Theoretical Economics Letters

Vol. 2 No. 3 (2012) , Article ID: 21510 , 7 pages DOI:10.4236/tel.2012.23056

Stackelberg-Cournot and Cournot Equilibria in a Mixed Markets Exchange Economy

1LEG, University of Burgundy, Dijon, France 2EconomiX, University of Paris West-Nanterre, Paris, France

3IRES, Catholic University of Louvain, Louvain, Belgium

Email: ludovic.julien@u-paris10.fr

Received April 6, 2012; revised May 8, 2012; accepted June 9, 2012

Keywords: Stackelberg-Cournot Equilibrium; Conjectural Variations; Preferences

ABSTRACT

In this note, we compare two strategic general equilibrium concepts: the Stackelberg-Cournot equilibrium and the Cournot equilibrium. We thus consider a market exchange economy including atoms and a continuum of traders, who behave strategically. We show that, when the preferences of the small traders are represented by Cobb-Douglas utility functions and the atoms have the same utility functions and endowments, the Stackelberg-Cournot and the Cournot equilibrium equilibria coincide if and only if the followers’ best responses functions have a zero slope at the SCE.

1. Introduction

Oligopolistic competition in general equilibrium has been developed in two main directions. The first is the Cournot-Walras equilibrium approach, which is modeled by Gabszewicz and Vial [1] in an economy with production, and in exchange economies by Codognato and Gabszewicz [2,3], Gabszewicz and Michel [4], and Busetto, Codognato and Ghosal [5,6]. This class of models includes agents who behave strategically (the atoms), while other agents behave competitively (the atomless continuum of traders). The second is the Cournot equilibrium (CE) based on strategic market games as notably modeled by Shapley and Shubik [7], Dubey and Shubik [8], Sahi and Yao [9], and Amir, Sahi, Shubik and Yao [10]. In this approach, all traders always behave strategically and can send quantity signals indicating how much of any commodity they are willing to buy and/or sell. Some contributions aim at comparing the CE with other strategic equilibria. Codognato [11] studies the equivalence between the Cournot-Walras equilibrium and the CE, while Codognato [12] compares two Cournot-Nash equilibrium models. In this note, we compare the CE and the Stackelberg-Cournot equilibrium (SCE) defined for finite economies in Julien and Tricou [13,14]. From the benchmark of strategic market games, the SCE concept inserts Stackelberg competition into interrelated markets. We determine the conditions under which the CE and the SCE are equivalent.

The equivalence is studied in an economy embodying atoms and a continuum of traders. We thus consider a mixed exchange economy a la Shitovitz [15] and Codognato [11], in which the traders who are endowed with a corner endowments are atoms, while the traders endowed with all other commodities are represented by an atomless continuum. Markets are complete and prices are consistent. We assume the individual positions and the timing of moves as given. In addition, existence and uniqueness of oligopoly equilibrium are deleted. We rather focus on the case for which both sets of strategic equilibria can have a nonempty intersection. Indeed, when the preferences of the small traders are represented by Cobb-Douglas utility functions, and when the atoms have the same endowments and utility functions, the SCE and the CE coincide if and only if the followers’ best responses functions have a zero slope at the SCE. We so spread the result obtained by Codognato [11] for Cournotian economies to a class of exchange economies in which the strategic interactions recover from sequential decisions. We also provide a generalization of Julien [16] because henceforth all the traders behave strategically.

The paper is organized as follows. Section 2 specifies the mixed markets exchange economy. Section 3 provides a characterization and a definition of the SCE. Section 4 is devoted to the statement and the proof of the proposition. In Section 5, an example is given. In Section 6, we conclude.

2. A Mixed Markets Exchange Economy

2.1. The Framework

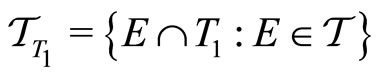

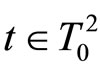

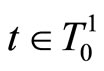

The space of commodites is . The economy thus includes a finite set

. The economy thus includes a finite set  of divisible consumption goods, indexed by

of divisible consumption goods, indexed by . Let

. Let  be a complete measure space of agents, where

be a complete measure space of agents, where  denotes the set of traders,

denotes the set of traders,  a

a  -algebra of all measurable subsets of

-algebra of all measurable subsets of , and

, and  a real valued (with

a real valued (with

), non negative and additive measure defined on

), non negative and additive measure defined on . The space of agents embodies large traders, represented by atoms, and small traders, represented by an atomless continuum. So, let

. The space of agents embodies large traders, represented by atoms, and small traders, represented by an atomless continuum. So, let , where

, where  is the set of atoms, while

is the set of atoms, while  is the set of small traders. The set of atoms embodies two subsets: the subset of leaders

is the set of small traders. The set of atoms embodies two subsets: the subset of leaders  and the subset of followers

and the subset of followers , so

, so . The measure space

. The measure space

is purely atomic, while the measure space

is purely atomic, while the measure space

is atomless. Therefore,

is atomless. Therefore,  is the counting measure on

is the counting measure on , when restricted to

, when restricted to , and the Lebesgue measure, when restricted to

, and the Lebesgue measure, when restricted to .

.

2.2. Assumptions

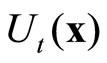

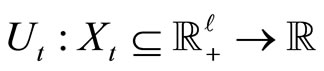

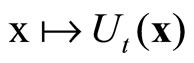

Any trader is represented by his initial endowments , his utility function

, his utility function  which represents his preferences among the commodity bundles

which represents his preferences among the commodity bundles , and his strategy set (see thereafter). A commodity bundle is a point in

, and his strategy set (see thereafter). A commodity bundle is a point in , where

, where  (a closed convex set). An assignment (of commodity bundles to traders) is an integrable function

(a closed convex set). An assignment (of commodity bundles to traders) is an integrable function  from

from  to

to . All integrals are with respect to

. All integrals are with respect to . We consider the following set of assumptions regarding utility and endowments.

. We consider the following set of assumptions regarding utility and endowments.

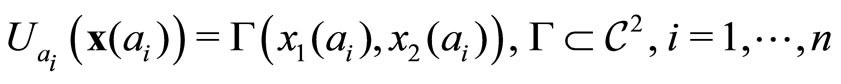

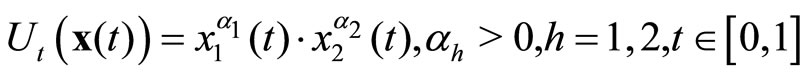

Assumption 1. For all ,

,  ,

,  is continuous, strictly monotone in

is continuous, strictly monotone in  and concave for

and concave for , and strictly quasi-concave on

, and strictly quasi-concave on  for

for . In addition,

. In addition,  is measurable.

is measurable.

Assumption 2. The distribution of initial endowments among traders satisfies:

(1)

(1)

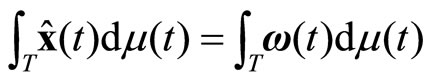

Traders will exchange some amounts of their endowments in order to reach their final allocations. A feasible allocation is an assignment  for which

for which

. The price vector is given by

. The price vector is given by

.

.

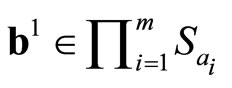

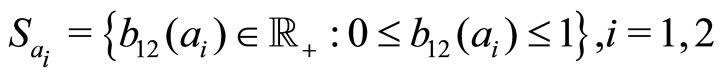

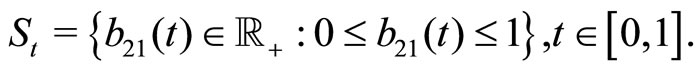

2.3. Strategy Sets

Each trader uses fractions of his initial endowment to trade them for the  commodities. The strategic behavior then involves all the amounts of the owned good(s) that are engaged in exchange of all commodities. A strategy for a trader

commodities. The strategic behavior then involves all the amounts of the owned good(s) that are engaged in exchange of all commodities. A strategy for a trader ,

,  , may be represented by an

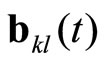

, may be represented by an  matrix

matrix , where bkl represents the amount of commodity k any trader t offers in exchange for commodity

, where bkl represents the amount of commodity k any trader t offers in exchange for commodity . A strategy set for any trader

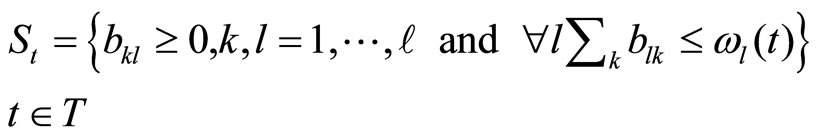

. A strategy set for any trader  may be written:

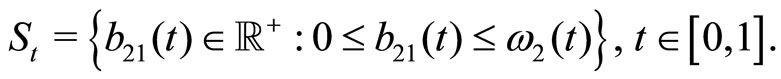

may be written:

(2)

(2)

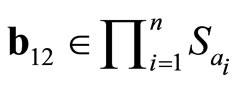

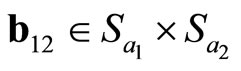

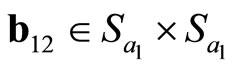

The strategy set of any trader  is the set of all matrices

is the set of all matrices  satisfying

satisfying . A strategy selection for

. A strategy selection for  is a function

is a function , defined on

, defined on  such that

such that  for all

for all , and such that

, and such that ,

,  are real valued integrable functions on

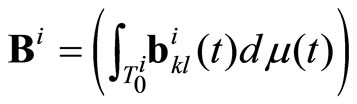

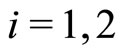

are real valued integrable functions on . Therefore, from (1) a strategy selection for

. Therefore, from (1) a strategy selection for  is a function

is a function  defined on

defined on  such that

such that , with

, with  for all

for all ,

,  , and such that

, and such that ,

,  are real valued integrable functions on

are real valued integrable functions on ,

, . Similarly, a strategy selection for

. Similarly, a strategy selection for  is a function

is a function  defined on

defined on  such that

such that , with

, with  for all

for all , and such that

, and such that ,

,  are real valued integrable functions on

are real valued integrable functions on . Given

. Given  (resp.

(resp. ) for all

) for all  (resp.

(resp. ),

),  , one can define a strategy profile

, one can define a strategy profile  as the aggregate matrix

as the aggregate matrix  (resp.

(resp.

),

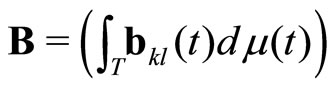

), . In addition, we define B as the aggregate matrix

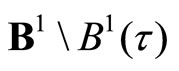

. In addition, we define B as the aggregate matrix . We also denote by

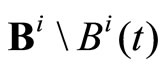

. We also denote by  a strategy profile obtained by replacing

a strategy profile obtained by replacing  in

in  by

by ,

, . The definition of a CE is given in Codognato [7] for mixed exchange economies. We now characterize and define the SCE.

. The definition of a CE is given in Codognato [7] for mixed exchange economies. We now characterize and define the SCE.

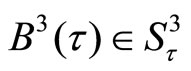

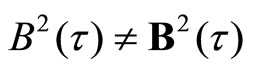

3. The Stackelberg-Cournot Equilibrium

3.1. The SCE: Characterization

A SCE can be modeled as a sequential game in two steps, which is solved by backward induction. The characterization of the SCE relies on the strategic market game mechanism provided by Sahi and Yao [9], since it generates consistent relative prices. Thus, given a strategy profile ,

,  , with

, with , is the solution to:

, is the solution to:

(3)

(3)

These conditions stipulate that the aggregate value of all goods supplied to buy any commodity l must be equal to the aggregate value of this good l supplied to buy any other commodity. From Sahi and Yao [9], we know that when the matrix B is irreducible, the market price  exists and is unique.

exists and is unique.

The strategic plan of follower t,  is determined by two elements: he manipulates the

is determined by two elements: he manipulates the  consistent relative prices, and he takes as given the matrices of bids of all leaders and all other followers. We thus denote by

consistent relative prices, and he takes as given the matrices of bids of all leaders and all other followers. We thus denote by  (resp.

(resp. ) a strategy profile which coincides with

) a strategy profile which coincides with  (resp.

(resp. ) for all

) for all  (resp.

(resp. ) except for

) except for  with

with  (resp.

(resp. ),

),  (resp.

(resp. ). The strategic plan of follower

). The strategic plan of follower  (resp.

(resp. ) may be written:

) may be written:

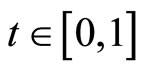

(4)

(4)

(5)

(5)

The solution to these programs yields the best response functions  of follower

of follower  and

and  of follower

of follower . Let

. Let  (resp.

(resp. ) be the real valued integrable function on

) be the real valued integrable function on  (resp.

(resp. ) with values in

) with values in  defined by

defined by

for all

for all  (resp.

(resp.

for all

for all ). In the symmetric equilibrium,

). In the symmetric equilibrium,  (resp.

(resp.

) for

) for ,

,

(resp.

(resp. ,

, ). The resulting best responses are

). The resulting best responses are

for all

for all , and

, and  for all

for all . Thenthe system of aggregate best response functions may be written:

. Thenthe system of aggregate best response functions may be written:

(6)

(6)

The system of equations given by (6) determines a consistency among the followers’ best response functions. We assume that the solution  exists and is unique. We denote

exists and is unique. We denote  a strategy profile which coincides with

a strategy profile which coincides with  for all

for all  except for

except for  with

with ,

, .

.

Leader , then solves the following program:

, then solves the following program:

(7)

(7)

The solution to this program yields the best response function  of leader

of leader . Let

. Let  be the real valued integrable function on

be the real valued integrable function on  with values in

with values in  defined by

defined by  for all

for all . In the symmetric SCE,

. In the symmetric SCE,  for

for ,

,

, so one gets the strategy profile

, so one gets the strategy profile , from which we deduce

, from which we deduce  and

and . The vector of equilibrium relative prices is

. The vector of equilibrium relative prices is , where

, where . The equilibrium allocation for any

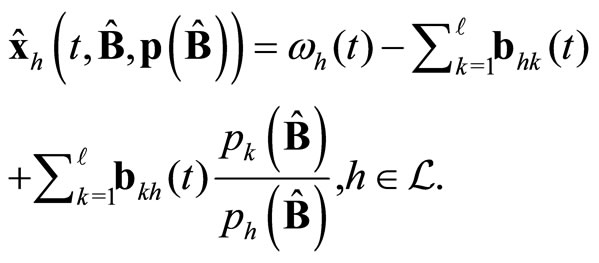

. The equilibrium allocation for any  corresponds to the assignment:

corresponds to the assignment:

(8)

(8)

3.2. The SCE: Definition

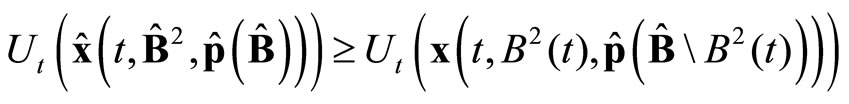

A SCE is a noncooperative equilibrium of a game where the players are the traders, the strategies are their supply decisions and the payoffs are their utility levels.

Definition. (SCE) A Stackelberg-Cournot equilibrium is given by a matrix , consistent prices

, consistent prices  and an allocation

and an allocation  such that:

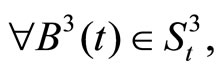

such that:

i.  for all

for all

ii.

iii. ,

,

iv. ,

,

v.

,

,  ,

, .

.

4. Equivalence between the SCE and the CE

Proposition. Assume that the preferences of the small traders are represented by Cobb-Douglas utility functions, and the atoms have the same endowments and utility functions. Then, the Stackelberg-Cournot and the Cournot equilibria coincide if and only if the followers’ best responses functions have a zero slope at the Stackelberg-Cournot equilibrium.

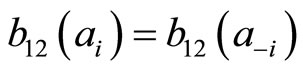

Proof. Consider n atoms, each being indexed by i,  (

( leaders and

leaders and  followers), and a continuum of traders, each being indexed by t,

followers), and a continuum of traders, each being indexed by t, . To simplify, suppose

. To simplify, suppose . Assume (A1) and (A2):

. Assume (A1) and (A2):

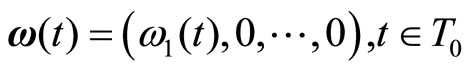

(A1)

(A1)

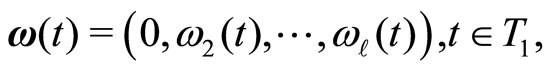

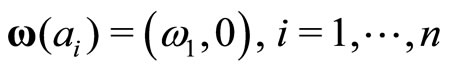

(A2)

(A2)

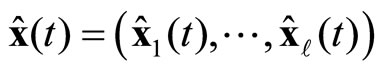

The strategy profiles are given by:

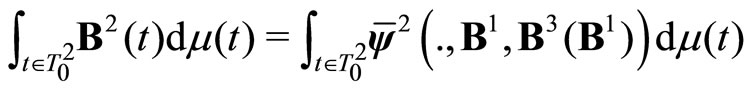

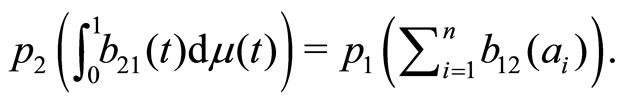

We first determine the SCE. Given strategy profiles  and

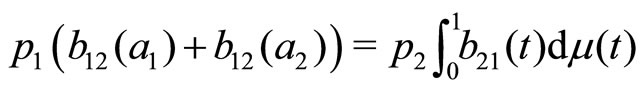

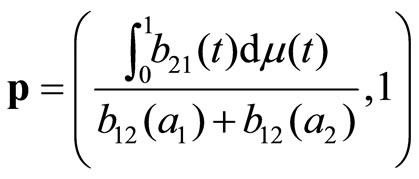

and  the market clearing condition given by (3) leads to:

the market clearing condition given by (3) leads to:

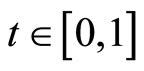

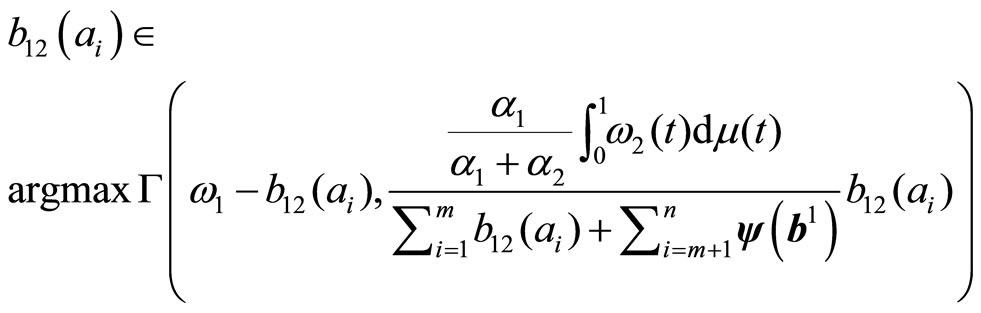

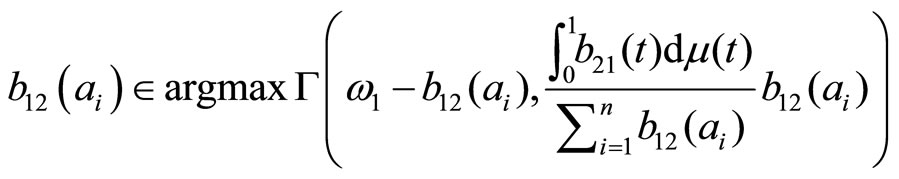

The first strategic step consists in determining the best-response functions of follower ,

,  , and follower

, and follower ,

,  , which are the solutions to:

, which are the solutions to:

Assuming symmetry, i.e. , for

, for ,

,  , one obtains:

, one obtains:

The second equation defines implicitly the best-response  of follower i,

of follower i,  where

where  is the vector of leaders’ strategies,

is the vector of leaders’ strategies,

is the vector of all followers strategies but

is the vector of all followers strategies but , while

, while  represents the strategy profile of the small traders. Note that from (A1)

represents the strategy profile of the small traders. Note that from (A1)  depends neither of

depends neither of  nor on

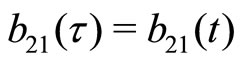

nor on . In the symmetric SCE, one gets

. In the symmetric SCE, one gets  for all

for all  and all

and all , with

, with , so

, so ,

, .

.

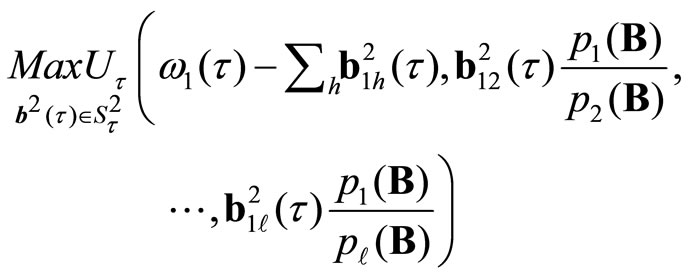

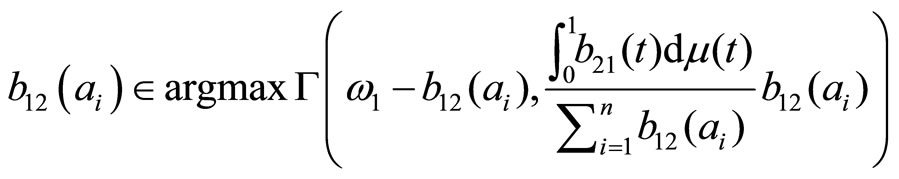

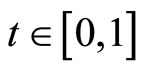

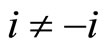

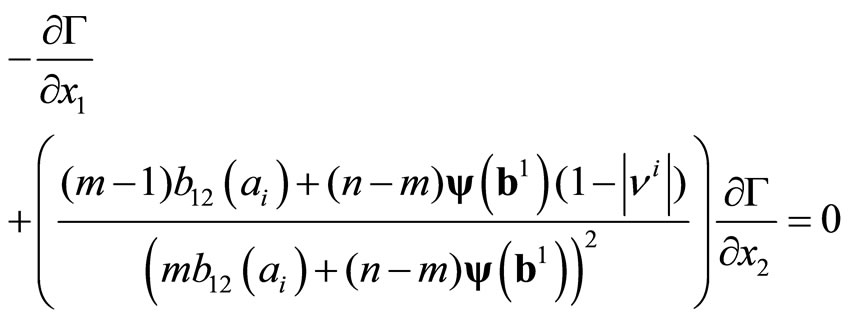

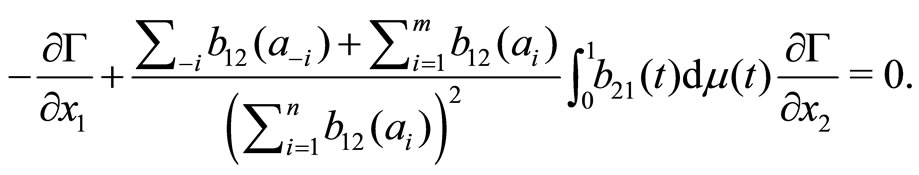

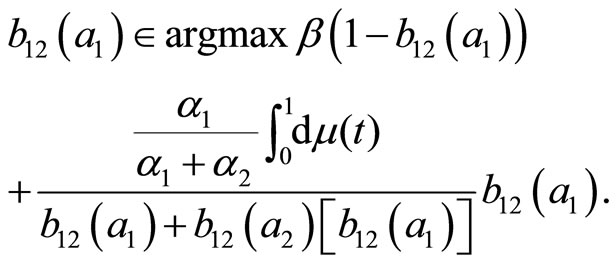

The second strategic step consists in determining the equilibrium strategy of any leader ,

,  , whom program may then be written:

, whom program may then be written:

At the symmetric SCE, we get  for all

for all  and all

and all , with

, with ,

,  , so:

, so:

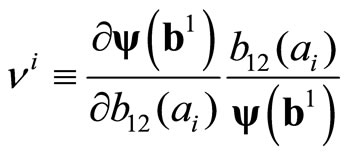

(C1)

(C1)

where ,

,  , represents the elasticity of the best response function of follower

, represents the elasticity of the best response function of follower ,

,  , (correctly) perceived by

, (correctly) perceived by ,

, .

.

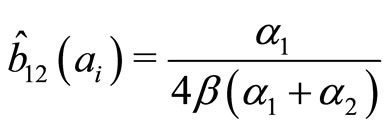

Equations (C1) yield the equilibrium strategy

of leader ,

,  , and then

, and then ,

,

,

,  and

and ,

,  , and

, and ,

, .

.

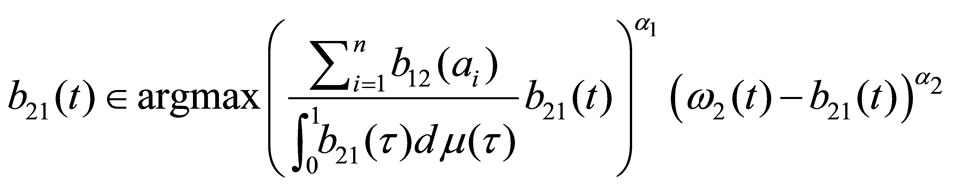

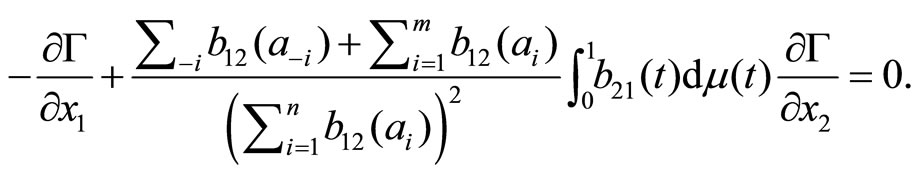

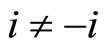

Let’s now determine the CE. Given strategy profiles  and

and  one deduces:

one deduces:

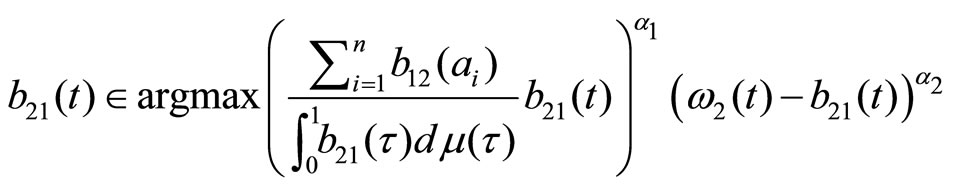

The first strategic step consists in determing the bestresponses of the followers ,

,  , and

, and ,

,  , which are the solutions to:

, which are the solutions to:

Assuming symmetry, i.e. ,

,  , one gets:

, one gets:

and:

The second equation defines implicitly the best-response of trader ,

, . Assuming symmetry among the atoms

. Assuming symmetry among the atoms  for all

for all  and all

and all , with

, with ,

,  , one deduces:

, one deduces:

(C2)

(C2)

where  represents the equilibrium strategy of atom

represents the equilibrium strategy of atom ,

, .

.

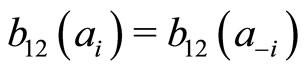

If for any ,

,  ,

,

,

,

, then

, then ,

, . In addition, if

. In addition, if ,

,  , then (C1) and (C2) are equivalent. So, one concludes that (C1) and (C2) lead to the same equilibrium strategies, prices and allocations. QED.

, then (C1) and (C2) are equivalent. So, one concludes that (C1) and (C2) lead to the same equilibrium strategies, prices and allocations. QED.

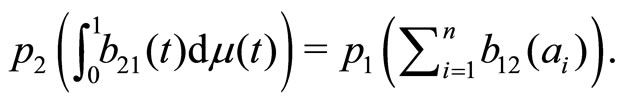

The equivalence result stipulates that Stackelberg competition in interrelated markets can lead to Cournot outcomes. Provided symmetry assumptions regarding the primitives, this equivalence holds if and only if the consistent conjectures are zero. Why? Any leader rationally expects that a change in his strategy will elicit no reaction from the followers. Consequently, it mimics the case where the traders take the decisions of their rivals as given when optimizing, thereby behaving as if they played a simultaneous move game (with the belief that their rivals behave following a Cournotian reaction function). In such a case, the value of the elasticity of the best response functions coincides with the true slope of the best response functions (here zero): conjectures are fulfilled and are thus consistent. This means that the strategies are neither substitutes nor complements in equilibrium. This result may be explained as follows. The shape of the reaction functions and their slopes at equilibrium depend notably on the market demand function. The Cobb-Douglas specification leads to an isoelastic aggregate market demand function (constant unitary price elasticity). So, when all atoms have the same endowments and preferences, their market powers are equal, which implies that their (Cournotian) equilibrium strategies are identical. Our proposition extends a result obtained in partial equilibrium by Julien [17] to cover a general equilibrium framework. In addition, it spreads the result obtained in Julien [16] to cover mixed markets exchange in which all traders behave strategically.

5. An Example

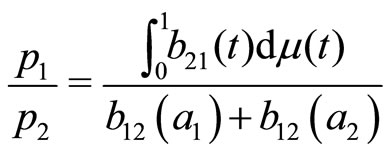

Consider the case for which . The price system is

. The price system is . The economy embodies two atoms

. The economy embodies two atoms  (the leader) and

(the leader) and  (the follower), each of measure

(the follower), each of measure ,

,  , and an atomless continuum of traders represented by the unit interval

, and an atomless continuum of traders represented by the unit interval , with the Lebesgue measure

, with the Lebesgue measure ,

, .

.

Assume the following specification for endowments:

(9)

(9)

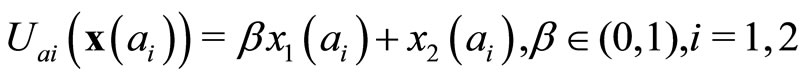

The preferences of any trader are represented by the following utility functions:

(10)

(10)

The strategy sets are given by:

(11)

(11)

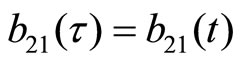

5.1. The SCE

Given  and

and , the Sahi and Yao [9] price mechanism yields

, the Sahi and Yao [9] price mechanism yields

, so one deduces the price system:

, so one deduces the price system:

(12)

(12)

The best-responses  and

and  of the followers

of the followers  and

and  are solutions to the following system of equations:

are solutions to the following system of equations:

(13)

(13)

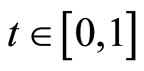

Assuming symmetry among the small traders, i.e. ,

,  ,

,  , one gets the bestresponses functions:

, one gets the bestresponses functions:

(14)

(14)

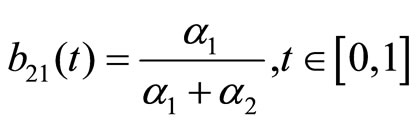

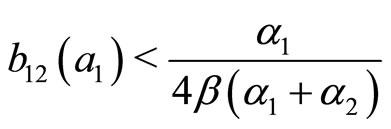

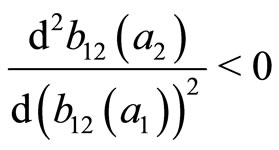

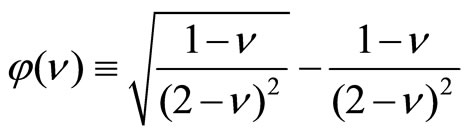

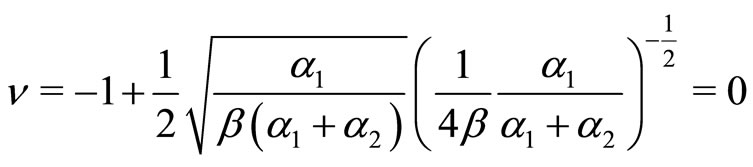

The former best response satisfies:  when

when , reflecting strategic complementarities, while

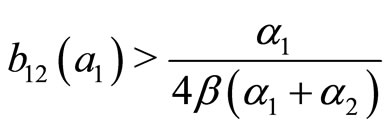

, reflecting strategic complementarities, while  when

when , reflecting strategic substituabilities. In addition,

, reflecting strategic substituabilities. In addition, .

.

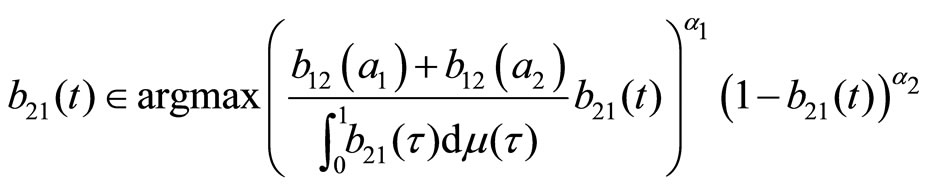

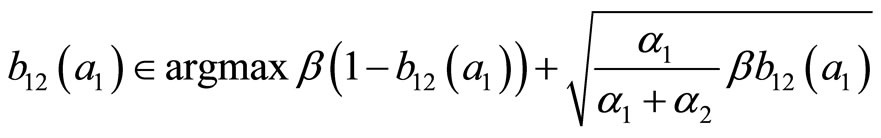

The program of the leader becomes:

(15)

(15)

Little algebra lead to the SCE strategy for the leader:

(16)

(16)

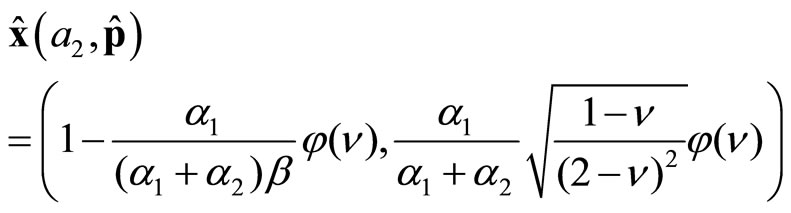

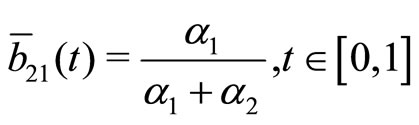

From (14), the equilibrium strategies of the followers are given by:

(17)

(17)

where .

.

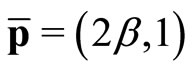

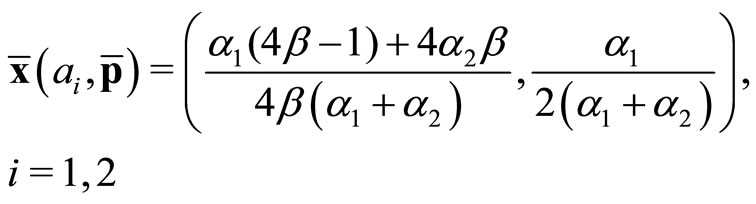

The SCE price system and allocations are given by:

(18)

(18)

(19)

(19)

5.2. The CE

Given  and

and , the same price mechanism yields:

, the same price mechanism yields:

(20)

(20)

The best-response functions of any atom ,

,  and of any trader

and of any trader  are the solutions to:

are the solutions to:

(21)

(21)

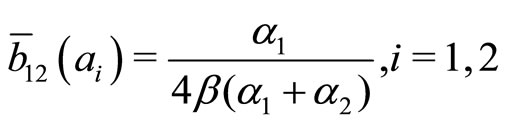

Little algebra lead to the CE strategies:

(22)

(22)

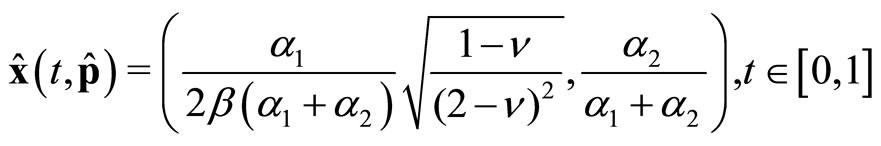

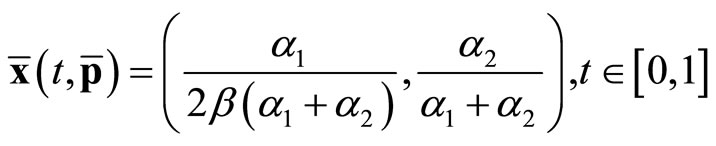

The CE equilibrium price system and allocations are then:

(23)

(23)

(24)

(24)

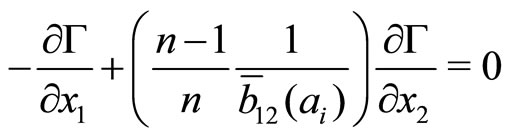

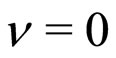

Consider (16)-(19) with (22)-(24). The SCE and the CE relative price and allocations coincide if and only if . In addition, note that (15) may be written as

. In addition, note that (15) may be written as

which leads to

which leads to ,

, . From

. From

(14), one gets

, so zero conjectures are consistent.

, so zero conjectures are consistent.

6. Conclusion

In this paper, we consider a general equilibrium concept - the Stackelberg-Cournot equilibrium—where all traders behave strategically. One side of the market includes negligible traders, while the other side embodies atoms. In this economy, the strategic interactions recover from sequential decisions.

The framework used belongs to the class of mixed markets exchange models. Traders have not the same “weight”: this idea is captured with a mixed measure space of traders. Such a specification notably enables to model asymmetries in the working of market power in interrelated markets. It also gives some insights regarding the consequences of market power in a general equilibrium perspective. Finally, it facilitates comparisons between general equilibrium concepts in economies where all agents behave strategically.

Within this framework, it is shown that the set of Stackelberg-Cournot equilibria and the set of Cournot equilibria can have a nonempty intersection. When the preferences of the small traders are represented by Cobb-Douglas utility functions, and when the atoms have the same endowments and utility functions, the SCE and the CE coincide if and only if the followers’ best responses functions have a zero slope at the SCE. Provided conjectures of atoms are consistent, the traders behave as if they played a simultaneous move game. So, the equivalence result stems from consistent conjectures formed by leaders.

7. Acknowledgements

I am grateful to an anonymous referee for her/his remarks and suggestions. All remaining deficiencies are mine.

REFERENCES

- J. J. Gabszewicz and J. P. Vial, “Oligopoly ‘à la Cournot’ in General Equilibrium Analysis,” Journal of Economic Theory, Vol. 4, No. 3, 1972, pp. 381-400. Hdoi:10.1016/0022-0531(72)90129-9

- G. Codognato and J. J. Gabszewicz, “Equilibres de Cournot-Walras dans une Économie d’Échange,” Revue Economique, Vol. 42, No. 6, 1991, pp. 1013-1026. Hdoi:10.2307/3502021

- G. Codognato and J. J. Gabszewicz, “Cournot-Walras Equilibria in Markets with a Continuum of Traders,” Economic Theory, Vol. 3, No. 3, 1993, pp. 453-464. Hdoi:10.1007/BF01209696

- J. J. Gabszewicz and P. Michel, “Oligopoly Equilibria in Exchange Economies,” In: B. C. Eaton and R. G. Harris, Eds., Trade, Technology and Economics. Essays in Honour of R.G. Lipsey, Edward-Elgar, Cheltenham, 1997, pp. 217-240.

- F. Busetto, G. Codognato and S. Ghosal, “Noncooperative Oligopoly in Markets with a Continuum of Traders,” Games and Economic Behavior, Vol. 72, No. 1, 2011, pp. 38-45. Hdoi:10.1016/j.geb.2010.06.009

- F. Busetto, G. Codognato and S. Ghosal, “Cournot-Walras Equilibrium as a Subgame Perfect Equilibrium,” International Journal of Game Theory, Vol. 37, No. 3, 2008, pp. 371-386. Hdoi:10.1007/s00182-008-0123-8

- L. Shapley and M. Shubik, “Trade Using One Commodity as a Means of Payment,” Journal of Political Economy, Vol. 85, No. 5, 1977, pp. 937-967. Hdoi:10.1086/260616

- P. Dubey and M. Shubik, “The Non Cooperative Equilibria of a Closed Trading Economy with Market Supply and Bidding Strategies,” Journal of Economic Theory, Vol. 17, No. 1, 1978, pp. 1-20. Hdoi:10.1016/0022-0531(78)90119-9

- S. Sahi and S. Yao, “The Noncooperative Equilibria of a Trading Economy with Complete Markets and Consistent Prices,” Journal of Mathematical Economics, Vol. 18, No. 4, 1989, pp. 325-346. Hdoi:10.1016/0304-4068(89)90010-4

- R. Amir, S. Sahi, M. Shubik and S. Yao, “A Strategic Market Game with Complete Markets,” Journal of Economic Theory, Vol. 51, No. 1, 1990, pp. 126-143. Hdoi:10.1016/0022-0531(90)90054-N

- G. Codognato, “Cournot-Walras Equilibria in Mixed Markets: A Comparison,” Economic Theory, Vol. 5, No. 2, 1995, pp. 361-370. Hdoi:10.1007/BF01215210

- G. Codognato, “Cournot-Nash Equilibria in Limit Exchange Economies with Complete Markets: A Comparison between Two Models,” Games and Economic Behavior, Vol. 31, No. 1, 2000, pp. 136-146. Hdoi:10.1006/game.1999.0735

- L. A. Julien and F. Tricou, “Oligopoly Equilibria ‘à la Stackelberg’ in Pure Exchange Economies,” Louvain Economic Review, Vol. 76, No. 2, 2010, pp. 239-252.

- L. A. Julien and F. Tricou, “Market Price Mechanisms and Stackelberg General Equilibria: An Example,” Bulletin of Economic Research, Vol. 64, No. 2, 2012, pp. 175- 194. Hdoi:10.1111/j.1467-8586.2010.00362.x

- B. Shitovitz, “Oligopoly in Markets with a Continuum of Traders,” Econometrica, Vol. 41, No. 3, 1973, pp. 467- 501. Hdoi:10.2307/1913371

- L. A. Julien, “Stackelberg-Walras and Cournot-Walras Equilibria in Mixed Markets: A Comparison,” Theoretical Economics Letters, Vol. 2, No. 1, 2012, pp. 69-74. Hdoi:10.4236/tel.2012.21013

- L. A. Julien, “A Note on Stackelberg Competition,” Journal of Economics, Vol. 103, No. 2, 2011, pp. 171-187. Hdoi:10.1007/s00712-010-0187-3