Open Journal of Statistics

Vol.06 No.05(2016), Article ID:71407,20 pages

10.4236/ojs.2016.65070

New Facts in Regression Estimation under Conditions of Multicollinearity

Anatoly Gordinsky

Berman Engineers LTD, Modiin, Israel

Copyright © 2016 by author and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY 4.0).

http://creativecommons.org/licenses/by/4.0/

Received: August 10, 2016; Accepted: October 18, 2016; Published: October 21, 2016

ABSTRACT

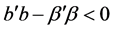

This paper considers the approaches and methods for reducing the influence of multicollinearity. Great attention is paid to the question of using shrinkage estimators for this purpose. Two classes of regression models are investigated, the first of which corresponds to systems with a negative feedback, while the second class presents systems without the feedback. In the first case the use of shrinkage estimators, especially the Principal Component estimator, is inappropriate but is possible in the second case with the right choice of the regularization parameter or of the number of principal components included in the regression model. This fact is substantiated by the study of the distribution of the random variable , where b is the LS estimate and

, where b is the LS estimate and  is the true coefficient, since the form of this distribution is the basic characteristic of the specified classes. For this study, a regression approximation of the distribution of the event

is the true coefficient, since the form of this distribution is the basic characteristic of the specified classes. For this study, a regression approximation of the distribution of the event  based on the Edgeworth series was developed. Also, alternative approaches are examined to resolve the multicollinearity issue, including an application of the known Inequality Constrained Least Squares method and the Dual estimator method proposed by the author. It is shown that with a priori information the Euclidean distance between the estimates and the true coefficients can be significantly reduced.

based on the Edgeworth series was developed. Also, alternative approaches are examined to resolve the multicollinearity issue, including an application of the known Inequality Constrained Least Squares method and the Dual estimator method proposed by the author. It is shown that with a priori information the Euclidean distance between the estimates and the true coefficients can be significantly reduced.

Keywords:

Linear Regression, Multicollinearity, Two Classes of Regression Models, Shrinkage Estimators, Inequality Constrained Least Squres Estimator, Dual Estimator

1. Introduction

In the statistical literature, the term “multicollinearity” is almost as popular as the term “regression”. And this is natural since the regression analysis is one of the powerful tools to reveal dependencies which are hidden in the empirical data while multicollinearity is one of the main pitfalls of this approach. Indeed, a high correlation between two or more of the explanatory variables (predictors) sharply increases the variance of estimators, which adversely affects the study of a degree and a direction of the predictor action on the response variable. Multicollinearity also impairs the predictive opportunities of the regression equation when the correlation in the new data significantly differs from the one in the training set. Numerous recent publications of researchers in various fields, such as medicine, ecology, economics, engineering, and others, devoted to the problem of multicollinearity, indicate that there are serious difficulties in this area until now. That is why the estimation of regression parameters under multicollinearity still remains one of the priorities of an applied and theoretical statistics.

The nature, methods of measurement, interpretation of the results, and methods of decreasing the effect of multicollinearity have been reviewed in numerous monographs and articles, of which we refer to the works have become classics [1] - [6] as well as the relatively recent articles [7] - [13] .

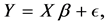

In this paper, we focus on the parameters estimation methods in the multiple linear regression which corresponds to the following equation and assumptions

(1)

(1)

where ,

,  is the variance of

is the variance of ,

,  , known

, known  of rank k, and

of rank k, and  is unknown.

is unknown.

Our goal is to consider the empirical and mathematical methods of improving the statistical characteristics of estimators and, consequently, facilitate their interpretation in conditions of multicollinearity. We also will briefly touch upon the questions of a prediction by regression equations.

Recommendations present in the literature to decrease the influence of multicollinearity, in particular in sources mentioned above, reduce to the following.

1) Eliminate the one of the predictors that is most strongly correlated with the others.

2) Ignore the multicollinearity issue if the regression model is designed for prediction.

3) Standardize the data.

4) Increase the data sample size.

5) Use the shrinkage, and therefore biased, estimators.

The approach formulated in the first item requires a careful analysis of the nature of the correlation between the predictors. In some cases, the deletion of some predictor can distort the essence of the regression model. For example, in studying a quadratic trend the linear term of an equation may be strongly correlated with the quadratic term, but the exclusion of one of them, of course, is unacceptable. Next will be considered a class of regression models for which such an exclusion is always undesirable.

The second approach is only acceptable when the correlation matrix of the new dataset on which the prediction is being performed differs little from the same matrix of the training dataset. If this condition is not fulfilled, the variance of the prediction can increase many times. Unfortunately, experience in solving the real problems shows that the necessary proximity of the two indicated correlation matrices is rarely present.

Data standardization undoubtedly improves the conditionality of computational algorithms for regression, which is essential with a high degree of multicollinearity. This effect is particularly useful in the case of polynomial regression models, and models containing certain other functions. According to the literature, the issue of the effect of standardization on the interpretability of the estimation results is still controversial and is not considered in this article.

Increasing the dataset size always improves the quality of the estimation. Unfortunately, in this case, the indicator of the severity of multicollinearity, called the variance inflation factor (VIF) [5] , reduces proportionately to , where n is the dataset size. This means, for example, that for an initial value of VIF = 50, one must increase n by a factor of 100 to reach the acceptable value VIF = 5. This is always expensive and is not always possible. Thus, given the above, it is advisable to study the last item of the recommendations to reduce the impact of multicollinearity, namely, the use of shrinkage estimators.

, where n is the dataset size. This means, for example, that for an initial value of VIF = 50, one must increase n by a factor of 100 to reach the acceptable value VIF = 5. This is always expensive and is not always possible. Thus, given the above, it is advisable to study the last item of the recommendations to reduce the impact of multicollinearity, namely, the use of shrinkage estimators.

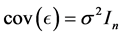

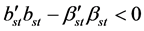

We shall discuss further some features of the use of penalized estimators, which include the ridge [14] and the Lasso [15] estimator, as well as the Principal Component estimator [16] , and the James-Stein estimator [17] . The study of these estimators has been one of the key directions in statistics in recent decades. We show that there exists a class of regression models for which the application of the James-Stein estimator is useless, and employment of other mentioned estimators is dangerous. Moreover, this danger can be catastrophic for the PCR estimator. This statement is illustrated by the counterexample discussed in the second chapter. In the same chapter, on the basis of Monte Carlo trials, it is suggested that this situation is explained by the high probability of an event , where b is the LS estimator and

, where b is the LS estimator and  is the vector of the true regression coefficients.

is the vector of the true regression coefficients.

This probability is studied in the third chapter. We obtained an analytical expression of the probability density function (pdf) for the simple regression, as well as analytical expressions for the four central moments for the multiple regression. Based on the last results, we derived an approximation of this pdf for multivariate regression, and its properties were examined.

The fourth chapter discusses the effect of the probability of the event  on the efficiency of the shrinkage estimators. This study is based on numerical modeling, the possibility of which is provided by the aforementioned approximation. The chapter introduces yet another class of regression models which is favorable for the application of shrinkage estimators. At the same time, the issue of setting the regularization parameter, which depends on the unknown coefficients

on the efficiency of the shrinkage estimators. This study is based on numerical modeling, the possibility of which is provided by the aforementioned approximation. The chapter introduces yet another class of regression models which is favorable for the application of shrinkage estimators. At the same time, the issue of setting the regularization parameter, which depends on the unknown coefficients , remains open. In this case, the James-Stein estimator, which does not require a parameter of regularization, may provide only a meager improvement in efficiency.

, remains open. In this case, the James-Stein estimator, which does not require a parameter of regularization, may provide only a meager improvement in efficiency.

Finally, the fifth chapter discusses alternative approaches. These approaches consist in an application of the known Inequality Constrained Least Squares method and the Dual estimator method proposed by the author in [18] . We show that in the presence of a priori information these approaches have significant advantages.

2. Methods

2.1. Counter Example for Shrinkage Estimators: A Degree of a Simultaneous Influence of Glucose and Insulin on the Blood Glucose Level

In this chapter, the author shows using counterexample that there are regression models with a high degree of multicollinearity for which the use of shrinkage estimators are useless or nearly useless, in the best case, and in the worst case the first three of the above methods give the mean squares error ( ) exceeding the quadratic risk

) exceeding the quadratic risk  of the least square (

of the least square ( ) estimator. As far as the author knows, this fact was not considered in the literature, although it may be very important for researchers.

) estimator. As far as the author knows, this fact was not considered in the literature, although it may be very important for researchers.

Let us now suppose that a researcher has experimental data corresponding to the assumptions of the normal multivariate linear regression (1), and has found the Least Square estimate

Let us also agree that the model is adequate, which means that F-criterion exceeds a critical value. This requirement is well founded as the estimate of coefficients does not make sense in the absence of adequacy. Moreover, the value of the F-test should exceed a critical value by several times [3] , if one aims to ensure the acceptable quality of prediction with the regression model. This requirement for the value of the F-criterion would be more rigid, if one wishes to reach the sufficiently significance level of the estimates of the regression coefficients. The further necessary condition is that the structure of the regression model is found, and it does not change afterwards. Let there be multicollinearity existing in the experimental data. The researcher can apply four of the aforementioned shrinkage estimators to estimate the regression coefficients. The first three of them dominate only under certain conditions, whereas the fourth always dominates, the LS estimator. The researcher, however, is not interested in domination itself. Instead, he is interested in the quantitative characteristic of dominance, in particular, the ratio of the mean squares error (

where

where

The shrinkage estimator will be almost useless, if the ratio

Let us illustrate this assertion by the following example. Consider the problem of computing of the maximum blood glucose in patients with the diabetes mellitus under the simultaneous action of the glucose given peroral, and the insulin given subcutaneously. The physicians recommend [19] evaluating the influence of the insulin in order to calculate its dose. Our approach provides a more realistic understanding of the interaction of glucose with insulin and, that is very important, the exclusion too large or too small the blood glucose levels. The regression model has the form:

where

Let us standardize these data, applying an approach somewhat different from that accepted in the literature, for example in [3] and numerous other sources. The fact is that, according to them, in order to obtain the standardized response after centering

where index i is a number of the coefficient and the column of the centered matrix

Table 1. Data for counterexample for shrinkage estimators.

F-test at the significance level of 0.05 is equal to 8.99, which exceeds the critical value by a factor of 2.42. Finally, the t-tests respectively equal 1.898 and −2.386, while the critical value is 2.365 for the same significance level of 0.05. That is, we can see that the derived estimates of coefficients are almost not significant, despite the fact that the overall model is quite significant. The correlation matrix of the model is equal to

inflation factor (VIF) is 56 for both variables, so that the presence of the considerable multicollinearity is not in doubt. Now we have complete data which are necessary for further studies.

Let us evaluate the potential capabilities of the shrinkage estimators for our task. Consider first the ridge estimator [14] the original form of which for our technique of standardization is written as

where br is the ridge estimator, r > 0 is the regularization parameter, and we obtain the minimum

For this we use approach [14] and derive the MSE expression in the matrix form:

where

Thus in this task the ridge estimator is potentially useless.

If we were to apply under the same conditions the technique of the automatic selection of r [3] , wherein

As for the Lasso method, it is not possible to find the explicit expression for the

where

Now we use the Monte Carlo method in an analogous manner to consider the possibilities of Principal Component Regression (PCR) [16] . For this case we derive

Finally, as to the James-Stein estimator, in our problem, we cannot apply this method in a canonical form [17] , as the number of predictor variables is less than three. But nothing prevents us from deriving the

where

Under known

where

For our data we have

Thus there are models with a high degree of multicollinearity for which the application of the shrinkage estimators is at least virtually useless. What is the reason for this phenomenon?

To answer this question, let us simulate the density of the random variable

For the approximation presented, we obtained:

It is evident that in order to ascertain the reasons for such a situation, it is necessary to explore the properties of the distribution of the random variable

2.2. Properties of the Distribution of the Random Variable

In this chapter, it will be shown that the random variable under study can be represented as a sum of the independent weighted central chi-square and normal variables. The author could not find the explorations of the distribution for this case, despite a vast literature on an approximation of the distribution of a sum of weighted chi-square variables (e.g., [21] - [23] ). Let us define

First we will get the exact expression of the probability density function in the one-dimensional case, if

Proposition 1. For the scheme (1) in the one-dimensional case and known

where

Proof.

Define

One can easily obtain for the one-dimensional case that

The result obtained shows that for dimensionality of two or more, the convolution of such a distribution would be extremely cumbersome and will require numerical solutions. For this reason, let us derive the equations for the first four central moments of the random variable

Proposition 2. For the scheme (1) for

Figure 1. Simulated probability density function of the random variable

where

Proof.

In the multidimensional case using (13), (15) we derive

Taking into account the orthogonality of the eigenvectors we represent

where

Once these moments are found, one can, if necessary, approximate the distribution by well-known methods using Pearson’s or Johnson’s families of curves [25] or by expansion into a certain series [26] . However, our ultimate goal is to estimate the probability of fulfillment of the inequality

Let us designate

as well as the skewness, the kurtosis, and the relative fifth central moment

Note that the indexes in (27-29) are equal to the indexes of the corresponding Hermite polynomials. The vector-row U of the first seven variables included in the Edgeworth series appears as follows

By using the probabilistic genetic algorithm, a model with interaction term is obtaining including the next four variables: intercept,

where

In addition, if

The above coefficients were established as follows. 15 tasks were generated and taken from literature, while for each of which 100 variants of the coefficients were used. That is, the volume of the training set was 1500. In the process we kept in mind the above mentioned restrictions to the coefficient of determination

The maximum number of predictors taken requires some explanation. The literature data and the author’s experience shows that the number of predictors permitting one to reach values of the coefficient of determination R2 of 0.8 and above, with rare exceptions does not exceed ten, if the researcher properly use the methodology of the model selection as well as the nonlinear predictors (in particular, the multivariate polynomials). It seems reasonable to argue that the steadily functioning technical, biological or other systems cannot be stable under a large number of degrees of freedom. As examples for such arguments, let us refer to the following works [28] - [33] .

In all these works, despite the heterogeneity of the modeling objects, the number of variables in the model does not exceed nine, with variations of

Let us consider the validation of the received model (33). Similar to the formation of the training set, the testing set of the same size was created. For this set, the following characteristics of the errors in the calculation of the probability are obtained: mean value −0.00054 against 0.00022 in the training set, the standard deviation 0.01289 against 0.01598, skewness 0.64 and kurtosis 9.17. 95 percent of the errors lie in the interval [−0.024583 0.028161]. We add that Equation (33) has also been continuously tested in the subsequent investigations and corresponded to the above results. Thus one can consider that the model (33) provides acceptable accuracy in determining the probability of the event

Let us give some properties of the probability under study.

1) As can be seen from (16-21) the central moments are even functions of

2) For fixed values of the coefficient of determination

ficients as follows:

The probability of the event

Thus, under equal values of

3) For any sample available to the researcher, even in the presence of a high degree of multicollinearity, the probability of the event

4) The probability increases with the increase in the coefficient of determination

Having derived the above results, in the next section the author will try to assess how the magnitude of the investigated probability affects the efficiency of the shrinkage estimators.

2.3. The Influence of the Probability Magnitude of the Event

In this chapter, the following shrinkage estimators will be considered: ridge estimator, the principal component estimator, and the James-Stein estimator. The Lasso method will not be considered separately, because this approach yields result that is close to the result of the ridge estimator, if the structure of the model is unchanged, as it was adopted in this paper. To calculate the above estimators we use the algorithms presented in [34] . Modeling of a number of tasks under the above stipulated conditions leads to the following conclusions.

1) The case of high probability of the considered event (0.4 and more).

First, note that in this case about half of the shrinkage point estimates will be worse than the LS point wise estimates. Further, the high probability unconditionally negatively affects the MSE of the shrinkage estimators. In this case, for the James-Stein estimator the ratio

2) The case of low probability of the considered event (0.3 and less).

This case is more favorable for the use of shrinkage estimators. So, for the James- Stein estimator we successfully reached

So, we found that the probability of the event

The analysis shows that a high probability of the event

Low probability of the event

2.4. The Inequality Constrained Least Squares and the Dual Estimator Methods in Conditions of Multicollinearity

In the previous chapter, we established that there are two classes of regression models. For the first class, the impact of some predictors on the response is compensated by other predictors. In the second class, there is no such compensation. In the language of specialists in control, this corresponds to models which describe systems with negative feedback and without. Let us emphasize, first, that strong negative feedback always results in multicollinearity, and second, that in this case the elimination of one of the compensated predictors is unacceptable. Statistically, the aforementioned models are fundamentally different. In the first case, the probability of the event

The first method has a fairly long history [35] and is presented in mathematical packages, particularly in Matlab package as a lsqlin function. This function performs a constrained optimization of the following form

where

The essence of the second method is as follows. For the regression model (1), one can use the estimator

where

One of these estimators is [18] unbiased, consistent, and its quadratic risk

From (36) it is clear that the latter can be significantly lower than

with the ratio

two alternatives (35) is carried out through the use of a priori information. It is also important that the method allows estimating of only part of the coefficients naturally for predictors that highly correlated with the others.

The value of any method of estimation based on the use of a priori information largely defined by its universality regarding possible forms of this information.

The shrinkage estimators allow only one kind of a priori information, which confirms the validity of the inequality

The Inequality Constrained Least Squares method has a high degree of flexibility, as is evident from (34) allowing to take into account constraints on the unknown regression coefficients in the form of systems of inequalities and equalities simultaneously. However, unlike the shrinkage estimators, this method permits only nonstrict inequalities, for example

The possibility of using a priori information for the Dual estimator is entirely universal. The advantages of this method are most obvious in the two following situations. The first of these, which is considered in the previous chapter as an example of the regression model for temperatures, is characterized by the presence multicollinearity and an absence of mutual compensation of the influence of the predictors. In this case, Inequality Constrained Least Squares method is not applicable, the shrinkage estimators are biased and require the additional parameters, whereas the Dual estimator method gives the unbiased and consistent solution in the explicit form

As indicated, the example of the first situation given in the previous section is the dependence of some temperature on two others. If we use the method under study and (4), (33), (36), we obtain the probability

Note also, that a priori information considered is qualitative, and thus in many cases it is the least burdensome and, hence, convenient for the researcher.

The second situation consists in confirmation of one of two competing theories with the help of an experiment. Application of the Dual estimator in this case is illustrated in details by a verification of the General Theory of Relativity based upon astronomical data [18] .

Of interest are the possibilities of the methods considered for solving the problem presented in the first chapter as a counterexample. Suppose the researcher have a priori information regarding the coefficient at a dose of insulin, which consists in the fact that

Let us use this information and find the ICLS estimate. In our case

does not correspond to a priori information, and our solution will be

Let us now compare the capabilities of the two methods under study on a set of trials of the first, difficult for estimation, class of regression models with a constraint in the form of nonstrict inequality. For the Dual estimator method, we shall apply the following algorithm to account for a priori information.

Let the limits for some true regression coefficient

Let us find the estimate

where

and

Having found

in which H is a row vector of size k that contains 1 in the ith position and zeroes in all the remaining positions.

Let us illustrate this method on the counterexample from the second Chapter. Using Monte Carlo method let us compute Euclidean distances between the estimates and the true values of the coefficients for the two methods (ICLS and DE) and then we find the ratio of these distances to the same distance, given by the LS method. We obtain the ratio of 0.67 for the rule (38)-(41) and 0.78 for the Inequality Constrained Least Squares method. While extremely unsymmetrical a priori interval will give these ratios 0.70 and 0.71 respectively.

These results are consistent with the detailed research in [18] . For the first method, a priori information which is symmetric with respect to the parameter

Finally, consider the question relative to the individual confidence intervals in the Dual estimator. Let

The initial individual confidence intervals for these three values are [3] [18] :

where

It remains to find the intersection of the confidence interval specified for the nearest element and a priori interval. This intersection will be the new confidence interval. The confidence intervals for the remaining coefficients are easily found with the aid of equation (41).

It is clear that one should compare the width of the new confidence intervals with the width of a priori interval. It is likewise evident that new confidence intervals cannot be wider than a priori intervals. Their ratio depends on the data sample properties, the value of a priori interval, and its location relative to the sought parameter. Tests on a large number of independent tasks have shown that a new confidence interval may be less by a factor of 1.3 than the a priori interval.

3. Results and Discussion

The article has analyzed the empirical approaches and the statistical methods which facilitate reducing the influence of multicollinearity on the estimation of coefficients in linear regression.

Cautions were expressed against the use without proper analysis of some unfortunately generally-accepted recommendations, such as excluding one of the correlated predictors and ignoring multicollinearity in the process of forecasting using the regression equation.

The concepts of the doubtful value of regression models with a large number of the predictors were presented.

The question of utilizing of shrinkage estimators for the purpose of reducing the influence of multicollinearity was considered in detail. It was shown that there are two classes of regression models, the first of which corresponds to systems with negative feedback, and the second of which corresponds to systems without this feedback. The use of shrinkage estimators is inappropriate in the first case. Particularly poor results may be obtained in using the Principal Component estimator. In the second case, the shrinkage estimators may be useful with the right choice of the regularization parameter or in the number of principal components included in the regression model, although this, generally speaking, is problematic. These facts were established by the study of the distribution of the random variable

For the purposes of this study, a regression approximation of the distribution of the event

The essential result is the investigation of alternative approaches to address the problem of multicollinearity. These approaches consist in application of the known Inequality Constrained Least Squares method and the Dual estimator method proposed by the author. It has been shown that for the models of both classes, with the presence of external information these methods can significantly reduce the Euclidean distance between vectors of estimates and true coefficients as well as the confidence intervals of the estimates. For the second class of models, the Dual estimator method gives unbiased and consistent solution in explicit form, and thus has no competitors. This method is also very effective in the problem of a confirmation of one of two competing theories with the help of an experiment.

Acknowledgements

The author is grateful to the anonymous referees and the editors for an excellent, constructive, and extremely helpful review of the paper.

Cite this paper

Gordinsky, A. (2016) New Facts in Regression Estimation under Conditions of Multicollinearity. Open Journal of Statistics, 6, 842-861. http://dx.doi.org/10.4236/ojs.2016.65070

References

- 1. Sen, A.K. and Srivastava, M.S. (1990) Regression Analysis: Theory, Methods, and Applications. Springer-Verlag, New York, 347.

- 2. Belsley, D.A., Kuh, T.D. and Welsch, R.E. (1980) Regression Diagnostics. John Wiley & Sons Inc., Hoboken, 291.

http://dx.doi.org/10.1002/0471725153 - 3. Draper, H.R. and Smith, H. (1998) Applied Regression Analysis. 3rd Edition, John Wiley & Sons Inc., New York, 713.

http://dx.doi.org/10.1002/9781118625590 - 4. Gruber, M.H.J. (1998) Improving Efficiency by Shrinkage: The James-Stein and Ridge Regression Estimators. Marcel Dekker Inc., New York.

- 5. Hocking, R.R. (2003) Methods and Applications of Linear Models. John Wiley and Sons Inc., Hoboken.

http://dx.doi.org/10.1002/0471434159 - 6. Rao, C.R. and Toutenburg, H. (1995) Linear Models: Least Squares and Alternatives. Springer, Berlin.

http://dx.doi.org/10.1007/978-1-4899-0024-1 - 7. Duzan, H. and Shariff, N.S.B.M. (2015) Ridge Regression for Solving the Multicollinearity Problem: Review of Methods and Models. Journal of Applied Sciences, 15, 392-404.

http://dx.doi.org/10.3923/jas.2015.392.404 - 8. El-Dereny, M. and Rashwan, N.I. (2011) Solving Multicollinearity Problem Using Ridge Regression Models. International Journal of Contemporary Mathematical Sciences, 6, 585-600.

- 9. Graham, M.H. (2003) Confronting Multicollinearity in Ecological Multiple Regression. Ecology, 84, 2809-2815.

http://dx.doi.org/10.1890/02-3114 - 10. Kraha1, A., Turner, H., Nimon, K., et al. (2012) Tools to Support Interpreting Multiple Regression in the Face of Multicollinearity. Frontiers in Psychology, 3, 44.

- 11. Vatcheva, K.P., Lee, M., McCormick, J.B. and Rahbar, M.H. (2016) Multicollinearity in Regression Analyses Conducted in Epidemiologic Studies. Epidemiology, 6, 227.

- 12. Yoo, W., Mayberry, R., Bae, S., et al. (2014) A Study of Effects of Multicollinearity in the Multivariable Analysis. International Journal of Applied Science and Technology, 4, 9-19.

- 13. Bersten, A.D. (1998) Measurement of Overinflation by Multiple Linear Regression Analysis in Patients with Acute Lung Injury. European Respiratory Journal, 12, 526-532.

http://dx.doi.org/10.1183/09031936.98.12030526 - 14. Hoerl, A.E. and Kennard, R.W. (1970) Ridge Regression. Biased Estimation for Nonorthogonal Problems. Technometrics, 42, 55-67.

http://dx.doi.org/10.1080/00401706.1970.10488634 - 15. Tibshirani, R. (1996) Regression Shrinkage and Selection via the Lasso. Journal of the Royal Statistical Society Series B, 58, 267-288.

- 16. Jolliffe, I.T. (2002) Principal Component Analysis. Springer, Berlin, 405.

- 17. James, W. and Stein, C. (1961) Estimation with Quadratic Loss. Proceedings of the 4th Berkeley Symposium on Mathematical Statistics and Probability, 1, 361-379.

- 18. Gordinsky, A. (2013) A Dual Estimator as a Tool for Solving Regression Problems. Electronic Journal of Statistics, 7, 2372-2394.

http://dx.doi.org/10.1214/13-EJS848 - 19. Neithercott, T. (2010) A User’s Guide to Insulin. Diabetes Forecast, 4. www.diabetesforecast.org

- 20. Yoshioka, S. (1986) Multicollinearity and Avoidance in Regression Analysis. Behaviormetrika, 13, 103-120.

http://dx.doi.org/10.2333/bhmk.13.19_103 - 21. Castano-Martineza, A. and Lopez-Blazquezb, F. (2006) Distribution of a Sum of Weighted Central Chi-Square Variables. Communications in Statistics-Theory and Methods, 34, 515-524.

http://dx.doi.org/10.1081/STA-200052148 - 22. Withers, C.S. and Nadarajah, S. (2013) Expressions for the Distribution and Percentiles of the Sums and Products of Chi-Squares. Statistics, 47, 1343-1362.

http://dx.doi.org/10.1080/02331888.2012.658399 - 23. Wood, A.T.A. (1989) An F Approximation to the Distribution of a Linear Combination of Chi-Squared Variables. Communication in Statistics Simulation and Computation, 18, 1439-1456.

http://dx.doi.org/10.1080/03610918908812833 - 24. Gnedenko, B. (1962) The Theory of Probability. Translated from the Russian, Chelsea, New York, 472.

http://dx.doi.org/10.1063/1.3057804 - 25. Cramer, H. (1946) Mathematical Methods of Statistics. Princeton Mathematical Series 9, Princeton University Press, Princeton, 575.

- 26. Mnatsakanov, R.M. and Hakobyan, B.S. (2009) Recovery of Distributions via Moments. IMS Lecture Notes Monograph Series, Optimality: The 3rd Erich L. Lehmann Symposium, 57, 252-265.

http://dx.doi.org/10.1214/09-lnms5715 - 27. Kendall, M.G. and Stuart, A. (1962) The Advanced Theory of Statistics, Vol. 1, Distribution Theory. 2th Edition, Griffin, London, 573.

- 28. Gordinsky, A., Plotkin, E., Benenson, E. and Leizerovich, A. (2000) A New Approach to Statistic Processing of Steam Parameter Measurements in the Steam Turbine Path to Diagnose Its Condition. Proceeding of the International Joint Power Generation Conference, Miami Beach, 23-26 July 2000, 1-5.

- 29. Gordinsky, A. (1996) Viscose Film and Textile Fibres Quality Investigation and Control in Industry. The 11th International Conference of the Israel Society for Quality, Jerusalem, 19-21 November 1996, 185-190.

- 30. Kessler, V., Guttmann, J. and Newth, C.J.L. (2001) Dynamic Respiratory System Mechanics in Infants during Pressure and Volume Controlled Ventilation. European Respiratory Journal, 17, 115-121.

http://dx.doi.org/10.1183/09031936.01.17101150 - 31. Leiphart, D.J. and Hart, B.S. (2001) Comparison of Linear Regression and a Probabilistic Neural Network to Predict Porosity from 3-D Seismic Attributes in Lower Brushy Canyon Channeled Sandstones, Southeast New Mexico. Geophysics, 66, 1349-1358.

http://dx.doi.org/10.1190/1.1487080 - 32. Muramatsu, K., Yukitake, K., Nakamura, M., Matsumoto, I. and Motohiro, Y. (2001) Monitoring of Nonlinear Respiratory Elastance Using a Multiple Linear Regression Analysis. European Respiratory Journal, 17, 1158-1166.

http://dx.doi.org/10.1183/09031936.01.00017801 - 33. Plotts, T. (2011) A Multiple Regression Analysis of Factors Concerning Superintendent Longevity and Continuity Relative to Student Achievement. Seton Hall University Dissertations and Theses (ETDs) Paper 484.

- 34. Pantula, J.F. (1987) Optimal Prediction in Linear Regression Analysis. A Dissertation, the University of North Carolina, Chapel Hill, 194.

- 35. Knopov, P.S. and Korkhin, A.S. (2012) Regression Analysis under a Priori Parameter Restrictions. Springer, Berlin.

http://dx.doi.org/10.1007/978-1-4614-0574-0