Theoretical Economics Letters

Vol.05 No.01(2015), Article ID:54024,4 pages

10.4236/tel.2015.51013

The Unemployment Volatility Puzzle: A Note on the Role of Reference Points

Vincent Boitier

Centre d'Economie de la Sorbonne, Université Paris 1 Panthéon-Sorbonne, Paris, France

Email: vincent.boitier@univ-paris1.fr

Copyright © 2015 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 23 January 2015; accepted 9 February 2015; published 12 February 2015

ABSTRACT

This theoretical note aims at studying the role of reference points in generating unemployment volatility. For this purpose, I introduce the notion of reference points in a standard Mortensen- Pissarides model. I obtain two results. First, I find that the obtained model is similar to the one found by Pissarides in 2009. Second, I show that the introduction of reference points can increase significantly unemployment volatility through a mechanism à la Hagerdorn and Manovskii.

Keywords:

Reference Points, Unemployment Volatility, Job Matching, Sequential Bargaining

1. Introduction

Economic studies and laboratory experiments clearly show that reference points play a fundamental role in (wage) negotiations (see, within a large literature, [1] - [3] ). Indeed, it is demonstrated that agents evaluate offers and outcomes as gains and losses relative to some reference points. Therefore, by affecting preferences, these points impact both the process and the outcome of bilateral bargaining.

Moreover, a pervasive challenge in macroeconomics is to understand why the standard Mortensen-Pissarides (hereafter MP) model cannot generate the volatility of the unemployment rate observed in US data. This is the so-called Shimer puzzle. Several solutions have been proposed to solve this puzzle. For example, [4] pleads in favor of high unemployment benefits while [5] considering additional matching costs.

The aim of this theoretical note is to draw a link between reference points and the unemployment volatility puzzle. For this purpose, I consider a simple MP model with exogenous separations, reference points and where the partition of the surplus is no longer derived by a Nash bargaining game. It is determined by a sequential bargaining game where the outcome of this new negotiation process is evaluated relative to a reference point. I then deduce the new wage equation and the new associated job creation. I find that the obtained model is equivalent to the one found by [5] . I also show that the presence of reference points raises considerably the unemployment volatility through a mechanism à la Hagerdorn and Manovskii. Indeed, I demonstrate that reference points can lower the firm’s profit and increase wage share by improving the outside option of the worker. Thus, this short article adds reference points to the list of solutions to the Shimer puzzle.

Notice finally that this is not the first framework that integrates reference dependence in a MP model. In a recent working paper, [6] studies the properties of a dynamical model with search and matching frictions and with a reference point in the productivity process of the firm. However, their model is quite different from the one developed in this paper. Among other things, it features wage stickiness, it amplifies unemployment volatility via a new mechanism independent from [4] and it does not aim at solving the Shimer puzzle.

This note is organized as follows. Section 2 describes the search and matching model with reference points. Section 3 provides a conclusion.

2. Search and Matching Model with Reference Points

The model considered hereafter is the standard search and matching model with reference points and sequential bargaining.

2.1. Basic Environment

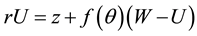

I follow [7] . Let U and W be the asset values of being unemployed and being employed. These asset values are given by:

(1)

(1)

and

(2)

(2)

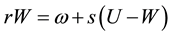

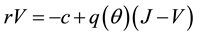

with r the risk-free interest rate, z the unemployment benefits, s the separation rate and  the job finding rate. Let V and J be the asset values of a vacancy and a filled job. These asset values are defined as:

the job finding rate. Let V and J be the asset values of a vacancy and a filled job. These asset values are defined as:

(3)

(3)

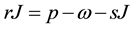

and

(4)

(4)

with c the cost of a vacancy, p the productivity of workers,  the wage and

the wage and  the job filling rate. Using Equation (3), Equation (4) and the free entry condition (i.e.

the job filling rate. Using Equation (3), Equation (4) and the free entry condition (i.e. ), the job creation equation is determined as:

), the job creation equation is determined as:

(5)

(5)

Furthermore, notice that the unemployment rate of the economy is given by the following standard Beveridge curve:

(6)

(6)

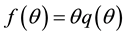

2.2. Wage Determination

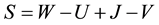

Once the match is made, employer and employee have to negotiate over the partition of the surplus defined as  according to a sequential bargaining game. In the first stage of the game, one player is randomly chosen to make a take-it or leave-it offer. The probability for the worker to be drawn is assumed to be

according to a sequential bargaining game. In the first stage of the game, one player is randomly chosen to make a take-it or leave-it offer. The probability for the worker to be drawn is assumed to be  while the probability for the firm is

while the probability for the firm is . If the offer is accepted by the opponent, the game ends. Conver- sely, if the offer is rejected, the game goes on to the next period where a player is again randomly selected and bargaining begins again. Note that the time interval separating one period from another is

. If the offer is accepted by the opponent, the game ends. Conver- sely, if the offer is rejected, the game goes on to the next period where a player is again randomly selected and bargaining begins again. Note that the time interval separating one period from another is . If players disagree forever, their payoffs are equal to zero. If players agree on a partition of the surplus, they enjoy the following utility function used by [8] 1:

. If players disagree forever, their payoffs are equal to zero. If players agree on a partition of the surplus, they enjoy the following utility function used by [8] 1:

(7)

(7)

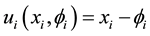

with  and where W is the index of the worker such that

and where W is the index of the worker such that

on the deviation of the value of the agreement from the reference point. In line with prospect theory, this means that outcomes are compared to a reference point that splits the agent preferences into gains and losses (i.e.

if and only if

This is the familiar “split the difference rule”: if demands are compatible (i.e.

Using the above sharing rule, the wage satisfies:

Likewise, using Equation (1), the job creation equation and the sharing rule, I obtain:

Plugging Equation (12) in Equation (11) yields:

1The comparison with [8] stops there since, in [8] , the reference points are endogenous and dynamically changing according to the offers previously made by the players. Also note that reference-dependence distorts the bargaining process by introducing fixed-costs only. It does not distort the matching process. However, one should introduce reference-dependent preferences from the Bellman equations. The results would be exactly the same.

2It is possible to consider a general utility function such that

Equation (13) shows that the worker’s reference point increases the wage by raising the reservation wage while the firm's reference point decreases the wage by lowering the expected return of the match. Moreover, observe that if reference points are equal (i.e.

where

2.3. Comparison with [5]

[5] considers a search and matching model with additional matching costs. In this setup, the job creation equation is

and the Beveridge curve is identical to the one in Equation (6). Thus, up to a coefficient

To conclude, contrary to [5] where matching costs are always assumed to be exogenous, it is easy to endogenize reference points in this setting. In this stationary framework, a natural candidate for the worker’s reference point is the partition of the surplus received by a worker in the standard MP model. This surplus is equal to 0.438. Assuming that the firm has no reference point, the reference point of the worker is

3. Conclusions

In this note, I integrate reference dependent preferences in the wage bargaining of the benchmark MP model. In so doing, I study how reference points affect unemployment volatility. I obtain two results. First, I show that reference points act similarly to matching costs in [5] . Second, I find that these reference points can generate unemployment volatility via a mechanism à la Hagerdorn and Manovskii.

Table 1. Simulations results at different H.

Several extensions can be considered. For example, reference points are introduced (in the present article) as a fixed reduction in utility. This means that there is no loss aversion: the valuation of gains and losses enters symmetrically in the utility function. Therefore, future research should be naturally directed at understanding the effect of reference points that exhibits loss aversion.

Acknowledgements

I thank the referee for his comments. I also thank Jean Olivier Hairault, Pierrick Clerc, Nicolas Dromel and Antoine Lepetit for their help.

References

- Kahneman, D. (1992) Reference Points, Anchors, Norms, and Mixed Feelings. Organizational Behavior and Human Decision Processes, 51, 296-312. http://dx.doi.org/10.1016/0749-5978(92)90015-Y

- Kahneman, D. and Tversky, A. (1979) Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47, 263- 291. http://dx.doi.org/10.2307/1914185

- Koszegi, B. and Rabin, M. (2006) A Model of Reference-Dependent Preferences. Quarterly Journal of Economics, 121, 1133-1166.

- Hagerdorn, M. and Manovskii, I. (2008) The Cyclical Behavior of Equilibrium Unemployment and Vacancies Revisited. American Economic Review, 98, 1692-1706. http://dx.doi.org/10.1257/aer.98.4.1692

- Pissarides, C. (2009) The Unemployment Volatility Puzzle: Is Wage Stickiness the Answer? Econometrica, 77, 1339- 1369. http://dx.doi.org/10.3982/ECTA7562

- Eliaz, K. and Spiegler, R. (2013) Reference-Dependence and Labor-Market Fluctuations. NBER Working Paper No. 19085.

- Pissarides, C. (2000) Equilibrium Unemployment Theory. MIT Press, Cambridge.

- Compte, O. and Jehiel, P. (2003) Bargaining with Reference Dependent Preferences, Mimeo.

NOTES

3So far, there is no calibration for H because of lack of empirical evidence. This limit is in line with [5] : “Since we do not have information about how the job creation costs are split between the costs that depend on the duration of vacancies and the costs that do not, we cannot choose one combination over another on the basis of independent evidence” in [5] (p. 1375).