Paper Menu >>

Journal Menu >>

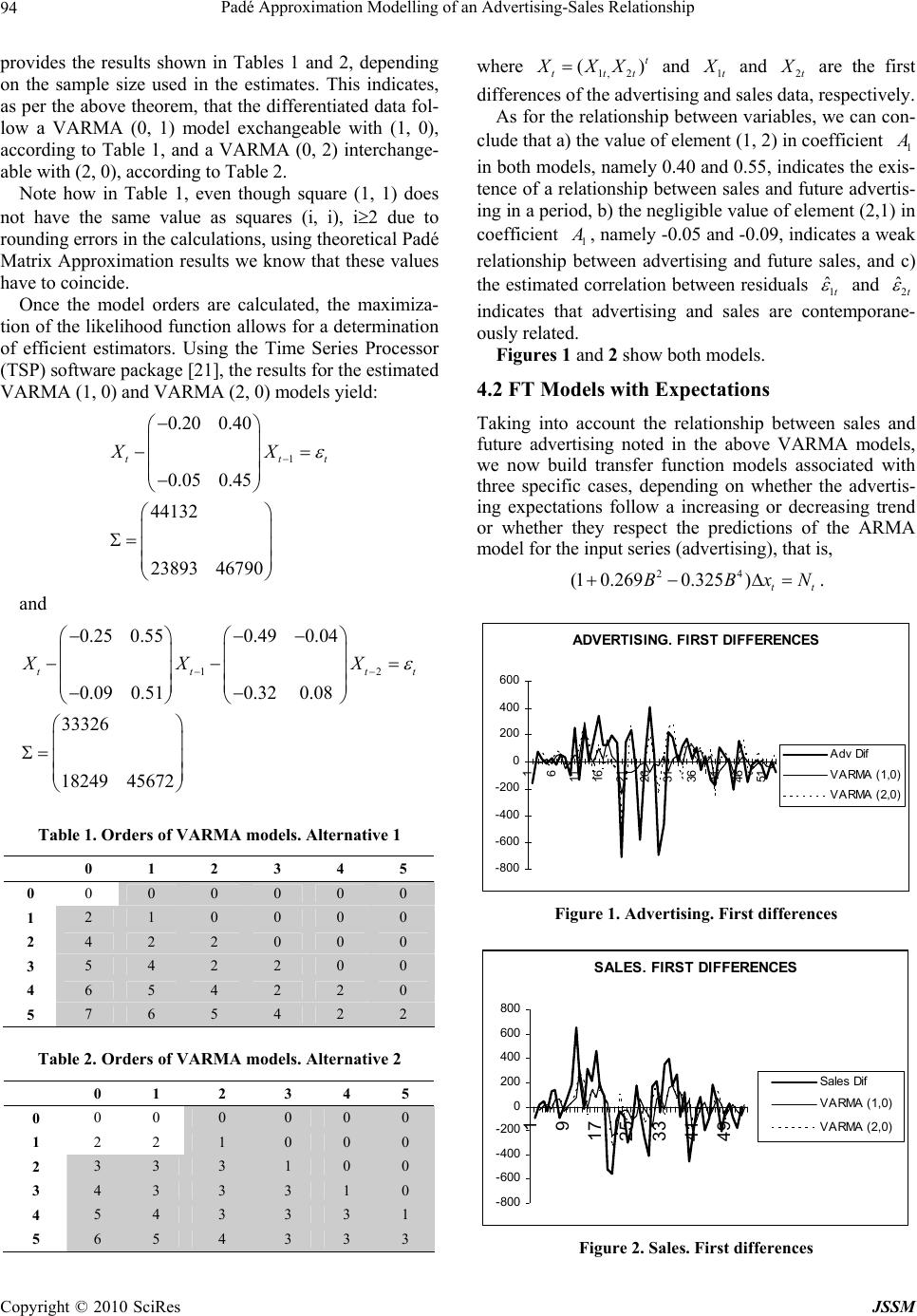

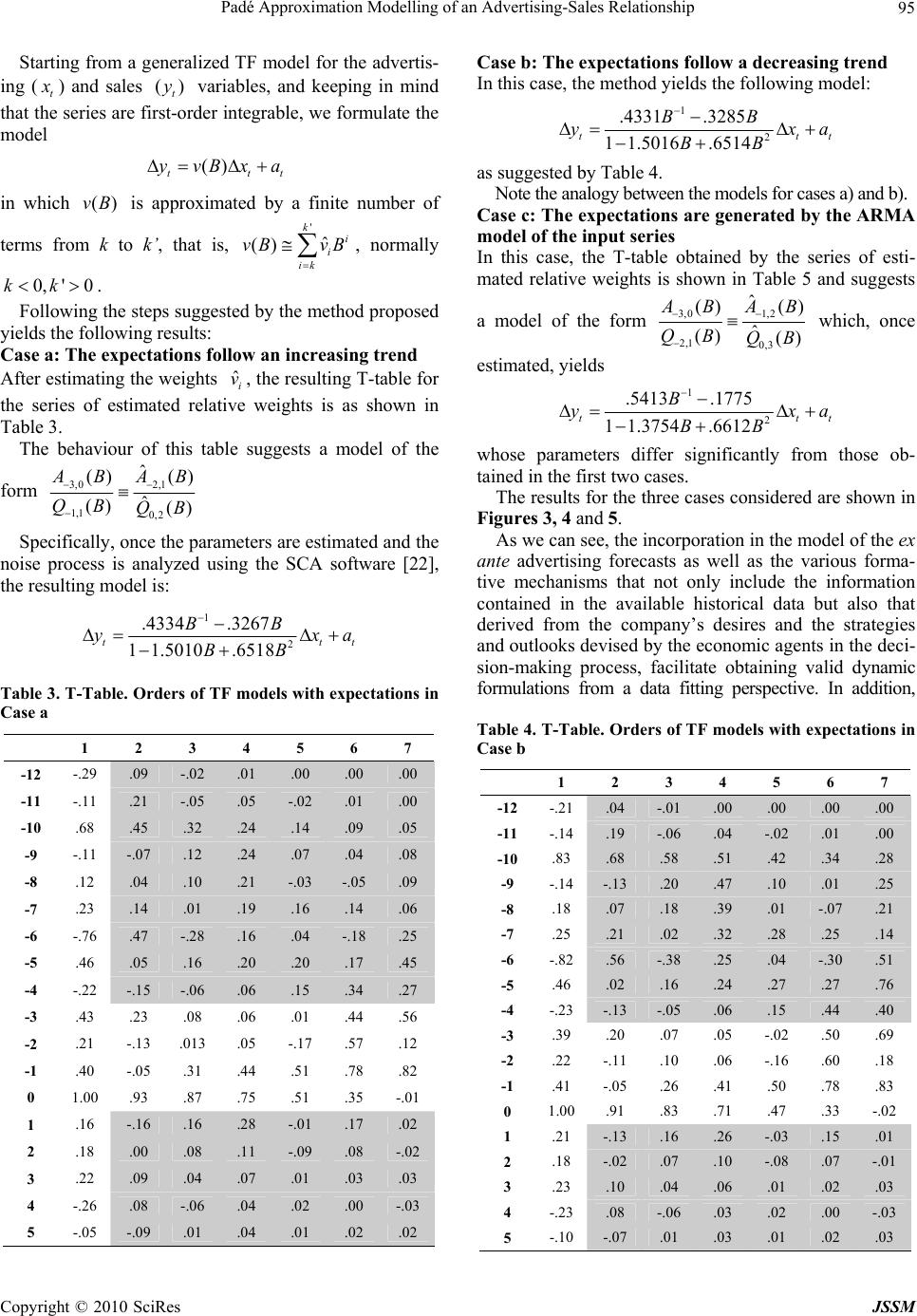

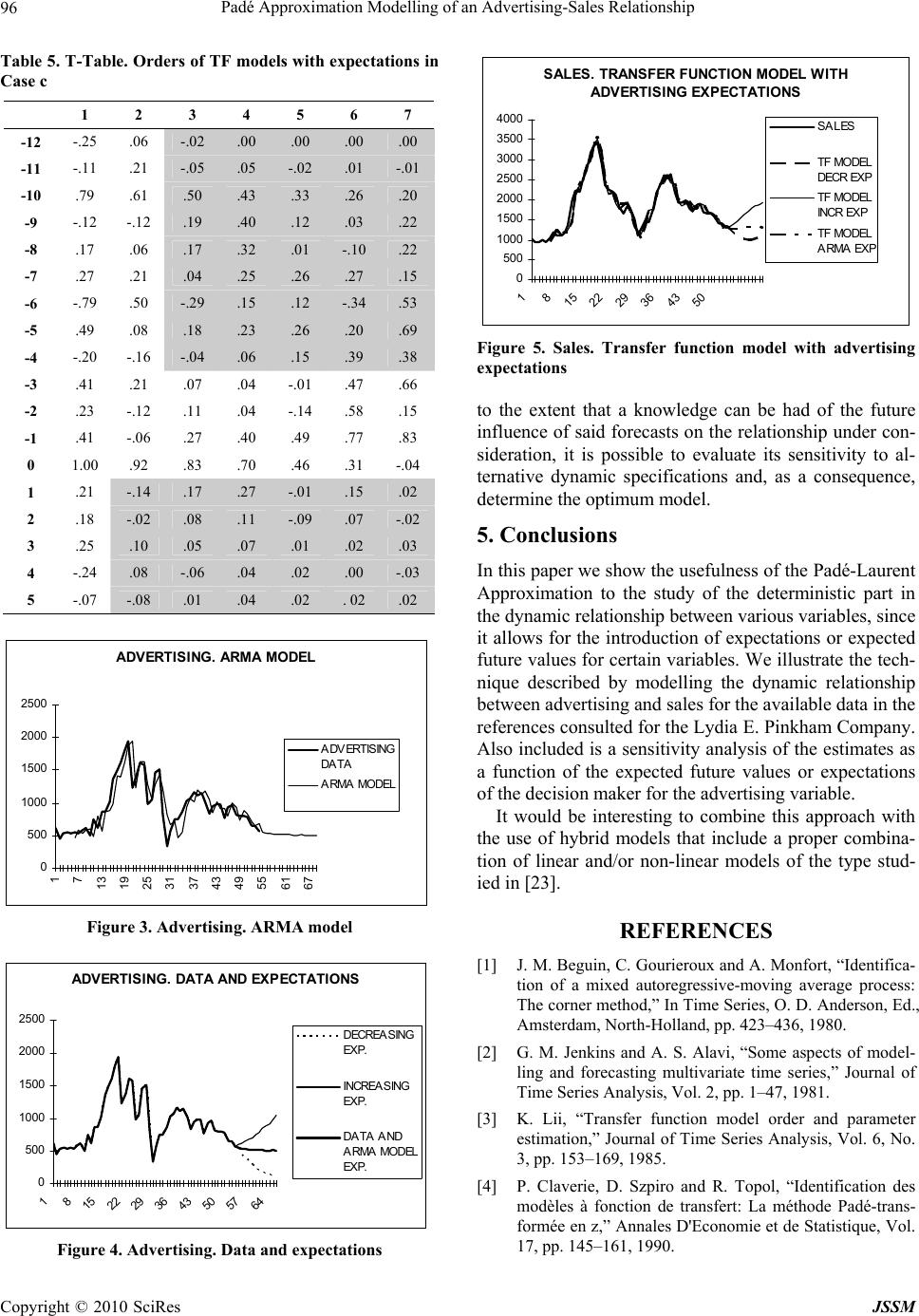

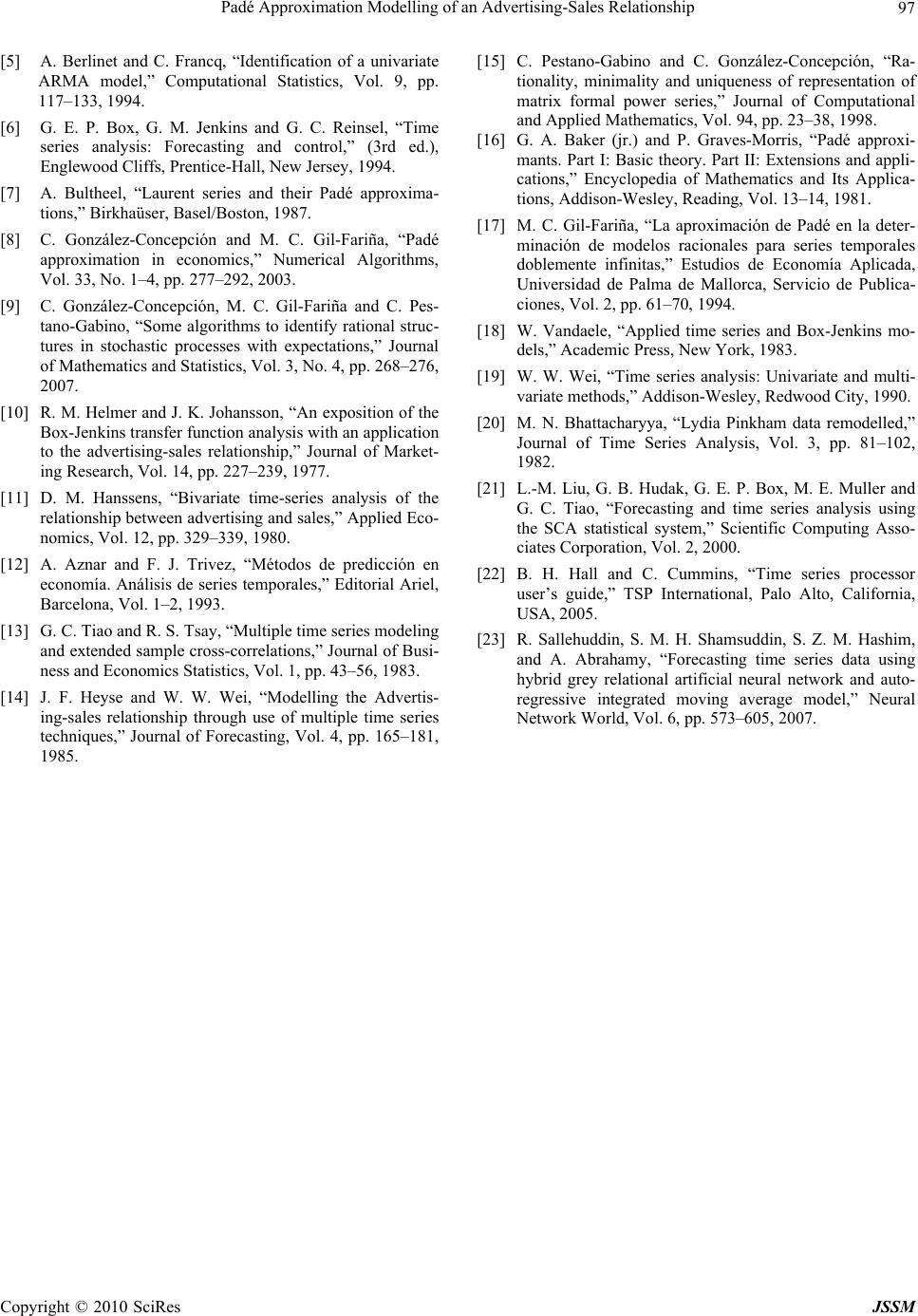

J. Service Science & Management, 2010, 3 : 91 -97 doi:10.4236/jssm.2010.31011 Published Online March 2010 (http://www.SciRP.org/journal/jssm) Copyright © 2010 SciRes JSSM 91 Padé Approximation Modelling of an Advertising-Sales Relationship* M. C. Gil-Fariña, C. Gonzalez-Concepcion, C. Pestano-Gabino Department of Applied Economics, Faculty of Economics and Business Administration, University of La Laguna (ULL), Campus of Guajara, Tenerife, Spain. Email: {mgil, cogonzal, cpestano}@ull.es Received December 18th, 2009; revised January 21st, 2010; accepted February 20th, 2010. ABSTRACT Forecasting reliable estimates on the future evolution of relevant variables is a main concern if decision makers in a variety of fields are to act with greater assurances. This paper considers a time series modelling method to predict relevant variables taking VARMA and Transfer Function models as its starting point. We make use of the rational Padé-Laurent Approximation, a relevant type of rational approximation in function theory that allows the decision maker to take part in the building of estimates b y providing the available info rmation and expectations for the decision variables. This method enhances the study of the dynamic relationship between variables in non-causal terms and al- lows for an ex ante sensibility analysis, an interesting matter in applied studies. The alternative proposed, however, must adhere to a type of model whose properties are of an asymptotic nature, meaning large chronological data series are required for its efficient application. The method is illustrated through the well-known data series on advertising and sales for the Lydia Pinkham Medicine Company, which has been used by various authors to illustrate their own proposals. Keywords: Time Series Modelling, Expectations, Economics, Numerical Methods, Padé Approximation 1. Introduction The possibility of forecasting reliable estimates for the future behaviour of relevant variables is main concern to decision making in numerous fields (including business, industry, energy, environmental, government agencies and medical and social network fields). Consequently, from a scientific standpoint, it is necessary to investigate alternative methods that can prov ide estimates while also introducing them into a technological system that allows the decision maker himself to participate in the composi- tion of said predictions. Many researchers have at- tempted to satisfy this requirement from different per- spectives, such that the prediction problem is always present in any generic data-mining task. And yet, the technique selected fo r use depend s on the availab ility an d type of data in relation to the hypotheses of the methods that sustain the desired technique and which yield dif- ferent degrees of accuracy, time horizons and different computational and social costs. The use of a relevant technique within the scope of rational approximation, namely the Padé Approximation (PA), has had a gratify- ingly enriching and stimulating effect on the study of the dynamic relationship structure between variables, espe- cially within the context of identifying univariate and multivariate ARMA models (see, among others, [1–5]). In particular, within the scope of rational model for- mulation in causal terms, this technique acquires a spe- cial relevance for characterizing simple models at a computational level with which to specify the determi- nistic part in certain time series models. At the same time, it provides reliable initial estimates for obtaining a de- finitive model by using more efficient, iterative methods once the random component has been ide nti fi ed. The choice of a particular VARMA model, namely the Transfer Function [6] model which constitutes one of the most widely used representations in the input-output context of dynamic stochastic systems through the use of polynomial rational expressions, serves to highlight the influence that the expectations or forecasts for an ex- planatory variable (input) exerts on the model under con- sideration. In this sense, the formulation of the time series analy- sis instruments that encompass the available sampling *This research was partially funded by Plan Nacional Projectno. MTM2008-06671, MTM2006-14961-C05-03 and the Centro de I nvestigación Matemátic a d e Ca n a r ias (CIMAC).  Padé Approximation Modelling of an Advertising-Sales Relationship Copyright © 2010 SciRes JSSM 92 information and the establishment of non-causal models into which the forecasts are incorporated, that is, the knowledge th at by way of ex ante or ex post expectations is provided by economic theory or by the empirical evi- dence, if any, about the model’s explanatory variable(s), provide a basic framework for tackling the study of the rational identification of time series models from a more general context. The method that allows for a sustained study of the time series identification from an evolutionary, but not necessarily causal, standpoint of the variables involved is based on a generalization of the PA concept to the study of formal Laurent series [7]. The use of this approach allows for the study of new dynamic identification pro- cedures by means of a single model that simultaneously approximates both time directions in a formal Laurent series while encompassing the classical case as a specific one when the expectations are not included (see, for ex- ample, [8,9 ]). The consideration of this broader dynamic framework, however, into which future information on the model’s variables is incorporated, favours a continuous feedback process through which the formulated expectations are replaced period by period by updated information as the em- pirical evidence modifi es or confirm s the predictions made. It is worth noting that the models are in no way insen- sitive to changes in the way the expectations are made; on the contrary, these changes lead to different dynamic behaviours insofar as it is the precise nature of the ex- pectations that determines the explicit dynamics of the forecasted variables. In this sense, the possibility of offering different mod- els for a single data series by simply modifying the ex ante expectations made by economic agents allows us to obtain future knowledge about their influence on the model and therefore to contrast and compare different dynamic specifications so as to yield an optimum model. In short, the performance of a sensibility analysis will permit for a contrast of the extent to which the forecasts of a variable’s future behaviour affect the mode’s predictions and, as a consequence , its adequacy to the empirical data. So as to illustrate the rational Padé Approximation in modelling time series, we develop an application for the study of data from the advertising-sales series involving the activity of the Lydia E. Pinkham Medicine Company for the period 1907–1960 [10]. This series, which has been analyzed by numerous authors to illustrate their proposed methods, presents, as noted in [11,12], various characteristics which make it the ideal example for studying the relationship between both variables. Some of the reasons that ju stify the pro minent role of this series in studies conducted to date are, among others, the im- portance of advertising as the company’s sole marketing instrument, as well as the elevated advertising costs to sales ratio (above 40%) which, in some instances, even exceeded 80%. This paper is structured into three sections. The first two present certain theoretical foundations for the prop- erties of the PA that allow for the identification of the orders in VARMA models and TF models with expecta- tions. We note the last section, which is devoted to the empirical results of the study on the aforementioned ad- vertising-sales series. We conclude the work with the more relevant conclusions and the main references. 2. VARMA Models A non-deterministic, k-dimensional centred process can be expressed as a vector autoregressive moving average model (VARMA(p, q)) if () () p tq t A BXB Ba, where 1 () ... p pp A BIAB AB and 1 ( )...q qq BBI BBBB are kxk polynomial matrices in the lag operator B, th at is, the coefficients i A and (1, ...,;1, ...,) j Bipj q are kxk matrices. The k vector t a is a series of i.i.d. random variables with a zero mean multivariate norm and covariance ma- trix . The series t X is said to be stationary when the zeros of ) P A B( are outside the unit circle and invertible when the same can be said for those of ) q BB( . This type of model is useful for understanding the dy- namic relationships between the components of the series t X . In this sense, one series can cause another or there may be a feedback relationship or they may be contem- poraneously related. In the case of the Lydia Pinkham advertising-sales se- ries, the joint modelling of these effects by means of the procedures described in [13] allows the type of dynamic relationship existing between both variables to be deter- mined [14]. A consideration of the PA matrix method yields the following theorem, which can be used in the first steps of the VARMA model identification. Theorem 1 [15].- Let t X be a second-order station- ary k-dimensional process. Let - ()( ) tth RhCovX X be the covariance matrices of the process. Let 1 ,0 1( ,)(((1))j kh MijRijk h . Then, ~ t XVARMA(,)pqrank 1( ,) M ij= rank 1(1,1) ,/, M ij ijiqjp  Padé Approximation Modelling of an Advertising-Sales Relationship Copyright © 2010 SciRes JSSM 93 3. Transfer Function Models with Expectations Based on the PA definitions for a formal power series [16] and its extension to the study of formal Laurent se- ries [7], we can provide a characterization for the identi- fication of a TF model with expectations by means of the Toeplitz determinants ,,1 ()( ) g fgif kj kj Tc detc Given two stationary time series , tt yx, let us assume the existence of a unidirectional causal dynamic rela- tionship tt x y given by the combination of simulta- neous and shifted effects of the input variables (including the presence of expected values that may or may not fol- low the same distribution as the data), and let us consider a generalized TF model of the form: (); ()i ttt i i yvBxNvB vB in which the ti x refers to the present and past of the input series (data) if 0i and to the expected values of the input series (expectation s) if 0i, and such that the exogenous variables represented by xt satisfy a VARMA model. A finite-order representation for the Impulse Response Function (IRF), namely, () i i i vB vB that simulta- neously approximates both directions in time and enables the estimation of a finite number of observations will be characterized by the following result: Theorem 2 [17].- Given the series () i i i vB vB , the following conditions are equivalent: a) 11 () (1)(1 ) Ki i iH NU ii ii ii aB vB qB qB b) ,,, ()0, ()0; ()0 <H>N; HN iKU iJM i Tv Tv TvJM , ()0 JM i Tv JKMU Due to the properties of the lag operator, the following equivalency holds: ,, , () () () () HK IL ttttt NU M AB AB yxNxN QB QB where , , , ,() y () IL M I HNLKNM NUABQB are polynomials of the form: ,0 () () LM ii ILiMi iI i A BaBQBqB Assuming the non-existence of common roots and the conditions for ensuring the stability of the model hold, the problem will consist of determining, in keeping with the sample information available and by means of a di- rect estimation of the IRF, the best orders ,, I LM that describe ()vB. With this in mind, the steps to follow in studying the dynamic identification for a generalized formulation of the TF model are: 1) Obtain the estimates ˆi v for the weights i v of the IRF ()vB, approximating ()vB by a finite number of terms, that is, 'ˆ () ki i ik vB vB with ,'kk Z, normally 0, '0kk . 2) Calculate the Toeplitz determinants associated with the series of estimated relative weights ˆ ˆˆ max i i i kik v v and arrange them in a tabular form (T-table) as a gener- alization of the C-Table for the classic case. 3) Estimate the model parameters. 4. Empirical Results The first model for the Lydia Pinkham advertising-sales for the period 1907–1960 involving the TF models method was proposed by [10], which assumed a unidi- rectional causal dynamic relationship from advertising to sales. The possible existence of a relationship in the other direction has, however, been mentioned by other authors. Various subsequent papers, including [14,18,19], have illustrated the application of this method using the ana- lyzed series as reference. This assumption of unidirec- tional causality has been questioned on several occasions, however, as some maintain there is a feedback relation- ship [11,14,19,20]. That is why, in what follows, we analyze two cases, one involving the identification of a VARMA model, and another in which, assuming the existence of a unidirectional causal dynamic relationship from advertising to sales, we present various TF models and analyze the influence on the sales trends of different behaviour schemes or ex ante forecasts for the variable input, which in this case is advertising. In any case, and given that both series exhibit non- stationarity, we present the models by taking first differences. 4.1 VARMA Models Once the ranks for 1( ,) M ij, 05, 05ij are obtained, applying Theorem 1 to the aforementioned data  Padé Approximation Modelling of an Advertising-Sales Relationship Copyright © 2010 SciRes JSSM 94 provides the results shown in Tables 1 and 2, depending on the sample size used in the estimates. This indicates, as per the above theorem, that the differentiated data fol- low a VARMA (0, 1) model exchangeable with (1, 0), according to Table 1, and a VARMA (0, 2) interchange- able with (2, 0), according to Table 2. Note how in Table 1, even though square (1, 1) does not have the same value as squares (i, i), i2 due to rounding errors in the calculations, using theoretical Padé Matrix Approximation results we know that these values have to coincide. Once the model orders are calculated, the maximiza- tion of the likelihood function allows for a determination of efficient estimators. Using the Time Series Processor (TSP) software package [21], the results for the estimated VARMA (1, 0) and VARMA (2, 0) models yield: 1 0.20 0.40 0.05 0.45 44132 23893 46790 ttt XX and 12 0.250.550.490.04 0.09 0.510.320.08 33326 18249 45672 tt tt XX X Table 1. Orders of VARMA models. Alternative 1 0 1 2 3 4 5 0 0 0 0 0 0 0 1 2 1 0 0 0 0 2 4 2 2 0 0 0 3 5 4 2 2 0 0 4 6 5 4 2 2 0 5 7 6 5 4 2 2 Table 2. Orders of VARMA models. Alternative 2 0 1 2 3 4 5 0 0 0 0 0 0 0 1 2 2 1 0 0 0 2 3 3 3 1 0 0 3 4 3 3 3 1 0 4 5 4 3 3 3 1 5 6 5 4 3 3 3 where 1,2 () t ttt XXX and 1t X and 2t X are the first differences of the advertising and sales data, respectively. As for the relationship between variables, we can con- clude that a) the value of element (1, 2) in coefficient 1 A in both models, namely 0.40 and 0.55, indicates the exis- tence of a relationship between sales and future advertis- ing in a period, b) the negligible value of element (2,1) in coefficient 1 A , namely -0.05 and -0.09, indicates a weak relationship between advertising and future sales, and c) the estimated correlation between residuals 1 ˆt and 2 ˆt indicates that advertising and sales are contemporane- ously related. Figures 1 and 2 show both models. 4.2 FT Models with Expectations Taking into account the relationship between sales and future advertising noted in the above VARMA models, we now build transfer function models associated with three specific cases, depending on whether the advertis- ing expectations follow a increasing or decreasing trend or whether they respect the predictions of the ARMA model for the input series (advertising), that is, 24 (1 0.2690.325)tt BBxN . ADV ERTIS ING. F IRS T DIFFERENCES -800 -600 -400 -200 0 200 400 600 1 6 11 16 21 26 31 36 41 46 51 Adv Dif VARMA (1,0) VARMA (2,0) Figure 1. Advertising. First differences SALES. FIRST DIFFERENCES -800 -600 -400 -200 0 200 400 600 800 1 9 17 25 33 41 49 Sales Dif VARMA (1,0) VARMA (2,0) Figure 2. Sales. First differences  Padé Approximation Modelling of an Advertising-Sales Relationship Copyright © 2010 SciRes JSSM 95 Starting from a generalized TF model for the advertis- ing (t x ) and sales () t y variables, and keeping in mind that the series are first-order integrable, we formulate the model () ttt yvBxa in which ()vB is approximated by a finite number of terms from k to k’, that is, 'ˆ () ki i ik vB vB , normally 0, '0kk. Following the steps suggested by the method proposed yields the following results: Case a: The expectations follow an increasing trend After estimating the weights ˆi v, the resulting T-table for the series of estimated relative weights is as shown in Table 3. The behaviour of this table suggests a model of the form 3,0 2,1 1,1 0,2 ˆ () () ˆ () () A BAB QB QB Specifically, once the parameters are estimated and the noise process is analyzed using the SCA software [22], the resulting model is: 1 2 .4334 .3267 1 1.5010.6518 ttt BB yxa BB Table 3. T-Table. Orders of TF models with expectations in Case a 1 2 3 4 5 6 7 -12 -.29 .09 -.02 .01 .00 .00 .00 -11 -.11 .21 -.05 .05 -.02 .01 .00 -10 .68 .45 .32 .24 .14 .09 .05 -9 -.11 -.07 .12 .24 .07 .04 .08 -8 .12 .04 .10 .21 -.03 -.05 .09 -7 .23 .14 .01 .19 .16 .14 .06 -6 -.76 .47 -.28 .16 .04 -.18 .25 -5 .46 .05 .16 .20 .20 .17 .45 -4 -.22 -.15 -.06 .06 .15 .34 .27 -3 .43 .23 .08 .06 .01 .44 .56 -2 .21 -.13 .013 .05 -.17 .57 .12 -1 .40 -.05 .31 .44 .51 .78 .82 0 1.00 .93 .87 .75 .51 .35 -.01 1 .16 -.16 .16 .28 -.01 .17 .02 2 .18 .00 .08 .11 -.09 .08 -.02 3 .22 .09 .04 .07 .01 .03 .03 4 -.26 .08 -.06 .04 .02 .00 -.03 5 -.05 -.09 .01 .04 .01 .02 .02 Case b: The expectations follow a decreasing trend In this case, the method yields the following model: 1 2 .4331 .3285 1 1.5016.6514 ttt BB y xa BB as suggested by Table 4. Note the analogy between the models for cases a) and b). Case c: The exp ectatio ns are g enerat ed by th e ARMA model of the input series In this case, the T-table obtained by the series of esti- mated relative weights is shown in Table 5 and suggests a model of the form 3,0 1,2 2,1 0,3 ˆ () () ˆ () () A BAB QB QB which, once estimated, yields 1 2 .5413 .1775 1 1.3754.6612 ttt B yxa BB whose parameters differ significantly from those ob- tained in the first two cases. The results for the three cases considered are shown in Figures 3, 4 and 5. As we can see, the incorporation in the model of the ex ante advertising forecasts as well as the various forma- tive mechanisms that not only include the information contained in the available historical data but also that derived from the company’s desires and the strategies and outlooks devised by the economic agents in the deci- sion-making process, facilitate obtaining valid dynamic formulations from a data fitting perspective. In addition, Table 4. T-Table. Orders of TF models with expectations in Case b 1 2 3 4 5 6 7 -12 -.21 .04 -.01 .00 .00 .00 .00 -11 -.14 .19 -.06 .04 -.02 .01 .00 -10 .83 .68 .58 .51 .42 .34 .28 -9 -.14 -.13 .20 .47 .10 .01 .25 -8 .18 .07 .18 .39 .01 -.07 .21 -7 .25 .21 .02 .32 .28 .25 .14 -6 -.82 .56 -.38 .25 .04 -.30 .51 -5 .46 .02 .16 .24 .27 .27 .76 -4 -.23 -.13 -.05 .06 .15 .44 .40 -3 .39 .20 .07 .05 -.02 .50 .69 -2 .22 -.11 .10 .06 -.16 .60 .18 -1 .41 -.05 .26 .41 .50 .78 .83 0 1.00 .91 .83 .71 .47 .33 -.02 1 .21 -.13 .16 .26 -.03 .15 .01 2 .18 -.02 .07 .10 -.08 .07 -.01 3 .23 .10 .04 .06 .01 .02 .03 4 -.23 .08 -.06 .03 .02 .00 -.03 5 -.10 -.07 .01 .03 .01 .02 .03  Padé Approximation Modelling of an Advertising-Sales Relationship Copyright © 2010 SciRes JSSM 96 Table 5. T-Table. Orders of TF models with expectations in Case c 1 2 3 4 5 6 7 -12 -.25 .06 -.02 .00 .00 .00 .00 -11 -.11 .21 -.05 .05 -.02 .01 -.01 -10 .79 .61 .50 .43 .33 .26 .20 -9 -.12 -.12 .19 .40 .12 .03 .22 -8 .17 .06 .17 .32 .01 -.10 .22 -7 .27 .21 .04 .25 .26 .27 .15 -6 -.79 .50 -.29 .15 .12 -.34 .53 -5 .49 .08 .18 .23 .26 .20 .69 -4 -.20 -.16 -.04 .06 .15 .39 .38 -3 .41 .21 .07 .04 -.01 .47 .66 -2 .23 -.12 .11 .04 -.14 .58 .15 -1 .41 -.06 .27 .40 .49 .77 .83 0 1.00 .92 .83 .70 .46 .31 -.04 1 .21 -.14 .17 .27 -.01 .15 .02 2 .18 -.02 .08 .11 -.09 .07 -.02 3 .25 .10 .05 .07 .01 .02 .03 4 -.24 .08 -.06 .04 .02 .00 -.03 5 -.07 -.08 .01 .04 .02 . 02 .02 ADV ERTISING. ARM A M O DEL 0 500 1000 1500 2000 2500 1 7 13 19 25 31 37 43 49 55 61 67 ADVERTISING DATA ARMA MODEL Figure 3. Advertising. ARMA model ADVERTISING. DATA AND EXPECTATIONS 0 500 1000 1500 2000 2500 1 8 15 22 29 36 43 50 57 64 DECREAS ING EXP. INCREASING EXP. DATA AND AR MA MODEL EXP. Figure 4. Advertising. Data and expectations SALES . TRANSFER FUNCTION MODEL W I TH ADVERTISING EXPECTATIONS 0 500 1000 1500 2000 2500 3000 3500 4000 1 8 15 22 29 36 43 50 SALES TF MODEL DECR EXP TF MODEL INCR E XP TF MODEL ARMA EXP Figure 5. Sales. Transfer function model with advertising expectations to the extent that a knowledge can be had of the future influence of said forecasts on the relationship under con- sideration, it is possible to evaluate its sensitivity to al- ternative dynamic specifications and, as a consequence, determine the optimum model. 5. Conclusions In this paper we show the usefulness of the Padé-Laurent Approximation to the study of the deterministic part in the dynamic relationship between various variables, since it allows for the introduction of expectations or expected future values for certain variables. We illustrate the tech- nique described by modelling the dynamic relationship between advertising and sales for the available data in the references consulted for the Lydia E. Pinkham Company. Also included is a sensitivity analysis of the estimates as a function of the expected future values or expectations of the decision maker for the advertising variable. It would be interesting to combine this approach with the use of hybrid models that include a proper combina- tion of linear and/or non-linear models of the type stud- ied in [23]. REFERENCES [1] J. M. Beguin, C. Gourieroux and A. Monfort, “Identifica- tion of a mixed autoregressive-moving average process: The corner method,” In Time Series, O. D. Anderson, Ed., Amsterdam, North-Holland, pp. 423–436, 1980. [2] G. M. Jenkins and A. S. Alavi, “Some aspects of model- ling and forecasting multivariate time series,” Journal of Time Series Analysis, Vol. 2, pp. 1–47, 1981. [3] K. Lii, “Transfer function model order and parameter estimation,” Journal of Time Series Analysis, Vol. 6, No. 3, pp. 153–169, 1985. [4] P. Claverie, D. Szpiro and R. Topol, “Identification des modèles à fonction de transfert: La méthode Padé-trans- formée en z,” Annales D'Economie et de Statistique, Vol. 17, pp. 145–161, 1990.  Padé Approximation Modelling of an Advertising-Sales Relationship Copyright © 2010 SciRes JSSM 97 [5] A. Berlinet and C. Francq, “Identification of a univariate ARMA model,” Computational Statistics, Vol. 9, pp. 117–133, 1994. [6] G. E. P. Box, G. M. Jenkins and G. C. Reinsel, “Time series analysis: Forecasting and control,” (3rd ed.), Englewood Cliffs, Prentice-Hall, New Jersey, 1994. [7] A. Bultheel, “Laurent series and their Padé approxima- tions,” Birkhaüser, Basel/Boston, 1987. [8] C. González-Concepción and M. C. Gil-Fariña, “Padé approximation in economics,” Numerical Algorithms, Vol. 33, No. 1–4, pp. 277–292, 2003. [9] C. González-Concepción, M. C. Gil-Fariña and C. Pes- tano-Gabino, “Some algorithms to identify rational struc- tures in stochastic processes with expectations,” Journal of Mathematics and Statistics, Vol. 3, No. 4, pp. 268–276, 2007. [10] R. M. Helmer and J. K. Johansson, “An exposition of the Box-Jenkins transfer function analysis with an application to the advertising-sales relationship,” Journal of Market- ing Research, Vol. 14, pp. 227–239, 1977. [11] D. M. Hanssens, “Bivariate time-series analysis of the relationship between advertising and sales,” Applied Eco- nomics, Vol. 12, pp. 329–339, 1980. [12] A. Aznar and F. J. Trivez, “Métodos de predicción en economía. Análisis de series temporales,” Editorial Ariel, Barcelona, Vol. 1–2, 1993. [13] G. C. Tiao and R. S. Tsay, “Multiple time series modeling and extended sample cross-correlations,” Journal of Busi- ness and Economics Statistics, Vol. 1, pp. 43–56, 1983. [14] J. F. Heyse and W. W. Wei, “Modelling the Advertis- ing-sales relationship through use of multiple time series techniques,” Journal of Forecasting, Vol. 4, pp. 165–181, 1985. [15] C. Pestano-Gabino and C. González-Concepción, “Ra- tionality, minimality and uniqueness of representation of matrix formal power series,” Journal of Computational and Applied Mathematics, Vol. 94, pp. 23–38, 1998. [16] G. A. Baker (jr.) and P. Graves-Morris, “Padé approxi- mants. Part I: Basic theory. Part II: Extensions and appli- cations,” Encyclopedia of Mathematics and Its Applica- tions, Addison-Wesley, Reading, Vol. 13–14, 1981. [17] M. C. Gil-Fariña, “La aproximación de Padé en la deter- minación de modelos racionales para series temporales doblemente infinitas,” Estudios de Economía Aplicada, Universidad de Palma de Mallorca, Servicio de Publica- ciones, Vol. 2, pp. 61–70, 1994. [18] W. Vandaele, “Applied time series and Box-Jenkins mo- dels,” Academic Press, New York, 1983. [19] W. W. Wei, “Time series analysis: Univariate and multi- variate methods,” Addison-Wesley, Redwood City, 1990. [20] M. N. Bhattacharyya, “Lydia Pinkham data remodelled,” Journal of Time Series Analysis, Vol. 3, pp. 81–102, 1982. [21] L.-M. Liu, G. B. Hudak, G. E. P. Box, M. E. Muller and G. C. Tiao, “Forecasting and time series analysis using the SCA statistical system,” Scientific Computing Asso- ciates Corporation, Vol. 2, 2000. [22] B. H. Hall and C. Cummins, “Time series processor user’s guide,” TSP International, Palo Alto, California, USA, 2005. [23] R. Sallehuddin, S. M. H. Shamsuddin, S. Z. M. Hashim, and A. Abrahamy, “Forecasting time series data using hybrid grey relational artificial neural network and auto- regressive integrated moving average model,” Neural Network World, Vol. 6, pp. 573–605, 2007. |