Applied Mathematics

Vol.3 No.12A(2012), Article ID:26048,9 pages DOI:10.4236/am.2012.312A291

Applications of Mogulskii, and Kurtz-Feng Large Deviation Results to Risk Reserve Processes with Aggregate Claims*

1Department of Mathematics, California State University Channel Islands, Camarillo, USA

2Departamento de Matemáticas, Facultad de Ciencias, Mexico City, Mexico

Email: ana.meda@ciencias.unam.mx

Received November 10, 2012; revised December 10, 2012; accepted December 17, 2012

Keywords: Large Deviations; Cramer-Lundberg Reserve Risk Processes; Probability Theory and Mathematical Statistics in Insurance; Stochastic Models for Claim Frequency; Claim Size and Aggregate Claims; Reserves

ABSTRACT

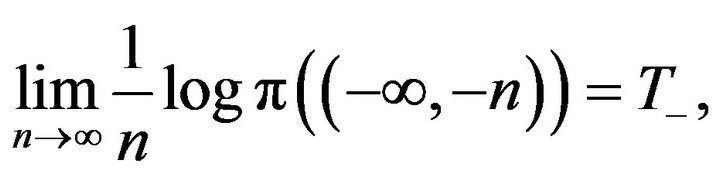

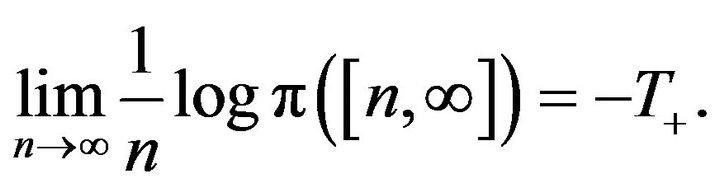

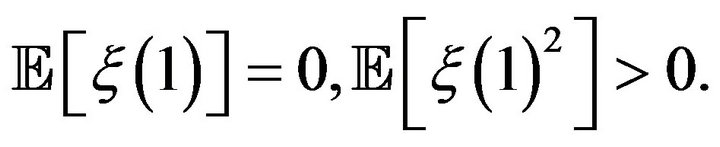

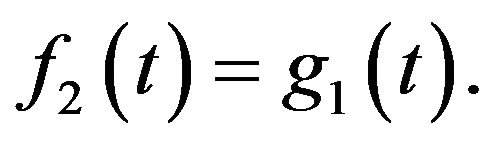

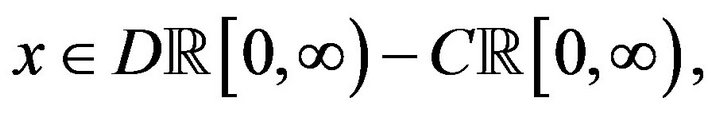

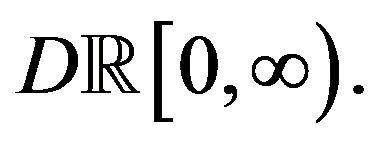

In this paper we examine the large deviations principle (LDP) for sequences of classic Cramér-Lundberg risk processes under suitable time and scale modifications, and also for a wide class of claim distributions including (the non-superexponential) exponential claims. We prove two large deviations principles: first, we obtain the LDP for risk processes on  with the Skorohod topology. In this case, we provide an explicit form for the rate function, in which the safety loading condition appears naturally. The second theorem allows us to obtain the LDP for Aggregate Claims processes on

with the Skorohod topology. In this case, we provide an explicit form for the rate function, in which the safety loading condition appears naturally. The second theorem allows us to obtain the LDP for Aggregate Claims processes on  with a different time-scale modification. As an application of the first result we estimate the ruin probability, and for the second result we work explicit calculations for the case of exponential claims.

with a different time-scale modification. As an application of the first result we estimate the ruin probability, and for the second result we work explicit calculations for the case of exponential claims.

1. Introduction

There is a wide literature on Large Deviation Techniques and Applications. Relevant to this paper are results by Mogulskii (1993), [1] who proved a Large Deviations result for independent, identically distributed (i.i.d.) random variables with generating functions finite on a neighborhood of the origin. In [2], Lynch and Sethuraman gave large deviations results for stochastic processes with independent and stationary increments. The analysis was done on the space of functions of bounded variation on  endowed with the weak*-topology. More general results were proved later, as Mogulskii and De Acosta did in [1,3,4] proving large deviations results for Lévy processes in very general settings.

endowed with the weak*-topology. More general results were proved later, as Mogulskii and De Acosta did in [1,3,4] proving large deviations results for Lévy processes in very general settings.

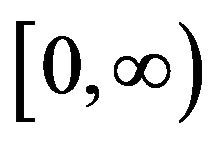

For compound Poisson processes, Li and Pechersky [5], following results by Dobrushin and Pechersky [6], proved the LDP for multi-dimensional compound Poisson processes defined on  with respect to the vague topology, and then strengthened it to the weakuniform topology introduced in [6].

with respect to the vague topology, and then strengthened it to the weakuniform topology introduced in [6].

The LDP for (reserve dependent premium with delayed claims) risk process was studied by Ganesh, Massi and Torrisi (2007) [7,8]. They proved the LDP with respect to the uniform topology in the case of superexponential claims i.e., claims for which the moment generating function is finite for every . Later, in [7], they illustrated the connection between risk processes and queues. They applied their large deviations result (valid only in the case of super-exponential claims) to obtain an approximation for the probability of ruin and to propose an importance sampling parameter for simulation. The super-exponential claims are an interesting but very particular case, since distributions such as gamma (including exponential), Negative Binomial (including geometric) claims, are not of this type.

. Later, in [7], they illustrated the connection between risk processes and queues. They applied their large deviations result (valid only in the case of super-exponential claims) to obtain an approximation for the probability of ruin and to propose an importance sampling parameter for simulation. The super-exponential claims are an interesting but very particular case, since distributions such as gamma (including exponential), Negative Binomial (including geometric) claims, are not of this type.

One way to deal with large deviations for risk processes is by proving the LDP for a sufficiently similar zero-mean Lévy process, and then using the Contraction Principle. That is the general approach we follow for Theorem 1: we examine the LDP for a sequence of risk processes with respect to the Skorohod topology under suitable time and scale modifications. We follow Mogulskii’s approach [1], whose results are based on Lynch and Sethuraman [2] to obtain an LDP for risk processes on  and give quite explicit forms for the rate function.

and give quite explicit forms for the rate function.

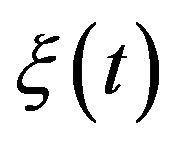

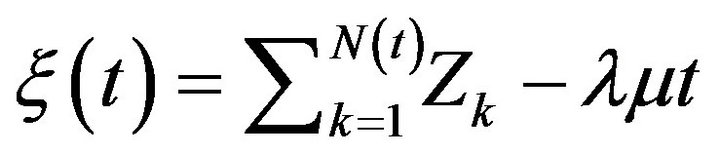

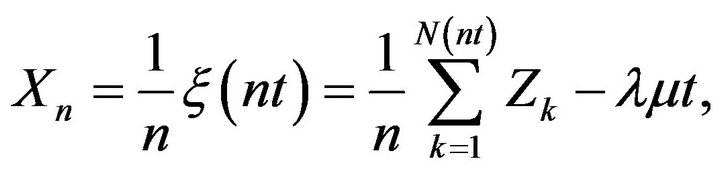

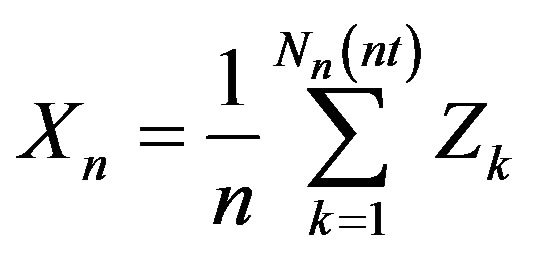

Another way to prove Large Deviations results is by first analyzing the compound Poisson component , via working with random walks

, via working with random walks  or their linearized counterpart, proving the LDP, and then dealing with the random time via exponential equivalence of the times. In this direction there is work by Feng and Kurtz, [9] and our Theorem 2 for aggregate claims processes. The difficulty with this approach is that a Poisson process could hardly be exponentially equivalent to a continuous one, and it becomes necessary to use a cumbersome change in time-space scale. We prove Large Deviation results for a wide class of claim distributions including the non-super-exponential case of exponential claims.

or their linearized counterpart, proving the LDP, and then dealing with the random time via exponential equivalence of the times. In this direction there is work by Feng and Kurtz, [9] and our Theorem 2 for aggregate claims processes. The difficulty with this approach is that a Poisson process could hardly be exponentially equivalent to a continuous one, and it becomes necessary to use a cumbersome change in time-space scale. We prove Large Deviation results for a wide class of claim distributions including the non-super-exponential case of exponential claims.

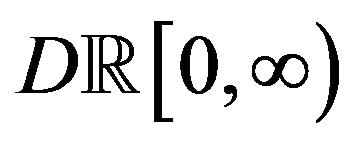

We get the LDP for aggregate claims processes on  with a suitable time-scale modification. Both results are LDP’s with respect to the Skorohod topology induced by the Skorohod distance, but the first one is in

with a suitable time-scale modification. Both results are LDP’s with respect to the Skorohod topology induced by the Skorohod distance, but the first one is in  and the second is in

and the second is in

Although the vague topology is coarser than Skorohod’s, Li and Pechersky’s large deviations results do not imply ours (Theorem 1 below) because the space  is not reflexive, and non-trivial exponential tightness should be proved first. On the other hand, we do not work with super exponential claims: we only need the moment generating function to exist on an open neighborhood of the origin, and for this reason our result is more general.

is not reflexive, and non-trivial exponential tightness should be proved first. On the other hand, we do not work with super exponential claims: we only need the moment generating function to exist on an open neighborhood of the origin, and for this reason our result is more general.

Large Deviations techniques have been used to study ruin probabilities for risk process. A standard reference here is the book by Asmussen [10], references therein, and subsequent work by the author.

On a generalization of the model, Asmussen, Klüppelberg, and Mikosch, in [11,12], studied asymptotic results for the compound Poisson process when the size of the jumps has a heavy tail (the moment generating function of the claims is  on the positive real numbers). In this case, the large deviations theory does not apply, the results are quite different, and that is not the subject of this paper.

on the positive real numbers). In this case, the large deviations theory does not apply, the results are quite different, and that is not the subject of this paper.

The organization of the paper is as follows: First, we have one Section to state the basic notation, to describe previous results, and at the end we have a small discussion about the precise shape of the rate function: that is Section 2. In Section 3, we state the basic Hypotheses that are needed all along the work.

The main results, LDP Theorems 1 and 2, are stated in Sections 4 and 5, respectively. Both are proved in the same Section they are stated. Section 6 is devoted to the explicit calculations for the case of exponential claims. These calculations are combined in Corollary 1, and later used in Section 7 to estimate the probability of ruin for exponential claims, and also for more general claims.

2. Notation, Previous Results, and the Rate Function

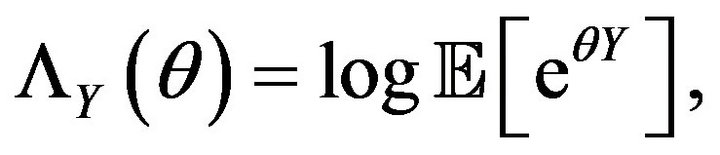

For a random variable ![]() and

and , we denote by

, we denote by  the moment generating function for Y, whenever it exists; its logarithmic generating function is

the moment generating function for Y, whenever it exists; its logarithmic generating function is  and

and

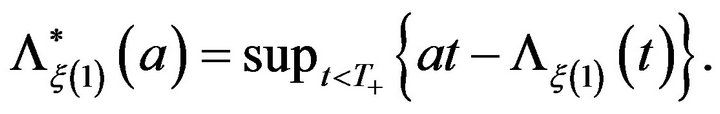

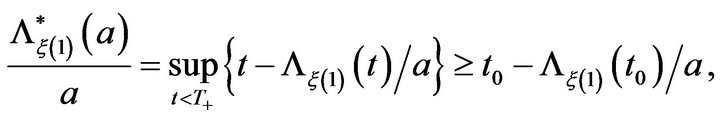

shall denote the FenchelLegendre transform of

shall denote the FenchelLegendre transform of

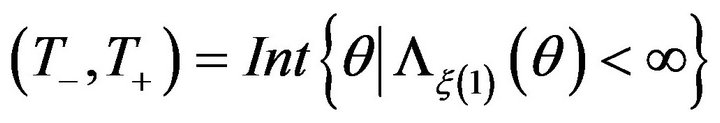

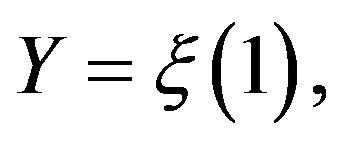

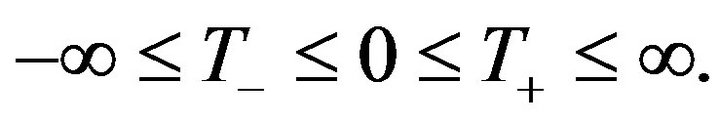

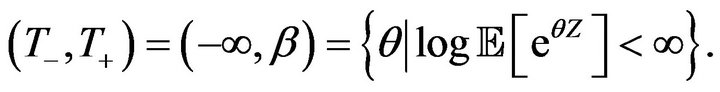

Let  denote the interior of the essential domain for the Laplace transform (and its log-generating function) of

denote the interior of the essential domain for the Laplace transform (and its log-generating function) of  where

where  is a process to be specified.

is a process to be specified.

Clearly,

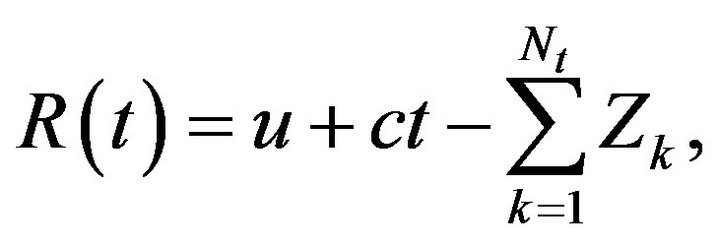

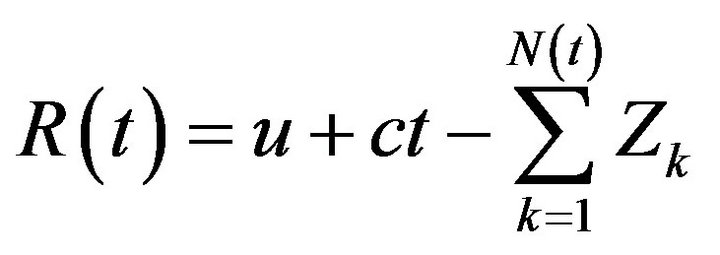

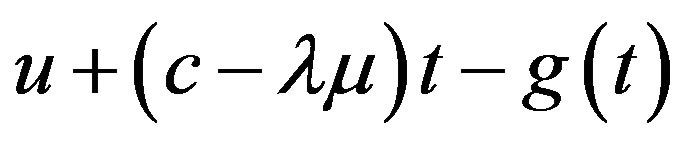

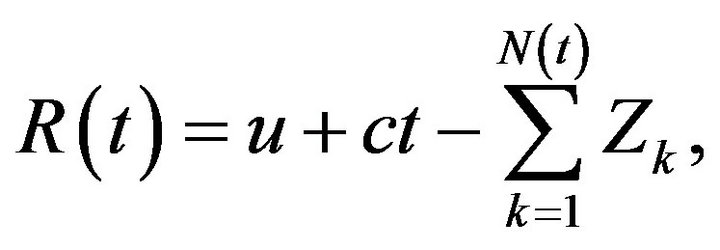

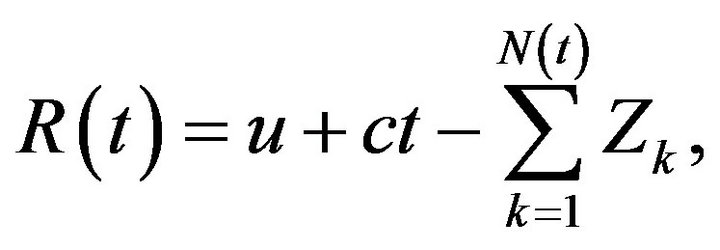

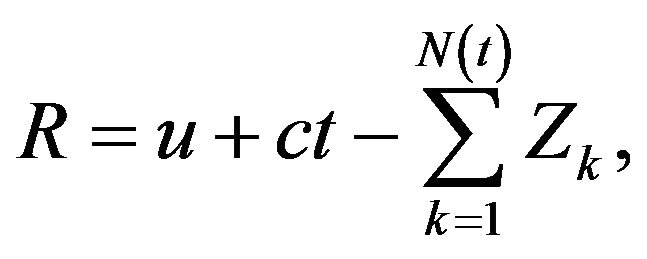

The classical risk process is given by

(1)

(1)

and the following will be our assumptions regarding this process1)  is a Poisson

is a Poisson process,

process,  , that models the number of claims received at time

, that models the number of claims received at time .

.

2)  are non negative i.i.d. random variables with mean

are non negative i.i.d. random variables with mean  independent of the process

independent of the process . We shall always assume the moment generating function of

. We shall always assume the moment generating function of ,

,  is finite for some

is finite for some  (not necessarily for all

(not necessarily for all ). These variables represent the size of the claims. The compound Poisson term

). These variables represent the size of the claims. The compound Poisson term

accounts for the aggregate claims.

3)  is the initial capital or reserve.

is the initial capital or reserve.

4) ![]() is positive. The term

is positive. The term  represents the (non random and linear) premiums the company charges.

represents the (non random and linear) premiums the company charges.

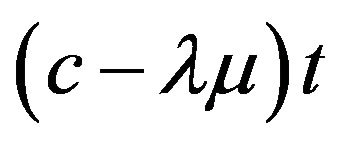

It is usually required to have a safety loading condition  to assure ruin does not occur almost surely. We do not need that condition for the moment; however, it shall appear when we give the explicit form of the large deviations rate function.

to assure ruin does not occur almost surely. We do not need that condition for the moment; however, it shall appear when we give the explicit form of the large deviations rate function.

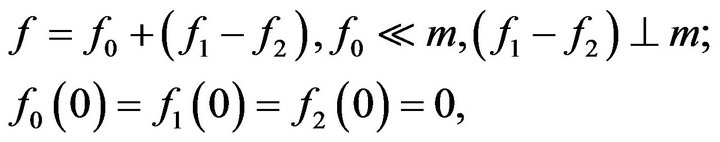

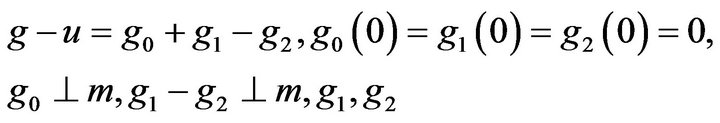

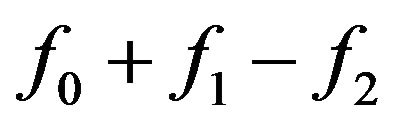

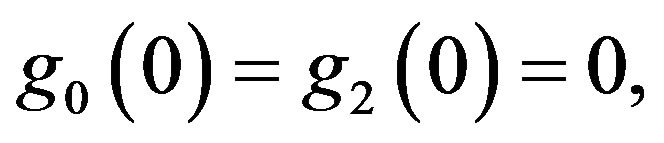

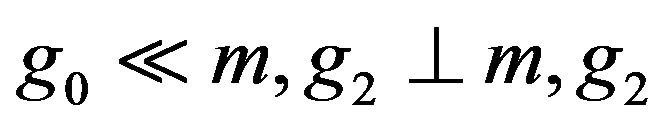

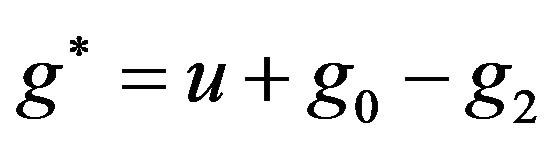

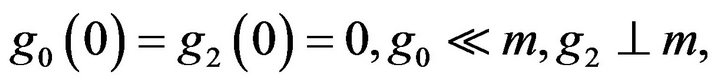

For each bounded variation  with

with  and

and , let

, let  be its standard decomposition such that

be its standard decomposition such that ,

,  is absolutely continuous with respect to the Lebesgue measure (here denoted as

is absolutely continuous with respect to the Lebesgue measure (here denoted as ),

),  is the Hahn-Jordan decomposition for the singular part of f with respect to the Lebesgue measure. Recall that

is the Hahn-Jordan decomposition for the singular part of f with respect to the Lebesgue measure. Recall that  and

and  are hence non-decreasing, and each one is singular with respect to

are hence non-decreasing, and each one is singular with respect to ![]() (which shall be denoted

(which shall be denoted ).

).

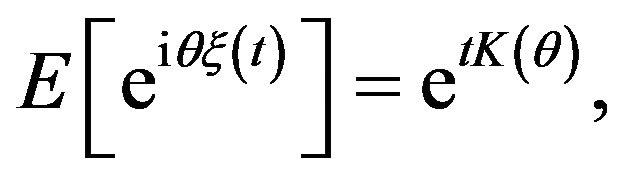

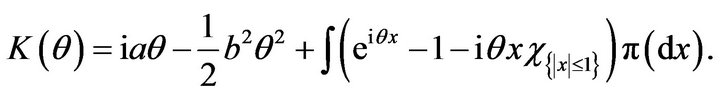

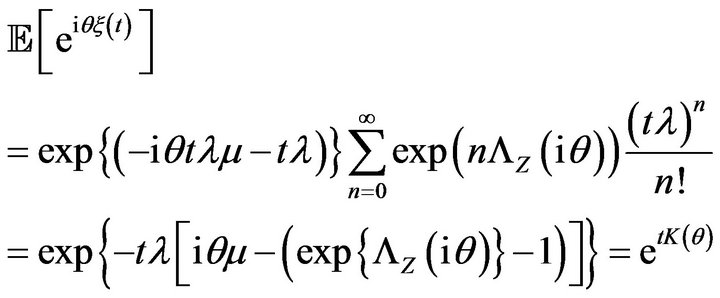

A standard representation for the characteristic function of a stationary process with independent increments  is

is

with

A regularity condition on the measure ![]() defined by the expression above, which will be needed in the main result (Theorem 1), is:

defined by the expression above, which will be needed in the main result (Theorem 1), is:

(2)

(2)

and

We shall apply Theorems 2.5 and 2.7 by Mogulskii [1] (see also [2]). We shall write here together all the results we apply, specialized to our settings, and use the notation defined above:

Proposition 1. (Mogulskii) Let  be a stochastic process defined on

be a stochastic process defined on  with values in

with values in  Assume it has stationary independent increments, and also suppose

Assume it has stationary independent increments, and also suppose

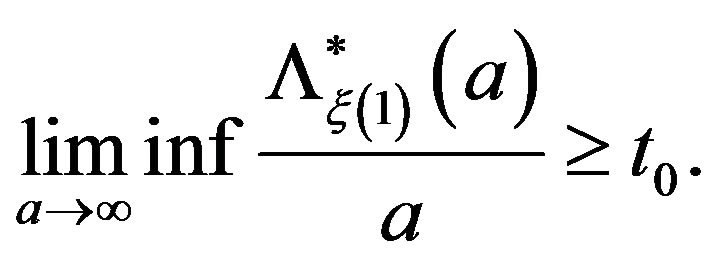

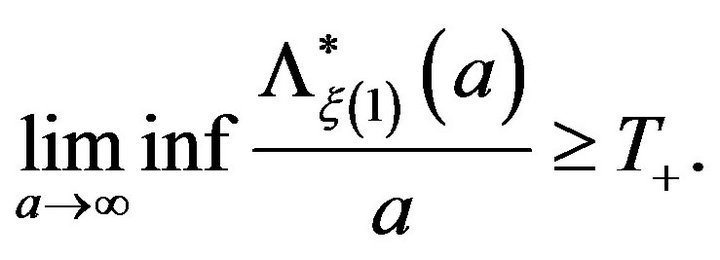

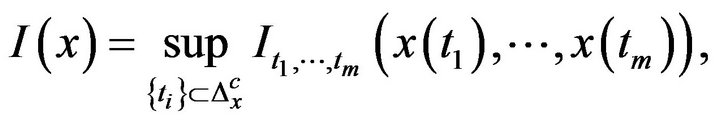

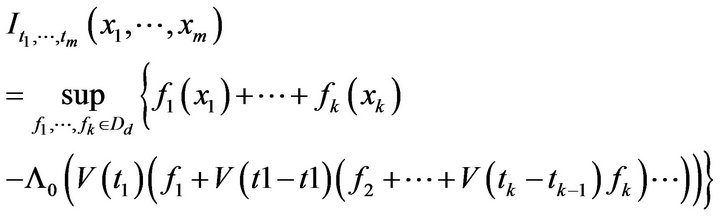

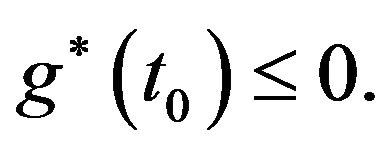

If  then ULDP:

then ULDP:  satisfies the upper large deviations principle with respect to the completed Skorohod topology, with good rate function

satisfies the upper large deviations principle with respect to the completed Skorohod topology, with good rate function . LLDP: If, additionally, the regularity condition

. LLDP: If, additionally, the regularity condition

(2) is satisfied, then the same sequence  satisfies the lower large deviations principle with respect to the completed Skorohod topology, with the same rate function

satisfies the lower large deviations principle with respect to the completed Skorohod topology, with the same rate function . The rate function

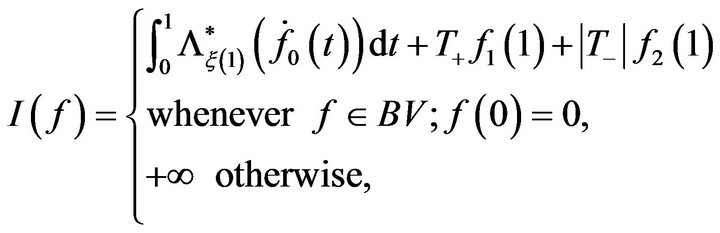

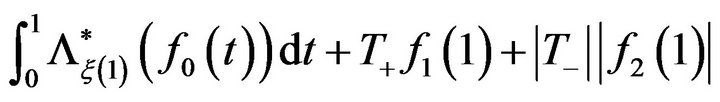

. The rate function  is

is

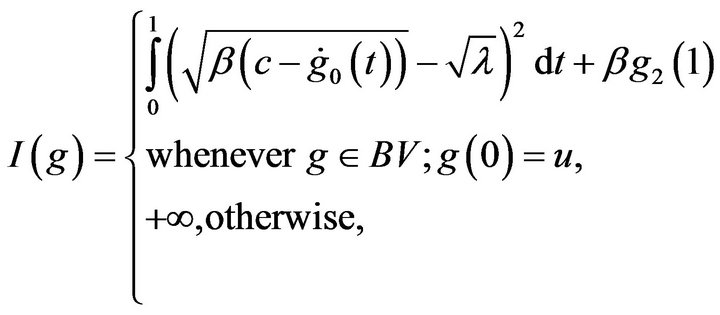

(3)

(3)

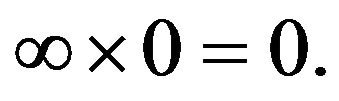

where

are non-decreasing, and with the understanding that

are non-decreasing, and with the understanding that  If

If  then the ULDP holds also with the uniform topology.

then the ULDP holds also with the uniform topology.

A Remark on the Rate Function

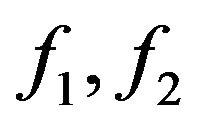

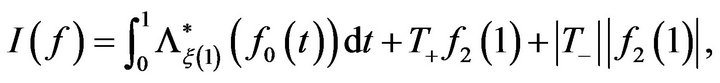

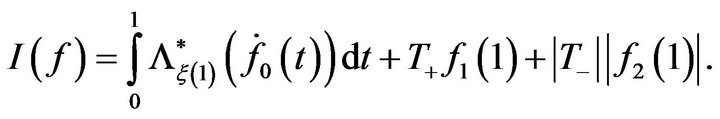

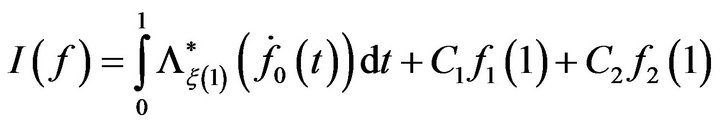

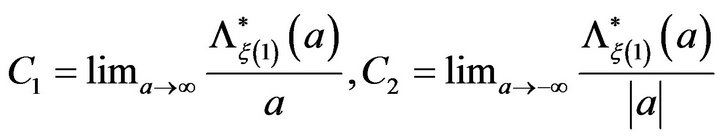

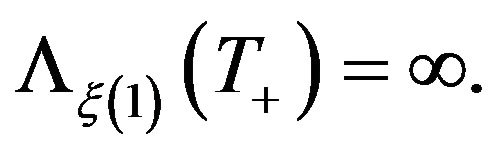

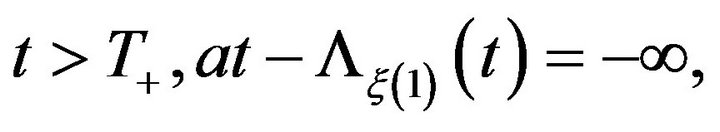

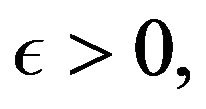

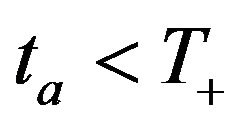

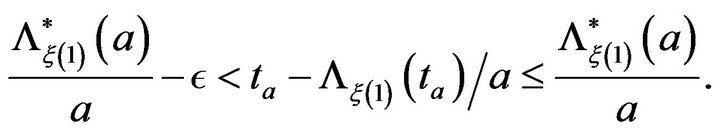

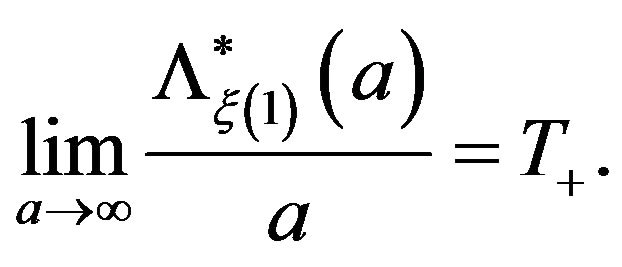

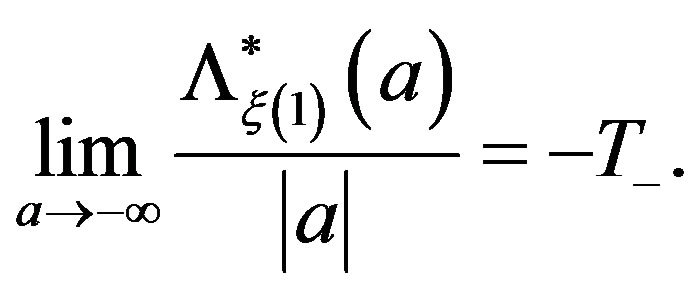

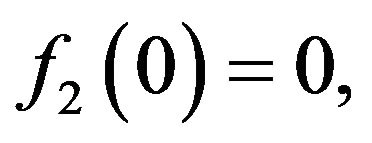

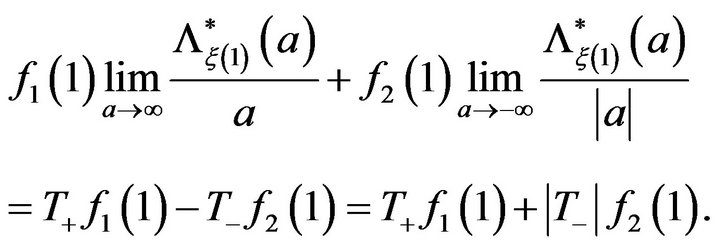

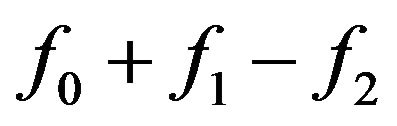

Remark 1. The rate function I that appears in Mogulskii [1] has two misprints. This can be verified in [2]. It says

whereas it should say

Indeed, for this rate function, Mogulskii refers to the paper by Lynch and Sethuraman ([2]), and according to the latter, the value for  is

is

where  and

and  Without loss of generality, suppose that

Without loss of generality, suppose that  Note that for

Note that for

hence

hence

If  then

then  and since

and since

making ![]() tend to

tend to  we obtain

we obtain

Now, if we let  we conclude

we conclude

(4)

(4)

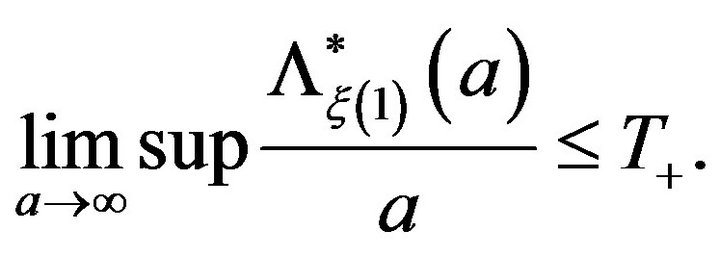

On the other hand, for every  and

and  there is

there is  such that

such that

taking limits as![]() , we conclude

, we conclude

(5)

(5)

In view of formulas (4) and (5) we conclude

With a similar argument we obtain

Finally, since  is non-decreasing and

is non-decreasing and

In the next Section we shall state the hypotheses we need.

3. Statement of Hypotheses

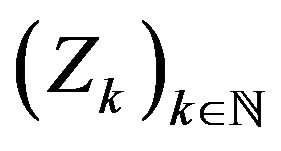

Let  be nonnegative independent and identically distributed random variables with mean

be nonnegative independent and identically distributed random variables with mean  and second moment

and second moment  (i.e. Z is non-degenerated).

(i.e. Z is non-degenerated).

Let  be a Poisson process with parameter

be a Poisson process with parameter  defined on the same probability space and independent of the

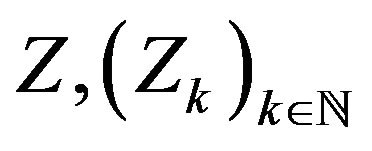

defined on the same probability space and independent of the  All our random variables Z, and Poisson processes

All our random variables Z, and Poisson processes  will be as just stated, unless otherwise noted.

will be as just stated, unless otherwise noted.

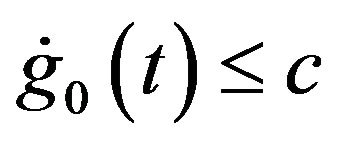

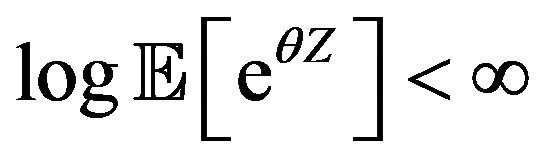

If  is finite in a neighborhood of the origin, we say Condition 1 is satisfied:

is finite in a neighborhood of the origin, we say Condition 1 is satisfied:

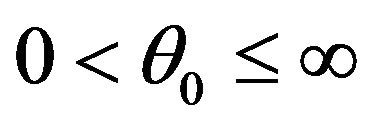

Condition 1. There is  such that

such that

for

for

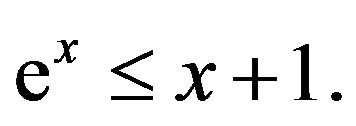

Remark 2. Finiteness of the function  is equivalent to that of the moment generating function

is equivalent to that of the moment generating function  Condition 1 is satisfied if

Condition 1 is satisfied if  is finite for some

is finite for some  (the negative part works due to Z being nonnegative).

(the negative part works due to Z being nonnegative).

Notice also that this condition implies , and every moment of the variables

, and every moment of the variables  are finite.

are finite.

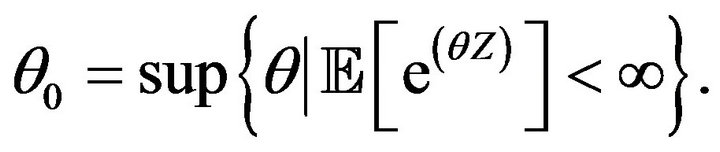

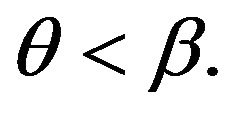

We shall fix  to be the maximum possible by letting

to be the maximum possible by letting

To have the LLDP in the topology we want, we require to ask an additional regularity condition:

Condition 2.

Remark 3. All the conditions on Z are satisfied if Z is, for example, exponentially distributed. This important case, for which many calculations can be made explicit, is discussed in Sections 6 and 7.

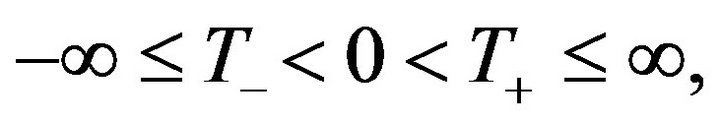

4. Large Deviations for the Risk Process on

![]()

Now we are ready to state the LDP in the space  with the Skorohod topology:

with the Skorohod topology:

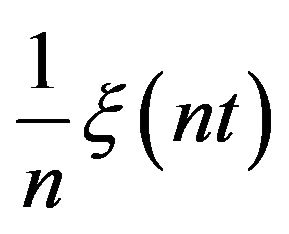

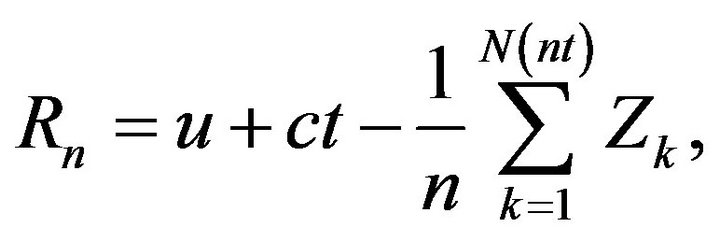

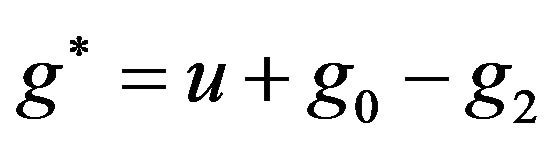

Theorem 1. Let  be a risk process as defined in (1). Under conditions 1 and 2, the sequence of processes

be a risk process as defined in (1). Under conditions 1 and 2, the sequence of processes

(6)

(6)

satisfies the large deviations principle in the space  with the completed topology induced by the Skorohod distance, and rate function

with the completed topology induced by the Skorohod distance, and rate function  defined as

defined as

(7)

(7)

where ![]() is decomposed as

is decomposed as

and  are non-decreasing.

are non-decreasing.

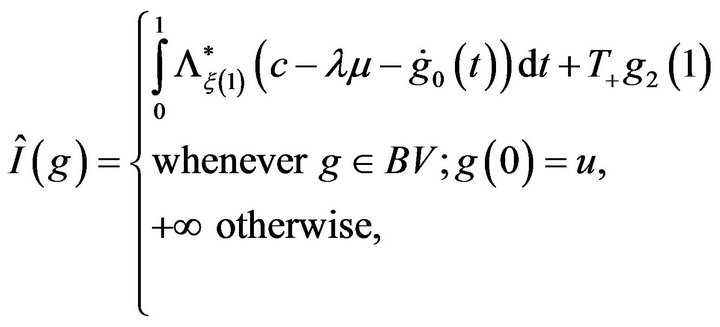

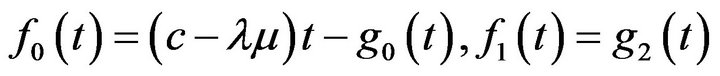

Remark 4. The form of the rate function is given by

(8)

(8)

with  as in expression (3). We also notice that, in this case,

as in expression (3). We also notice that, in this case,

Proof of Theorem 1.

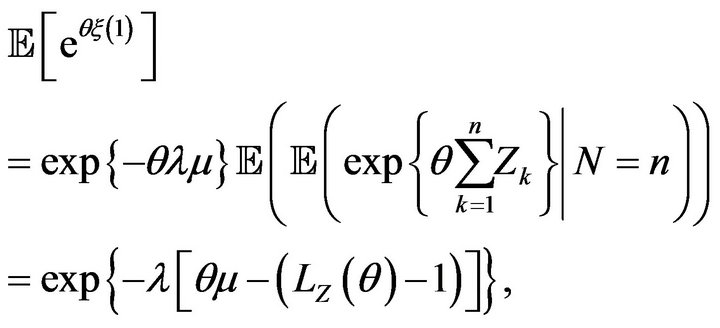

Let  be the compound Poisson process. Using the assumptions about

be the compound Poisson process. Using the assumptions about  and N we conclude that

and N we conclude that  has stationary and independent increments,

has stationary and independent increments,  and that

and that

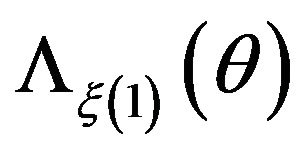

The Laplace transform  of

of  is

is

We notice that the log-Laplace

![]() is finite as long as

is finite as long as

is finite. By Condition 1, we can guarantee that

is finite. By Condition 1, we can guarantee that  is finite for

is finite for  in fact both,

in fact both,  and

and  have the same support. By similar calculations,

have the same support. By similar calculations,

where

which means that the Lévy measure ![]() of this process is

of this process is ![]() times the distribution of the claims

times the distribution of the claims . We notice that if

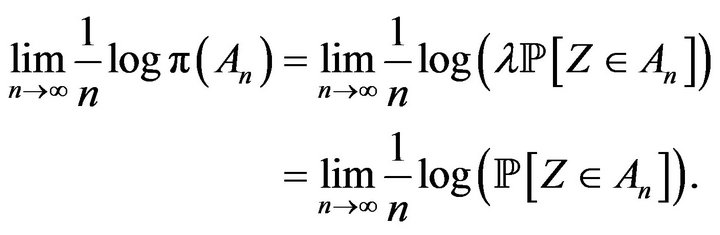

. We notice that if  is a sequence of sets, then

is a sequence of sets, then

Regarding the Lévy measure  we see that for each

we see that for each  therefore

therefore

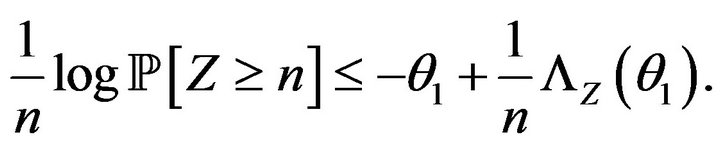

and if

and if , by the Markov inequality,

, by the Markov inequality,

Taking the limit in the previous inequality as n approaches to , and using

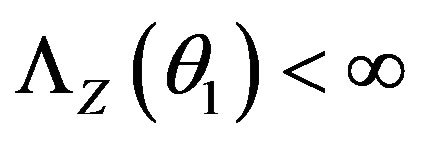

, and using  gives us

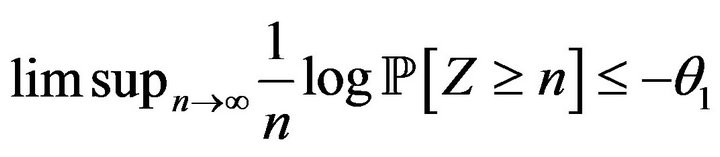

gives us

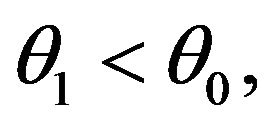

and since this assertion is valid for each

and since this assertion is valid for each  we obtain

we obtain

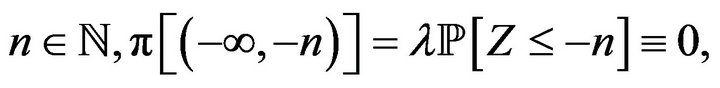

We observe that by Condition 2,

Since  we conclude that

we conclude that

which is the regularity Condition 2. In summary, the process  satisfies the hypotheses of Proposition 1, therefore the process

satisfies the hypotheses of Proposition 1, therefore the process

satisfies the LDP with respect to the Skorohod topology with rate function provided by 3.

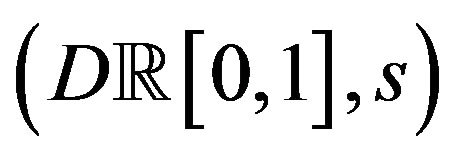

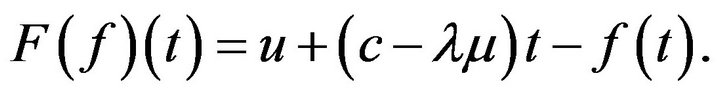

We now consider  the metric space

the metric space  endowed with the completed topology induced by the Skorohod distance and we also consider the functional

endowed with the completed topology induced by the Skorohod distance and we also consider the functional  defined by

defined by

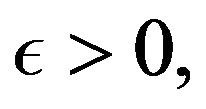

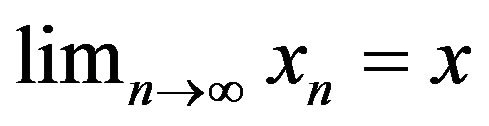

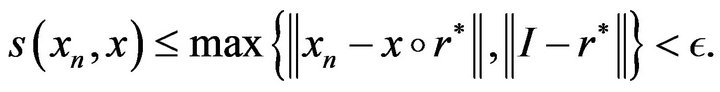

To verify continuity of F on this specific topology, take  and

and  with

with  in the Skorohod topology. Recall that the Skorohod distance in

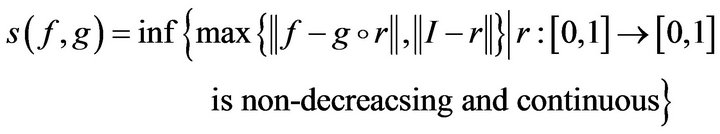

in the Skorohod topology. Recall that the Skorohod distance in  is given by

is given by

Then, there is  so that for each

so that for each  we can find

we can find , where

, where  is an non-decreasing continuous function for which

is an non-decreasing continuous function for which

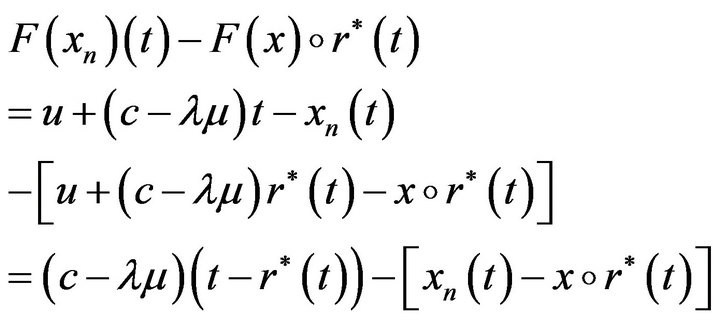

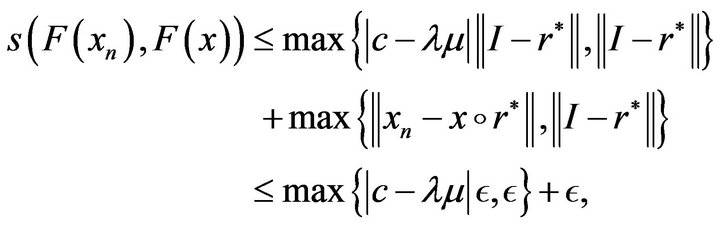

Now,

therefore

hence  tends to

tends to  Therefore F is continuous with respect to the Skorohod topology. By the Contraction Principle,

Therefore F is continuous with respect to the Skorohod topology. By the Contraction Principle,

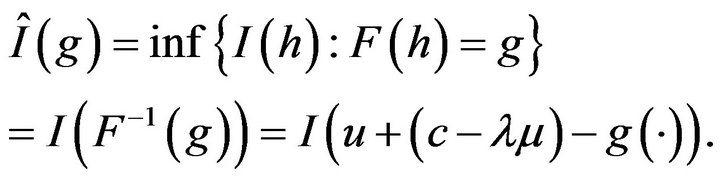

satisfies the LDP with rate function given by

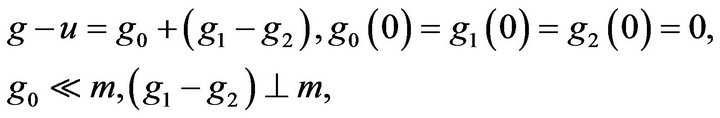

If we consider the Hahn-Jordan decomposition for  and we observe that

and we observe that  is absolutely continuous with respect to the Lebesgue measure m, we conclude that the Hahn-Jordan decomposition

is absolutely continuous with respect to the Lebesgue measure m, we conclude that the Hahn-Jordan decomposition  for the function

for the function  is

is

, and

, and

Evaluating

Evaluating  and using (3), we obtain formula (7), this concludes the proof of Theorem 1. □

and using (3), we obtain formula (7), this concludes the proof of Theorem 1. □

5. Large Deviations for the Aggregate

Claims Process on ![]()

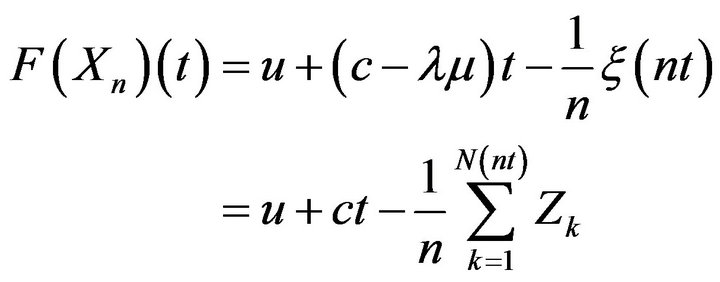

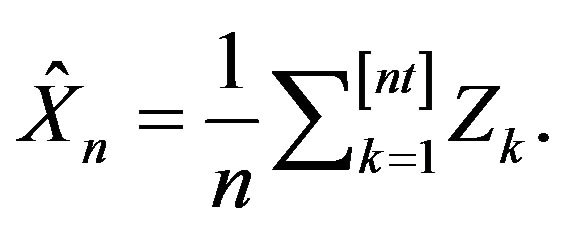

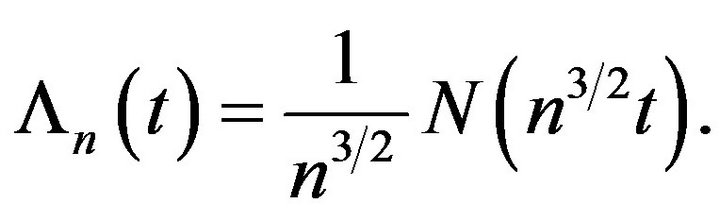

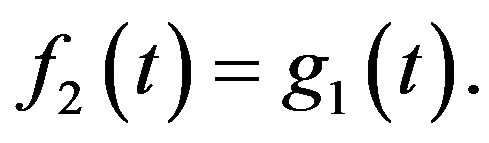

In this Section we prove the LDP for the process of aggregate claims, on a different space, with another time-scale parametrization, and using very different results.

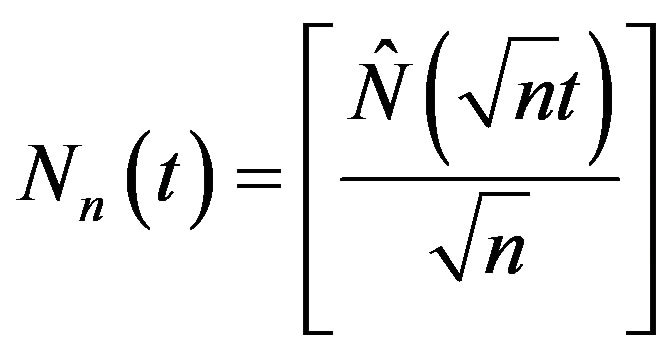

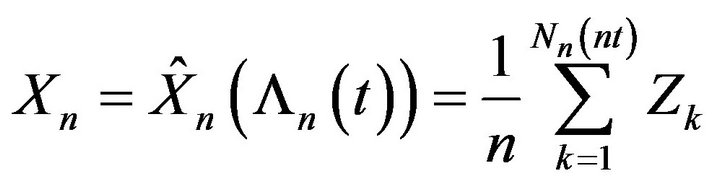

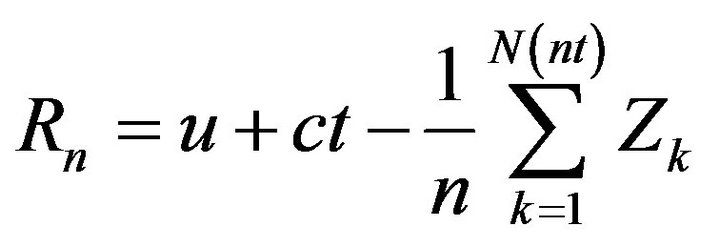

Theorem 2. Assume Condition 1, but now let us denote the Poisson process as , with parameter

, with parameter  defined on the same probability space and independent of the

defined on the same probability space and independent of the

Let . Then, the sequence of processes

. Then, the sequence of processes

satisfies the large deviations principle in the space  with the topology induced by the Skorohod distance.

with the topology induced by the Skorohod distance.

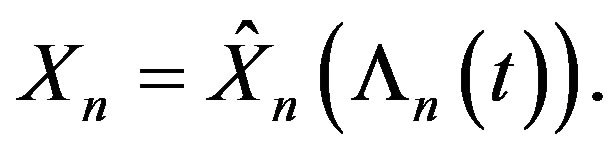

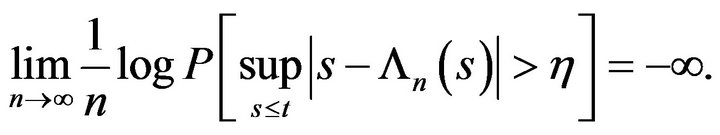

We will use results from Feng and Kurtz [9], Lemma 4.9 and Theorem 10.1, that we compile in next two Propositions:

Proposition 2. For each  let

let  be a process in

be a process in . Let

. Let  be a nonnegative, nondecreasing process

be a nonnegative, nondecreasing process  valued, independent of

valued, independent of . Define

. Define

Suppose that for each  and

and

(9)

(9)

If  is exponentially tight, then the LDP holds for

is exponentially tight, then the LDP holds for  if and only if it holds for

if and only if it holds for .

.

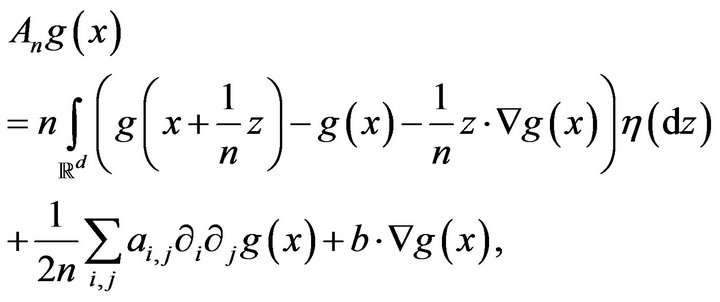

Proposition 3. Let  be given by

be given by

for . Suppose that

. Suppose that  is a solution of the martingale problem for

is a solution of the martingale problem for  and that the LDP holds for

and that the LDP holds for  in

in  with a good rate function

with a good rate function  and rate transform

and rate transform . Then the LDP holds for

. Then the LDP holds for  in

in  with good rate function:

with good rate function:

(10)

(10)

where

And if  then

then .

.

Proof of Theorem 2.

Let

Due to the fact that  for some

for some  Proposition 3 can be applied to sequences of processes with independent increments such as

Proposition 3 can be applied to sequences of processes with independent increments such as —as discussed in Section 10.2 of Feng and Kurtz [9]. Therefore

—as discussed in Section 10.2 of Feng and Kurtz [9]. Therefore  satisfies the LDP with a good rate function defined as in (10). Since this rate function is good, and our space is Polish, then the sequence

satisfies the LDP with a good rate function defined as in (10). Since this rate function is good, and our space is Polish, then the sequence  is exponentially tight in

is exponentially tight in

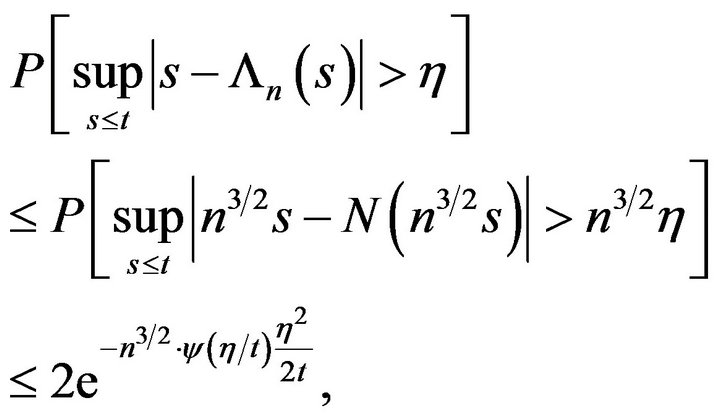

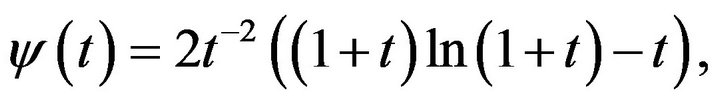

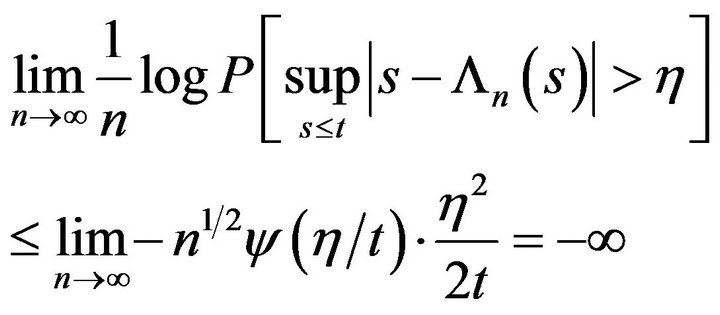

Now, let  By the MasonShorack, Wellner inequality [13] (p. 545) we have,

By the MasonShorack, Wellner inequality [13] (p. 545) we have,

where  hence

hence

which is (9). Applying Proposition 2 we conclude that

satisfies the LDP with a good rate function. □

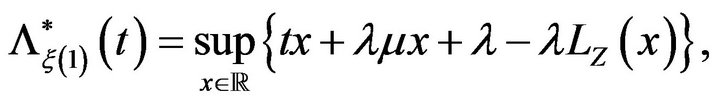

6. Exponential Claims

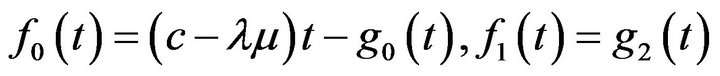

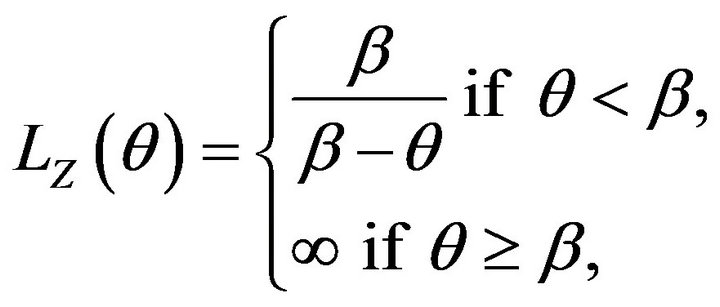

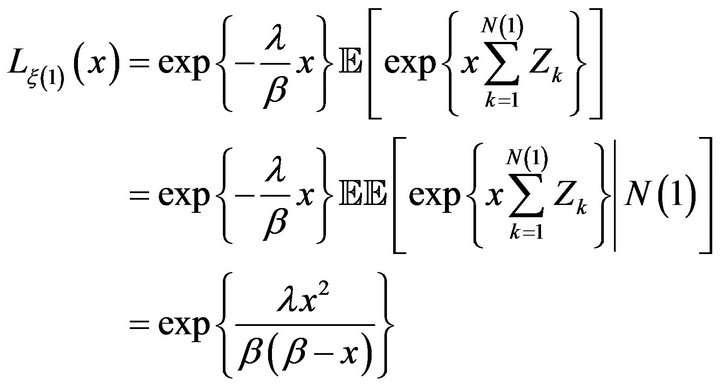

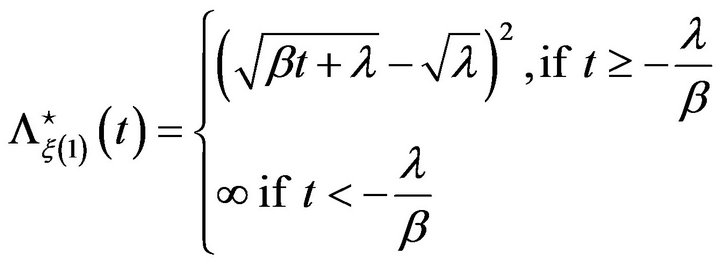

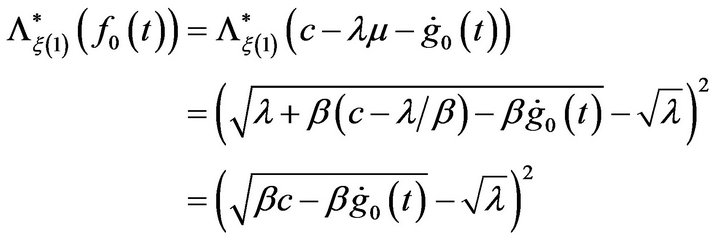

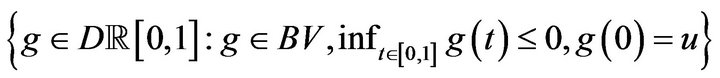

In this Section we give the explicit calculations when the law of the claims is exponential, and we also find the particular shape for the rate function. We have the following Corollary to Theorem 1:

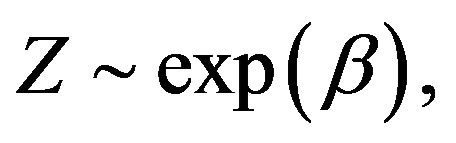

Corollary 1. Consider a classical risk process as defined in (1) with exponentially distributed claims:

with

with  and

and

The sequence of processes

(11)

(11)

satisfies the LDP in the space  with the completed topology induced by the Skorohod distance, and rate function given by

with the completed topology induced by the Skorohod distance, and rate function given by

(12)

(12)

with

non-decreasing, and .

.

Proof. The Moment Generating function in this case is

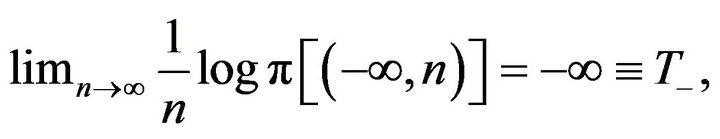

hence  if and only if

if and only if  Therefore, Condition 1 holds. In this case

Therefore, Condition 1 holds. In this case

Also,

so Condition 2 also holds.

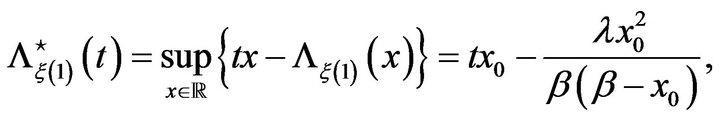

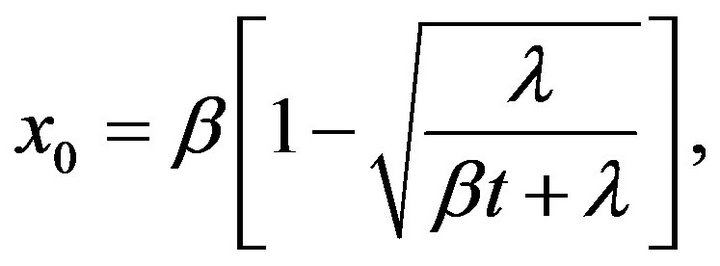

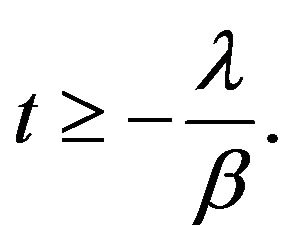

Applying Theorem 1, we conclude that  satisfies the LDP with rate function given by (7). It remains to show that the rate function has the explicit form (12). Let us calculate, for

satisfies the LDP with rate function given by (7). It remains to show that the rate function has the explicit form (12). Let us calculate, for

Now

with  if

if  Therefore,

Therefore,

(13)

(13)

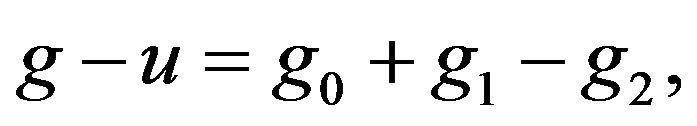

Here, again the Hahn-Jordan decomposition

for the function

for the function  is

is

, and

, and

Therefore,

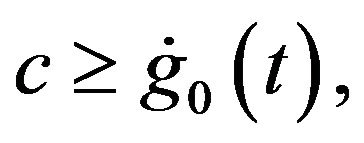

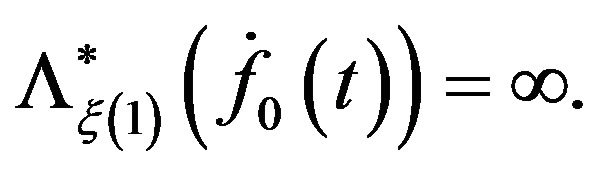

Therefore,

provided  (otherwise

(otherwise ).

).

Since  the value

the value

in the rate function (7) provides us information only when

in the rate function (7) provides us information only when  and since

and since  is non-decreasing and

is non-decreasing and  this implies that

this implies that  in our case

in our case  Finally,

Finally,  hence the rate function

hence the rate function  takes the form (12). This proves Corollary 1. □

takes the form (12). This proves Corollary 1. □

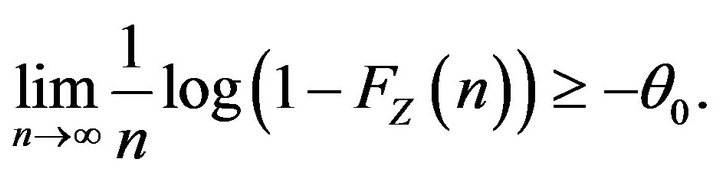

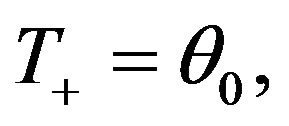

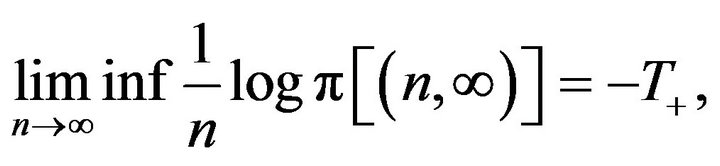

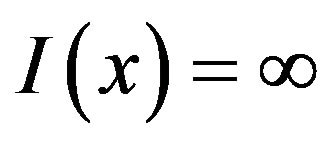

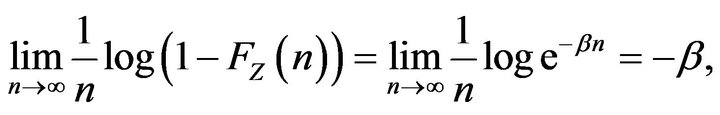

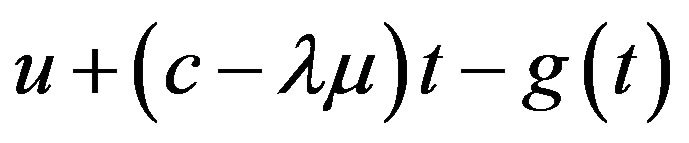

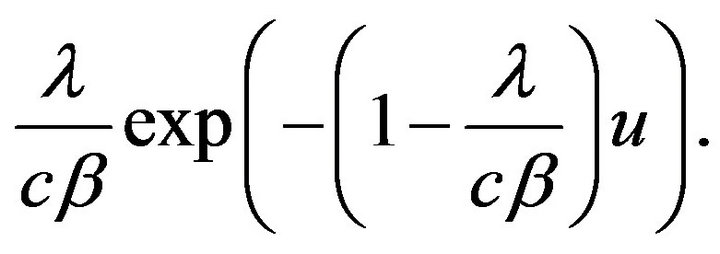

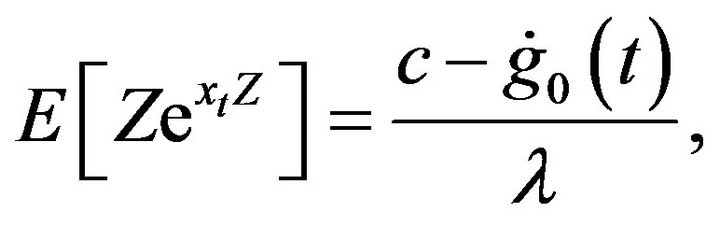

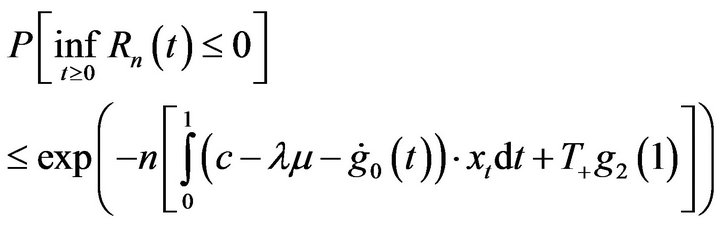

7. Estimating the Ruin Probability of the Process Rn

In this section we give an upper bound for the Probability of Ruin for the process  as studied in Section 6 and in Corollary 1; i.e. when the claims are exponentially distributed with parameter

as studied in Section 6 and in Corollary 1; i.e. when the claims are exponentially distributed with parameter

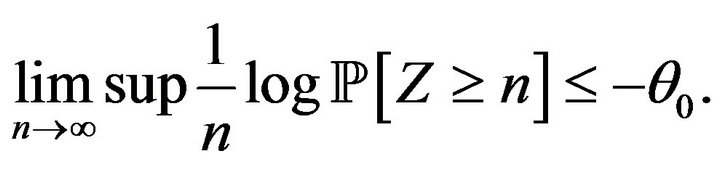

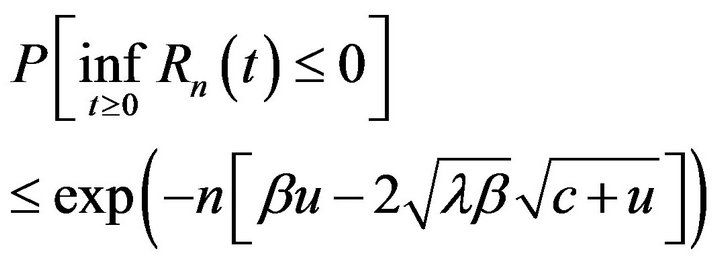

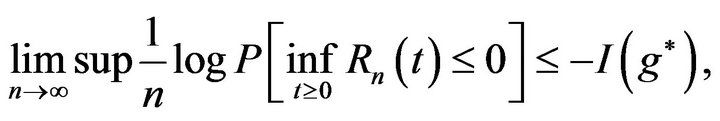

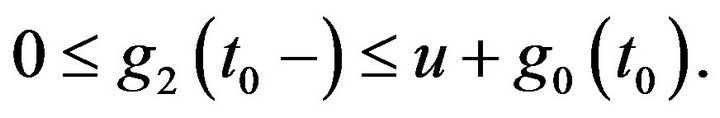

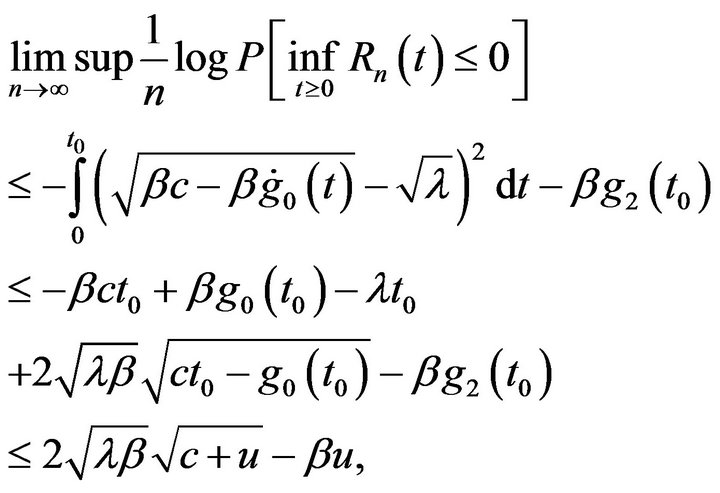

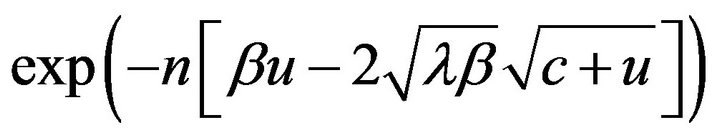

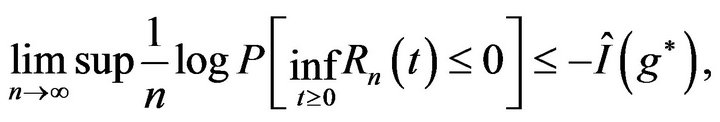

Theorem 3. For the process  defined in Corollary 1, we have that

defined in Corollary 1, we have that

(14)

(14)

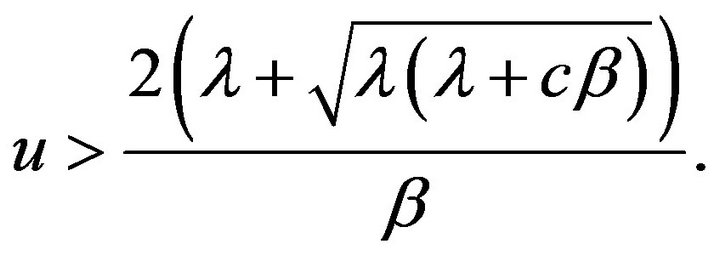

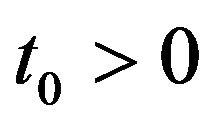

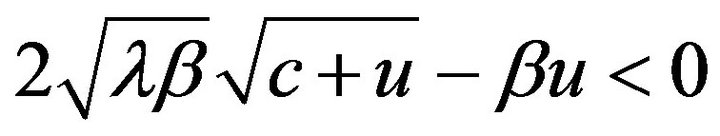

for sufficiently large n. The estimate is meaningful when

(15)

(15)

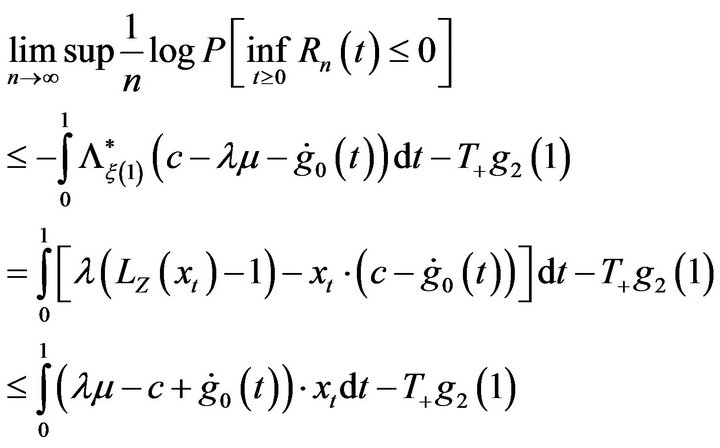

Proof of Theorem 3.

By Corollary 1,  satisfies the LDP with good rate function given by (12), therefore

satisfies the LDP with good rate function given by (12), therefore

for some function  in the essential domain of

in the essential domain of  hence

hence  satisfies:

satisfies:

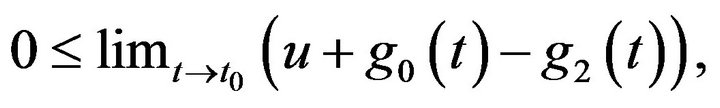

where

where

non-decreasing, there is a first time

non-decreasing, there is a first time  when

when

By definition of  we have

we have

since

since  is continuous and

is continuous and  is non-decreasing, we conclude that

is non-decreasing, we conclude that

Therefore

the second inequality is due to Jensen’s inequality. Note that  if and only if

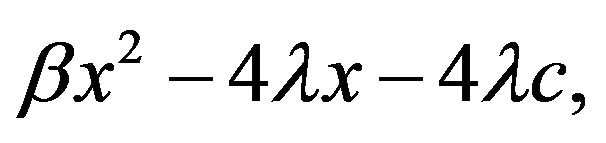

if and only if ![]() is above the largest root of the polynomial

is above the largest root of the polynomial  such root is precisely the right hand side of inequality (15). This proves Theorem 3. □

such root is precisely the right hand side of inequality (15). This proves Theorem 3. □

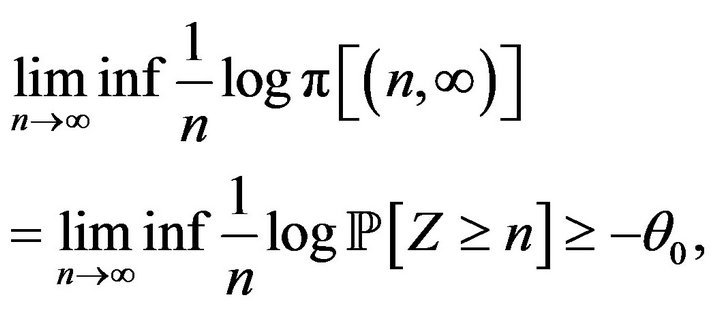

Remark 5. The estimate of the probability ruin provided here for the process  is

is , whereas the exact probability of ruin for the process

, whereas the exact probability of ruin for the process  (seefor instance, Section 1.2 of [14]) is

(seefor instance, Section 1.2 of [14]) is

Note that the exponent in our estimation also behaves as a polynomial on

Note that the exponent in our estimation also behaves as a polynomial on ![]() of first degree when

of first degree when ![]() is large.

is large.

If the claims are not exponentially distributed, we can still make the following observation regarding the probability of ruin.

Corollary 2. Consider the rate function for the process in Theorem 1,  , and let

, and let  be the dominating point of

be the dominating point of

with respect to

with respect to . Consider also the decomposition

. Consider also the decomposition

, where

, where

and with

and with  nondecreasing.

nondecreasing.

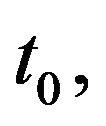

If  is a solution of

is a solution of

(16)

(16)

then, for the process  defined in (6), we have

defined in (6), we have

(17)

(17)

for sufficiently large n.

Recall that the LDP proved in Theorem 1 holds for claims with moment generating functions much less restrictive than the super-exponential case.

Proof of Corollary 2. By Corollary 1,  satisfies the LDP with good rate function

satisfies the LDP with good rate function  given by (7), therefore

given by (7), therefore

where the function  is as in the statement above.

is as in the statement above.

Since

and since  is as in (16), then

is as in (16), then

![]()

Finally,

For the second inequality we used the fact that  □

□

8. Acknowledgements

We would like to thank both our universities CSUCI and UNAM, for their hospitality while doing this joint work.

REFERENCES

- A. A. Mogulskii, “Large Deviations for Processes with Independent Increments,” Annals of Probability, Vol. 21, No. 1, 1993, pp. 202-215. doi:10.1214/aop/1176989401

- J. Lynch and J. Sethuraman, “Large Deviations for Processes with Independent Increments,” Annals of Probability, Vol. 15, No. 2, 1987, pp. 610-627. doi:10.1214/aop/1176992161

- A. de Acosta, “Large Deviations for Vector-Valued Lévy Processes,” Stochastic Processes and Their Applications, Vol. 51, No. 1, 1994, pp. 75-115. doi:10.1016/0304-4149(94)90020-5

- A. de Acosta, “Exponential Tightness and Projective Systems in Large Deviation Theory,” In: D. Pollard, E. Togersen and G. Yang, Eds., Festschrift for Lucien Le Cam, Springer, New York, 1997, pp. 143-156.

- Z. H. Li and E. A. Pechersky, “On Large Deviations in Queuing Systems,” Resenha, Vol. 4, No. 2, 1999, pp. 163-182.

- R. L. Dobrushin and E. A. Pechersky, “Large Deviations for Tandem Queueing Systems,” Journal of Applied Mathematics and Stochastic Analysis, Vol. 7, No. 3, 1994, pp. 301-330. doi:10.1155/S1048953394000274

- A. Ganesh, C. Macci and G. L.Torrisi, “A Class of Risk Processes with Reserve-Dependent Premium Rate: Sample Path Large Deviations and Importance Sampling,” Queueing Systems, Vol. 55, No. 2, 2007, pp. 83-94. doi:10.1007/s11134-006-9000-y

- A. Ganesh, C. Macci and G. L. Torrisi, “Sample Path Large Deviations Principles for Poisson Shot Noise Processes, and Applications,” Electronic Journal of Probability, Vol. 10, No. 32, 2005, pp. 1026-1043.

- J. Feng and T. G. Kurtz, “Large Deviations for Stochastic Processes,” Vol. 131, Mathematical Surveys and Monographs, American Mathematical Society, Providence, 2006.

- S. Asmussen, “Ruin Probabilities,” Vol. 2, Advanced Series on Statistical Science & Applied Probability, World Scientific Publishing Co. Inc., River Edge, 2000.

- S. Asmussen and C. Klüppelberg, “Large Deviations Results for Subexponential Tails, with Applications to Insurance Risk,” Stochastic Processes and their Applications, Vol. 64, No. 1, 1996, pp. 103-125. doi:10.1016/S0304-4149(96)00087-7

- C. Klüppelberg and T. Mikosch, “Large Deviations of Heavy-Tailed Random Sums with Applications in Insurance and Finance,” Journal of Applied Probability, Vol. 34, No. 2, 1997, pp. 293-308. doi:10.2307/3215371

- G. R. Shorack and J. A. Wellner, “Empirical processes with applications to statistics of Wiley Series in Probability and Mathematical Statistics: Probability and Mathematical Statistics,” John Wiley & Sons Inc., New York, 1986.

- P. Embrechts, C. Klüppelberg and T. Mikosch, “Modelling Extremal Events,” Vol. 33, Applications of Mathematics, Springer-Verlag, Berlin, 1997.

NOTES

*This work was partially supported by Projects PAPIIT—IN103606, IN117109 DGAPA—UNAM, and PAEP—2008, 2009—UNAM.