Modern Economy

Vol. 3 No. 2 (2012) , Article ID: 18151 , 5 pages DOI:10.4236/me.2012.32030

Institutional Quality, Economic Growth and Fluctuations of Oil Prices in Oil Dependent Countries: A Panel Cointegration Approach

1Department of Agricultural Economics, University of Zabol, Zabol, Iran

2Department of Economics, Faculty of Economics, University of Tehran, Tehran, Iran

Email: alirezakeikha@gmail.com, keikha@uoz.ac.ir, mmehrara@ut.ac.ir

Received November 26, 2011; revised January 6, 2012; accepted January 19, 2012

Keywords: Fluctuations; Economic Growth; Panel Cointegration; Institutional Quality

ABSTRACT

The principle aim of this investigation is the study of fluctuations of oil prices impacts on economic growth of oil-dependent countries with respect to institutional quality. For this purpose we use panel cointegration methodology and error-correction model for 32 oil abundant countries covering the period 1975-2010. The result implies that fluctuations of oil prices impact on economic growth of countries depend on institutional quality index so that the impact of fluctuation is avoided by countries with sufficiently good institutions. More ever, the long-run ratio of investment to products effect is negative and small that shows the quality of investment projects is more importance than the quantity of them in the economic growth of these countries. The effect of trade openness on economic growth in the long-run is positive, statistically significant, and economically sizable.

1. Introduction

Iran’s industry is a single-product’s industry that has intensive dependence to oil income then oil price fluctuation which can make an irrecoverable change in its industry. Common economy expresses that increase in resource revenues of a country make upper long-run growth. But‚in spite of that claim‚some considerable evidence show that natural resources not only are growth factor‚ but also cause the decrease of that so this issue as a paradox is in contrary with theories of classical economists ,who believed that resources make opportunity for growth and outspread by accumulation of capital‚and caused make the concept of “resource curse” [1].

But‚ is the essence of natural resource revenues may cause resource curse phenomenon in countries? We can see some countries in the world, though having so many natural resources, but were not facing with these problems. Botswana is a good example in this area‚that could overcome on this curse with considerable export of precious stone of diamond [2]. In this study‚the effect of fluctuation of oil prices on economic growth of 32 oil dependence1 countries was studied with considering the quality of institutions in these countries by using Panel Cointegration method.

2. Theory of Resource Curse

Resource curse term was introduced by Richard Auty to express that rich countries in natural resources could not use this wealth for economical growth of their countries and perhaps was accursed by these resources [3]. The base of this argument as an important international problem was founded after World War II and civil war of Latin America‚and it was clear since after 1970s that rich countries (that have natural resources) have weak operation of economic growth [4]. The most important explanatory factors of resource curse are: Dutch disease‚ fluctuation of price of natural resources‚ instable policy of state and existent of weak institutions and rent seeking. According Dutch disease theory increase in the value of internal currency in period of increase of oil make tradable products section (contain non oil export production) contracts and Non tradable products section (mainly contain services and housing) expands. Therefore‚increase of oil and national currency reinforcement can decrease economical growth by entering consumption goods‚provoke to short yield investment and exacerbate rent seeking activities. In fact increase in real currency rate affect industry and agricultural section by lost their rivalry power in international marketing and become encounter with decrease in export [5].

Instability and fluctuation are main properties of primary raw goods market. Fluctuations of price to 30 percent or more are not unconceivable issue in duration of one year period or two years in these markets. Although this market instability is dangerous for all primary raw goods exporters‚ but more than all it damaged oil exporters. The first and the more importance outcome is uncertainty about the amount of oil revenues and consequently government’s expenditure. This uncertainty causes some problems in policy making [6].

Rent seeking‚ corruption and weak institution are related together in countries that have rich natural resources. Considering perfect studies had been done in this area we can easily conclude that important resource curse channel‚ is the institution quality. Production of primary goods makes rent seeking. Government‚ company or persons (Those who have accessibility to natural resources) can receive natural resource revenues and they can use them for rent seeking activities.

In countries that have so many natural resources‚ expected of rent seeking activities was high and the opportunity cost of these activates is low. Accordingly‚ different politicians and organizations challenge with each other for controlling this resources. Since in most countries‚ government have the natural resources‚ producers are following make close connection with government’s official responses for earn privilege of economical activates. Challenge for attain rent may cause corruption. Severe competitions on taking over a share of this big wealth with weak institutional quality in this countries‚ have not any result except increase of corruption. This problem in Middle East has been seen so many times. Creation of different political sides‚ prevalence of bribery and corruption and power concentration in some especial group are factors that have negative effect on economical growth [5].

Existence rent makes that governments have not sensitive for providing financial of expenditure and establishing strong institutions with exact legal organization. Most countries that have natural resources‚ have not strong bureaucracy and making decision in these countries are weak and are base on expected of resources. In this condition setting for more corruption‚bribery and crime are provided and any kind of motivation for innovation and creation will destroy [7].

3. Review of Literature

“Resource curse” for first time have been used in literature of economy in 1993. Auty says that while so many countries because of invasion of natural resources involved curse‚but in some other countries conditions was not like this; so resource curse phenomenon is not an iron law‚but it is a phenomenon that possibility of its repetition is so much. Other researchers like Bulmer-Thomas; Lal and Myint; Sachs and Warner and Sala-i-Martin again emphasized on it. They show in their studies that economics that have natural resources have lesser growth respect to poor economies [8-10].

Sachs and Warner via one sample of 95 developing countries‚gain negative relation between exporting natural resources (agriculture‚mineral material and fuels) and growth in 1970-1990. They found only Malaysia and Morris, among countries with rich natural resources, which have annual growth equal to 2% between 1970- 1980. Auty shows that between 1960 to 1990‚ income of countries which are poor regarding resources‚ had growth between two to three double faster than countries that have rich resources. Tobias Kronenberg had investigated different channel of resource curse and his found confirm the existence of resource curse and concluded that among developing economies‚ the primary reason of resource curse are corruption and inattention to education and these economies for stand in development direction must battle with the corruption and make sure that resource revenues have been invested in human stock or in protecttion of natural capitals [11]. Collier and Goderis have shown in their article that increase in natural resource prices in short run period has positive effect on economical growth but‚ in long run period this effect is negative. He showed that negative effect of long run is concern to high rents of agricultural section and in countries that have efficient institutions‚ this effect is reversal [12].

4. Materials and Procedure

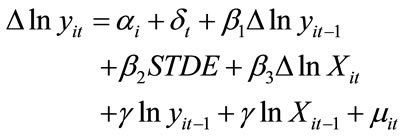

In this section we investigate the influence of fluctuations of oil prices on economical growth of oil exporting countries in model of economic growth with emphasis on institutional quality of exporting countries. Therefore; we use econometrics method of Panel Cointegration for period 1975 to 2010 for 32 main exporting countries. The following error correction model has been used for get the effect of fluctuations of oil price on real gross domestic produc:

(1)

(1)

In which  is the first degree of difference‚ ln is natural logarithm‚ yit is real gross domestic product (non oil)‚

is the first degree of difference‚ ln is natural logarithm‚ yit is real gross domestic product (non oil)‚  is especial fixed effect for countries‚

is especial fixed effect for countries‚  is especial fixed effect for time (year)‚ STDE2 is fluctuation of oil price and Xit is the vector of control’s variable.

is especial fixed effect for time (year)‚ STDE2 is fluctuation of oil price and Xit is the vector of control’s variable.

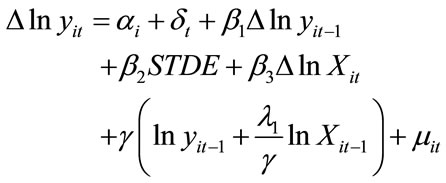

For avoiding from wrong relation in this paper, Dependent variable is considering Economic growth of oil exporting countries without calculation of oil portion. because increase in value of oil portion‚ itself is one of the important component of domestic gross product of these country‚if the purpose be the survey of the effect of oil on economic growth‚ the best way is that growth of domestic gross product consider without calculation of oil portion. Various variable use as control variable in x vector in growth models. In this study‚ four variable: ratio of investment to domestic gross product (inv)‚ commercial independence or openness (openness)‚ oil price (roi) and index of institutional quality use as control variable in x vector with considering accessibility of data and diagnostics examination. Control of corruption‚ Rule of law‚ Regulatory quality‚ Government effectiveness and Political stability are used to product an index of institutional quality. We use Principle component method for combining institutional index to product a single institutional index because institutional index are in high multicollinearity with each other. We also use simple average way to combine institutional indexes (which is a common method in most study) and the results were compared (the index which was made by principal component method were shown with iq1 and the index which was made by simple average were shown with iq2). Data were collected from World Development Indicator and International Financial Statistics. By using of the relation (1) and by factoring parameter , long run relation in error correction model is attainable [12]:

, long run relation in error correction model is attainable [12]:

(2)

(2)

In which ,

,  ,

,  and

and  are short run coefficient and

are short run coefficient and  shows long run coefficient. In this research all calculation is done with eviews7 software.

shows long run coefficient. In this research all calculation is done with eviews7 software.

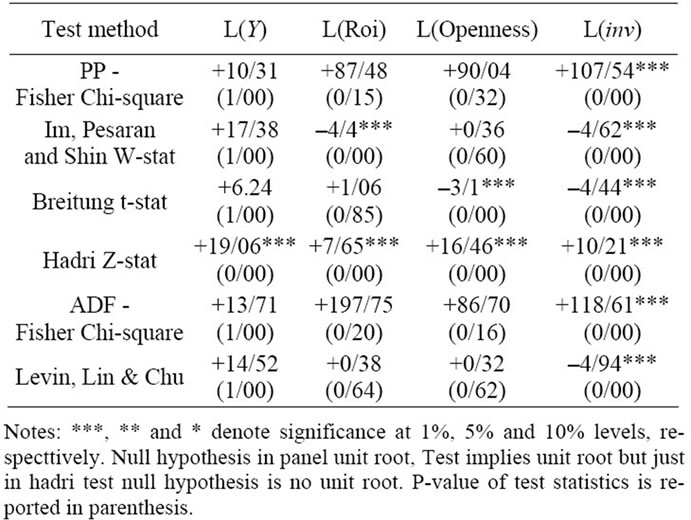

5. Unit Root and Cointegration Test

At the first, stationary of variables must be test and then cointegration analysis must be done. In this study‚ Stationary of the logarithm of ratio of investment to domestic gross product‚ logarithm of oil price, logarithm of commercial independence or openness and logarithm of real domestic gross product has been tested (the index of fluctuations of oil price hasn’t been tested because it is naturally stationary). For this reason, five methods of most important panel unit root tests were used‚though it is possible different method in panel unit root test express paradoxical results. These methods are:

o Levin, Lin and Chu (2002) test [13].

o Im, Pesaran and Shin (2003) test [14].

o Breitung (2000) test [15].

o Fisher-type tests using ADF and PP tests (Maddala and Wu (1999) and Choi (2001)) [16].

o Hadri test [17].

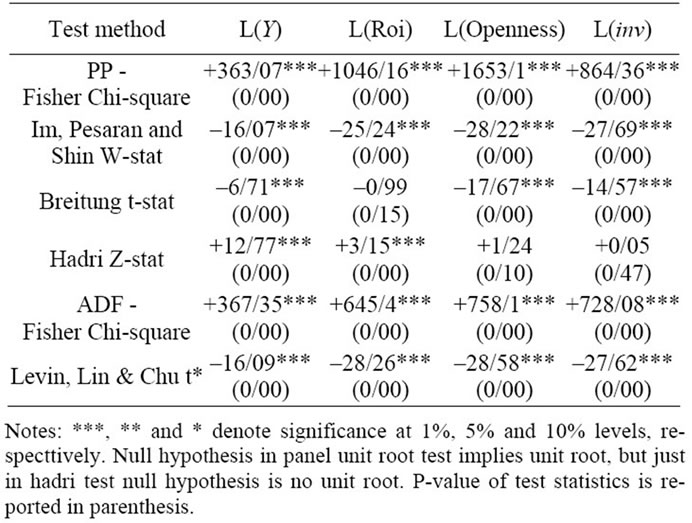

In cointegration analyses‚ the existence of long run economical relation is tested. Main idea in analysis of cointegration is that though so many of economical time series are nonstationary but it is possible liner combination of these variable become stationary in long run period [18]. Pedroni and Fisher method is used for Cointegration test in panel data. The tests of unit root showed that real local gross output logarithm‚ oil price logarithm‚ commercial independence index logarithm‚ investment of stock to local gross output logarithm are nonstationary ‚but the first difference of them become stationary (result shown in Tables 1 and 2).

Table 1. Panel unit root tests for model variables.

Table 2. Panel unit root tests for first difference of variables.

The conclusion of cointegration test showed in Table 3. As can see cointegration or the existence of long run relationship between model’s variables have been accepted in all cases.

6. Results and Conclusions

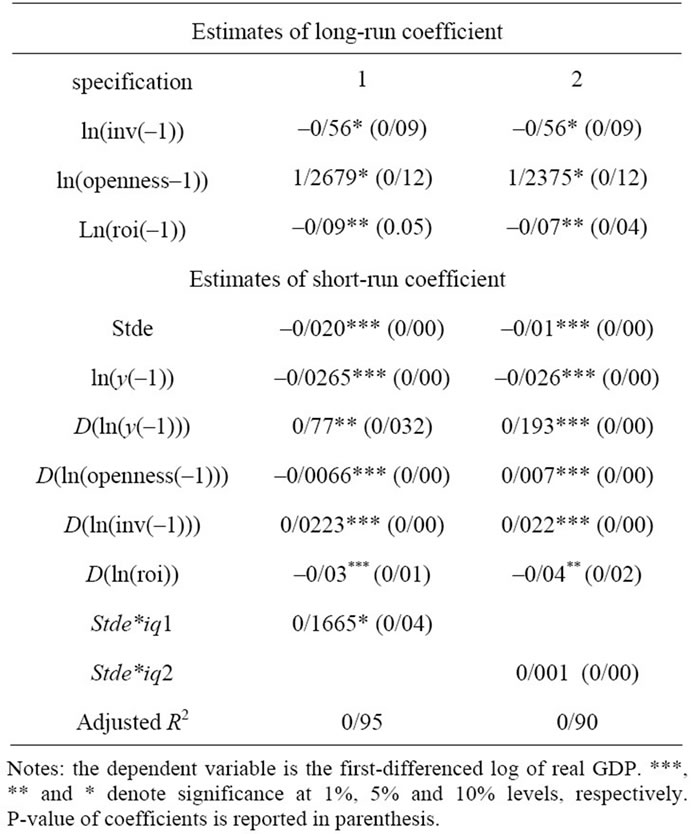

The result of error correction models estimation was showed in Table 4. The difference between two specifications in Table 4 is concerned to use of two different institutional quality indexes in economic growth equation. As you see in the Table 4‚ stde coefficient in both specification are negative and meaningful. According to specification (1) ‚10% of increase in fluctuations of oil price make 2% decreases in economic growth in the countries under investigation. Also in the second specification this is equal to 18% and therefore it is one of the

Table 3. Panel cointegration tests.

Table 4. Estimation result.

channels of resource curse (the negative effect of oil price on economic growth) in these countries. But in both specifications‚ the effect of stde multiplied by institution quality index variable (Stde*iq1 in first specification and Stde*iq2 in second specification) are positive. Therefore; the effect of oil fluctuations on the economic growth of oil exported countries depend on their institutional quality index so that in countries with good institutions‚ oil price fluctuation has weaker effect on their economic growth while in country with weak institutions they suffer from instability of oil price. Trade openness has positive effect on the economic growth of oil country in long run but the effect of this policy in short run is insignificant or even is negative. Increase the ratio of investment to production is expected to takes positive effect on GDP in short run usually from supply channel and in long run from demand channel. However, the effect of ratio of investment on economic growth though in short run is according to our expectation positive but in long run is negative. The negative effect of investments GDP ratio is not compatible with the economic theory in long run. The results probably indicate the low quality of investments‚corruption and rent seeking activities in oil exported countries.

These results have also shows, if the oil exported countries have low institutional quality, they encounter with serious obstacles in long run economic growth. Then beware of these dangers and do serious endeavor for overtop on institutional problems is very important. In short run these countries could avoid of transform of oil strokes to other economic portion by doing consolidations activities like currency reservation fund and effecttive use of oil revenues. In long run institutional reformations have substantial necessity in these countries.

7. Acknowledgements

This paper was funded by grant from the University of Zabol submitted to the author.

REFERENCES

- P. Collier and A. Hoeffler, “Greed and Governance in Civil War,” Policy Research Working Paper 2355, Development Research Group, World Bank, Washington DC, 2000.

- J. D. Sachs and A. M. Warne, “Natural Resource Abundance and Economic Growth,” NBER Working Paper No 5398, 1995.

- R. Auty, Ed., “Resource Abundance and Economic Development,” UNU/WIDER Studies in Development Economics, Oxford University Press, Oxford, 2001.

- A. D. Boschini, J. Pettersson and J. Roine, “Resource Curse or Not: A Question of Appropriability,” Working Paper, Department of Economics, Stockholm University, Stockholm, 2004.

- T. Gylfason, “Natural Resources, Education, and Economic Development,” European Economic Review, Vol. 45, No. 4-6, 2001, pp. 847-859. doi:10.1016/S0014-2921(01)00127-1

- M. L. Ross, “Does Oil Hinder Democracy?” World Politics, Vol. 53, No. 3, 2001, pp. 325-361. doi:10.1353/wp.2001.0011

- H. Mehlum, K. Moene and R. Torvik, “Institutions and the Resource Curse,” The Economic Journal, Vol. 116, No. 508, 2006, pp. 1-20. doi:10.1111/j.1468-0297.2006.01045.x

- V. Bulmer-Thomas, “The Economic History of Latin America Sinceindependence,” Cambridge Latin American Studies, Cambridge University Press, New York, Vol. 77, 1994.

- D. Lal and H. Myint, “The Political Economy of Poverty, Equity and Growth,” Clarendon Press, Oxford, 1996.

- S.-M. Xavier, “I Just Ran Two Million Regressions,” American Economic Review Papers and Proceedings, Vol. 87, No. 2, 1997, pp. 178-183.

- T. Kronenberg, “The Curse of Natural Resources in the Transition Economies,” Economics of Transition, Vol. 12, No. 3, 2004, pp. 399-426. doi:10.1111/j.0967-0750.2004.00187.x

- P. Collier and B. Goderis, “Commodity Prices, Growth, and the Natural Resource Curse: Reconciling a Conundrum,” The Economic Journal, Vol. 92, No. 368, 2007, pp. 825-848.

- L. Andrew, C.-F. Lin and J. Chu, “Unit Root Tests in Panel Data: Asymptotic and Finite Sample Properties,” Journal of Econometrics, Vol. 108, No. 1, 2002, pp. 1-24. doi:10.1016/S0304-4076(01)00098-7

- I. Kyung, S. M. H. Pesaran and Y. Shin, “Testing for Unit Roots in Heterogeneous Panels,” Journal of Econometrics, Vol. 115, 2003, pp. 53-74. doi:10.1016/S0304-4076(03)00092-7

- J. Breitung, “Nonparametric Tests for Unit Roots and Cointegration,” Journal of Econometrics, Vol. 108, No. 2, 2000, pp. 343-363. doi:10.1016/S0304-4076(01)00139-7

- E. Weinthal and P. J. Luong, “Combating the Resource Curse: An Alternative Solution to Managing Mineral Wealth,” Perspectives on Politics, Vol. 4, No. 1, 2006, pp. 36-53. doi:10.1017/S1537592706060051

- K. Hardi, “Testing for Stationary in Heterogeneous Panel Data,” Econometrics Journal, Vol. 3, No. 2, 2000, pp. 148-161. doi:10.1111/1368-423X.00043

- R. Engle and C. W. J. Granger, “Cointegration and Error-Correction: Representation, Estimation, and Testing,” Econometric, Vol. 55, No. 2, 1987, pp. 251-276. doi:10.2307/1913236

NOTES

1Iran, Saudi Arabia, Kuwait, united Arab emirates, Qatar, Algeria, Libya, Nigeria, Indonesia, Venezuela, Colombia, Congo, Ecuador, Gabon, Malaysia, Mexico, Norway, Thailand, Oman, Russia, Australia, Bahrain, Brunei, Cameron, Canada, chili, Denmark, Egypt, Italy, nether land, Syria, Yemen.

2Stde = (ln(roi)^2 + ln(roi(–1))^2 + ln(roi(–2)^2)/3 – ((ln(roi) + ln(roi(–1)) + ln(roi(–2))/3)^2