Theoretical Economics Letters

Vol.05 No.06(2015), Article ID:62290,18 pages

10.4236/tel.2015.56088

An Empirical Examination of Efficiency Theory of Mergers in Emerging Market India

Kavita Wadhwa*, Sudhakara Reddy Syamala

IBS Hyderabad, IFHE University, Hyderabad, India

Copyright © 2015 by authors and Scientific Research Publishing Inc.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Received 1 December 2015; accepted 26 December 2015; published 29 December 2015

ABSTRACT

The “inconclusive” existing literature on long-term horizon studies of mergers is the motivation of this paper to reexamine the post-merger performance and explore the reasons of unsatisfactory performance. We test efficiency theory of mergers by examining the industry adjusted operating performance of mergers. Unlike the existing literature which examines the operating performance of mergers at end level (ROA or ROE), we not only examine the operating performance at end level but also analyze the performance at each stage of operation i.e. material, labor, overheads, tax, interest and sales. We do not find synergy creation at the end level (i.e. ROA level). However, we observe synergy creation at tax and interest level and synergy destruction at labor and overheads level. The performance of different categories of mergers which are group/non-group mergers, related/unrelated mergers and BIFR/non-BIFR mergers is also examined. Factors explaining the post-merger profitability, efficiency and cash flows are also examined.

Keywords:

Mergers, Efficiency Theory, Operating Performance, Merger Motives

1. Introduction

Mergers and acquisitions (M & As) have attracted international attention due to economic integration and removal of barriers to trade at the global level. Due to increasing competition, companies are competing not only in domestic markets but also in foreign markets to maintain a competitive edge. Different firms undertake mergers with different motives as explained by various theories behind merger motives. These theories are developed and tested by various researchers across the globe in different time periods. The various theories of mergers are efficiency theory, monopoly theory, raider theory, valuation theory, empire building theory, process theory, agency theory, etc. The most prominent among all the theories is efficiency theory. According to efficiency theory, mergers are planned and executed to achieve synergies. These synergies can be in the form of reduction in cost or increase in sales. However, this is not always observed, and so a question of relevance to ask of each deal is: “Does the merger provide benefits in the form of synergies?” Thus, in this paper, we make an attempt to find out, “Do we really achieve efficiency gains or reduction in costs after the merger?” In this way, this paper tests the efficiency theory of mergers in India.

The efficiency theory of mergers, which views mergers as effective tools to reap benefits of synergy, is still the basis of many merger studies. Though the efficiency theory of mergers has dominated the field of research on merger motives for many years, its empirical validity is still very limited. For testing the efficiency theory of mergers, various researchers have carried out event studies to analyze if there is a change in the efficiency of the firm after a merger in terms of creation of shareholders’ wealth. The results of event studies are more or less generalizable but the main drawback of such studies is that these are short term studies and deal only with the announcement period abnormal stock returns for both the target and bidder firm’s shareholders. Another limitation of event study is that the methodology cannot be used to examine the performance of unlisted companies. Thus, there is a need to understand the long-term financial performance of firms after mergers to know if mergers lead to efficiency gains in the form of synergies. Since, it takes long-time to fully realize the benefits of merger, if there are any; the studies with long-term horizon may provide better insights on whether mergers have served the intended purpose. This is one of the motivations for the present study in which we test efficiency theory of mergers by using long-term horizon studies/operating studies.

Even the existing literature on long-term horizon studies/operating studies is inconclusive. The studies which are based on pre- and post-merger financial/accounting measures do not provide clear evidence about the efficiency effects of mergers. Most of the studies find no significant change in the performance after merger whereas a few of the studies find that there is a decline in the performance after merger. These results raise a question, “If there are no efficiency gains in mergers, if there is no improvement in the performance of firms post- merger, then why are mergers still taking place at a rapid rate?” This question motivates us to test efficiency theory and reexamine the post-merger performance to find reasons for unsatisfactory performance.

The long-term horizon multi-industry studies show that many mergers are not successful. Unfortunately, we cannot infer from these studies whether mergers are efficient. Thus, we carry out our analysis in one industry because most of the previous studies are on multiple industries and only a very few studies on a single industry have given fruitful results and validated efficiency theory. According to [1] , there are few single industry studies which indicate that mergers were successful. For example, studies in the hospital industry show that mergers are associated with cost reductions, although price enhancing effects are seen if concentration is high. [2] [3] observe in the banking industry that reduction in cost after mergers is not consistent over time, but there are efficiency gains on the basis of product mix enhancements. [4] shows that brewing industry mergers facilitate asset reorganization in efficiently. All these are the reasons for us to carry out the present study in the Indian manufacturing sector.

So, the present study aims at testing the efficiency theory of mergers in the manufacturing sector of India by examining operating performance. We have broadly four objectives. One, we examine the impact of mergers on the operating performance of the acquiring companies. Two, we identify the sources of operating synergy created by merger and find out synergy creation at each stage of operation. For this, we decompose return on assets (ROA) into six cost and efficiency components which are at material level, labor level, overheads level, tax level, interest level and sales level. Three, we study the pattern of synergy creation at each stage of operation for different categories of mergers which are group versus non-group mergers, related versus unrelated mergers and BIFR versus non-BIFR mergers. Four, we examine the factors which explain the post-merger profitability and efficiency.

We consider the fact that the impact of merger is different in different categories of mergers which has also been ignored by many of the previous studies. We examine three kinds of mergers; one of them is country-spe- cific and found mainly in India. We compare related with unrelated mergers, group with non-group mergers and Board for Industrial and Financial Reconstruction (BIFR) with non-BIFR mergers. Related mergers are those mergers in which the acquirer and target operate in the same industry sector whereas in unrelated mergers acquirer and target both come from different industries. Group mergers are the mergers in which acquirer and target belong to same business group whereas in non-group mergers acquirer and target come from different business groups. BIFR category of mergers is a different story altogether. These mergers are unique and prevalent only in India. In this type of merger, a healthy company takes over a financially sick company which is suffering from losses in order to fulfill the mandatory order of Board for Industrial and Financial Reconstruction (BIFR). Savings in tax is the incentive for a healthy company to acquire loss-making company. Savings in tax results from the writing off accumulated losses of sick company from the profits of the healthy company or the acquirer. An important reason to examine the different categories of mergers is to understand the differences in mergers of developed and developing countries. Existence of family business groups is one of the important characteristics which differentiate business structure of developing country like India from many other developed countries. Unlike most of the developed countries but like many developing countries such as Japan, Korea, Turkey, Brazil, Israel, etc. India has high percentage of family business groups in India. Therefore, it is important to study group and non-group category of mergers. Moreover, prevalence of BIFR mergers only in India makes India different from rest of the world and hence, it is important to examine BIFR category of mergers independently. Since all categories of mergers are planned and executed with different motives, we cannot expect the same type of outcome from different types of mergers and hence, examination of different kinds of mergers in isolation is important. For instance, related mergers are undertaken to achieve operating synergy that could be in the form of reduction in cost or increase in sales whereas the main objective of unrelated merger is to achieve financial synergy which could be in the form of reduction in the financial cost. The objectives behind the group merger could be the use of resources of firms under the same business umbrella (group), access to internal capital markets, tunneling, etc. whereas the same may not be true for non-group mergers. Similarly, the objective of acquirer in BIFR merger is to get the tax advantage. All these reasons seek for examination of different types of mergers in isolation.

Although we do not find significant change in the end level (ROA, ROE, and Cash flows from operations divided by total assets) performance parameters but we observe significant differences in the decomposed parameters after merger. We find significant improvement in tax to sales and interest to sales and significant decline in labor to sales and overheads to sales in post-merger period in most of cases. The remaining two―material to sales and sales to assets do not show any significant change. The synergy creation at two or more stages of operation is neutralized by synergy destruction at other two stages of operation. Our results vary with respect to different categories of mergers. We also find that apart from the type of merger, various pre-merger cost specific parameters explain the post-merger profitability, efficiency and cash flows to assets.

The remainder of the paper is organized as follows: Section 2 provides a brief literature review and hypotheses are formulated in Section 3. Data and methodology is explained in Section 4 and results are discussed in Section 5. Finally, Section 6 concludes the paper.

2. Prior Evidence and Hypotheses Development

2.1. Prior Evidence

In this section, we provide prior evidence related to our study. Prior evidence presents review of international as well as Indian studies which look at the impact of mergers on the operating performance of firms along with other related issues.

[5] analyzes 22 U.S. mergers during 1960-65 and finds evidence for a high degree of failures, especially for conglomerate mergers but horizontal and vertical integration are found to be successful. [6] assesses 478 U.S. mergers in 1951 and concludes that not all mergers are successful. However, there are many successful merged firms but it cannot be said that the firms would not have been successful if they had not gone through with a merger. In other words, there is no strong evidence to suggest that mergers add value. Also in the U.S., [7] , after analyzing 43 mergers in 1953 finds that investment performance of firms engaged heavily in merger activity was found to be worse than the average investment performance of their respective industries. The study concludes that mergers are risky investments. In the U.K., [8] analyzes a sample of 2,126 mergers during 1948-60 and finds that the performance of 57% of firms declined after merger―the study concludes that mergers are not profitable. In a sample of 60 companies drawn from the list of Fortune 500 companies, [9] finds that on average the financial performance of conglomerates after merger was no better than the related industry averages. Nevertheless, great variation in the performance of conglomerates is found. [10] examine a sample of 69 U.S. mergers which took place between 1952 and 1963 and find that the profitability of the firms after merger is higher than the non-merging firms, but they do not provide any clear evidence of the effects of mergers on the riskiness, growth, financial structure, income taxes paid and liquidity of the acquiring firm. In line with these results [11] - [20] also do not find any significant improvement in the operating performance of firms in the post-merger period. However, there are very few studies which show that mergers lead to improvement in the financial performance of firms. [21] examines 22 U.K. mergers and finds significant improvement in the profitability of firms after merger. [22] examine 50 big U.S. mergers and observe higher operating cash flow returns due to significant improvement in asset productivity compared to their industries. A strong positive relationship is found between post acquisition operating cash flows and abnormal stock returns at the acquisition announcement. The results of other studies which show improvement in the performance of firms after merger are [23] -[28] .

From international studies mentioned above, we find that majority of studies find that mergers do not significantly improve the operating performance of firms but Indian studies add few new dimensions to the literature. In Indian context [29] -[32] analyze the impact of merger by examining the mergers of sick companies. These researchers conclude that merger is an effective way to rehabilitate the sick companies and performance meets the projected performance. However, studies on the normal mergers such as [33] -[36] show that mergers do not improve the performance of the firms. Only [37] shows that the operating cash flow improves after merger in the form of synergies and his study does not find efficient utilization of assets to generate sales.

2.2. Formulation of Hypotheses

On the basis of literature review, it can be said that many studies assess the economic impact of mergers on the performance by analyzing the changes in the profitability or other measures of the combined firm. Studies prior to early 90s are based on the analysis of accrual accounting measures and from 90s onwards, researchers have started using cash flow measures in addition to accrual accounting measures to examine the changes in the operating performance after merger. The first study that uses cash flow measures and has given new direction to this research is [22] . Nevertheless, most accounting/operating based studies, whether based on US, UK, India or other parts of the world do provide evidence and support to the view that mergers do not improve the operating performance of firms (for example, [5] [8] [11] ). However, on the contrary, a handful of studies provide evidence of efficiency gains after mergers (for example [22] -[25] [27] [37] [38] ). From the above discussion, it is clear that most of the studies are of the view that mergers do not improve the operating performance of the firms, so we frame the following hypothesis:

H1: There is no significant improvement in the operating performance of firms after merger.

While examining the impact of mergers on the operating performance of the acquiring firms, it is not sufficient to examine the end level performance parameters such as ROA, ROE and CFO alone. Instead, examination of operating performance ought to be completed only after examining performance at each stage of operation. According to [39] , operating synergies are scale economies and occur when the physical process of the firm is changed so that the same amount of inputs or factors of production, produce more quantity of outputs. Having more production with lesser inputs, the firm is able to lower its average cost curve and enjoy an edge over the competing firms. Reduction in cost can be in the form of savings in material cost, labour cost, overheads cost, interest cost and tax cost. He further states that these savings result from the ability of firms to sell the product at a lower price than that of its competitors and thus, captures market share by reaping high profits. He also argues that although the intuition behind all these synergies is appealing but these have never been proved. So with this idea, we take this issue in our study to examine synergy creation at each stage of operation. Since, we have hypothesized in H1 that there is no significant improvement in the operating performance of firms after merger at the end level. Thus, we also hypothesize that there is no significant improvement in the performance at each stage of operation. Hence, we frame the following hypothesis:

H2: Mergers do not create synergy at any stage of operation.

One of the determinants of successful mergers is the type of merger. [17] suggest that successful mergers which lead to higher profitability are from related mergers having similar operations. This is because diversification by large holding firms through mergers can have problems of loss of control. According to [40] , mergers between group and subsidiary firms are very common in India. Many group mergers in India are attributed to the government policies which played an active role in the progress and growth of firms until 1991. This practice of merging firms within the same group has been a major part of restructuring process to improve the performance. These approaches suggest that the direction of mergers whether related/unrelated or group/non-group could influence post-merger process. This implies that mergers with different motives can have different impact on the performance. So, we examine this in our last objective. Having known the financial performance of these two categories of mergers, we go back and find out the motives behind these categories of mergers. [5] found high degree of failure in conglomerate mergers whereas horizontal and vertical mergers are found to be successful. [9] also found that on an average, the performance of conglomerates after merger was not better than the industry average. However, [20] found that the type of acquisition (conglomerate vs non-conglomerate) do not significantly influence post acquisition performance. [41] found that performance of group firms is better than non- group firms. Since the results regarding the types of mergers are mixed and inconclusive, we frame the following hypothesis:

H3: There are no significant differences in pre-merger and post-merger performance of different categories of mergers-related/unrelated mergers, group/non-group mergers and BIFR/non-BIFR mergers.

3. Data and Methodology

3.1. Data, Sample and Time Period

The present study deals with the mergers which took place in post liberalization era in Indian manufacturing sector. The data consists of all the mergers which took place in manufacturing sector in India from April 1, 2000 to March 31, 2010. The time period is selected to focus on the mergers which took place after the economic reforms of 1991 and to have sufficient post-merger operating performance data. We restrict our study only to manufacturing companies in order to minimize the potential confounding of extraneous variables [20] [41] [42] . The final sample size used for analyses is 62 pairs of mergers consisting of 128 firms (62 bidders and 66 targets). The sample size of 62 mergers is comparable to the previous studies carried out in significantly larger markets like US, UK, and other parts of the globe.

3.2. Sample Classification

To examine the performance of different types of mergers, we classify our sample into three categories. On the basis of ownership group, first we classify our sample mergers into group and non-group mergers. We use the ownership classification given by Prowess database of CMIE (Centre for Monitoring Indian Economy) to find the ownership status of acquirer and target firms. Prowess gives a firm an ownership status as Private (Indian) if the firm is an independent firm and does not belong to any family business group whereas if the firm belongs to a particular business group then Prowess gives the name of that particular business group as the ownership status of the firm. Out of 62 mergers in our sample, 39 are group mergers and 23 are non-group mergers. Second, on the basis of relatedness of the nature of the business, we classify our sample mergers into related and unrelated mergers. We use National Industry Classification (NIC) given by Prowess database to classify mergers into related and unrelated mergers. NIC codes used in India are similar to Standard Industry Classification (SIC) codes used in U.S. to classify firms into different industries. The broad category of classification in SIC codes is called “Division” whereas it is called “Section” in NIC codes. In SIC codes, each division is further sub divided into various groups whereas in NIC codes, each section is further sub divided into various divisions. Our sample contains all the mergers of section C that is manufacturing section. We classify a merger as related merger if the five digit NIC codes of acquirer and target are same and unrelated merger if the five digit NIC codes of acquirer and target are different. According to the classification based on the related of the nature of the business, there are 46 related and 16 unrelated mergers in our sample. Most of mergers in our sample are concentrated in division 24 which is “manufacture of basis metals”. Third, we classify our sample into BIFR and non-BIFR mergers which are explained earlier. CMIE classify a merger as BIFR merger if the merger is on the order of BIFR. We have 10 BIFR mergers and 52 non-BIFR mergers in our sample.

3.3. Test Variables

It is obvious that the pre-merger (Pre1) and post-merger (Post2) operating performance of firms involved in merger could be affected due to economy wide and industry factors, or simply could be continuation of per merger performance. In order to control economy wide and industry factors, the study employs an adjusted performance measure while evaluating the post-merger operating performance. The study follows [22] and [20] and combines the pre-merger financial performance data of acquiring and target firms to obtain yearly aggregate performance indicators of the combined firm for pre-merger period. A comparison of the post-merger indicator with the above calculated pre-merger benchmark facilitates the measurement of the impact of merger on the operating performance of the combined firms. For the pre-merger period, the industry average indicator (Pre3) is subtracted from the pre-merger combined firm indicator (Pre1) to obtain pre-merger industry adjusted indicator (X). Similarly, for the post-merger period, the industry average indicator (Post4) is subtracted from the combined firm indicator (Post2) to obtain the post-merger industry adjusted indicator (Y). Pre-merger adjusted (X) indicator is compared with post-merger adjusted (Y) indicator to evaluate the post-merger performance of the combined acquiring and target firm. Industry average performance indicators are calculated for each firm. The industry of the acquiring firm at the time of merger is used to identify the industry. Average performance indicators of all the firms in that particular industry are calculated, which are then used as benchmark. Comparison of five year pre-merger industry adjusted performance measures is made with five year post-merger industry adjusted performance measures.

3.4. Variable Definition

Financial data for five years prior and five years post-merger for each firm (62 acquiring firms, 66 target firms) and for each industry average is extracted from Prowess database of CMIE. The extracted financial data encompasses the period from 1999-2000 to 2009-2010. The end level operating performance parameters which are used in the study are: Return on Assets (ROA), Return on Equity (ROE) and Cash flow from operations to total assets (CFO/TA). All these measures are calculated for pre-merger and post-merger period. Pre-merger performance measure is the weighted average of acquirer and target firm(s), weights being assets for calculating weighted ROA and CFO/TA and equity for calculating weighted ROE. Post-merger parameter is the parameter of the acquirer (since target got merged into acquirer). Both pre-merger and post-merger parameters are adjusted against the industry averages each year. ROA is computed as ratio of profit after tax plus interest expense to total assets, which is given as ROA = (PAT + Interest expense)/Total Assets. ROE is computed as ratio of profit after tax minus preference dividend to net worth minus preference share capital, which is given as ROE = (PAT − Preference Dividend)/(Net Worth − Preference share capital). Cash flow from operations to total assets is net cash flow from operations divided by total assets. Net cash flow from operating activities is directly available in Prowess. It can also be calculated by using the following formula given by [20] :

Cash flow from operations (CFO) = WCFO ± changes in (Trade receivables + Prepayments + Inventories + other receivables) ± changes in (Trade creditors + Interest received + Provision for employee entitlements + other creditors).

Working capital from operations (WCFO) = (Operating profit before tax + Interest expense +/− Extraordinary items + Depreciation + Loss on sale of assets and investment + other write off) − (Profit on sale of assets and investment).

In addition to end level parameters, we also examine synergy at each stage of operation by decomposing ROA into six sub level parameters: material to sales, labor to sales, overheads to sales, tax to sales, interest to sales and sales to total assets. These are the sources of economic gain/synergy on merger. All these parameters are calculated for pre-merger and post-merger period. Pre-merger parameter is the weighted average of acquirer and target(s), weights being combined sales of acquirer and target(s). Post-merger parameter is the parameter of the acquirer (since target gets merged into acquirer). Pre-merger parameters and post-merger parameters are adjusted against industry average each year.

3.5. Methodology

1) Match paired t test: The paper examines the proposed hypotheses using statistical data based on mean. Matched paired t test is used to compare five pre-merger industry adjusted performance parameters and five post-merger industry adjusted performance parameters. The year “0” i.e., the year of event is excluded from the analysis. The year of event (year “0”) figures are affected by onetime merger cost incurred during the year. So, it is difficult to compare the results of year “0” with the other years. The test determines whether there is a significant change in the “before/after merger” performance and allows us to attribute the result to the merger. Match paired t test compares pre-merger and post-merger industry adjusted parameters for overall sample and also for different categories of mergers.

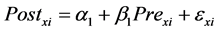

2) Cross Section Regression: While using the matched pair t test on mean basis, we assume that the pre- merger performance will continue in future. But it is unreasonable to assume that pre-merger performance will continue in post-merger period at a constant rate [20] . Therefore, following [22] and Manson et al (1994) we relax this assumption and we investigate the impact of merger on the post-merger performance through a cross- sectional regression. The change in industry adjusted operating performance is estimated using the following two regression models for all the nine parameters:

(1)

(1)

where, Postxi is the average post-merger industry adjusted performance parameter x for company i. Prexi is average pre-merger industry adjusted performance parameter x for company i. β1 represents the association between pre-merger and post-merger industry adjusted performance. A significant β1 indicates the continuance of pre-merger performance in the post-merger period. α1 is the intercept which is independent of the pre-merger performance and indicates the extent to which post-merger performance is a function of merger [20] ). exi is error term. The benefit of using regression is that it does not make assumptions regarding the relative change in performance from pre-merger to post-merger.

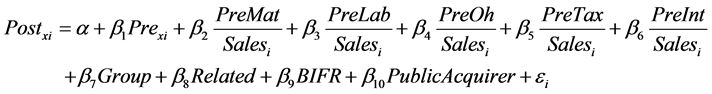

We use the following regression the find the factor which explain post-merger performance:

(2)

(2)

where,  is the post-merger performance parameter x which are ROA, ROE, CFO/TA and Sales/TA for company i.

is the post-merger performance parameter x which are ROA, ROE, CFO/TA and Sales/TA for company i.  is the pre-merger performance parameter x which are ROA, ROE, CFO/TA and Sales/TA for

is the pre-merger performance parameter x which are ROA, ROE, CFO/TA and Sales/TA for

company i.  is pre-merger material to sales ratio of company i,

is pre-merger material to sales ratio of company i,  is the pre-merger labor to sales ratio of company i,

is the pre-merger labor to sales ratio of company i,  is the pre-merger overheads to sales ratio of company i,

is the pre-merger overheads to sales ratio of company i,  is the pre-merger tax to sales ratio of company i,

is the pre-merger tax to sales ratio of company i,  is the pre-merger interest to sales ratio of company i,

is the pre-merger interest to sales ratio of company i,

Group is a dummy variable which takes the value 1 if the merger is group merger and 0 if the merger is non- group merger. Related is a dummy variable which takes the value 1 if the merger is related merger and 0 if the merger is unrelated merger. BIFR is a dummy variable which takes the value 1 if the merger is BIFR merger and 0 if the merger is non-BIFR merger. PublicAcquirer is also a dummy variable which takes the value 1 if the acquirer is public company and 0 if the acquirer is private company.

The multivariate regression is used in order to know the factors including type of merger which explain the post-merger profitability, efficiency and cash flows.

4. Empirical Results and Discussion

The section is divided into three sub sections. Section 4.1 presents the summary statistics of the measures of profitability, efficiency and size of acquirer and target on the basis of five year average before the merger. We measure profitability by using ROA, efficiency by using Sales/TA and size by using assets and sales of the companies engaged in merger. Section 4.2 presents the results of matched paired t test comparing the pre-merger industry adjusted performance and post-merger industry adjusted performance for the overall sample and also for the decomposed sample. The sample is decomposed into subsamples on the basis of types of mergers. These are group vs. non-group mergers, related vs. unrelated mergers and BIFR vs. non-BIFR mergers. Section 4.3 provides results of the regressions. Lastly, section 4.4 presents the overall results of synergy creation at each stage of operation for two categories of mergers: related/non-related mergers and group/non-group mergers in order to examine the differences in the motives of these two categories of mergers.

4.1. Summary Statistics

Table 1 shows the summary statistics of our sample of 62 mergers. In a sample of 62 mergers, there are 62 acquirers and 66 targets. There are 4 such mergers in which the acquirer acquired two targets. We compare acquirer companies with the target companies in terms of size, profitability and efficiency. All these parameters are measured as five year average prior to merger i.e. from t − 5 to t − 1 years, t = 0 being the year of merger.

Table 1. Summary statistics―size, profitability and efficiency of acquirer and target companies.

The size is measured on the basis of total assets and sales. Profitability is measured through ROA and efficiency is measured by using sales to total assets ratio.

In Table 1, Panel A shows the comparison of size, profitability and efficiency of acquirers and targets for the overall sample of 62 mergers. However, not much difference is visible in the efficiency of acquirers and the targets. Panel B and Panel C of the Table 1 reports the summary statistics for group and non-group mergers respectively. We label a merger as group merger if both acquirers and target companies belong to same business group and non-group if the acquirer and target are from different business groups. We observe the same pattern in group and non-group mergers as well. On an average, acquirers are more profitable, more efficient and bigger than the targets. However, if we compare group and non-group mergers, we observe that although the number of group mergers is more than the number of non-group mergers but acquirers of group mergers are less profitable, less efficient and smaller than the acquirers of non-group mergers. Targets of both these categories of mergers are more or less similar. Panel D and Panel E of Table 1 show the summary statistics for related and unrelated mergers respectively. We classify related and unrelated mergers on the basis of first two digits of NIC (National Industry Classification) Code. Indian NIC codes are similar to U.S. SIC (Standard Industrial Classification) codes. If first two digits of NIC code of acquirer and target are same then we classify that merger as related merger otherwise unrelated merger. Here, we observe a different pattern. Though related mergers are more than unrelated mergers in number and acquirers of related mergers are bigger than the acquirer of unrelated merger, acquirers of unrelated mergers are more profitable and efficient than the acquirers of related mergers. This gives an indication that acquirer of related mergers seek mergers to acquire companies which are in the same industry and business to become more profitable and efficiency. Acquisition of firms in the same industry can help them to attain operating synergies in form of reduction in cost or increase in sales and this is how they can become more profitable and efficient. Again, in both kinds of mergers, acquirers seem to be bigger, more profitable and efficient than the targets. Furthermore, on average acquirers are always bigger, more profitable and efficient than the targets in both BIFR and non-BIFR mergers which is consistent with the pattern seen in other categories of mergers.

4.2. Post-Merger Operating Performance―Matched Pair t Test Results

The industry adjusted mean performance of pre-merger period is compared with the industry adjusted mean performance of post-merger period for the overall sample and the decomposed sample. Match paired t test is used to test whether the difference between pre-merger and post-merger performance is significantly different from zero. If the difference is significantly different from zero then we can say that there is a change in the performance due to merger. If the difference i.e. post-performance minus pre-performance is significantly positive then it means that on an average, merger had a positive impact on the operating performance of firms whereas if this difference is negative then it means that the merger failed to contribute and resulted in negative performance. This analysis is done for two event windows, three year (−3, +3) and five year (−5, +5) windows.

Table 2 and Table 3 show t test results for industry adjusted performance parameters for three year (−3, +3) and five year (−5, +5) window. Three year analysis compares the mean of three years pre-merger performance parameters with mean of the three years post-merger parameters. Similarly, five year analysis compares the mean of five years pre-merger performance parameters with the mean of the three years post-merger performance parameters. Column 1 shows the significance of difference in means of post and pre-merger parameters for the overall sample. The decomposed sample results are given in the subsequent columns.

In both the tables, we can see that there is no significant difference in the pre-merger and post-merger end level parameters of profitability (which are ROA, ROE and CFFO/TA) for the overall sample i.e. 62 mergers. However, unlike the previous literature, we do not conclude that mergers do not change the performance of the firms. If mergers do not add value to the firms then why do companies merge? In order to find answer to this question, we analyze the change in the performance not only at the end level but at different stages of operation. We examine whether mergers lead to synergy creation or synergy destruction at each stage of operation. Table 2 and Table 3 show that there is no significant difference in the pre-merger and the post-merger ROA, ROE and CFFO/TA. In order to examine synergy creation at each stage of operation we decompose ROA in to six constituents which are Materials/Sales (Mat/Sales), Labor/Sales (Lab/Sales), Overheads/Sales (Oh/Sales), Tax/Sales, Interest/Sales (Int/Sales) and Sales/Total Assets (Sales/TA). Table 2 and Table 3 show that labor cost and overheads cost significantly increase after merger whereas tax cost significantly decrease after the merger. In other words, there is synergy creation at tax level but synergy destruction at labor and overheads level resulting

Table 2. Match paired t test results for industry adjusted performance measures (3 year analysis).

in no synergy creation overall. Next, if we examine different types of mergers carefully, we can see that group merger create synergy at ROE level whereas there is a significant decrease in post-merger ROE for non-group mergers. Due to this, there is no change in the ROE after merger for the overall sample. This intuitively explains that group mergers benefit shareholders in the form of higher returns on equity after merger. Further examination at each stage of operation shows group mergers increase labor and overheads cost but they save on tax in post-merger period. On the other hand, non-group mergers increase labor, overheads and interest cost but decrease tax cost in post-merger period. So, it is visible that group mergers underperform at two and non-group mergers underperform at three stages of operation but both the mergers outperform at one stage of operation resulting in no improvement overall profitability. Related and unrelated types of mergers also show the same type of pattern.

Table 3. Match paired t test results for industry adjusted performance measures (5 year analysis).

We can observe that these related mergers do well at tax level and material level but at the same time they increase labor and overheads costs. This result is consistent with the theory that related mergers are undertaken to achieve economies of scale thereby reducing the material cost. However, there is an increase in labor cost which shows that there might be some overlapping in employees skills after merger and companies have not retrenched those employees resulting in high labor costs. Looking into unrelated mergers, we can see that there is reduction in tax cost and interest cost ratio after merger for unrelated category of mergers. This result is consistent with the theory that companies undertake unrelated mergers in order to achieve financial synergy or to reduce the financial cost. The third category of mergers is BIFR and non-BIFR mergers. We can see from the tables that merger had a significant and favorable impact on ROA, ROE, and overheads cost, and interest cost for BIFR cases. On the other hand, non-BIFR mergers show change in performance similar to overall sample. They save on material and tax but loose on labor and overheads resulting in no synergy creation at end level ROA.

In a nutshell, t test results of end level parameters and overall sample highlight the importance of examination of synergy creation at each stage of operation and for each category of merger independently. On account of this, we have seen that examination of synergy at each stage of operation and analyzing the decomposed sample gives a better picture of the impact of mergers on the operating performance of firms.

4.3. Post-Merger Operating Performance―Regression Results

(A) Univariate Regression Results

An assumption of comparison of means performance of pre-merger and post-merger through matched pair t-test is that pre-merger performance will continue into the future in the post-merger period. But pre-merger performance cannot continue into post-merger period at constant rate with 100 per cent. Therefore, in this section the effect of merger is also investigated through a cross-sectional regression on the post-merger performance. This is also done by [20] [22] [27] . As mentioned above, in univariate regression, we regress post-merger industry adjusted performance parameter on the same pre-merger industry adjusted parameter in order to capture the impact of merger on the performance measure through intercept. A significant intercept shows the significant change in performance after merger. Univariate regression results are given in Table 4 and Table 5 for three year and five year analysis respectively. In both the tables, we can see that the intercepts of end level parameters which are ROA, ROE, and CFO/TA are not significant (except CFO/TA in case of three year which shows improvement in post-merger period). This shows that there is no significant difference in these pre-merger and post-merger performance measures at aggregate level performance. This result is consistent with our t test results and calls for examination of synergy creation at each stage of operation. Intercept at each stage of operation

Table 4. Univariate results of the equation POSTxi = α1 + β1PRExi + exi (Industry adjusted measures (3 year analysis).

t values are given in the parentheses. ***, **, * indicate significance at 1%, 5% and 10% levels, respectively.

Table 5. Univariate results of the equation POSTxi = α1 + β1PRExi + exi (Industry adjusted measures (5 year analysis).

t values are given in the parentheses. ***, **, * indicate significance at 1%, 5% and 10% levels, respectively.

is significant except Int/Sales. Table 4 and Table 5 show that there is a significant decrease in material and tax costs after merger and there is a significant increase in labor and overheads costs after merger. Efficiency in the form of sales to total assets also improved after merger. Put differently, we can say that synergy creation at material and tax levels is being nullified by synergy destruction at labor and overheads levels resulting in no synergy creation at the end level ROA.

Our univariate regression results are similar to our t test results which make our findings more robust. With this, we challenge the existing literature which shows that merger do not lead to improvement in operating performance or mergers have a negative impact on the operating performance of mergers. We provide evidence of synergy creation at different stages of operation. Due to this reason, companies still undergo into mergers at high rate as it gives them an opportunity to leverage the benefits at different stages of operation.

(B) Multivariate Regression Results

In multivariate regression, we examine the factors which explain post-merger profitability and post-merger efficiency. In addition to all the pre-merger cost measures, we capture the effect of the type of merger by using dummy as an independent variable. The results are given in Table 6 and Table 7 for three year and five year analysis respectively. We run five regressions with post ROA, post ROE and post CFFO/TA as dependent variables in Model I, Model II and Model III respectively, and post Sales/TA as dependent variable in Model IV and Model V. Five dummies are used to represent type of merger and the public status of acquirer and target.

Dummy variable “Group Merger” is 1 if the acquirer and target belong to same business group and 0 if they are from different business groups. Dummy variable “Related Merger” is 1 if the merger takes place between two companies in the same industry and 0 if the acquirer and target are from two different industries. Similarly, dummy variable “Public Acquirer” is 1 if the acquirer is public company and 0 if the acquirer if private company

Table 6. Multivariate regression results for industry adjusted performance measures (3 year analysis).

t values are given in the parentheses. ***, **, * indicate significance at 1%, 5% and 10% levels, respectively.

Table 7. Multivariate regression results for industry adjusted performance measures (5 year analysis).

t values are given in the parentheses. ***, **, * indicate significance at 1%, 5% and 10% levels, respectively.

and dummy variable “Public Target” is 1 if the target is public company and 0 if the target is private company. Lastly, dummy variable “BIFR Merger” is 1 if it is a merger in which a financially healthy company acquires a financially sick company on the mandatory order of BIFR and 0 if the merger is a non-BIFR merger.

The model I shows that there is a significant and positive relation between BIFR dummy and post-merger ROA which means ROA in post-merger increases only in case of BIFR merger.

This is somewhat consistent with our t test results in which we have seen that there is no significant improvement in post-merger ROA for the overall sample but if we decompose then it improves only in case of BIFR mergers. The positive relation between pre-tax to sales and post ROA shows that acquirers who pay more in pre-merger period tend to acquire those companies which have less earnings but have sound sales base so that they can reduce their tax post-merger but at the same time can enjoy more profits (due to more sales of target) after the merger. In model II, we observe a negative relation between public acquirer and ROE. This could be due to the fact that a public acquirer can pay the consideration of merger to the target in form of stock and in such scenario, the number of shareholders increase. If there is no much improvement in the profitability post- merger then the increase in shareholders base can lead to decline in ROE.

The model III shows that pre-merger CFFO/TA and pre-merger labor costs affect post-merger CFFO/TA significantly. Lesser labor cost in pre-merger period leads to improvement in post-merger CFFO/TA and higher CFFO/TA in pre-merger also leads to improvement in post-merger CFFO/TA. As regards as post-merger Sales/ TA is concerned, Model IV and Model V show that post-merger has a significant and negative relationship with pre-merger tax and interest cost and positive relationship with pre-merger Sales/TA. Lesser tax and interest in pre-merger period improves Sales/TA in post-merger and obviously, higher Sales/TA also improves efficiency in post-merger period. Our results of five year analysis given in Table 7 are similar to the results of three year analysis explaining the factors of post-merger profitability and efficiency.

5. Conclusion

In this paper, we examine efficiency theory of mergers which states that the mergers are executed in order to achieve synergy benefits. To measure efficiency gains, we analyze post-merger operating performance of firms. Similar to the findings of prior literature, we do not find any significant change in the end-level parameters in the post-merger period. In order words, there is no significant improvement in post-merger ROA, ROE and cash flow from operations to total assets. However, like previous literature we do not stop our analysis at end-level parameters, we go further and examine the economic gain or synergy creation at each stage of operation. We measure synergy at material, labor, overheads, tax, interest and sales to total assets level. We find significant change in these performance parameters after merger. Overall, we observe synergy creation at tax and interest level and synergy destruction at labor and overheads level resulting in no synergy creation at the end level. We also examine the performance of different categories of mergers which are group/non-group mergers, related/ unrelated mergers and BIFR/non-BIFR mergers. The analysis of these categories of mergers in isolation is important because different types of mergers are undertaken with different motives and same outcome cannot be expected from different categories of mergers. We find different results in different types of mergers. Finally, we also examine the factors which explain the post-merger profitability, efficiency and cash flows. The post- merger profitability (ROA) is high if the merger is BIFR merger and if the pre-merger tax to sales ratio is high. This shows that acquisitions of financially sick companies prove beneficial to healthy acquirers in form of tax savings and with this, they can improve their profitability. The positive relation between pre-tax to sales and post ROA shows that acquirers which pay more in pre-merger period tend to acquire those companies that have less earnings but have sound sales base so that they can reduce their tax post-merger but at the same time can enjoy more profits (due to more sales of target) after the merger. Post-merger ROE can be improved after merger if the acquirer is a public acquirer because the public acquirer can pay the price to the target in form to stock and in such scenario, the number of shareholders increases. If there is no much improvement in the profitability post-merger then the increase in shareholders base can lead to decline in ROE. There is a positive relation of post-merger efficiency with pre-merger interest to sales and tax to sales. In order words, if the companies have interest and tax advantage pre-merger then they can increase their efficiency in the post-merger.

Cite this paper

KavitaWadhwa,Sudhakara ReddySyamala, (2015) An Empirical Examination of Efficiency Theory of Mergers in Emerging Market India. Theoretical Economics Letters,05,757-774. doi: 10.4236/tel.2015.56088

References

- 1. Pautler, P.A (2001) Evidence on Mergers and Acquisitions. Federal Trade Commission Working Paper 243. http://www.ftc.gov/be/workpapers/wp243.pdf

- 2. Berger, A.N. and Humphrey, D.B. (1989) Megamergers in Banking and the Use of Cost Efficiency as a Defense. The Antitrust Bulletin, 37.

- 3. Cornett, M.M. and Tehranian, H. (1992) Changes in Corporate Performance Associated with Bank Acquisitions. Journal of Financial Economics, 31, 211-234. http://dx.doi.org/10.1016/0304-405X(92)90004-H

- 4. Tremblay, V.J. and Tremblay, C.H. (1988) The Determinants of Horizontal Acquisitions: Evidence from the U.S. Brewing Industry. Journal of Industrial Economics, 37, 21-45. http://dx.doi.org/10.2307/2098551

- 5. Kitching, J. (1967) Why Do Mergers Miscarry? Harvard Business Review, 45, 84-101.

- 6. Reid, S.R. (1968) Mergers, Managers and the Economy. McGraw Hills, US.

- 7. Hogarty, T.F. (1970) The Profitability of Corporate Mergers. The Journal of Business, 43, 317-327. http://dx.doi.org/10.1086/295284

- 8. Singh, A. (1971) Takeovers, Their Relevance to Stock Market and Theory of the Firm. Cambridge University Press, Cambridge.

- 9. Weston, F.J. and Mansinghka, S.K. (1971) Tests of Efficiency Performance of Conglomerate Firms. Journal of Finance, 26, 25-39. http://dx.doi.org/10.1111/j.1540-6261.1971.tb00928.x

- 10. Lev, B. and Mandelkar, G. (1972) The Microeconomic Consequences of Corporate Mergers. The Journal of Business, 45, 85-104. http://dx.doi.org/10.1086/295427

- 11. Utton, M.A. (1974) Measuring the Effects of Industrial Mergers. Scottish Journal of Political Economy, 21, 13-28. http://dx.doi.org/10.1111/j.1467-9485.1974.tb00173.x

- 12. Kuehn, D. (1975) Takeovers and Theory of the Firm. Macmillan, London. http://dx.doi.org/10.1007/978-1-349-02169-7

- 13. Meeks, G. (1977) Disappointing Marriage: A Study of Gains from Mergers. Cambridge University Press, Cambridge.

- 14. Hoshino, Y. (1982) The Performance of Corporate Mergers in Japan. Journal of Business Finance & Accounting, 9, 153-165. http://dx.doi.org/10.1111/j.1468-5957.1982.tb00982.x

- 15. Levin, P. and Aaronovitch, S. (1981) The Financial Characteristics of Firms and Theories of Merger Activity. The Journal of Industrial Economics, 30, 149-172. http://dx.doi.org/10.2307/2098200

- 16. Philippatos, G.C., Choi, D. and Dowling, W.A. (1985) Effects of Mergers on Operational Efficiency: A Study of the S&L Industry in Transition. The Northeast Journal of Business & Economics, 11, 1-14.

- 17. Ravenscraft, D.J. and Scherer, F.M. (1989) The Profitability of Mergers. International Journal of Industrial Organization, 7, 101-116. http://dx.doi.org/10.1016/0167-7187(89)90048-9

- 18. Clark, K. and Ofek, E. (1994) Mergers as a Means of Restructuring Distressed Firms: An Empirical Investigation. Journal of Financial and Quantitative Analysis, 29, 541-565. http://dx.doi.org/10.2307/2331109

- 19. Dickerson, A.P., Gibson, H.D. and Tsakalotos, E. (1997) The Impact of Acquisitions on Company Performance: Evidence from a Large Panel of UK Firms. Oxford Economic Papers, 49, 344-361. http://dx.doi.org/10.1093/oxfordjournals.oep.a028613

- 20. Sharma, D.S. and Ho, J. (2002) The Impact of Acquisitions on Operating Performance: Some Australian Evidence. Journal of Business Finance & Accounting, 29, 155-200. http://dx.doi.org/10.1111/1468-5957.00428

- 21. Cosh, A., Hughes, A. and Singh, A. (1980) The Causes and Effects of Takeovers in United Kingdom: An Empirical Investigation of Late 1960’s at Microeconomic Level. In: Mueller, D.C., Ed., The Determinants and Effects of Mergers: An International Comparison, Oelgeschlager, Gunn & Hain, Publishers, Inc., Cambridge.

- 22. Healy, P.M., Palepu, K.G. and Ruback, R.S. (1992) Does Corporate Performance Improve after Mergers? Journal of Financial Economics, 31, 135-175. http://dx.doi.org/10.1016/0304-405X(92)90002-F

- 23. Switzer, J.A. (1996) Evidence on Real Gains in Corporate Acquisitions. Journal of Economics & Business, 48, 443-460. http://dx.doi.org/10.1016/S0148-6195(96)00033-1

- 24. Manson, S., Powell, R., Stark, A.W. and Thomas, H.M. (2000) Identifying the Sources of Gains from Takeovers. Accounting Forum, 24, 319-343. http://dx.doi.org/10.1111/1467-6303.00044

- 25. Ghosh, A. (2001) Does Operating Performance Really Improve Following Corporate Acquisitions? Journal of Corporate Finance, 7, 151-178. http://dx.doi.org/10.1016/S0929-1199(01)00018-9

- 26. Ramaswamy, K.P. and Waegelein, J.F. (2003) Firm Financial Performance Following Mergers. Review of Quantitative Finance and Accounting, 20, 115-126. http://dx.doi.org/10.1023/A:1023089924640

- 27. Rahman, A.R. and Limmack, R.J. (2004) Corporate Acquisitions and the Operating Performance of Malaysian Companies. Journal of Business Finance & Accounting, 31, 359-400. http://dx.doi.org/10.1111/j.0306-686X.2004.00543.x

- 28. Carline, N.F., Linn, S.C. and Yadav, P.K. (2008) Can the Stock Market Systematically Make Use of Firm- and Deal-Specific Factors When Initially Capitalizing the Real Gains from Mergers and Acquisitions? Working Paper No. 04-08, Centre for Financial Research (CFR), Cologne.

- 29. Kaveri, V.S. (1986) Financial Analysis of Company Mergers in India. Himalaya Publishing House, New Delhi.

- 30. Kumar, M. (1994) Growth, Acquisition and Investment. Cambridge University Press, Cambridge.

- 31. Yadav, S.S., Jain, P.K. and Jain, N. (1999) Profitability of Merger—Some Selected Cases. The Management Accountant, 34, 502-507.

- 32. Mandal, R. (1995) Corporate Mergers in India: Objectives and Effectiveness. Kanisk Publishers, New Delhi, 75-76, 222-223.

- 33. Beena, P.L. (2004) An Analysis of Mergers in the Private Corporate Sector in India. Working Paper No. 301, Centre for Development Studies, Thiruvananthapuram.

- 34. Mantravadi, P. and Reddy, A.V. (2007) Mergers and Operating Performance Indian Experience. ICFAI Journal of Mergers & Acquisitions, 4, 52-66.

- 35. Bhaumik, S.K. and Selarka, E. (2008) Impact of M&A on Firm Performance in India: Implications for Concentration of Ownership and Insider Entrenchment. Working Paper No. 907, William Davidson Institute.

- 36. Kumar, R. (2009) Post-Merger Corporate Performance: An Indian Perspective. Management Research News, 32, 145-157. http://dx.doi.org/10.1108/01409170910927604

- 37. Ramakrishnan, K. (2008) Long-Term Post Merger Performance of Firms in India. Vikalpa, 33, 47-63.

- 38. Lubatkin, M. (1983) Mergers and the Performance of the Acquiring Firm. Academy of Management Review, 8, 218-225.

- 39. Pawaskar, V. (2001) Effect of Mergers on Corporate Performance in India. Vikalpa, 26, 19-32.

- 40. Singh, F. and Mogla, M. (2008) Impact of Mergers on Profitability of Acquiring Companies. ICFAI University Journal of Mergers & Acquisitions, 5, 60-76.

- 41. Deakin, E.B. (1976) Distributions of Financial Accounting Ratios: Some Empirical Evidence. The Accounting Review, 51, 90-96.

- 42. McDonald, B. and Morris, M.H. (1984) The Statistical Validity of the Ratio Method in Financial Analysis: An Empirical Examination. Journal of Business Finance & Accounting, 11, 89-97. http://dx.doi.org/10.1111/j.1468-5957.1984.tb00059.x

NOTES

*Corresponding author.