Paper Menu >>

Journal Menu >>

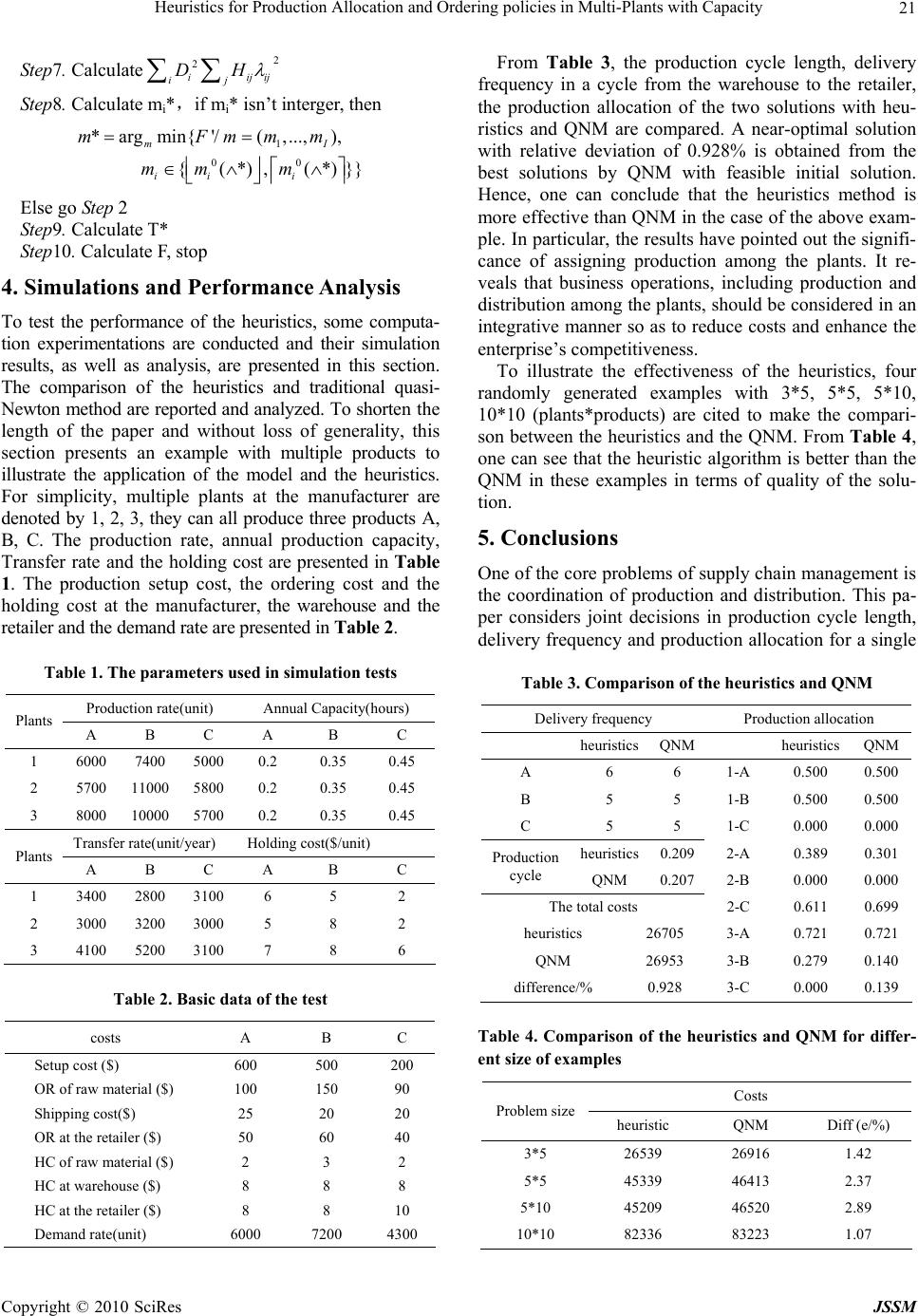

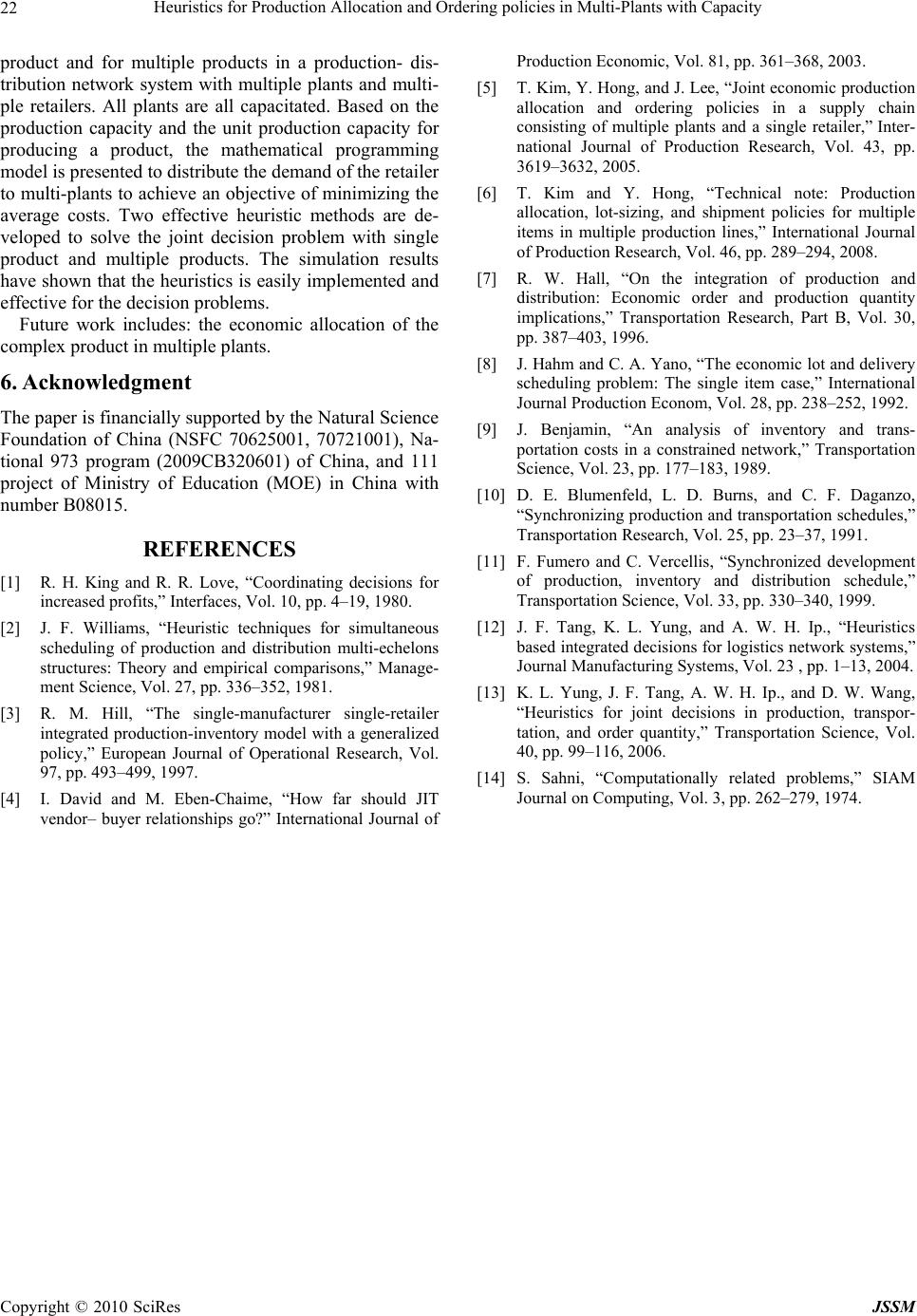

J. Service Science & Management, 2010, 3 : 16 -22 doi:10.4236/jssm.2010.31002 Published Online March 2010 (http://www.SciRP.org/journal/jssm) Copyright © 2010 SciRes JSSM Heuristics for Production Allocation and Ordering Policies in Multi-Plants with Capacity Jie Zang1,2, Jiafu Tang1 1School of Information Science and Engineering, Northeastern University, Shenyang, China; 2School of Information, Liaoning University, Shenyang, China. Email: jiez00509@sina.com, jftang@mail.neu.edu.cn Received October 19th, 2009; revised November 27th, 2009; accepted January 5th, 2010. ABSTRACT Joint decisions in production allocation and ordering policies for single and multiple products in a produc- tion-distribution network system consisting of multiple plants are discussed, production capacity constraints of multi-plants and unit production capacity for producing a product are considered. Based on the average total cost in unit time, the decisive model is established. It tries to determine the production cycle length, delivery frequency in a cycle from the warehouse to the retailer and the economic production allocation. The approach hinges on providing an optimized solution to th e joint decision model through the heuristics methods. The heuristic algorithms are proposed to solve the single-product joint decision model and the multi-products decision prob lem. Simulations on different sizes of problems have shown that the heuristics is effective, and in general more effective than Quasi-Newton method (QNM). Keywords: Joint Decisions, Production-Distribution; Multiple Plants, Capacitated, Heuristic Algorithm 1. Introduction In the past, logistic decision among material procurement management, production and distribution were made in isolation. Previous studies have examined production, transportation and inventory separately. These major ac- tivities are closely related with each other and should be coordinated effectively to enhance its profit in today’s competitive market. Uncoordinated and isolated deci- sion-making among functional related activities in supply chain system may weaken its system-wide competitive- ness. Hence, more efforts are now being made to inte- grate coordinate production and distribution, production and transportation, production and inventory, as well as transportation and inventory in the form of supply chain management. King [1] described the implementation of a coordi- nated production-distribution system, a major tire manufacturer with four factories and nine major dis- tribution centers. Williams [2] considered the problem of joint scheduling of production and distribution in a complex network, the objective of the problem was to minimize average production and distribution cost per period. Hill [3] discussed production-delivery policies in a single manufacturer and a single retailer. David [4] attempted to identify lot sizing and delivery schedul- ing in a single manufacturer and a single retailer sys- tem. Kim [5] discussed the production and ordering policies in a supply chain consisting of a single manu- facturer and a single retailer. He proposes an efficient heuristic algorithm to determine the near optimal pro- duction allocation ratios. Kim [6] extended their paper and develops joint economic production allocation, lot-sizing, and shipment policies in a supply chain where a manufacturer produces multiple items in mul- tiple production lines and ships the items to the re- spective retailers. Their formulations are often based on economic order quantity (EOQ) and mathe- matical programming. Accordingly, the corresponding solu- tion methods are EOQ [7,8], heuristics [5,6,9] and decomposition [10,11]. In recent studies, model for coordinating production- distribution network systems have tended to focus on joint decisions on all activities. More complicated inte- grated decisions on production, transportation, and in- ventory have received relatively little attention, as in [12] and [13]. Tang [12] discussed an integrated decision on production assignment, lot-sizing, transportation, and order quantity for a multiple-supplier/multiple-destin- ations logistics network in a global manufacturing system and proposed a heuristics to solve medium and large- scale integrated decision problems. Yung [13] attempted  Heuristics for Production Allocation and Ordering policies in Multi-Plants with Capacity Copyright © 2010 SciRes JSSM 17 to tackle joint decisions in assign ing production, lot-size, transportation, and order quantity for sing and multiple products in a production-distribution network system with multiple suppliers and multiple destinations. He provided an optimized so lution to so lve the jo int decision model through a two-layer decomposition method that combines several heuristics. This paper addresses the issue of how to effectively allocate production requirement to multiple plants in sup- ply chain system. Kim [5,6] discussed the production and ordering policies in a supply chain consisting of a single manufacturer with multiple plan ts and a single retailer or multiple retailers. The retailers place orders based on the EOQ-like policy, and the multiple plants produce de- mand requirement from the retailers. Each of multiple plants has its production and tran sfer rates. In real life, all the plants in the manufacturer have production capacity constraints. All the plants should produce within its ca- pacity to meet the demands of the retailers. The problem discussed in this paper extends the model proposed by [5,6], and production capacity constraints of multi-plants and unit production capacity for producing a product are considered in the model. The heuristics methods have been developed to solve the problem with single product and multiple products, respectively. In this paper, the model for a single product will be dis- cussed in Section 2, followed by detailed discussion to solve multiple products in Section 3. One illustrated ex- ample with several testing problems and their respective simulation results and analyses are presented in Section 4. 2. Formulations and Heuristics with Single Product 2.1 Problem Formulations In a global manufacturing enterprise, there are plants each producing multiple parts and multiple assemblies that serve multiple assembly plants in a year, or alterna- tively, each assembly plant demands multiple parts from many different suppliers. Hence, such a global manufac- turing enterprise can be formulated as a combined pro- duction-distribution network consisting of multiple sup- pliers and multiple destinations. In this paper, we con- sider a production-distribution network composed of a single manufacturer with multiple plants and multiple retailers. The retailers are given annual demand of the product. To meet the annual demands of the product, the manufacturer procures the materials and multi-plants produce within their capacity in the manufacturer. The multi-plants of the manufacturer have their production rate. Th e fin ished produ cts ar e tr ansf err ed to the co mmon warehouse at the plants’ transfer rate. Finally, the ware- house delivers the ordered lots of a fixed size to the re- tailer periodically. The network is shown in Figure 1. The cost components considered include two parts, the first part is the ordering cost from raw materials, the pro- Supplier Procuremen inventory Plant1 Plant2 Plant 。。。 Warehouse Retailer1 Retailer2 Retailer n 。。。 Figure 1. Production-distribution network duction setup cost, the ordering cost at the warehouse, and the ordering cost of the retailer; the second part is the holding costs for raw materia ls, work-in-process invento- ries, finished items at the warehouse and the retailer. Assume that there are mplants in a manufacturer, where each of the plants is indicated by the subscripts j. The following notations and d ecision vari ables are applied. j P= annual production rate at plantj (unit/year) j Q= annual production capacity at plantj (year) j d= annual transfer rate from plantjto the warehouse (unit) j u= production capacity needed to produce unit prod- uct at plant j (year) j h= holding cost for work-in-pro cesses at plant j ($) p S= production setup cost at the manufacturer ($) m A =ordering cost for raw materials at the manufac- turer ($) w A = order handling cost for finished products at the warehouse ($) r A = ordering cost at the retailer ($) m H = holding cost for raw materials at the manufac- turer ($) w H = holding cost for finished products at the ware- house ($) r H = holding cost for finished products at the retailer ($) D=demand rate in units at the retailer (unit/year) T= decision variable, production cycle length at the manufact ur er (year) m= decision variable, delivery frequency in a produc- tion cycle from the warehou se to the retailer 1 ( ,...,) j decision variable, production allocation for multiple plants These notations will be extended in Section 3 to in- clude multiple products. Accordingly, from the above parameters and decision variables, j jdD and j j Pd should be satisfied for the relevance of the pro-  Heuristics for Production Allocation and Ordering policies in Multi-Plants with Capacity Copyright © 2010 SciRes JSSM 18 posed model. 2.2 Joint Decision Model for a Single Product The average cost components considered in this problem include two parts, the first part is the ordering cost; the second part is the holding costs these two parts of the costs are denoted by F1 (T, m) and F2 (m, ) respectively. In a production cycle has m delivery from the warehouse to the retailer, so the ordering cost F1 (T, m) are given as 1(, )[()()]/ mp wr F TmA SmA AT (1) For the second part of the co sts, the average inventor y levels for raw materials, work-in-process in plant (j), and finished products at the warehouse and the retailer over the production cycle are denoted by Im, Ij, Iw and Ir, respectively. Im and Iw can be derived by the appendix of Reference [5]. From the decision variables, we can de- rived the production lot size is DT, and the apportioned production lot size for plant i is jDT . During a pro- duction cycle, the production time is / ii DT P , the deliv- ery time is / jj DT d , as illustrated in Figure 2. I t can be shown that, the average inventory for work-in-process Ij is 22 11 1 [( /)( /)] 22 (/2)[(/)(1/)] jjjjjjj jj jj I DT dDTDTPDT T DTdd P Hence, Im, Ij, Iw and Ir [5] a re gi ven a s 22 1 (/2) / n mjj i I DT P (2) 22 (/2)[(/)(1/)] j jj jj I DTdd P (3) 22 1 (/2)(11/)( /2)/ n wjj i I DTmD Td (4) /2 r I DT m (5) Hence, the holding cost F2(m, ) are given as 21 (,) n mmj jwwrr j F mHI hIHIHI (6) Substituting (2)–(5) into (6), we can obtain Figure 2. Inventroy trajectory for work-in-process in plant j 2 21 (,) (/2)[()/] where H n wwr jj j jm wj j jj FmDTHHHmDH hHH h Pd (7) The integrated decisions of the economic production allocation and delivery policies are expressed as the fol- lowing model: Min W= F1(T, m) +F2(m, ) 2 1 [() ()]/ (/2)[ ()/] mp wr n wwr jj j AS mAAT DTHHHmDH s.t. 1 j j (9) 0 /1,2,..., jj dD jn (10) 0 /1,2,..., jj j QDu jn (11) In this model, (8) is the objective of minimizing the average ordering and holding cost for raw materials, work-in-process, finished products at the warehouse and the retailer. The constraint (9) is the allocation vector for multiple plants. The constraints (10) and (11) should be satisfied by definition, respectively . 2.3 Heuristics Solution Procedures The model is a fractional nonlinear programming model that is neither convex nor concave and is difficult to be solved. So we transform this model with the decision variables (T, m , ) into a more simplified and equivalent problem with a decision variable , the last transformed problem is computed using a heuristic procedure. First, the problem is strictly convex with respect to T, thus the optimal cycle length T*(m, ) for a fixed pair of m and can be uniquely derived by solving dW/dT=0: 1/2 2 1 2[() ()] T* [()/()] mp wr n wwr jj j AS mAA HHHmDH D (12) Substituting T* into (8), we can derive E(m, ): 21/2 1 (,)(*,,) {2[() ()] [()/()]} mp wr n wwr jj j EmWT m AS mAA HHHmDH D (13) For (13), we can derive: 2 1 (/)[() ()] [()/( )] mP wr n wwr jj j SmA SmA A H HHmDHD (14) (8)  Heuristics for Production Allocation and Ordering policies in Multi-Plants with Capacity Copyright © 2010 SciRes JSSM 19 We can obtain (15) for fixed : n2 i1 2 2 23 (/) ()[ ] ()() 2( )() (/) wrw jj mpw r mpw r dS mAAH DH dm ASHH m ASHH dSm dm m (15) Since )/( 2 mSd /2 dm >0, we can obtain m from dS/dm=0 and is given by n21/2 1 () {()()/() [()]} mpw rwr wjj j mASHHAA HDH (16) Since other terms in (17) are constant regardless of except 2 1 n j j jDH , we reformulate the next problem equivalently as follows: 2 1 () s.t. (9),(10),(11) n j j j MaxG H This problem belongs to the class of quadratic maxi- mization problems subject to linear constraints with a positive definite quadratic term. Reference [14] has proved it is an NP-hard problem. Since this problem aims to assign production allocation j , a heuristic procedure is proposed as follows to solve it. The heuristic algorithm steps Step1. Resequence Hi in the descending order, such that 123 m H HH H; Step2. Let t be the current index number of the plant to be assigned, and 1 t ti i R be the total amount of the production allocation t=0, Rt =0; Step3. t=t+1 assignment to production to the tth plant point: If Rt-1<1 set 1 min{1,/ ,/} ttttt RdDQDu 1tt t RR Else 1 0, tttt RR End if Step4. If t<m , go to Step 3; else, go to Step5; Step5. Calculate the MaxG( ), then stop. After deriving *, we can obtain m* and T* from (16) and (12). 3. Joint Decisions for Multiple Products 3.1 Formulation with Multiple Products In many real cases, the manufacture often produces multi- ple products to meet the need of the retailers. In this pro- duction-distribution network of multiple products, the main issue is how joint decisions can be made annually on production cycle length, delivery frequency and produc- tion allocation at a minimal average cost to the network. To derive the solution, the notations are defined as follows: Pij = annual production rate for product i at plant j (unit/year) Qij = annual production capacity for product i at plant j (year) dij = annual transfer rate for product i from plant j to the warehouse (unit) uij = production capacity needed to produce unit prod- uct i at plant j (year) hij = holding cost for product i at plant j($) Si = production setup cost for product i at the manu- facturer ( $) R i A = ordering cost of raw materials for product i($) W i A = order handling cost for finished product i at the warehouse ($) C i A = ordering cost for product i at the retailer ($) R i H = holding cost of raw materials for product i($) W i H = holding cost for finished product i at the ware- house ($) C i H = holding cost for finis hed product i at the retailer ($) Di = demand rate for product i (unit/year) T = decision variable, production cycle length at the manufacture r ( year) mi = decision variable, delivery fr equency for product i in a production cycle from the warehouse to the retailer ij = decision variable, production allocation for prod- uct i in plant j Similar to the average cost structure of a single prod- uct, the ordering costs and the holding costs are repre- sented as follows, respectively: 1(, )[()()] RWC i iiiii i F TmASm AAT (18) The second part is the holding costs for raw materials, work-in-process inventories, finished items at the ware- house and the retailer. They are denoted by ,, R iij I I , i WC i I I respectively 22 1 (/2) / n R ii ijij j I DT P (19) 22 (/2)[(/)(1/)] ijiijijij ij j I DTdd P (20) 22 1 (/2)(11/)( /2)/ i n Wiiiijij j I DTmD Td (21) /2 C ii i I DT m (22) Hence, the holding cost 2(,) iij Fm are given as  Heuristics for Production Allocation and Ordering policies in Multi-Plants with Capacity Copyright © 2010 SciRes JSSM 20 2(,) i R RWWCC iijiiijij iii iiji i FmHIhI HIHI (23) Substituting (19)–(22) into (23), we can obtain 2 2(,)(/2)[ ()/] WWC iiji iiiiiijij ij FmTDHHHm DH (24) ()/()/ RW ijijiijiij ij H hHP Hhd (25) The integrated decisions of the economic production allocation and delivery policies are expressed as the fol- lowing model: 12 2 min(,)(,) [() ()] (/2) [ ()/] iiij RWC ii ii i i WWC iiiiiiij ij ij FFTmFm ASmAAT TDHHHmDH (26) .1 ij j s ti (27) 0/, ijij i dD ij (28) 0/ iji jiij QDu j (29) 3.2 Heuristics Method for Multiple Products The model is a fractional nonlinear programming model that is the same as the model with the single product. It can be solved by traditional nonlinear programming techniques, such as GINO, gradient search methods, where only the local optimal solution may be found. A heuristics is proposed to solve this problem. First, the problem is strictly convex with respect to T, thus the optimal cycle length T*(mi, ij) for a fixed pair of mi and ij can be uniquely derived by solving dF/dT=0: 1/2 2 2[()()] *( ,)[( )/] RWC iiii i i iij WWC iiiiiiij ij ij ASmA A Tm DHHHm DH (30) Substituting T* into (26), we can derive: 21/2 min' {2[(()())] [(( )/)]} RWC iiiii i WWC iiiiiiijij ij FASmAA DHHHm DH (31) For (31), we can derive: 2 (/){[()()]} {[ ()/]} RWC Ei ijiiiii i WWC iiiiiiij ij ij SmA S mAA DHHHm DH (32) We can obtain (33) for fixedij : 2 2 (/)()( ) ()() Ei ijWC W iiiii ijij ij i WCR iii ii i i i dS mAA DHDH dm HHD AS m (33) 2 23 2() () (/) WC R iii ii Ei iji ii i H HDA S dSm dm m (34) Since 2(/) E iij dS m /2 i dm >0, we can obtain m from dSE/dmi=0 and is given by 1/2 0 2 ()() () ()( ) WC R iii ii i iij WC W iiiii ijij ij HHD AS mAA DHDH (35) Substituting (35) in to (31), we get F(ij ): 21/2 1/2 (){2 ()[()]} [2()()] RW ijiiiiiij ij ii j WCW C iii ii i FASDHDH AAHHD (36) Since other terms in (36) are constant regardless of ij except 2 iijij j DH , we reformulate the next prob- lem equivalently as follows: 2 () iiij ij j Maximize GH s.t (27), (28), (29) This problem belongs to the class of quadratic maxi- mization problems subject to linear constraints with a positive definite quadratic term. Since this problem aims to assign production allocationi , a heuristic procedure is proposed as follows to solve t he model . The heuristi cs is Step1. Resequence Hij in the descending order for product i, such that123ii iin H HH H; Step2. i=i+1, Let t be the current index number of the plant to be assigned, and 1,0, 0 t itij it j RtR Step3. t=t+1 assignment to production to the tth plant point: If Rit<1 set min{1,/ ,/} ititit iit iit RdDQ Du ,1iti tit RR go Step 4 Else ,1 0, ititi tit RR End if Stetp4. if t<n, go to Step 3; else, go to Step5; Step5. Calculate () ii G ; Step6. if i<m, go Step 5  Heuristics for Production Allocation and Ordering policies in Multi-Plants with Capacity Copyright © 2010 SciRes JSSM 21 Step7. Calculate2 2 iijij ij DH Step8. Calculate mi*,if mi* isn’t interger, then 1 00 *arg min{'/(,...,), {(*),(*) }} mI iii mFmmm mmm Else go Step 2 Step9. Calculate T* Step10. Calculate F, stop 4. Simulations and Performance Analysis To test the performance of the heuristics, some computa- tion experimentations are conducted and their simulation results, as well as analysis, are presented in this section. The comparison of the heuristics and traditional quasi- Newton method are reported and analyzed. To shorten th e length of the paper and without loss of generality, this section presents an example with multiple products to illustrate the application of the model and the heuristics. For simplicity, multiple plants at the manufacturer are denoted by 1, 2, 3, they can all produce three products A, B, C. The production rate, annual production capacity, Transfer rate and the ho lding cost are presented in Table 1. The production setup cost, the ordering cost and the holding cost at the manufacturer, the warehouse and the retailer and the demand rate are presented in Table 2. Table 1. The parameters used in simulation tests Production rate(unit) Annual C apacity(hours) Plants A B C A B C 1 6000 7400 5000 0.2 0.35 0.45 2 5700 11000 5800 0.2 0.35 0.45 3 8000 10000 5700 0.2 0.35 0.45 Transfer rate(unit/year) Holding cost($/unit) Plants A B C A B C 1 3400 2800 3100 6 5 2 2 3000 3200 3000 5 8 2 3 4100 5200 3100 7 8 6 Table 2. Basic data of the test costs A B C Setup cost ($) 600 500 200 OR of raw material ($) 100 150 90 Shipping cost($) 25 20 20 OR at the retailer ($) 50 60 40 HC of raw material ($) 2 3 2 HC at warehouse ($) 8 8 8 HC at the retailer ($) 8 8 10 Demand rate(unit) 6000 7200 4300 From Table 3, the production cycle length, delivery frequency in a cycle from the warehouse to the retailer, the production allocation of the two solutions with heu- ristics and QNM are compared. A near-optimal solution with relative deviation of 0.928% is obtained from the best solutions by QNM with feasible initial solution. Hence, one can conclude that the heuristics method is more effective than QNM in the case of the above exam- ple. In particular, the results have pointed out the signifi- cance of assigning production among the plants. It re- veals that business operations, including production and distribution among the plants, should be considered in an integrative manner so as to reduce costs and enhance the enterprise’s competitiveness. To illustrate the effectiveness of the heuristics, four randomly generated examples with 3*5, 5*5, 5*10, 10*10 (plants*products) are cited to make the compari- son between the heuristics and the QNM. From Table 4, one can see that the heuristic algorithm is better than the QNM in these examples in terms of quality of the solu- tion. 5. Conclusions One of the core problems of supply chain management is the coordination of production and distribution. This pa- per considers joint decisions in production cycle length, delivery freq uency and production allocation for a single Table 3. Comparison of the heuristics and QNM Delivery frequency Prod uction allocation heuristicsQNM heuristicsQNM A 6 6 1-A 0.500 0.500 B 5 5 1-B 0.500 0.500 C 5 5 1-C 0.000 0.000 heuristics0.209 2-A 0.389 0.301 Production cycle QNM 0.207 2-B 0.000 0.000 The total costs 2- C 0 .611 0.699 heuristics 26705 3-A 0.721 0.721 QNM 26953 3-B 0.279 0.140 difference/% 0.928 3-C 0.000 0.139 Table 4. Comparison of the heuristics and QNM for differ- ent size of examples Costs Problem sizeheuristic QNM Diff (e/%) 3*5 26539 26916 1.42 5*5 45339 46413 2.37 5*10 45209 46520 2.89 10*10 82336 83223 1.07  Heuristics for Production Allocation and Ordering policies in Multi-Plants with Capacity Copyright © 2010 SciRes JSSM 22 product and for multiple products in a production- dis- tribution network system with multiple plants and multi- ple retailers. All plants are all capacitated. Based on the production capacity and the unit production capacity for producing a product, the mathematical programming model is presented to distribute the demand of the retailer to multi-plants to ach ieve an objective of minimizing the average costs. Two effective heuristic methods are de- veloped to solve the joint decision problem with single product and multiple products. The simulation results have shown that the heuristics is easily imple mented and effective for the decision problems. Future work includes: the economic allocation of the complex product in multiple plants. 6. Acknowledgment The paper is financ ially supported by the Natu ral Scienc e Foundation of China (NSFC 70625001, 70721001), Na- tional 973 program (2009CB320601) of China, and 111 project of Ministry of Education (MOE) in China with number B08015. REFERENCES [1] R. H. King and R. R. Love, “Coordinating decisions for increased profits,” Interfaces, Vol. 10, pp. 4–19, 1980. [2] J. F. Williams, “Heuristic techniques for simultaneous scheduling of production and distribution multi-echelons structures: Theory and empirical comparisons,” Manage- ment Science, Vol. 27, pp. 336–352, 1981. [3] R. M. Hill, “The single-manufacturer single-retailer integrated production-inventory model with a generalized policy,” European Journal of Operational Research, Vol. 97, pp. 493–499, 1997. [4] I. David and M. Eben-Chaime, “How far should JIT vendor– buyer relationships go?” International Journal of Production Economic, Vol. 81, pp. 361–368, 2003. [5] T. Kim, Y. Hong, and J. Lee, “Joint economic production allocation and ordering policies in a supply chain consisting of multiple plants and a single retailer,” Inter- national Journal of Production Research, Vol. 43, pp. 3619–3632, 2005. [6] T. Kim and Y. Hong, “Technical note: Production allocation, lot-sizing, and shipment policies for multiple items in multiple production lines,” International Journal of Production Research, Vol. 46, pp. 289–294, 2008. [7] R. W. Hall, “On the integration of production and distribution: Economic order and production quantity implications,” Transportation Research, Part B, Vol. 30, pp. 387–403, 1996. [8] J. Hahm and C. A. Yano, “The economic lot and delivery scheduling problem: The single item case,” International Journal Production Econom, Vol. 28, pp. 238–252, 1992. [9] J. Benjamin, “An analysis of inventory and trans- portation costs in a constrained network,” Transportation Science, Vol. 23, pp. 177–183, 1989. [10] D. E. Blumenfeld, L. D. Burns, and C. F. Daganzo, “Synchronizing production and transportation schedules,” Transportation Research, Vol. 25, pp. 23–37, 1991. [11] F. Fumero and C. Vercellis, “Synchronized development of production, inventory and distribution schedule,” Transportation Science, Vol. 33, pp. 330–340, 1999. [12] J. F. Tang, K. L. Yung, and A. W. H. Ip., “Heuristics based integrated decisions for logistics network systems,” Journal Manufacturing Systems, Vol. 23 , pp. 1–13, 2004. [13] K. L. Yung, J. F. Tang, A. W. H. Ip., and D. W. Wang, “Heuristics for joint decisions in production, transpor- tation, and order quantity,” Transportation Science, Vol. 40, pp. 99–116, 2006. [14] S. Sahni, “Computationally related problems,” SIAM Journal on Computing, Vol. 3, pp. 262–279, 1974. |