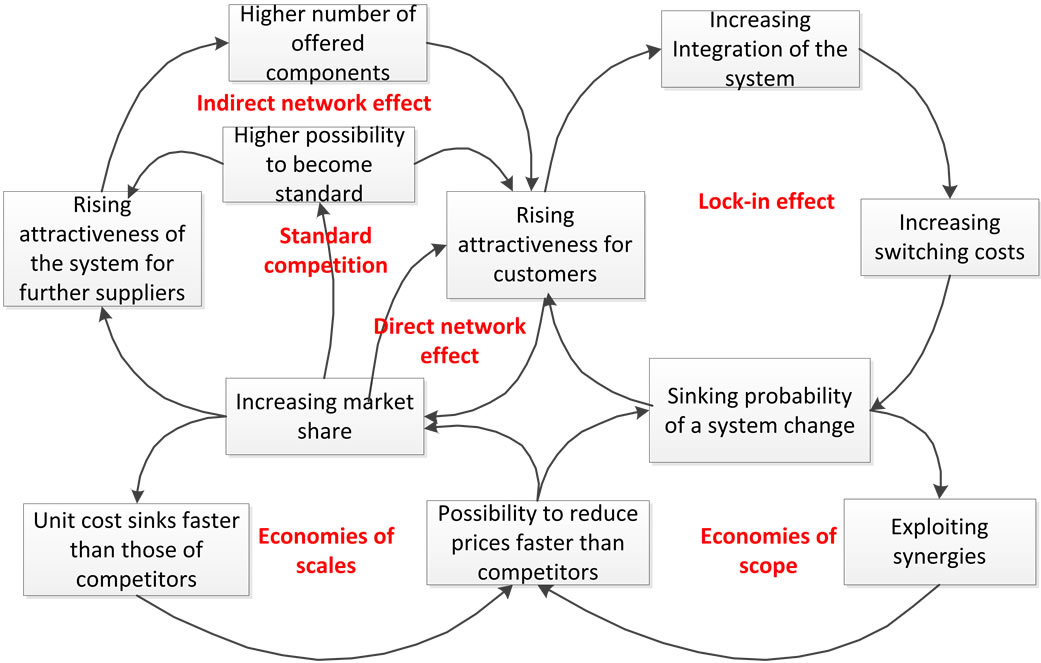

2.2.1. The Driver from Potential Monopoly Profit

In the former section, we have mentioned that the item” winner takes all”, which means as along as someone dominant the market, he can possess huge monopoly profits. Take Tencent (A Chinese Internet Company who wins a monopoly position in IM market in China) for example, increasing profit ARPU accompanies with its stronger market force, see Table 3. The potential monopoly profits attract many participants to conduct technological innovation and join the race, these companies try to offer better products/service and meet customers’ need in order to win market shares and achieve profits. We can always see the scene that one falls and another step into the breach and promote the prosperity of bit-product market competition.

2.2.2. Short Lifecycle of Bit Product

Compared to traditional products, the lifecycle of bit product is much shorter. The constantly changing of consumers’ demand facilitates the quickly upgrade of bit product. Usually, the next generation of alternative products appears before the former ones have completely standardized. And instead of saturation and recession of the

Table 3. ARPU of tencent users from 2004 to 2010.

old products, the replacement happens mainly because of the change of customers’ value evaluation which means there is chance for new comers to challenge the incumbents.

The short lifecycle largely weaken the durability of the technology barrier of the market, which means it is impossible for companies to obtain a long-term monopoly profits relying on making a great effort to innovate once and for all to save future trouble. An incumbent has to be alert even with high market share, because once a new comer launches a substitute or upgrading product that is more attractive to customers; it can break the monopoly of the current market and provoke fierce market competetion

2.2.3. Differentiation

Differentiation is always an effective way to enforce competition, no matter under what economic circumstance. Since bit product is consist of code sequences in strings of 0 and 1, it has better variability and its producers are easier to conduct customization and personalizetion. In other words, the companies’ ability to offer differential product is strengthen. Meanwhile, customers’ preferences on diversity and differentiation are growing stronger and stronger. In traditional market, it’s rather difficult to match suppliers’ ability with customers’ requirement effectively, because the shelves’ volumes are limited while user’s needs are infinite and people can hardly find all they want in one place. However, the digital revolution has changed the situation and created extremely favorable conditions to realize people’s dreams: not only connect the world's computer users together and to create a new form of market, a virtual one based on the cyber space. Firstly, the internet eliminates the physical distance between each user and enlarges the scale of buyers and sellers. Secondly, the searching engine technologies greatly reduce people’s searching costs and help customers quickly get the information correlates with their desire and at the same time, help the companies to find their potential customers precisely. Thanks to the new technology, the even greater variability in demand, and the opportunities for demand fragmentation and price discrimination for different demand segments, the “long tail” theory does work in the market share distribution area [13] .

2.2.4. Altruistic and Intrinsic Behavior to Prevent Monopolistic Power

People more or less have some sense of exclusion for monopoly power, in case that the dominant vendor would abuse this power and harm consumers’ rights and interests. Recently, the emerging of open source movement has a great impact on the market structure, and to some extent, this can be view as an altruistic and intrinsic behavior to prevent monopolistic power.

2.2.5. Institutional Barriers and Government Intervention

Institutional barriers such as national tax laws or rules for invoicing and language barriers may prevent global monopolies [3] . Also, government interventions such as subsidies and purchase can hinder the formation of monopolies and promote competition in the market.

2.2.6. Others

Furthermore, some argues that monopolization tendencies with digital companies are not severe, because of the competition phase to acquire a monopoly implies low prices while this may not be profit-maximized or optimized. Also, it should be conceded that the previouslymentioned forces towards monopolization might not be all-dominant. Firms such as taobao.com could not have functioned on the internet alone but rely on financial (payment system) and distribution system.

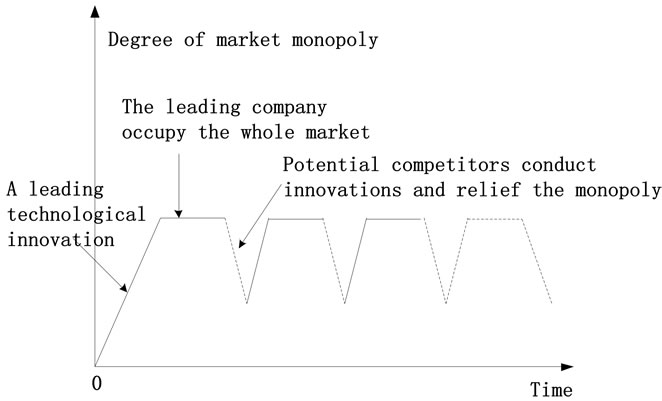

2.3. Factors That Contribute to Transformation between Monopolization and Competition

As for the relationship between market structure and technological innovation, it is an old industrial organizational paradigm. In recent years, there is a renewed interest in the relationship between market structure and technological innovation. On one hand, market structure can affect technological innovation. Most researchers believed that a relatively reasonable market mechanism (monopoly competition) can promote the enterprise technology innovation, and we think this is still reliable under the new economic environment. On the other hand, technological innovation can affect market structure in return and has become a key factor that accelerates the evolution of market, especially in the digital economy environment because the digital evolution resulted from the internet technology progress [5]. So, we think that the market mechanism and the technical innovation have one kind of bidirectional relations, they mutually affect each other, and technological innovation has enhanced the transform of monopoly and competition, as we can see in the Figure 2.

On one hand, since monopoly in bit product market is mainly the result of technological innovation (or we can

Figure 2. The mediation function of technological innovations.

also call it technological monopoly), the company who owns a technology advantage may play a dominant role in the market by creating great technology barriers. And the standardization of products also means the market will only tolerate the existence of just one technology and this to some extent protects the incumbents.

On the other hand, when we look into the whole market, we’ll that technological innovation actually is good for competition. Although technological progress can generate short-term excess profits and accompanied by a certain degree of monopoly. But in the long term, it will be undermined by imitation or new innovation because of the inherent diffusion and share characteristic of bit product. In the new environment, the best way for an entrant to defeat the incumbent is to innovate. The faster upgrading speed of technology contributes to the shorter lifecycle of bit product and the higher customer desire for the varieties and differentiations, which guarantees the survival of more companies, thus keeping the overall competitiveness of the market.

From the aspect of long-term evolution, technological innovation stimulates market structure constantly varies from monopoly to competition alternately, see Figure 3. At one stage, when a leading company finishes a technological breakthrough successfully, it can gradually take up the market. And then, the omnipresent of potential competitors can break the market statue by innovation and reduce the degree of monopoly market. In the next stage, no matter the new technology win the attack or the old one finishes its self-replacement upgrading, the degree of monopoly market will rebound again, see Figure 3. So, the dynamic evolution of market structure from monopoly to completion and then back to monopoly occurs repeatedly due to the technological innovation, which keeps the economy constantly moving forward.

3. Conclusions

In this paper, we explore the economic impact of outstanding characteristics of the bits products on its market structure and discuss what strengths the monopoly ten-

Figure 3. The dynamic evolution of market structure.

dency while compelling the market environment becomes more competitive and why the structure is unstable. We also emphasize the importance contribution of technological innovations to the dynamic evolution of market structure in the long run.

In a systematic view, the monopoly of bit product market is inevitable because it is the result of supply-side economies of scale, network effects, lock-in, economies of scope and standardization. Meanwhile, the huge monopoly profit attracts companies to pour into the competition and the developing technology and short lifespan of bit products guarantee the possibility for entrants to defeat the incumbents. And the process of all the companies competing to gain a monopolistic power compels the sustainable development of the economy.

REFERENCES

- Q. N. Ma, “Literature Review Research on the Bit Economics,” Master Dissertation, Beijing University of Post and Telecommunications, Beijing, 2009.

- K. P. Qian, “Research on the Market Structure of the Bit Economics,” Master Dissertation, Beijing University of Post and Telecommunications, Beijing, 2010.

- M. Vogelsang, “Digitalization in Open Economies: Theory and Policy Implications,” Springer, Berlin, 2010. doi:10.1007/978-3-7908-2392-9

- H. Li and L. M. Gao, “Competitive Monopoly Market Structure under the Conditions of New Economy: A Theory Model to Observe Microsoft,” Economic Research Journal, 2001.

- Q. L. Zhu, “The Research on the Interaction of Technology Innovation and Market Structure Based on Network Division of Labor,” Master Dissertation, Nanjing University of Finance and Economics, Nanjing, 2007.

- K. Pi, “The Analysis of the Monopoly Market Structure Based on Fictitious,” Master Dissertation, Xiangtan University, Xiangtan, 2009

- L. F. Zhang and M. H. Zhang, “Market Structure Transformation of Network Economic System: From Theory to Application,” Information Management and Engineering, Kuala Lumpur, 3-5 April 2009, pp. 248-252

- D. S. Evans, A. Hagiu and R. Schmalensee, “A Survey of the Economic Role of Software Platforms in Computer-Based Industries,” CESifo Economic Studies, Vol. 51, No. 2-3, 2005, pp. 189-224. doi:10.1093/cesifo/51.2-3.189

- J. Hou, “Summary of Theoretical Research on Natural Monopoly,” Accounting and Finance, No. 3, 2009.

- J. Yan, “A Theory Research on the Market Structure of Information Industry,” Party School of the Central Committee of C.P.C., Beijing, 2007.

- X. Y. Shang, “The Mechanism and Characteristic of Monopoly under Network Economy,” Journal of Central University of Finance & Economics, 2009.

- L. F. Zhang, “Positive Feedback in Network Economic System,” Control and Decision Conference, Guilin, 17-19 June 2009, pp. 5695-5699. doi:10.1109/CCDC.2009.5195214

- B. Bates, “Transforming Information Markets: Implications of the Digital Network Economy,” Proceedings of the American Society for Information Science and Technology, Vol. 45, No. 1, 2009, p. 11. doi:10.1002/meet.2008.1450450218