Theoretical Economics Letters

Vol.06 No.02(2016), Article ID:65863,12 pages

10.4236/tel.2016.62026

The Use of Non-Verifiable Information Regarding the Agent’s Action in Compensation Contracts

Pattarin Adithipyangkul

School of Accounting, Curtin University of Technology, Perth, Australia

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 4 March 2016; accepted 23 April 2016; published 26 April 2016

ABSTRACT

Subjective, non-verifiable information (such as satisfaction rating) is often used to supplement objective, verifiable information (such as financial numbers) in contracting. Empirical research finds that non-verifiable information can be used in contracting as a subjective performance measure or as subjective weighting on an objective performance measure. The differences between the two options have not yet been thoroughly explored analytically. This paper considers a multi-task setting where the non-verifiable performance signal provides incremental information about an aspect of the agent’s action. The research finds that when the agent has unlimited liability, both contracting schemes deliver the same payoff to the principal. However, the principal may strictly prefer a subjective weighting scheme in a setting where the agent has limited liability.

Keywords:

Subjective Performance Evaluation, Implicit Contract, Non-Verifiable Information

1. Introduction

Compensation is an important tool to help align employees’ interests with shareholders’ interests. Conventionally, compensation contracts are based on objective, verifiable performance measures such as financial and accounting numbers. While objective performance measures can provide useful information about an employee’s work effort, they are often imperfect in the sense that they may not capture all relevant information and they may be affected by random events beyond an employee’s control. In addition, some of the objective measures (such as accounting profit) may be subject to manipulation (Baker et al., 1988 [1] ). Because objective performance measures are imperfect, in practice, firms often supplement the use of objective performance measures with subjective performance evaluations (such as supervisor or peer evaluation and satisfaction rating). A subjective performance evaluation is useful because it can provide incremental information about an employee’s actions or uncontrollable events affecting the objective measures (Bol, 2008 [2] ; Gibbs et al., 2004 [3] ; Murphy and Oyer, 2004 [4] ; Woods, 2012 [5] ). When the objective measures (such as accounting numbers) are subject to manipulation, a subjective assessment of the actual performance can be used to undo the manipulation (Bol, 2008 [2] ; Gibbs et al., 2004 [3] ; Woods, 2012 [5] ).

While subjective, non-verifiable information is useful for contracting; previous analytical literature provides little guidance on how it should be used in a contract. Subjectivity can be introduced into a compensation contract in various ways. For example, consider a setting where both the output quantity and quality are important to an employer and an employee is rewarded based on both the quantity and quality of the production output. The output quantity is an objective performance measure, which can be verified by a third party. However, assume that the output quality is based on an evaluator’s subjective assessment. The employer can pay the employee based on the output quantity with a fixed piece rate and pay an extra bonus based on the output quality. In this way, the output quality is introduced into a compensation contract as a subjective performance measure. Alternatively, the employer can use the subjective information (quality) to determine the weight on the objective measures (quantity), i.e., pay the employee based on the output quantity with a piece rate determined by the output quality (the better the quality, the higher the piece rate).

Although the analytical literature which investigates how subjective, non-verifiable information should be used in contracting is scarce, empirical research on subjectivity in compensation contracts is growing (Bol, 2008 [2] ) and recent empirical studies start to examine different ways in which subjectivity can be introduced into a compensation contract (Bushman et al., 1996 [6] ; Ederhof, 2010 [7] ; Gibbs et al., 2004 [3] ; Höppe and Moers, 2011 [8] ; Ittner et al., 2003 [9] ; Murphy and Oyer, 2004 [4] ; Wood, 2012 [5] ). This paper aims to fill the gap in the analytical literature and to provide guidance for future empirical research in this area. This paper contributes to the literature by investigating the two different ways in which subjective, non-verifiable performance information can be used in compensation contracts: as a subjective performance measure or as a subjective weight on an objective performance measure. Intuitively, which approach is better should depend, at least to some extent, on the reasons for using a subjective performance evaluation (e.g., because the subjective performance evaluation provides incremental information about the agent’s action, about the noise in other performance measures, or about the manipulation of the objective measures, etc.). This paper considers the situation where the subjective performance evaluation provides incremental information about the agent’s action. The research question is, given that the non-verifiable information is related to the agent’s action, how should the non-verifiable information be used in contracting: as an additional performance measure or as an adjustment to the weight of the existing measure?

Following previous studies, this paper adopts the principal-agent framework in which a principal (an employer) hires an agent (an employee) to perform certain tasks. The agent’s effort is not observable to the principal. The principal, however, observes objective and subjective performance signals, which can be used for contracting. This paper considers a two-task setting where the verifiable performance measure captures the information about one task and the non-verifiable information is related to another task. Assume that the agent is risk neutral. The research finds that when the agent has unlimited liability, the two contracting schemes deliver the same payoff to the principal (given that some regularity condition holds). When the agent has limited liability and the lower bound on the fixed compensation is sufficiently large, the principal prefers a subjective weight contract. Intuitively, the reason is as follows. When a subjective weight is used on an objective measure, the bonus is multiplicative in the realized objective and subjective signals, and therefore, the agent’s ex ante expected payoff is multiplicative in the efforts allocated to the two tasks. The complementarity of efforts in the agent’s payoff function is useful because it helps motivate efforts in both tasks. Given the same amount of variable pay, the subjective weight contract provides greater incentives to the agent. Therefore, the expected amount of bonus needed to induce a certain action is lower and the limited liability rent is smaller under the subjective weight contract. The research also finds that the incremental payoff from using the subjective weight scheme rather than the subjective measure scheme is larger as the marginal benefits of effort from the two actions increase; the degree of complementarity between the two actions in the production function is greater, and the commitment problem is less severe.

The research findings imply that if the subjective performance evaluation is used to provide incremental information on the agent’s action, the use of subjective weighting schemes is more likely observed among low- level employees than high-level employees because the low-level employees tend to have a lower reservation wage. Hence, it is more likely that the limited liability constraint will be binding for the low-level employees. The research also implies that with limited liability problems, the subjective weight scheme tends to deliver a greater payoff to an employer for a job with greater degree of complementarity between various actions and for a job where the employee’s effort is more crucial for success (e.g., a labor-intensive job as compared with a capital-intensive job).

The rest of the paper is organized as follows. Section 2 reviews the literature. Section 3 describes the model. Section 4 considers a benchmark setting where the agent has unlimited liability. Section 5 considers the setting with a limited liability constraint. Section 6 concludes the paper.

2. Literature Review

This paper is related to the literature on implicit contract (a contract based on non-verifiable information). Earlier research in this area considers the setting where only non-verifiable information is available for contracting. The key issue is the commitment problems which arise due to the non-verifiability of the information. The moral hazard problem is double-sided. The agent may shirk, and the principal may renege by not paying the bonus based on the non-verifiable performance evaluation. For example, to avoid paying bonuses, the principle may intentionally understate the performance assessment results. There are several ways in which the use of non- verifiable information in contracting can be sustained: by considering an infinitely repeated game (as in the literature on cartel agreements), by assuming the agent is not certain about the principal’s type (as in Kreps and Wilson, 1982 [10] ), or by using a bonus pool as a commitment tool (e.g. Baiman and Rajan, 1995 [11] ). Earlier work adopts the first approach and considers a trigger strategy where the agent will no longer cooperate once the principal reneges. The key for an implicit contract to be self-enforceable is that the long-term gain from contract continuation to the principal must be greater than the gain from reneging. (See, for example, Bull (1983 [12] , 1987 [13] ), Levin (2002 [14] , 2003 [15] ), and MacLeod and Malcomson (1989) [16] .)

Subsequent research considers the setting where both verifiable and non-verifiable information are available for contracting. Baker et al. (1994) [17] , for example, consider the setting where both an objective performance measure (based on verifiable information) and a subjective performance measure (based on non-verifiable information) are available for contracting. The authors show that a bonus based on the subjective measure cannot be sustained when the distortion in the objective measure is sufficiently low. The authors also investigate the use of non-verifiable information as a subjective weight on the objective performance measure when the agent can “game” the compensation system. Schöttner (2008) [18] extends Baker et al. (1994) [17] to a multi-task setting.

Instead of considering a super game with an infinite horizon, another branch of literature investigates the use of a bonus pool where the principal can commit to pay a bonus pool based on verifiable performance measures to a group of agents. The total compensation (“bonus pool”) to be shared among the agents is determined by the verifiable measures, but the allocation of the bonus pool to each individual agent is based on both the verifiable measure and the subjective measure(s) observed by the principal. Assume no renegotiation, no influence activity, and no collusion. Once committed to the bonus pool amount through an explicit contract, the principal has no incentive to renege. Baiman and Rajan (1995) [11] show in a binary, two-agent setting that the principal is better off when the subjective measure can be used in an implicit contract. Rajan and Reichelstein (2009) [19] extend Baiman and Rajan (1995) [11] to more general single- and multi-agent settings. Rajan and Reichelstein (2006) [20] show that the principal assigns less weight to the non-verifiable measure while relying more on the objective measure when the agents’ non-verifiable measures are negatively correlated. Budde (2007) [21] extends Rajan and Reichelstein (2006) [20] by considering a setting where the agent has limited liability.

In summary, the previous literature has investigated the conditions under which an implicit contract is self- enforceable, and examined when and how a subjective measure should be used in contracting when an objective performance measure is also available. In most cases, researchers consider the setting where subjective, non- verifiable information is introduced into a compensation contract as an additional performance measure. The principal chooses the weight on the objective and subjective measures ex ante. However, as Ittner et al. (2003) [9] suggest, an alternative way to use non-verifiable information is to make the weight on an objective performance measure dependent on the subjective, non-verifiable signal (a subjective weighting scheme). The interesting question is whether the two approaches (subjective measure VS subjective weight) are equivalent. If not, under which conditions is the firm better off choosing one approach over the other? This paper aims to answer these questions in a setting where subjective performance evaluation provides incremental information about the agent’s action.

3. Model Description

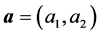

Traditionally, principal-agent models are based on an assumption that an agent is risk averse. To simplify analyses, researchers have recently assumed instead that an agent is risk neutral but has limited liability. Following previous work such as Sappington (1983) [22] and Innes (1990) [23] , this paper assumes that an agent is risk neutral for model tractability. Consider a moral hazard model in which a risk-neutral principal hires a risk-neu- tral, work-averse agent.1 The principal moves first to offer a contract to the agent, who then decides whether to accept the job offer. The agent will accept the job offer if the payoff from the contract is no less than the agent’s reservation utility denoted by U. After the agent accepts the contract, she chooses the level of effort to exert on each of two productive tasks. Let  where

where , i = 1, 2 denote the agent’s action. Assume

, i = 1, 2 denote the agent’s action. Assume

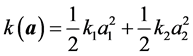

that the agent’s action is not observable to the principal and is costly to the agent, with

representing the agent’s disutility from working.

The production outcome, x, is a random variable with mean  and variance

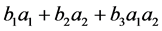

and variance . The agent’s effort in each task increases the production outcome in expectation. Assume that the production outcome is not contractible (for example, the outcome from the manager’s action may not be known until the future period). However, there are two performance measures that are observable to both contracting parties. Let

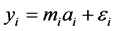

. The agent’s effort in each task increases the production outcome in expectation. Assume that the production outcome is not contractible (for example, the outcome from the manager’s action may not be known until the future period). However, there are two performance measures that are observable to both contracting parties. Let  denote the performance measure that is informative about ai, i = 1, 2. The noise in performance measure ei is a random variable with mean zero and variance

denote the performance measure that is informative about ai, i = 1, 2. The noise in performance measure ei is a random variable with mean zero and variance , i = 1, 2. Assume that y1 is verifiable and hence can be used for explicit contracting. Assume further that y2 is observable to both contracting parties but is not verifiable to the court. In other words, y2 represents subjective performance information while y1 is an objective performance measure. The subjective performance signal y2 provides incremental information regarding the agent’s action a2, which is not reflected in the measure y1. To simplify the analysis, assume that

, i = 1, 2. Assume that y1 is verifiable and hence can be used for explicit contracting. Assume further that y2 is observable to both contracting parties but is not verifiable to the court. In other words, y2 represents subjective performance information while y1 is an objective performance measure. The subjective performance signal y2 provides incremental information regarding the agent’s action a2, which is not reflected in the measure y1. To simplify the analysis, assume that  , i.e., y2 is not informative about the noise in y1 and vice versa.

, i.e., y2 is not informative about the noise in y1 and vice versa.

In this paper, I consider two ways in which subjectivity can be introduced into contracting: 1) through the use of a subjective performance measure with a predetermined weight, and 2) through the use of a subjective weight on an objective performance measure. For simplicity, I consider a linear contract. For the first contracting choice, the bonus is determined by a formula based on one objective measure and one subjective measure, i.e., the contract is of an additive form . The agent receives a fixed payment fA and a bonus v1y1 + v2y2. This contractual form is consistent with the one documented in an empirical study by Höppe and Moers (2011) [8] , which finds that 147 (out of 1753) contracts studied include subjective performance measures with explicit weights on both the objective (financial) and subjective measures.

. The agent receives a fixed payment fA and a bonus v1y1 + v2y2. This contractual form is consistent with the one documented in an empirical study by Höppe and Moers (2011) [8] , which finds that 147 (out of 1753) contracts studied include subjective performance measures with explicit weights on both the objective (financial) and subjective measures.

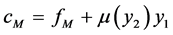

Another way to use non-verifiable information for contracting is to use the information to determine the weight on another performance measure. Höppe and Moers (2011) [8] find that 416 (out of 1753) contracts studied involve the use of subjective weights (on objective and/or subjective measures). Let  denote the contract with a subjective weight on an objective measure. The agent receives a fixed payment fM and a bonus μ(y2)y1. The subjective weight function μ(y2) can take various forms. To simplify the analysis, I adopt a simple form where the subjective weight function is linear in y2, i.e.,

denote the contract with a subjective weight on an objective measure. The agent receives a fixed payment fM and a bonus μ(y2)y1. The subjective weight function μ(y2) can take various forms. To simplify the analysis, I adopt a simple form where the subjective weight function is linear in y2, i.e.,  so that the contract is represented by

so that the contract is represented by . Note that the variable a is included in the contract so that the principal has an option to contract based on y1 alone by choosing β = 0. With the subjective weight on an objective measure, the compensation is multiplicative in y1 and y2.

. Note that the variable a is included in the contract so that the principal has an option to contract based on y1 alone by choosing β = 0. With the subjective weight on an objective measure, the compensation is multiplicative in y1 and y2.

Compared with the payoff from the subjective measure contract cA, if under a certain condition the principal is better off with the simple linear subjective weight contract , then the principal will also be better off with a more general subjective weight scheme. Therefore, the conditions under which the principal prefers the simple subjective weight scheme cM with

, then the principal will also be better off with a more general subjective weight scheme. Therefore, the conditions under which the principal prefers the simple subjective weight scheme cM with  over the subjective measure scheme cA is a sufficient condition for the principal to also prefer a more general subjective weight scheme over the linear subjective performance measure scheme.

over the subjective measure scheme cA is a sufficient condition for the principal to also prefer a more general subjective weight scheme over the linear subjective performance measure scheme.

Although the subjective performance information can be useful for contracting, commitment problems arise in this setting because a court cannot enforce a bonus based on a subjective evaluation. To account for this commitment problem, I adopt the Kreps and Wilson (1982) [10] approach for tractability. Assume that there are two types of principals, honest and dishonest, and the agent ex ante does not know the principal’s type. The agent’s prior belief is that the principal is honest with probability r Î (0, 1). An honest principal will never cheat. He will always pay the bonus based on non-verifiable information as promised. A dishonest principal will cheat by paying the lowest bonus possible no matter what the realized y2 is. (Assume that the dishonest principal will renege on y2 but not on y1 because y1 is verifiable to the court so that reneging on y1 can result in a costly lawsuit.) Let  denote the lower bound of y2. The agent’s expected utility from the contracts cA and cM are denoted by the following, respectively.

denote the lower bound of y2. The agent’s expected utility from the contracts cA and cM are denoted by the following, respectively.

The principal’s expected utility is denoted by

The analyses below consider pooling equilibriums where a dishonest principal offers the same contract as an honest principal. By mimicking the honest principal, the dishonest principal can benefit from the agent’s effort in action a2 without paying for the service ex post. By offering a different contract, however, the dishonest principal reveals his type. Learning that the principal is dishonest, the agent will not supply any effort on the action a2 because the agent anticipates that the dishonest principal will renege ex post. The dishonest principal is thus better off mimicking the honest principal than offering a different contract and not being able to induce the effort for action a2. Thus, this paper considers pooling equilibriums in which both the honest and dishonest principals offer the same contract to the agent. As discussed above, this paper follows the previous literature and assumes the agent’s risk neutrality to simplify analyses. Below, I start with a benchmark case in which the agent is assumed to have unlimited liability in Section 4. Section 5 considers the setting of interest in which the agent has limited liability.

4. The Agent Has Unlimited Liability

As a benchmark case, in this section, assume that the agent is risk neutral and has unlimited liability. In the optimization problem below, I adopt the two-stage approach as in Grossman and Hart (1983) [24] . The first step is to derive the least-cost contract, which can induce the agent to accept the contract and to choose an arbitrary action

4.1. A Formula-Based Contract with a Subjective Performance Measure

Assume for simplicity that

The agent’s maximization problem is as follows.

The agent will choose the action that maximizes her expected payoff. The first-order conditions to the agent’s problem are shown below.

The second-order conditions for the agent’s problem are satisfied for all action choices because

Assume that the principal is honest. The least-cost contract, which can induce the agent to accept the contract and to choose an arbitrary action,

subject to

(PC)A

(IC)A

To induce the agent to select the action

thus must be such that the agent’s first-order conditions (4.1.1) and (4.1.2) are satisfied, i.e.,

the participation constraint (PC)A, i.e.,

Note that the minimized compensation cost above is the first-best cost plus the additional cost from the commitment problem. Consistent with intuition, it becomes more costly to induce a certain action when the commitment problem is more severe in the sense that the probability of an honest principal r is smaller.

The second step is to find the action that maximizes the principal’s payoff. The principal’s optimization problem is shown below.

where CA(a) is as defined in (4.1.3).

The principal’s payoff thus is equal to

Consistent with intuition, the principal induces greater effort as the marginal benefit of effort in each action increases and the cost of effort decreases, i.e.,

When b3 = 0, i.e., there is no complementarity between a1 and a2 in the production function,

4.2. A Contract with Subjective Weighting

With a subjective weight contract

The agent’s maximization problem follows.

The first-order conditions are shown below.

With

Assume that the second-order conditions are satisfied. From (4.2.1) and (4.2.2), the agent’s action choice is therefore

The honest principal solves the following minimization problem to find the least-cost contract that can induce the agent to accept the contract and to choose an arbitrary action

subject to

(PC)M

(IC)M

To be able to induce an arbitrary action

Assume that the second-order conditions (4.2.3) are satisfied.3

With (a*, b*), the fixed payment that will induce the agent to accept the contract must satisfy the participation constraint (PC)M, i.e.,

Again, the minimized compensation cost to induce

The second step is to find the action that maximizes the principal’s payoff. The principal’s optimization problem is shown below.

where CM(a) is as defined in (4.2.4).

Assume that the cost parameters k1 and k2 are sufficiently large such that the second-order conditions are satisfied for all a.4

The solution to the above problem is

From (4.2.5) and (4.1.4), the principal induces the same action under both contracting schemes. This is because the minimized costs of inducing an arbitrary action under the two contracting schemes are equal when the agent has unlimited liability (given that the regularity condition holds). The principal can use either contract to achieve the same payoff. The results above are summarized in the proposition below.

Proposition 1: Assume that the agent is risk neutral with unlimited liability. The principal induces the same action and receives the same payoff under the two contracting schemes.

It should be noted that while the total contracting costs are equal under the two schemes, the variable component is larger and the fixed component is smaller under the subjective measure scheme as shown in Table 1.

5. The Agent Has Limited Liability

In the previous section, I assume that the agent has unlimited liability. In practice, there may be a limited liability constraint on the amount of the fixed payment. Minimum wage requirements, for example, are imposed worldwide and salaries that we observed in the real world are usually non-negative. Bankruptcy clauses in contracts can also result in corporate stakeholder’s limited liability. Following previous work such as Sappington (1983) [22] and Innes (1990) [23] , I introduced a limited liability constraint in this section. Assume that the fixed payment has to be no less than the lower bound F. In other words, in addition to the participation constraint and the incentive compatibility constraint, there is a limited liability constraint in the principal’s cost- minimization problem.

(LL)i

Recall that when there is no limited liability constraint, the optimal fixed payment under the subjective measure scheme cA is

1) The limited liability constraint is not binding under both contracting schemes, i.e.,

2) The limited liability constraint is binding under both contracting schemes, i.e.,

3) The limited liability constraint is binding under the subjective measure scheme only, i.e.,

The solution to case 1 is as characterized in the previous section. In case 3, because the lower bound F is such that

When the limited liability constraint is binding under both contracting schemes, the characterizations of least-cost contracts to induce the action

With the regularity condition holds,5

5.1. A Formula-Based Contract with a Subjective Performance Measure

Given the contracting cost in Table 2, the principal’s maximization problem is as shown below.

Table 1. Minimized-cost contracts to induce â when the agent has unlimited liability.

Table 2. Minimized-cost contracts to induce â when the limited liability constraints are binding.

Assume that the cost parameters k1 and k2 are sufficiently large so that the second-order conditions6 are satisfied. The solution to the above problem and the principal’s maximized payoff are as follows.

The comparative static results for

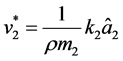

5.2. A Contract with Subjective Weightings

With

Assume that the cost parameters k1 and k2 are sufficiently large so that the second-order conditions7 are satisfied for all a. The solution to the above problem and the principal’s maximized payoff are as follows.

The comparative static results for

Proposition 2: Assume that the agent is risk-neutral and the lower bound on fixed compensation is sufficiently large (such that the limited liability constraint is binding no matter which contractual form is used). The principal induces greater effort for action a2 under the subjective weight scheme than under the subjective mea- sure scheme. If b3 > 0, the principal also induces greater effort for action a1 under the subjective weight scheme.

Compare the principal’s payoff from the subjective measure scheme (5.1.2) and the payoff from the subjective weight scheme (5.2.2), the principal is better off with the subjective weight scheme. The incremental payoff the principal receives from using the subjective weight scheme rather than the subjective measure scheme is

Proposition 3: Assume that the agent is risk-neutral and the lower bound on fixed compensation is sufficiently large (such that the limited liability constraint is binding no matter which contractual form is used). The principal prefers the subjective weight contract cM to the subjective measure contract cA.

Under the subjective weight scheme, the contract is multiplicative in y1 and y2. The incentives for a1 and a2 hence mutually reinforce each other. As a result, the variable pay needed to implement a certain action is lower under the subjective weight scheme. In other words, with the same amount of variable pay, the subjective weight scheme provides greater incentives. The fixed payment to satisfy the participation constraint is thus higher under the subjective weight scheme. When the lower bound on fixed compensation is sufficiently large so that the principal bears the rent from the agent’s limited liability, the principal incurs a lower rent under the subjective weight scheme.

Note that the incremental payoff

6. Conclusions

This paper investigates the question whether the non-verifiable information about the agent’s action should be introduced into the compensation contract as a subjective performance measure or as a subjective weight on an objective performance measure. When the agent has unlimited liability, the two contracting schemes deliver the same payoff to the principal and the principal optimally induces the agent supply the same level of effort under the two schemes. However, it should be noted that while the minimized total compensation cost to induce an arbitrary action is the same under the two contracting schemes, the variable pay is smaller and the fixed pay is larger under the subjective weight scheme. This is because the subjective weight contract is such that the agent’s ex ante expected payoff is multiplicative in the two actions. The incentives for the two actions mutually reinforce each other. With the same amount of variable pay, the subjective weight scheme provides greater incentives to the agent. This is useful in a setting where the agent has limited liability. With less incentive pay needed, the fixed payment to satisfy the participation constraint becomes larger and the limited liability rent becomes smaller with the subjective weight contract. Since the limited liability constraint is more likely to be binding when the agent’s reservation utility is smaller, empirically, one can expect to see greater use of subjective weight contracts for low-level employees with lower reservation wages than for high-level employees.

This paper investigates the setting where subjective performance signals provide incremental information about the agent’s action. As mentioned in previous literature (Bol, 2008 [2] ), subjective performance information may be related to the noise in objective measures or related to the manipulation of objective measures. Subjectivity can also be viewed as ex post contracting to account for the change in environment or to account for the new information, which was not previously available. If the purposes for the use of a subjective performance evaluation are different, the answer to the question whether the non-verifiable information should be used as a subjective performance measure or as a subjective weight may be different as well. Future research that investigates the use of non-verifiable information for other purposes will contribute greatly to our knowledge in this field.

Acknowledgements

The author is very grateful for comments and suggestions of Robert Göx, Suresh Radhakrishnan, Sudipta Basu, and other workshop participants at City University of Hong Kong and the EAA Annual Congress 2011. Part of the work in this paper was done when the author was at City University of Hong Kong and the author would like to gratefully acknowledge financial support from City University of Hong Kong (Project No. 7002169).

Cite this paper

Pattarin Adithipyangkul, (2016) The Use of Non-Verifiable Information Regarding the Agent’s Action in Compensation Contracts. Theoretical Economics Letters,06,234-245. doi: 10.4236/tel.2016.62026

References

- 1. Baker, G.P., Jensen, M.C. and Murphy, K.J. (1988) Compensation and Incentives: Practice vs. Theory. Journal of Finance, 43, 593-616.

http://dx.doi.org/10.1111/j.1540-6261.1988.tb04593.x - 2. Bol, J. (2008) Subjectivity in Compensation Contracting. Journal of Accounting Literature, 27, 1-24.

- 3. Gibbs, M., Merchant, K.A., Van der Stede, W.A. and Vargus, M.E. (2004) Determinants and Effects of Subjectivity in Incentives. Accounting Review, 79, 409-436.

http://dx.doi.org/10.2308/accr.2004.79.2.409 - 4. Murphy, K. and Oyer, P. (2004) Discretion in Executive Incentive Contracts. Unpublished Working Paper, University of Southern California and Stanford University.

- 5. Woods, A. (2012) Subjective Adjustments to Objective Performance Measures: The Influence of Prior Performance. Accounting, Organizations, and Society, 37, 403-425.

http://dx.doi.org/10.1016/j.aos.2012.06.001 - 6. Bushman, R.M., Indjejikian, R.J. and Smith, A. (1996) CEO Compensation: The Role of Individual Performance Evaluation. Journal of Accounting and Economics, 21, 161-193.

http://dx.doi.org/10.1016/0165-4101(95)00416-5 - 7. Ederhof, M. (2010) Discretion in Bonus Plans. Accounting Review, 85, 1921-1949.

http://dx.doi.org/10.2308/accr.2010.85.6.1921 - 8. Hoppe, F. and Moers, F. (2011) The Choice of Different Types of Subjectivity in CEO Annual Bonus Contracts. Accounting Review, 86, 2023-2046.

http://dx.doi.org/10.2308/accr-10132 - 9. Ittner, C.D., Larcker, D.F. and Meyer, M.W. (2003) Subjectivity and the Weighting of Performance Measures: Evidence from a Balanced Scorecard. Accounting Review, 78, 725-758.

http://dx.doi.org/10.2308/accr.2003.78.3.725 - 10. Kreps, D.M. and Wilson, R. (1982) Reputation and Imperfect Information. Journal of Economic Theory, 27, 253-279.

http://dx.doi.org/10.1016/0022-0531(82)90030-8 - 11. Baiman, S. and Rajan, M.V. (1995) The Informational Advantages of Discretionary Bonus Schemes. Accounting Review, 70, 557-579.

- 12. Bull, C. (1983) Implicit Contracts in the Absence of Enforcement and Risk Aversion. American Economic Review, 73, 658-671.

- 13. Bull, C. (1987) The Existence of Self-Enforcing Implicit Contracts. Quarterly Journal of Economics, 102, 147-159.

http://dx.doi.org/10.2307/1884685 - 14. Levin, J. (2002) Multilateral Contracting and the Employment Relationship. Quarterly Journal of Economics, 117, 1075-1103.

http://dx.doi.org/10.1162/003355302760193968 - 15. Levin, J. (2003) Relational Incentive Contracts. American Economic Review, 93, 835-857.

http://dx.doi.org/10.1257/000282803322157115 - 16. MacLeod, W.B. and Malcomson, J.M. (1989) Implicit Contracts, Incentive Compatibility, and Involuntary Unemployment. Econometrica, 57, 447-480.

http://dx.doi.org/10.2307/1912562 - 17. Baker, G., Gibbons, R. and Murphy, K.J. (1994) Subjective Performance Measures in Optimal Incentive Contracts. Quarterly Journal of Economics, 109, 1125-1156.

http://dx.doi.org/10.2307/2118358 - 18. Schottner, A. (2008) Relational Contracts, Multitasking, and Job Design. Journal of Law, Economics, and Organizations, 24, 138-162.

http://dx.doi.org/10.1093/jleo/ewm044 - 19. Rajan, M.V. and Reichelstein, S. (2009) Objective versus Subjective Indicators of Managerial Performance. Accounting Review, 84, 209-237.

http://dx.doi.org/10.2308/accr.2009.84.1.209 - 20. Rajan, M.V. and Reichelstein, S. (2006) Subjective Performance Indicators and Discretionary Bonus Pools. Journal of Accounting Research, 44, 585-618.

http://dx.doi.org/10.1111/j.1475-679X.2006.00212.x - 21. Budde, J. (2007) Bonus Pools, Limited Liability, and Tournaments. Discussion Paper No. 205, Department of Economics, University of Bonn.

- 22. Sappington, D. (1983) Limited Liability Contracts between Principal and Agent. Journal of Economic Theory, 29, 1-21.

http://dx.doi.org/10.1016/0022-0531(83)90120-5 - 23. Innes, R.D. (1990) Limited Liability and Incentive Contracting with Ex-Ante Action Choices. Journal of Economic Theory, 52, 45-67.

http://dx.doi.org/10.1016/0022-0531(90)90066-S - 24. Grossman, S.J. and Hart, O.D. (1983) An Analysis of the Principal-Agent Problem. Econometrica, 51, 7-45.

http://dx.doi.org/10.2307/1912246

NOTES

1While the agent is risk-neutral, assume that the agent has limited liability and the agent does not have sufficient wealth to buy the firm from the principal.

2The second-order conditions for the principal’s problem are satisfied when

3With (a*, b*), the second-order condition (4.2.3) is not restrictive when the following condition holds:

4The second-order conditions for the principal’s problem are satisfied when

5The regularity condition is

6The second-order conditions for the principal’s problem are satisfied when

7The second-order conditions for the principal’s problem are satisfied when