Paper Menu >>

Journal Menu >>

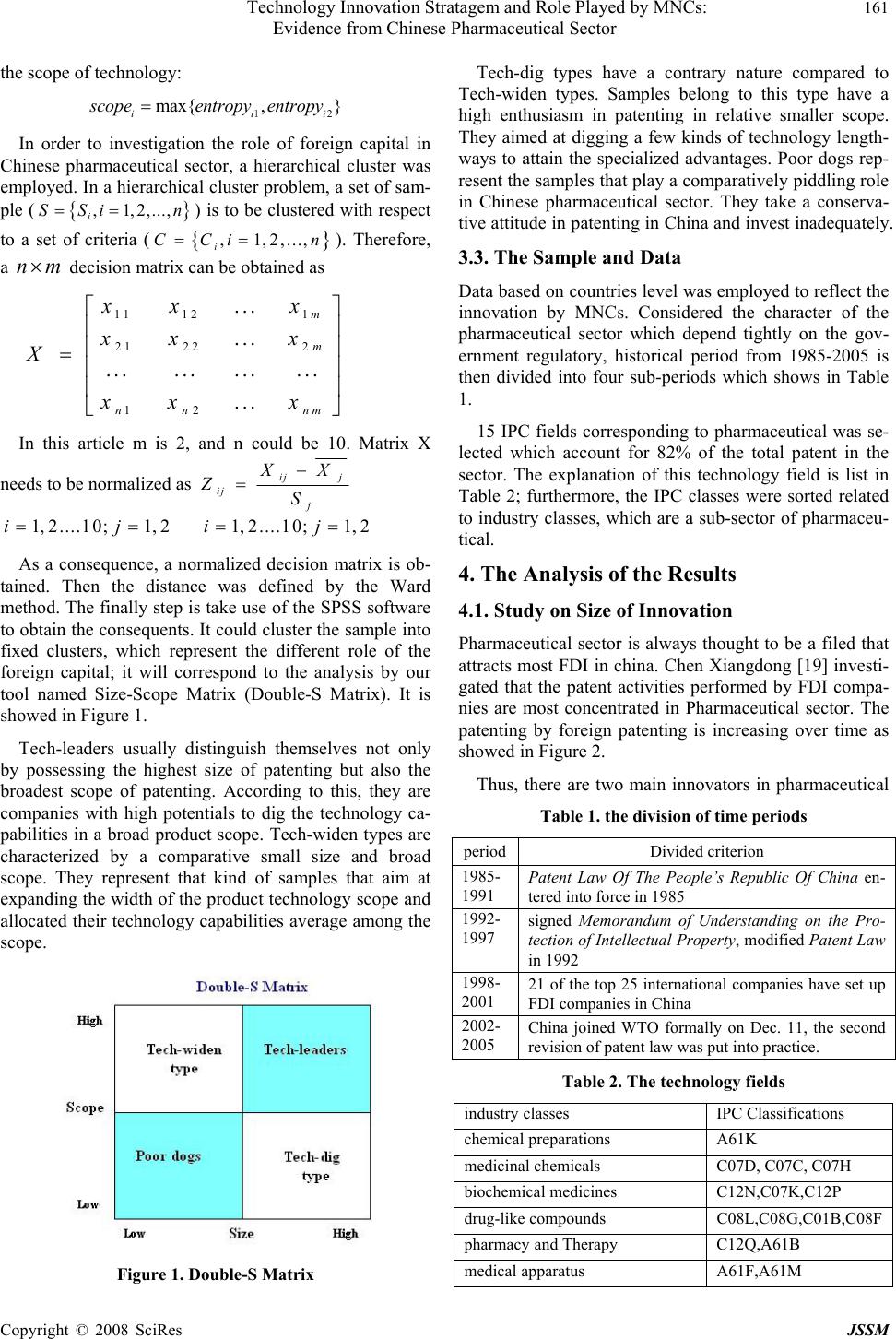

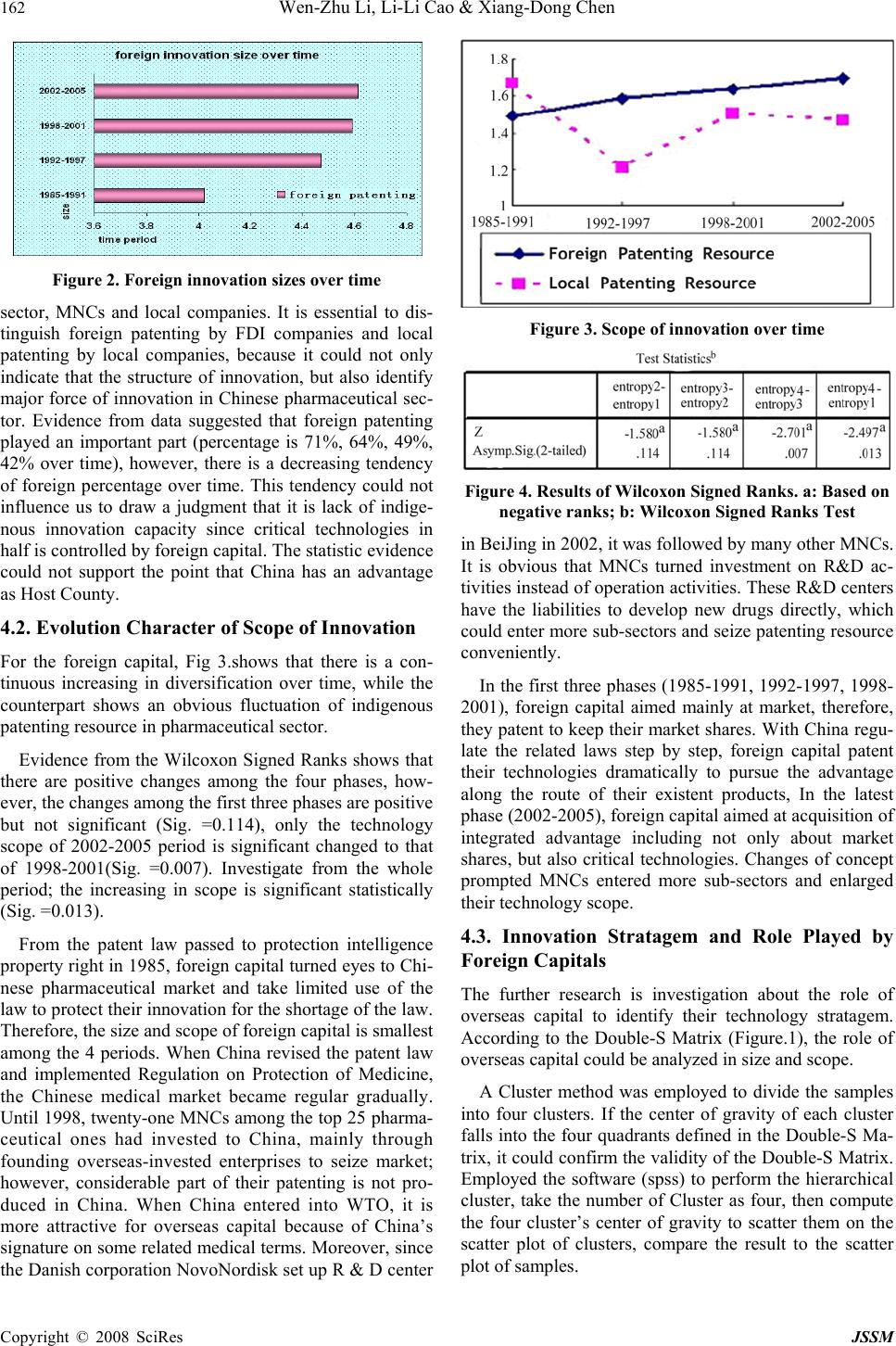

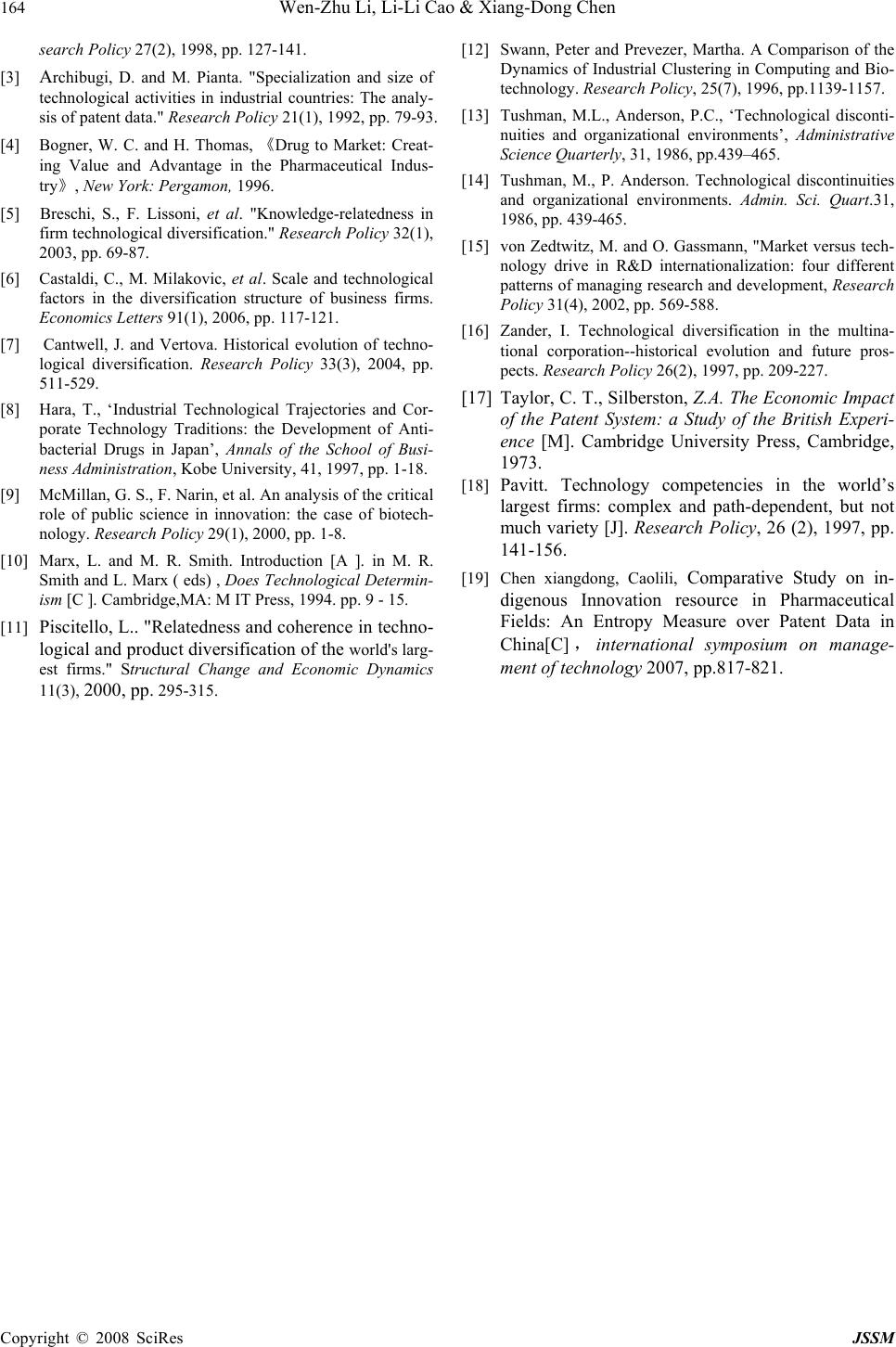

J. Serv. Sci. & Management, 2008, 1: 159-164 Published Online August 2008 in SciRes (www.SRPublishing.org/journal/jssm) copyright © 2008 SciRes JSSM Technology Innovation Stratagem and Role Played by MNCs: Evidence from Chinese Pharmaceutical Sector Li-Li Cao1 & Xiang-Dong Chen1 1The School of Economics & Management. Bei Hang University, Beijing, 100083, P. R. China Email:caolili31083125@sina.com ABSTRACT It is widely regarded that the pharmaceutical sector is quite different from other manufactures for its character in in- novation activities. This paper analyzed the nature of innovation activities by multinational companies (MNCs), which stand for foreign capital, focusing on two parameters named: size and scope of innovation through investigating patent data from 1985 to 2005. The paper reveals the role of the foreign capital and identifies their technology stratagem by developing a tool named Double- S Matrix. Research finding indicates that foreign capitals play an important role on overall national innovative competitiveness in this sector. Implications from this research can be used as reference to policy makers and business companies in China. Keywords: size of innovation, scope of innovation, Double- S Matrix 1. Introduction It is widely believed in international literature that inno- vation movement in pharmaceutical field is unique if one compares with other manufacture sectors. The major rea- sons for this are frequently listed as typical R&D inten- sive sectors, more explicit knowledge based technologies, and one of the industries highly interdependent among larger MNCs and local SMEs in high tech sectors, espe- cially, due to discontinuity nature in innovation process accompanied with emergence of bio-pharmaceutical tech- nology in 1970’s [7]. Technology development route in pharmaceutical in- dustries thus can beco me more versatile or diversified, as Bogner and Thomas’s work [4] indicated (as four differ- ent technology trajectories based on historical facts in pharmaceutical sectors in the US). Bogner and Thomas [4] therefore considered that strategic innovation and its clas- sification were the major issues for firms in the industries, especially for larger MNCs. The sophisticated nature in innovation strategies in firms as well as in countries in the whole in pharmaceutical sectors can be best described by Hara’s hypothesis [8]. He emphasized four basic forces regarding to input of R&D activities and outcome of the R&D process, namely, molecule-biological (technologi- cal) learning, interact factors during application process, market forces, and strategic roles of organizations. The objective of this paper is to produce new empirical evidence pertaining to the characters of technology com- petition by MNCs. Based on patent data; this article hold s several original features. Firstly, investigate the charac- ters of innovator from a macro-level, data based on coun- tries level was employed to reflect the innovation by MNCs. Secondly, developed a tool to analysis the role of the foreign capital and reveal their stratagem. 2. Literature Review and Research Frame- work 2.1. Innovation in the Pharmaceutical Sector Due to its exceptionally high R&D to sales, the pharma- ceutical industry is often characterized as a technology- and science-driven sector. The radical innovation in drug industry is a function of the new technological and scien- tific knowledge embedded in the drug development [1]. The current research on innovation in the sector falls into four major aspects. Firstly, regional character is more significant in drug industry. Previous research shows that there is a intensive demand of regional proximity due to the science-based nature [12]. Secondly, it is a complex progress of innovation due to a long industry chain and diversiform actors. Most of scholars considered that in- novation in the sector reflects breakthrough of innovation chain, which is also decided by the science-based charac- ter [10]. Thirdly, patents are a good measure of inventive activity [6]. The pharmaceutical sector has a high propen- sity to patent relative to other industries [17], also corre- lated with ratings of basic research excellence [18]. 2.2. Technology Competition Based Diversifica- tion There are many literatures to reveal the character of tech- nology competition. Many of them focus on the two pa- rameters: size and diversification, as well as their rela- tionship [3]. It wildly believed that larger countries have a  160 Wen-Zhu Li, Li-Li Cao & Xiang-Dong Chen Copyright © 2008 SciRes JSSM tendency to spread their research activities across many technological fields while small countries tend to concen- trate on narrow niches. Later, Cantwell [7] used the data of 24 famous MNCs, focused on the size-diversification relationship has been stable over time or has changed in different historical periods, shows how the nature of this relationship has changed historically. Castaldi [6] analysis diversification patterns of Italian manufacturing firms, offered empirical evidence on a robust relationship be- tween firm size and diversification. Breschi [5] analysis the diversification of innovation activates by identified two type of innovators: diversified innovators and spe- cialized innovators . However, The theoretical and em- pirical literature has paid extensive attention to large firms’ technological diversification of technology compe- tition [11]; the equivalent phenomenon has been largely neglected and there are paucity of research at a country level. 3. Empirical Methodology and the Data 3.1. Hypothesis In China, it is necessary for local firms to innovation to increase added value of products. It is important to study the innovation disciplinarian of the sector could promote industry’s development and renew the structure of indus- try. However, the innovation disciplinarian must be influ- enced by foreign innovation activities because of the na- ture of FDI in China’s pharmaceutical. This paper pro- vides a research on the foreign patenting activities based on three main hypothesizes. Hypothesis 1: Technology resource competition is de- termined at least by two parameters: size of technology and scope of technology. Hypothesis 2: In Chinese pharmaceutical sector, there are two kinds of innovators, one is local firms and the other is MNCs invested by overseas capital. The two kinds of innovators interact with each other to control more technological resource. One side, they pursue the quantity of patent to ensure they have the expert advan- tage in certain field; the o ther side, they explore the tech- nological scope to achieve the diversification effect. Hypothesis 3: The diversification effect mainly comes from two aspects. One is from the diversification among the different product portfolio like the diversification be- tween chemical preparations and biochemical medicines. The other is from the different process technology in pro- ducing a certain product. For example: the diversification between C07K and C12P which both belong to the tech- nology for biochemical medicines. 3.2. The Empirical Methodology Size of innovation It is not our objective to examine the overall effect of region size upon specialization in general (e.g. in new production and trade) ,but rather to concentrate on the innovation effort. Therefore, size here is related only to the technological activities carried out by regions in China’s pharmaceutical sector. This paper measured in- novation through the number of patent. However, patent data is a kind of count variable that obey the Poisson dis- tribution. So we defined it in log ii s ize TP=where i TP represents the accumulative patent in ith period. Scope of innovation It is demonstrated that the entropy value is an effective measurement of the degree of diversification. This meas- ure takes into account both the number of technologies in which a region might be active, as well as the relative distribution of technological activity across the technolo- gies. Thus, this study will also utilize the entro py inde x to analysis the technological diversification among the sam- ple in order to analysis the scope of technology resource. Therefore, we defined: 1 1 ln n jij iij entropyp p = =∑ , where ij p in the present context represents the share of patents in China’s pharmaceutical sector accounted for by the ith technology. The value of the entropy measure ranges be- tween zero andln n, where a value of zero represents a region concentrating on one technology only and a value approaching ln nrepresents a region with an even distri- bution of patents. One distinct advantage of using the entropy measure is its addictive properties. Specifically, the measure can be decomposed into elements, which define the contribution of technological diversification at various levels of ag- gregation to the total. The analysis in the present study makes use of the additive by examining technological diversification at two related level of aggregation. The first level of aggregation follows the classification used by the China Patent Office, which make a distinction between 15 fields we selected such as A61K and C07D and so on. it is possible to distinguish between rather nar- rowly defined technological capability and diversification. It is a reflection of the total diversification both from the product various and process discrepancy. The second level aggregates the classes of technology into the 6 sub- sectors. In this classification, patents might fall into fields like biochemical medicines, Chemical preparations and so on. it could provide information about distribution of products among different regions. It is a proxy to reflect the scope of product technologies. Considering the addic- tive properties of entropy, the diversification of process technologies could be obtained as follow: 12 iiTi entropyentropyentropy − = , where the iT entropy Stand for the entropy of total 15IPC classes,1i entropy Stand for the entropy of 6 sub-sectors which represent diversification of product, 2i entropy Stand for the diversi- fication of process technologies. And the main body of diversification will be defined as  Technology Innovation Stratagem and Role Played by MNCs: 161 Evidence from Chinese Pharmaceutical Sector Copyright © 2008 SciRes JSSM the scope of technology: 2 max{ ,} iii s copeentropy entropy=1 In order to investigation the role of foreign capital in Chinese pharmaceutical sector, a hierarchical cluster was employed. In a hierarchical cluster problem, a set of sam- ple ( { } , 1,2,..., i SSi n== ) is to be clustered with respect to a set of criteria ( { } , 1,2,..., i CCi n== ). Therefore, a nm× decision matrix can be obtained as 11 121 21 222 12 ... ... ...... ...... ... m m nn nm x xx x xx X x xx ⎡⎤ ⎢⎥ ⎢⎥ =⎢⎥ ⎢⎥ ⎣⎦ In this article m is 2, and n could be 10. Matrix X needs to be normalized as ij j ij j X X ZS − = 1, 2....10;1, 2ij== 1, 2....10;1, 2ij== As a consequence, a normalized decision matrix is ob- tained. Then the distance was defined by the Ward method. The finally step is take use of the SPSS software to obtain the consequents. It could cluster the sample into fixed clusters, which represent the different role of the foreign capital; it will correspond to the analysis by our tool named Size-Scope Matrix (Double-S Matrix). It is showed in Figure 1. Tech-leaders usually distinguish themselves not only by possessing the highest size of patenting but also the broadest scope of patenting. According to this, they are companies with high potentials to dig the technology ca- pabilities in a broad product scope. Tech-widen types are characterized by a comparative small size and broad scope. They represent that kind of samples that aim at expanding the width of the product technology scope and allocated their technology capabilities average among the scope. Figure 1. Double-S Matrix Tech-dig types have a contrary nature compared to Tech-widen types. Samples belong to this type have a high enthusiasm in patenting in relative smaller scope. They aimed at digging a few kinds of technology length- ways to attain the specialized advantages. Poor dogs rep- resent the samples that play a comparatively piddling role in Chinese pharmaceutical sector. They take a conserva- tive attitude in patentin g in China an d invest inad equately. 3.3. The Sample and Data Data based on countries level was employed to reflect the innovation by MNCs. Considered the character of the pharmaceutical sector which depend tightly on the gov- ernment regulatory, historical period from 1985-2005 is then divided into four sub-periods which shows in Table 1. 15 IPC fields corresponding to pharmaceutical was se- lected which account for 82% of the total patent in the sector. The explanation of this technology field is list in Table 2; furthermore, the IPC classes were sorted related to industry classes, which are a sub-sector of pharmaceu- tical. 4. The Analysis of the Results 4.1. Study on Size of Innovation Pharmaceutical sector is always thought to be a filed that attracts most FDI in china. Chen Xiangdong [19] investi- gated that the patent activities performed by FDI compa- nies are most concentrated in Pharmaceutical sector. The patenting by foreign patenting is increasing over time as showed in Figure 2. Thus, there are two main innovators in pharmaceutical Table 1. the division of time periods periodDivided criterion 1985- 1991 Patent Law Of The People’s Republic Of China en- tered into force in 1985 1992- 1997 signed Memorandum of Understanding on the Pro- tection of Intellectual Property, modified Patent Law in 1992 1998- 2001 21 of the top 25 international companies have set up FDI companies in China 2002- 2005 China joined WTO formally on Dec. 11, the second revision of patent law was put into practice. Table 2. The technology fields industry classes IPC Classifications chemical preparations A61K medicinal chemicals C07D, C07C, C07H biochemical medicines C12N,C07K,C12P drug-like compounds C08L,C08G,C01B,C08F pharmacy and Therapy C12Q,A61B medical apparatus A61F,A61M  162 Wen-Zhu Li, Li-Li Cao & Xiang-Dong Chen Copyright © 2008 SciRes JSSM Figure 2. Foreign innovation sizes over time sector, MNCs and local companies. It is essential to dis- tinguish foreign patenting by FDI companies and local patenting by local companies, because it could not only indicate that the structure of innovation, but also identify major force of innovation in Chinese pharmaceutical sec- tor. Evidence from data suggested that foreign patenting played an important part (percentage is 71%, 64%, 49%, 42% over time), however, there is a decreasing tendency of foreign percentage over time. This tendency could not influence us to draw a judgment that it is lack of indige- nous innovation capacity since critical technologies in half is controlled by foreig n cap ital. The statistic ev iden ce could not support the point that China has an advantage as Host County. 4.2. Evolution Character of Scope of Innovation For the foreign capital, Fig 3.shows that there is a con- tinuous increasing in diversification over time, while the counterpart shows an obvious fluctuation of indigenous patenting resource in pharmaceutical sector. Evidence from the Wilcoxon Signed Ranks shows that there are positive changes among the four phases, how- ever, the changes among the first three phases are positive but not significant (Sig. =0.114), only the technology scope of 2002-2005 period is significant changed to that of 1998-2001(Sig. =0.007). Investigate from the whole period; the increasing in scope is significant statistically (Sig. =0.013). From the patent law passed to protection intelligence property right in 1985, foreign capital turned eyes to Chi- nese pharmaceutical market and take limited use of the law to protect their innovation for the shortage of the law. Therefore, the size and scope of foreign capital is smallest among the 4 periods. When China revised the patent law and implemented Regulation on Protection of Medicine, the Chinese medical market became regular gradually. Until 1998, twenty-one MNCs among the top 25 pharma- ceutical ones had invested to China, mainly through founding overseas-invested enterprises to seize market; however, considerable part of their patenting is not pro- duced in China. When China entered into WTO, it is more attractive for overseas capital because of China’s signature on some related medical terms. Moreover, since the Danish corporation NovoNordisk set up R & D center Figure 3. Scope of innovation over time Figure 4. Results of Wilcoxon Signed Ranks. a: Based on negative ranks; b: Wilcoxon Signed Ranks Test in BeiJing in 2002, it was followed by many other MNCs. It is obvious that MNCs turned investment on R&D ac- tivities instead of op eration activities. These R&D centers have the liabilities to develop new drugs directly, which could enter more sub-sectors and seize patenting resource conveniently. In the first three phases (1985-1991, 1992-1997, 1998- 2001), foreign capital aimed mainly at market, therefore, they patent to keep their market shares. With China regu- late the related laws step by step, foreign capital patent their technologies dramatically to pursue the advantage along the route of their existent products, In the latest phase (2002-2005), foreign capital aimed at acquisition of integrated advantage including not only about market shares, but also critical technologies. Changes of concept prompted MNCs entered more sub-sectors and enlarged their technology scope. 4.3. Innovation Stratagem and Role Played by Foreign Capitals The further research is investigation about the role of overseas capital to identify their technology stratagem. According to the Double-S Matrix (Figure.1), the role of overseas capital could be analyzed in size and scope. A Cluster method was employed to divide the samples into four clusters. If the center of gravity of each cluster falls into the four quadrants defined in the Double-S Ma- trix, it could confirm the validity of the Double-S Matrix. Employed the software (spss) to perform the hierarchical cluster, take the number of Cluster as four, then compute the four cluster’s center of gravity to scatter them on the scatter plot of clusters, compare the result to the scatter plot of samples.  Technology Innovation Stratagem and Role Played by MNCs: 163 Evidence from Chinese Pharmaceutical Sector Copyright © 2008 SciRes JSSM Figure 5. Comparative scatters Figure 5 shows the result from the Cluster method is accordant with the four types defined by the Double –S Matrix. It is apparently that four clusters belong to four quadrants to confirm the validity of the Matrix. Hierar- chical cluster offers a class statistically corresponding to the four roles defined by the Matrix. It is list in table 3. In Chinese pharmaceutical sector, America and Japan process the plentiful technology resource in most of the sub-sectors. They play a significant role as the tech-leader in patenting activities in Chinese pharmaceutical sector. Usually, they have absolutely advantage in most of the sub-sectors, while they have strength to carry out inte- grated innovation strategy to expand the width and depth of the technology. Tech – dig types with Represent of German, mainly concern about a few sub-sectors, which is important or familiar to them. They dig the potential technology capability with motivation to obtain the expert status and specialized technologies in some special sub- sectors which they have related competition advantage; therefore, they could capture monopoly profit by leading the dominant paradigm or establishing the technology criterion of these sub-sectors. Korea is the typical country, which belongs to the tech-width type, which has charac- ters of using a relative smaller size to cover a relative broad scope of technology. They dabble in a broad filed and seize technology resource as broad as possible. They stimulate by diversified technology in order to achieve the scope economy, through integrating the operating and marketing of their diversified technologies and products. Refer to the poor dogs, they have a narrow scope and small size compare to the other three types. It could sug- gest that they hold a conserv ative attitude to the Chi nese pharmaceutical sector. However, they only keep the ap- propriate size and scope of technology to ensure their qualification to take part in this sector. If they have the expectation to seize the dominant technology in some sub-sector, they could increase their innovation activities to be tech-dig type. If there are business opportunities in many sub-sectors, they could implement a diversified stratagem to obtain profit. Table 3. Role of foreign capital 5. Main Founding and Conclusion This paper investigated in the size and scope of tech- nology as well as originally developing the double-S Matrix to distinguish the role of foreign countries, based on the patent data from 1985 to 2005. There are two main founding this paper achieves: Firstly, foreign capital played a critical role in pharma- ceutical sector in China, with respect to the size and scope over time. Secondly, there are four types of foreign capital defined by the double-S matrix. Accordingly, the largest countries, which called Tech-leaders, were always digging the technology capabilities in a broad product scope. While, smaller countries face two stratagems to select: technologically specialized in existed sub-sector with related comparative advantage, or expanding the product technology scope in a low technologically poten- tial. These findings carry some suggestions for public pol- icy. Governments should understand that the role of the foreign capital. Public policy should be, therefore, tai- lored according to the condition. One side, the govern- ment should attract foreign capital to invest in China to obtain the technology transfer and other profit. According to the previous literature, the effect of technology transfer is depend on the absorb capabilities to a large distant, therefore, the new role of governments should be a “god father” to support education and training, public research and universities, and to encourage firms to invest in re- search. It will give indigenous innovation support, includ- ing finance to R&D activities and special funds support. These actions could stand for public knowledge base; enhance the attraction of the region and development of China’s pharmaceutical sector. Further, it will foster some pharmaceutical cluster, which embody MNCs in the in- novation network, and make full use of the MNCs to pull the local innovation in the global economic. REFERENCES [1] Abernathy, W. J. and K. B. Clark. "Innovation: Mapping the winds of creative destruction." Research Policy 14(1), 1985, pp. 3-22. [2] Arundel A., I. Kabla. What percentage of innovations are patented? Empirical estimates for European firms. Re- Cluster Countries Type Cluster 1 America, Japan Tech-leaders Cluster 2 England, Holland, Korea Tech-widen types Cluster 3 Sweden, Italy Poor dogs Cluster 4 Switzerland, France, German Tech-dig type  164 Wen-Zhu Li, Li-Li Cao & Xiang-Dong Chen Copyright © 2008 SciRes JSSM search Policy 27(2), 1998, pp. 127-141. [3] Archibugi, D. and M. Pianta. "Specialization and size of technological activities in industrial countries: The analy- sis of patent data." Research Policy 21(1), 1992, pp. 79-93. [4] Bogner, W. C. and H. Thomas, 《Drug to Market: Creat- ing Value and Advantage in the Pharmaceutical Indus- try》, New York: Pergamon, 1996. [5] Breschi, S., F. Lissoni, et al. "Knowledge-relatedness in firm technological diversification." Research Policy 32(1), 2003, pp. 69-87. [6] Castaldi, C., M. Milakovic, et al. Scale and technological factors in the diversification structure of business firms. Economics Letters 91(1), 2006, pp. 117-121. [7] Cantwell, J. and Vertova. Historical evolution of techno- logical diversification. Research Policy 33(3), 2004, pp. 511-529. [8] Hara, T., ‘Industrial Technological Trajectories and Cor- porate Technology Traditions: the Development of Anti- bacterial Drugs in Japan’, Annals of the School of Busi- ness Administration, Kobe University, 41, 1997, pp. 1-18. [9] McMillan, G. S., F. Narin, et al. An analysis of the critical role of public science in innovation: the case of biotech- nology. Research Policy 29(1), 2000, pp. 1-8. [10] Marx, L. and M. R. Smith. Introduction [A ]. in M. R. Smith and L. Marx ( eds) , Does Technological Determin- ism [C ]. Cambridge,MA: M IT Press, 1994. pp. 9 - 15. [11] Piscitello, L.. "Relatedness and coherence in techno- logical and product diversification of the world's larg- est firms." Structural Change and Economic Dynamics 11(3), 2000, pp. 295-315. [12] Swann, Peter and Prevezer, Martha. A Comparison of the Dynamics of Industrial Clustering in Computing and Bio- technology. Research Policy, 25(7), 1996, pp.1139-1157. [13] Tushman, M.L., Anderson, P.C., ‘Technological disconti- nuities and organizational environments’, Administrative Science Quarterly, 31, 1986, pp.439–465. [14] Tushman, M., P. Anderson. Technological discontinuities and organizational environments. Admin. Sci. Quart.31, 1986, pp. 439-465. [15] von Zedtwitz, M. and O. Gassmann, "Market versus tech- nology drive in R&D internationalization: four different patterns of managing research and development, Research Policy 31(4), 2002, pp. 569-588. [16] Zander, I. Technological diversification in the multina- tional corporation--historical evolution and future pros- pects. Research Policy 26(2), 1997, pp. 209-227. [17] Taylor, C. T., Silberston, Z.A. The Economic Impact of the Patent System: a Study of the British Experi- ence [M]. Cambridge University Press, Cambridge, 1973. [18] Pavitt. Technology competencies in the world’s largest firms: complex and path-dependent, but not much variety [J]. Research Policy, 26 (2), 1997, pp. 141-156. [19] Chen xiangdong, Caolili, Comparative Study on in- digenous Innovation resource in Pharmaceutical Fields: An Entropy Measure over Patent Data in China[C] ,international symposium on manage- ment of technology 2007, pp.817-821. |