Theoretical Economics Letters

Vol. 2 No. 2 (2012) , Article ID: 19296 , 8 pages DOI:10.4236/tel.2012.22034

Hyperbolic Transformation and Average Elasticity in the Framework of the Fixed Effects Logit Model

Faculty of Economics, Kyushu Sangyo University, Fukuoka, Japan

Email: kitazawa@ip.kyusan-u.ac.jp

Received January 13, 2012; revised February 11, 2012; accepted February 20, 2012

Keywords: Fixed Effects Logit; Conditional Logit Estimator; Hyperbolic Transformation; Moment Conditions; GMM; Monte Carlo Experiments; Average Elasticity

ABSTRACT

In this paper, a simple transformation is proposed for the fixed effects logit model, which constructs some valid moment conditions including the first-order condition for one of the conditional MLE proposed by Chamberlain (1980) [1]. Some Monte Carlo experiments are carried out for the GMM estimator based on the transformation. In addition, the average elasticity of the logit probability with respect to the exponential function of explanatory variable is proposed in the framework of the fixed effects logit model, which is computable without the fixed effects.

1. Introduction

Chamberlain (1980) [1] proposes the useful and established estimator for the fixed effects logit model in panel data.1 This estimator is referred to as the conditional logit estimator, which maximizes the likelihood function composed of the probabilities of the (binary) dependent variables conditional on the fixed effects, the (real-valued) explanatory variables, and the intertemporal sums of the dependent variables. The conditional logit estimator is consistent for the situation of small number of time periods and large cross-sectional size, since its conditional likelihood function rules out the fixed effects and accordingly circumvents the incidental parameters problems pointed out by Neyman and Scott (1948) [2].2 This paper advocates another method of consistently estimating the fixed effects logit model for the situation of small number of time periods and large cross-sectional size.3 The procedure of the method is as follows: First, a hyperbolic transformation is applied to the fixed effects logit model with the aim of eliminating the fixed effects. Next, the GMM (generalized method of moments) estimator proposed by Hansen (1982) [20] is constructed by using the moment conditions based on the hyperbolic transformation. It will be seen that these moment conditions include one type of the first-order conditions of the likelihood for the conditional logit estimator. Then, the preferable small sample property of the GMM estimator using the moment conditions based on the hyperbolic transformation is shown by some Monte Carlo experiments.

In addition, this paper presents the calculation formula of the average elasticity of the logit probability with respect to the exponential function of explanatory variable for the fixed effects logit model. The average marginal effect is not obtained due to the incidental parameters problems for the case of the fixed effects logit model with time dimension being strictly fixed, while it seems that no appropriate index measuring the effect of the change of explanatory variable is developed, in author’s best knowledge. Since the average elasticity is able to be calculated using the consistent estimator of the parameter of interest and the average of binary dependent variables without relation to the fixed effects, it can be said that it is a revolutionary index for the fixed effects logit model.

The rest of the paper is as follows: Section 2 presents the implicit form of the fixed effects logit model, the moment conditions based on the hyperbolic transformation, and the GMM estimator. Section 3 illustrates the link between the conditional maximum likelihood estimator (CMLE) mentioned in the first paragraph in this section and the GMM estimator for the case of two periods. Section 4 reports some Monte Carlo results for the GMM estimator. Section 5 presents the average elasticity in the framework of the fixed effects logit model. Section 6 concludes.

2. Fixed Effects Logit Model, Hyperbolic Transformation and GMM Estimator

In this section, the (static) fixed effects logit model is implicitly defined where the error term is of additive form.4 The hyperbolic transformation, which eliminates the fixed effects and then based on which the moment conditions is constructed for estimating the model consistently, is the fruits of the model defined implicitly. The GMM estimator is defined by using the moment conditions constructed. Throughout this paper, the subscripts  and

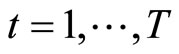

and  denote the individual and time period respectively, while

denote the individual and time period respectively, while  and

and  are number of individuals and number of time periods respectively. Since the short panel is supposed, it is assumed that

are number of individuals and number of time periods respectively. Since the short panel is supposed, it is assumed that  and

and  is fixed. In addition, it is assumed that the variables in the model are independent among individuals.

is fixed. In addition, it is assumed that the variables in the model are independent among individuals.

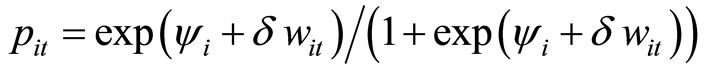

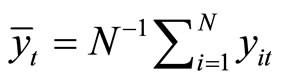

The fixed effects logit model is able to be written in the implicit form as follows:

, for

, for ,(2.1)

,(2.1)

(2.2)

(2.2)

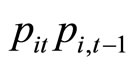

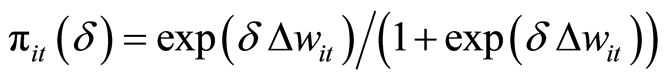

where the observable variables  and

and  are the binary dependent variable and the real-valued explanatory variable respectively, while the unobservable variables

are the binary dependent variable and the real-valued explanatory variable respectively, while the unobservable variables  and

and  are the individual fixed effect and the disturbance respectively.5 Equations (2.1) say that

are the individual fixed effect and the disturbance respectively.5 Equations (2.1) say that  take one with probability

take one with probability , while it is seen from Equations (2.2) that the probability is the logistic cumulative distribution function of

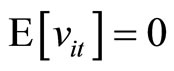

, while it is seen from Equations (2.2) that the probability is the logistic cumulative distribution function of . Allowing for the serially uncorrelated disturbances, the uncorrelatedness between the disturbances and the fixed effect and the strictly exogenous explanatory variables, the assumptions on the disturbances are specified as

. Allowing for the serially uncorrelated disturbances, the uncorrelatedness between the disturbances and the fixed effect and the strictly exogenous explanatory variables, the assumptions on the disturbances are specified as

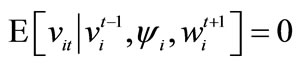

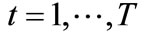

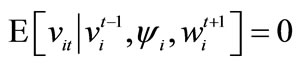

, for

, for ,(2.3)

,(2.3)

where  for

for ,

,  is defined as the empty set for convenience and

is defined as the empty set for convenience and

. The assumptions (2.3) can be derived from the assumption underlying the fixed effects logit model, which is that

. The assumptions (2.3) can be derived from the assumption underlying the fixed effects logit model, which is that  for

for  are mutually independent conditional on

are mutually independent conditional on  and

and .6 From now on, based on the fixed effects logit model composed of (2.1) and (2.2) with (2.3), the moment conditions for estimating the parameter of interest

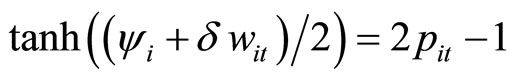

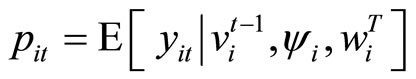

.6 From now on, based on the fixed effects logit model composed of (2.1) and (2.2) with (2.3), the moment conditions for estimating the parameter of interest  consistently are constructed by using a hyperbolic transformation, as stated below. Taking notice of the fact that

consistently are constructed by using a hyperbolic transformation, as stated below. Taking notice of the fact that

(2.4)

(2.4)

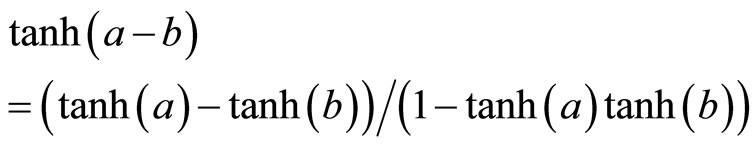

and using the formula that

(2.5)

(2.5)

with  and

and  being any real numbers, it follows that

being any real numbers, it follows that

, (2.6)

, (2.6)

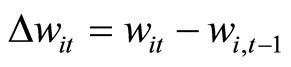

where  is the first differencing operator, such as

is the first differencing operator, such as . Since

. Since  and

and  are written as

are written as

(2.7)

(2.7)

and

(2.8)

(2.8)

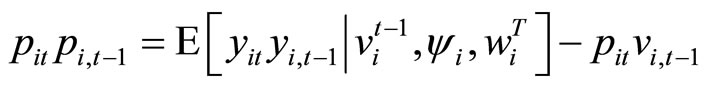

respectively by using (2.1) and (2.3), plugging (2.7) and (2.8) into (2.6) gives

(2.9)

(2.9)

Equations (2.7) and (2.8) are obtained by plugging (2.1) into  and

and

and then applying (2.3) to them.

and then applying (2.3) to them.

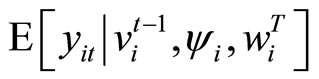

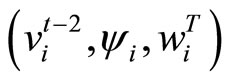

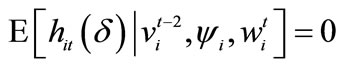

Taking the expectation conditional on  for both sides of (2.9) and then applying law of iterated expectation and (2.3) dated

for both sides of (2.9) and then applying law of iterated expectation and (2.3) dated , it follows that

, it follows that

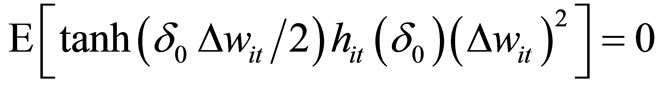

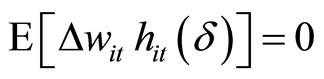

(2.10)

(2.10)

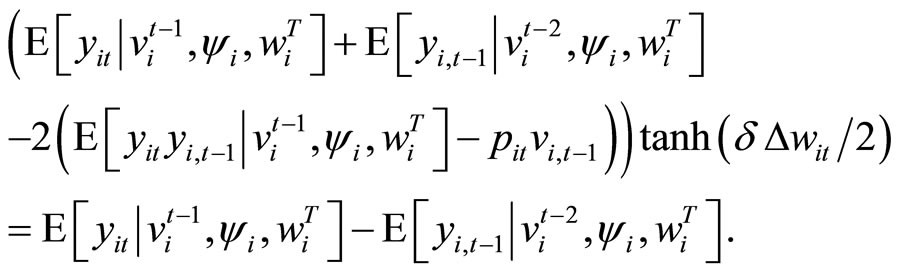

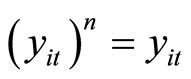

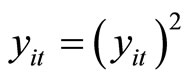

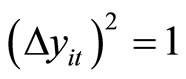

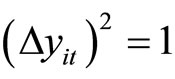

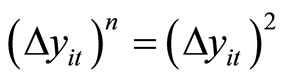

Since  for any positive integer value

for any positive integer value  due to the property of binary variable (and accordingly

due to the property of binary variable (and accordingly  and

and ), Equation (2.10) results in

), Equation (2.10) results in

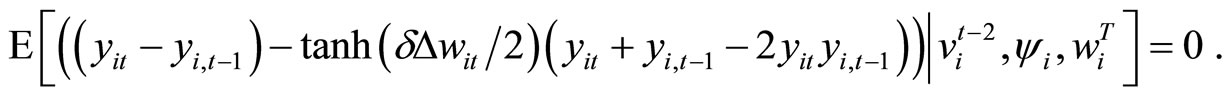

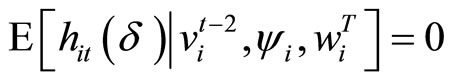

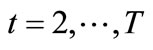

, for

, for , (2.11)

, (2.11)

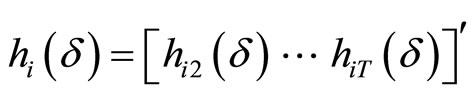

where

. (2.12)

. (2.12)

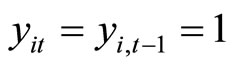

The transformation (2.12) is referred to as “the hyperbolic tangent differencing transformation” for the fixed effects logit model in this paper and hereafter abbreviated to “the HTD transformation”.7 It should be noted that as seen from (2.11) and (2.12), observations for which  and

and  make no direct contribution to obtaining the estimates of

make no direct contribution to obtaining the estimates of  based on the moment conditions (2.11), since

based on the moment conditions (2.11), since  is invariably zero for these observations.

is invariably zero for these observations.

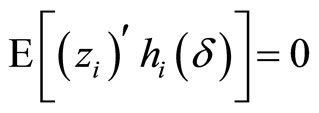

The conditional moment conditions (2.11) give the following  vector of unconditional moment conditions:

vector of unconditional moment conditions:

, (2.13)

, (2.13)

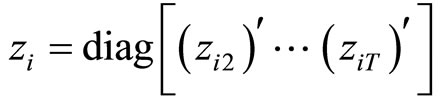

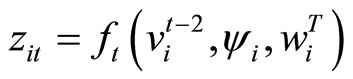

where  is the

is the  vector and

vector and  is the

is the  matrix with

matrix with . The (transposed) blocks

. The (transposed) blocks

, for

, for , (2.14)

, (2.14)

are the  vector-valued functions of

vector-valued functions of ,

,  and

and  at time

at time , where

, where  is number of instruments for time

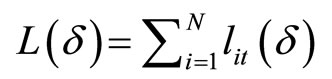

is number of instruments for time . By using the empirical counterpart of (2.13):

. By using the empirical counterpart of (2.13):

(2.15)

(2.15)

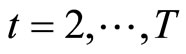

and the  inverse of optimal weighting matrix:

inverse of optimal weighting matrix:

, (2.16)

, (2.16)

where  is any initial consistent estimator for

is any initial consistent estimator for , the GMM estimator is constructed as follows:

, the GMM estimator is constructed as follows:

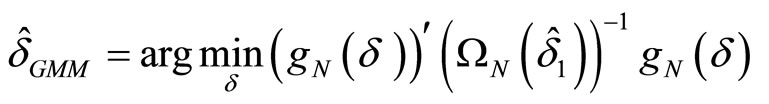

, (2.17)

, (2.17)

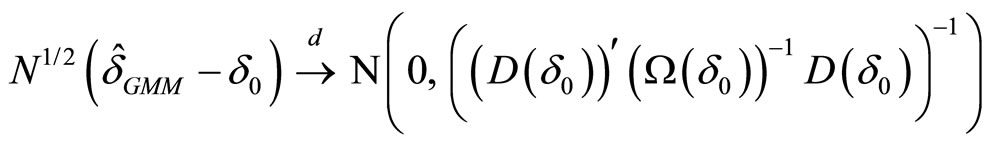

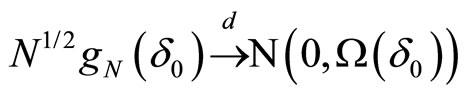

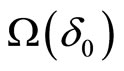

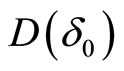

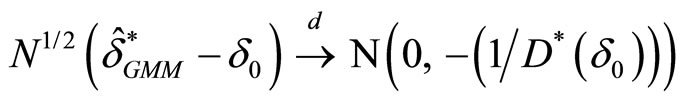

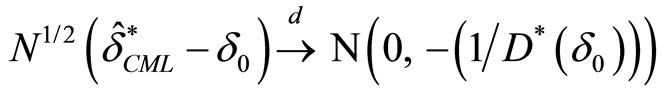

where  converges in distribution to the normal distribution as follows:

converges in distribution to the normal distribution as follows:

(2.18)

(2.18)

with  being the true value of

being the true value of . Taking notice of the assumption that the variables are independent among individuals and adding the assumption that the variables are identically distributed among individuals,

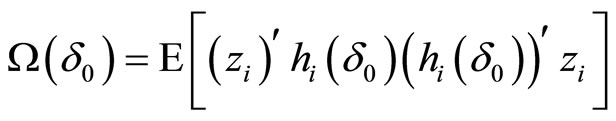

. Taking notice of the assumption that the variables are independent among individuals and adding the assumption that the variables are identically distributed among individuals,  , which is the (asymptotic) variance-covariance matrix of the moment conditions (2.13), can be written by using

, which is the (asymptotic) variance-covariance matrix of the moment conditions (2.13), can be written by using  as follows:

as follows:

, (2.19)

, (2.19)

where it should be noted that (2.16) is the empirical counterpart of (2.19) if  is replaced by

is replaced by  and

and

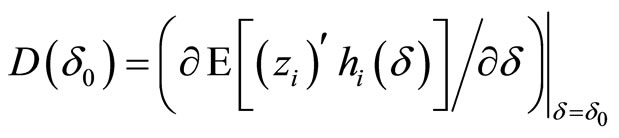

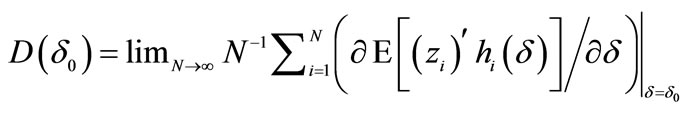

. Further, the first derivative of (2.13) with respect to

. Further, the first derivative of (2.13) with respect to  for

for  is as follows:

is as follows:

. (2.20)

. (2.20)

It is conceivable that the discussions for the GMM estimator based on the HTD transformation could be permitted to be conducted on the basis of numbers of observations for which  instead of

instead of , on the grounds that observations except for those for which

, on the grounds that observations except for those for which  make no direct contribution to estimating

make no direct contribution to estimating .

.

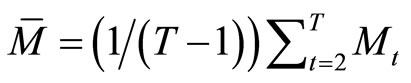

In this case,  is expediently used instead of

is expediently used instead of  in this section, where

in this section, where  is number of observations for which

is number of observations for which  at time

at time .

.

3. Link between CMLE and GMM Estimator

The discussion here is conducted for the case of two periods (i.e.  and

and ). It is shown in this section that the GMM estimator opting for an instrument is identical to the CMLE in this case.

). It is shown in this section that the GMM estimator opting for an instrument is identical to the CMLE in this case.

First, the GMM estimator is presented. With  and

and  (both of which are scalars), Equation (2.13) turns to

(both of which are scalars), Equation (2.13) turns to

. (3.1)

. (3.1)

The moment condition (3.1) says that  is used as the instrument for the HTD transformation

is used as the instrument for the HTD transformation . The GMM estimator for

. The GMM estimator for  is the just-identified one when using only the moment condition (3.1) for the two periods. This is denoted by

is the just-identified one when using only the moment condition (3.1) for the two periods. This is denoted by  hereafter.

hereafter.

The first derivative of  with respect to

with respect to  and the square of

and the square of  are respectively calculated as follows:

are respectively calculated as follows:

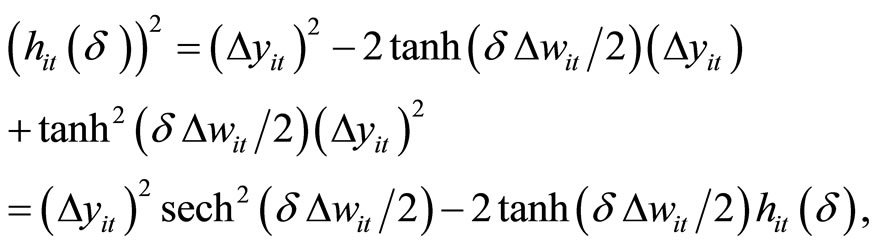

(3.2)

(3.2)

and

(3.3)

(3.3)

where the relationship that  if

if  is even and

is even and  if

if  is odd is used since

is odd is used since  is binary. Using (2.19), (2.20), (3.2), and (3.3),

is binary. Using (2.19), (2.20), (3.2), and (3.3),  and

and  for (3.1) are respectively calculated as follows:

for (3.1) are respectively calculated as follows:

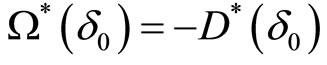

(3.4)

(3.4)

where  is usedwhich is obtained from (2.11), and

is usedwhich is obtained from (2.11), and

(3.5)

(3.5)

Looking at (3.4) and (3.5), it can be seen that

. (3.6)

. (3.6)

In addition, the relationship (2.18) is also applicable to the just-identified estimator (see pp. 486-487 in Hayashi, 2000, [23]). Therefore, it follows from (2.18) and (3.6) that the following relationship holds for :

:

. (3.7)

. (3.7)

Lee (2002, pp. 84-87) [24] elucidates the equality conceptually identical to (3.6) in the context of the CMLE to be hereafter described. In addition, Bonhomme (2012) [25] demonstrates that the conditional moment restriction which he proposes for the fixed effects logit model can give birth to the unconditional moment condition identical to (3.1).

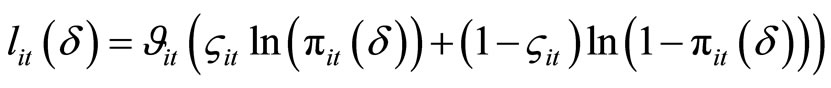

Next, the conventional CMLE proposed by Chamberlain (1980) [1] is presented for the two periods as follows:

, (3.8)

, (3.8)

where . Referring to Wooldridge

. Referring to Wooldridge

(2002, pp. 490-492) [26], the logarithm of probability composing the conditional log-likelihood function for the two-periods fixed effects logit model is written as follows, with :

:

, (3.9)

, (3.9)

where  if

if  and

and  otherwise, while

otherwise, while  if

if  and

and  and

and  if

if  and

and . In (3.9),

. In (3.9),  stands for the probability with which

stands for the probability with which  takes one given

takes one given ,

,  ,

,  and

and , while

, while  stands for the probability with which

stands for the probability with which  takes zero given

takes zero given ,

,  ,

,  and

and .

.

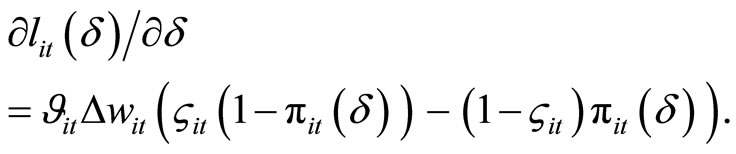

The first-order condition of  is

is

(3.10)

(3.10)

with

(3.11)

(3.11)

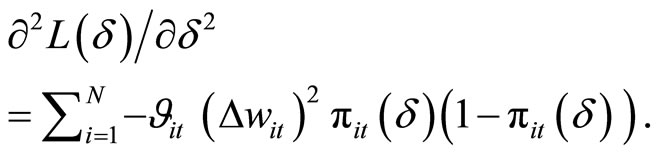

It is corroborated from (3.10) with (3.11) that the first-order condition of  divided by

divided by  is the empirical counterpart of the moment condition (3.1) for the GMM estimator. The second-order derivative of

is the empirical counterpart of the moment condition (3.1) for the GMM estimator. The second-order derivative of  with respect to

with respect to  is written as

is written as

(3.12)

(3.12)

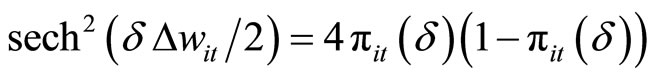

Taking notice of the fact that

, it is evident that if

, it is evident that if  is replaced by

is replaced by , (3.12) divided by

, (3.12) divided by  is the empirical counterpart of (3.5) and accordingly identical to

is the empirical counterpart of (3.5) and accordingly identical to  from (3.6). Therefore, the following relationship holds for

from (3.6). Therefore, the following relationship holds for :

:

. (3.13)

. (3.13)

Judging from the above, it is ascertained that for the two periods the conventional CMLE for the fixed effects logit model is identical to the GMM estimator selecting  as the instrument for the HTD transformation.

as the instrument for the HTD transformation.

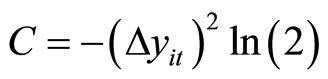

To make doubly sure, the integration of

with respect to

with respect to  is conducted:

is conducted:

(3.14)

(3.14)

where  is the constant of integration. With

is the constant of integration. With  for (3.14), the logarithm of probability (3.9), which composes the conditional log-likelihood function for the two-periods fixed effects logit model, is compactly rewritten as

for (3.14), the logarithm of probability (3.9), which composes the conditional log-likelihood function for the two-periods fixed effects logit model, is compactly rewritten as

(3.15)

(3.15)

The exponential of  in (3.15), which is equivalent to (3.9), represents the probability density when the restriction

in (3.15), which is equivalent to (3.9), represents the probability density when the restriction  is imposed. In this case, number of observations for which

is imposed. In this case, number of observations for which  is used instead of

is used instead of  in this section and therefore

in this section and therefore , which is equivalent to

, which is equivalent to , could be interpreted as being the asymptotically efficient estimator. This is because the CramérRao inequality is applicable in this case.

, could be interpreted as being the asymptotically efficient estimator. This is because the CramérRao inequality is applicable in this case.

Incidentally, Abrevaya (1997) [27] shows that for the fixed effects logit model, a scale-adjusted ordinary maximum likelihood estimator is equivalent to the CMLE for the case of two periods.

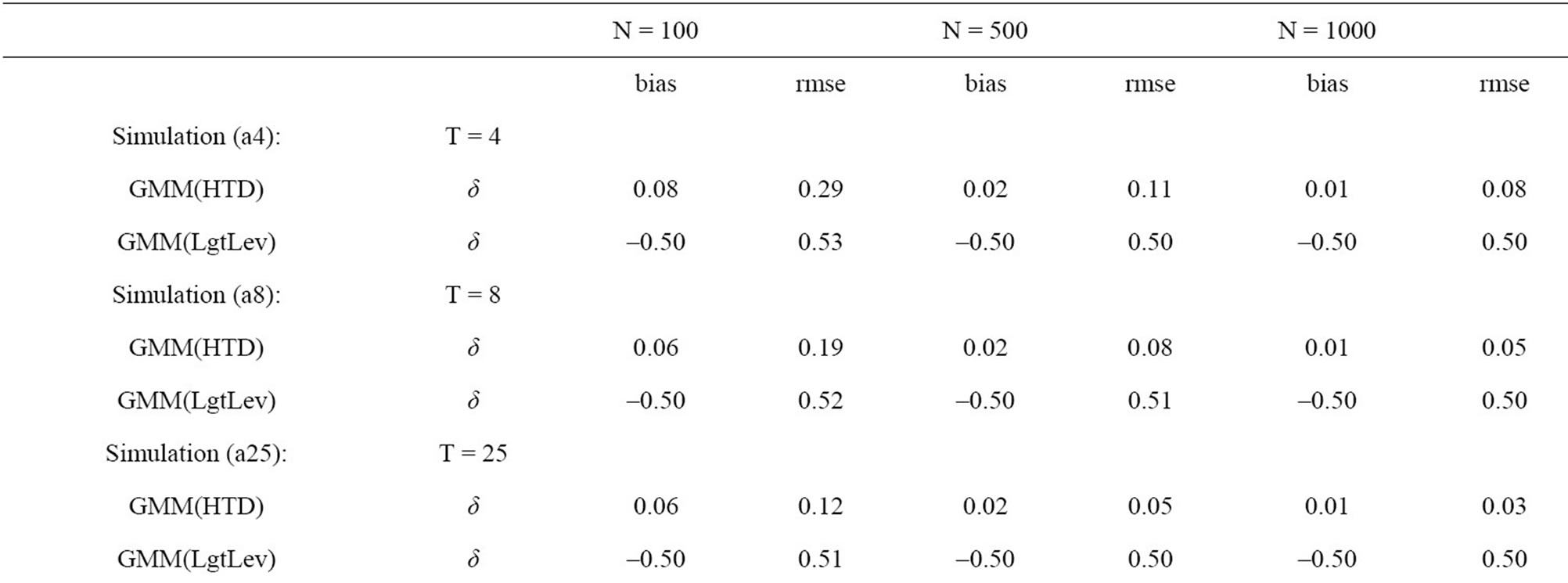

4. Monte Carlo

In this section, some Monte Carlo experiments are conducted to investigate the small sample performance of the GMM estimator for the fixed effects logit model described in Section 2. The experiments are implemented by using an econometric software TSP version 4.5 (see Hall and Cummins, 2006, [28]).

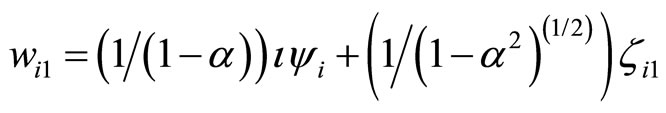

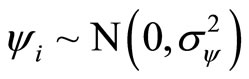

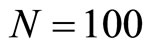

The data generating process (DGP) is as follows:

,

,

,

,

,

,

,

,

,

,

;

; .

.

In the DGP, values are set to the parameters ,

,  ,

,  ,

,  and

and . The experiments are carried out with the cross-sectional sizes

. The experiments are carried out with the cross-sectional sizes ,

,  and

and , the numbers of time periods

, the numbers of time periods ,

,  and

and , and the number of replications

, and the number of replications .

.

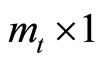

In the experiments, the GMM estimator based on the HTD transformation selects  as the instruments for the transformation

as the instruments for the transformation . That is, the GMM(HTD) estimator uses the vector of moment conditions (2.13) with

. That is, the GMM(HTD) estimator uses the vector of moment conditions (2.13) with , which is able to be written piecewise as follows:

, which is able to be written piecewise as follows:

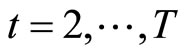

, for

, for .8 (4.1)

.8 (4.1)

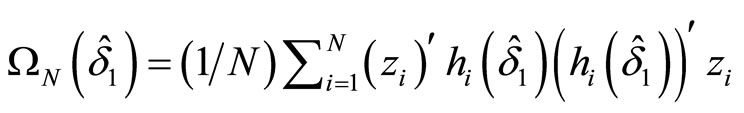

As a control, another GMM estimator is used, which employs the following moment conditions disregarding the unobservable heterogeneity:

, for

, for . (4.2)

. (4.2)

where . The GMM (LgtLev) estimator (i.e. the level GMM estimator for the logit model) for

. The GMM (LgtLev) estimator (i.e. the level GMM estimator for the logit model) for  is inconsistent due to the ignorance of the fixed effects.

is inconsistent due to the ignorance of the fixed effects.

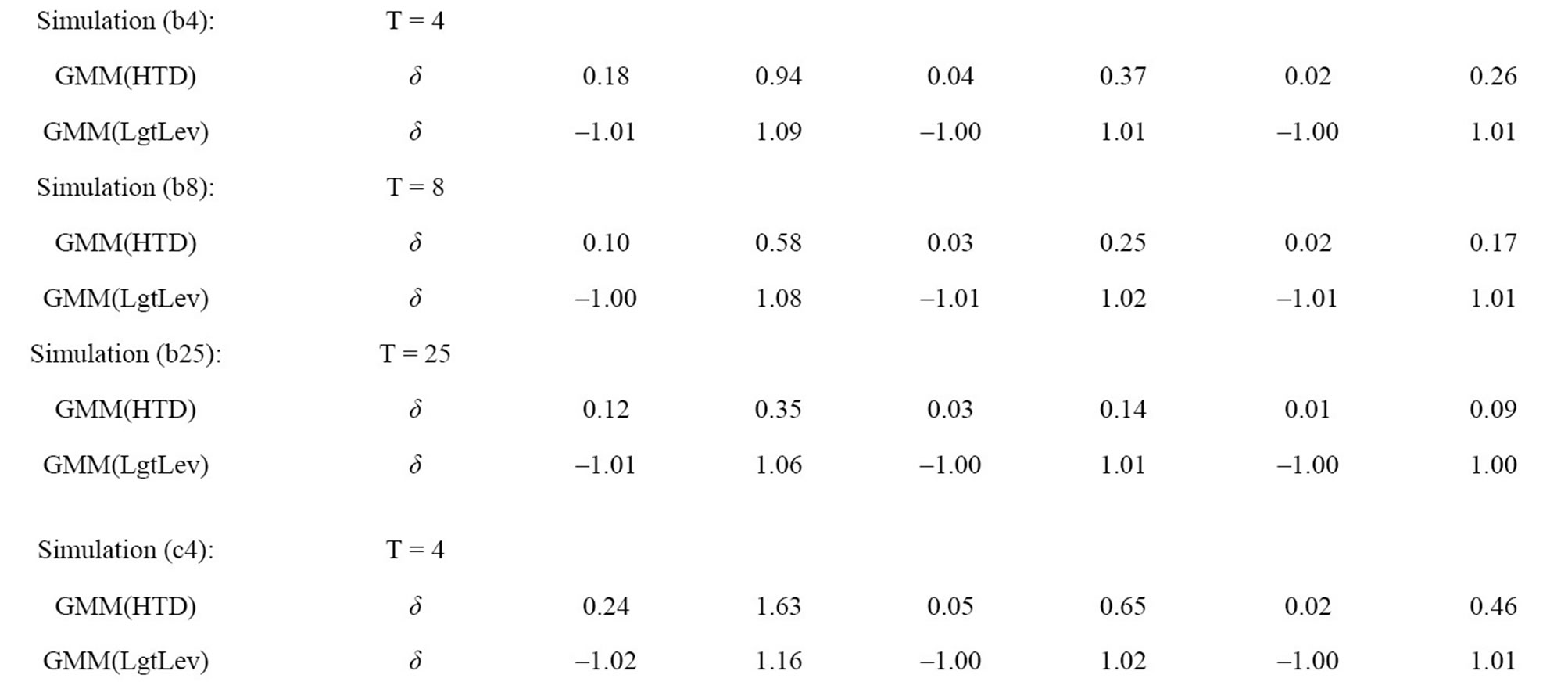

The Monte Carlo results are exhibited in Table 1. The settings of values of the parameters for the explanatory variables  are the same as those used by Blundell et al. (2002) [21] for count panel data model. The small sample property of the GMM(HTD) estimator can be said to be preferable and their bias and rmse (root mean squared error) decrease as the cross-sectional size

are the same as those used by Blundell et al. (2002) [21] for count panel data model. The small sample property of the GMM(HTD) estimator can be said to be preferable and their bias and rmse (root mean squared error) decrease as the cross-sectional size  increases, which is the reflection of the consistency. In contrast, the sizable downward bias and rmse for the (inconsistent) GMM(LgtLev) estimator remain at virtually constant levels when

increases, which is the reflection of the consistency. In contrast, the sizable downward bias and rmse for the (inconsistent) GMM(LgtLev) estimator remain at virtually constant levels when  increases. As is seen from comparisons among Simulations (a4), (a8) and (a25), among Simulations (b4), (b8) and (b25), and Simulations (c4), (c8) and (c25) for the GMM(HTD) estimator, the small sample performance of the GMM(HTD) estimator is better off as the number of time periods increases, reflecting the substantive increase of sample size. Furthermore, comparisons among Simulations (a4), (b4) and (c4), among Simulations (a8), (b8) and (c8), and among Simulations (a25), (b25) and (c25) for the GMM(HTD) estimator raise the possibility that more persistent series of the explanatory variables might bring about more deteriorated small sample performance of the GMM(HTD) estimator.9

increases. As is seen from comparisons among Simulations (a4), (a8) and (a25), among Simulations (b4), (b8) and (b25), and Simulations (c4), (c8) and (c25) for the GMM(HTD) estimator, the small sample performance of the GMM(HTD) estimator is better off as the number of time periods increases, reflecting the substantive increase of sample size. Furthermore, comparisons among Simulations (a4), (b4) and (c4), among Simulations (a8), (b8) and (c8), and among Simulations (a25), (b25) and (c25) for the GMM(HTD) estimator raise the possibility that more persistent series of the explanatory variables might bring about more deteriorated small sample performance of the GMM(HTD) estimator.9

Table 1. Monte Carlo results for the fixed effects logit model.

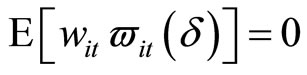

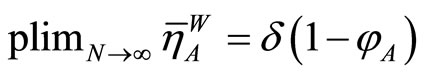

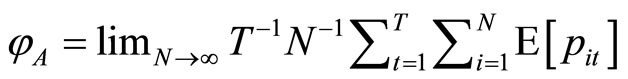

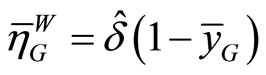

5. Average Elasticity

For the fixed effects logit model composed of (2.1) and (2.2), the new index is constructed by using both the consistent estimator for  described in previous sections and the average of

described in previous sections and the average of . The average elasticity of the logit probability with respect to the exponential function of explanatory variable (which is calculated without relation to the fixed effects) is an appropriate index in the framework of the fixed effects logit model with time dimension being strictly fixed, where no (consistent) average marginal effect is available.10 In this section, the assumption that the variables are identically distributed among individuals is unfastened.11

. The average elasticity of the logit probability with respect to the exponential function of explanatory variable (which is calculated without relation to the fixed effects) is an appropriate index in the framework of the fixed effects logit model with time dimension being strictly fixed, where no (consistent) average marginal effect is available.10 In this section, the assumption that the variables are identically distributed among individuals is unfastened.11

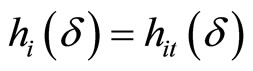

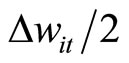

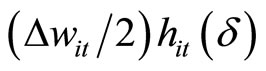

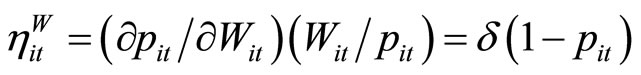

With , the elasticity of the probability

, the elasticity of the probability  with respect to the positive-valued variable

with respect to the positive-valued variable  (with

(with  being held constant) is defined as follows:

being held constant) is defined as follows:

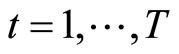

for

for

. (5.1)

. (5.1)

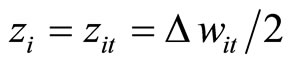

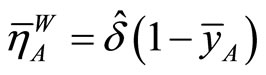

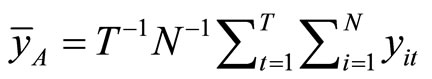

Under the assumption that , the overall average elasticity of

, the overall average elasticity of  with respect to

with respect to  is calculated with the following formula:

is calculated with the following formula:

, (5.2)

, (5.2)

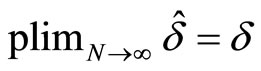

where  is the consistent estimator for

is the consistent estimator for  such that

such that

and

and . Since

. Since

is the probability and

is the probability and  (and accordingly variances of

(and accordingly variances of  are finite), it can be seen that

are finite), it can be seen that , if

, if

(which is referred to as the average logit probability in this paper).12

(which is referred to as the average logit probability in this paper).12

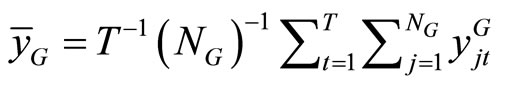

In addition, the cross-section average elasticity for a specific time period and the group average elasticity for a group (e.g. a gender) are able to be calculated as follows, respectively: The formula calculating the cross-section average of  with respect to

with respect to  for period

for period  is

is

, (5.3)

, (5.3)

where , while that calculating the group average elasticity for group

, while that calculating the group average elasticity for group  in population is

in population is

, (5.4)

, (5.4)

where  with subscript

with subscript

denoting the member of group ,

,  being number of individual units belonging to group

being number of individual units belonging to group , and

, and  being the binary dependent variable for the individual

being the binary dependent variable for the individual  appertaining to group

appertaining to group  at period

at period .

.

6. Conclusion

This paper proposed the hyperbolic tangent differencing (HTD) transformation for the fixed effects logit model, with the intention of ruling out the fixed effects. The consistent GMM estimator was constructed by using the HTD transformation. The equivalence of the GMM estimator opting for an instrument and the CMLE proposed by Chamberlain (1980) [1] was revealed for the case of two periods. Then, the Monte Carlo experiments indicated the desirable small sample property of the GMM estimator based on the HTD transformation. In addition, the average elasticity of the logit probability with respect to the exponential function of explanatory variable was proposed, which is an appropriate index from the point of view that it is able to be calculated without the fixed effects. Both of the simple estimator and index will facilitate empirical researchers exploring the binary choice panel data model.

REFERENCES

- G, Chamberlain, “Analysis of Covariance with Qualitative Data,” Review of Economic Studies, Vol. 47, No. 1, 1980, pp. 225-238. doi:10.2307/2297110

- J. Neyman and E. L. Scott, “Consistent Estimates Based on Partially Consistent Observations,” Econometrica, Vol. 16, No. 1, 1948, pp. 1-32.

- G, Rasch, “Probabilistic Models for Some Intelligence and Attainment Tests,” The Danish Institute for Educational Research, 1960.

- G, Rasch, “On General Laws and the Meaning of Measurement in Psychology,” Preceeding of the 4th Berkeley Symposium on Mathematical Statistics and Probability, Vol. 4, 1961, pp. 321-333.

- B. E. Honoré and E. Kyriazidou, “Panel Data Discrete Choice Models with Lagged Dependent Variables,” Econometrica, Vol. 68, No. 4, 2000, pp. 839-874. doi:10.1111/1468-0262.00139

- C. Hsiao, “Analysis of Panel Data,” 2nd Edition, Cambridge University Press, Cambridge, 2003.

- A. Thomas, “Consistent Estimation of Binary-Choice Panel Data Models with Heterogeneous Linear Trends,” Econometrics Journal, Vol. 9, No. 3, 2006, pp. 177-195. doi:10.1111/j.1368-423X.2006.00181.x

- J. Hahn and W. Newey, “Jackknife and Analytical Bias Reduction for Nonlinear Panel Models,” Econometrica, Vol. 72, No. 4, 2004, pp. 1295-1319. doi:10.1111/j.1468-0262.2004.00533.x

- D. R. Cox and N. Reid, “Parameter Orthogonality and Approximate Conditional Inference,” Journal of the Royal Statistical Society, Series B, Vol. 49, No. 1, 1987, pp. 1-39.

- T. Lancaster, “Orthogonal Parameters and Panel Data,” Review of Economic Studies, Vol. 69, No. 3, 2002, pp. 647-666. doi:10.1111/1467-937X.t01-1-00025

- M. Arellano, “Discrete Choices with Panel Data,” Investigaciones Económicas, Vol. 27, No. 3, 2003, pp. 423-458. doi:10.2139/ssrn.261048

- M. Arellano and S. Bonhomme, “Robust Priors in Nonlinear Panel Data Models,” Econometrica, Vol. 77, No. 2, 2009, pp. 489-536. doi:10.3982/ECTA6895

- J, Carro, “Estimating Dynamic Panel Data Discrete Choice Models with Fixed Effects,” Journal of Econometrics, Vol. 140, No. 2, 2007, pp. 503-528. doi:10.2139/ssrn.384021

- I. Fernández-Val, “Fixed Effects Estimation of Structural Parameters and Marginal Effects in Panel Probit Models,” Journal of Econometrics, Vol. 150, No. 1, 2009, pp. 71- 85. doi:10.1016/j.jeconom.2009.02.007

- T. A. Severini, “An Approximation to the Modified Profile Likelihood Function,” Biometrika, Vol. 85, No. 2, 1998, 403-411. doi:10.1093/biomet/85.2.403

- L. Pace and A. Salvan, “Adjustments of the Profile Likelihood from a New Perspective,” Journal of Statistical Planning and Inference, Vol. 136, No. 10, 2006, pp. 3554-3564. doi:10.1016/j.jspi.2004.11.016

- A. Bester and C. Hansen, “A Penalty Function Approach to Bias Reduction in Nonlinear Panel Models with Fixed Effects,” Journal of Business and Economic Statistics, Vol. 27, No. 2, 2009, pp. 131-148. doi:10.1198/jbes.2009.0012

- M. Arellano and J. Hahn, “Understanding Bias in Nonlinear Panel Models: Some Recent Developments,” In: R. Blundell, W. Newey and T. Persson, Eds., Advances in Economics and Econometrics, Cambridge University Press, Cambridge, 2007, pp. 381-409.

- C. Hsiao, “Longitudinal Data Analysis,” In: S. N. Durlauf and E. B. Blume, Eds., Microeconometrics, Palgrave and Macmillan, Basingstoke, 2010, pp. 89-107.

- L. P. Hansen, “Large Sample Properties of Generalized Method of Moments Estimators,” Econometrica, Vol. 50, No. 4, 1982, pp. 1029-1054.

- R, Blundell, R. Griffith and F. Windmeijer, “Individual Effects and Dynamics in Count Data Models,” Journal of Econometrics, Vol. 108, No. 1, 2002, pp. 113-131. doi:10.1016/S0304-4076(01)00108-7

- A. C. Cameron and P. K. Trivedi, “Microeconometrics: Methods and Applications,” Cambridge University Press, Cambridge, 2005.

- F. Hayashi, “Econometrics,” Princeton University Press, Princeton, 2000.

- M. J. Lee, “Panel Data Econometrics,” Academic Press, London, 2002.

- S. Bonhomme, “Functional Differencing,” Econometrica, 2012, in Press.

- J. M. Wooldridge, “Econometric Analysis of Cross-Section and Panel Data,” MIT Press, Cambridge, 2002.

- J. Abrevaya, “The Equivalence of Two Estimators of the Fixed Effects Logit Model,” Economics Letters, Vol. 55, No. 1, 1997, pp. 41-43. doi:10.1016/S0165-1765(97)00044-X

- B. H. Hall and C. Cummins, “TSP 5.0 User’s Guide,” TSP International, 2006.

- R. Blundell and S. Bond, “Initial Conditions and Moment Restrictions in Dynamic Panel Data Models,” Journal of Econometrics, Vol. 87, No. 1, 1998, pp. 115-143. doi:10.1016/S0304-4076(98)00009-8

NOTES

1The rootstock of this estimator is Rasch (1960) [3], (1961) [4].

2Additionally, Honoré and Kyriazidou (2000) [5] propose an estimator for the fixed effects logit model with the lagged dependent variable (as for details, see also pp. 211-216 in Hsiao, 2003 [6]). Further, Thomas (2006) [7] proposes two estimators for the fixed effects logit model with heterogeneous linear trends.

3It seems that the mainstream of late is the development of the biasadjusted estimators, which is available in nonlinear panel data models and aims at the reduction of time-series finite sample bias (i.e. the approximately unbiased estimation of the incidental parameters as well as the parameters of interest, leading to obtaining the approximate marginal effects). Various approaches are proposed in line with the bias-adjustment: Hahn and Newey (2004) [8], Cox and Reid (1987) [9], Lancaster (2002) [10], Arellano (2003) [11], Arellano and Bonhomme (2009) [12], Carro (2007) [13], Fernández-Val (2009) [14], Severini (1998) [15], Pace and Salvan (2006) [16], Bester and Hansen (2009) [17], etc. Some of the approaches are reviewed in Arellano and Hahn (2007) [18] and Hsiao (2010) [19]. However, author’s policy is to conduct the consistent estimation for the case of small time dimension and therefore this paper is not bent upon the bias-adjusted estimators.

4The regression form defined implicitly is also used by Blundell et al. (2002) [21] for count panel data.

5It is generally assumed that the individual effect  is correlated with the explanatory variables

is correlated with the explanatory variables  for each

for each .

.

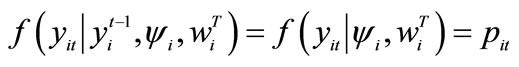

6If the underlying assumption holds, the following relationship is obtained: , where

, where  is the conditional probability density function and

is the conditional probability density function and . Accordingly, it follows that

. Accordingly, it follows that . As for details, see p. 23 in Cameron and Trivedi (2005) [22]. Taking notice of (2.1) and the fact that

. As for details, see p. 23 in Cameron and Trivedi (2005) [22]. Taking notice of (2.1) and the fact that , the assumptions (2.3) are obtained.

, the assumptions (2.3) are obtained.

7If the much weaker assumptions  for

for  are used instead of (2.3), the moment conditions

are used instead of (2.3), the moment conditions  for

for  can be obtained instead of (2.11), where

can be obtained instead of (2.11), where  and

and  is defined as the empty set for convenience. It should be noted that under the assumptions

is defined as the empty set for convenience. It should be noted that under the assumptions  for

for , the (consistent) CMLE proposed by Chamberlain (1980) [1] is no longer obtained for

, the (consistent) CMLE proposed by Chamberlain (1980) [1] is no longer obtained for . The implication of

. The implication of  is that although the decision

is that although the decision  wields no influence over the explanatory variable

wields no influence over the explanatory variable  just behind its decision, it can make some sort of influences on the explanatory variables after

just behind its decision, it can make some sort of influences on the explanatory variables after , while that of (2.3) is that the decision

, while that of (2.3) is that the decision  have no influence on the explanatory variables after its decision. In addition, it is regrettable that at this stage, author is unable to construct the valid moment conditions when

have no influence on the explanatory variables after its decision. In addition, it is regrettable that at this stage, author is unable to construct the valid moment conditions when  is endogenous. This would be a task for the future.

is endogenous. This would be a task for the future.

8Since the moment conditions (4.1) are valid even under the assumptions  for

for , the usage of the GMM (HTD) estimator using the moment conditions (4.1) is generally more conservative than that of the CMLE proposed by Chamberlain (1980) [1] (see footnote 7 in section 2). The CMLE is inconsistent under the assumptions

, the usage of the GMM (HTD) estimator using the moment conditions (4.1) is generally more conservative than that of the CMLE proposed by Chamberlain (1980) [1] (see footnote 7 in section 2). The CMLE is inconsistent under the assumptions  for

for  and

and .

.

9This possibility is also pointed out in the framework of ordinary and count panel data models. For example, see Blundell and Bond (1998) [29] and Blundell et al. (2002) [21].

10Frequently, the explanatory variables in the fixed effects logit model are logarithmically transformed.

11In this case, (2.19) and (2.20) in Section 2 are replaced by  and

and , respectively. The same is applied to (3.4) and (3.5) in Section 3.

, respectively. The same is applied to (3.4) and (3.5) in Section 3.

12Just in case, it is assumed that both  and

and  exist for each

exist for each  and

and . However, author thinks that it seems that this assumption is satisfied in any case.

. However, author thinks that it seems that this assumption is satisfied in any case.